The global denim and fabric treatment market has seen robust expansion in recent years, driven by rising consumer demand for comfort, sustainability, and unique aesthetics in textile products. According to a 2023 report by Mordor Intelligence, the global denim market was valued at approximately USD 68.5 billion and is projected to grow at a CAGR of over 5.8% from 2023 to 2028. A key driver behind this growth is the increasing preference for pre-washed denim finishes—particularly enzyme and rag wash techniques—that enhance softness, reduce shrinkage, and offer a vintage appeal without extensive wear. Rag wash, known for its artisanal texture and durability, has become a sought-after process among premium denim manufacturers. As brands prioritize sustainable and water-efficient techniques, innovation in washing technologies has placed leading manufacturers at the forefront of the value chain. Based on production capacity, technological adoption, and global client footprint, the following list highlights the top five rag wash manufacturers shaping the future of denim finishing.

Top 5 Rag Wash Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 All Products

Domain Est. 2000

Website: theragcompany.com

Key Highlights: Free delivery over $144 · 30-day returns…

#2 Rag Company Vendor Collection

Domain Est. 2014

Website: chem-x.com

Key Highlights: Free delivery 30-day returnsThe Rag Company Off road Baja Pack: Wash Mitt + Wash pad Combo – Chem. The Rag Company Off road Baja Pack: Wash Mitt + Wash pad Combo. Regular price $22…

#3 Rag Company Cyclone Ultra Wash Mitt

Domain Est. 2018

Website: washproduct.com

Key Highlights: Rating 4.8 (6) · Free delivery over $99The CYCLONE ULTRA WASH MITT features a unique Microfiber blend that allows contaminates to release more easily into your wash bucket, red…

#4 The Rag Company

Domain Est. 2023

Website: thecarcarebn.com

Key Highlights: The Rag Company has become a cornerstone in the automotive detailing world, trusted by professionals and enthusiasts for delivering some of the highest quality ……

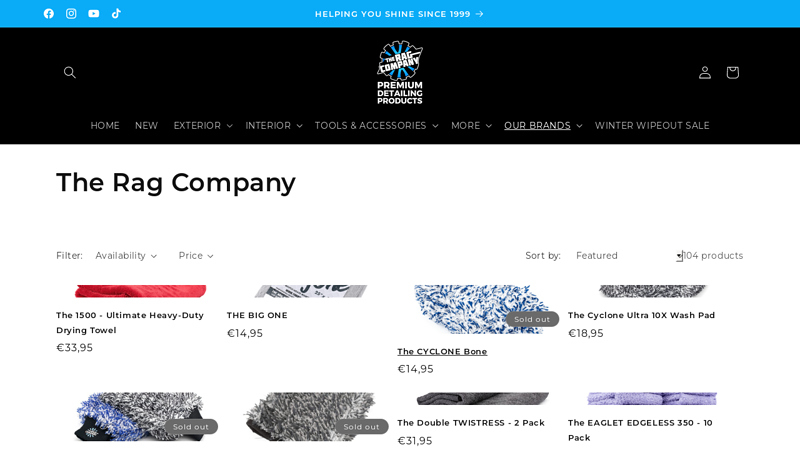

#5 The Rag Company

Website: theragcompany.eu

Key Highlights: Discover high-quality microfiber towels and cloths from The Rag Company, offering the best selection for all your cleaning needs….

Expert Sourcing Insights for Rag Wash

H2: 2026 Market Trends for Rag Wash

The rag wash textile segment, known for its vintage aesthetics and sustainable appeal, is poised for notable evolution by 2026. Driven by shifting consumer preferences, technological advancements, and global sustainability mandates, the market is expected to experience both challenges and opportunities. Below are the key H2 2026 trends shaping the rag wash industry:

-

Sustainability as a Core Driver

By 2026, environmental regulations and consumer demand for eco-friendly fashion will push brands toward low-impact rag wash techniques. Traditional water- and chemical-intensive denim finishing processes are being replaced with ozone treatment, laser finishing, and bio-enzymatic washing. These innovations reduce water consumption by up to 80%, aligning with ESG (Environmental, Social, and Governance) goals increasingly mandated by retailers and governments. -

Circular Fashion Integration

Rag wash production is increasingly incorporating recycled cotton and post-consumer textile waste. Closed-loop systems, where wastewater from washing processes is treated and reused, are becoming standard in leading manufacturing hubs such as Turkey, India, and Bangladesh. This shift supports circular economy models and enhances brand credibility. -

Digital Customization and On-Demand Production

Advancements in digital twin technologies and AI-driven design platforms enable consumers to customize rag wash finishes online. By H2 2026, fast fashion and premium brands alike are adopting on-demand rag wash production to minimize overstock and reduce waste, responding to the rise of personalized fashion. -

Rise of Regenerative Cotton Sourcing

Leading textile suppliers are partnering with farms using regenerative agriculture to source cotton for rag wash garments. This trend not only improves soil health and carbon sequestration but also appeals to eco-conscious consumers willing to pay a premium for traceable, ethically produced clothing. -

Geopolitical Shifts in Manufacturing

Due to increasing labor costs in traditional centers like China, rag wash production is migrating to Southeast Asia and parts of Africa. Countries such as Vietnam, Cambodia, and Ethiopia are investing in green textile parks equipped with modern washing technologies, making them competitive hubs by 2026. -

Consumer Demand for Authenticity and Transparency

Blockchain-enabled traceability is becoming a differentiator. By H2 2026, major brands are using QR codes on rag wash garments to showcase the washing process, water usage, and labor conditions. This transparency builds trust and supports premium pricing strategies. -

Blending Heritage with Innovation

While rag wash has historically represented a worn-in, artisanal look, brands are fusing traditional hand-washing techniques with cutting-edge finishing tech to create unique textures. This hybrid approach caters to the growing demand for “slow fashion” with a modern edge.

Conclusion:

By H2 2026, the rag wash market will be defined by sustainability, digitalization, and ethical production. Brands that invest in eco-efficient technologies, transparent supply chains, and consumer-driven customization will lead the segment. As environmental regulations tighten and consumer awareness grows, rag wash is evolving from a stylistic choice to a symbol of responsible fashion innovation.

Common Pitfalls in Sourcing Rag Wash (Quality, IP)

Sourcing rag wash, often used in industries like textiles, cleaning, or as a base material in manufacturing, presents several challenges related to both quality consistency and intellectual property (IP) risks. Awareness of these pitfalls is crucial for maintaining product integrity and avoiding legal complications.

Quality Inconsistencies

One of the most frequent issues when sourcing rag wash is inconsistent quality. Rag wash typically consists of recycled or reclaimed textile materials, and its composition can vary significantly between batches. Factors such as fiber type, colorfastness, contamination (e.g., oils, dyes, or foreign materials), and fabric weight may not be standardized, leading to performance issues in end applications. Suppliers may lack rigorous sorting or cleaning processes, resulting in subpar material that fails to meet technical specifications. Without clear quality benchmarks and third-party testing, buyers risk receiving material that compromises their production efficiency or product quality.

Lack of Traceability and Transparency

Many rag wash suppliers operate within fragmented or informal supply chains, making it difficult to trace the origin of materials. This lack of transparency increases the risk of inadvertently sourcing materials from unethical or environmentally harmful sources. Additionally, without proper documentation, verifying claims such as “organic,” “recycled,” or “non-toxic” becomes nearly impossible, potentially affecting brand reputation and compliance with regulations.

Intellectual Property Risks

Sourcing rag wash can carry IP-related pitfalls, especially if the material contains remnants of branded or copyrighted fabrics. Using recycled textiles that include logos, patented weaves, or distinctive patterns without authorization may expose the buyer to claims of trademark or design infringement. Even if unintentional, repurposing materials with recognizable IP elements in a new product could lead to legal disputes. Buyers must ensure suppliers have protocols to remove or neutralize branded content and provide warranties against IP violations.

Inadequate Supplier Vetting

Failing to thoroughly vet suppliers exacerbates both quality and IP issues. Many rag wash providers may not have the certifications, quality control systems, or legal safeguards necessary for reliable sourcing. Conducting site audits, requesting material safety data sheets (MSDS), and reviewing compliance with environmental and labor standards are critical steps often overlooked.

Conclusion

To mitigate these risks, buyers should establish clear specifications, require certifications (e.g., GRS for recycled content), perform batch testing, and include IP indemnity clauses in supplier contracts. Proactive due diligence ensures that rag wash sourcing supports both product quality and legal compliance.

Logistics & Compliance Guide for Rag Wash

This guide outlines the essential logistics procedures and compliance requirements for the collection, handling, processing, and disposal of rags used in industrial, commercial, and maintenance operations—commonly referred to as “rag wash” services. Proper management ensures environmental safety, regulatory adherence, and operational efficiency.

Collection & Segregation

Collect soiled rags in clearly labeled, leak-proof, and fire-resistant containers to prevent contamination and hazardous spills. Segregate rags based on the type of contaminant—such as petroleum-based solvents, heavy metals, or water-based fluids—to comply with waste classification standards. Never mix rags contaminated with ignitable, corrosive, reactive, or toxic substances unless authorized by regulatory guidelines.

Transportation Requirements

All rag transport must be conducted by licensed hazardous waste carriers if the rags are classified as hazardous under local, state, or federal regulations (e.g., EPA’s RCRA in the U.S.). Vehicles must be equipped with spill containment kits, appropriate signage, and manifests documenting the waste type, quantity, origin, and destination. Drivers must have proper training and documentation, including DOT Hazardous Materials Endorsements where applicable.

Regulatory Compliance

Ensure compliance with all relevant environmental and safety regulations:

– EPA RCRA (Resource Conservation and Recovery Act): Determine if rags are hazardous based on solvent content and flashpoint.

– OSHA Standards: Provide employees with training on handling contaminated materials and access to safety data sheets (SDS).

– Local Environmental Agencies: Adhere to state or municipal rules on solvent-laden waste disposal and recycling.

Note: Rags cleaned and reused through a regulated laundry service may be exempt from hazardous waste classification under certain conditions (e.g., Solvent-Contaminated Wipe Rule in the U.S.).

Storage Protocols

Store used rags in designated, ventilated areas away from heat sources and incompatible materials. Containers must be kept closed except when adding or removing rags to minimize vapor release and fire risk. Label all storage areas with appropriate hazard warnings and ensure spill containment measures are in place. Conduct regular inspections to maintain compliance and safety.

Processing & Recycling

Partner with certified rag-washing or recycling facilities that follow environmentally sound practices. Ensure facilities provide documentation of proper processing, including solvent recovery, wastewater treatment, and recycling rates. Reusable rags should be inspected for wear and contamination before reuse to maintain operational safety and quality.

Documentation & Recordkeeping

Maintain detailed records for a minimum of three years (or as required by law), including:

– Waste manifests

– Training logs

– Inspection reports

– Contracts with service providers

– Certificates of recycling or disposal

Accurate documentation supports audits, regulatory inspections, and corporate sustainability reporting.

Emergency Response

Establish a spill response plan specific to rag and solvent incidents. Equip storage and handling areas with fire extinguishers, absorbent materials, and spill kits. Train personnel in emergency procedures, evacuation routes, and first aid. Report significant spills or exposures to appropriate regulatory bodies as required.

Sustainability & Best Practices

Promote sustainability by:

– Using reusable rags instead of disposable wipes

– Choosing biodegradable or low-toxicity cleaning solvents

– Tracking waste reduction metrics

– Auditing rag usage and disposal practices annually

Adhering to this guide ensures safe, legal, and environmentally responsible management of rag wash operations across your organization.

Conclusion for Sourcing Rag Wash:

Sourcing rag wash effectively requires a strategic approach that balances quality, cost, sustainability, and supply chain reliability. By evaluating suppliers based on fabric quality, consistency in finishing, environmental practices, and ethical production standards, businesses can ensure the procurement of high-performing rag wash materials suitable for diverse applications such as cleaning, industrial use, or textile recycling. Establishing long-term partnerships with reputable suppliers, conducting regular quality audits, and staying informed about market trends and sustainable alternatives will enhance sourcing efficiency. Ultimately, a well-structured rag wash sourcing strategy not only supports operational needs but also aligns with broader environmental and corporate responsibility goals.