The global demand for recycled paper products has seen steady growth, driven by rising environmental concerns, corporate sustainability commitments, and stringent government regulations on deforestation and waste management. According to a 2023 report by Mordor Intelligence, the global recycled paper market was valued at approximately USD 45.6 billion and is projected to grow at a CAGR of 5.2% from 2023 to 2028. A significant portion of this market comprises rag paper—known for its durability, high cotton or linen fiber content, and use in archival documents, currency, and luxury stationery. Rag paper stands out due to its longevity and superior quality compared to wood-pulp-based alternatives, making it a preferred choice in specialized applications. As industries prioritize sustainable sourcing without sacrificing performance, key manufacturers have emerged as leaders in innovation, quality control, and supply chain transparency. Based on production capacity, market reach, fiber sourcing practices, and industry reputation, the following eight companies represent the forefront of rag paper manufacturing worldwide.

Top 8 Rag Papaer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Moab Entrada Rag

Domain Est. 2003

Website: moabpaper.com

Key Highlights: Moab Entrada Rag is a 100% cotton digital inkjet paper ideal for fine art and photography. Its smooth surface enhances color and detail, …Missing: papaer manufacturer…

#2 Rag Photographique

Domain Est. 1998

Website: us.canson.com

Key Highlights: Canson® Infinity Rag Photographique is a 100% cotton museum grade white Fine Art and photo paper. The exceptional smooth white tone is achieved during ……

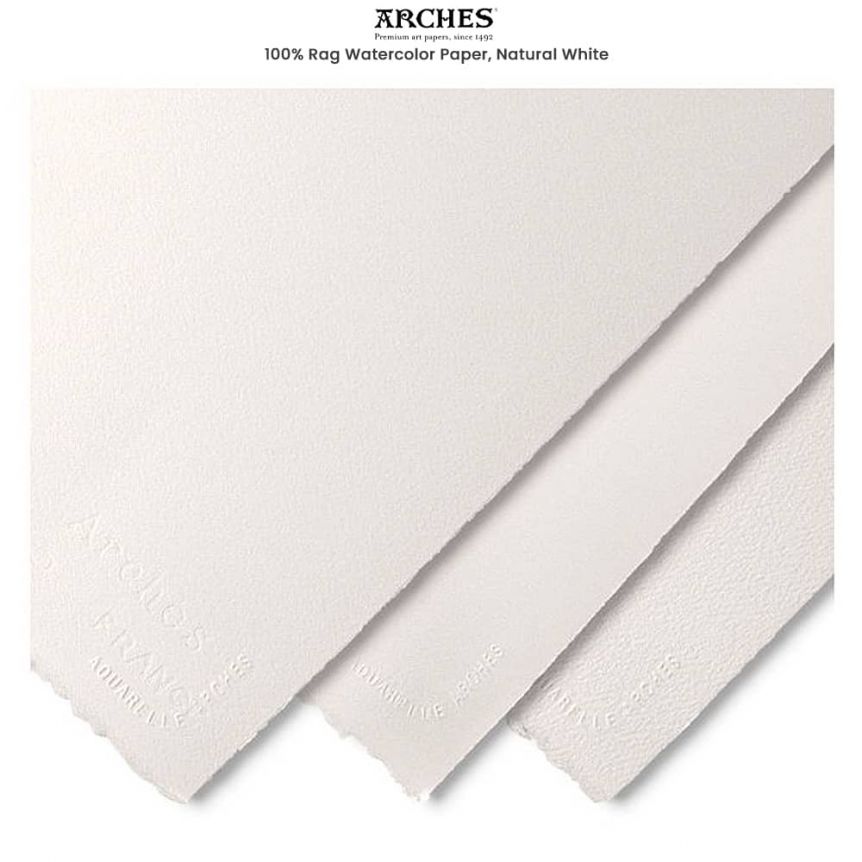

#3 Arches makes Art papers suitable for all artistic techniques

Domain Est. 1998

Website: arches-papers.com

Key Highlights: ARCHES is the paper mill that offers the most extensive range of fine art papers made on a cylinder mould….

#4 About the paper

Domain Est. 1998

Website: khadi.com

Key Highlights: KHADI RAG PAPERS are made in Karnataka, South India at our paper mill, KHADI PAPERS INDIA. They are made from 100% cotton rag. Cotton rags have longer fibres ……

#5 Rag Content Paper

Domain Est. 2003

#6 Rag Photographique 210 or 310

Domain Est. 2007

Website: canson-infinity.com

Key Highlights: Canson Infinity Rag Photographique is a 100% cotton museum grade white Fine Art and photo paper. The exceptional smooth white tone is achieved during ……

#7 Two Rivers Paper handmade rag papers for artists and designers

Domain Est. 2013

Website: tworiverspaper.com

Key Highlights: Dedicated to maintaining the English tradition of making handmade watercolour paper for artists. Two Rivers was formed in 1976 and relocated to Pitt Mill, ……

#8 Ilford Galerie Textured Cotton Rag 310gsm

Domain Est. 2020

Website: fineartpapers.ie

Key Highlights: Ilford Galerie Textured Cotton Rag 310gsm paper is a soft textured (low tooth), 100% cotton based paper with no optical brighteners ensuring maximum archival ……

Expert Sourcing Insights for Rag Papaer

H2 2026 Market Trends for Rag Paper

As we look toward the second half of 2026, the rag paper market is poised for continued evolution driven by sustainability imperatives, niche demand growth, and technological innovation. Here are the key trends expected to shape the market in H2 2026:

1. Accelerated Demand from Sustainable and Luxury Sectors

Rag paper, traditionally made from cotton or linen fibers, will see heightened demand from high-end stationery, archival, and luxury packaging industries. As corporate sustainability goals intensify, brands will increasingly turn to rag paper as a premium, biodegradable alternative to wood-pulp-based papers. Its long fiber strength and archival quality make it ideal for certificates, fine art prints, and heirloom-quality products.

2. Supply Chain Pressures and Raw Material Sourcing

A key challenge in H2 2026 will be securing consistent supplies of high-quality cotton and linen rags. With rising competition for recycled textiles from the fashion and apparel recycling sectors, rag paper manufacturers may face upward pressure on raw material costs. This will likely drive investments in closed-loop recycling systems and partnerships with textile waste processors.

3. Technological Advancements in Processing

Innovations in de-inking and fiber purification technologies will improve the efficiency and environmental footprint of rag paper production. By H2 2026, several manufacturers are expected to implement AI-driven sorting systems and waterless processing techniques, reducing energy and water consumption—key selling points for eco-conscious buyers.

4. Regulatory Support and Green Certification Growth

Global environmental regulations, especially in the EU and North America, will increasingly favor papers with high post-consumer recycled content and low carbon footprints. Rag paper, which often qualifies for green certifications like FSC Recycled or EU Ecolabel, will benefit from compliance-driven procurement in government and institutional sectors.

5. Niche Expansion in Artisanal and Custom Markets

The maker economy and demand for personalized products will fuel growth in custom rag paper offerings. Printmakers, calligraphers, and boutique wedding stationers will drive demand for specialty finishes, colors, and textures. Online marketplaces and direct-to-consumer platforms will enable small mills to reach global audiences more effectively.

6. Price Premium and Market Differentiation

Rag paper will maintain a significant price premium over conventional paper, reinforcing its positioning as a luxury or specialty product. However, this premium will be increasingly justified by proven sustainability metrics and superior performance, allowing producers to command higher margins in competitive markets.

Conclusion

In H2 2026, the rag paper market will remain a high-value, niche segment defined by environmental responsibility and craftsmanship. While supply chain constraints and cost challenges persist, innovation and growing consumer preference for sustainable materials will underpin steady market growth. Companies that invest in traceability, transparency, and eco-efficient production will be best positioned to capitalize on these trends.

Common Pitfalls in Sourcing Rag Paper: Quality and Intellectual Property Concerns

Sourcing rag paper—paper made primarily from cotton or linen fibers—can present several challenges, particularly when it comes to maintaining consistent quality and ensuring compliance with intellectual property (IP) standards. Understanding these pitfalls is essential for businesses in industries such as luxury packaging, archival printing, art supplies, and high-end stationery.

Quality-Related Pitfalls

1. Inconsistent Fiber Content and Purity

One of the most common quality issues is misleading or inconsistent fiber composition. True rag paper should contain a high percentage of cotton or linen fibers (typically 75–100%). However, some suppliers may blend rag fibers with wood pulp or lower-grade materials without clear disclosure, resulting in reduced durability, absorbency, and archival quality.

2. Variability in Manufacturing Processes

Rag paper quality heavily depends on manufacturing methods. Poor pH control, improper sizing, or inconsistent drying can lead to issues like yellowing, brittleness, or ink bleeding. Sourcing from manufacturers without standardized production protocols increases the risk of batch-to-batch inconsistency.

3. Lack of Certification and Testing

Without third-party certifications (e.g., ISO 9706 for archival permanence), it can be difficult to verify claims about longevity, acid-free composition, or resistance to degradation. Buyers may unknowingly purchase paper unsuitable for long-term use or sensitive applications.

4. Supply Chain Transparency Issues

The origin of raw materials (e.g., recycled cotton rags vs. virgin cotton linters) significantly impacts quality. A lack of transparency in the supply chain makes it hard to assess sustainability, ethical sourcing, or contamination risks (e.g., dyes or chemicals from recycled fabrics).

Intellectual Property-Related Pitfalls

1. Unauthorized Use of Branded or Proprietary Paper

Some high-end rag papers are trademarked or patented by specific manufacturers (e.g., certain watermark designs, textures, or finishes). Sourcing generic versions that closely mimic protected designs can lead to IP infringement claims, especially in competitive markets like luxury goods.

2. Misrepresentation of Origin or Heritage Claims

Suppliers may falsely claim that their rag paper is produced using traditional methods or comes from a renowned region (e.g., “Italian cotton rag” or “French mill”). Such misrepresentations can constitute false advertising and violate geographical indication (GI) protections or trademarks.

3. Counterfeit or Gray Market Materials

In high-demand markets, counterfeit rag paper or diverted stock from authorized channels may enter the supply chain. These materials may lack the quality assurance of genuine products and expose buyers to IP liability, particularly if used in branded end-products.

4. Lack of Licensing for Specialized Treatments

Some rag papers include proprietary coatings, security features, or watermarks protected by patents. Using such paper without proper licensing—especially in official documents, currency, or secure printing—can result in legal action and reputational damage.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require detailed specifications and material certifications from suppliers.

– Conduct independent quality testing, especially for archival or high-performance uses.

– Vet suppliers for ethical sourcing and production transparency.

– Perform IP due diligence, including trademark and patent searches for specialized paper types.

– Use contracts that include warranties on fiber content, origin, and IP compliance.

By proactively addressing both quality and IP concerns, organizations can ensure they source authentic, high-performing rag paper while minimizing legal and reputational risks.

Logistics & Compliance Guide for Rag Paper

Overview of Rag Paper in Supply Chains

Rag paper, made primarily from cotton or linen fibers, is widely used in archival documentation, currency, art, and specialty packaging due to its durability and longevity. Unlike wood-pulp paper, rag paper requires specialized handling and compliance considerations across the logistics chain due to its value, sensitivity, and regulatory implications.

Sourcing and Raw Material Compliance

Ensure all raw materials—especially recycled cotton or linen rags—are sourced from ethical and traceable suppliers. Compliance with environmental and labor regulations such as the EU’s REACH, U.S. EPA guidelines, and the Modern Slavery Act is critical. Certifications like GOTS (Global Organic Textile Standard) or FSC (when applicable) add credibility and ensure sustainable sourcing.

Manufacturing and Production Standards

Production facilities must adhere to ISO 9001 (quality management) and ISO 14001 (environmental management) standards. Water and chemical usage during pulping and bleaching must comply with local environmental regulations. Avoid chlorine-based bleaching; opt for oxygen or hydrogen peroxide methods to meet eco-compliance standards.

Packaging Requirements

Use acid-free, recyclable, or biodegradable packaging to preserve the integrity of rag paper. Clearly label packages with handling instructions (e.g., “Fragile,” “Keep Dry”). Include batch numbers and production dates for traceability. Avoid plastic where possible to align with sustainability goals.

Storage Conditions

Store rag paper in a climate-controlled environment (temperature: 18–22°C; humidity: 40–50%) to prevent mold, brittleness, or warping. Keep away from direct sunlight and pollutants. Use pallets and shelving to prevent floor moisture absorption. Implement FIFO (First In, First Out) inventory rotation.

Transportation and Handling

Use enclosed, dry vehicles with temperature monitoring for long-distance shipping. Secure loads to prevent shifting. Train personnel in proper handling techniques to avoid creasing, tearing, or contamination. For international shipments, comply with ISPM 15 regulations for wooden packaging materials.

Import/Export Regulations

Verify customs classification under HS Code 4802 or 4806 (depending on form and use). Declare accurate fiber composition (e.g., 100% cotton rag) to avoid misclassification. Ensure compliance with country-specific import restrictions, especially in regions with strict environmental or cultural heritage laws (e.g., EU Ecolabel requirements).

Environmental and Recycling Compliance

Rag paper is inherently recyclable but may require separate waste streams due to its high fiber quality. Follow local waste disposal regulations and consider take-back programs. Document recycling rates and sustainability efforts for corporate reporting and ESG compliance.

Documentation and Traceability

Maintain comprehensive records including certificates of origin, mill test reports, shipping manifests, and compliance certifications. Utilize digital tracking systems (e.g., blockchain or ERP modules) to ensure end-to-end traceability from rags to finished paper.

Quality Assurance and Testing

Conduct regular testing for pH levels (neutral to slightly alkaline), tear resistance, and archival stability (per ISO 9706). Third-party lab certification enhances market trust and meets compliance demands in sectors like government and museum archiving.

Disposal and End-of-Life Management

Even degraded rag paper should be disposed of responsibly. Partner with certified recycling facilities familiar with cotton-based paper. Avoid incineration unless in approved waste-to-energy plants with emissions controls.

Conclusion

Managing rag paper logistics requires a balance of preservation, regulatory compliance, and sustainability. By adhering to industry standards and proactive documentation, businesses can ensure the safe, legal, and environmentally sound movement of rag paper across global supply chains.

Conclusion for Sourcing Rag Paper

In conclusion, sourcing rag paper requires a careful balance between quality, sustainability, cost, and reliability of supply. As a premium paper made from cotton or linen fibers, rag paper offers superior durability, archival quality, and a luxurious feel, making it ideal for certificates, artistic prints, high-end stationery, and preservation purposes. When sourcing, it is essential to identify reputable suppliers who provide transparency regarding fiber content, production processes, and environmental practices.

Building long-term relationships with trusted vendors, verifying certifications (such as acid-free or 100% cotton), and requesting samples before bulk purchases can ensure consistency and performance. Additionally, considering factors like environmental impact and ethical sourcing aligns with growing consumer and corporate demands for sustainable materials.

Ultimately, successful sourcing of rag paper not only supports product quality and brand integrity but also contributes to sustainable and responsible consumption. By prioritizing both performance and principles, businesses and individuals can make informed decisions that meet their needs while supporting environmentally sound practices.