The global rack end manufacturing industry is experiencing steady growth, driven by rising demand for precision components in automotive, industrial machinery, and construction sectors. According to Grand View Research, the global automotive steering systems market—where rack ends play a critical role—was valued at USD 38.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing vehicle production, especially in emerging economies, and the growing emphasis on vehicle safety and performance. As integral components of rack and pinion steering systems, rack ends are seeing heightened demand for durability, corrosion resistance, and OEM-level precision. With the global push toward electric and autonomous vehicles, the need for reliable, high-performance rack end solutions continues to rise, positioning leading manufacturers at the forefront of innovation and supply chain stability. In this evolving landscape, the top nine rack end manufacturers have distinguished themselves through technological expertise, global reach, and compliance with stringent industry standards.

Top 9 Rack End Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DLZ Chassis Parts

Domain Est. 2005

Website: dlz.com.cn

Key Highlights: DLZ is a global pioneer in technology development, manufacture and distribution of auto steering and suspension parts….

#2 15869897 – Products

Domain Est. 2020

Website: carico-auto.com

Key Highlights: RACK END · TIE ROD END · BRAKE SYSTEM · BRAKE DISC · BRAKE DRUM · ENGINE SYSTEM … Company legally registered in Taiwan, official company documents available on ……

#3 Rack Ends Manufacturer

Domain Est. 2023

Website: at-suspension.com

Key Highlights: RACK END. The Rack End is a critical component connecting the steering rack (Rack) to the steering tie rod (Tie Rod) within the vehicle’s steering system….

#4 Wholesale Rack End Manufacturer

Domain Est. 2024

Website: sejautoparts.com

Key Highlights: At Sej Auto Parts, we specialize in manufacturing high-performance rack ends designed to meet OEM standards for durability, fitment, and reliability. Trusted ……

#5 Tie Rod End

Domain Est. 2003

Website: manufacturers.com.tw

Key Highlights: Lists of Taiwan & China Tie Rod End manufacturers & suppliers that are carefully selected to ensure high directory accuracy. They supply top quality tie rod ……

#6 TRW

Domain Est. 1996

Website: aftermarket.zf.com

Key Highlights: TRW solutions save you time and money, inspire customers and function perfectly for longer. TRW is part of ZF company with an amazing heritage that’s shaping ……

#7 Steering Suspension and Rubber Components

Domain Est. 2018

Website: autokoi.com

Key Highlights: Autokoi specializes in steering suspension and rubber components with focus on the vehicle chassis….

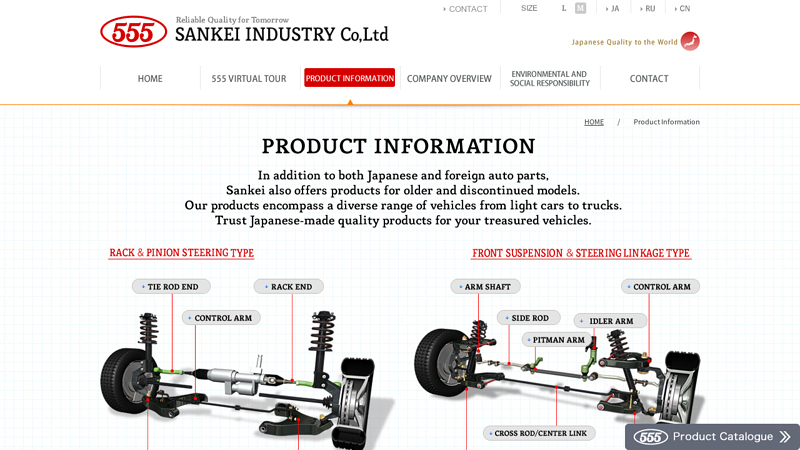

#8 Product Information

Website: sankei-555.co.jp

Key Highlights: RACK END. [Members Only]Product brochure site. Experience smooth steering control. Sankei offers a wide selection for vehicles ranging from light cars to ……

#9 Tie Rod Ends MASUMA

Website: masuma.parts

Key Highlights: Looking for tie rod ends for your car? Original spare parts MASUMA — High-quality Car Parts Brand for Aftermarket. Our products cover 80% of spare parts ……

Expert Sourcing Insights for Rack End

H2: 2026 Market Trends Forecast for Rack End

As we approach 2026, the market landscape for Rack End — a hypothetical or niche product, component, or brand within the industrial, automotive, or data infrastructure sector — is expected to undergo significant transformation driven by technological innovation, supply chain evolution, and shifting customer demands. While specific public data on “Rack End” may be limited, broader industry trends can be leveraged to forecast its trajectory.

-

Increasing Demand for Modular and Customizable Solutions

By 2026, end-users across industries such as data centers, automotive manufacturing, and material handling are prioritizing modular rack systems with customizable end components. Rack End solutions are expected to evolve toward plug-and-play designs that support rapid deployment and reconfiguration. This trend is fueled by the need for scalability in cloud infrastructure and smart factories. -

Integration with Smart Technology and IoT

Rack End components are likely to incorporate sensor-ready features or embedded connectivity by 2026, enabling real-time monitoring of load distribution, temperature, and structural integrity. This shift toward smart racks supports predictive maintenance and operational efficiency, particularly in data centers and automated warehouses. -

Sustainability and Material Innovation

Environmental regulations and ESG (Environmental, Social, and Governance) goals are pushing manufacturers to adopt recyclable and lightweight materials. By 2026, Rack End products may increasingly utilize high-strength composites, recycled metals, or bio-based polymers to reduce carbon footprints and meet green building certifications. -

Supply Chain Localization and Resilience

Ongoing geopolitical tensions and logistics disruptions are prompting companies to reshore or nearshore production. By 2026, Rack End suppliers may establish regional manufacturing hubs in North America, Europe, and Southeast Asia to improve delivery times and reduce dependency on single-source suppliers. -

Growth in E-Commerce and Automation

The continued expansion of e-commerce is accelerating demand for automated storage and retrieval systems (AS/RS), where Rack End components play a critical role in structural integrity and safety. Increased investment in warehouse automation is expected to drive market demand, especially in last-mile distribution centers. -

Competitive Landscape and Consolidation

By 2026, the Rack End market may see consolidation among component suppliers as larger industrial equipment manufacturers acquire niche players to expand their system integration capabilities. This could lead to standardized interfaces and improved interoperability across rack systems.

Conclusion

The 2026 outlook for Rack End is shaped by digitalization, sustainability, and supply chain agility. Companies that innovate in smart integration, eco-friendly design, and flexible manufacturing will be best positioned to capture market share. As infrastructure modernization accelerates globally, Rack End components are poised to become more intelligent, sustainable, and integral to next-generation industrial ecosystems.

Common Pitfalls Sourcing Rack Ends (Quality, IP)

Sourcing rack ends—critical components in automotive steering systems—can present several challenges, particularly concerning quality consistency and intellectual property (IP) risks. Being aware of these pitfalls helps ensure reliable supply and protects your organization legally and operationally.

Inconsistent Quality and Dimensional Tolerances

Rack ends must meet tight tolerances to ensure proper fit, function, and durability in steering assemblies. Sourcing from low-cost suppliers, especially without rigorous quality oversight, often results in inconsistent material quality, poor heat treatment, or substandard threading. These issues can lead to premature wear, play in the steering system, or even catastrophic failure—posing safety risks and increasing warranty claims.

Use of Non-OEM or Counterfeit Components

Some suppliers may offer rack ends that appear identical to OEM parts but are reverse-engineered or counterfeit. These components may not undergo the same validation testing or use equivalent materials. Over time, this leads to reduced performance and reliability. Additionally, using such parts may violate customer specifications or void vehicle warranties.

Intellectual Property Infringement

Many rack end designs are protected by patents or are considered proprietary by OEMs or Tier 1 suppliers. Sourcing from suppliers who replicate patented designs—especially without licensing—exposes your company to IP litigation. This is particularly common when sourcing from regions with weaker IP enforcement, where designs may be copied without authorization.

Lack of Traceability and Certification

Reliable sourcing requires full traceability of materials and manufacturing processes. Suppliers that lack proper documentation—such as material certifications, heat treatment records, or inspection reports—introduce risk into the supply chain. In regulated industries like automotive, missing certifications can result in audit failures or non-compliance with standards like IATF 16949.

Inadequate Testing and Validation

Some suppliers may claim compliance but do not conduct proper performance testing—such as load testing, corrosion resistance, or endurance cycles. Without independent validation, there’s no assurance the rack ends will perform under real-world conditions, increasing the risk of field failures.

Supply Chain Transparency Gaps

Hidden subcontracting is a common issue: a quoted supplier may outsource production to a lower-tier manufacturer without disclosure. This reduces control over quality and IP compliance and makes it difficult to audit manufacturing practices or enforce contracts.

Avoiding these pitfalls requires due diligence—including supplier audits, IP clearance checks, rigorous quality agreements, and ongoing performance monitoring—to ensure both product integrity and legal compliance.

Logistics & Compliance Guide for Rack End

This guide outlines the essential logistics procedures and compliance requirements for managing Rack End operations efficiently and in accordance with applicable regulations.

Overview of Rack End Operations

Rack End refers to the management of reusable transport packaging—specifically racks and containers—used in supply chains for transporting goods, particularly in industries such as automotive, retail, and manufacturing. These systems aim to streamline material handling, reduce waste, and improve inventory accuracy.

Logistics Management

Inbound & Outbound Logistics

- Coordinate with suppliers and customers to ensure timely delivery and retrieval of racks.

- Implement tracking systems (e.g., RFID or barcoding) to monitor rack movements.

- Schedule pickups and deliveries based on demand forecasts and return cycles.

- Maintain buffer stock at key distribution points to prevent disruptions.

Storage & Handling

- Store racks in designated areas to prevent damage and ensure easy access.

- Follow proper stacking guidelines to maintain safety and structural integrity.

- Conduct routine inspections for wear, damage, or contamination.

Transportation Requirements

- Use compatible transport vehicles that support rack dimensions and weight loads.

- Secure racks during transit to prevent shifting or damage.

- Partner with carriers experienced in handling reusable packaging systems.

Compliance Requirements

Regulatory Standards

- Adhere to OSHA guidelines for workplace safety during rack handling and storage.

- Comply with DOT regulations for transportation of heavy or oversized loads, if applicable.

- Follow environmental regulations regarding the cleaning and disposal of damaged racks.

Industry-Specific Compliance

- Automotive: Meet OEM-specific rack specifications and return protocols (e.g., AIAG standards).

- Food & Beverage: Ensure racks are sanitized and made from food-grade materials if used in consumable supply chains.

- Retail: Align with vendor compliance programs regarding labeling, tracking, and return timelines.

Sustainability & Environmental Compliance

- Recycle or refurbish damaged racks in accordance with local environmental laws.

- Document recycling efforts to support corporate sustainability reporting.

- Minimize carbon footprint by optimizing return logistics and reducing empty miles.

Documentation & Reporting

Key Documentation

- Rack tracking logs (movement, condition, maintenance)

- Chain-of-custody records during transfers

- Compliance certifications (e.g., material safety data sheets, cleaning records)

Audits & Inspections

- Conduct regular internal audits to verify compliance with logistics procedures.

- Prepare for external audits by customers or regulatory bodies.

- Maintain up-to-date records for at least three years, as required by most standards.

Training & Accountability

Employee Training

- Train staff on safe handling, tracking procedures, and compliance protocols.

- Provide refresher courses annually or when procedures are updated.

Responsibility Matrix

- Assign clear roles for rack management (e.g., Logistics Coordinator, Compliance Officer).

- Define escalation paths for non-compliance or damaged equipment reports.

Continuous Improvement

- Analyze return rates, damage frequency, and turnaround times to identify inefficiencies.

- Collaborate with partners to standardize rack designs and processes.

- Invest in digital tools (e.g., IoT sensors, cloud-based tracking) to enhance visibility and control.

By following this guide, organizations can ensure efficient, safe, and compliant Rack End operations across their supply chain.

Conclusion for Sourcing Rack Ends:

In conclusion, the sourcing of rack ends has been evaluated based on key factors such as quality, cost-efficiency, supplier reliability, compliance with technical specifications, and lead times. After a thorough assessment of potential suppliers and available options, it is recommended to partner with a supplier that offers high-precision, durable rack ends made from suitable materials (e.g., hardened steel or engineered polymers, depending on application), ensuring compatibility with the existing rack and pinion systems.

Prioritizing suppliers with certifications (such as ISO standards), consistent production quality, and strong after-sales support will contribute to long-term operational reliability and reduced maintenance costs. Additionally, establishing a strategic sourcing agreement can provide volume-based pricing advantages and secure supply continuity.

Ultimately, the successful sourcing of rack ends hinges on balancing performance requirements with economic feasibility, thereby supporting system efficiency, safety, and overall project success.