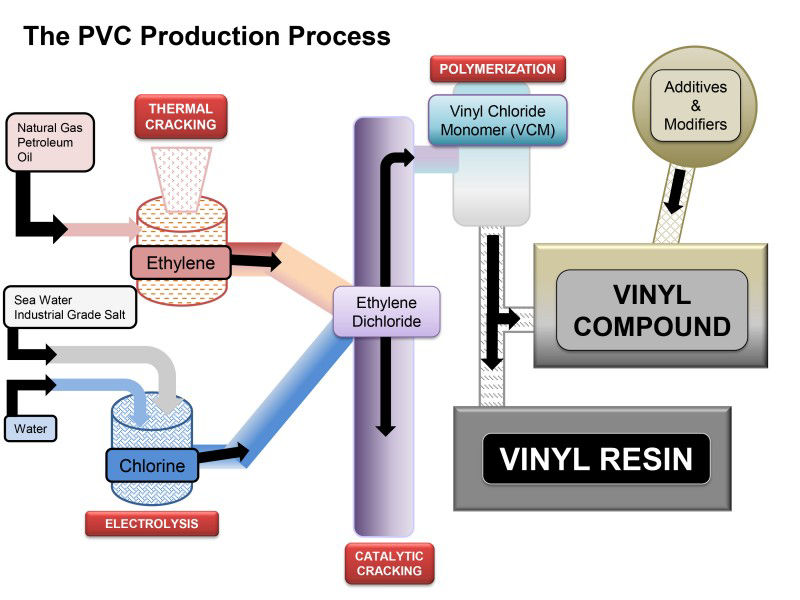

The global PVC vinyl fabric market is experiencing robust growth, driven by rising demand across industries such as construction, automotive, healthcare, and upholstery. According to Grand View Research, the global PVC flooring market—closely tied to vinyl fabric applications—was valued at USD 69.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Similarly, Mordor Intelligence reports that the PVC resins market is expected to grow at a CAGR of over 4.5% during the forecast period 2023–2028, underpinned by increasing infrastructure development and the material’s cost-effectiveness, durability, and versatility. This sustained market momentum has positioned PVC vinyl fabric as a preferred choice for indoor and outdoor applications worldwide. As demand intensifies, a select group of manufacturers have emerged as leaders, combining scale, innovation, and global reach to dominate the supply chain. Here, we spotlight the top 9 PVC vinyl fabric manufacturers shaping the industry’s present and future.

Top 9 Pvc Vinyl Fabric Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Westlake Corporation

Domain Est. 1994

Website: westlake.com

Key Highlights: Westlake is a global manufacturer and supplier of materials and essential products used in the housing and construction, packaging and healthcare, ……

#2 Stock Line

Domain Est. 2003

Website: mississippipolymers.com

Key Highlights: Mississippi Polymers is among the leading polyvinylchloride (vinyl) and polyolefin film manufacturers, offering calendered, printed and laminated films….

#3 Vinyl & PVC Coated Fabrics By The Yard

Domain Est. 1998

#4 OMNOVA

Domain Est. 1999

Website: omnova.com

Key Highlights: OMNOVA – A Division of SURTECO, is a global innovator of aesthetic and performance-enhancing surfaces for a variety of applications….

#5 Sioen Industries

Domain Est. 1999

Website: sioen.com

Key Highlights: Sioen is the world market leader in technical textiles and technical apparel, protecting people and their belongings….

#6 Premier Polyfilm Ltd

Domain Est. 2000

Website: premierpoly.com

Key Highlights: Our Products. Range of PVC Flooring · PVC Leather · PVC Film & Sheeting · Walltastic Vinyl Wallpaper · POLYSWIM Pool Liners · AQUALINING PVC Geomembrane….

#7 Rhino Tex

Domain Est. 2018

Website: rhinotex.com

Key Highlights: At Rhino Tex, we sell PVC coated fabric wholesale so that you can get the material you need at a lower rate….

#8 Renegade Plastics

Domain Est. 2021

Website: renegadeplastics.com

Key Highlights: Renegade Plastics is a U.S. supplier of non-toxic, recyclable, lightweight PP fabric that can be used in any industry from agriculture to healthcare….

#9 VinylPlus

Website: vinylplus.eu

Key Highlights: VinylPlus® is the European PVC industry’s commitment to sustainable development, working to improve the sustainability performance of polyvinyl chloride, known ……

Expert Sourcing Insights for Pvc Vinyl Fabric

2026 Market Trends for PVC Vinyl Fabric: Key Developments and Projections

The global PVC vinyl fabric market is poised for continued evolution by 2026, driven by shifting consumer preferences, regulatory pressures, technological innovations, and regional economic dynamics. While maintaining its established presence in traditional sectors, the market will face significant challenges and opportunities that will shape its trajectory.

Sustainability and Regulatory Pressure Intensify

By 2026, environmental concerns will be a dominant force reshaping the PVC vinyl fabric landscape. Increasing global regulations targeting plastic waste, phthalates, and carbon emissions will push manufacturers toward more sustainable practices. Demand will surge for phthalate-free plasticizers (such as DOTP, DINCH, and bio-based alternatives) and PVC formulations with higher recycled content. Major markets, particularly the European Union under the Green Deal and stricter REACH regulations, will lead this shift, forcing global suppliers to adapt. Companies investing in closed-loop recycling systems and transparent supply chains will gain a competitive advantage, while those lagging risk market exclusion.

Growth in Niche and High-Performance Applications

Despite competition from alternative materials, PVC vinyl fabric will maintain strong growth in specific high-value segments. The automotive industry will continue to be a key driver, with demand for durable, easy-to-clean, and aesthetically versatile interior trims, seating, and convertible tops—especially in emerging markets and for cost-effective electric vehicle (EV) models. Additionally, the construction sector will bolster demand for geomembranes, roofing membranes, and inflatable structures due to infrastructure development and climate resilience projects. The healthcare sector will also see sustained use in medical curtains, inflatable medical devices, and protective covers, where hygiene and durability are paramount.

Innovation in Material Science and Product Development

Technological advancements will focus on enhancing performance while reducing environmental impact. By 2026, expect wider commercialization of bio-based PVC alternatives and hybrid materials combining PVC with recycled PET or other polymers to improve recyclability and reduce fossil fuel dependence. Surface treatments will evolve to offer superior UV resistance, anti-microbial properties, and self-cleaning capabilities, expanding applications in outdoor furniture, marine environments, and public spaces. Digital printing technologies will enable greater customization and design flexibility, particularly in the furniture and retail display sectors, appealing to consumers seeking personalized products.

Regional Market Divergence and Competitive Landscape

Market growth will vary significantly by region. Asia-Pacific, led by China, India, and Southeast Asia, will remain the fastest-growing region due to rapid urbanization, industrial expansion, and rising disposable incomes driving demand in construction, automotive, and consumer goods. North America and Europe will experience more moderate growth, heavily influenced by sustainability mandates and mature markets. However, innovation and high-performance applications will sustain value growth in these regions. The competitive landscape will see consolidation among major players seeking economies of scale and R&D capabilities, while niche manufacturers focusing on eco-friendly or specialty products will gain market share through differentiation.

Challenges from Alternative Materials

PVC vinyl fabric will face persistent competition from alternative materials such as polyurethane (PU) leather, thermoplastic polyolefins (TPO), and bio-based textiles. These materials often boast better environmental profiles and are increasingly favored in eco-conscious consumer markets, particularly in fashion and upholstery. To counter this, PVC manufacturers must effectively communicate lifecycle benefits—such as durability, longevity, and recyclability potential—while continuing to improve the material’s sustainability credentials.

In conclusion, the 2026 PVC vinyl fabric market will be characterized by a dual focus: adapting to stringent environmental standards while capitalizing on growth in resilient and specialized applications. Success will depend on innovation, sustainability integration, and strategic positioning within evolving regional and industrial landscapes.

Common Pitfalls When Sourcing PVC Vinyl Fabric: Quality and Intellectual Property Issues

Logistics & Compliance Guide for PVC Vinyl Fabric

Overview

PVC vinyl fabric is a versatile material widely used in industries such as automotive, construction, upholstery, and outdoor applications. Due to its chemical composition and potential environmental impact, shipping and handling PVC vinyl fabric require strict adherence to logistics best practices and regulatory compliance measures. This guide outlines key considerations for the safe and legal transportation, storage, and import/export of PVC vinyl fabric.

Classification and Hazard Identification

PVC vinyl fabric is generally categorized as a non-hazardous material for transport under normal conditions. However, certain additives (e.g., phthalates, flame retardants) may affect classification:

– Check for hazardous components per GHS (Globally Harmonized System) standards.

– Review Safety Data Sheets (SDS) to confirm transport classification.

– If containing restricted substances, may fall under Class 9 (Miscellaneous Dangerous Goods) for air or sea freight.

Packaging and Handling

Proper packaging ensures product integrity and safety during transit:

– Roll goods should be tightly wound on robust cores and wrapped in protective film (e.g., polyethylene).

– Use edge protectors and cardboard sleeves to prevent damage.

– Secure rolls on pallets with stretch wrap or strapping; avoid overhang.

– Label packages clearly with product details, batch numbers, and handling instructions (e.g., “This Side Up,” “Protect from Moisture”).

Storage Conditions

To maintain quality and prevent degradation:

– Store in a cool, dry, and well-ventilated area away from direct sunlight.

– Ideal temperature range: 10°C to 30°C (50°F to 86°F).

– Keep away from heat sources, open flames, and oxidizing agents.

– Avoid prolonged stacking to prevent flattening or creasing.

Transportation Regulations

Compliance with international and regional transport rules is essential:

– Road (ADR): Not typically classified as hazardous unless containing regulated plasticizers. Verify with SDS.

– Sea (IMDG Code): Declare accurately; most PVC fabrics ship as general cargo.

– Air (IATA): Confirm non-hazardous status; some treated fabrics may require testing.

– Use freight forwarders experienced in textile or chemical-adjacent materials.

Import/Export Compliance

Trade of PVC vinyl fabric is subject to regulatory scrutiny in many countries:

– REACH (EU): Ensure compliance with SVHC (Substances of Very High Concern) restrictions, especially phthalates like DEHP, DBP, and BBP.

– RoHS (EU & China): Applies if used in electrical/electronic applications; restricts certain hazardous substances.

– TSCA (USA): Comply with EPA regulations on chemical reporting and use.

– Proposition 65 (California): Disclose if product contains listed chemicals (e.g., lead, certain phthalates).

– Provide accurate HS (Harmonized System) codes (e.g., 3921.12 or 5903.20) for customs clearance.

Environmental and Sustainability Considerations

Increasing focus on eco-compliance affects PVC vinyl logistics:

– Recyclability and end-of-life disposal must be addressed per local regulations (e.g., WEEE, ELV in EU).

– Some regions restrict landfill disposal of PVC; promote take-back or recycling programs.

– Consider eco-labels (e.g., OEKO-TEX®, Bluesign®) to meet buyer sustainability requirements.

Documentation Requirements

Maintain thorough records for compliance and traceability:

– Commercial Invoice

– Packing List

– Bill of Lading/Air Waybill

– Certificate of Origin

– SDS (Safety Data Sheet)

– REACH/ROHS Compliance Declaration

– Import permits (if applicable)

Risk Mitigation Strategies

- Conduct regular audits of suppliers for compliance.

- Train logistics staff on proper handling and emergency procedures.

- Insure shipments against damage, delay, or regulatory seizure.

- Use tracking systems for real-time visibility.

Conclusion

Successfully managing the logistics and compliance of PVC vinyl fabric requires a proactive approach to safety, regulation, and documentation. By adhering to international standards and staying informed on evolving chemical regulations, businesses can ensure smooth transportation, avoid customs delays, and maintain market access worldwide.

In conclusion, sourcing PVC vinyl fabric requires careful consideration of quality, supplier reliability, cost-efficiency, and compliance with environmental and safety standards. It is essential to evaluate suppliers based on their manufacturing capabilities, consistency in product quality, adherence to international certifications (such as REACH, RoHS, or ISO), and ability to meet specific customization needs such as thickness, color, texture, and flame resistance. Additionally, building long-term relationships with trustworthy suppliers can enhance supply chain stability and ensure timely delivery. With growing emphasis on sustainability, exploring eco-friendly PVC options or alternative materials may also be prudent for future-proofing sourcing strategies. Overall, a well-structured sourcing approach will ensure the procurement of durable, high-performance PVC vinyl fabric that meets both technical requirements and broader business objectives.