The global PVC fittings market is experiencing robust growth, driven by rising demand in construction, water supply, and infrastructure development. According to Grand View Research, the global PVC pipes and fittings market was valued at USD 52.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by the material’s corrosion resistance, lightweight nature, and cost efficiency compared to traditional piping materials. Mordor Intelligence further projects that increasing urbanization and government investments in water management systems—particularly across Asia-Pacific and the Middle East—are accelerating the adoption of PVC fittings in both residential and industrial applications. As demand surges, a select group of manufacturers has emerged as leaders in innovation, production scale, and global reach. Based on market share, product diversity, and geographic footprint, the following are the top 10 PVC fitting manufacturers shaping the industry in 2024.

Top 10 Pvc Fitting Types Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastic Fittings

Domain Est. 1996

Website: nibco.com

Key Highlights: Plastic fittings made of ABS, PVC, and CPVC-CTS include a range of tees, adapters, elbows, crosses, couplings, bushings, caps, plugs, traps, and unions….

#2 Cresline Plastic Pipe Co.

Domain Est. 1998

Website: cresline.com

Key Highlights: As one of the largest full-line pipe manufacturers, Cresline’s family of companies offers industry leading coast-to-coast service….

#3 JM Eagle™

Domain Est. 2007

Website: jmeagle.com

Key Highlights: JM Eagle · Delivering life’s essentials through the most eco-friendly plastic pipe products on the market. · Express Service Trucks (ESTs) Deliver within 24 hours ……

#4 IPEX Inc.

Domain Est. 2009

Website: ipexna.com

Key Highlights: IPEX Inc. manufactures advanced PVC & CPVC piping systems for several applications for the Canadian market. Learn more….

#5 Finolex Pipes: PVC Pipes & Fittings

Domain Est. 2014

Website: finolexpipes.com

Key Highlights: Explore high-quality PVC pipes and fittings from Finolex, a leading manufacturer. Find durable, reliable solutions for all your construction and plumbing ……

#6 Westlake Pipe

Domain Est. 2021

Website: westlakepipe.com

Key Highlights: From PVC pipe to fittings, Westlake Pipe is pioneering the piping industry, developing innovations that propel your business forward faster and more ……

#7 Spears Manufacturing, PVC & CPVC Plastic Pipe Fittings & Valves

Domain Est. 1996

Website: spearsmfg.com

Key Highlights: ISO9001 Certified – PVC & CPVC Sch 40 and 80 fittings molded from 1/8 – 14 inch….

#8 PVC Schedule 40 Pressure Pipe & Fittings

Domain Est. 1997

Website: charlottepipe.com

Key Highlights: PVC schedule 40 is highly durable, with high-tensile and high-impact strength. It is easy to install and has better sound-deadening qualities than PVC schedule ……

#9 Kraloy Fittings

Domain Est. 1999

Website: kraloyfittings.com

Key Highlights: Kraloy Rigid PVC Fittings includes adapters, couplings, elbows, access fittings, boxes, cover plates, expansion fittings and conduit spacers – virtually any ……

#10 LESSO America

Domain Est. 2012

Website: lessoamerica.com

Key Highlights: LESSO America offers a comprehensive range of pipe fittings products that comply with the ASTM standards, including PVC SCH40 fittings, PVC SCH80 fittings, ……

Expert Sourcing Insights for Pvc Fitting Types

H2: 2026 Market Trends for PVC Fitting Types

The global market for PVC (polyvinyl chloride) fittings is poised for significant evolution by 2026, driven by technological advancements, sustainability initiatives, regulatory changes, and shifting demand across key end-use sectors. As urbanization accelerates and infrastructure development expands—particularly in emerging economies—the demand for durable, cost-effective, and chemically resistant piping solutions continues to grow. This analysis explores key trends shaping the PVC fitting types market in 2026, focusing on product innovation, material improvements, regional dynamics, and sector-specific adoption.

1. Rising Demand for Solvent-Weld and Push-Fit PVC Fittings

By 2026, solvent-weld fittings remain a dominant type due to their reliability, leak-proof joints, and widespread use in residential and commercial plumbing. However, push-fit (or quick-connect) PVC fittings are gaining momentum, especially in retrofit and repair applications. These fittings offer tool-free installation, reducing labor costs and time—a major advantage in fast-paced construction environments. The push-fit segment is expected to record the highest CAGR, supported by growing DIY (do-it-yourself) trends and demand for modular plumbing solutions.

2. Growth in Electrofusion and Flanged Fittings for Industrial Applications

In industrial and municipal water treatment sectors, electrofusion and flanged PVC fittings are seeing increased adoption. Electrofusion fittings provide strong, automated joints ideal for large-diameter pipelines used in water and wastewater management. Flanged fittings, meanwhile, are preferred in high-pressure systems and applications requiring frequent disassembly. With governments investing in water infrastructure upgrades (e.g., in North America and Europe), demand for these specialized fittings is projected to rise steadily through 2026.

3. Shift Toward Sustainable and Recyclable PVC Materials

Environmental concerns are driving innovation in PVC resins. By 2026, manufacturers are increasingly adopting bio-based plasticizers, lead-free stabilizers, and recyclable PVC compounds to meet stringent environmental regulations (e.g., EU REACH and RoHS directives). This shift supports the development of “green” PVC fittings that maintain structural integrity while reducing environmental impact. Recycled PVC content in fittings is also expected to increase, particularly in non-potable water and drainage systems.

4. Regional Market Diversification

Asia-Pacific is expected to remain the largest market for PVC fittings by 2026, fueled by rapid urbanization in India, Southeast Asia, and China. The region’s focus on affordable housing and smart city projects boosts demand for standard compression and socket-type fittings. In contrast, North America and Western Europe show stronger growth in high-performance and specialty fittings due to aging infrastructure replacement and stricter building codes. Latin America and the Middle East are emerging as high-potential markets, with irrigation and desalination projects driving PVC fitting demand.

5. Integration of Smart Technologies and IoT-Enabled Monitoring

While still in early stages, some manufacturers are exploring smart PVC fittings embedded with sensors to monitor flow rates, pressure, and leaks in real time. Though not yet mainstream, this innovation is expected to gain traction by 2026 in industrial and municipal applications, particularly as cities adopt smart water management systems. This trend is likely to influence the design of future PVC fittings, promoting modular and sensor-compatible structures.

6. Competitive Landscape and Consolidation

The PVC fittings market is becoming increasingly competitive, with key players investing in R&D to differentiate product offerings. Companies such as Uponor, GF Piping Systems, Charlotte Pipe, and Supreme Plastics are expanding their portfolios to include specialized fittings for niche applications (e.g., UV-resistant fittings for outdoor use or corrosion-resistant variants for chemical plants). Mergers and acquisitions are expected to increase as firms aim to enhance distribution networks and technological capabilities ahead of 2026.

In conclusion, the 2026 outlook for PVC fitting types reflects a market in transition—balancing traditional reliability with innovation, sustainability, and digital integration. As demand diversifies across geographies and applications, manufacturers that adapt to evolving regulatory, environmental, and performance requirements will be best positioned for long-term growth.

Common Pitfalls When Sourcing PVC Fitting Types (Quality and Intellectual Property)

Logistics & Compliance Guide for PVC Fitting Types

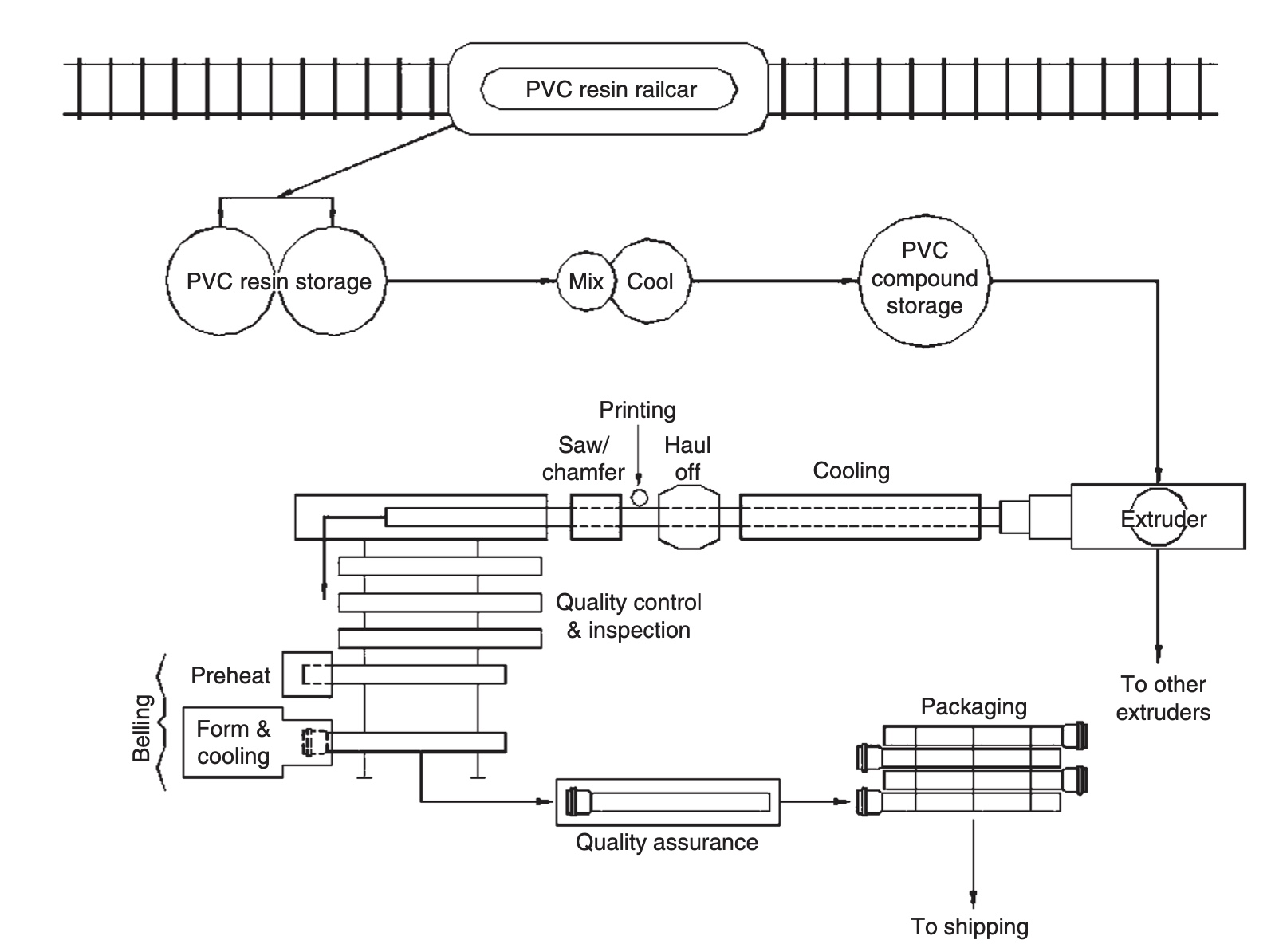

Understanding the logistics and compliance requirements for PVC (polyvinyl chloride) fittings is essential for manufacturers, distributors, contractors, and importers. Proper handling, transportation, storage, labeling, and adherence to regulatory standards ensure safety, performance, and legal compliance across supply chains.

Material Specifications and Standards Compliance

PVC fittings must conform to recognized industry standards to ensure quality and safety. Key compliance standards include:

- ASTM D2466: Standard specification for socket-type PVC fittings for use with PVC pipe.

- ASTM D2467: Standard specification for threaded plastic (PVC) pipe fittings.

- NSF/ANSI 14: Covers plastic piping system components and related materials, ensuring suitability for potable water applications.

- NSF/ANSI 61: Health effects standard for products that contact drinking water; required for fittings used in municipal water systems.

- UL 651 or CSA B137.1: Applicable in fire sprinkler and certain industrial applications.

Ensure all PVC fittings are certified and labeled accordingly, especially when used in potable water, irrigation, or fire protection systems.

Product Classification and Types

Common types of PVC fittings include:

- Elbows (90°, 45°): Change direction of flow.

- Tees: Connect three sections of pipe, either equal or reducing.

- Couplings: Join two pipes in a straight line.

- Reducers: Connect pipes of different diameters.

- Unions: Allow for disassembly without cutting pipes.

- Caps and Plugs: Seal the ends of pipes.

- Adapters: Transition between PVC and other materials (e.g., metal or CPVC).

Each type must meet dimensional tolerances and pressure ratings as defined by ASTM standards.

Packaging and Labeling Requirements

Proper packaging and labeling ensure product integrity and regulatory compliance:

- Packaging: Fitings should be packed in durable, moisture-resistant materials (e.g., corrugated cardboard, shrink-wrapped bundles) to prevent physical damage during transit.

- Labeling: Each package must include:

- Product type and size

- Material designation (e.g., PVC Schedule 40, Schedule 80)

- ASTM specification(s)

- Manufacturer name and batch/lot number

- Compliance markings (NSF, UPC, cUPC where applicable)

- Country of origin (for import/export)

- Handling symbols (e.g., “Fragile,” “Do Not Stack”)

Ensure bilingual labeling (e.g., English and Spanish) in regions where required.

Storage and Handling Guidelines

To maintain product integrity:

- Storage Environment: Store in a dry, shaded area away from direct sunlight and extreme temperatures (ideally 40°F to 100°F / 4°C to 38°C). UV exposure can degrade PVC over time.

- Stacking: Limit stack height to prevent crushing. Use pallets and avoid direct ground contact to reduce moisture absorption and contamination.

- Handling: Use mechanical aids (e.g., forklifts, pallet jacks) for large shipments. Avoid dropping or dragging fittings, which may cause cracks or deformation.

Transportation and Shipping Logistics

- Mode of Transport: PVC fittings are commonly shipped via truck, rail, or sea container. For international shipments, use ISPM 15-compliant wooden pallets or plastic alternatives.

- Securement: Load must be properly secured to prevent shifting. Use stretch wrap, straps, or dunnage as needed.

- Documentation: Include commercial invoice, packing list, bill of lading, and certificates of compliance (e.g., ASTM, NSF). For cross-border shipments, ensure Harmonized System (HS) code 3917.32 or 3917.40 is correctly applied.

- Hazard Classification: PVC fittings are generally non-hazardous, but verify with carriers for any specific requirements.

Import and Export Compliance

- Customs Clearance: Provide accurate product descriptions, material composition, and value declarations. Misclassification can lead to delays or penalties.

- Country-Specific Regulations:

- USA: Comply with EPA and state plumbing codes (e.g., UPC, IPC). NSF certification often required.

- Canada: Requires cUPC certification under CSA B137.1.

- EU: Must comply with REACH and may require CE marking depending on application.

- Australia/NZ: WaterMark certification required for plumbing use under AS/NZS 1260.

Quality Assurance and Traceability

- Implement lot tracking and traceability systems to support recalls or audits.

- Conduct periodic quality checks for dimensional accuracy, joint integrity, and material consistency.

- Maintain compliance documentation for a minimum of 5 years (or per local regulation).

Sustainability and Disposal Considerations

- PVC is recyclable (resin identification code 3). Encourage end-user recycling where facilities exist.

- Waste generated during logistics (e.g., packaging) should be disposed of in accordance with local environmental regulations.

- Some regions restrict the use of certain plasticizers; ensure compliance with RoHS or REACH if applicable.

By adhering to this logistics and compliance guide, stakeholders can ensure that PVC fittings are safely transported, stored, and used in accordance with industry standards and regulatory requirements.

In conclusion, sourcing PVC fitting types requires careful consideration of application requirements, material specifications, pressure and temperature ratings, compliance with industry standards (such as ASTM or NSF), and compatibility with existing piping systems. The wide variety of PVC fittings—such as elbows, tees, couplings, adapters, and unions—serves diverse purposes in plumbing, irrigation, and industrial systems. Selecting the right type and size ensures a durable, leak-free installation and long-term system performance. Additionally, working with reputable suppliers and verifying product certifications are crucial steps in securing high-quality fittings that meet safety and regulatory requirements. Ultimately, a thorough understanding of PVC fitting types and informed sourcing decisions contribute to efficient, cost-effective, and reliable piping solutions.