The global PVC cladding market is experiencing robust growth, driven by rising demand for durable, low-maintenance building materials in both residential and commercial construction. According to Grand View Research, the global PVC wall panels market size was valued at USD 37.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This upward trajectory is fueled by increasing urbanization, advancements in material technology, and a growing preference for sustainable and energy-efficient construction solutions. As one of the most cost-effective and versatile cladding options, PVC has become a go-to choice for architects and developers worldwide. With market expansion comes a competitive landscape of manufacturers pushing innovation in aesthetics, fire resistance, and environmental performance. In this evolving sector, identifying the top performers is key. Here are the top 8 PVC cladding manufacturers leading the industry through product innovation, global reach, and strong market presence.

Top 8 Pvc Cladding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dumaplast: Sustainable PVC wall cladding

Domain Est. 2012

Website: dumaplast.com

Key Highlights: Dumaplast is a leading manufacturer of PVC wall cladding, ceiling cladding, waterproof flooring, outside wall cladding and much more….

#2 Altro Whiterock

Domain Est. 1994

Website: altro.com

Key Highlights: Altro Whiterock high performance wall cladding is the hygienic alternative to tiles that is impact resistant, grout-free and easy to clean – perfect for ……

#3 Advanced PVC Cladding

Domain Est. 1996

Website: timbertech.com

Key Highlights: In both closed- and open-joint applications, TimberTech cladding is a superior choice, providing unsurpassed protection against the elements….

#4 PVC Wall Cladding & Liner Solutions

Domain Est. 1999

Website: palram.com

Key Highlights: Discover Palram’s range of hygienic alternatives to tiles. Suitable for hospitals, commercial kitchens, animal containment, labs, and more!…

#5 Hygienic FRP wall & ceiling cladding

Domain Est. 2000

Website: lamilux.com

Key Highlights: LAMILUX wall and ceiling cladding is certified for use in companies that work according to a HACCP-based food safety programme. The cladding, which is tested by ……

#6 BioClad®

Domain Est. 2000

Website: biocote.com

Key Highlights: Antimicrobial wall cladding panels found in BioClad®’s portfolio are designed to combat bacteria and other microbes to uphold a fully hygienic environment….

#7 PVC Cladding for Ceiling & Walls

Domain Est. 2007

Website: caribbeanawning.com

Key Highlights: Our main product categories: Awnings, Canopies & Tents, Blinds & Shades, Shutters & Garage Doors, Marine, PVC Cladding for Ceiling & Walls, Aluminium, Railings ……

#8 TimberTech Cladding

Domain Est. 2018

Website: azekexteriors.com

Key Highlights: AZEK cladding delivers the rich look of wood without the constant upkeep required with lumber. View stylish open-join and closed-joint cladding here….

Expert Sourcing Insights for Pvc Cladding

H2: 2026 Market Trends for PVC Cladding

The global PVC cladding market is poised for steady growth by 2026, driven by increasing demand for cost-effective, durable, and low-maintenance building materials across residential, commercial, and industrial sectors. Key trends shaping the market include sustainability initiatives, technological advancements, and shifting construction dynamics.

1. Rising Demand in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa are expected to be primary growth drivers for PVC cladding by 2026. Rapid urbanization, expanding infrastructure projects, and a growing middle class are fueling construction activity. Countries such as India, Indonesia, and Nigeria are witnessing increased adoption of PVC cladding due to its affordability and weather resistance compared to traditional materials like wood and metal.

2. Focus on Energy Efficiency and Sustainability

As environmental regulations tighten, manufacturers are investing in eco-friendly PVC formulations. Recyclable and low-VOC (volatile organic compound) PVC cladding solutions are gaining traction. Additionally, PVC cladding’s insulating properties contribute to improved building energy efficiency, aligning with global green building standards such as LEED and BREEAM. This sustainability push is expected to enhance market appeal, especially in Europe and North America.

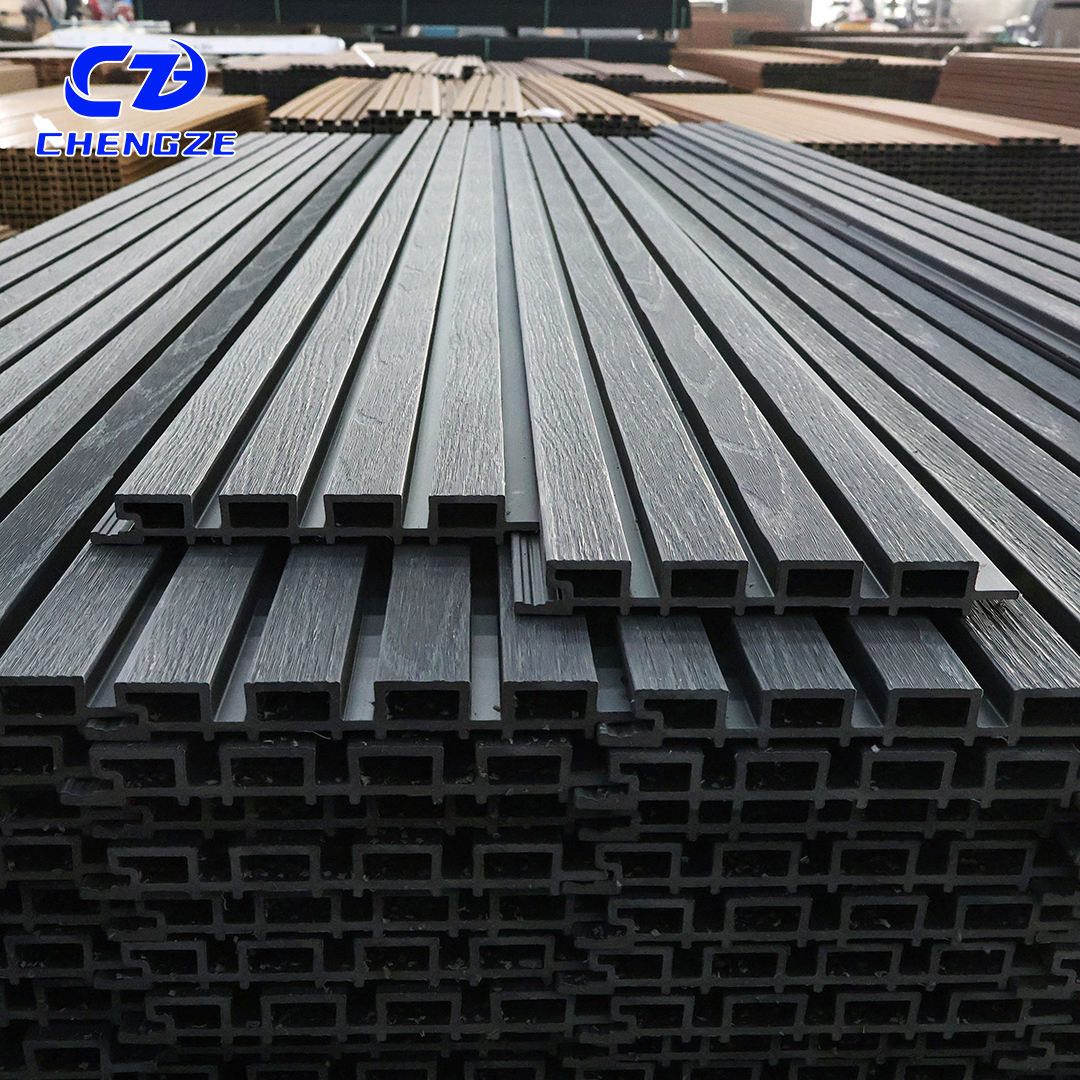

3. Technological Innovation and Aesthetic Enhancement

Advancements in co-extrusion and surface finishing technologies are enabling PVC cladding to mimic natural materials such as wood, stone, and brick with high realism. By 2026, the market will likely see a surge in premium-grade PVC panels offering enhanced UV resistance, color retention, and anti-microbial properties. These innovations are broadening the product’s application in high-end residential and commercial architecture.

4. Growth in Renovation and Retrofitting Projects

With aging building stock in developed regions, there is a growing trend toward retrofitting existing structures. PVC cladding is favored in renovation projects due to its lightweight nature, ease of installation, and minimal disruption. This trend is particularly strong in Western Europe and North America, where energy-efficient retrofits are incentivized by government programs.

5. Competitive Landscape and Regional Shifts

The market is becoming increasingly competitive, with key players focusing on product differentiation, strategic mergers, and expansion into untapped regions. Regional production hubs in China and Southeast Asia continue to dominate supply chains, but localized manufacturing is on the rise to reduce logistics costs and comply with regional building codes.

In conclusion, the PVC cladding market in 2026 will be characterized by innovation, sustainability, and geographic diversification. Stakeholders who prioritize eco-conscious manufacturing, aesthetic versatility, and market responsiveness are well-positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing PVC Cladding: Quality and Intellectual Property Concerns

Sourcing PVC cladding can offer cost-effective and durable solutions for construction projects, but it comes with several potential pitfalls—especially concerning product quality and intellectual property (IP) rights. Being aware of these challenges helps buyers make informed decisions and avoid costly mistakes.

Poor Material Quality and Durability

One of the most frequent issues when sourcing PVC cladding, particularly from low-cost suppliers, is substandard material quality. Inferior PVC formulations may contain excessive fillers, recycled content, or low-grade stabilizers and UV inhibitors. This leads to premature degradation, including fading, chalking, warping, or cracking under weather exposure. Buyers may receive products that fail to meet advertised performance standards or local building code requirements.

Inconsistent Manufacturing Standards

Suppliers—especially those without third-party certifications—may lack consistent quality control processes. This inconsistency can result in variations in color, thickness, profile dimensions, and surface finish across batches. Such discrepancies not only affect the aesthetic outcome but also complicate installation and compromise long-term performance.

Misrepresentation of Product Specifications

Some suppliers may exaggerate or falsify technical specifications such as fire resistance (e.g., incorrect fire rating claims), UV stability, impact strength, or thermal expansion properties. Without independent testing reports or verifiable compliance documentation (e.g., CE marking, ASTM, or ISO standards), buyers risk specifying cladding that does not perform as expected in real-world conditions.

Lack of Traceability and Certification

Reputable PVC cladding should come with traceable documentation, including material safety data sheets (MSDS), test reports, and compliance certificates. Sourcing from suppliers who cannot provide these raises red flags about product legitimacy and regulatory compliance. This absence of documentation can also lead to issues during project inspections or insurance claims.

Intellectual Property Infringement

A significant but often overlooked risk is the unauthorized replication of patented cladding profiles or design systems. Some manufacturers—particularly in regions with weak IP enforcement—may copy the profile geometry, interlocking mechanisms, or surface textures of established brands. Purchasing such products may expose the buyer or contractor to legal liability, especially in markets where IP laws are strictly enforced.

Use of Counterfeit or Branded Imitations

Counterfeit products that mimic well-known brands can infiltrate supply chains, offering lower prices but significantly reduced performance. These products not only breach IP rights but may also bypass safety and environmental regulations. Buyers might unknowingly install subpar materials that compromise building integrity and aesthetics.

Limited Warranty and After-Sales Support

Low-cost or IP-infringing PVC cladding often comes with weak or unenforceable warranties. If issues arise post-installation, the supplier may be unresponsive or unable to honor claims. This lack of support increases long-term maintenance and replacement costs.

Recommendations to Mitigate Risks

To avoid these pitfalls, buyers should:

– Source from reputable manufacturers with verifiable track records and certifications.

– Request independent test reports and full technical documentation.

– Verify IP status of cladding profiles—especially for proprietary designs.

– Include quality assurance clauses and penalties for non-compliance in procurement contracts.

– Conduct pre-shipment inspections or factory audits when sourcing internationally.

By proactively addressing quality and IP concerns, stakeholders can ensure they procure durable, compliant, and legally sound PVC cladding solutions.

Logistics & Compliance Guide for PVC Cladding

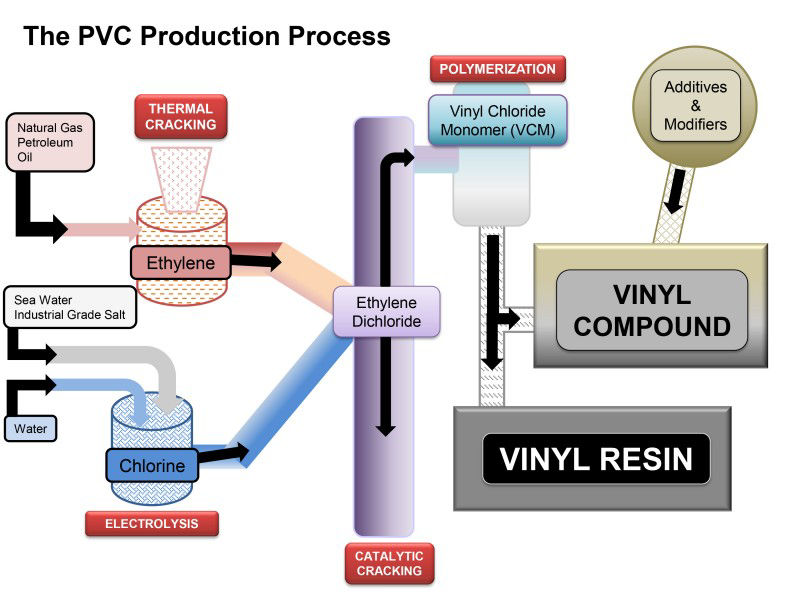

Overview of PVC Cladding

PVC (Polyvinyl Chloride) cladding is a lightweight, durable, and low-maintenance building material widely used for interior and exterior wall coverings. Its resistance to moisture, rot, and insects makes it ideal for various architectural applications. However, transporting and using PVC cladding requires adherence to specific logistics protocols and compliance standards to ensure safety, quality, and regulatory conformity.

Transportation and Handling

- Packaging: PVC cladding panels are typically bundled and wrapped in protective film or shrink-wrapped onto wooden pallets to prevent scratches, moisture exposure, and mechanical damage during transit.

- Loading and Unloading: Use forklifts or pallet jacks to handle full pallets. Avoid dragging or dropping bundles. Ensure even weight distribution when loading into containers or trucks.

- Storage Conditions: Store in a dry, well-ventilated area, preferably indoors. If outdoor storage is necessary, cover with UV-resistant tarpaulins and elevate off the ground to prevent moisture absorption. Keep away from direct sunlight to avoid warping or discoloration.

- Stacking: Limit stack height to manufacturer recommendations (usually no more than 2 meters) to prevent deformation. Place spacers between layers if stacking horizontally.

Import and Export Regulations

- Customs Documentation: Ensure all shipments are accompanied by a commercial invoice, packing list, bill of lading, and certificate of origin. Some countries may require a material safety data sheet (MSDS) or product compliance certificate.

- Tariff Classifications: PVC cladding is generally classified under HS Code 3925.90 (other articles of plastics, for building) or 3926.90 (other plastic articles). Confirm classification with local customs authorities to determine applicable duties.

- Import Restrictions: Certain countries regulate the import of PVC products due to environmental or health concerns (e.g., phthalate content, chlorine emissions). Verify compliance with destination country standards before shipping.

Environmental and Safety Compliance

- REACH (EU): Comply with the EU’s Registration, Evaluation, Authorisation, and Restriction of Chemicals regulation. Ensure PVC cladding does not contain banned or restricted substances such as certain phthalates or heavy metals.

- RoHS (EU): Although primarily for electronics, RoHS principles may influence material choices in construction products. Confirm absence of lead, cadmium, and other hazardous substances.

- VOC Emissions: PVC cladding should meet low volatile organic compound (VOC) emission standards, especially for indoor use. Look for certifications like GREENGUARD or ISO 16000 for indoor air quality.

- Fire Safety: PVC is combustible and may release toxic fumes when burned. Ensure compliance with local fire safety codes (e.g., ASTM E84 or EN 13501-1 for flame spread and smoke development). Fire-retardant additives may be required for certain applications.

Building Code and Certification Requirements

- CE Marking (Europe): Mandatory for construction products placed on the EU market. PVC cladding must be assessed under the Construction Products Regulation (CPR) and carry a CE mark indicating conformity with declared performance (e.g., fire reaction, durability).

- ICC-ES or APA Certification (USA): While not always mandatory, third-party evaluation reports (e.g., ICC-ES Evaluation Reports) can facilitate code compliance and acceptance by building officials.

- Local Building Codes: Verify adherence to regional standards for moisture resistance, thermal performance, and wind load resistance. Some jurisdictions may require specific installation methods or approvals.

Sustainability and Disposal

- Recyclability: PVC is recyclable but requires proper sorting and processing. Encourage end-of-life recycling through certified facilities.

- Waste Management: Follow local regulations for disposal of off-cuts and packaging. Avoid incineration without proper emission controls due to potential dioxin release.

- Environmental Product Declarations (EPD): Provide EPDs to demonstrate environmental impact transparency, supporting green building certifications like LEED or BREEAM.

Quality Assurance and Traceability

- Batch Tracking: Maintain documentation for each production batch, including raw material sources, manufacturing dates, and test results.

- Third-Party Testing: Conduct regular testing for dimensional stability, impact resistance, UV resistance, and fire performance by accredited laboratories.

- Supplier Audits: Audit suppliers of raw materials (e.g., resin, stabilizers) to ensure compliance with environmental and ethical standards.

Conclusion

Successful logistics and compliance for PVC cladding require coordinated efforts across supply chain management, regulatory adherence, and quality control. By following this guide, manufacturers, distributors, and contractors can ensure safe transport, legal import/export, environmental responsibility, and acceptance in target markets. Always consult local regulations and industry standards for project-specific requirements.

Conclusion for Sourcing PVC Cladding:

Sourcing PVC cladding offers a practical and cost-effective solution for both residential and commercial construction projects. Its durability, low maintenance, resistance to moisture and pests, and versatility in design make it an attractive alternative to traditional cladding materials like wood or metal. When sourcing PVC cladding, it is essential to partner with reliable suppliers who provide high-quality, certified products that meet relevant industry standards for fire resistance, UV stability, and environmental safety.

Careful consideration should be given to factors such as product specifications, color retention, warranty, and sustainability practices of the manufacturer. Additionally, evaluating total lifecycle costs—rather than just initial pricing—helps ensure long-term value and performance. With proper sourcing strategies, including due diligence on suppliers and compliance with local building codes, PVC cladding can deliver an aesthetically pleasing, resilient, and economical exterior finish that stands the test of time.