The global PVC bags market is experiencing steady growth, driven by rising demand across retail, packaging, and consumer goods sectors. According to Grand View Research, the global polyvinyl chloride (PVC) market size was valued at USD 58.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This growth is mirrored in the PVC bags segment, where durability, cost-efficiency, and water resistance make them a preferred choice for both branded and generic packaging applications. Additionally, Mordor Intelligence projects that Asia-Pacific will dominate the PVC products market, fueled by expanding manufacturing activities and urbanization in countries like China, India, and Vietnam. As demand rises, a select group of manufacturers has emerged as leaders in production capacity, innovation, and global distribution—shaping the landscape of the PVC bags industry.

Top 10 Pvc Bags Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

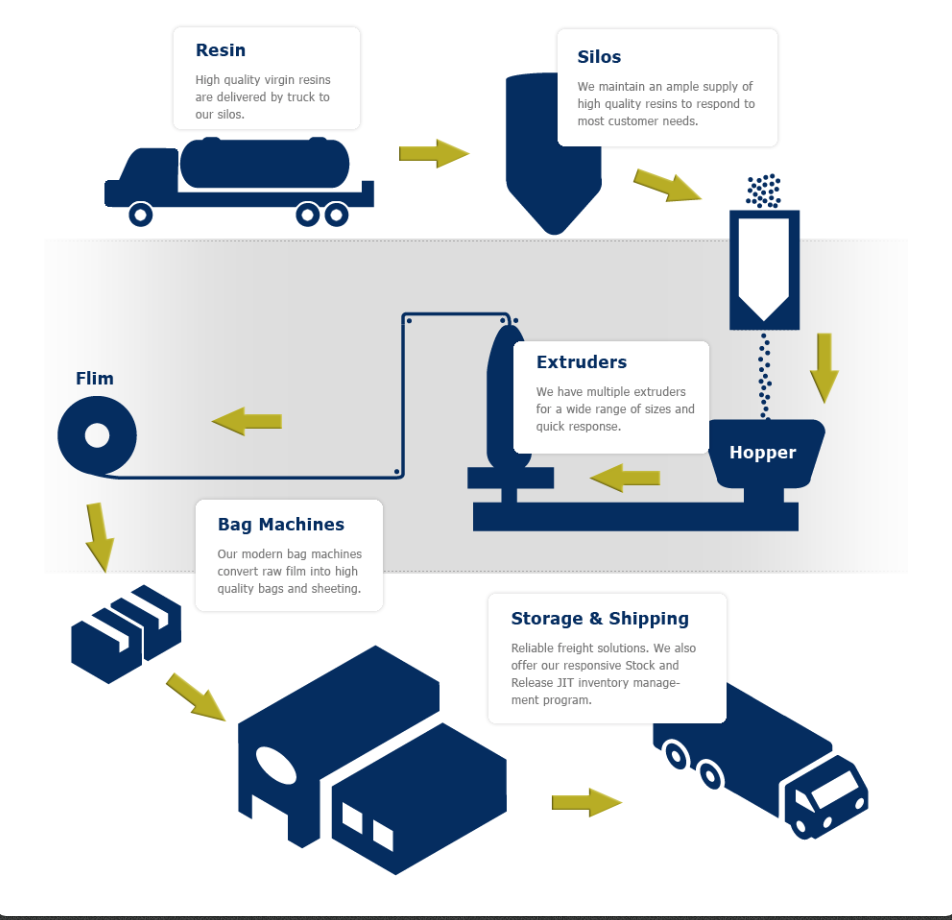

#1 Primary Packaging Inc.: Heavy

Domain Est. 2001

Website: primarypackaging.com

Key Highlights: PPI is a fully-integrated manufacturer of film and bags that services industrial and retail markets with high-quality heavy-duty packaging for demanding ……

#2 Advance Polybag, Inc.: Plastic Bag Manufacturer

Domain Est. 1996

Website: apicorp.com

Key Highlights: Advance Polybag, Inc. is a recognized leader in the plastic bag industry. API manufactures t-shirt bags and produce bags….

#3 M Plastics Inc

Domain Est. 2011

Website: mplasticsinc.com

Key Highlights: M Plastics Inc. A leading custom Packaging Film & Bag Manufacturer located in Los Angeles, CA. We Provide Packaging bags, wholesale poly bags & custom poly ……

#4 Inteplast Group

Domain Est. 1996

Website: inteplast.com

Key Highlights: Inteplast Group is a North American manufacturer that takes pride in sustaining hundreds of industries and the livelihoods of thousands of professionals….

#5 Paper and Plastic Bag Manufacturers

Domain Est. 1996

Website: bulldogbag.com

Key Highlights: Discover premium paper bag options for all your needs. Eco-friendly, stylish, and reusable bags perfect for any occasion….

#6 Greif

Domain Est. 1997

Website: greif.com

Key Highlights: Greif is an industrial packaging products and services leader with a vision to be the best performing customer service company in the world….

#7 Associated Bag

Domain Est. 1998

Website: associatedbag.com

Key Highlights: Associated Bag. Find guaranteed lowest prices on plastic bags, packaging & shipping supplies, boxes, etc. Same day shipping, custom packaging….

#8 Packaging Solutions: Clear Plastic, Paper and Eco

Domain Est. 1999

Website: clearbags.com

Key Highlights: ClearBags provides clear plastic bags, shipping boxes, zipper pouches, and packaging supplies at wholesale prices. Custom and Eco-Friendly options ……

#9 Universal Plastic Bag Manufacturing Co

Domain Est. 1999

#10 Revolution

Domain Est. 2013

Website: revolutioncompany.com

Key Highlights: We manufacture products with up to 100% post-consumer resin. Be a part of something better….

Expert Sourcing Insights for Pvc Bags

2026 Market Trends for PVC Bags

The global PVC (polyvinyl chloride) bags market is poised for notable evolution by 2026, influenced by shifting consumer preferences, regulatory developments, and advancements in material science. This analysis explores the key trends anticipated to shape the PVC bags industry in the coming years.

Rising Demand in Emerging Economies

One of the dominant trends driving the PVC bags market in 2026 is increasing demand from emerging economies in Asia-Pacific, Latin America, and Africa. Rapid urbanization, expanding middle-class populations, and growth in retail and e-commerce sectors are fueling the need for affordable, durable packaging solutions. PVC bags—valued for their water resistance, flexibility, and cost-effectiveness—are being widely adopted in sectors such as fashion accessories, industrial packaging, and consumer goods.

Countries like India, Vietnam, and Indonesia are witnessing a surge in local manufacturing of PVC bags, supported by government initiatives to boost plastic processing industries. This regional growth is expected to account for over 55% of global PVC bag consumption by 2026.

Regulatory Pressures and Environmental Concerns

Despite their utility, PVC bags face mounting scrutiny due to environmental and health concerns. PVC production involves chlorine and can release harmful dioxins, while disposal poses challenges due to slow degradation and potential toxic emissions when incinerated. As a result, several governments and municipalities are tightening regulations on single-use plastics, including certain PVC applications.

By 2026, compliance with environmental standards such as the EU’s Single-Use Plastics Directive and extended producer responsibility (EPR) schemes will be critical for market players. Companies are responding by investing in recyclable PVC formulations and closed-loop recycling systems. The adoption of bio-based plasticizers and chlorine-free PVC alternatives is also gaining momentum to meet sustainability targets.

Innovation in Material Technology

Technological advancements are redefining the PVC bag landscape. In 2026, the market will see broader adoption of modified PVC compounds that offer enhanced recyclability, lower environmental impact, and improved performance. Innovations such as PVC plastisol-free coatings, UV-resistant additives, and antimicrobial finishes are being integrated into bags for specialized uses in healthcare, food packaging, and outdoor gear.

Additionally, manufacturers are exploring hybrid materials—blending PVC with bioplastics or recycled content—to balance durability and eco-friendliness. These innovations are particularly relevant in premium segments, where brands seek to maintain product quality while aligning with green consumer values.

Shift Toward Reusable and Multi-Use Designs

Consumer sentiment is increasingly favoring reusable over disposable products. In response, the PVC bags market is pivoting toward reusable tote bags, cosmetic pouches, and protective cases designed for long-term use. Brands are leveraging PVC’s aesthetic versatility—its ability to be printed, laminated, and textured—to create fashionable, functional products that appeal to environmentally conscious shoppers.

By 2026, the reusable PVC bag segment is projected to grow at a CAGR of 6.8%, outpacing single-use variants. Retailers and fashion labels are incorporating PVC into seasonal collections with recyclable packaging and take-back programs, further enhancing brand sustainability credentials.

Competitive Landscape and Strategic Alliances

The PVC bags market in 2026 will be shaped by consolidation and strategic partnerships. Major chemical and packaging companies are forming alliances with recyclers and technology providers to develop circular economy models. For instance, collaborations between PVC producers and waste management firms aim to scale mechanical and chemical recycling of post-consumer PVC waste.

Moreover, vertical integration is becoming common, with manufacturers acquiring downstream bag producers to control quality and reduce costs. Key players such as LG Chem, Shin-Etsu Chemical, and Formosa Plastics are expanding their specialty PVC portfolios to capture higher-margin applications in medical, automotive, and electronics sectors.

Conclusion

The 2026 outlook for PVC bags reflects a market at a crossroads—balancing functional utility with environmental responsibility. While demand remains strong in developing regions and niche applications, long-term success will depend on innovation, regulatory compliance, and sustainable practices. Companies that invest in eco-friendly materials, circular systems, and consumer education are likely to lead the transformed PVC bags market in the coming years.

Common Pitfalls When Sourcing PVC Bags: Quality and Intellectual Property Issues

Logistics & Compliance Guide for PVC Bags

Overview

Polyvinyl Chloride (PVC) bags are widely used in packaging due to their durability, flexibility, and cost-effectiveness. However, their production, transportation, and disposal are subject to various logistical and regulatory requirements globally. This guide outlines key considerations for the safe and compliant handling, shipping, and documentation of PVC bags across international supply chains.

Regulatory Compliance

Environmental & Chemical Regulations

PVC contains chlorine and may include plasticizers such as phthalates, which are regulated under several international frameworks:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals requires disclosure of Substances of Very High Concern (SVHC). Phthalates like DEHP, DBP, and BBP are restricted in certain applications.

– RoHS (EU): Restriction of Hazardous Substances applies if PVC bags are part of electrical or electronic equipment.

– TSCA (USA): The Toxic Substances Control Act regulates chemical substances, including certain additives used in PVC.

– Proposition 65 (California, USA): Requires warning labels if PVC bags contain chemicals known to cause cancer or reproductive harm (e.g., certain phthalates).

Packaging & Waste Directives

- EU Packaging Waste Directive (94/62/EC): Mandates recyclability, limits on heavy metals, and producer responsibility.

- Extended Producer Responsibility (EPR): Many countries require importers or producers to contribute to the recycling or disposal costs of packaging materials, including PVC.

- Single-Use Plastic Bans: Some regions restrict PVC in single-use bags or packaging due to environmental concerns.

Labeling & Documentation

Product Labeling

- Clearly label PVC content on packaging (e.g., “Made from PVC” or use resin identification code #3).

- Include warnings if restricted substances exceed thresholds (e.g., phthalates under REACH or Prop 65).

- Provide care and disposal instructions (e.g., “Do not incinerate – may release harmful fumes”).

Shipping & Customs Documentation

- Accurate HS Code classification (e.g., 3923.29 for plastic sacks and bags, excluding specific types).

- Safety Data Sheet (SDS) under GHS if transporting in bulk or classified as hazardous.

- Certificate of Compliance (CoC) confirming adherence to regional chemical and safety regulations.

- Declaration of origin and material composition for customs clearance.

Packaging & Handling Requirements

Inner Packaging

- Use protective liners (e.g., polyethylene) to prevent contamination or fusion during transit, especially in high-temperature environments.

- Avoid direct contact with food or sensitive goods unless the PVC is certified as food-grade (e.g., FDA 21 CFR compliant).

Palletization & Unit Load Stability

- Stack bags uniformly to prevent shifting.

- Secure with stretch wrap or strapping, avoiding excessive compression that may damage contents.

- Use edge protectors if necessary to prevent damage during handling.

Transportation Considerations

Temperature Sensitivity

- PVC becomes brittle below 0°C and may soften above 60°C. Avoid exposure to extreme temperatures during transit.

- Use climate-controlled containers for long sea or land shipments in extreme climates.

Ventilation & Storage

- Store in dry, well-ventilated areas away from direct sunlight to prevent degradation.

- Avoid prolonged contact with metals that may catalyze degradation (e.g., copper, zinc).

Hazard Classification

- Most PVC bags are non-hazardous for transport. However, if containing regulated additives or shipped in powder/resin form, verify under:

- IMDG Code (sea)

- IATA DGR (air)

- ADR (road, Europe)

Sustainability & End-of-Life

Recycling Challenges

- PVC is recyclable but often excluded from curbside programs due to contamination risks.

- Promote take-back programs or industrial recycling partnerships.

- Consider alternatives like polyolefin-based materials if sustainability is a priority.

Reporting & Certifications

- Maintain records for EPR compliance.

- Obtain certifications like ISO 14001 (Environmental Management) or Declare Labels for transparency.

Conclusion

Successfully managing the logistics and compliance of PVC bags requires attention to chemical regulations, accurate documentation, proper handling, and environmental responsibility. Staying informed about evolving global standards ensures smooth international trade and reduces legal and reputational risks. Always consult local regulators and legal experts when entering new markets.

Conclusion for Sourcing PVC Bags:

Sourcing PVC bags can be a cost-effective and practical solution for businesses requiring durable, waterproof, and lightweight packaging or consumer products. The material’s versatility allows for a wide range of applications, from promotional tote bags to protective packaging. However, when sourcing PVC bags, it is essential to consider factors such as supplier reliability, product quality, environmental impact, and compliance with safety and regulatory standards.

While PVC offers advantages in terms of strength and chemical resistance, its environmental footprint—particularly its non-biodegradable nature and potential release of harmful chemicals during production and disposal—should be carefully evaluated. As sustainability becomes increasingly important, businesses may want to explore eco-friendly alternatives or source from suppliers that offer recyclable or phthalate-free PVC options.

In summary, successful sourcing of PVC bags requires a balanced approach that considers cost, functionality, quality control, and environmental responsibility. Establishing long-term relationships with ethical and certified suppliers, conducting regular quality audits, and staying informed about evolving regulations and sustainable innovations will help ensure a responsible and efficient supply chain.