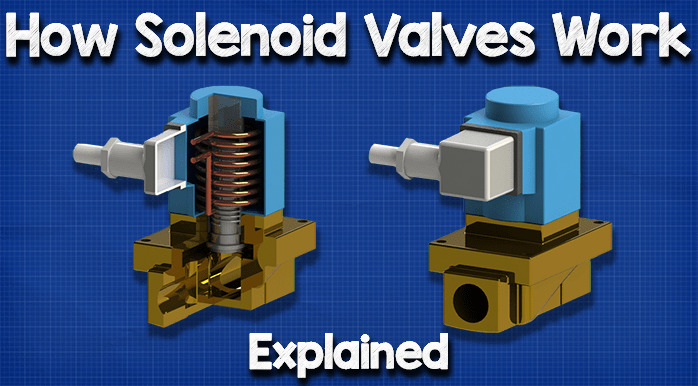

The global solenoid valve market is experiencing robust expansion, driven by increasing automation across industrial, automotive, and HVAC sectors. According to Grand View Research, the global solenoid valve market size was valued at USD 4.87 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Purge control solenoid valves, a critical component in emission control systems—particularly in internal combustion engines and industrial machinery—are benefiting significantly from stricter environmental regulations and the rising demand for precision fluid control. As industries prioritize reliability and compliance, manufacturers of purge control solenoid valves are scaling innovation and production capacity. This growing demand underscores the importance of identifying leading suppliers capable of delivering high-performance, durable solutions. Below are the top 8 purge control solenoid valve manufacturers shaping the industry through technological advancement, global reach, and consistent product quality.

Top 8 Purge Control Solenoid Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Canister Purge Valve

Domain Est. 2004

Website: boschautoparts.com

Key Highlights: Bosch is the Original Equipment Manufacturer (OEM) for this application; OE Technology provides the correct function and calibration to ensure trouble-free ……

#2 Flow Control Valves

Domain Est. 1996

Website: meggitt.com

Key Highlights: Meggitt provide a full range of Whittaker Controls aerospace valves & industrial controls for aircraft, power generation & mechanical drive applications….

#3 31319904

Domain Est. 1994

Website: usparts.volvocars.com

Key Highlights: Genuine Volvo Part # 31319904 – Vapor Canister Purge Solenoid. VALVE. Fits S60, S60 Cross Country, S60 Inscription, S80, V60, V60 Cross Country, V70, XC60, ……

#4 Solenoid Valves

Domain Est. 1995

Website: emerson.com

Key Highlights: Emerson’s ASCO solenoid valves set industry standards for reliability, adaptability and energy efficiency across many applications and industries….

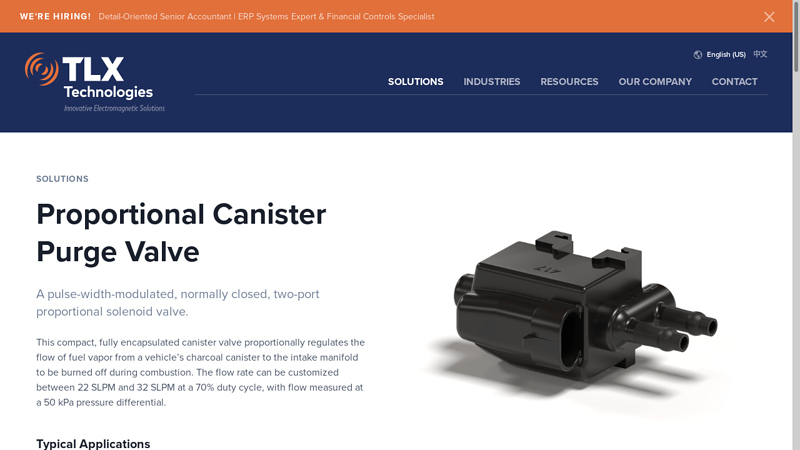

#5 Proportional Canister Purge Valve

Domain Est. 1999

Website: tlxtech.com

Key Highlights: The proportional canister purge valve is a compact, normally closed, fully encapsulated, pulse-width-modulated solenoid valve with a customizable flow rate….

#6 Canister Purge Valves

Domain Est. 2000

Website: standardbrand.com

Key Highlights: Standard® offers a line of canister purge solenoids/valves to help with your emission system repairs in addition to canister vent solenoids. Our high-grade ……

#7 Vapor Canister Purge Solenoid

Domain Est. 2010

Website: wellsve.com

Key Highlights: Wells Vapor Canister Purge Solenoids are engineered and tested to match OE parts in fit, form and function and are compatible with both domestic and imported ……

#8 Purge Valve

Domain Est. 2016

Website: tu-lok.com

Key Highlights: Purge Valve Solenoid is opened moderately when the engine is up and running. This allows the charcoal canisters to burn in the engine. P0445 is a generic code ……

Expert Sourcing Insights for Purge Control Solenoid Valve

2026 Market Trends for Purge Control Solenoid Valve

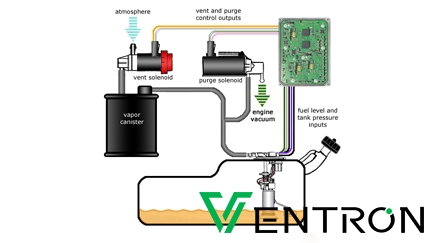

The global market for purge control solenoid valves is poised for significant evolution by 2026, driven by regulatory mandates, technological advancements, and shifting automotive and industrial landscapes. These compact yet critical components, primarily used in evaporative emission control systems (EVAP) in internal combustion engine (ICE) vehicles and increasingly in hybrid models, are experiencing both challenges and opportunities.

Stringent Emission Regulations Driving Demand

Environmental regulations are becoming increasingly rigorous across major markets such as North America, Europe, and China. By 2026, standards like Euro 7 in Europe and Tier 4 in the U.S. are expected to impose tighter controls on hydrocarbon emissions. This regulatory pressure is prompting automakers to enhance EVAP system efficiency, directly increasing the demand for high-precision purge control solenoid valves. These valves play a key role in managing fuel vapor flow from the charcoal canister to the engine intake manifold, ensuring minimal VOC emissions.

Transition to Electrification: A Dual Impact

The rise of electric vehicles (EVs), which do not require purge control solenoid valves due to the absence of fuel systems, presents a long-term challenge to market growth. However, the widespread adoption of hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) offers a counterbalance. These vehicles still utilize internal combustion engines intermittently and thus require functional EVAP systems. By 2026, as hybrid models gain market share, demand for purge control solenoid valves is expected to remain resilient, particularly in regions with gradual EV transition timelines.

Technological Advancements and Miniaturization

Manufacturers are investing in smart valve technologies that offer better diagnostics, enhanced sealing, and improved durability. By 2026, the integration of onboard diagnostics (OBD-II) compatibility and variable duty cycle control is expected to become standard. Additionally, miniaturization and weight reduction are key trends, driven by the need for space-efficient designs in increasingly compact engine compartments. Advanced materials such as high-temperature thermoplastics and corrosion-resistant alloys are being adopted to extend valve lifespan under harsh operating conditions.

Regional Market Dynamics

Asia-Pacific, led by China, India, and Japan, is projected to be the fastest-growing market for purge control solenoid valves by 2026. Rapid industrialization, expanding automotive production, and tightening emission norms in these countries are fueling demand. Meanwhile, North America and Europe will continue to be significant markets, supported by retrofitting programs and the need for compliance with evolving environmental regulations.

Supply Chain and Cost Pressures

Automotive suppliers face ongoing cost optimization pressures. By 2026, there will be a greater emphasis on localized manufacturing and supply chain resilience, especially in the wake of recent global disruptions. This trend favors regional valve manufacturers who can offer competitive pricing and shorter lead times. Additionally, the push for sustainability is leading to increased interest in recyclable components and greener production processes within the solenoid valve industry.

In conclusion, while the long-term outlook is influenced by the shift toward full electrification, the purge control solenoid valve market is expected to maintain steady growth through 2026, supported by hybrid vehicle adoption, regulatory enforcement, and technological innovation.

Common Pitfalls When Sourcing a Purge Control Solenoid Valve (Quality, IP)

Sourcing the right purge control solenoid valve is critical for system performance and reliability, particularly in applications involving emissions control, fuel systems, or industrial processes. However, overlooking key factors related to quality and Ingress Protection (IP) rating can lead to premature failure, safety hazards, or non-compliance. Below are common pitfalls to avoid:

1. Prioritizing Cost Over Quality

One of the most frequent mistakes is selecting a low-cost valve without verifying material quality and manufacturing standards. Cheap valves may use inferior seals, weak coils, or low-grade metals that degrade quickly when exposed to fuel vapors, heat, or pressure fluctuations. This can result in:

– Internal leaks or failure to seal

– Coil burnout due to poor insulation

– Short operational lifespan

Solution: Specify valves from reputable manufacturers with proven track records. Request material certifications and test reports (e.g., burst pressure, cycle life testing).

2. Ignoring Ingress Protection (IP) Rating Requirements

The IP rating defines a valve’s resistance to dust and moisture. Using a valve with insufficient IP protection in harsh environments (e.g., under-hood automotive, outdoor industrial settings) leads to:

– Moisture ingress causing coil short circuits

– Dust accumulation interfering with mechanical operation

– Corrosion of electrical contacts or moving parts

Example: Using an IP65 valve outdoors in heavy rain instead of IP67 or higher can result in water penetration during prolonged exposure.

Solution: Match the IP rating to the operating environment. For wet or high-dust areas, use IP67 (dust-tight and protected against immersion) or IP69K (high-pressure, high-temperature washdown).

3. Assuming All “Automotive-Grade” Valves Are Equal

Many suppliers label valves as “automotive-grade,” but this term is not standardized. Some may meet minimal performance specs, while others comply with OEM-level durability standards (e.g., ISO 16750 for environmental stresses).

Pitfall: Substituting an OEM valve with a generic version that fails under thermal cycling or vibration.

Solution: Require compliance with relevant industry standards and request validation data such as thermal cycling (e.g., -40°C to +125°C), vibration resistance, and salt spray testing.

4. Overlooking Compatibility with Media and Temperature

Purge valves often handle fuel vapors, which can degrade certain elastomers (e.g., NBR seals in high ethanol blends). Additionally, valves near engines face high ambient temperatures.

Pitfall: Selecting a valve with EPDM seals that swell or deteriorate when exposed to hydrocarbon vapors.

Solution: Confirm seal and body material compatibility with the specific media (e.g., FKM/FPM for fuel resistance) and ensure temperature ratings exceed maximum operating conditions.

5. Neglecting Certification and Regulatory Compliance

In applications like automotive or industrial emissions, valves may need certifications such as:

– ATEX/IECEx for explosive atmospheres

– EPA or CARB compliance

– RoHS/REACH for material restrictions

Pitfall: Sourcing non-compliant valves that invalidate system certifications or fail emissions testing.

Solution: Verify all necessary regulatory markings and documentation are provided by the supplier.

6. Failing to Validate Long-Term Reliability Data

Some suppliers provide limited or no lifecycle testing data. Without proof of durability (e.g., 100,000+ cycle life), there’s a risk of unexpected field failures.

Solution: Request third-party or in-house test reports on operational lifespan, leak rate over time, and failure mode analysis.

By addressing these pitfalls—focusing on true quality, appropriate IP protection, material compatibility, and compliance—procurement teams can ensure reliable, long-term performance of purge control solenoid valves in demanding applications.

Logistics & Compliance Guide for Purge Control Solenoid Valve

Overview

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, import/export, and regulatory adherence related to Purge Control Solenoid Valves. These components are commonly used in emission control systems (e.g., in automotive or industrial applications) and may be subject to various environmental, safety, and trade regulations.

Regulatory Compliance

Environmental Regulations

Purge Control Solenoid Valves are often part of evaporative emission control (EVAP) systems and may be regulated under environmental standards such as:

– EPA (U.S. Environmental Protection Agency) – Compliance with Title 40 of the Code of Federal Regulations (CFR), particularly Parts 86 and 1068 for motor vehicle emissions.

– EU Emissions Standards (Euro 5, Euro 6, etc.) – Adherence to Regulation (EC) No 715/2007 and subsequent amendments for vehicle type approval.

– China GB Standards – Compliance with GB 18352.6-2016 for light-duty vehicles.

Ensure product documentation includes certification marks (e.g., EPA, E-mark, CCC) where applicable.

RoHS and REACH Compliance

- RoHS (Restriction of Hazardous Substances Directive 2011/65/EU) – Verify that the valve’s materials do not exceed permissible limits for lead, mercury, cadmium, hexavalent chromium, PBB, PBDE, or phthalates.

- REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) – Confirm that all substances in the valve (especially in plastics, seals, or coatings) are registered and do not contain Substances of Very High Concern (SVHCs) above thresholds.

Electrical Safety Standards

If the solenoid valve includes electrical components:

– IEC 60529 (IP Code) – Ensure appropriate ingress protection rating for dust and moisture (e.g., IP65, IP67).

– UL/CSA/EN Standards – Compliance with safety standards such as UL 508 or EN 60204-1 for industrial controls may be required for certain markets.

Packaging and Labeling

Packaging Requirements

- Use anti-static, shock-resistant packaging to protect sensitive electrical and mechanical components.

- Include desiccants if moisture-sensitive; seal in moisture-barrier bags if necessary.

- Clearly label packages with:

- Product name and part number

- Quantity

- Manufacturer and country of origin

- Handling symbols (e.g., “Fragile,” “This Side Up”)

Labeling for Compliance

- Affix required regulatory marks (e.g., CE, UKCA, FCC, RoHS).

- Include batch/lot number and date of manufacture for traceability.

- For hazardous materials (if applicable), comply with GHS labeling (though most solenoid valves are non-hazardous).

Transportation and Shipping

Domestic and International Shipping

- Classify under correct HS Code (e.g., 8481.80 for valves, or 8536.50 for solenoid-operated electrical apparatus).

- Verify Incoterms (e.g., FOB, EXW, DDP) in contracts to define responsibility for compliance, insurance, and customs clearance.

- Use carriers experienced in handling industrial electronic components.

Hazardous Materials Classification

- Most purge control solenoid valves are non-hazardous for transport (UN3363 does not apply unless containing pressurized gas or hazardous fluids).

- Confirm with manufacturer MSDS/SDS (Safety Data Sheet) to rule out hazardous content.

Storage and Handling

Storage Conditions

- Store in a dry, temperature-controlled environment (typically 5°C to 40°C).

- Avoid exposure to direct sunlight, corrosive atmospheres, or excessive humidity.

- Keep in original packaging until deployment to prevent contamination or damage.

Shelf Life and Inventory Management

- Monitor shelf life, especially for components with rubber seals or lubricants (typical shelf life: 2–5 years).

- Use FIFO (First In, First Out) inventory practices.

- Periodically inspect stored units for packaging integrity and corrosion.

Import and Export Compliance

Export Controls

- Check for ITAR/EAR (U.S. Department of Commerce) restrictions; most solenoid valves are EAR99 (low concern) but verify based on technical specifications.

- For dual-use items, ensure compliance with Wassenaar Arrangement guidelines.

Import Requirements

- Provide accurate commercial invoices, packing lists, and certificates of origin.

- Prepare for customs inspections; declare correct HTS/EU TARIC codes.

- In some countries (e.g., India, Brazil), product certification (BIS, INMETRO) may be required prior to import.

Documentation and Traceability

Required Documentation

- Certificate of Conformity (CoC) for applicable standards

- RoHS/REACH compliance declaration

- Bill of Materials (BOM) for substance disclosure

- Test reports (e.g., pressure, cycle life, temperature)

- Warranty and technical specifications

Traceability

- Maintain lot-level traceability from manufacturer to end-user.

- Record serial numbers (if applicable) and distribution chain data for recalls or audits.

End-of-Life and Recycling

WEEE Compliance (EU)

- Label with the crossed-out wheeled bin symbol.

- Provide take-back or recycling options per WEEE Directive 2012/19/EU.

- Report quantities placed on the market to national authorities.

General Disposal

- Follow local e-waste regulations.

- Do not dispose of in regular landfill; separate metal, plastic, and electronic components for recycling.

Summary

Proper logistics and compliance management for Purge Control Solenoid Valves ensures regulatory adherence, avoids shipment delays, and supports environmental responsibility. Always verify region-specific requirements and maintain thorough documentation throughout the product lifecycle.

Conclusion for Sourcing Purge Control Solenoid Valve

After a comprehensive evaluation of technical specifications, supplier reliability, cost-effectiveness, quality certifications, and lead times, the recommended sourcing strategy for the purge control solenoid valve ensures optimal performance, durability, and compliance with industry standards. The selected supplier offers a high-quality valve that meets the required specifications—including pressure ratings, flow capacity, material compatibility, and environmental resilience—while maintaining competitive pricing and consistent delivery schedules.

Additionally, the supplier has demonstrated strong after-sales support, traceability, and adherence to ISO and other relevant quality management systems, which mitigates supply chain risks. By establishing a long-term partnership with this supplier, the organization can ensure reliable operation of emission control systems, particularly in evaporative emission (EVAP) systems, while supporting sustainability and regulatory compliance goals.

In conclusion, proceeding with the recommended source for the purge control solenoid valve aligns with technical, operational, and strategic procurement objectives, providing a balanced solution that supports product quality, cost efficiency, and supply chain resilience. Continued supplier performance monitoring and periodic reviews are advised to maintain alignment with evolving requirements.