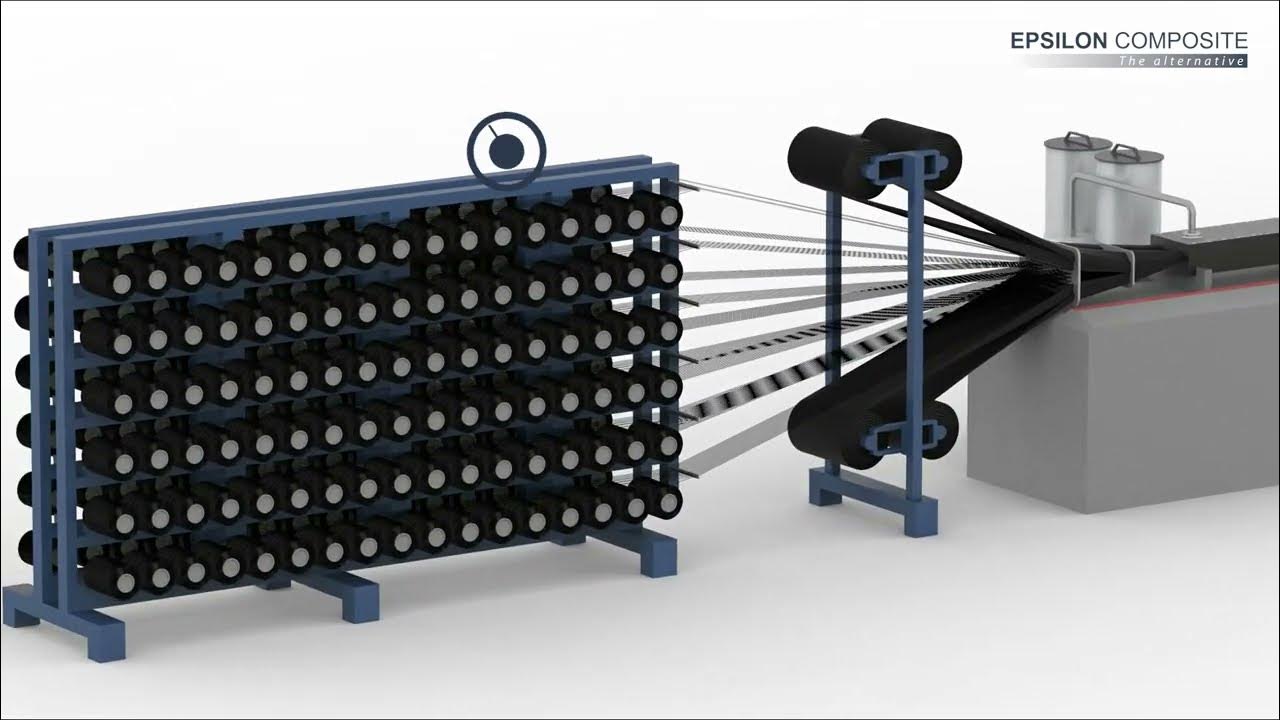

The global pultruded carbon fiber market is experiencing robust growth, driven by increasing demand for lightweight, high-strength materials across aerospace, automotive, wind energy, and infrastructure sectors. According to a 2023 report by Mordor Intelligence, the carbon fiber market is projected to grow at a CAGR of over 10.8% from 2023 to 2028, with pultrusion—a continuous manufacturing process ideal for producing constant-cross-section composite profiles—emerging as a key segment due to its cost-efficiency and scalability. Similarly, Grand View Research valued the global carbon fiber market at USD 4.4 billion in 2022 and forecasts a CAGR of 10.5% from 2023 to 2030, citing advancements in manufacturing technologies and rising adoption in commercial aerospace and renewable energy as primary drivers. As demand for high-performance composites intensifies, a select group of manufacturers has risen to prominence through innovation, scale, and consistency in pultruded carbon fiber production. Below are the top nine companies shaping this dynamic landscape.

Top 9 Pultruded Carbon Fiber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 a pioneer in carbon fiber design & manufacturing

Domain Est. 2003

Website: epsilon-composite.com

Key Highlights: We design and manufacture carbon fiber parts to improve performance and solve challenges for clients in industrial, energy & aerospace sectors….

#2 About Us

Domain Est. 2003

Website: dragonplate.com

Key Highlights: DragonPlate is an industry leader of carbon fiber, advanced composite shapes and custom engineering. We produce carbon fiber products in the USA….

#3 Long Fiber Technology

Domain Est. 2003

Website: avient.com

Key Highlights: We manufacture specialty long fiber composite pellets using a proprietary pultrusion process that melt impregnates continuous carbon, glass or other specialty ……

#4 Toray

Domain Est. 2012

Website: toray-cfe.com

Key Highlights: Carbon Rods and Plates: Our pultruded profiles made from Torayca® Carbon Fibers. Discover our products. Support & Technical Expertise. Toray Carbon Fibers ……

#5 ZOLTEK Corporation – The world’s trusted cost

Domain Est. 1995

Website: zoltek.com

Key Highlights: Wind Energy. Pultruded carbon fiber blades are prevalent in wind turbines, providing strength and durability while maintaining lightweight characteristics….

#6 Hexcel Partners with METYX for High Performance Carbon …

Domain Est. 1995

Website: hexcel.com

Key Highlights: Hexcel Corporation (NYSE: HXL) today announced that it is collaborating with METYX to manufacture high-performance carbon pultruded profiles….

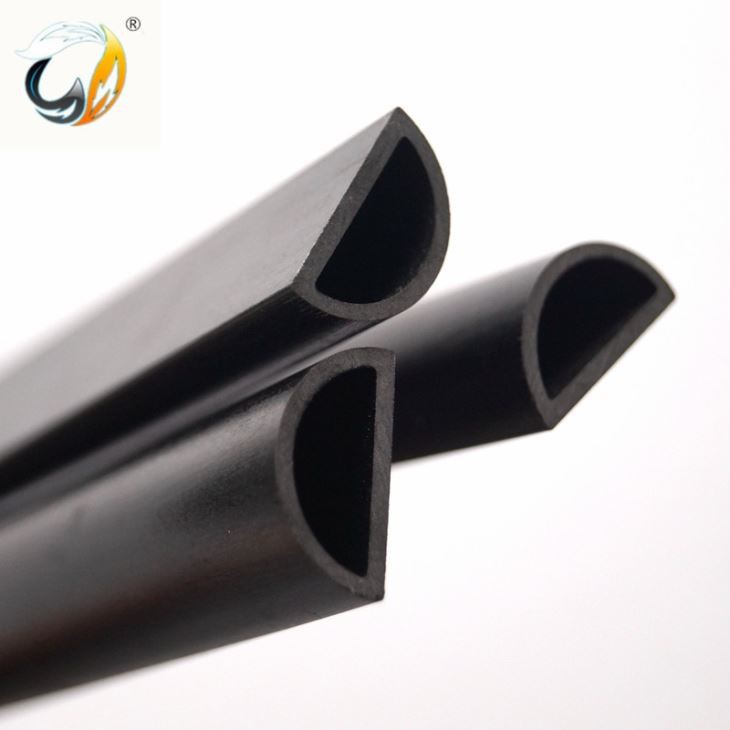

#7 Pultruded Fiberglass and Carbon Fiber Profiles

Domain Est. 2002

Website: fiberprofil.com

Key Highlights: Fiber Profil designs and manufactures high-performance pultruded profiles in fiberglass and carbon fiber, offering machining, drilling, and milling….

#8 Rock West Composites Page

Domain Est. 2009

Website: rockwestcomposites.com

Key Highlights: … Carbon Fiber Tubes · Roll Wrapped Carbon Fiber Tubes · Filament Wound Carbon Fiber Tubes · Pultruded Carbon Fiber Tubes · Pullbraided Carbon Fiber Tubes….

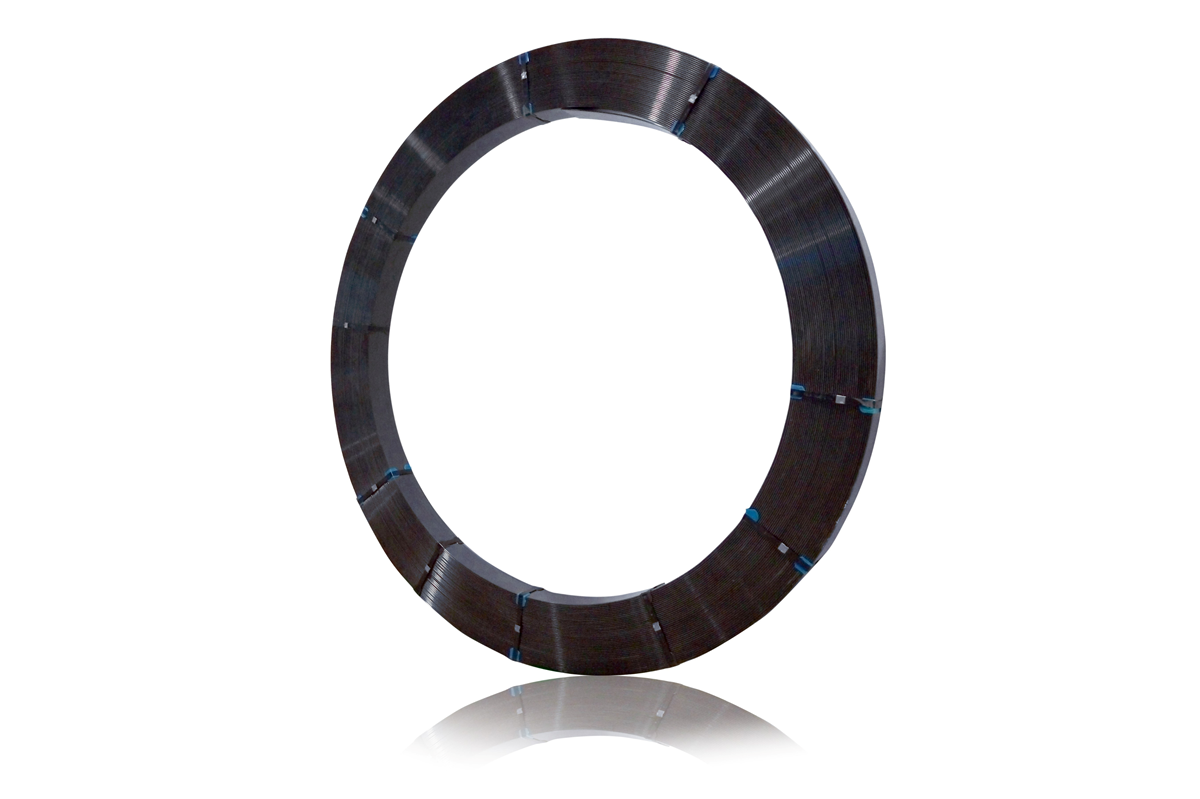

#9 Pultruded Products-Rod, Plate etc

Domain Est. 2021

Website: cf-composites.toray

Key Highlights: TORAYCA™ pultruded laminates are made by arranging carbon fibers in the same direction and impregnating them with epoxy resin….

Expert Sourcing Insights for Pultruded Carbon Fiber

H2: 2026 Market Trends for Pultruded Carbon Fiber

By 2026, the global market for pultruded carbon fiber is projected to experience robust growth, driven by increasing demand across high-performance industries such as renewable energy, aerospace, transportation, and construction. This analysis explores the key trends shaping the market landscape, including technological advancements, regional dynamics, sustainability pressures, and competitive developments.

-

Accelerated Adoption in Renewable Energy

The wind energy sector remains a dominant driver for pultruded carbon fiber demand. As wind turbines grow larger to enhance efficiency and power output, manufacturers are increasingly turning to pultruded carbon fiber for spar caps and structural components due to its high strength-to-weight ratio and fatigue resistance. By 2026, global investments in offshore wind farms—particularly in Europe, China, and the U.S.—are expected to significantly boost demand, with carbon fiber pultrusions enabling longer, lighter blades that improve energy capture. -

Growth in Lightweight Transportation Solutions

Automotive and rail industries are adopting pultruded carbon fiber to meet stringent emissions and fuel efficiency standards. In electric vehicles (EVs), lightweighting is critical for extending battery range, and pultruded profiles offer a cost-effective method for reinforcing chassis, battery enclosures, and structural beams. By 2026, increased EV production and the scaling of hybrid composite structures are expected to elevate pultruded carbon fiber use in mass-market vehicles, supported by advancements in high-speed pultrusion techniques. -

Technological Innovation and Cost Reduction

Ongoing R&D efforts are focused on improving the speed, scalability, and cost-efficiency of the pultrusion process. Innovations such as automated fiber placement, improved resin systems (e.g., epoxy and vinyl ester with faster cure times), and digital process monitoring are enhancing product consistency and reducing cycle times. Additionally, the emergence of lower-cost, intermediate modulus carbon fibers is helping to bridge the affordability gap, making pultruded solutions more accessible to mid-tier industrial applications. -

Sustainability and Circular Economy Pressures

Environmental regulations and corporate ESG (Environmental, Social, Governance) goals are pushing manufacturers to adopt sustainable materials. Pultruded carbon fiber, while energy-intensive to produce, offers long-term lifecycle benefits due to its durability and reduced maintenance. In 2026, recyclability and end-of-life management will become key competitive differentiators. Companies are investing in closed-loop recycling technologies and bio-based or recyclable resin systems to align with circular economy principles. -

Regional Market Shifts

Asia-Pacific is expected to lead global market growth, fueled by China’s aggressive renewable energy targets and expanding EV manufacturing base. North America will see strong demand from aerospace and defense sectors, particularly for unmanned aerial vehicles (UAVs) and lightweight infrastructure. Europe continues to emphasize green technologies, supporting adoption in sustainable construction and public transit systems. Regional supply chain localization—especially in response to geopolitical tensions—will drive investments in domestic carbon fiber and pultrusion capacity. -

Consolidation and Strategic Partnerships

The competitive landscape is poised for consolidation, with major carbon fiber producers (e.g., Toray, SGL Carbon, Hexcel) forming strategic alliances with pultrusion specialists and end-use OEMs. Vertical integration, joint ventures, and licensing agreements are enabling faster commercialization of tailored pultruded solutions. By 2026, companies offering end-to-end solutions—from fiber to finished profile—will gain significant market advantage.

In conclusion, the 2026 market for pultruded carbon fiber is characterized by strong cross-sector demand, technological maturation, and sustainability-driven innovation. As production costs decline and performance benefits become more widely recognized, pultruded carbon fiber is set to transition from a niche material to a cornerstone of next-generation lightweight engineering.

Common Pitfalls Sourcing Pultruded Carbon Fiber (Quality, IP)

Sourcing pultruded carbon fiber profiles presents unique challenges, particularly concerning consistent quality and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, supply chain disruptions, and legal exposure.

Quality Inconsistencies

One of the most significant risks in sourcing pultruded carbon fiber is variability in product quality, which directly impacts structural performance and reliability.

-

Fiber Misalignment and Voids: Poor manufacturing control can result in misaligned carbon fibers or internal voids within the profile. These defects drastically reduce tensile and flexural strength, leading to premature failure under load. Suppliers with inconsistent tensioning, resin impregnation, or curing processes are particularly prone to these issues.

-

Resin-Rich or Resin-Starved Zones: Non-uniform resin distribution—either too much (resin-rich) or too little (resin-starved)—compromises mechanical properties and environmental resistance. This often stems from uncontrolled resin bath conditions or improper die design.

-

Dimensional Inaccuracy: Pultruded profiles must meet tight tolerances for integration into assemblies. Inconsistent pull speed, die wear, or thermal control can cause dimensional deviations, leading to fit-up problems and increased scrap rates in downstream manufacturing.

-

Surface Defects and Finish Variability: Surface cracks, fiber read-through, or inconsistent surface finish can affect adhesion in bonding applications or aesthetics in visible components. These issues often arise from poor cure cycles or inadequate release agent use.

-

Batch-to-Batch Variability: Lack of rigorous quality control (QC) protocols and material traceability means mechanical properties—such as modulus and strength—can vary significantly between production batches, undermining design reliability.

Intellectual Property (IP) Risks

Sourcing pultruded carbon fiber, especially from offshore or less-regulated suppliers, introduces serious IP exposure that can jeopardize competitive advantage.

-

Reverse Engineering and Design Theft: Sharing detailed specifications, tooling, or custom profile designs with suppliers may enable them to replicate your product for competitors. This is especially prevalent in regions with weak IP enforcement.

-

Unauthorized Subcontracting: A supplier may outsource production to third-party facilities without disclosure, increasing the risk of IP leakage and loss of quality oversight. These subcontractors may lack necessary certifications or quality systems.

-

Lack of IP Clauses in Contracts: Absent clear contractual terms defining ownership of designs, tooling, and process know-how, suppliers may claim partial rights or reuse your IP for other clients. This is particularly risky when custom dies or formulations are involved.

-

Inadequate Data Protection: Suppliers with weak cybersecurity or document controls may expose design data, test results, or proprietary resin systems to unauthorized access or theft.

-

Gray Market Diversion: Excess production or off-spec material may be sold by the supplier into unauthorized markets, undermining brand integrity and creating counterfeit risk.

Mitigation Strategies: To address these pitfalls, conduct thorough supplier audits, require material certifications (e.g., ASTM standards), implement robust QC sampling, and enforce strong IP protection agreements—including NDAs, explicit IP ownership clauses, and restrictions on subcontracting. Engaging suppliers with proven quality management systems (e.g., ISO 9001, AS9100) significantly reduces risk.

Logistics & Compliance Guide for Pultruded Carbon Fiber

Overview and Key Characteristics

Pultruded carbon fiber is a high-strength, lightweight composite material manufactured through a continuous process that pulls fiber reinforcements through a resin bath and heated die. Its exceptional mechanical properties make it ideal for aerospace, automotive, renewable energy, and construction applications. However, its composition and manufacturing process necessitate specific logistics handling and regulatory compliance protocols.

Classification and Regulatory Identification

Pultruded carbon fiber is typically classified as a composite material, not a hazardous substance in its cured form. However, proper identification is essential for international shipping and customs purposes.

– HS Code: Commonly falls under 3916.90 (other plastic rods, bars, and profiles) or 7019.90 (glass wool and articles thereof, though sometimes used by analogy). Specific carbon fiber products may require 3926.40 (articles of reinforced plastics). Confirm based on resin matrix and final use.

– UN Number: Not applicable for cured pultruded profiles under normal conditions. However, uncured resins or raw fibers may have separate classifications.

– IMO/IMDG: Not typically regulated as dangerous goods when cured. Always verify with current IMDG Code editions.

Transportation and Handling Procedures

Proper handling ensures product integrity and worker safety during transit.

– Packaging: Use edge-protected wooden crates or heavy-duty cardboard with corner boards. Wrap profiles in anti-static or breathable plastic to prevent surface damage and moisture absorption.

– Loading and Securing: Avoid point loads and bending. Use cradles or supports for long profiles. Secure loads to prevent shifting during transport.

– Environmental Conditions: Store and transport in dry, temperature-controlled environments (15–25°C recommended). Avoid prolonged exposure to UV light, which may degrade resin matrices over time.

– Forklift and Crane Use: Use soft slings or padded clamps to prevent surface abrasion. Never drag or drop bundles.

Storage Requirements

- Indoor Storage: Ideal in a clean, dry warehouse with controlled humidity (<60% RH).

- Racking: Store horizontally on flat, level surfaces with adequate support to prevent warping. Keep off the floor using pallets.

- Segregation: Keep away from chemicals, solvents, and sharp objects. Maintain separation from raw carbon fiber tows to avoid confusion.

Occupational Health and Safety (OH&S)

- Dust and Particulate Control: Machining or cutting pultruded profiles may generate fine carbon dust. Use local exhaust ventilation (LEV), NIOSH-approved respirators (N95 or higher), and protective clothing.

- Skin and Eye Protection: Wear gloves and safety glasses. Carbon fiber splinters can cause skin irritation.

- Static Electricity: Carbon fiber is electrically conductive. Ground workstations during processing to prevent static discharge, especially in flammable environments.

Environmental and Disposal Compliance

- Waste Classification: Cured pultruded carbon fiber is generally non-hazardous waste. However, confirm with local regulations (e.g., EPA, EU Waste Framework Directive).

- Recycling: Carbon fiber composites are increasingly recyclable via pyrolysis or solvolysis. Partner with certified recyclers specializing in advanced composites.

- Landfill Disposal: Avoid if possible due to persistence. Only dispose in permitted facilities if recycling is not available.

International Trade and Documentation

- Export Controls: Carbon fiber may be subject to export restrictions under regimes like the Wassenaar Arrangement due to dual-use potential (civilian and military applications).

- Required Documents: Commercial invoice, packing list, bill of lading, certificate of origin, and material safety data sheet (MSDS/SDS).

- Customs Clearance: Provide accurate product description, HS code, and value. Be prepared for inspection, especially for aerospace-grade materials.

Quality Assurance and Traceability

- Batch Tracking: Maintain lot numbers and production dates for traceability.

- Compliance Certifications: Provide mill test reports, conformity certificates (e.g., ISO 9001), and, if applicable, aerospace standards (e.g., NADCAP).

- Incoming Inspection: Check for surface defects, dimensional accuracy, and packaging integrity upon receipt.

Emergency Response

- Fire Response: Pultruded carbon fiber is combustible at high temperatures. Use CO₂ or dry chemical extinguishers. Avoid water jets, which may spread burning resin.

- Spill or Damage: Contain debris using non-sparking tools. Collect in sealed containers for proper disposal.

- First Aid: Flush eyes with water if dust exposure occurs. Remove contaminated clothing and wash skin thoroughly. Seek medical attention for embedded fibers.

Conclusion

Safe and compliant logistics for pultruded carbon fiber rely on accurate classification, careful handling, regulatory awareness, and environmental responsibility. Partnering with experienced freight forwarders and staying updated on international regulations ensures smooth supply chain operations.

Conclusion on Sourcing Pultruded Carbon Fiber

Sourcing pultruded carbon fiber requires a strategic approach that balances performance requirements, cost efficiency, supply chain reliability, and long-term scalability. Pultruded carbon fiber profiles offer exceptional strength-to-weight ratios, corrosion resistance, and dimensional stability, making them ideal for high-performance applications in aerospace, renewable energy, transportation, and infrastructure.

When sourcing, it is essential to partner with reputable suppliers who adhere to consistent manufacturing standards and can provide certified material data. Evaluating suppliers based on technical capabilities, quality control processes, customization options, and geographic proximity helps mitigate risks related to lead times and logistics. Additionally, understanding the different grades of carbon fiber (e.g., standard, intermediate, or high modulus) and resin systems ensures optimal material selection for specific application needs.

As demand for lightweight, durable materials grows and production technologies advance, securing long-term agreements and exploring regional supply options can enhance supply chain resilience. Investing in supplier relationships and staying informed about innovations in pultrusion techniques and fiber availability will position organizations to leverage the full benefits of pultruded carbon fiber while managing costs and risks effectively.

In summary, successful sourcing of pultruded carbon fiber hinges on a thorough evaluation of technical, logistical, and economic factors—ensuring high-quality materials are delivered reliably to support performance-driven applications and sustainable growth.