The global serpentine belt market is experiencing steady growth, driven by rising vehicle production and the increasing demand for more efficient engine accessory drive systems. According to a report by Mordor Intelligence, the global automotive belt market was valued at USD 5.8 billion in 2023 and is projected to grow at a CAGR of over 4.2% from 2024 to 2029. Similarly, Grand View Research estimates that the global V-belt and serpentine belt market is expected to expand due to ongoing advancements in belt materials, such as ethylene propylene diene monomer (EPDM) and reinforced tensile cords, which enhance durability and performance under extreme conditions. As original equipment manufacturers (OEMs) and aftermarket suppliers continue to prioritize reliability and fuel efficiency, serpentine belts have become a critical component in modern automotive design, consolidating multiple belts into a single, optimized system. With North America, Europe, and Asia Pacific leading in both production and consumption, the competitive landscape is shaped by innovation, global supply chain integration, and adherence to stringent emission and performance standards. In this evolving market, the following nine manufacturers have emerged as key players based on market share, technological leadership, and global reach.

Top 9 Pulley Serpentine Belt Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial belt manufacturer

Domain Est. 2001

Website: hutchinsontransmission.com

Key Highlights: Industrial belt manufacturer. Hutchinson, Belt drive manufacturer, develops and manufactures complete industrial power transmission systems incorporating ……

#2 BRECOflex: Timing Belt Manufacturer

Domain Est. 1996

Website: brecoflex.com

Key Highlights: BRECOflex CO., L.L.C. manufacturers timing belts, pulleys and drive components for linear drives, conveying & power transmission applications….

#3 V

Domain Est. 1999

Website: web.optibelt.com

Key Highlights: High-quality V-belts and timing belts from the german manufacturer Optibelt. We have been setting standards in drive systems with first-class system ……

#4 Power Transmission

Domain Est. 1994

Website: gates.com

Key Highlights: In 1979, we created the serpentine belt that changed automotive transmission as we know it. Continuous innovation isn’t just what we do. It’s who we are. Trust ……

#5 Pulleys – North America

Domain Est. 1998

Website: dayco.com

Key Highlights: Replace serpentine belts, pulleys, tensioners together for best performance. Serpentine belts on today’s cars can have over 10 points of contact, creating very ……

#6 B&B Manufacturing

Domain Est. 1999

Website: bbman.com

Key Highlights: Our expertly engineered belted drive solutions are trusted across industries like 3D Printing, Air-Cooled Heat Exchangers, CNC Machinery, and Oil & Gas, ……

#7 Drive Belts Supplier

Domain Est. 2005

Website: c-rproducts.com

Key Highlights: Our range of drive belts, pulleys and tools are built for lasting performance with premium-grade rubber materials, patented belt manufacturing processes, and ……

#8 Continental Aftermarket

Domain Est. 2018

Website: continental-engineparts.com

Key Highlights: Specifically designed to resist heat and cracking, the dual sided Multi V-belt has ribs on both sides of the belt to accommodate smaller diameter pulleys, ……

#9 Multi V

Domain Est. 2018

Website: continental-industry.com

Key Highlights: Continental offers a variety of multi V-belts for wraparound drives with small pulley diameters, in which slip is permissible. Continental multi-V-belts are ……

Expert Sourcing Insights for Pulley Serpentine Belt

2026 Market Trends for Pulley Serpentine Belt

Rising Demand from the Automotive Aftermarket

One of the most significant drivers shaping the pulley serpentine belt market in 2026 is the growing demand from the automotive aftermarket. As the global vehicle fleet ages, especially in developed regions like North America and Europe, the need for replacement parts such as serpentine belts increases. These components typically require replacement every 60,000 to 100,000 miles, ensuring a steady demand. The rise in vehicle ownership in emerging markets further amplifies this trend, as extended usage leads to higher wear and tear, creating consistent aftermarket opportunities.

Advancements in Belt Material and Durability

In 2026, manufacturers are increasingly focusing on improving the performance and longevity of serpentine belts through advanced materials such as Ethylene Propylene Diene Monomer (EPDM) and reinforced fiber composites. These materials offer better resistance to heat, ozone, and abrasion compared to traditional rubber compounds. The shift toward high-performance materials not only extends belt life but also enhances engine efficiency and reliability. This technological evolution is being driven by both OEMs looking to reduce warranty claims and aftermarket brands aiming to differentiate their products.

Electrification Impact on Market Dynamics

The global push toward electric vehicles (EVs) presents both challenges and opportunities for the serpentine belt market. Fully electric vehicles typically do not use internal combustion engines and therefore do not require serpentine belts, which could reduce long-term market size. However, hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) still rely on internal combustion engines for part of their operation, maintaining demand for serpentine belts through 2026. Additionally, some EVs use auxiliary belts for components like air conditioning compressors, preserving a niche application. As the transition to full electrification progresses gradually, the serpentine belt market is expected to experience a moderate decline rather than a sudden collapse.

Regional Market Growth and Manufacturing Shifts

Asia-Pacific remains the fastest-growing region for pulley serpentine belts in 2026, fueled by expanding automotive production in countries like India, Thailand, and Vietnam. Local manufacturing and cost-effective labor are attracting global suppliers to set up production facilities in the region. Meanwhile, North America and Europe continue to emphasize high-quality, long-lasting belts, with a strong preference for branded aftermarket products. Latin America and the Middle East are also showing increased demand due to rising vehicle ownership and infrastructure development.

Consolidation and Strategic Partnerships

The pulley serpentine belt market in 2026 is witnessing increased consolidation among key players such as Gates Corporation, Continental AG, and Mitsuboshi Belting. Companies are engaging in strategic partnerships, mergers, and acquisitions to expand their global footprint and enhance R&D capabilities. These collaborations are focused on integrating smart monitoring technologies into belt systems, such as sensors that detect wear and predict failure—aligning with the broader trend toward predictive maintenance in the automotive industry.

Sustainability and Environmental Regulations

Environmental regulations are influencing material sourcing and manufacturing processes in the serpentine belt industry. By 2026, there is a growing emphasis on recyclable materials and energy-efficient production methods. Regulatory bodies in Europe and North America are pushing for reduced emissions across the vehicle lifecycle, indirectly affecting component manufacturing. As a result, leading manufacturers are investing in eco-friendly production lines and exploring bio-based rubber alternatives to meet sustainability goals.

In conclusion, while the long-term outlook for pulley serpentine belts faces headwinds from vehicle electrification, the 2026 market remains robust due to strong aftermarket demand, material innovations, and regional growth. Companies that adapt to changing technologies and sustainability requirements will be best positioned to thrive in this evolving landscape.

Common Pitfalls When Sourcing Pulley Serpentine Belts (Quality and Intellectual Property)

Sourcing pulley serpentine belts—critical components in automotive and industrial power transmission systems—requires careful evaluation to avoid performance issues, safety risks, and legal complications. Two major areas of concern are product quality and intellectual property (IP) infringement. Falling into common pitfalls in these areas can lead to costly downtime, warranty claims, and reputational damage.

Poor Material Quality and Construction

One of the most frequent issues is sourcing belts made from substandard rubber compounds or reinforcement materials. Low-quality belts may use inferior ethylene propylene diene monomer (EPDM) or fail to incorporate proper tensile cord (e.g., aramid or fiberglass), leading to premature cracking, delamination, or stretching. Buyers may be tempted by lower prices, but such belts often fail well before their expected service life, increasing maintenance costs and risking equipment damage.

Inaccurate Dimensional Specifications

Slight deviations in belt length, rib count, pitch, or width can result in improper fit, slippage, or excessive tension. Counterfeit or non-OEM belts often lack precise adherence to original equipment (OE) specifications. This mismatch causes noise, reduced efficiency, and accelerated wear on pulleys and accessories like alternators, power steering pumps, and air conditioning compressors.

Lack of Performance Testing and Certification

Reputable manufacturers subject serpentine belts to rigorous testing for heat resistance, ozone degradation, tensile strength, and fatigue life. Many low-cost suppliers skip or falsify such testing. Without third-party certifications (e.g., ISO, SAE, or OE approvals), buyers have no assurance that the belt meets required operational standards, especially under high-stress or extreme temperature conditions.

Counterfeit or IP-Infringing Products

A significant risk when sourcing from unauthorized or offshore suppliers is receiving counterfeit belts that mimic branded products (e.g., Gates, Dayco, or Continental). These copies often bear fake logos, part numbers, or packaging and infringe on trademarks and design patents. Using such belts exposes the buyer to legal liability and voids warranties on both the belt and the equipment it powers.

Absence of Traceability and Documentation

Authentic, high-quality belts come with traceable batch numbers, manufacturing dates, and compliance documentation. IP-infringing or low-quality belts frequently lack these details, making it difficult to verify origin, conduct recalls if needed, or prove due diligence in case of failure or litigation.

Overreliance on Price Over Proven Suppliers

Prioritizing the lowest bid often leads to compromised quality and IP risks. Established suppliers invest in R&D, quality control, and IP compliance. Sourcing from unknown vendors—especially through unverified online marketplaces—increases the chance of receiving non-compliant or dangerous products that fail to meet safety and performance expectations.

Inadequate Supply Chain Transparency

Without visibility into a supplier’s manufacturing processes and sourcing of raw materials, buyers cannot assess quality control practices or ensure ethical and legal compliance. Opaque supply chains are breeding grounds for counterfeit goods and inconsistent product quality, especially in regions with weak IP enforcement.

Avoiding these pitfalls requires due diligence: verifying supplier credentials, requesting test reports and IP documentation, inspecting samples, and sourcing through authorized distribution channels whenever possible.

Logistics & Compliance Guide for Pulley Serpentine Belt

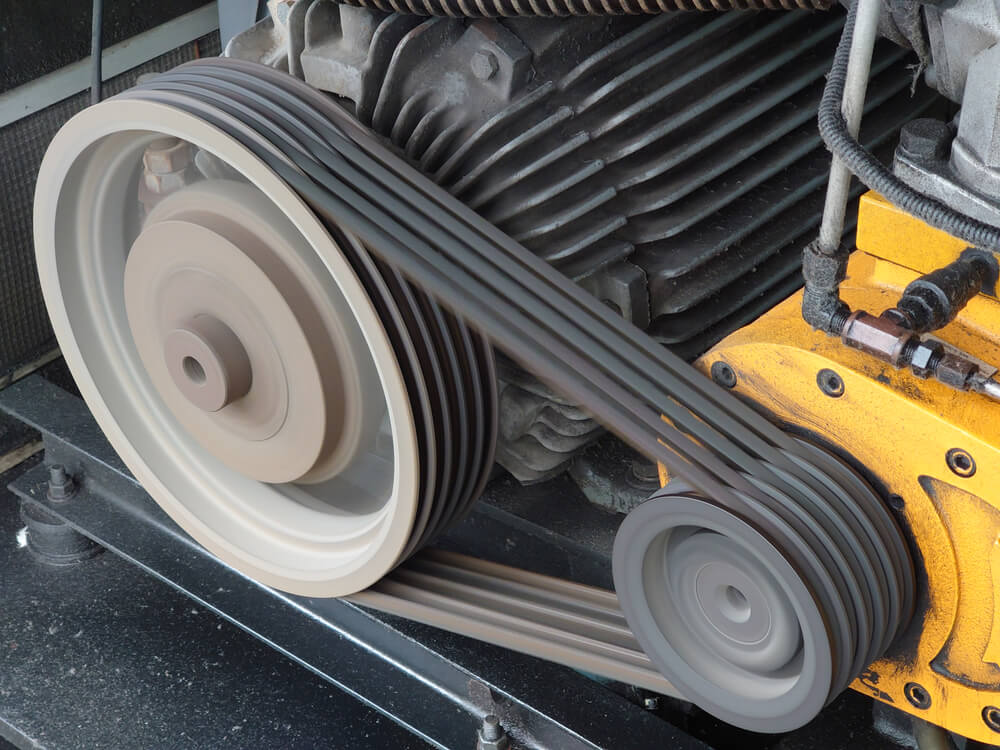

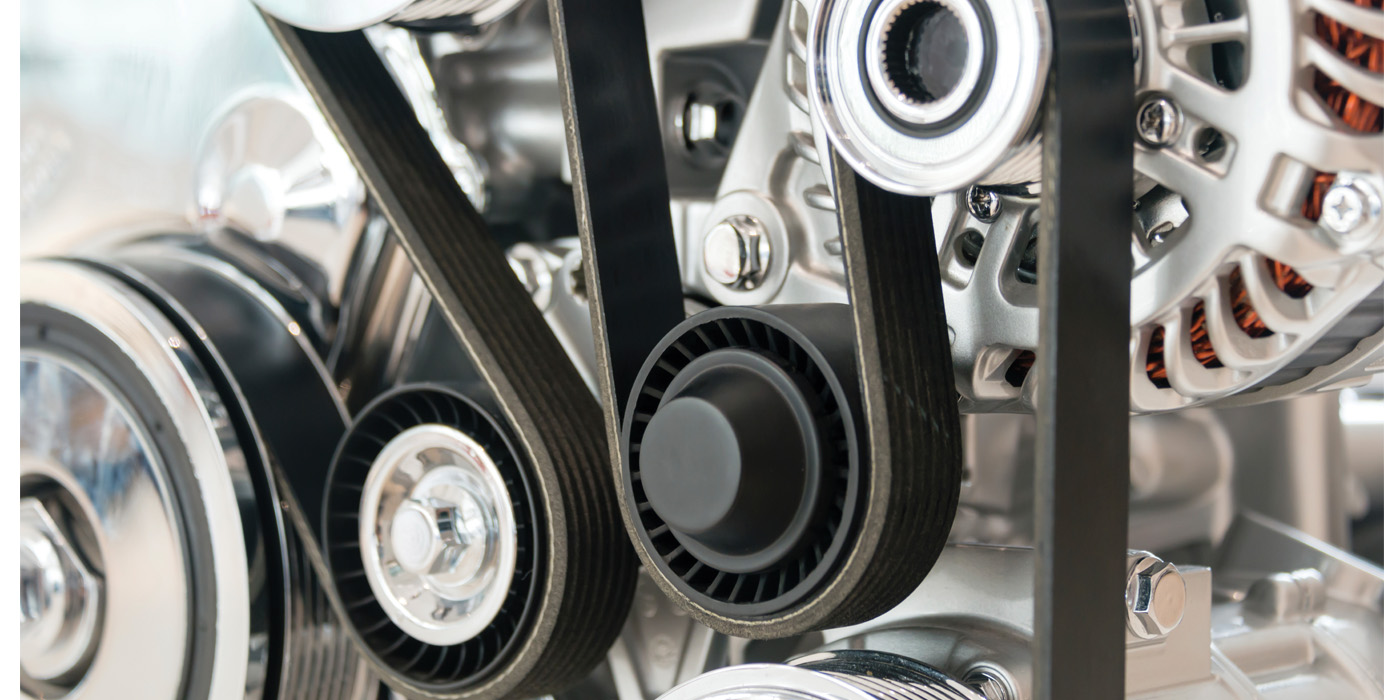

Product Overview

The pulley serpentine belt is a critical component in automotive engine systems, responsible for driving multiple peripheral devices such as the alternator, power steering pump, water pump, and air conditioning compressor. Proper logistics handling and compliance adherence are essential to ensure product integrity, regulatory approval, and customer satisfaction.

Packaging Requirements

- Use durable, moisture-resistant packaging (e.g., corrugated cardboard with polyethylene lining) to prevent belt deterioration.

- Include desiccant packs in packaging for humid climates to prevent rubber degradation.

- Clearly label each package with product details, part number, batch/lot number, and handling instructions (e.g., “Do Not Stack,” “Keep Dry”).

- Ensure individual belts are protected with plastic sleeves or wraps to prevent abrasion and contamination.

Storage Conditions

- Store in a cool, dry environment with temperatures between 10°C and 25°C (50°F–77°F).

- Avoid direct sunlight and UV exposure to prevent rubber cracking.

- Maintain humidity levels below 65% to minimize ozone and moisture damage.

- Keep belts away from electric motors, welding equipment, and other sources of ozone.

- Follow FIFO (First In, First Out) inventory rotation to prevent aging of stock.

Transportation Guidelines

- Use enclosed, climate-controlled vehicles when possible, especially in extreme climates.

- Secure loads to prevent shifting; do not stack heavier items on top of belt packages.

- Avoid long-term exposure to high heat or freezing conditions during transit.

- For international shipments, ensure compliance with IATA/IMDG regulations if transported by air or sea.

Regulatory Compliance

- REACH (EU): Confirm that belt materials (rubber compounds, additives) comply with SVHC (Substances of Very High Concern) restrictions.

- RoHS (EU): Ensure no restricted hazardous substances (e.g., lead, cadmium) are present in belt components or packaging.

- DOT / FMVSS (USA): While not directly regulated, ensure product meets OEM specifications used in certified vehicles.

- ISO 9001 & IATF 16949: Maintain quality management systems for manufacturing and distribution processes.

- Customs & Tariff Codes: Classify under HS Code 8708.93 (Belts for engines) for international trade; verify country-specific codes.

Labeling & Documentation

- Include multilingual labels (English, local language) for export shipments.

- Provide Safety Data Sheets (SDS) upon request, especially for bulk or industrial customers.

- Attach compliance certificates (e.g., Certificate of Conformance, RoHS/REACH declarations) to shipping documentation.

- Ensure traceability with batch/lot numbers and manufacturing dates on both packaging and invoices.

Import/Export Considerations

- Validate country-specific import regulations (e.g., China CCC, Indian BIS) if applicable.

- Use Incoterms® 2020 clearly in contracts (e.g., FOB, DDP) to define responsibility for logistics and compliance.

- Partner with licensed freight forwarders experienced in automotive parts shipping.

- Retain documentation for at least five years for audit and recall purposes.

Environmental & Sustainability Practices

- Recycle packaging materials wherever possible.

- Offer take-back programs or support end-of-life recycling initiatives for used belts.

- Optimize packaging size to reduce material use and transportation emissions.

Quality Control & Recalls

- Conduct regular in-process and final inspections per ISO standards.

- Maintain a product recall plan compliant with local regulations (e.g., NHTSA in the U.S.).

- Report any non-compliance issues immediately to relevant authorities and customers.

Conclusion

Effective logistics and strict compliance protocols ensure the pulley serpentine belt reaches customers in optimal condition while meeting global regulatory standards. Adherence to this guide minimizes risks, supports brand reputation, and promotes environmental responsibility.

In conclusion, sourcing a serpentine belt pulley requires careful consideration of compatibility, quality, and reliability. It is essential to identify the correct specifications—such as belt size, pulley type (idler or tensioner), material composition, and OEM or aftermarket equivalence—based on the vehicle make, model, and year. Opting for reputable suppliers and trusted brands ensures durability, proper fitment, and long-term performance, minimizing the risk of premature failure and costly repairs. Whether for maintenance, replacement, or upgrade purposes, a well-sourced pulley contributes significantly to the efficient operation of the engine’s accessory drive system. Proper sourcing not only enhances vehicle reliability but also supports safety and optimal performance on the road.