The global PTFE (polytetrafluoroethylene) rings market is experiencing robust growth, driven by rising demand across aerospace, automotive, oil & gas, and semiconductor industries for high-performance sealing solutions. According to a 2023 report by Mordor Intelligence, the global PTFE market is projected to grow at a CAGR of over 6.2% from 2023 to 2028, fueled by the material’s exceptional thermal stability, chemical resistance, and low friction properties. PTFE rings, in particular, are critical components in dynamic and static sealing applications where reliability under extreme conditions is non-negotiable. As industrial automation and high-pressure processing systems expand globally, the need for precision-engineered PTFE rings is amplifying. Grand View Research further supports this trajectory, noting that Asia Pacific dominates both consumption and production, with China and India emerging as key growth hubs due to expanding manufacturing infrastructure. Against this backdrop, identifying leading PTFE ring manufacturers with proven capabilities in material science, quality compliance, and global supply chain integration has become essential for procurement leaders and OEMs alike.

Top 10 Ptfe Ring Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 PTFE O-Rings

Domain Est. 1998

Website: rocketseals.com

Key Highlights: Rocket Seals supplies PTFE O-rings and seals for industrial applications, offering excellent chemical resistance and high-temperature stability….

#2 PTFE X-Rings

Domain Est. 1997

Website: ctgasket.com

Key Highlights: CT Gasket & Polymer Co. specializes in PTFE X-Rings. With over 100 years of engineering expertise we are dedicated to offering the highest quality PTFE X-Rings….

#3 PTFE Seal Rings

Domain Est. 1998

Website: houmfg.com

Key Highlights: At HMS, we also manufacture buttress rings for tubing, casing and couplings. ABC, API Spec 8 Round and Buttress rings are available in large quantities….

#4 Manufacturer of PTFE Seals, Sanitary Gaskets & Custom Polymer …

Domain Est. 2018

Website: kelcoind.com

Key Highlights: Precision-engineered PTFE seals, sanitary gaskets, and polymer components manufactured in the USA. Partner with WCT for custom sealing solutions built for ……

#5 PTFE O-Rings

Domain Est. 1996

Website: trelleborg.com

Key Highlights: PTFE O-Ring for axial static face or flange-type applications. Resistant to practically all chemicals and to high temperatures. Available in any required size….

#6 Teflon O

Domain Est. 1997

Website: marcorubber.com

Key Highlights: Looking for high performance plastics? Explore Teflon® o-rings and a number of other product material options from Marco Rubber — the o-ring industry leader ……

#7 PTFE (Teflon) O

Domain Est. 2007

Website: globaloring.com

Key Highlights: Teflon o-rings are known for high heat resistance, high resistance to chemical agents and solvents, anti-adhesiveness, dielectric properties, low friction ……

#8 AS568

Domain Est. 2008

#9 PTFE O

Domain Est. 2011 | Founded: 1989

Website: ptfe-orings.com

Key Highlights: As an o-ring supplier since 1989, we have the experiance, and the sources to provide quality PTFE O-Rings at competitive prices. Solutions. Not sure if PTFE ……

#10 PTFE O Rings & Backup Rings

Domain Est. 2013

Website: ptfedf.com

Key Highlights: PTFE O Ring is mainly used for static sealing application in pipes, cylinders, bushings, stems, flanges and connections….

Expert Sourcing Insights for Ptfe Ring

H2 2026 Market Trends for PTFE Rings

Rising Demand Across Industrial Sectors

In H2 2026, the market for PTFE (Polytetrafluoroethylene) rings is expected to experience robust growth, driven by increasing demand in key industrial sectors such as automotive, aerospace, chemical processing, and semiconductor manufacturing. The exceptional chemical resistance, thermal stability, and low friction coefficient of PTFE make it ideal for sealing applications in extreme environments. With global industrial recovery gaining momentum post-2025, capital expenditure in manufacturing and infrastructure is fueling demand for high-performance sealing components like PTFE rings.

Expansion in Semiconductor and Electronics Manufacturing

A significant driver of PTFE ring demand in H2 2026 is the continued expansion of semiconductor fabrication facilities, particularly in Asia-Pacific and North America. PTFE components are critical in cleanroom environments due to their ultra-purity and resistance to aggressive chemicals used in etching and cleaning processes. As chip production scales to meet AI, 5G, and IoT demands, procurement of PTFE seals and rings for vacuum systems and wafer handling equipment is rising sharply.

Sustainability and Regulatory Pressures

Environmental regulations are shaping material choices in sealing technologies. PTFE, despite its durability, is under scrutiny for its environmental footprint during production. In response, manufacturers are investing in sustainable fluoropolymer alternatives and closed-loop production systems. However, high-purity grades of PTFE remain irreplaceable in many applications, leading to a trend toward recyclable PTFE composites and improved end-of-life management solutions.

Regional Market Dynamics

Asia-Pacific remains the largest consumer and producer of PTFE rings in H2 2026, led by China, Japan, and South Korea. Domestic demand is supported by strong manufacturing bases and government-backed industrial modernization programs. Meanwhile, North America is seeing renewed growth due to onshoring of critical supply chains and investments in clean energy infrastructure, where PTFE rings are used in hydrogen and battery production equipment.

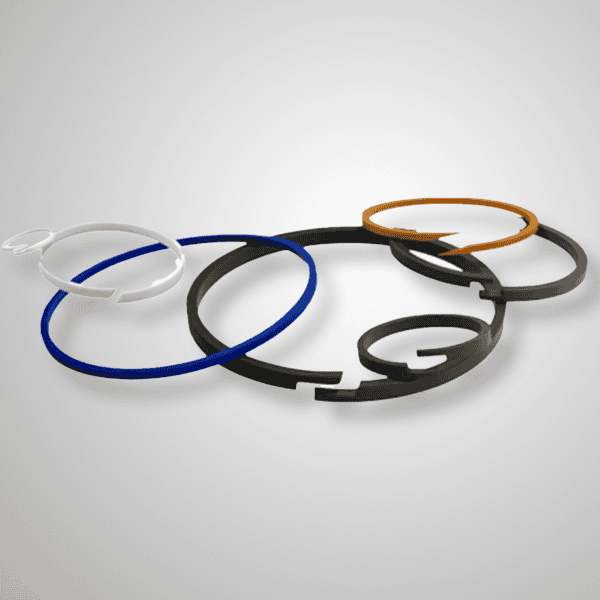

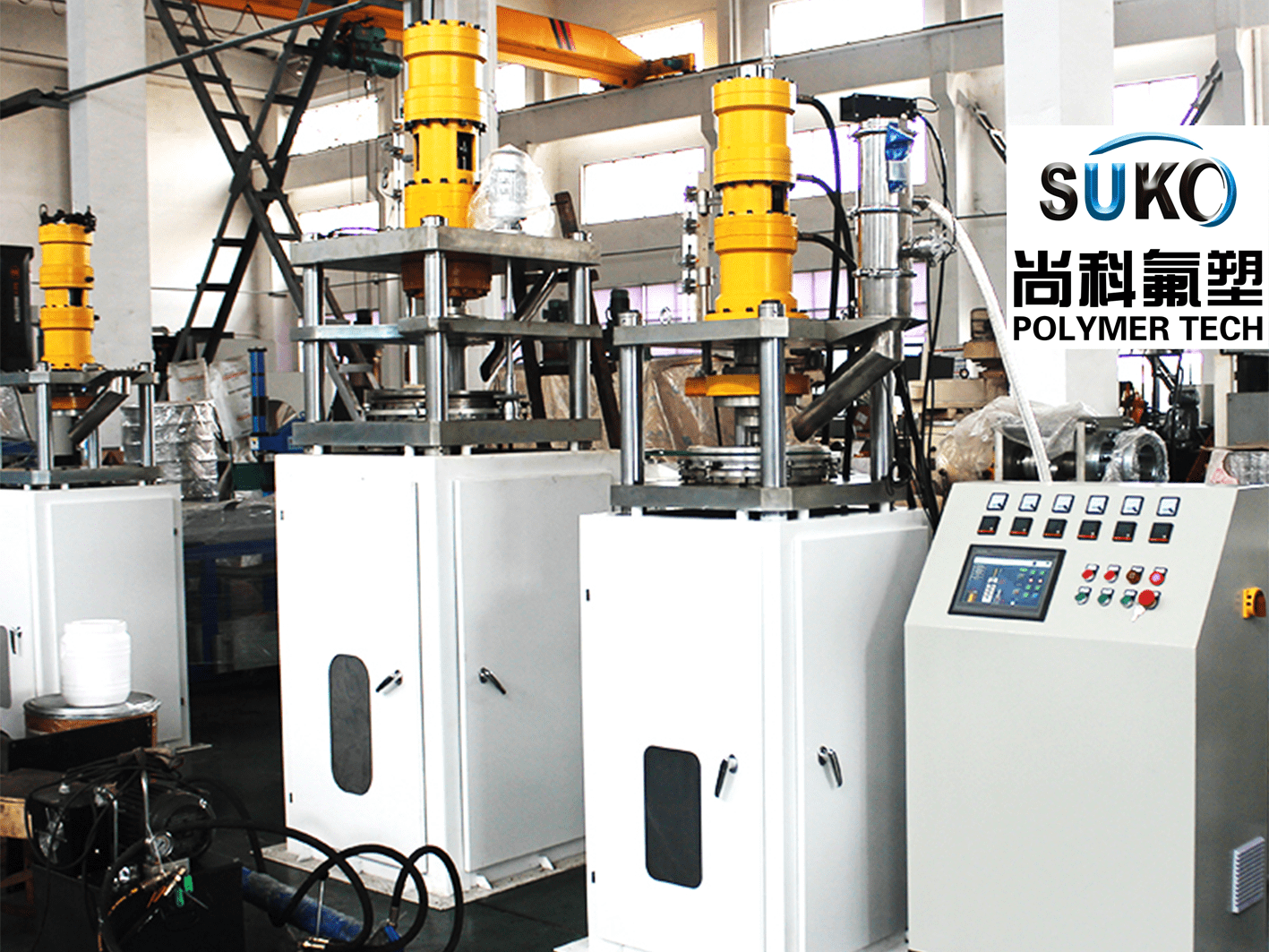

Innovation in Composite and Filled PTFE Materials

To enhance mechanical properties and reduce cold flow, manufacturers are increasingly offering PTFE rings reinforced with fillers such as glass fiber, carbon, graphite, and bronze. These filled variants provide improved wear resistance and dimensional stability, expanding PTFE ring applications into high-load and dynamic sealing environments. In H2 2026, customized composite formulations are gaining traction, especially in oil & gas and renewable energy sectors.

Supply Chain and Pricing Outlook

Raw material costs for fluoropolymers have stabilized in H2 2026 after volatility in early 2025. However, logistics costs remain elevated due to geopolitical tensions and shipping constraints. Leading producers are localizing production and forming strategic partnerships to ensure supply continuity. Price premiums are observed for high-specification and custom-engineered PTFE rings, reflecting tight supply in niche performance segments.

Conclusion

The PTFE ring market in H2 2026 is characterized by strong demand, technological innovation, and regional diversification. While environmental considerations continue to influence long-term material strategies, PTFE’s unmatched performance ensures its dominance in critical sealing applications. Market players focusing on sustainability, customization, and supply chain resilience are best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing PTFE Rings: Quality and Intellectual Property Risks

Sourcing PTFE (Polytetrafluoroethylene) rings, while seemingly straightforward, involves significant risks related to both material quality and intellectual property (IP) protection. Overlooking these aspects can lead to product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inconsistent Material Purity and Grade

One of the most frequent issues is receiving PTFE rings made from substandard or mislabeled material. Suppliers may use regrind PTFE, off-spec resin, or blends that degrade performance. This compromises critical properties such as chemical resistance, temperature tolerance, and creep resistance, leading to premature seal failure in demanding applications.

Poor Dimensional Accuracy and Tolerances

PTFE rings often require tight tolerances for proper sealing and installation. Poor machining practices or lack of precision equipment result in rings with inconsistent inner/outer diameters, thickness variations, or non-uniform cross-sections. This can cause leaks, improper fit, and increased maintenance costs.

Inadequate Documentation and Certification

Reputable suppliers provide material certifications (e.g., ASTM D1710, ISO 13000) and traceability documents. Sourcing from vendors who cannot supply CoAs (Certificates of Analysis) or full traceability increases the risk of counterfeit or non-compliant materials entering critical systems.

Improper Machining and Post-Processing

PTFE is sensitive to machining parameters. Poor handling—such as inadequate stress-relief annealing after machining—can lead to internal stresses, dimensional instability, and cracking during service. Suppliers without proper post-processing protocols often deliver rings prone to deformation.

Intellectual Property (IP) Risks

Unauthorized Use of Proprietary Designs

Sourcing PTFE rings based on OEM (Original Equipment Manufacturer) drawings or specifications without proper licensing infringes on design patents or technical IP. This exposes buyers to legal action, especially when replacing parts in patented equipment.

Reverse Engineering and IP Infringement

Some suppliers offer “compatible” or “replacement” rings by reverse-engineering branded components. While cost-effective, this practice may violate intellectual property rights if dimensional or performance characteristics are too closely replicated, leading to litigation risks.

Lack of IP Indemnification in Supply Agreements

Many procurement contracts fail to include clauses that hold the supplier liable for IP infringement. Without such protections, the buyer assumes full legal and financial responsibility if a third party claims the sourced part violates their patents or trademarks.

Counterfeit or Grey Market Parts

Unverified suppliers may sell counterfeit PTFE rings bearing fake brand names or certifications. These parts not only risk performance failure but also implicate the buyer in distributing unauthorized reproductions, damaging compliance and brand integrity.

Mitigation Strategies

To reduce these pitfalls, buyers should:

– Audit suppliers for quality management systems (e.g., ISO 9001).

– Require full material traceability and third-party testing.

– Use legal agreements with explicit IP indemnification.

– Work with authorized distributors or licensed manufacturers.

– Conduct incoming inspection and periodic quality audits.

Proactively addressing both quality and IP concerns ensures reliable performance and legal compliance when sourcing PTFE rings.

Logistics & Compliance Guide for PTFE Ring

Product Overview

Polytetrafluoroethylene (PTFE) rings are high-performance sealing components known for their excellent chemical resistance, low friction, wide temperature range (-200°C to +260°C), and electrical insulation properties. Commonly used in aerospace, automotive, chemical processing, pharmaceutical, and semiconductor industries, proper logistics and compliance handling is essential to maintain product integrity and ensure regulatory adherence.

Classification & HS Code

PTFE rings are typically classified under the following Harmonized System (HS) Code:

– HS Code: 3920.93 – “Other plates, sheets, film, foil and strip, of plastics, non-cellular and not reinforced, laminated, supported or similarly combined with other materials: Of polymers of tetrafluoroethylene.”

– Note: Confirm with local customs authorities, as sub-classifications may vary by country and product specification (e.g., filled vs. virgin PTFE).

Packaging Requirements

- Primary Packaging: Individually wrapped in anti-static or polyethylene bags to prevent contamination and physical damage.

- Secondary Packaging: Use rigid, corrugated cardboard boxes with internal dividers or foam inserts to prevent movement during transit.

- Labeling: Clearly mark each package with:

- Product name (e.g., “PTFE Ring”)

- Material type (e.g., “Virgin PTFE” or “Filled PTFE – Specify Filler”)

- Batch/lot number

- Net weight and quantity

- Handling symbols (e.g., “Fragile”, “Protect from Moisture”)

- Manufacturer/importer details

Storage Conditions

- Temperature: Store between 5°C and 35°C; avoid extreme heat or cold.

- Humidity: Low to moderate humidity; protect from direct water exposure.

- Environment: Clean, dry, and well-ventilated area; away from direct sunlight and ozone sources (e.g., electric motors).

- Shelf Life: Typically indefinite if stored properly; inspect for physical damage or contamination before use.

Transportation Guidelines

- Mode of Transport: Suitable for air, sea, and ground freight.

- Hazardous Classification: PTFE is non-hazardous under normal conditions (not classified under ADR, IATA, or IMDG).

- Special Handling: Avoid sharp impacts or compression; do not stack heavy items on PTFE ring packaging.

- Documentation: Include commercial invoice, packing list, and certificate of compliance (CoC) with each shipment.

Regulatory Compliance

- REACH (EU): PTFE is exempt from registration under REACH (Annex V, entry 15) as a polymer. However, if additives or fillers are used (e.g., glass, carbon), ensure compliance of those substances.

- RoHS (EU): PTFE rings are generally RoHS compliant, but verify filler materials (e.g., PTFE with lead-based fillers may not comply).

- FDA (USA): Virgin PTFE complies with FDA 21 CFR 177.1550 for food contact applications. Specify “FDA-compliant” if intended for food or pharmaceutical use.

- TSCA (USA): PTFE is listed on the TSCA Inventory; no restrictions apply under normal use.

- Proposition 65 (California): PTFE itself is not listed, but confirm filler content for listed chemicals (e.g., certain metal compounds).

Export Controls

- ECCN (Export Control Classification Number): Typically EAR99 (not specifically controlled).

- Exception: If used in military, aerospace, or nuclear applications, verify if stricter controls apply (e.g., ITAR or specific ECCN like 1C997).

- Export Licenses: Generally not required for commercial PTFE rings, but required for restricted end-uses or embargoed destinations (e.g., sanctioned countries).

Documentation & Certifications

- Certificate of Conformance (CoC): Must include material specification, dimensions, test results (if applicable), and compliance statements (e.g., REACH, RoHS).

- Material Safety Data Sheet (MSDS/SDS): Required for occupational safety. PTFE is stable, but thermal decomposition above 350°C releases toxic fumes (e.g., HF).

- Origin Certificate: May be required for preferential tariffs; issue based on manufacturing location.

End-of-Life & Environmental Considerations

- Disposal: Non-hazardous waste; dispose according to local regulations. Incineration must be conducted in controlled facilities due to potential release of fluorinated compounds.

- Recycling: Limited recyclability; consult specialized recyclers for PTFE reprocessing.

Summary of Key Actions

- Verify HS code and ECCN for destination country.

- Use protective, labeled packaging.

- Provide CoC and SDS with shipments.

- Ensure filler materials meet RoHS/REACH/FDA as applicable.

- Avoid thermal degradation during handling or use.

Always consult local regulations and update compliance documentation as standards evolve.

Conclusion for Sourcing PTFE Rings:

After a thorough evaluation of suppliers, material specifications, quality standards, and pricing, sourcing PTFE (Polytetrafluoroethylene) rings from qualified and reliable manufacturers ensures optimal performance in demanding applications requiring chemical resistance, thermal stability, and low friction. Key factors such as material purity, dimensional accuracy, compliance with industry standards (e.g., ASTM D4894), and consistent quality control processes are critical for ensuring product reliability. Establishing long-term partnerships with reputable suppliers not only supports cost-efficiency but also guarantees continuity of supply and technical support. In conclusion, a strategic sourcing approach focused on quality, traceability, and supplier capability is essential to meet application requirements and maintain operational excellence.