The global PTFE (polytetrafluoroethylene) market, driven by increasing demand for non-stick, heat-resistant, and chemically inert materials, is projected to grow at a CAGR of 6.3% from 2023 to 2028, according to Mordor Intelligence. This upward trajectory is mirrored in niche applications such as PTFE cutting boards—widely used in food processing, pharmaceutical, and laboratory environments for their hygiene, durability, and resistance to contamination. As industries prioritize safety and compliance, the demand for high-performance cutting surfaces has intensified, leading to a surge in specialized PTFE board manufacturing. With North America and Europe maintaining strong regulatory standards, and Asia-Pacific emerging as a key production hub, sourcing decisions are increasingly guided by material quality, compliance certifications, and manufacturing scale. In this competitive landscape, a select group of manufacturers have risen to prominence, combining technical expertise with rigorous quality control to meet the evolving needs of industrial users. The following analysis highlights the top eight PTFE cutting board manufacturers shaping this growing market.

Top 8 Ptfe Cutting Board Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

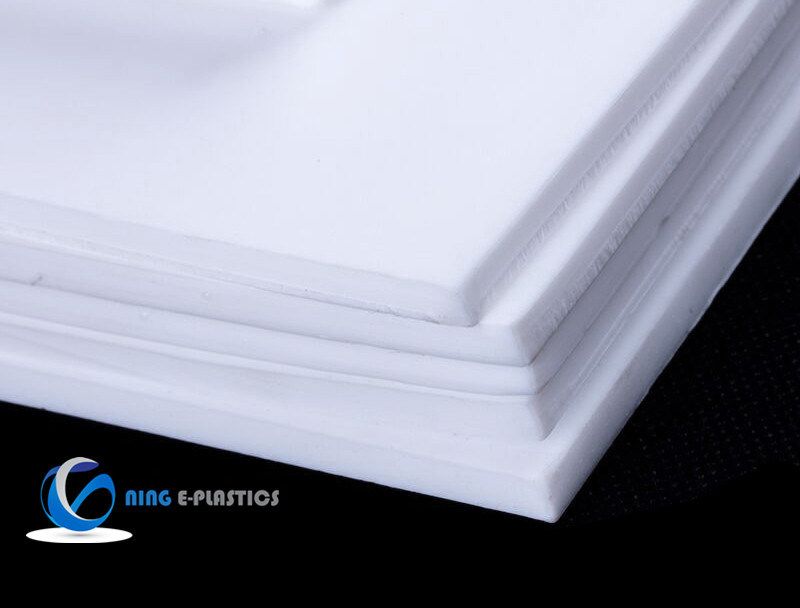

#1 Teflon Cutting Board

Domain Est. 2019

Website: jinggu-plastics.com

Key Highlights: Teflon Cutting Board – Factory, Suppliers, Manufacturers from China · MC Nylon Sheet · PA66 Rod · HDPE Rod · HDPE Sheet · PTFE Tube · PVC Rod · PP Sheet · ABS Sheet….

#2 Alro Plastics Product

Domain Est. 1996

Website: alro.com

Key Highlights: Alro Plastics offers Cutting Board, a non-porous, non-absorbent, stain resistant material made from a specially formulated high density Polyethylene plastic ……

#3 Zotefoams

Domain Est. 1996

Website: zotefoams.com

Key Highlights: Zotefoams offers lightweight, high-performance AZOTE and ZOTEK foam solutions for aerospace, automotive, and construction industries….

#4 PTFE Standard

Domain Est. 2000

Website: curbellplastics.com

Key Highlights: 1–9 day delivery 15-day returnsBuy PTFE standard plastic materials from Curbell Plastics. Shop a variety of high-quality PTFE sheets and rods that can be cut to size for your next …

#5 Cut

Domain Est. 2001

Website: cuttingboardcompany.com

Key Highlights: These cutting boards are resistant to moisture, odor, and bacteria and are the most dense plastic cutting boards available that will not dull your knives….

#6 Plastic Hand Tool and Machine Teflon Cutting Board

Domain Est. 2002

Website: micronamerica.com

Key Highlights: Free delivery 5-day returns35.40mm x 16mm mushroom-style cutting board for PL-10, TEP-1, and TEP-3 machines. Made from heavy-duty PA6 nylon (Teflon plastic). Not reversible – singl…

#7 Titanium Cutting Board V1

Domain Est. 2024

Website: siraatskitchen.com

Key Highlights: Free delivery 100-day returnsUpgrade your kitchen with the Titanium Cutting Board from Siraats Kitchen. Durable, antibacterial, and easy to clean—perfect for professional or home c…

#8 Cutting Boards

Website: dotmar.com.au

Key Highlights: These cutting boards are designed to withstand heavy-duty use, frequent cutting, and are often made from durable materials that can endure rigorous conditions….

Expert Sourcing Insights for Ptfe Cutting Board

H2: Projected Market Trends for PTFE Cutting Boards in 2026

The global market for PTFE (Polytetrafluoroethylene) cutting boards is poised for notable transformation by 2026, driven by evolving consumer preferences, advancements in material science, and increasing awareness of hygiene and sustainability in kitchenware. While PTFE is traditionally associated with non-stick cookware, its application in cutting boards remains niche but is gaining traction due to unique performance benefits. Below are the key market trends anticipated for PTFE cutting boards in 2026:

1. Rising Demand for Hygienic and Non-Porous Materials

By 2026, health and food safety concerns will continue to influence kitchen product choices. PTFE’s non-porous, bacteria-resistant surface makes it an attractive alternative to wood or low-density plastic cutting boards that can harbor pathogens in crevices. Consumers, especially in North America and Europe, are expected to prioritize easy-to-clean, antimicrobial surfaces, boosting demand for PTFE-based boards.

2. Innovation in Composite PTFE Materials

Manufacturers are investing in hybrid materials that combine PTFE with food-grade thermoplastics or reinforcing fibers to enhance durability, reduce warping, and improve knife-friendliness. These composite PTFE cutting boards aim to address the traditionally softer surface of pure PTFE, which can show knife marks more easily. By 2026, second-generation PTFE composites are expected to offer better structural integrity and longer lifespans, expanding their appeal.

3. Growth in Premium and Specialty Kitchenware Segments

The premium kitchen tools market is expanding, with consumers willing to pay more for high-performance, long-lasting products. PTFE cutting boards, often marketed as “professional-grade” or “laboratory-safe,” will find a niche among chefs, food enthusiasts, and in commercial kitchens where cross-contamination is a critical concern. This shift supports the premium pricing strategy and brand differentiation for PTFE board manufacturers.

4. Sustainability and Environmental Concerns

Environmental scrutiny around fluoropolymers, including PTFE, will intensify by 2026. Concerns about microplastic shedding and end-of-life recyclability may challenge market growth. However, companies are expected to respond with eco-certified PTFE alternatives, closed-loop production systems, and take-back recycling programs. Brands that transparently address environmental impact will gain competitive advantage.

5. E-Commerce and Direct-to-Consumer Expansion

Online retail will remain a dominant channel for specialty kitchen products. By 2026, digital platforms will enable smaller innovators to reach global markets with targeted marketing emphasizing PTFE’s non-reactive, stain-resistant, and odor-proof properties. Subscription models, bundled kitchen kits, and influencer-led campaigns are expected to fuel consumer adoption.

6. Regional Market Diversification

While North America and Western Europe lead in early adoption, emerging markets in Asia-Pacific—particularly South Korea, Japan, and China—are anticipated to show increased interest in high-tech kitchen solutions. Urbanization, rising disposable incomes, and compact living spaces favor lightweight, multi-functional, and easy-maintenance cutting boards, creating growth opportunities for PTFE products.

Conclusion

By 2026, the PTFE cutting board market will remain a niche but growing segment within the broader kitchenware industry. Success will depend on overcoming material perception challenges, advancing sustainable manufacturing, and effectively communicating hygiene and performance benefits. As innovation continues, PTFE cutting boards are likely to transition from specialty items to mainstream premium offerings in professional and high-end home kitchens.

Common Pitfalls When Sourcing PTFE Cutting Boards (Quality and Intellectual Property)

Sourcing PTFE (Polytetrafluoroethylene) cutting boards—often marketed as non-stick, chemical-resistant surfaces for industrial or specialized culinary use—can present significant challenges related to both product quality and intellectual property (IP) risks. Being aware of these pitfalls is essential for making informed procurement decisions and avoiding legal, safety, or performance issues.

Poor Material Quality and Performance

One of the most frequent issues when sourcing PTFE cutting boards is receiving materials that do not meet the required performance standards. Low-cost suppliers may use substandard PTFE resins or blend PTFE with fillers (such as glass fiber or carbon) without proper disclosure, which can compromise non-stick properties, chemical resistance, or mechanical strength. Boards that are improperly sintered may exhibit brittleness, warping, or inconsistent thickness, leading to premature failure in demanding environments.

Misrepresentation of PTFE Grade and Purity

Suppliers may falsely claim that their cutting boards are made from virgin or high-purity PTFE when, in fact, they are using recycled or regrind PTFE. This can significantly impact performance, especially in applications requiring FDA compliance, high-temperature resistance, or resistance to aggressive chemicals. Without proper certification or material test reports (MTRs), buyers risk receiving products unsuitable for their intended use.

Lack of Compliance Documentation

Many industrial or food-processing applications require PTFE products to meet regulatory standards such as FDA 21 CFR, NSF, or EU food contact regulations. A common pitfall is sourcing from suppliers who cannot provide valid compliance documentation. This not only risks regulatory non-compliance but may also void insurance or liability coverage if contamination or failure occurs.

Intellectual Property Infringement Risks

Some PTFE cutting boards incorporate proprietary designs, textures, or manufacturing techniques protected by patents or design rights. Sourcing generic versions that closely mimic branded products (e.g., specific groove patterns, edge treatments, or laminate structures) can expose buyers to IP infringement claims. This is especially concerning when sourcing from regions with lax IP enforcement, where counterfeit or cloned products are common.

Inadequate Traceability and Supplier Vetting

Without thorough due diligence, buyers may inadvertently source from unauthorized distributors or counterfeit manufacturers. Poor traceability makes it difficult to verify the origin of the PTFE material or confirm whether the manufacturer holds necessary certifications (e.g., ISO 9001, ASTM standards). This lack of transparency increases both quality and legal risks.

Conclusion

To avoid these pitfalls, buyers should require detailed specifications, third-party testing reports, and full compliance documentation. Conducting supplier audits and verifying IP status of product designs can mitigate both performance failures and legal exposure. Investing in reliable, transparent suppliers—even at a higher initial cost—often proves more economical in the long term by preventing downtime, recalls, or litigation.

Logistics & Compliance Guide for PTFE Cutting Board

Product Overview and Classification

PTFE (Polytetrafluoroethylene) cutting boards are non-stick, durable kitchen tools valued for their chemical resistance and ease of cleaning. Due to their material composition and intended use, proper logistics handling and compliance with safety and regulatory standards are essential for legal distribution and consumer safety.

Regulatory Compliance Requirements

PTFE cutting boards are typically classified as food contact materials (FCMs) and must comply with regulations governing substances that come into contact with food. Key compliance standards include:

– FDA 21 CFR §177.2510 (USA): Regulates PTFE for use in repeated food contact applications. Manufacturers must ensure the PTFE used meets FDA specifications for purity and safety.

– EU Framework Regulation (EC) No 1935/2004: Requires all FCMs, including PTFE, to be safe and not transfer harmful substances to food. Additional compliance with EU Commission Regulation (EU) No 10/2011 may apply.

– REACH (EU): PTFE products must be registered and evaluated under REACH, ensuring no use of banned or restricted substances (e.g., PFOA, which is regulated under EU POPs Regulation).

– Proposition 65 (California, USA): Requires warning labels if the product contains chemicals known to cause cancer or reproductive harm. PTFE itself is not listed, but manufacturing additives may require evaluation.

International Shipping and Transportation

When shipping PTFE cutting boards internationally, adhere to the following logistics guidelines:

– Packaging: Securely package to prevent damage during transit. Use recyclable or sustainable materials where possible to meet environmental standards.

– Labeling: Include product identification, material composition (e.g., “100% PTFE”), country of origin, and compliance markings (e.g., FDA-compliant, EU FCM logo).

– HS Code: Use Harmonized System code 3924.10 for tableware and kitchenware of plastics, which covers PTFE cutting boards. This ensures proper customs classification and tariff application.

– Temperature Sensitivity: Although PTFE is stable under normal conditions, avoid prolonged exposure to temperatures above 260°C (500°F) during storage or transport to prevent degradation.

Import/Export Documentation

Ensure all required documentation is prepared for customs clearance:

– Commercial invoice detailing product description, value, and country of origin.

– Packing list with item quantities and weights.

– Certificate of Conformity (CoC) confirming compliance with destination country regulations.

– FDA Prior Notice (for U.S. imports, if required based on shipment type).

– EU Declaration of Conformity for products placed on the European market.

Environmental and Disposal Considerations

- PTFE is non-biodegradable and not widely recyclable through standard municipal systems. Include disposal guidance in product literature, recommending responsible waste handling.

- Manufacturers should comply with local extended producer responsibility (EPR) regulations where applicable.

Quality Assurance and Testing

Implement routine quality control measures, including:

– Third-party testing for food safety compliance (migration testing, heavy metals, and volatile content).

– Batch traceability to support recalls or audits.

– Supplier audits to ensure raw material (PTFE resin) meets regulatory standards.

Conclusion

Successful distribution of PTFE cutting boards requires strict adherence to food safety regulations, accurate classification, and proper documentation throughout the supply chain. Proactive compliance reduces risk, supports market access, and ensures consumer trust in product safety and quality.

Conclusion for Sourcing PTFE Cutting Board:

Sourcing PTFE (Polytetrafluoroethylene) cutting boards presents a unique opportunity to provide a high-performance, low-friction, and chemical-resistant cutting surface suitable for specialized industrial, laboratory, or food processing applications. While PTFE offers exceptional non-stick properties, ease of cleaning, and resistance to corrosion and high temperatures, it is important to acknowledge its relative softness compared to traditional cutting board materials, which may impact durability under heavy repeated use.

When sourcing PTFE cutting boards, key considerations include material purity—especially for food-grade or medical applications—certifications (such as FDA, NSF, or RoHS compliance), thickness, dimensions, and supplier reliability. Partnering with reputable manufacturers or suppliers who provide consistent quality, customization options, and technical support is crucial to ensure product suitability and long-term value.

In summary, while PTFE cutting boards are not ideal for all environments, they are an excellent solution where contamination control, hygiene, and chemical resistance are paramount. Strategic sourcing focused on quality assurance, compliance, and application-specific requirements will ensure optimal performance and cost-effectiveness in the intended use case.