The global market for Positive Temperature Coefficient (PTC) sensors has experienced steady growth, driven by increasing demand for precision temperature control across automotive, industrial, and consumer electronics sectors. According to a 2023 report by Mordor Intelligence, the global temperature sensor market—of which PTC sensors are a key component—is projected to grow at a CAGR of approximately 6.8% from 2023 to 2028. This expansion is fueled by rising adoption in electric vehicles (EVs), HVAC systems, and advanced manufacturing processes that require reliable thermal management. As industrial automation and smart technologies continue to evolve, the need for high-accuracy, stable PTC thermistors has intensified, prompting both innovation and competition among manufacturers. In this data-driven landscape, identifying the leading PTC sensor producers becomes essential for OEMs and system integrators seeking performance, scalability, and long-term reliability. Based on market presence, product range, technological advancements, and global distribution, the following seven companies stand out as key players shaping the future of PTC sensing technology.

Top 7 Ptc Sensor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 THINKING ELECTRONIC INDUSTRIAL CO., LTD.

Domain Est. 1997

Website: thinking.com.tw

Key Highlights: Thinking provides protective circuit components for over-voltage protection, over-temperature protection, and over-current protection….

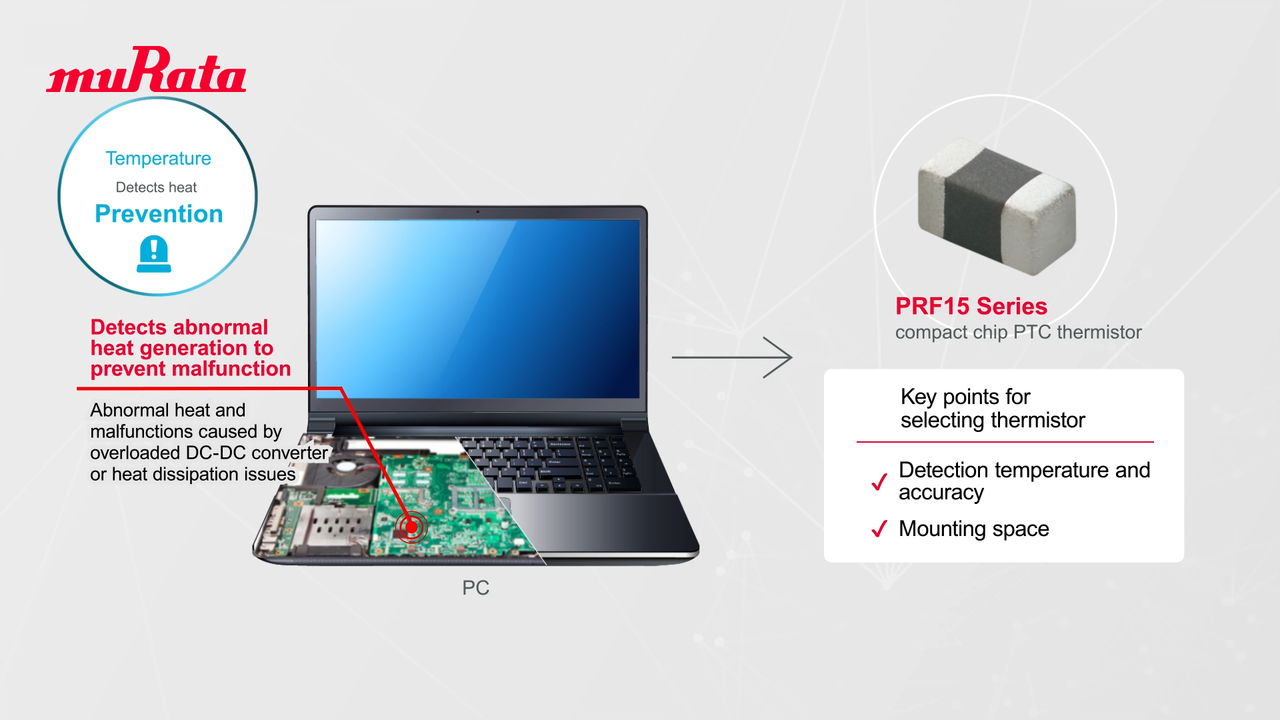

#2 PTC Thermistors (POSISTOR)

Domain Est. 1994

Website: murata.com

Key Highlights: PTC thermistors are elements whose resistance rises with an increase in temperature, and find use in applications such as temperature sensing and current ……

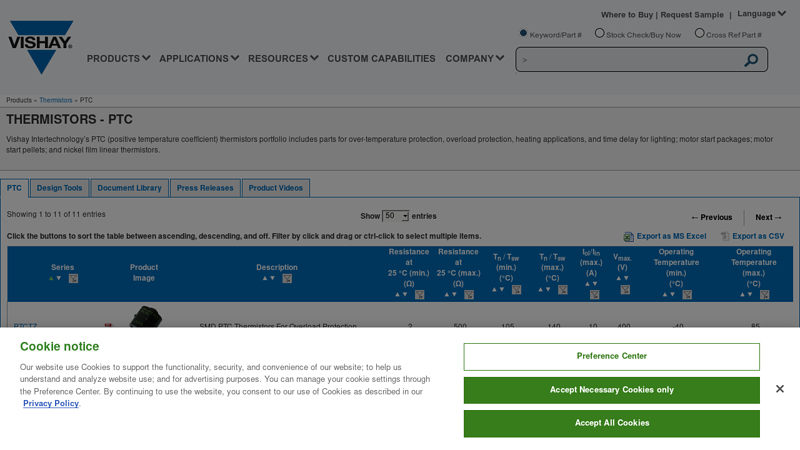

#3 PTC Thermistors

Domain Est. 1995

Website: vishay.com

Key Highlights: Vishay Intertechnology’s PTC (positive temperature coefficient) thermistors portfolio includes parts for over-temperature protection, overload protection, ……

#4 Browse PTC’s Software Solutions

Domain Est. 1993

Website: ptc.com

Key Highlights: Integrate intelligent devices, sensors, and software applications to gather, analyze, and utilize machine data for optimizing processes, increasing efficiency, ……

#5 PTC Thermistors (POSISTOR) – Video Library

Domain Est. 1994

Website: video.murata.com

Key Highlights: Thermistors provides temperature detection and current suppression to improve the performance and safety of equipment for electrification and automation….

#6 Ametherm

Domain Est. 1996

Website: ametherm.com

Key Highlights: Our Inrush Current Limiters and Temperature Sensors are built to last. We proudly manufacture our products in Carson City, Nevada – USA. Rugged and Reliable ……

#7 Temperature Sensors

Domain Est. 2013

Website: amphenol-sensors.com

Key Highlights: PTC Thermistors are temperature-dependent resistors manufactured from doped barium titanate and are available with transition temperatures from 60°C to 200°C….

Expert Sourcing Insights for Ptc Sensor

H2: Analysis of 2026 Market Trends for PTC Sensors

The Positive Temperature Coefficient (PTC) sensor market is poised for significant evolution by 2026, driven by advancements in technology, increasing demand for energy-efficient systems, and the expansion of smart and electric applications across multiple industries. Below is a detailed analysis of key market trends expected to shape the PTC sensor landscape in 2026.

1. Growing Demand in Electric Vehicles (EVs)

The automotive sector, particularly electric vehicles, is a major growth driver for PTC sensors. By 2026, PTC heating elements and sensors will play a critical role in battery thermal management systems (BTMS), cabin heating, and motor protection. With global EV adoption accelerating due to environmental regulations and government incentives, the need for reliable temperature monitoring and self-regulating heating solutions will boost PTC sensor demand.

2. Expansion in Consumer Electronics and Smart Appliances

Smart home devices, including air purifiers, hair dryers, space heaters, and refrigeration units, increasingly integrate PTC sensors for overheat protection and energy efficiency. In 2026, the proliferation of IoT-connected appliances will further increase the need for compact, durable, and self-regulating temperature sensors—core attributes of PTC technology.

3. Industrial Automation and 4.0 Integration

As industries embrace Industry 4.0, the integration of intelligent sensors for predictive maintenance and process optimization is rising. PTC sensors are being deployed in motors, power supplies, and industrial heaters to prevent overheating and ensure operational safety. By 2026, their role in condition monitoring systems will expand, supported by digital twin technologies and real-time data analytics.

4. Energy Efficiency and Regulatory Compliance

Global energy efficiency standards (e.g., EU Ecodesign Directive, ENERGY STAR) are pushing manufacturers to adopt components that minimize power consumption. PTC sensors, known for their self-regulating nature and low power draw, align well with these requirements. This regulatory tailwind will favor PTC adoption in HVAC systems and green technologies.

5. Advancements in Material Science

Innovation in ceramic and polymer-based PTC materials will enhance sensor sensitivity, response time, and durability. By 2026, manufacturers are expected to launch next-generation PTC sensors with higher precision and broader operating temperature ranges, opening new applications in aerospace, medical devices, and renewable energy systems.

6. Regional Market Growth

Asia-Pacific, led by China, Japan, and South Korea, will remain the largest market for PTC sensors due to robust electronics manufacturing and EV production. North America and Europe will also see strong growth, driven by automotive electrification and smart infrastructure development.

7. Competitive Landscape and Consolidation

The PTC sensor market is expected to witness increased M&A activity and strategic partnerships as key players (e.g., Amphenol, TE Connectivity, Murata) aim to expand product portfolios and geographic reach. Smaller innovators focusing on niche applications will attract investment, fostering technological diversity.

Conclusion

By 2026, the PTC sensor market will be characterized by strong growth, technological innovation, and expanding applications across automotive, industrial, and consumer sectors. As sustainability and digitalization become central to global industry strategies, PTC sensors will remain a critical component in ensuring safety, efficiency, and performance. Manufacturers who invest in R&D and align with emerging application trends will be best positioned to capture market share.

Common Pitfalls When Sourcing PTC Sensors (Quality and IP)

Sourcing Positive Temperature Coefficient (PTC) sensors—especially PTC thermistors or self-regulating heaters—requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, compliance issues, or legal risks. Below are key pitfalls to avoid:

1. Prioritizing Cost Over Quality

One of the most common mistakes is selecting low-cost PTC sensors without verifying their performance and reliability. Cheap components may use inferior materials or lack proper calibration, leading to:

- Inaccurate temperature readings or inconsistent self-regulating behavior

- Premature failure under thermal cycling or electrical stress

- Reduced lifespan in demanding environments (e.g., automotive or industrial applications)

Solution: Evaluate total cost of ownership, not just unit price. Request samples for testing under real-world conditions and verify certifications (e.g., AEC-Q200 for automotive use).

2. Inadequate IP Due Diligence

PTC sensor designs—especially those with proprietary materials, formulations, or geometries—may be protected by patents. Sourcing from suppliers without proper IP clearance can expose your company to infringement claims.

Common risks include:

- Using patented PTC ceramic compositions or manufacturing processes

- Copying sensor designs with protected structural features

- Sourcing from suppliers who reverse-engineer or misuse IP

Solution: Conduct a patent landscape analysis and require suppliers to provide IP warranties or freedom-to-operate (FTO) assurances.

3. Lack of Traceability and Documentation

Poor documentation from suppliers—such as missing material composition data, test reports, or calibration records—can hinder quality control and regulatory compliance.

Issues include:

- Inability to replicate performance across batches

- Challenges in root cause analysis during field failures

- Non-compliance with industry standards (e.g., ISO 9022, IEC 60751)

Solution: Demand full documentation packages, including RoHS/REACH compliance, material data sheets (MDS), and batch-specific test data.

4. Overlooking Environmental and Regulatory Compliance

PTC sensors used in consumer electronics, medical devices, or industrial systems must comply with regional and industry-specific regulations.

Pitfalls include:

- Using hazardous substances not compliant with RoHS, REACH, or China RoHS

- Failing to meet flammability standards (e.g., UL 94)

- Non-compliance with safety standards like IEC 60664 (insulation coordination)

Solution: Verify that sensors meet all applicable regulatory requirements and request certified test reports from accredited labs.

5. Supplier Reliability and Long-Term Availability

Relying on suppliers without proven track records or long-term product roadmaps can disrupt production.

Risks include:

- Sudden discontinuation of sensor models

- Inconsistent supply due to poor manufacturing capacity

- Lack of technical support for integration or troubleshooting

Solution: Audit suppliers’ financial stability, manufacturing capabilities, and product lifecycle policies. Prefer suppliers with established market presence and strong customer support.

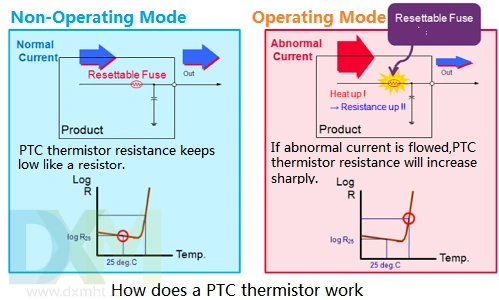

6. Misunderstanding PTC Sensor Specifications

Incorrect interpretation of key parameters—such as Curie temperature, resistance-temperature curves, or power ratings—can lead to improper selection.

Common mistakes:

- Confusing PTC thermistors with PTC heaters

- Assuming linear response when PTC behavior is highly non-linear

- Overlooking response time and thermal hysteresis

Solution: Work closely with application engineers to ensure the sensor meets actual use-case requirements. Request detailed performance curves and application notes.

By addressing these pitfalls proactively, companies can ensure reliable, compliant, and legally secure sourcing of PTC sensors for their applications.

Logistics & Compliance Guide for PTC Sensors

Overview of PTC Sensor Characteristics

PTC (Positive Temperature Coefficient) sensors are electronic components that exhibit an increase in electrical resistance with rising temperature. Commonly used for overcurrent protection, temperature monitoring, and self-regulating heating applications, PTC sensors are typically composed of ceramic-based semiconductor materials. Due to their sensitivity to temperature, mechanical stress, and electrostatic discharge (ESD), specific handling, packaging, and transportation protocols must be followed to ensure performance integrity and regulatory compliance.

Packaging and Handling Requirements

Proper packaging is essential to protect PTC sensors during transit. Use anti-static bags or conductive foam for individual components to prevent ESD damage. Sensors should be stored in sealed, moisture-resistant packaging, especially in humid environments, to avoid degradation of ceramic elements. Handling must occur in ESD-protected areas (EPAs) with grounded workstations, wrist straps, and appropriate tools. Always avoid direct contact with sensor terminals using bare hands to prevent contamination and static damage.

Storage Conditions

Store PTC sensors in a climate-controlled environment with temperatures between 15°C and 30°C and relative humidity below 60%. Avoid exposure to direct sunlight, corrosive gases, or extreme temperature fluctuations. Components should be kept in their original packaging until ready for use to minimize exposure to environmental contaminants. Adhere to FIFO (First In, First Out) inventory practices to prevent prolonged storage that may affect sensor reliability.

Transportation Guidelines

When shipping PTC sensors, ensure packages are clearly labeled with ESD-sensitive and fragile handling indicators. Use cushioning materials such as bubble wrap or molded foam to prevent physical damage during transit. For international shipments, comply with IATA, IMDG, or ADR regulations as applicable—although PTC sensors are generally not classified as hazardous materials, documentation must confirm the absence of restricted substances. Air, sea, and ground shipments should maintain ambient temperature ranges and avoid exposure to excessive vibration.

Regulatory Compliance

PTC sensors must comply with relevant international and regional standards. Key certifications include:

– RoHS (Restriction of Hazardous Substances): Ensure sensors are free of lead, mercury, cadmium, and other restricted materials.

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Confirm no use of substances of very high concern (SVHCs).

– UL/CSA/IEC Standards: Verify compliance with safety standards such as IEC 60730 for automatic electrical controls.

– Conflict Minerals Compliance: Provide documentation (e.g., CMRT) confirming sourcing from conflict-free regions as per U.S. SEC Rule 13p-1.

Documentation and Labeling

Accurate labeling and documentation are essential for customs clearance and traceability. Each shipment must include:

– Commercial invoice with detailed product description

– Packing list specifying quantities and packaging types

– Certificate of Conformance (CoC) or Declaration of Compliance (DoC) for RoHS, REACH, and other applicable standards

– SDS (Safety Data Sheet) if required, though typically not mandatory for PTC sensors

Barcodes or QR codes should be applied for inventory tracking and lot traceability throughout the supply chain.

Import and Export Controls

Verify export classification under the Export Control Classification Number (ECCN) system. PTC sensors generally fall under EAR99 (not specifically listed), but confirm with the manufacturer or legal counsel to ensure compliance with U.S. Bureau of Industry and Security (BIS) or equivalent national regulations. Screen end-users and destinations against denied party lists (e.g., U.S. OFAC, EU Consolidated List) to prevent unauthorized shipments to embargoed countries or restricted entities.

End-of-Life and Environmental Considerations

Dispose of defective or obsolete PTC sensors in accordance with local e-waste regulations. Partner with certified electronic waste recyclers to ensure environmentally sound treatment and recovery. Promote recycling initiatives and provide take-back programs where feasible to support circular economy goals and comply with WEEE (Waste Electrical and Electronic Equipment) directives in the EU and similar regulations globally.

Conclusion for Sourcing PTC Sensors

After a thorough evaluation of technical requirements, supplier capabilities, and market options, sourcing PTC (Positive Temperature Coefficient) sensors should focus on suppliers that offer a balance of reliability, cost-efficiency, and consistent quality. Key factors such as temperature accuracy, response time, durability under operating conditions, and compliance with industry standards (e.g., RoHS, ISO) must be prioritized.

It is recommended to establish long-term partnerships with suppliers that demonstrate proven manufacturing expertise, strong quality control processes, and the ability to scale production as needed. Additionally, considering regional suppliers can reduce lead times and logistics costs while improving supply chain resilience.

In conclusion, a strategic sourcing approach that emphasizes technical compatibility, supplier reliability, and total cost of ownership will ensure optimal performance and integration of PTC sensors into the target application—supporting product safety, efficiency, and long-term success.