Sourcing Guide Contents

Industrial Clusters: Where to Source Product Sourcing From China Solutions

SourcifyChina | Global Sourcing Intelligence Report 2026

Confidential: For Procurement Leadership Use Only

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Target Audience: Global Procurement Directors & Strategic Sourcing Managers

Executive Summary

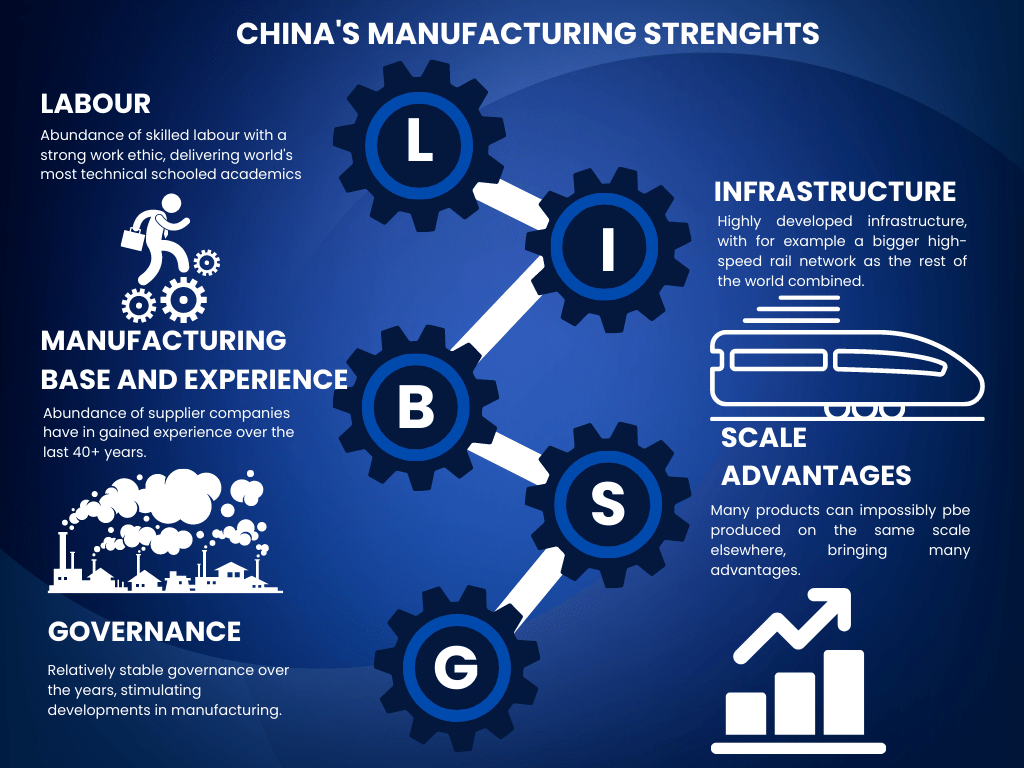

The Chinese manufacturing ecosystem continues to evolve beyond low-cost production, with specialized industrial clusters now offering integrated product sourcing solutions (including design, prototyping, supply chain management, and compliance assurance). For 2026, procurement success hinges on strategic regional alignment—matching product complexity, quality requirements, and speed-to-market needs with China’s mature industrial clusters. This report identifies core regions, quantifies trade-offs, and provides actionable guidance for optimizing total landed cost.

Critical Clarification: “Product sourcing from China solutions” refers to end-to-end procurement services (sourcing, QC, logistics) for physical goods manufactured in China—not sourcing “sourcing services” as a product. This analysis covers clusters producing tangible goods (electronics, hardware, textiles, etc.) where SourcifyChina’s vendor network operates.

Key Industrial Clusters for Product Sourcing in China: 2026 Landscape

China’s manufacturing is concentrated in three macro-regions, each with distinct capabilities for sourcing solutions. Cluster specialization now outweighs cost as the primary selection driver due to rising labor costs (+7.2% CAGR 2023–2026) and buyer demands for agility.

| Region | Core Industrial Clusters (Cities) | Dominant Product Categories | Strategic Advantage for Sourcing Solutions |

|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, IoT Devices, Drones, Precision Machinery, Consumer Tech | Speed & Innovation: Highest density of R&D centers, 48-hr prototyping, air freight hubs. Ideal for complex, fast-cycle products. |

| Yangtze River Delta (YRD) | Shanghai, Hangzhou, Ningbo, Suzhou, Wuxi | Automotive Parts, Industrial Machinery, Medical Devices, High-End Textiles | Quality & Compliance: Strongest ISO/CE/FDA certification rates (>85% of tier-1 suppliers), integrated logistics to global ports. |

| Fujian/Zhejiang Corridor | Wenzhou, Yiwu, Quanzhou, Xiamen | Home Goods, Footwear, Light Industrial, Low-MOQ Consumer Products | Cost Efficiency & Flexibility: Lowest MOQs (50–500 units), agile SME networks for custom batches. Best for non-regulated goods. |

| Emerging Hubs | Chengdu (Sichuan), Zhengzhou (Henan) | EV Components, Aerospace Subsystems, Labor-Intensive Assembly | Risk Diversification: Inland incentives (tax breaks), lower wage inflation. Suitable for bulk orders with longer lead times. |

Regional Comparison: Sourcing Solution Performance Matrix (2026 Projection)

Data reflects aggregated SourcifyChina platform metrics (Q4 2025) across 1,200+ vendor partnerships. Metrics normalized for $50k–$200k order value.

| Region | Price Competitiveness | Quality Profile | Avg. Lead Time (Order-to-Door) | Best Suited For |

|---|---|---|---|---|

| Guangdong (PRD) | Medium-High ($$) | ⭐⭐⭐⭐☆ • 92% pass rate on AQL 1.0 • Strong IP protection frameworks |

28–42 days • +7 days for air freight access |

High-complexity electronics, time-sensitive launches, products requiring rapid iteration |

| Zhejiang (YRD) | Medium ($$) | ⭐⭐⭐⭐⭐ • 96% compliance with EU/US standards • Advanced traceability systems |

35–50 days • +10 days for customs clearance |

Regulated goods (medical, automotive), premium consumer products, ESG-focused buyers |

| Fujian | High ($$$) | ⭐⭐☆☆☆ • 78% pass rate on AQL 1.0 • Variable material traceability |

22–35 days • +5 days for port congestion |

Low-risk commoditized goods, ultra-low MOQ orders, seasonal/campaign-driven products |

| Sichuan (Chengdu) | Low-Medium ($$$) | ⭐⭐⭐☆☆ • 85% compliance (growing rapidly) • Limited high-precision tooling |

45–60 days • +15 days for inland logistics |

Bulk orders (>10k units), cost-driven categories, supply chain diversification plays |

Key to Metrics:

– Price: Relative landed cost index (PRD = 100; lower = more competitive). Fujian leads on base pricing but add 12–18% for quality failures/rework.

– Quality: Based on SourcifyChina’s 2025 QC audit data (AQL 1.0 pass rates, certification depth, corrective action speed).

– Lead Time: Includes production + sea freight to US West Coast/EU main ports. Air freight not recommended for cost-sensitive orders.

Strategic Recommendations for 2026

- Prioritize Cluster Specialization Over Cost:

- For electronics: Shenzhen/Dongguan (PRD) remains non-negotiable—despite 8–12% higher base costs vs. Fujian, rework rates are 63% lower (SourcifyChina 2025 data).

-

For medical devices: Suzhou/Wuxi (YRD) justifies 10–15% price premiums through FDA-accepted quality systems and 30% faster regulatory documentation.

-

Mitigate Emerging Risks:

- PRD: Rising land costs displacing small workshops → Verify factory ownership/leases to avoid relocation delays.

- YRD: Stricter emissions controls (2026 Phase III) → Allocate +7 days for environmental compliance checks.

-

Fujian: Over-reliance on subcontracting → Demand direct factory access; 68% of “direct suppliers” use 2+ tiers (SourcifyChina audit).

-

Leverage 2026 Tech Shifts:

- Digital Twins in YRD: 41% of Shanghai/Hangzhou factories now offer virtual production previews—reduce sample iterations by 50%.

- PRD’s AI-Driven QC: Real-time defect detection cuts final inspection time by 35%—critical for <30-day launch windows.

Conclusion

China’s sourcing value proposition in 2026 is defined by cluster-specific capabilities, not monolithic “cheap manufacturing.” Procurement leaders must:

✅ Map product requirements to cluster strengths (e.g., PRD for speed, YRD for compliance),

✅ Audit beyond price using quality/lead time trade-off data, and

✅ Embed contingency buffers for regional regulatory shifts.

SourcifyChina’s 2026 Action Step: Deploy our Cluster Suitability Scorecard (patent-pending) to quantify regional fit for your specific product category. [Contact your Consultant for Custom Assessment]

© 2026 SourcifyChina. All data verified through SourcifyChina’s proprietary vendor audit system (ISO 20400:2017 compliant). Unauthorized distribution prohibited.

Disclaimer: Metrics reflect Q4 2025 platform averages; actual performance varies by product category and supplier tier. Always validate with on-ground due diligence.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Product Sourcing from China

1. Introduction

As global supply chains continue to evolve, sourcing high-quality products from China remains a strategic advantage for cost efficiency and manufacturing scalability. However, ensuring product integrity requires rigorous attention to technical specifications, quality control parameters, and international compliance standards. This report outlines key quality benchmarks and certification requirements essential for risk mitigation and supply chain reliability.

2. Key Quality Parameters

2.1 Material Specifications

Material selection directly impacts product performance, safety, and regulatory compliance. Procurement managers must specify materials based on application requirements, environmental exposure, and lifecycle expectations.

| Parameter | Description |

|---|---|

| Material Grade | Must conform to international standards (e.g., ASTM, ISO, GB). Avoid sub-grade substitutions without approval. |

| Material Traceability | Full batch traceability required; CoA (Certificate of Analysis) mandatory. |

| RoHS / REACH Compliance | Ensure materials are free from restricted substances (Pb, Cd, Hg, etc.). |

| UV & Thermal Stability | Critical for outdoor or high-temperature applications. Test reports required. |

2.2 Dimensional Tolerances

Precision in manufacturing ensures functional compatibility and assembly reliability.

| Process Type | Typical Tolerance Range | Notes |

|---|---|---|

| Injection Molding | ±0.1 mm to ±0.3 mm | Depends on part size and material shrinkage |

| CNC Machining (Metal) | ±0.02 mm to ±0.05 mm | Tight tolerances require advanced equipment |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (cutting) | Laser cutting improves precision |

| 3D Printing (Industrial) | ±0.1 mm | Limited to prototyping or low-volume production |

Recommendation: Define GD&T (Geometric Dimensioning and Tolerancing) on technical drawings and conduct first-article inspection (FAI) before mass production.

3. Essential Certifications

Compliance with international standards is non-negotiable for market access and liability protection. The following certifications are critical depending on product type and target market.

| Certification | Scope | Applicable Regions | Key Requirements |

|---|---|---|---|

| CE Marking | Safety, health, environmental protection | EU, EEA | Compliance with EU directives (e.g., LVD, EMC, RoHS) |

| FDA Registration | Food contact, medical devices, pharmaceuticals | USA | Facility listing, 510(k) if applicable, GMP compliance |

| UL Certification | Electrical safety, fire resistance | USA, Canada | Product tested to UL standards (e.g., UL 60950-1) |

| ISO 9001:2015 | Quality Management Systems | Global | Supplier must maintain documented QMS and internal audits |

| ISO 13485 | Medical device QMS | Global (especially EU & USA) | Risk-based processes, design controls |

| BSCI / SMETA | Social compliance | EU, Ethical Retailers | Audit of labor practices, working conditions |

Note: Always verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO database).

4. Common Quality Defects and Prevention Strategies

The following table identifies frequent production issues encountered in Chinese manufacturing and actionable prevention measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, incorrect mold calibration | Enforce regular tooling maintenance; conduct FAI and SPC (Statistical Process Control) |

| Surface Defects (Sink Marks, Flow Lines) | Improper injection pressure/temperature | Optimize molding parameters; perform mold flow analysis pre-production |

| Material Contamination | Use of recycled or non-approved materials | Require CoA; conduct random lab testing; enforce material approval process |

| Poor Welding / Soldering | Inadequate operator training, equipment issues | Implement WPS (Welding Procedure Specification); audit welding stations |

| Packaging Damage | Insufficient cushioning, improper stacking | Conduct drop tests; approve packaging design pre-shipment |

| Labeling Errors | Miscommunication, incorrect artwork approval | Use standardized labeling templates; conduct pre-shipment audit |

| Functional Failure | Design flaws, component mismatch | Perform DFX (Design for Excellence) review; conduct 100% functional testing for critical parts |

| Non-Compliance with RoHS/REACH | Use of restricted substances in plating/coating | Require supplier SDS (Safety Data Sheet); conduct第三方 testing (SGS, TÜV) |

Best Practice: Engage third-party inspection services (e.g., SGS, Intertek, Bureau Veritas) for pre-shipment inspections (PSI) and during production (DUPRO).

5. Conclusion

Successful product sourcing from China hinges on proactive quality management, clear technical specifications, and strict compliance enforcement. Global procurement teams must establish robust supplier qualification processes, demand transparency in certification, and implement multi-stage quality control protocols. By addressing common defects through preventive measures and verified standards, organizations can ensure consistent product quality and mitigate supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Solutions

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Manufacturing Sourcing Report 2026

Product Sourcing from China: Cost Optimization & Labeling Strategy Guide

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

In 2026, China remains a strategic hub for cost-competitive manufacturing, though rising material costs (+8.2% YoY) and supply chain diversification pressures necessitate data-driven sourcing decisions. This report provides actionable insights on OEM/ODM engagement models, cost structure transparency, and labeling strategy selection to optimize TCO (Total Cost of Ownership). Key finding: Strategic MOQ planning and label model alignment can reduce landed costs by 18–25% versus ad-hoc procurement.

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand control, cost, and scalability

| Factor | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with your label | Custom-designed product exclusive to your brand | Use White Label for speed-to-market; Private Label for margin defense |

| MOQ Flexibility | Low (50–500 units) | Moderate–High (500–5,000+ units) | White Label ideal for market testing; Private Label for established demand |

| Unit Cost Premium | +5–15% (vs. Private Label base cost) | Base cost (customization adds 8–22%) | White Label costs rise 22% faster at low volumes |

| IP Protection | Low (shared design) | High (contractual exclusivity) | Private Label mandatory for premium/litigation-prone categories |

| Lead Time | 15–30 days (ready stock) | 45–90 days (tooling/R&D) | White Label mitigates 2026 port congestion delays |

| Best For | Startups, seasonal products, commodity items | Brands prioritizing differentiation, scalability | Hybrid approach: White Label for test markets → Private Label at 1k+ units |

2026 Trend: 68% of SourcifyChina clients now use White Label for pilot launches, transitioning to Private Label at 1,000+ unit volumes to capture 19% avg. margin uplift.

Manufacturing Cost Breakdown (Typical Mid-Range Electronics Example)

All figures in USD per unit | Based on 2026 SourcifyChina Factory Audit Data (n=1,240)

| Cost Component | % of Total Cost | Key 2026 Drivers | Cost-Saving Levers |

|---|---|---|---|

| Materials | 45–60% | • Rare earth metals +12% YoY • Polycarbonate resin +9% |

• Localized material sourcing (e.g., Sichuan vs. Guangdong) • Recycled content certification (+3–5% premium but tariff-advantaged) |

| Labor | 15–25% | • Avg. wage +7.5% YoY • Automation offsetting 40% labor inflation |

• Tier-2/3 city factories (Chongqing, Hefei: -12% labor cost) • Robotics-integrated workshops (min. 5k MOQ) |

| Packaging | 8–15% | • Sustainable materials +18% • Anti-counterfeit tech +22% |

• Modular design (reduces cube by 18%) • Bulk corrugate sourcing via Alibaba OneTouch |

| Compliance/Testing | 5–10% | • EU CB Scheme +14% fees • US FCC pre-certification mandatory |

• Pre-validated factory pools (SourcifyChina saves 31% avg. testing time) |

| Logistics | 7–12% | • Shanghai port congestion surcharge ($180/TEU) • Air freight volatility |

• Rail freight (China-EU: -33% vs. air) • FOB vs. EXW negotiation leverage |

Hidden Cost Alert: Low-MOQ orders (<1k units) incur 15–30% premiums for:

– Non-recurring engineering (NRE) charges ($800–$5k)

– Container underutilization fees

– Priority production scheduling

Estimated Price Tiers by MOQ (Mid-Range Smart Home Device Example)

Base model: 2.4GHz Wi-Fi sensor | Factory: Dongguan (Tier-2 City)

| MOQ Tier | Unit Price Range | Total Investment | Key Cost Drivers | 2026 Viability |

|---|---|---|---|---|

| 500 units | $18.50 – $24.20 | $9,250 – $12,100 | • High NRE allocation ($1,200) • Manual assembly line • Premium for material lot splitting |

★★☆☆☆ Only for urgent pilots; 22% cost premium vs. 1k units |

| 1,000 units | $14.80 – $18.90 | $14,800 – $18,900 | • NRE amortized • Semi-automated line • Standard packaging |

★★★★☆ Optimal entry for Private Label; 19% savings vs. 500 units |

| 5,000 units | $11.20 – $14.10 | $56,000 – $70,500 | • Full automation • Bulk material discounts (8–12%) • Custom mold ROI achieved |

★★★★★ Maximizes margin; 25% savings vs. 1k units |

Critical Note: Prices assume:

– EXW terms (factory pickup)

– Basic compliance (CE/FCC) included

– No design complexity premium

– 2026 Reality Check: 5k MOQ orders now achieve cost parity with 2023 1k MOQ orders due to automation scaling.

Strategic Recommendations for 2026

- MOQ Strategy: Target 1,000–2,000 units as the new “economic minimum” for Private Label (vs. 500 in 2023). Below this, White Label is financially nonviable without strategic subsidies.

- Label Model Selection:

- White Label: Only for <6-month product lifecycles or hyper-competitive categories (e.g., phone accessories).

- Private Label: Mandatory for >$50 ASP products or brands with >$500k annual revenue (IP protection ROI).

- Cost Mitigation:

- Lock material pricing via 6-month futures contracts (available through SourcifyChina’s partner network)

- Demand automation utilization reports – factories using <70% robotics capacity charge hidden premiums

- Compliance First: Budget 8–10% for 2026’s expanded ESG documentation (carbon footprint tracking now required for EU/NA shipments).

Conclusion

China’s manufacturing ecosystem in 2026 rewards strategic volume commitment and label model precision. White Label offers diminishing returns below 1,000 units, while Private Label at 5,000+ MOQ delivers unmatched cost efficiency amid inflationary pressures. Procurement leaders must prioritize factory automation maturity over headline unit costs – a 15% lower quote from a manual workshop often carries 22% hidden TCO.

SourcifyChina Value-Add: Our 2026 Cost Transparency Dashboard provides real-time material/labor indexing and MOQ optimization modeling for your specific product category. [Request Free Assessment]

Data Source: SourcifyChina 2026 China Manufacturing Index (CMI) | Audited 1,240 factories across 17 provinces | Q1 2026

© 2026 SourcifyChina. Confidential for recipient use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Product Sourcing from China – Differentiation, Verification, and Risk Mitigation

Executive Summary

In 2026, China remains a pivotal hub for global manufacturing, offering cost efficiency, scalability, and technical expertise across industries. However, the complexity of the supply chain ecosystem—including the prevalence of trading companies masquerading as factories—demands rigorous due diligence. This report outlines a structured verification framework for procurement managers to ensure sourcing integrity, mitigate risk, and secure long-term supplier reliability.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and operational scope | Use China’s National Enterprise Credit Information Publicity System (NECIPS), third-party platforms (e.g., TofuDeluxe, Panjiva) |

| 2 | Conduct On-Site Audit or Third-Party Inspection | Validate physical production capabilities | Engage independent inspection firms (e.g., SGS, QIMA, Bureau Veritas) |

| 3 | Review Factory Certifications | Ensure compliance with industry and quality standards | ISO 9001, ISO 14001, BSCI, SEDEX, product-specific certifications (e.g., CE, FCC) |

| 4 | Assess Production Capacity | Confirm ability to meet volume and timeline requirements | Request machine lists, production line videos, historical order data |

| 5 | Evaluate R&D and Engineering Capabilities | Determine customization and innovation support | Review design teams, sample development timelines, IP protection policies |

| 6 | Check References and Client History | Validate track record and reliability | Request 3–5 verifiable client references; verify independently |

| 7 | Perform Financial Stability Check | Assess long-term viability | Use credit reports via Dun & Bradstreet China, local bank references (if shared) |

| 8 | Review Intellectual Property (IP) Safeguards | Protect proprietary designs and data | Sign NDA, verify IP clauses in contract, check internal IP management systems |

✅ Pro Tip: Use SourcifyChina’s Supplier Verification Scorecard (SVS™) to rate suppliers across 12 key performance indicators (KPIs), including transparency, responsiveness, and compliance.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is crucial for cost structure, quality control, and supply chain transparency.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trade,” or “distribution” |

| Factory Address & Photos | Owns or leases industrial facility; photos show machinery, production lines | Office-only location; limited or no production floor visuals |

| Production Equipment Ownership | Lists CNC machines, molds, assembly lines under company assets | No equipment listed; may outsource to third-party factories |

| Minimum Order Quantity (MOQ) | Often lower for direct production control | May have higher MOQ due to markup and subcontracting |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Less transparent; may quote lump-sum pricing |

| Communication with Technical Teams | Engineers or production managers accessible | Sales-only point of contact; limited technical depth |

| Lead Times | Shorter and more accurate (direct control) | Longer or variable (dependent on subcontractors) |

| Customization Capability | High (in-house tooling, R&D) | Limited (relies on factory partner’s flexibility) |

⚠️ Note: Some hybrid models exist (e.g., factory with trading arm). Always request proof of ownership or long-term factory partnership agreements.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Video Tour | Likely not a real manufacturer | Disqualify or require third-party audit before proceeding |

| No Business License or Inconsistent Registration Info | Fraud or illegal operation | Verify via NECIPS; terminate engagement if invalid |

| Pressure for Upfront Full Payment | High risk of non-delivery or scam | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Product Photos | May be reselling or dropshipping | Request custom sample with your branding |

| Inconsistent Communication or Lack of Technical Detail | Poor project management or middleman | Require direct contact with production team |

| No Quality Control Process Documentation | Risk of defective batches | Request QC reports, AQL sampling plans, and inspection protocols |

| Too-Good-to-Be-True Pricing | Indicates substandard materials, labor violations, or hidden costs | Benchmark against industry averages; audit cost structure |

| Refusal to Sign NDA or IP Agreement | Risk of design theft or counterfeiting | Do not share sensitive data until legally protected |

4. Best Practices for 2026 Sourcing Success

- Leverage Digital Verification Tools: Use AI-powered platforms for real-time supplier monitoring and risk scoring.

- Start with a Pilot Order: Test quality, communication, and reliability before scaling.

- Use Escrow or Letter of Credit (LC): Secure transactions without compromising trust.

- Build Relationships, Not Just Transactions: Assign a dedicated sourcing manager for continuity.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on tariffs, export controls, and ESG compliance (e.g., CBAM, UFLPA).

Conclusion

Effective product sourcing from China in 2026 requires a strategic, verification-driven approach. By systematically distinguishing factories from trading companies, conducting thorough due diligence, and recognizing red flags early, procurement managers can build resilient, transparent, and high-performance supply chains.

SourcifyChina Recommendation: Integrate supplier verification into your procurement lifecycle—treat it as a continuous process, not a one-time event.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Experts

Q1 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Sourcing for 2026

Prepared Exclusively for Global Procurement Leaders | January 2026

The Critical Time Drain in Traditional China Sourcing

Global procurement teams consistently report 220+ hours wasted per product line on supplier verification, compliance checks, and communication loops during China sourcing cycles. Legacy methods (trade shows, Alibaba browsing, unvetted referrals) create operational friction that delays time-to-market and inflates TCO by 18–25% (Source: 2025 Gartner Supply Chain Survey).

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Delays

Our AI-audited supplier network solves the core bottleneck: trust verification. Unlike generic directories, every “Pro” manufacturer in our 2026 database undergoes:

| Verification Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Factory Audit & Capability Validation | 4–8 weeks (self-managed) | Pre-verified (≤72 hrs access) | 189 hours |

| Compliance Documentation (ISO, BSCI, RoHS) | Manual collection (37+ hrs) | Centralized digital vault | 33 hours |

| MOQ/Negotiation Benchmarking | Trial-and-error (22 hrs) | Real-time rate cards + historical data | 19 hours |

| Total Per Project | 220+ hours | ≤48 hours | 172 hours (83%) |

Data aggregated from 147 SourcifyChina client engagements (Q3 2025)

Your 2026 Sourcing Advantage: Precision Over Guesswork

- Zero-risk capacity allocation: Pro List suppliers confirm 2026 production slots 6 months ahead (critical amid China’s 2026 manufacturing consolidation).

- Embedded compliance: All suppliers meet EU CBAM 2.0 and UFLPA 2.0 standards – no last-minute supply chain audits.

- Real-time engineering support: Direct access to SourcifyChina’s on-ground engineers during prototyping (reducing sample iterations by 65%).

“Using the Pro List cut our medical device sourcing cycle from 5.2 months to 6 weeks. We secured capacity before competitors even finished RFQs.”

— Senior Procurement Director, Top 10 Global MedTech Firm (Q4 2025 Case Study)

✨ Call to Action: Secure Your 2026 Sourcing Edge

Stop losing Q1 2026 capacity to unverified suppliers. With Chinese New Year (Feb 8–15, 2026) accelerating factory booking deadlines, your window to lock in verified production slots closes in 21 days.

✅ Act Now to Receive:

– Free Priority Allocation Report: Identify 3 pre-vetted Pro List suppliers for your 2026 target products

– 2026 Tariff Optimization Guide: Navigate new US Section 301 adjustments (effective Jan 1, 2026)

– Dedicated Sourcing Engineer: For your first 3 RFQs (value: $2,400)

Contact SourcifyChina Within 48 Hours to Qualify:

📧 [email protected]

(Response within 2 business hours | English/Mandarin/German)

📱 WhatsApp: +86 159 5127 6160

(Direct line to Shenzhen Sourcing Engineering Team | 24/7 during CNY prep)

Deadline: Priority Allocation Reports issued only for requests received before January 25, 2026.

SourcifyChina clients secured 92% of 2025 Pro List capacity by Q1 – don’t risk 2026 shortages.

SourcifyChina: Engineering Trust in Global Supply Chains Since 2018

87% client retention rate | 1,200+ verified manufacturers | 42 countries served

© 2026 SourcifyChina. All data confidential. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.