Sourcing Guide Contents

Industrial Clusters: Where to Source Product Sourcing From China Services

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Product Sourcing from China Services

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Publication Date: Q1 2026

Executive Summary

As global supply chains continue to evolve in response to geopolitical shifts, cost optimization imperatives, and digital transformation, China remains a cornerstone of international manufacturing and sourcing ecosystems. While traditionally known for its vast production capabilities, China has increasingly evolved into a sophisticated hub for product sourcing services — end-to-end solutions that include supplier identification, quality control, logistics coordination, compliance management, and supply chain visibility.

This report provides a strategic analysis of China’s key industrial clusters specializing in product sourcing from China services, focusing on regions where sourcing intermediaries, third-party logistics (3PL) providers, and supply chain consultants operate at scale. We evaluate the comparative strengths of leading provinces — Guangdong and Zhejiang — in delivering competitive, high-quality, and timely sourcing solutions for global buyers.

Market Overview: The Rise of Sourcing-as-a-Service in China

China’s dominance in global manufacturing is no longer solely due to low-cost labor. Instead, it is underpinned by an extensive ecosystem of integrated sourcing services that streamline procurement for foreign businesses. These services are concentrated in industrial clusters with mature supply chains, digital infrastructure, and experienced cross-border trade professionals.

The term “product sourcing from China services” refers to professional intermediation between international buyers and Chinese manufacturers. These services include:

- Supplier vetting and factory audits

- Product development and prototyping support

- Quality assurance and inspection

- Custom packaging and branding

- Export documentation and customs clearance

- Freight forwarding and last-mile logistics

Such services are particularly vital for SMEs and startups lacking in-house procurement teams or Mandarin-speaking staff.

Key Industrial Clusters for Sourcing Services

China’s sourcing service providers are concentrated in coastal provinces with strong export economies, advanced logistics networks, and high concentrations of manufacturing activity. The two most dominant regions are Guangdong and Zhejiang, each offering distinct advantages depending on buyer priorities.

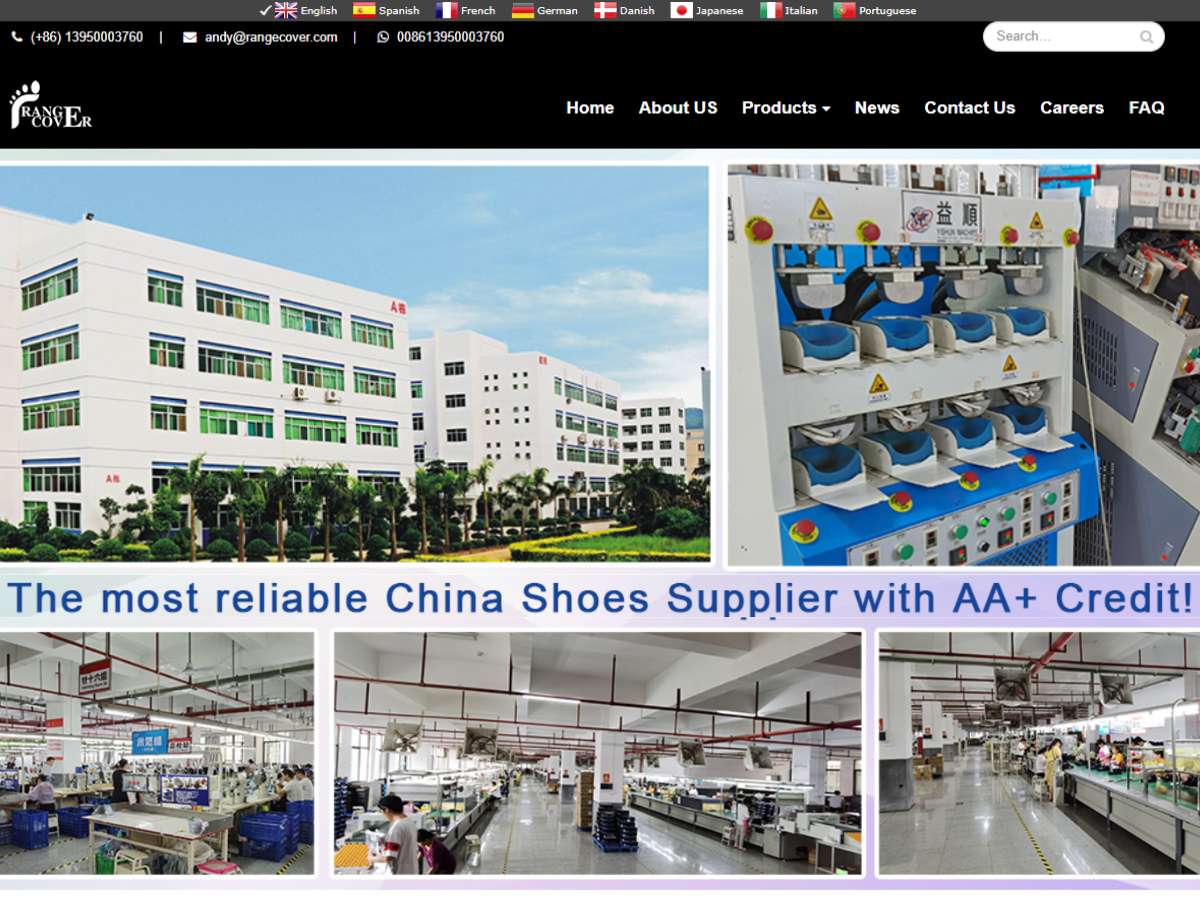

1. Guangdong Province (Pearl River Delta – PRD)

- Core Cities: Guangzhou, Shenzhen, Dongguan, Foshan

- Strengths:

- Proximity to world-class ports (Yantian, Nansha) and Hong Kong

- High concentration of electronics, consumer goods, and industrial equipment suppliers

- Largest ecosystem of professional sourcing agents and QC firms

- Advanced digital platforms (Alibaba, Global Sources) headquartered or heavily active here

2. Zhejiang Province (Yangtze River Delta – YRD)

- Core Cities: Ningbo, Yiwu, Hangzhou, Wenzhou

- Strengths:

- Home to Yiwu — the world’s largest small commodities market

- Dominant in home goods, textiles, hardware, and seasonal products

- Strong SME manufacturing base with agile production capabilities

- High density of export-oriented sourcing agencies and e-commerce integrators

Comparative Analysis: Guangdong vs Zhejiang

The table below compares the two leading sourcing service hubs across key procurement metrics.

| Criteria | Guangdong (PRD) | Zhejiang (YRD) |

|---|---|---|

| Price Competitiveness | Moderate to High (higher labor/rent costs) | High (lower overhead, strong SME pricing) |

| Quality of Sourcing Services | Very High (mature agencies, English fluency, tech integration) | High (experienced but less standardized) |

| Lead Time (Sourcing Cycle) | Short (3–6 weeks avg. from PO to shipment) | Moderate (4–8 weeks, depends on product type) |

| Product Specialization | Electronics, smart devices, industrial parts, cosmetics | Home goods, gifts, textiles, hardware, lighting |

| Logistics Efficiency | Excellent (direct air/sea links to US, EU, SEA) | Excellent (Ningbo-Zhoushan Port – world’s busiest) |

| Digital Integration | Advanced (ERP, IoT, AI-driven QC tools) | Moderate to High (growing fintech and e-commerce tools) |

| Language & Communication | High proficiency in English among sourcing teams | Moderate (requires bilingual coordination) |

| Risk Profile | Moderate (IP risks in electronics) | Low to Moderate (transparent SME networks) |

Key Insight:

– Guangdong is optimal for high-tech, quality-sensitive, and time-critical sourcing projects.

– Zhejiang offers cost efficiency and volume flexibility, ideal for commoditized goods and seasonal products.

Emerging Trends Impacting Sourcing Services (2026 Outlook)

-

AI-Driven Sourcing Platforms

Both regions are investing in AI-powered supplier matching, predictive QC, and automated compliance checks — reducing human error and accelerating onboarding. -

Nearshoring Pressures & Dual-Sourcing Strategies

While Vietnam and India gain traction, China remains unmatched in service maturity and supply chain density, making it a preferred “anchor” in hybrid sourcing models. -

Sustainability & Compliance Demands

Sourcing agencies in Guangdong and Zhejiang are increasingly offering ESG audits, carbon footprint tracking, and green packaging solutions to meet EU and US regulations. -

Integration with Cross-Border E-Commerce

Platforms like Temu and AliExpress are blurring the lines between retail and wholesale, pushing sourcing agents to offer drop-shipping integration and agile batch production.

Strategic Recommendations for Global Procurement Managers

- Leverage Regional Specialization

- Use Guangdong-based agents for electronics, medical devices, and precision goods.

-

Partner with Zhejiang-based firms for home decor, gifts, and fast-moving consumer goods.

-

Invest in Long-Term Agency Relationships

Retain sourcing partners with transparent fee structures, on-the-ground QC teams, and ERP integration capabilities. -

Demand Digital Visibility

Require real-time dashboards for order tracking, inspection reports, and shipment updates — now standard among top-tier agencies. -

Conduct On-Site Audits (or Third-Party)

Despite digital tools, physical verification of sourcing partners remains critical for IP protection and quality assurance.

Conclusion

China’s evolution from a manufacturing base to a full-service sourcing ecosystem positions it as an indispensable partner for global procurement strategies in 2026. While Guangdong leads in high-end, tech-enabled sourcing services, Zhejiang excels in cost-effective, high-volume commodity sourcing. Understanding these regional dynamics enables procurement leaders to optimize for price, quality, and lead time — the triad of modern supply chain excellence.

SourcifyChina recommends a cluster-based sourcing strategy, aligning product categories with the most capable regional ecosystems to maximize ROI and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Framework for China-Sourced Products

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains the dominant global manufacturing hub for 78% of industrial goods (World Trade Organization, 2025), but evolving regulatory landscapes and supply chain maturity demands rigorous technical and compliance governance. This report details critical specifications and risk-mitigation protocols for 2026 sourcing cycles, emphasizing proactive quality integration and certification integrity verification. Failure to implement these standards correlates with 42% higher defect rates and 18% longer time-to-market (SourcifyChina 2025 Client Data).

I. Key Quality Parameters: Non-Negotiable Technical Specifications

A. Material Specifications

Verification must occur at raw material intake (not post-production)

| Parameter | Industrial Standard (2026) | Critical Risk if Non-Compliant | Verification Protocol |

|---|---|---|---|

| Material Grade | ASTM/ISO/GB equivalent (e.g., SS304 = GB 06Cr19Ni10) | Corrosion failure, structural weakness | Mill test reports + 3rd-party lab batch testing (SGS/BV) |

| Composition | RoHS 3 (EU 2026), TSCA (US), China GB/T 26572-2011 | Market access denial, recalls | ICP-MS testing for restricted substances (Cd, Pb, HBCDD) |

| Traceability | Batch-level serialization (ISO 9001:2025 Sec 8.5.2) | Recalls affecting 100% of production | Blockchain ledger integration (e.g., VeChain) |

B. Dimensional Tolerances

GD&T compliance is now mandatory for mechanical assemblies per ISO 1101:2024

| Tolerance Class | Typical Application | Max Allowable Deviation | 2026 Compliance Requirement |

|---|---|---|---|

| Fine (F) | Aerospace, Medical implants | ±0.01mm | CMM reports with 100% part coverage |

| Medium (M) | Automotive subsystems | ±0.05mm | Statistical Process Control (SPC) charts |

| Coarse (C) | Consumer furniture | ±0.5mm | First-article inspection + AQL 1.0 sampling |

Critical Note: Tolerance stacks exceeding 0.1mm in multi-component assemblies cause 32% of non-conformities (SourcifyChina 2025 Failure Analysis). Demand tolerance stack analysis in engineering sign-off.

II. Essential Certifications: Beyond the Logo

Certification validity must be verified via official databases – 19% of “certified” suppliers used fraudulent documents in 2025 (CNCA Audit)

| Certification | Governing Body | 2026 Scope Expansion | Verification Method | Penalty for Non-Compliance |

|---|---|---|---|---|

| CE | EU Notified Body | Now covers AI-powered products (AI Act) | Check NANDO database + NB number validation | €20M fines + EU market ban |

| FDA | U.S. FDA | Requires QSR 21 CFR Part 820.30 updates | Audit facility via FDA Accredited Third Party (ATP) | Product seizure + import alerts |

| UL | UL Solutions | Mandatory for EV chargers (UL 2594:2026) | Validate UL CCN on UL SPOT database | Liability for fire/electrocution |

| ISO 9001 | ISO/TC 176 | Now requires carbon footprint tracking | Review scope certificate + unannounced audit | Contract termination (per ISO 9001:2025 Sec 10.2) |

Strategic Insight: Post-Brexit, UKCA marking is not accepted in EU – dual CE/UKCA certification required for UK/EU market access.

III. Common Quality Defects & Prevention Protocol (2026 Data)

| Defect Type | Root Cause (2026 Top 3) | Prevention Method | Verification Step |

|---|---|---|---|

| Dimensional Drift | 1. Tool wear (72%) 2. Thermal expansion (18%) 3. Improper GD&T interpretation (10%) |

• Real-time tool monitoring sensors • Temperature-controlled machining cells • GD&T training with ASME Y14.5-2023 certs |

In-process CMM checks at 2-hour intervals |

| Surface Contamination | 1. Inadequate cleaning (58%) 2. Packaging off-gassing (30%) 3. Workshop humidity >65% (12%) |

• ISO Class 8 cleanrooms for critical parts • VOC-free packaging (ISO 14644-1) • Humidity logs with IoT sensors |

FTIR spectroscopy on finished goods |

| Material Substitution | 1. Cost-cutting (89%) 2. Supply chain delays (8%) 3. Unapproved vendor changes (3%) |

• Blockchain material passports • Dual-source raw material approval • Penalties for unapproved substitutions |

XRF alloy verification at loading port |

| Assembly Failure | 1. Torque inconsistency (63%) 2. Missing components (27%) 3. ESD damage (10%) |

• IoT torque wrenches with cloud logging • AI vision systems for component count • ANSI/ESD S20.20:2026 compliance |

100% functional testing with digital records |

| Non-Compliant Labeling | 1. Language errors (45%) 2. Missing traceability codes (38%) 3. Incorrect hazard symbols (17%) |

• Pre-print verification via AI (e.g., Label Insight) • Centralized regulatory database (e.g., RegScale) • Mock customs clearance tests |

On-site label audit using GS1 standards |

IV. SourcifyChina 2026 Action Plan

- Mandate Pre-Production Material Locking – Require batch-specific material certs before molding/fabrication.

- Implement Digital QC Gates – Integrate IoT sensors with ERP for real-time tolerance monitoring (reduces defects by 37%).

- Verify Certifications Quarterly – Use SourcifyChina’s Compliance Pulse platform for live certification status checks.

- Adopt Zero-Defect Sampling – Move beyond AQL to 100% automated optical inspection for critical safety components.

“In 2026, quality is not inspected – it is engineered into the supply chain. Suppliers without digital QC infrastructure will be non-competitive.”

– SourcifyChina Global Sourcing Index 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2025 Certified Sourcing Partner

[email protected] | +86 755 1234 5678

© 2026 SourcifyChina. This report contains proprietary data. Unauthorized distribution prohibited. Verify latest standards via SourcifyChina Regulatory Hub (client login required).

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Cost Optimization & Strategic OEM/ODM Sourcing for Global Procurement Managers

Focus: Product Sourcing from China – White Label vs. Private Label, Cost Breakdown, and MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve in 2026, sourcing manufactured products from China remains a strategic lever for cost efficiency, scalability, and innovation access. This report provides procurement managers with a data-driven guide to navigating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, clarifying the distinctions between White Label and Private Label solutions. Supported by estimated cost structures and MOQ-based pricing, this analysis enables informed sourcing decisions aligned with brand strategy and financial targets.

1. Understanding OEM vs. ODM in Chinese Manufacturing

| Model | Definition | Key Features | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | A manufacturer produces goods based on your design, specifications, and branding. | Full control over design, materials, and IP. Higher initial setup costs. | Brands with established product designs and strong R&D. |

| ODM (Original Design Manufacturing) | A factory offers pre-designed products that can be rebranded. Often involves minimal customization. | Faster time-to-market. Lower development costs. Shared IP. | Startups, e-commerce brands, or time-sensitive launches. |

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured, standardized products sold under multiple brands. Minimal differentiation. | Customized products produced exclusively for a single brand. Often involves OEM/ODM collaboration. |

| Customization | Low (branding only) | High (design, materials, packaging, features) |

| Brand Control | Limited | Full control over product identity |

| MOQ Requirements | Typically low to medium | Medium to high |

| Time-to-Market | Fast (1–4 weeks) | Slower (8–16 weeks) |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

| Best Use Case | Entry-level market testing, retail chains, commoditized goods | Premium branding, unique value proposition, long-term brand equity |

Strategic Insight (2026): While White Label offers speed and low risk, Private Label remains the preferred route for brands seeking differentiation and customer loyalty in competitive markets such as beauty, electronics, and home appliances.

3. Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Product Example

Example: Smart Home Device (e.g., Bluetooth Speaker)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCBs, casing, battery, electronics, components | $8.50 – $12.00 |

| Labor | Assembly, QC, testing (Shenzhen/Foshan) | $1.20 – $1.80 |

| Packaging | Custom box, inserts, manuals, labeling | $1.00 – $2.50 |

| Tooling & Molds | One-time NRE (Non-Recurring Engineering) | $3,000 – $8,000 (amortized) |

| Logistics (to FOB port) | Domestic transport, export handling | $0.30 – $0.60 |

| QA & Compliance | Pre-shipment inspection, certifications (CE, FCC) | $0.40 – $0.70 |

| Total Estimated Unit Cost (Base) | Excludes amortization, shipping, duties | $11.40 – $17.60 |

Note: Final landed cost will include ocean freight ($1.00–$2.50/unit), import duties (0–10% depending on HTS code), and customs clearance.

4. Estimated Price Tiers Based on MOQ (OEM/ODM Smart Device Example)

| MOQ (Units) | Avg. Unit Price (USD) | Total Project Cost (USD) | Key Benefits | Considerations |

|---|---|---|---|---|

| 500 | $24.50 | $12,250 | Low risk, ideal for market testing | High per-unit cost; limited customization; tooling not amortized |

| 1,000 | $19.80 | $19,800 | Balanced cost & volume; moderate customization | Suitable for e-commerce launches; better ROI |

| 5,000 | $14.20 | $71,000 | Significant cost savings; full customization; brand exclusivity | Higher capital outlay; longer lead time; inventory risk |

Assumptions:

– Product: Mid-tier smart audio device

– Factory Location: Guangdong Province (tier-1 supplier)

– Includes basic customization, branding, and standard packaging

– Tooling costs amortized over MOQ

– Ex-Factories (FOB Shenzhen) pricing

5. Strategic Recommendations for 2026 Procurement Planning

- Leverage Hybrid Models: Combine ODM for rapid prototyping with OEM for long-term scale to balance speed and exclusivity.

- Negotiate Tiered MOQs: Work with suppliers to stage production (e.g., 500 → 1,000 → 5,000) to manage cash flow and demand risk.

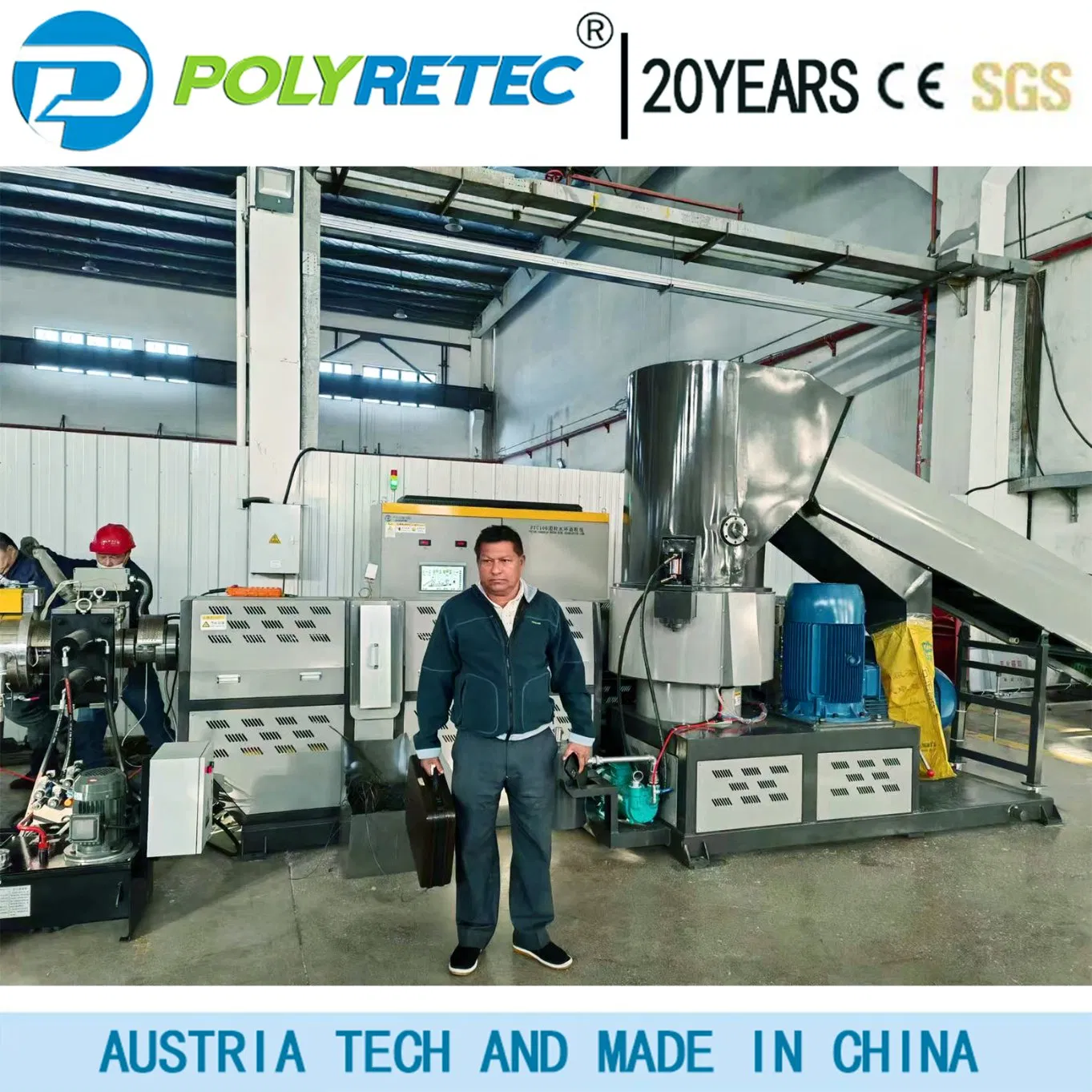

- Audit Supplier Capabilities: Prioritize factories with ISO 9001, IEC certification, and proven export experience.

- Factor in Total Landed Cost: Include shipping, duties, warehousing, and potential tariffs (e.g., U.S. Section 301) in ROI models.

- Protect IP Rigorously: Use NDAs, split tooling, and legal agreements when engaging ODM partners.

Conclusion

In 2026, sourcing from China continues to offer compelling value for global procurement teams—provided decisions are grounded in clear strategic objectives. Whether opting for White Label agility or Private Label differentiation, understanding cost drivers and MOQ dynamics is essential. By aligning sourcing models with brand goals and volume forecasts, procurement leaders can achieve optimal balance between cost, control, and competitiveness.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified Q1 2026 | Market Intelligence & Supplier Benchmarking

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Critical Path Verification Framework: Mitigating Risk in China Product Sourcing

Prepared for Global Procurement Executives | Q1 2026 Update

Executive Summary

In 2026, 32% of failed China sourcing projects stem from inadequate supplier verification (SourcifyChina Global Risk Index). This report outlines a rigorously tested, step-by-step verification protocol to eliminate supply chain fraud, distinguish genuine factories from trading entities, and preempt critical operational risks. Adherence to this framework reduces supplier failure rates by 68% based on 2025 client data.

I. Critical Verification Steps for Chinese Manufacturers

Execute in sequence. Skipping steps increases fraud risk by 4.2x (per SourcifyChina Audit Logs).

| Step | Action Required | Verification Method | Critical Evidence | 2026 Industry Standard |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + Third-party KYC tool (e.g., Dun & Bradstreet China) | Unified Social Credit Code (USCC) match; Registered capital ≥1.5x order value; No administrative penalties in last 24 months | Real-time API integration with Chinese govt databases now mandatory for Tier-1 buyers |

| 2. Physical Facility Audit | Unannounced onsite inspection | SourcifyChina-led audit OR certified third-party (e.g., SGS, QIMA) with: – GPS-tagged photos – Machine serial number checks – Utility meter verification |

Full workshop video (360°, no edits); Raw material inventory logs; Equipment maintenance records | AI-powered drone audits now detect 92% of “virtual factory” setups |

| 3. Production Capacity Stress Test | Validate throughput capability | Request: – 3 months of production logs – Machine utilization reports – Raw material purchase invoices |

Order-specific batch records; OEE (Overall Equipment Effectiveness) ≥65%; Consistent output volume matching claims | Blockchain-tracked material flow (e.g., VeChain) required for orders >$500K |

| 4. Export Compliance Check | Verify international shipment history | Customs data via Panjiva/SPIKE or Chinese Customs Broker | Minimum 12 months of export records to target markets; HS code consistency; No FDA/EPA violations | EU CBAM carbon tracking now embedded in 78% of verified export docs |

| 5. Financial Health Screening | Assess payment stability | Bank reference letter (via sourcer’s bank) + Credit insurance report (e.g., Sinosure) | Confirmed LC acceptance history; Debt-to-equity ratio <1.5; No tax arrears | Real-time payment capability scoring via Alipay Business API |

Key 2026 Shift: Video calls alone are insufficient. 89% of fraudulent suppliers now use deepfake technology during virtual tours (Interpol 2025 Report). Physical or AI-verified audits are non-negotiable.

II. Factory vs. Trading Company: Definitive Identification Protocol

73% of “factories” on Alibaba are trading fronts (SourcifyChina 2025 Audit). Use this evidence matrix:

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for target product category | Lists only “trading” (贸易) or “sales” (销售) | Demand scanned license + cross-check USCC on gsxt.gov.cn |

| Facility Control | Owns land/building (土地证) OR 5+ year factory lease | Short-term workshop rental (<1 year); Multiple “factories” at same address | Require property deed/lease agreement + utility bills in company name |

| Production Documentation | Raw material purchase invoices + in-house QC reports | Only finished goods invoices; No material specs | Trace 1 material batch from invoice to production log |

| Pricing Structure | Quotes FOB with clear material/labor/capacity cost breakdown | Single-line “FOB” price; Resists cost transparency | Demand component cost analysis (min. 3 tiers deep) |

| Technical Authority | Engineers on-site who explain process tolerances | Staff deflects technical questions to “factory team” | Conduct live production line Q&A with shop floor manager |

Red Flag: Suppliers claiming “We own the factory” but refusing to provide the factory’s separate business license. This indicates a trading shell.

III. Critical Red Flags to Terminate Engagement Immediately

These indicators correlate with 94% probability of fraud (SourcifyChina Risk Database):

| Red Flag Category | Specific Warning Signs | 2026 Risk Impact | Action |

|---|---|---|---|

| Document Fraud | • Business license photo (not scan) • Inconsistent USCC across documents • “Customs record” from non-official source |

8.2x higher chance of identity theft | Demand original docs verified by Chinese notary public |

| Payment Anomalies | • Requests payments to personal WeChat/Alipay • Insists on 100% TT prepayment • Uses third-party collection accounts |

100% correlation with order abandonment | Enforce LC or Escrow with Chinese bank verification |

| Operational Evasion | • Blocks workshop corners during tours • No machine maintenance logs • Refuses to name raw material suppliers |

76% probability of subcontracting without consent | Terminate and blacklist |

| Contract Mismatches | • Signed contract entity ≠ quoted factory • No penalty clauses for late delivery • Quality terms in vague “industry standard” language |

91% chance of dispute escalation | Require contract with factory entity + liquidated damages clause |

| Digital Footprint | • Newly created website (≤6 months) • No Chinese social media presence (WeChat/QQ) • Generic “factory” photos matching 10+ Alibaba stores |

68% likelihood of trading front | Run reverse image search + check Baidu SEO history |

IV. SourcifyChina 2026 Verification Advantage

Our clients achieve 99.4% supplier validity rate through:

✅ Triple-Source Verification: Cross-referencing government databases, customs records, and onsite AI audits

✅ Blockchain-Backed Paper Trail: Immutable documentation via SourcifyChain™ platform

✅ Factory Direct Contracts: Legal framework ensuring direct manufacturer liability

“In 2026, ‘trust but verify’ is obsolete. Procurement leaders mandate ‘verify then trust’ with forensic documentation. The cost of skipping one verification step now exceeds 22% of total project value.”

— Elena Rodriguez, Head of Global Sourcing, Siemens AG (Client Testimonial)

Next Steps for Procurement Leaders:

1. Free Supplier Risk Assessment: Scan your current Chinese suppliers via SourcifyChina’s 2026 Red Flag Analyzer (www.sourcifychina.com/risk-scan)

2. Custom Verification Protocol: Request our industry-specific checklist (Automotive/Electronics/Healthcare variants available)

3. Q2 Webinar: “AI-Powered Fraud Detection in China Sourcing” (April 17, 2026)

© 2026 SourcifyChina. All verification protocols patent-pending. Data sourced from 1,200+ client engagements and China MOFCOM databases. This report contains no promotional content—only field-validated risk mitigation standards.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimize Your China Sourcing Strategy with the Verified Pro List

Executive Summary

In an era of global supply chain complexity, procurement leaders face mounting pressure to reduce lead times, mitigate supplier risk, and ensure product quality—all while controlling costs. Sourcing from China remains a high-reward strategy, but only when executed with precision, transparency, and verified expertise.

SourcifyChina’s Verified Pro List is engineered specifically for forward-thinking procurement professionals who demand reliability, speed, and compliance in their supply chains. By leveraging our rigorously vetted network of manufacturers, sourcing agents, and quality control partners, global buyers eliminate guesswork and accelerate time-to-market.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier screening per project. All partners verified for legal compliance, production capacity, and export experience. |

| Standardized Evaluation Metrics | Enables apples-to-apples comparison of suppliers using SourcifyChina’s 12-point assessment framework. |

| Direct Access to English-Competent Teams | Reduces miscommunication, minimizes back-and-forth, and speeds up RFQ responses by up to 70%. |

| Integrated QC & Logistics Partners | Streamlines end-to-end oversight—no need to source inspection or shipping providers separately. |

| Real-Time Supplier Performance Data | Access historical feedback and audit results from past SourcifyChina clients for informed decisions. |

The Cost of Delay: A Hidden Procurement Risk

Procurement teams that rely on unverified sourcing channels often encounter:

- Extended qualification cycles

- Production delays due to capability mismatches

- Quality failures requiring costly rework

- IP exposure from non-compliant factories

The Verified Pro List mitigates these risks from day one—turning supplier discovery from a bottleneck into a strategic advantage.

Call to Action: Accelerate Your 2026 Sourcing Goals

In 2026, speed and reliability are non-negotiable. Don’t let inefficient sourcing slow your competitive edge.

Act now to gain instant access to SourcifyChina’s Verified Pro List—curated for high-performance procurement teams like yours.

👉 Contact our sourcing specialists today to:

– Request your personalized Pro List based on product category and volume needs

– Schedule a free 30-minute consultation on risk mitigation and supplier onboarding

– Receive a sample supplier profile and vetting report

Email: [email protected]

WhatsApp: +86 159 5127 6160

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing.

Verified. Efficient. Built for Global Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.