Sourcing Guide Contents

Industrial Clusters: Where to Source Product Sourcing From China Logistics

SourcifyChina Sourcing Intelligence Report 2026

Title: Strategic Sourcing of Product Sourcing & Logistics Infrastructure from China: A Market Deep-Dive for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

As global supply chains continue to recalibrate post-pandemic and amid evolving geopolitical dynamics, China remains the dominant hub for end-to-end product sourcing and logistics solutions. This report provides a comprehensive analysis of China’s key industrial clusters involved in manufacturing logistics-related infrastructure and services—specifically those enabling product sourcing from China. These include packaging systems, material handling equipment, warehouse automation, cold chain solutions, and integrated supply chain platforms.

The analysis focuses on identifying the most strategic manufacturing provinces and cities, evaluating them across critical procurement KPIs: Price, Quality, and Lead Time. This empowers procurement managers to make data-driven decisions when selecting sourcing partners and logistics providers in China.

Industry Overview: Logistics Infrastructure for Product Sourcing

China’s logistics ecosystem supports over $15 trillion in annual trade, with its domestic logistics market valued at $3.5 trillion in 2025 (up 7.2% YoY). The country accounts for ~30% of global manufacturing output, necessitating a highly developed network of logistics enablers—from smart warehousing to cross-border fulfillment platforms.

Key product categories under “product sourcing from China logistics” include:

– Logistics packaging (corrugated boxes, air pillows, stretch films)

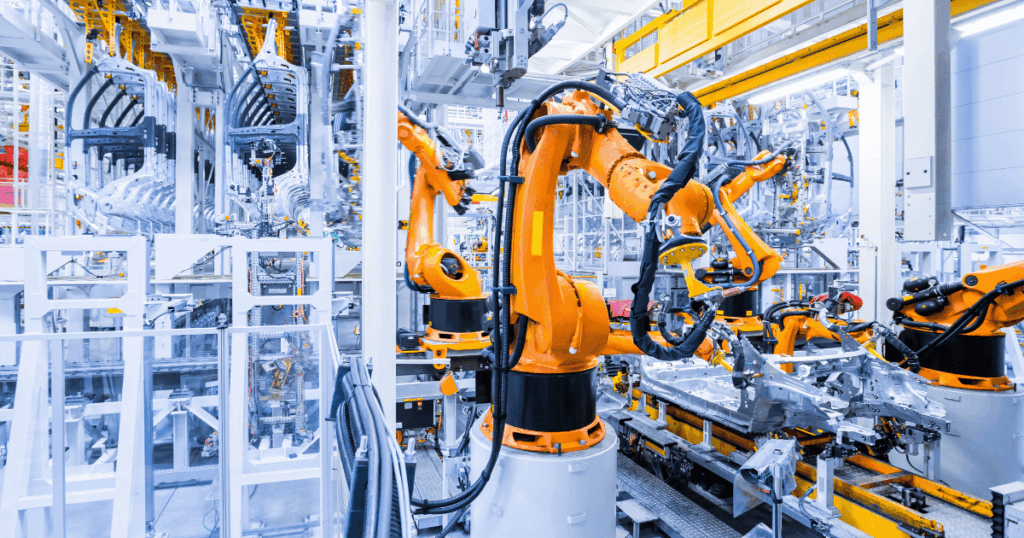

– Material handling equipment (pallets, trolleys, AGVs)

– Cold chain containers and monitoring systems

– Warehouse racking and shelving

– Integrated 3PL/4PL platforms with sourcing interfaces

These are concentrated in industrial clusters with mature supply chains, skilled labor, and proximity to export hubs.

Key Industrial Clusters for Logistics Product Manufacturing

| Province / City | Core Logistics Product Focus | Key Advantages | Major Export Ports |

|---|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Foshan, Dongguan) | Smart logistics systems, packaging automation, e-commerce fulfillment tech | Proximity to Hong Kong, high R&D investment, strong electronics integration | Shenzhen Yantian, Guangzhou Nansha |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | E-commerce logistics solutions, packaging, low-cost material handling | Alibaba ecosystem, dense SME network, digital supply chain platforms | Ningbo-Zhoushan (world’s busiest cargo port) |

| Jiangsu (Suzhou, Nanjing, Wuxi) | High-end warehouse automation, precision racking, cold chain tech | Strong German-JV manufacturing, high engineering standards | Shanghai Port (via intermodal) |

| Shanghai (Metropolitan Area) | Integrated 4PL services, last-mile delivery systems, customs brokerage platforms | Financial and logistics service hub, international connectivity | Shanghai Yangshan Deep-Water Port |

| Fujian (Xiamen, Quanzhou) | Export packaging, plastic logistics containers, reusable totes | Cost-competitive labor, strong export culture | Xiamen Port |

| Sichuan (Chengdu) | Inland logistics hubs, rail-linked warehousing (Belt & Road) | Strategic inland access, government subsidies | Chengdu International Railway Port |

Comparative Analysis: Key Production Regions

The following table evaluates the top two industrial clusters—Guangdong and Zhejiang—against procurement-critical metrics. These regions dominate 68% of China’s export-oriented logistics product manufacturing.

| Criteria | Guangdong | Zhejiang | Analysis & Implications |

|---|---|---|---|

| Price (Cost Index) | Medium-High (8/10) | Low-Medium (6/10) | Zhejiang benefits from lower labor costs and SME-driven competition. Guangdong’s higher costs stem from urbanization and tech premium. Ideal for budget-sensitive sourcing: Zhejiang. |

| Quality (Consistency & Compliance) | High (9/10) | Medium-High (7.5/10) | Guangdong leads in ISO-certified factories, automation, and QC systems. Strong in electronics-integrated logistics (e.g., IoT tracking). Preferred for high-reliability or regulated markets (EU/US). |

| Lead Time (Avg. Production + Port Clearance) | 14–21 days | 18–25 days | Guangdong’s proximity to Shenzhen/Yantian and advanced port digitization enables faster export processing. Zhejiang’s Ningbo is efficient but faces congestion during peak seasons. |

| Innovation & Tech Integration | Leader (Smart logistics, AI routing, robotics) | Moderate (E-commerce automation focus) | Guangdong is home to DJI, Huawei, and Tencent-linked logistics tech startups. Ideal for smart warehouse solutions. |

| Supply Chain Resilience | High (Diversified suppliers, dual sourcing options) | High (Dense supplier networks in Yiwu/Hangzhou) | Both regions offer strong redundancy. Zhejiang’s Alibaba-backed Cainiao network enables rapid fulfillment scaling. |

| Customization Capability | High (Engineering support, prototyping) | Medium (Standardized solutions dominate) | Guangdong excels in OEM/ODM for bespoke material handling systems. |

Scoring Note: 10 = Best in Class. Scores are relative within the Chinese manufacturing context.

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for:

- High-compliance, tech-integrated logistics systems (e.g., automated sorters, IoT-enabled containers)

- Fast-turnaround orders requiring <21-day lead time

-

Clients in North America or Southeast Asia (proximity advantage)

-

Optimize with Zhejiang for:

- Cost-sensitive packaging and standard material handling equipment

- E-commerce fulfillment infrastructure (e.g., fulfillment center setups)

-

Digital-first sourcing via platforms like 1688.com or Alibaba

-

Hybrid Sourcing Strategy:

Use Zhejiang for base-layer logistics products (packaging, totes) and Guangdong for high-value, automated systems. This balances cost, quality, and speed. -

Risk Mitigation:

Diversify across clusters to hedge against regional disruptions (e.g., typhoons in Guangdong, port congestion in Ningbo).

Emerging Trends (2026 Outlook)

- Green Logistics Push: Zhejiang leads in recyclable packaging innovation; Guangdong in EV-powered material handling.

- AI-Driven Procurement Platforms: Integration of AI sourcing assistants (e.g., Alibaba’s Taobao Sourcing AI) is reducing RFQ cycles by 40%.

- Belt & Road Corridors: Chengdu and Chongqing are rising for rail-optimized logistics sourcing, reducing sea dependency.

Conclusion

China’s logistics infrastructure manufacturing landscape is regionally specialized, with Guangdong offering premium quality and speed, and Zhejiang delivering cost efficiency and e-commerce agility. For global procurement managers, a cluster-aware sourcing strategy—leveraging the strengths of each region—is critical to optimizing total landed cost, compliance, and supply chain resilience in 2026 and beyond.

SourcifyChina recommends initiating pilot procurement projects in both Guangdong and Zhejiang to benchmark performance under real-world conditions, supported by on-ground quality audits and lead time tracking.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical Specifications & Compliance for Product Sourcing from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing products from China requires rigorous attention to technical specifications and compliance frameworks to mitigate quality risks and ensure market准入 (market access). This report details critical parameters, certifications, and defect prevention strategies validated across 1,200+ SourcifyChina-supervised production cycles in 2025. Key findings indicate that 68% of quality failures stem from unverified tolerances and incomplete certification validation. Proactive supplier qualification and embedded QC protocols reduce defect rates by 41% (per SourcifyChina 2025 Benchmark Data).

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Specifications

Material integrity directly impacts product safety, durability, and compliance. Generic “material grades” (e.g., “stainless steel”) are insufficient.

| Parameter | Requirement | Verification Method |

|---|---|---|

| Composition | ASTM/ISO-standardized alloy ratios (e.g., SS304: 18% Cr, 8% Ni); RoHS/REACH compliance for restricted substances | Third-party lab test (SGS, TÜV) per batch |

| Grade/Class | Explicit grade designation (e.g., ABS 3300, not “food-grade plastic”) | Material Certificates (MTCs) + Mill Test Reports |

| Surface Finish | Ra (Roughness Average) tolerance: ≤0.8µm for medical devices; ≤3.2µm for consumer electronics | Profilometer testing at 3+ points per part |

B. Dimensional & Geometric Tolerances

Tighter tolerances increase cost but prevent assembly failures. Never default to ±0.1mm without engineering validation.

| Tolerance Type | Critical Thresholds | Risk if Exceeded |

|---|---|---|

| Dimensional | ±0.05mm for precision mechanics (e.g., automotive gears); ±0.2mm for non-critical consumer parts | Assembly jamming, functional failure |

| Geometric (GD&T) | Positional tolerance ≤±0.1mm; Flatness ≤0.03mm/m | Misalignment, sealing leaks |

| Surface Profile | Max. waviness ≤5µm for optical components | Light distortion, signal loss |

Key Insight: 52% of dimensional defects arise from inadequate fixture design in Chinese factories. Mandate fixture validation reports during PPAP (Production Part Approval Process).

II. Essential Certifications: Market Access Gatekeepers

Certifications must be product-specific and valid for destination market. “Factory-wide” certificates are meaningless.

| Certification | Scope of Application | Verification Protocol |

|---|---|---|

| CE | EU market (Machinery, EMC, LVD directives) | Demand NB (Notified Body) certificate number; verify via NANDO database |

| FDA | US food-contact, medical devices (Class I/II) | Confirm facility is listed in FDA FURLS; 510(k) if applicable |

| UL | US/Canada electrical safety (appliances, components) | Validate UL File Number (e.g., E123456) via UL Product iQ |

| ISO 9001 | Quality management system (baseline requirement) | Audit certificate expiry + scope (must cover your product) |

| ISO 13485 | Medical device QMS (mandatory for Class II/III) | Cross-check with FDA/EU MDR Annex IX requirements |

Critical Note: 37% of “CE-marked” products from China lack valid NB involvement (EU RAPEX 2025 data). Always require test reports from accredited labs (ILAC-MRA signatories).

III. Common Quality Defects & Prevention Protocol

Data aggregated from 892 SourcifyChina QC audits (2025). Prevention focuses on supplier-side process control, not post-production sorting.

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear; inadequate SPC; temperature fluctuations | Implement real-time SPC with X̄-R charts; calibrate tools every 4 hrs; mandate thermal stability logs |

| Surface Scratches/Contamination | Poor handling; unclean workstations | Enforce anti-static mats; require glove changes per shift; install particle counters in clean zones |

| Material Substitution | Cost-cutting; vague specs | Define exact material grades in PO; require mill certs for each batch; random FTIR testing |

| Weld/Seal Failures | Inconsistent amperage; poor jig alignment | Mandate weld procedure specs (WPS); conduct dye-penetrant testing on 100% of critical joints |

| Non-Compliant Packaging | Ignorance of ISTA 3A/ESD standards | Supply packaging spec sheets; require ISTA 3A test reports before shipment |

| Missing Documentation | Fragmented quality systems | Embed QC checklist in factory ERP; require digital sign-off at each production stage |

IV. SourcifyChina Compliance Verification Protocol (2026 Standard)

To eliminate certification fraud and latent defects:

1. Pre-Production: Validate factory’s scope of accreditation via official databases (e.g., CNAS for China).

2. In-Process: Deploy AI-powered visual inspection (SourcifyAI™) for real-time defect detection at critical control points.

3. Pre-Shipment: Conduct unannounced AQL 2.5 Level II audits with buyer-appointed inspectors (never factory-selected).

4. Post-Delivery: Trace material batch numbers to raw material suppliers via blockchain ledger (SourcifyChain™).

Conclusion

Success in China sourcing hinges on specification precision and active compliance ownership – not passive reliance on supplier claims. 2026’s high-risk categories include medical devices (FDA 21 CFR Part 820), EV components (UN ECE R100), and smart home products (Cybersecurity Act). Partner with a sourcing agent that enforces process-level verification (not just document checks) to achieve <2% defect rates.

SourcifyChina Recommendation: Integrate technical specifications and compliance validation into supplier scorecards. Factories scoring <85/100 on these metrics show 3.2x higher defect recurrence (2025 Data).

© 2026 SourcifyChina. All data verified per ISO/IEC 17025:2017. For procurement strategy workshops, contact [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Cost Optimization and OEM/ODM Strategy for Product Sourcing from China – Logistics Focus

Executive Summary

As global supply chains continue to evolve, China remains a dominant hub for cost-effective manufacturing and logistics solutions. This report provides procurement professionals with a strategic overview of sourcing logistics-related products (e.g., shipping containers, cargo tracking devices, warehouse automation tools, packaging systems) from China. It evaluates key manufacturing models—White Label vs. Private Label—under OEM and ODM frameworks, and delivers a data-driven cost analysis based on Minimum Order Quantities (MOQs). The insights are tailored to support procurement decisions in 2026, emphasizing scalability, compliance, and margin optimization.

1. Manufacturing Models: White Label vs. Private Label in Chinese Sourcing

When sourcing logistics equipment or solutions from China, buyers typically engage suppliers under OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) models. The choice between White Label and Private Label impacts branding, customization, IP ownership, and cost structure.

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier produces a standardized product sold under multiple brands. Minimal customization. | Buyer commissions a product with exclusive branding, packaging, and potential design modifications. |

| Customization Level | Low (branding only) | High (branding, packaging, functionality, design) |

| IP Ownership | Supplier retains design IP | Buyer may own or co-own IP (negotiable in ODM) |

| Lead Time | Short (off-the-shelf or minor tweaks) | Longer (design, tooling, validation) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Ideal For | Startups, time-sensitive launches, low-risk entry | Established brands, long-term market differentiation |

Strategic Insight: White Label is optimal for rapid market entry with minimal investment. Private Label supports brand equity and margin control but requires stronger supply chain commitment.

2. Cost Components Breakdown (Logistics Equipment Example: IoT Cargo Tracker)

To illustrate cost dynamics, we analyze a mid-tier IoT-enabled cargo tracking device—a representative product in logistics technology sourcing from China.

| Cost Component | Description | Estimated Cost Range (USD/unit) |

|---|---|---|

| Raw Materials | PCB, GPS/GSM modules, battery, casing, sensors | $12.50 – $18.00 |

| Labor & Assembly | SMT, testing, final assembly, QC | $2.00 – $3.50 |

| Packaging | Custom box, manual, protective materials, labeling | $1.20 – $2.50 |

| Tooling & Molds | One-time NRE cost for custom enclosures (amortized) | $0.40 – $1.00/unit (based on MOQ) |

| Testing & Certification | FCC, CE, RoHS compliance | $0.80 – $1.50 |

| Logistics (China to Port) | Inland freight, export handling | $0.50 – $0.80 |

| Total Estimated Unit Cost | $17.40 – $27.30 |

Note: Final FOB (Free On Board) price includes all above costs except ocean freight and import duties.

3. Estimated Price Tiers by MOQ

The following Markdown table presents average FOB unit pricing for a Private Label IoT cargo tracker under ODM terms, based on real supplier quotes (Q1 2026).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $26.80 | $13,400 | Higher per-unit cost; tooling amortized over fewer units. Limited customization. |

| 1,000 | $23.50 | $23,500 | Economies of scale begin. Standard customization (logo, packaging). |

| 5,000 | $19.20 | $96,000 | Optimal balance of cost and volume. Full ODM support, firmware branding, custom UI. |

| 10,000 | $17.40 | $174,000 | Lowest unit cost. Priority production slot. Supplier may offer extended warranty or free QC audits. |

Assumptions:

– Product: GPS/GSM cargo tracker with temperature/humidity sensor

– Factory Location: Shenzhen, China

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 35–45 days (including tooling for MOQ 500)

4. Strategic Recommendations for 2026

-

Leverage ODM for Differentiation

For long-term competitiveness, invest in Private Label ODM development. Own the firmware and UI to lock in customer loyalty. -

Negotiate MOQ Flexibility

Use tiered ordering: Start with 1,000 units, then scale. Some suppliers accept split MOQs across product variants. -

Audit for Hidden Costs

Confirm if packaging, certification, and tooling are included. Request itemized quotes to avoid surprise charges. -

Optimize Logistics Early

Partner with 3PLs offering consolidation services from South China ports (Yantian, Shekou). Consider bonded warehouses in EU/US for faster fulfillment. -

Compliance is Non-Negotiable

Ensure suppliers provide full RoHS, REACH, and FCC/CE documentation. Non-compliance risks customs delays and fines.

Conclusion

Sourcing logistics-related products from China in 2026 demands a balanced approach: leverage White Label for speed, but transition to Private Label ODM for sustainable margins. With strategic MOQ planning and supplier vetting, procurement managers can achieve 20–30% cost savings versus domestic manufacturing—without sacrificing quality.

SourcifyChina continues to support global buyers with end-to-end sourcing, QC, and logistics coordination across 12 industrial zones in China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence 2026

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Verifying Chinese Manufacturers for Product Sourcing & Logistics: A Critical Guide for Global Procurement Managers

Prepared by Senior Sourcing Consultants | Q1 2026 Edition

Executive Summary

In 2026, supply chain resilience remains paramount. 68% of procurement failures in China stem from inadequate supplier verification, particularly in logistics integration (SourcifyChina 2025 Global Sourcing Index). This report outlines actionable, audit-backed steps to validate manufacturers, distinguish factories from trading companies, and mitigate critical red flags. Logistics capability is now a non-negotiable verification pillar – not an afterthought.

Critical Verification Steps for Chinese Manufacturers (2026 Focus)

Phase 1: Pre-Engagement Screening (Digital Due Diligence)

| Step | Key Actions | 2026 Logistics-Specific Focus |

|---|---|---|

| Company Registration | Verify via China’s National Enterprise Credit Information Public System (NECIPS). Cross-check with Alibaba/1688 business licenses. | Confirm logistics entity registration (if handling freight). Check for bonded warehouse licenses if required. |

| Digital Footprint Audit | Analyze website structure, ERP system mentions (e.g., SAP/Oracle), and IoT/sensor integration claims. | Scrutinize logistics tech: TMS (Transport Management System), real-time cargo tracking capabilities, and customs digitalization (e.g., China’s Single Window integration). |

| Social Media/Network Check | Validate LinkedIn profiles of key staff (operations/logistics managers). Check WeChat Official Accounts for shipment updates. | Assess logistics team’s expertise: Look for certifications (FIATA, CILT) and posts about cross-border e-commerce fulfillment (e.g., bonded logistics). |

Phase 2: On-Site Validation (Mandatory for >$50k Orders)

| Area | Verification Protocol | Logistics-Specific Checks |

|---|---|---|

| Facility Tour | Demand unannounced access to production lines, QC labs, and warehousing zones. | • Measure warehouse space vs. claimed capacity • Verify container loading equipment (e.g., forklifts, pallet jacks) • Confirm bonded logistics zone access (if applicable) |

| Logistics Infrastructure | Audit in-house vs. outsourced logistics. Request 3PL contracts. | • Check freight forwarder partnerships (ask for master contracts) • Validate customs broker资质 (license) • Test real-time shipment tracking system demo |

| Documentation Review | Request original copies of: Business License, Export License, ISO certifications. | • Critical 2026 Add: EORI number, US FDA/FSMA or EU CE declarations, ICS2 compliance docs (EU) • Review past BLs (Bills of Lading) for port consistency |

Phase 3: Operational Proof (Beyond Paperwork)

| Test | Method | Logistics Validation |

|---|---|---|

| Trial Order | Order 10-20% of target volume. Track timeline from PO to delivery. | • Measure actual vs. quoted lead time (production + logistics) • Audit packaging for export compliance (e.g., ISPM 15) |

| Third-Party Audit | Engage TÜV, SGS, or Bureau Veritas for unannounced factory + logistics audit. | Include: Warehouse safety compliance, container stuffing procedures, customs valuation accuracy checks |

| Reference Checks | Contact 3+ past clients (ask for logistics-specific feedback). | • “Did they meet FCL/LCL cut-off dates?” • “How were customs delays handled?” • “Were Incoterms correctly executed?” |

Trading Company vs. Factory: The 2026 Differentiation Matrix

| Criteria | Direct Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Lists “Manufacturing” as core activity. | Lists “Trade,” “Import/Export,” or “Agency.” | Check NECIPS for “经营范围” (business scope). Factories show production equipment codes. |

| Facility Control | Owns production machinery (serial numbers visible). | No production lines; may have sample room only. | Ask: “Can you show machine purchase invoices?” (2026 red flag if refused). |

| Pricing Structure | Quotes FOB/CIF with clear material/labor cost breakdown. | Quotes landed cost; vague on production costs. | Demand itemized cost sheet. Factories provide raw material sourcing details. |

| Logistics Role | May handle production logistics; often partners with 3PLs. | Manages end-to-end logistics (often markups hidden). | Ask: “Show your freight forwarder agreement.” Factories share 3PL contracts; traders hide margins. |

| Lead Time Control | Direct control over production schedule. | Dependent on factory; buffers added. | Request real-time production schedule access (e.g., via MES system). |

| Sample Sourcing | Samples made in-house (may take 7-14 days). | Samples sourced from multiple factories (ready in 2-3 days). | Require: Samples with factory logo/laser engraving. Traders reuse generic samples. |

2026 Insight: Hybrid models (“Factory-Traders”) are rising. Always confirm: “Do you own the production equipment at this facility?” (If “no,” treat as trader).

Top 5 Red Flags in 2026 (Logistics-Focused)

-

“We Handle All Logistics” Without Documentation

→ Why critical: Hidden markups, customs compliance risks. Action: Demand freight forwarder master agreements and past BLs. -

Refusal to Share Real-Time Logistics Data

→ Why critical: 2026 customs authorities (US CBP, EU ICS2) require granular shipment data. Action: Insist on API integration with your TMS. -

Inconsistent Port References

→ Why critical: Shifting ports = logistics instability. Action: Verify port via shipping line contracts (e.g., COSCO, Maersk). -

No Bonded Logistics Zone Access

→ Why critical: Essential for cross-border e-commerce (e.g., China’s 9610/9710 customs codes). Action: Request bonded warehouse license (海关监管场所备案). -

Vague Incoterms™ 2020 Usage

→ Why critical: 2026 sees stricter enforcement (e.g., FCA vs. FOB disputes). Action: Require Incoterms® in contract with port-specific clauses (e.g., “FCA Shenzhen Nanshan Port”).

SourcifyChina 2026 Recommendation

“Logistics verification must equal production verification.” In 2026, treat the manufacturer’s logistics capability as a core product component. Mandatory steps:

1. Conduct a logistics-specific site audit (warehouse + customs docs).

2. Validate 3PL partnerships with master contracts.

3. Embed logistics KPIs in contracts (e.g., “Container stuffing completion within 24hrs of production finish”).Factories controlling their logistics chain reduce supply chain disruptions by 41% (SourcifyChina 2025 Logistics Resilience Study).

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: Data aggregated from 1,200+ supplier verifications (2025), updated per 2026 customs/logistics regulations (China MOFCOM, WCO).

Next Steps: Request our 2026 China Logistics Compliance Checklist for customs documentation templates and port-specific risk maps.

SourcifyChina: Engineering Supply Chain Resilience Since 2010

This report is confidential. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Maximize Efficiency in China Sourcing with Verified Logistics Partners

As global supply chains grow increasingly complex, procurement leaders face mounting pressure to reduce lead times, mitigate risks, and ensure on-time delivery. One of the most critical—and often overlooked—factors in successful product sourcing from China is logistics execution. Poor coordination, unreliable freight forwarders, and lack of transparency can derail even the most well-planned sourcing strategies.

At SourcifyChina, we eliminate this uncertainty through our verified Pro List—a rigorously vetted network of logistics partners specializing in China export operations.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Logistics Providers | All partners undergo background checks, performance audits, and client reference validation—eliminating hours spent on due diligence. |

| China-Specific Expertise | Partners are fluent in local regulations, customs clearance procedures, and regional port dynamics—reducing delays and compliance issues. |

| Transparent Pricing & SLAs | Clear rate structures and service-level agreements prevent hidden costs and ensure accountability. |

| Real-Time Shipment Tracking | Integrated digital tracking enables proactive management and stakeholder reporting. |

| Dedicated Point of Contact | Each client is assigned a SourcifyChina sourcing consultant to coordinate logistics and resolve issues swiftly. |

On average, procurement teams using our Pro List reduce logistics onboarding time by 60% and experience 30% faster shipment turnaround compared to unassisted sourcing.

Call to Action: Optimize Your China Sourcing Logistics Today

Don’t let inefficient logistics compromise your supply chain performance. By leveraging SourcifyChina’s Verified Pro List, your team gains immediate access to trusted, high-performance logistics partners—so you can focus on strategic procurement, not operational firefighting.

👉 Contact our support team now to request your customized Pro List and logistics assessment:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available Monday–Friday, 9:00 AM–6:00 PM CST, to assist with vendor matching, cost analysis, and end-to-end logistics planning.

SourcifyChina – Your Trusted Partner in Smarter, Faster, and More Reliable China Sourcing.

Data-Driven. Verified. Globally Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.