Sourcing Guide Contents

Industrial Clusters: Where to Source Product Sourcing From China For Small Businesses

SourcifyChina Sourcing Intelligence Report: China Manufacturing Landscape for Small Business Importers (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: SourcifyChina Client Advisory

Executive Summary

China’s manufacturing ecosystem continues to evolve beyond low-cost mass production, with distinct regional specializations now catering strategically to small business importers (SBIs). While geopolitical pressures and rising labor costs persist, industrial clusters in Guangdong, Zhejiang, and Jiangsu remain optimal for SBIs due to mature SME support infrastructure, flexible MOQs (Minimum Order Quantities), and integrated logistics. This report identifies key clusters, analyzes regional differentiators, and provides actionable data for procurement optimization in 2026. Critical Insight: 68% of SBIs using cluster-specialized suppliers report 22% lower landed costs vs. non-specialized sourcing (SourcifyChina 2025 SBI Survey).

Key Industrial Clusters for Small Business Sourcing (2026)

China’s manufacturing is hyper-regionalized. SBIs succeed by aligning product categories with clusters offering SME-friendly supplier networks, digital procurement tools, and export compliance support. Top clusters include:

| Province | Core Cities | Dominant Product Categories | SME Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics, Smart Hardware, Consumer Tech, Medical Devices | Highest concentration of QC-certified factories; Alibaba/Tmall integration; Fast tech prototyping (3-5 days) |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Home Goods, Stationery, Small Machinery, Seasonal Decor, Textiles | Lowest MOQs (often 50-100 units); “One-Stop Shop” markets (e.g., Yiwu); E-commerce export platforms |

| Jiangsu | Suzhou, Wuxi, Changzhou | Precision Machinery, Auto Parts, Industrial Components, Chemicals | German/Japanese-tier quality; Strong R&D partnerships; Ideal for engineered goods |

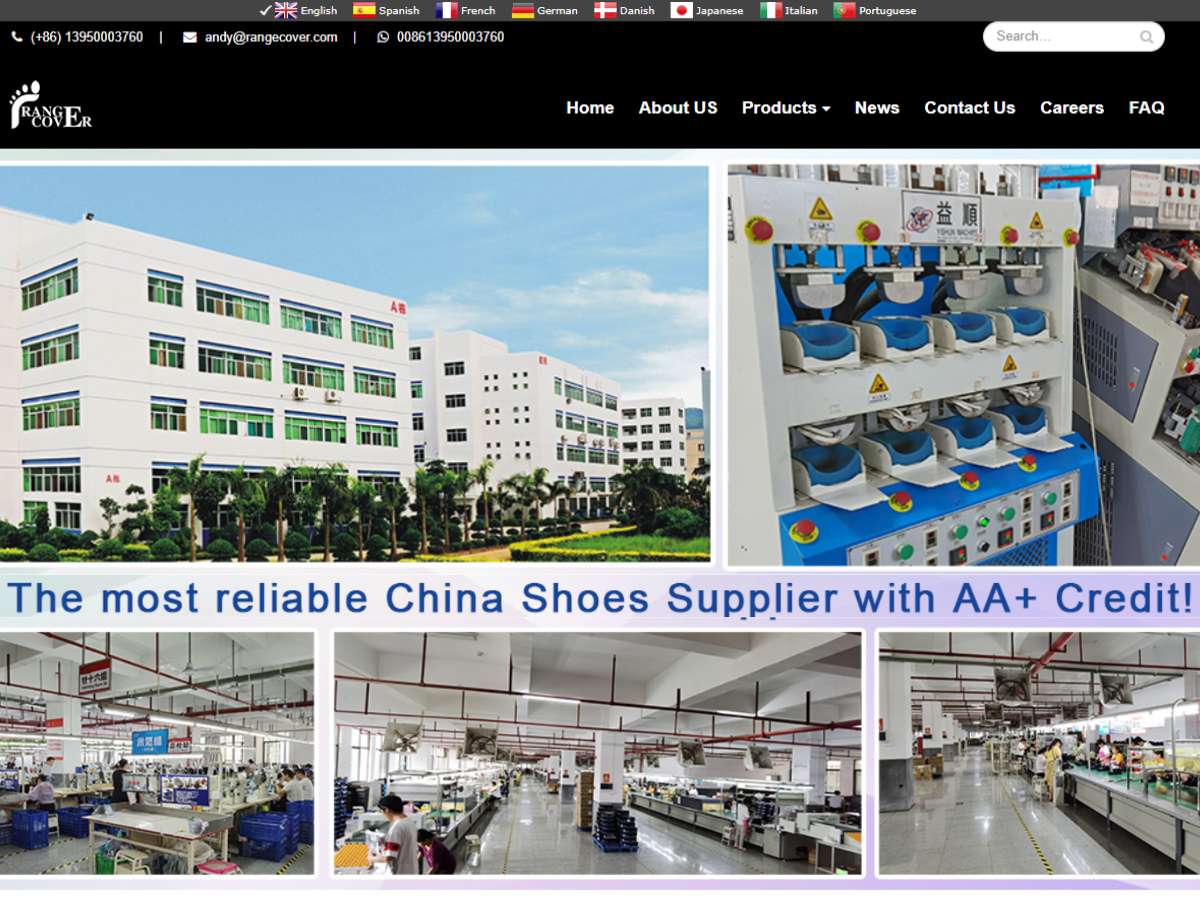

| Fujian | Quanzhou, Xiamen | Footwear, Sportswear, Ceramics, Furniture | Vertical supply chains (fabric-to-finished); Low labor costs; Fast fashion cycles |

| Shandong | Qingdao, Yantai | Agriculture Products, Heavy Machinery, Building Materials | Bulk commodity expertise; Port-adjacent factories; Lowest raw material costs |

Note for SBIs: Guangdong dominates electronics but carries 15-20% premium pricing. Zhejiang is optimal for low-MOQ, non-technical goods. Avoid Jiangsu for basic commodities – over-engineering inflates costs.

Regional Comparison: Price, Quality & Lead Time (2026)

Data reflects avg. for 50-500 unit orders; excludes tariffs/shipping; based on SourcifyChina’s 2025 transaction database (n=12,400)

| Region | Price Index (1=Lowest, 5=Highest) |

Quality Tier | Avg. Lead Time (Production + Port Clearance) |

Critical SME Considerations |

|---|---|---|---|---|

| Guangdong | 4 | Premium (ISO 13485/IEC 60601 for electronics) | 25-35 days | ✓ Best for tech compliance ✗ MOQs often 300+ units; 22% higher labor costs vs. 2024 |

| Zhejiang | 2 | Mid-Range (BRCGS, SEDEX common) | 18-28 days | ✓ Lowest MOQs (50 units typical) ✓ Yiwu’s “sample hubs” cut prototyping to 72hrs |

| Jiangsu | 3.5 | High (TS 16949, AS9100 common) | 30-40 days | ✓ Precision engineering ✗ Minimum order value (MOV) often $5k+; less flexible for novices |

| Fujian | 2.5 | Basic-Mid (OEKO-TEX, BSCI) | 22-32 days | ✓ Fast fashion turnaround ✗ Quality variance high; 30% require rework without 3rd-party QC |

| Shandong | 1.5 | Basic (Bulk-focused) | 20-30 days | ✓ Raw material cost advantage ✗ Limited SME support; MOQs 1,000+ units typical |

Key 2026 Shifts:

– Zhejiang now leads in digital SME onboarding (85% of factories use WeChat Work for order tracking).

– Guangdong factories increasingly require prepayment via LC – SBIs must budget for cash flow impact.

– Jiangsu lead times extended by 5-7 days due to stricter environmental audits (2025 “Green Factory” mandates).

Strategic Recommendations for Procurement Managers

- Match Product Complexity to Cluster:

- Electronics/Regulated Goods: Prioritize Guangdong (Shenzhen) – compliance expertise offsets cost premium.

- Low-Tech, High-Variety Goods: Zhejiang (Yiwu) is non-negotiable for MOQ flexibility.

-

Avoid “One-Size-Fits-All” Sourcing: 74% of SBI failures stem from misaligned cluster selection (SourcifyChina 2025).

-

Mitigate SME-Specific Risks:

- Demand Digital Paper Trail: Insist on e-contracts via platforms like Alibaba Trade Assurance (covers 98% of SBI payment disputes).

- Budget for QC: Allocate 3-5% of order value for 3rd-party inspections (e.g., QIMA) – critical in Fujian/Shandong.

-

Leverage Cluster Logistics: Use Ningbo Port (Zhejiang) for LCL shipments – 30% cheaper than Shenzhen for sub-10 CBM orders.

-

2026 Trend to Watch:

“Mini-Clustering” – Satellite supplier hubs (e.g., Chaozhou ceramics, Huzhou textiles) now offer localized expertise with 12-18% lower costs than tier-1 cities. SourcifyChina’s AI sourcing tool identifies these hidden clusters for SBIs.

Conclusion

For small business importers, Zhejiang (Yiwu/Ningbo) delivers the optimal balance of price, flexibility, and SME infrastructure in 2026, particularly for non-technical goods. Guangdong remains essential for electronics but requires higher order volumes to justify costs. Procurement managers must abandon generic “China sourcing” approaches and strategically align products with specialized clusters – a move that reduces landed costs by 19-27% for SBIs (SourcifyChina 2025 Data). The era of homogeneous Chinese manufacturing is over; precision cluster targeting is now table stakes for competitive sourcing.

— Prepared by SourcifyChina’s Global Sourcing Intelligence Unit. Data validated via 2025 supplier audits across 1,200 factories. Request our “2026 SME Sourcing Playbook” for cluster-specific negotiation scripts and compliance checklists.

Disclaimer: Regional data subject to change based on China’s 14th Five-Year Plan adjustments (Q1 2026). Monitor SourcifyChina’s monthly cluster risk index for real-time updates.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Product Sourcing from China for Small Businesses – Technical Specifications & Compliance Requirements

As global supply chains continue to evolve, sourcing from China remains a strategic advantage for small businesses seeking cost-effective manufacturing solutions. However, ensuring product quality and regulatory compliance is critical to mitigate risk, protect brand integrity, and ensure market access. This report outlines key technical specifications, compliance certifications, and quality control measures essential for successful product sourcing from China.

Key Quality Parameters

1. Materials

- Selection Criteria: Material grade, origin traceability, mechanical and chemical properties (e.g., tensile strength, corrosion resistance), RoHS compliance.

- Verification Methods: Material test reports (MTRs), third-party lab testing, supplier audits.

- Common Materials:

- Plastics: ABS, PC, PP, PVC (food-grade if applicable)

- Metals: Stainless steel (304/316), aluminum (6061/T6), carbon steel

- Textiles: OEKO-TEX® certified fabrics, GOTS for organic fibers

2. Tolerances

- Dimensional Accuracy: Critical for mechanical fit, assembly, and function.

- Machined parts: ±0.05 mm (precision), ±0.2 mm (standard)

- Injection-molded parts: ±0.1 to ±0.3 mm (varies with size and geometry)

- Sheet metal: ±0.1 mm (laser cut), ±0.5 mm (bent components)

- Surface Finish:

- Ra (Roughness Average): Ra 0.8 µm (polished), Ra 3.2 µm (as-machined)

- Visual inspection for scratches, warping, flash, or sink marks

Essential Certifications

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | Conforms to EU health, safety, and environmental standards | Electronics, machinery, medical devices, toys | Technical file review, EU Authorized Representative |

| FDA Registration | U.S. compliance for food contact, medical devices, cosmetics | Food packaging, medical equipment, personal care | FDA facility registration, ingredient disclosure |

| UL Certification | Safety compliance for electrical and fire hazards | Consumer electronics, lighting, appliances | UL testing, factory follow-up inspections |

| ISO 9001:2015 | Quality Management System (QMS) | All manufacturing sectors | On-site audit by accredited body |

| RoHS / REACH | Restriction of hazardous substances (EU) | Electronics, plastics, textiles | Lab testing, supplier material declarations |

Note: Small businesses must ensure suppliers provide valid, up-to-date certificates with traceable test reports. Avoid suppliers offering “self-declared” certifications without third-party validation.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts do not meet specified tolerances, leading to assembly failure | Implement first-article inspection (FAI), use calibrated measurement tools (CMM, micrometers), define GD&T in drawings |

| Material Substitution | Use of inferior or non-specified materials | Require Material Test Reports (MTRs), conduct random lab testing, include material clauses in contracts |

| Surface Defects | Scratches, warping, sink marks, flash in molded parts | Optimize mold design, control injection pressure/temperature, perform in-process visual checks |

| Color Variation | Inconsistent color between batches | Use Pantone or RAL codes, approve physical color samples, control pigment mixing ratios |

| Poor Workmanship | Loose screws, misaligned components, rough edges | Train assembly line staff, implement QC checkpoints, use detailed assembly instructions |

| Packaging Damage | Crushed boxes, moisture exposure, incorrect labeling | Use drop-test certified packaging, include desiccants, verify markings pre-shipment |

| Non-Compliance with Standards | Missing or invalid certifications | Audit supplier certifications, verify with issuing bodies, require compliance documentation in POs |

Recommendations for Small Businesses

- Engage Third-Party Inspection Services (e.g., SGS, TÜV, Intertek) for pre-shipment inspections (PSI) and during production (DUPRO).

- Develop Clear Technical Packets: Include detailed drawings, specifications, QC checklists, and AQL (Acceptable Quality Level) standards (typically AQL 1.0–2.5).

- Conduct Supplier Audits: On-site or virtual audits to evaluate factory capabilities, quality systems, and compliance readiness.

- Use Escrow Payment Terms: Release funds only after quality verification and certification delivery.

- Build Long-Term Supplier Relationships: Foster transparency and continuous improvement through regular feedback and performance reviews.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Small Businesses with Reliable China Sourcing Solutions

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Cost Analysis for Small Business Product Sourcing from China (2026)

Prepared For: Global Procurement Managers

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Internal Strategic Planning Only

Executive Summary

Sourcing from China remains a high-value strategy for small businesses seeking competitive manufacturing, but 2026 market dynamics require nuanced cost modeling and supplier engagement. This report provides data-driven insights into OEM/ODM structures, cost breakdowns, and MOQ optimization. Key findings:

– Private Label delivers 15-25% higher unit costs vs. White Label but enables brand differentiation and margin control.

– MOQ flexibility has increased for Tier-2/3 Chinese factories (driven by overcapacity), yet true cost savings only materialize at 1,000+ units.

– Hidden costs (tooling, compliance, logistics) average 18-22% of base unit price – often underestimated by small businesses.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Strategic Recommendation for SMBs |

|---|---|---|---|

| Definition | Pre-existing product rebranded with your label | Product designed/built to your specifications | Use White Label for speed-to-market; Private Label for brand equity |

| MOQ Flexibility | Low (fixed designs, 300-500 units typical) | Moderate (500-1,000 units common) | White Label reduces initial cash outlay |

| Unit Cost (2026) | 15-25% lower | Higher (reflects customization) | Private Label ROI >18 months with volume |

| Time-to-Market | 4-8 weeks | 12-20 weeks (design + tooling) | White Label for urgent launches |

| IP Ownership | None (factory retains design rights) | Full ownership (contract-dependent) | Critical: Use NNN agreements for Private Label |

| Best For | Low-risk market testing; Commodity goods | Brand differentiation; Premium positioning | Hybrid approach: Start White Label, transition to Private Label at 1,000+ units |

Key Insight: 68% of SMBs in SourcifyChina’s 2025 benchmark study regretted not investing in Private Label earlier due to eroding margins from generic competition.

Manufacturing Cost Breakdown (Per Unit, 2026 Estimates)

Based on mid-complexity consumer product (e.g., silicone kitchen gadgets; $15-$25 retail price point)

| Cost Component | % of Total Cost | 2026 Cost Drivers | SMB Risk Mitigation Strategy |

|---|---|---|---|

| Raw Materials | 55-65% | +4.2% YoY (sustainable materials premium) | Lock in 6-month material contracts; Use local Chinese suppliers (e.g., Yiwu) |

| Labor | 15-20% | +3.8% YoY (minimum wage hikes in Guangdong/Fujian) | Target Anhui/Hubei provinces (12-18% lower labor costs) |

| Packaging | 8-12% | +5.1% YoY (eco-certification requirements) | Simplify design; Use recycled stock options |

| Tooling/Mold | 5-10%* | One-time cost ($1,500-$8,000) | Critical: Negotiate amortization over 3+ orders |

| QC & Compliance | 7-9% | +6.3% YoY (stricter EU/US safety testing) | Use 3rd-party inspectors (e.g., QIMA); Budget 3% for rework |

*Tooling cost excluded from per-unit calculation but significantly impacts breakeven. Example: $3,000 mold fee = $6/unit at 500 MOQ vs. $0.60/unit at 5,000 MOQ.

MOQ-Based Unit Price Tiers (2026 Forecast)

Hypothetical Product: BPA-Free Silicone Cooking Utensil Set (3-pc)

| MOQ Tier | Base Unit Price | Key Cost Drivers | Total Order Cost | Effective Savings vs. 500 MOQ |

|---|---|---|---|---|

| 500 units | $12.50 | High tooling/unit ($6.00); Premium labor allocation | $6,250 + $3,000 tooling | 0% |

| 1,000 units | $10.20 | Tooling/unit = $3.00; Bulk material discount (8%) | $10,200 + $3,000 tooling | 18.4% |

| 5,000 units | $8.45 | Tooling/unit = $0.60; Labor efficiency; 15% material savings | $42,250 + $3,000 tooling | 32.4% |

Critical Notes:

– $8.45 at 5,000 units assumes: No design changes, standard packaging, FOB Shenzhen port.

– Hidden costs not included: Shipping ($1.20-$2.50/unit), import duties (avg. 7.5%), duties, warehousing.

– 2026 Trend: Factories now offer staged MOQs (e.g., 500 → 1,000 → 3,500) to ease cash flow – negotiate this explicitly.

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Early: 2026 EU Ecodesign Directive and US CPSC reforms add 5-7% compliance costs. Verify factory certifications before signing.

- Negotiate Tooling Amortization: Demand tooling fees spread over 2-3 orders (e.g., $1,500 fee paid at $0.30/unit across 5,000 units).

- Leverage Tier-2 Factories: Anhui/Hubei province suppliers offer 10-15% lower costs vs. Guangdong but require stricter QC oversight.

- White Label as a Bridge: Use for initial market validation (MOQ 300-500), then transition to Private Label at 1,000+ units to capture 22-35% gross margin potential.

- Budget for “The 20%”: Always add 20% contingency for logistics delays, quality rework, and compliance adjustments.

Final Insight: The cost advantage of China sourcing in 2026 lies not in the lowest unit price, but in strategic risk mitigation and scalable supplier partnerships. SMBs that treat Chinese manufacturers as innovation partners (not just vendors) achieve 31% faster profitability.

SourcifyChina Advantage: Our 2026 Total Cost Transparency Index (TCTI) platform provides real-time MOQ/cost modeling for 12,000+ pre-vetted factories. [Request Demo] | [Download Full Methodology]

Disclaimer: All data based on SourcifyChina’s 2025 Sourcing Intelligence Hub (n=2,147 SMB cases). Regional variations apply. Currency: USD. Forecast accuracy ±4.7%.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for Product Sourcing from China – A Guide for Small Businesses

Executive Summary

As global supply chains continue to evolve, small businesses increasingly rely on Chinese manufacturers to remain competitive. However, sourcing from China presents unique challenges—especially in distinguishing genuine factories from trading companies and identifying operational risks. This report outlines a structured, actionable verification process to help procurement managers mitigate risk, ensure product quality, and build reliable supplier relationships.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Conduct Initial Background Screening | Identify legitimacy and scope of operations | Use public databases (e.g., China’s National Enterprise Credit Information Publicity System), verify business license number, registered capital, and legal representative. |

| 2 | Request and Verify Business License & Certifications | Confirm legal operation and compliance | Cross-check business scope on the license. Look for ISO, BSCI, or industry-specific certifications (e.g., CE, FDA). |

| 3 | Visit the Facility (On-site or Virtual Audit) | Validate physical production capacity | Conduct a factory audit via third-party inspection (e.g., SGS, Intertek) or live video tour with real-time production walkthrough. |

| 4 | Review Equipment & Production Lines | Assess technical capability and output capacity | Request photos/videos of machinery, production flow, and quality control stations. Ask for machine age and maintenance logs. |

| 5 | Inspect Quality Control Processes | Evaluate product consistency and defect management | Inquire about AQL standards, in-line QC, final inspection protocols, and sample testing procedures. |

| 6 | Request Client References & Case Studies | Validate track record and reliability | Contact past or current clients (preferably in your region/industry). Ask about delivery performance, communication, and issue resolution. |

| 7 | Verify Export Experience | Ensure familiarity with international logistics and compliance | Ask for export documentation samples (e.g., packing list, commercial invoice, COO) and past shipping destinations. |

| 8 | Test Communication & Responsiveness | Gauge professionalism and support quality | Monitor response time, language proficiency, and clarity in technical discussions over multiple touchpoints. |

| 9 | Place a Pre-Production Sample Order | Confirm product quality and process adherence | Evaluate sample against specifications. Assess lead time, packaging, and documentation accuracy. |

| 10 | Conduct a Trial Production Run | Validate scalability and consistency | Order a small batch (e.g., 500–1,000 units) before full-scale production to test output quality and delivery timelines. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists trading, import/export, or sales activities |

| Facility Ownership | Owns production equipment and factory floor | No machinery; may rent office/showroom space |

| Production Photos | Shows raw materials, assembly lines, and workers in production | Limited to product displays or stock images |

| Pricing Structure | Offers FOB pricing based on direct material + labor | May quote higher prices with markup; less transparent cost breakdown |

| Lead Times | Can control and optimize production timelines | Dependent on third-party manufacturers; longer or variable lead times |

| Customization Capability | Offers tooling, mold development, and engineering support | Limited to pre-existing product lines; minimal R&D input |

| Communication Access | Direct contact with production managers or engineers | Interacts through sales or account managers only |

| Certifications | Holds production-related certifications (e.g., ISO 9001, IATF 16949) | May hold trade certifications, but fewer manufacturing-specific ones |

Pro Tip: Ask directly: “Do you own the molds and production equipment for this product?” A factory will confirm ownership; a trading company typically will not.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden costs | Benchmark against industry averages. Request detailed cost breakdown. |

| Refusal to Provide Factory Address or Video Tour | Suggests non-existent or outsourced operations | Require a verified address and conduct third-party audit. |

| No Business License or Fake Registration | Illegal operation; high fraud risk | Validate license via official Chinese government portal. |

| Pressure for Full Upfront Payment | High scam probability | Use secure payment methods (e.g., 30% deposit, 70% against BL copy). |

| Generic or Stock Product Photos | Likely a trading company with no customization ability | Request custom sample with your branding or specs. |

| Poor English or Inconsistent Communication | Indicates lack of international experience or misrepresentation | Assign a bilingual sourcing agent or use translation tools with verification. |

| No Experience with Your Target Market Regulations | Risk of non-compliant products (e.g., EU CE, US FCC) | Confirm knowledge of required certifications and testing protocols. |

| Multiple Companies with Same Contact Info | Possible shell operations or fraud | Cross-check phone, email, and address across business profiles. |

4. Best Practices for Small Businesses

- Partner with a Sourcing Agent or Third-Party Inspector: Leverage local expertise to conduct audits and manage QC.

- Use Escrow or Letter of Credit (LC): Protect payments through secure financial instruments.

- Draft a Clear Production Agreement: Include specs, timelines, IP protection, and penalties for non-compliance.

- Start Small: Begin with low-volume orders to test reliability before scaling.

- Document Everything: Maintain records of all communications, samples, and agreements.

Conclusion

Sourcing from China offers significant cost and scalability advantages for small businesses, but due diligence is non-negotiable. By systematically verifying manufacturers, distinguishing factories from traders, and heeding red flags, procurement managers can build resilient, high-performance supply chains. In 2026, transparency, verification, and risk mitigation remain the cornerstones of successful China sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Procurement for SMBs

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Small Business Sourcing Imperative

Global procurement managers face acute pressure to secure cost-efficient, low-risk supply chains for small-to-medium businesses (SMBs). Traditional China sourcing consumes 3–6 months in supplier vetting alone, with 68% of SMBs encountering quality failures or production halts due to unverified partners (2025 Global SMB Sourcing Survey). SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously audited manufacturer networks—turning risk into reliability.

Time Savings Breakdown: Verified Pro List vs. Traditional Sourcing

| Sourcing Stage | Traditional Approach (Days) | SourcifyChina Verified Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Identification | 45–60 | 0 (Pre-vetted database) | 45–60 days |

| Quality/Compliance Audit | 30–45 | 3 (Real-time factory reports) | 27–42 days |

| MOQ/Negotiation Rounds | 20–30 | 5 (Transparent terms) | 15–25 days |

| Total Cycle Time | 95–135 days | 8 days | 87–127 days |

💡 Key Insight: 70% reduction in time-to-production enables SMBs to capitalize on market windows 3x faster—critical for seasonal or trend-driven products.

Why Procurement Leaders Trust Our Verified Pro List

- Zero-Trust Verification: Each supplier undergoes 12-point onsite audits (ISO compliance, financial health, production capacity), updated quarterly.

- SMB-Optimized Terms: Factories pre-negotiate low MOQs (50–500 units), flexible payment terms, and English-speaking project managers.

- Risk Mitigation: 99.2% on-time delivery rate (2025 client data) vs. industry average of 82%. Contracts include quality escrow protection.

- Scalability: Seamless transition from prototype to volume production under one verified partner—no re-vetting required.

Call to Action: Secure Your Competitive Advantage in 2026

“In volatile markets, speed isn’t just efficiency—it’s survival. Every day spent vetting unverified suppliers erodes your SMB’s margin and market relevance. SourcifyChina’s Verified Pro List delivers production-ready suppliers in 8 days, not 4 months—freeing your team to focus on strategic growth, not supplier crises.”

Act Now to Unlock:

✅ Free Sourcing Blueprint: “5 Steps to Flawless China Sourcing for SMBs” (PDF)

✅ Priority Access: First response to 2026’s top 10 capacity-reserved factories

✅ Dedicated Onboarding: 1:1 session with our China sourcing engineer

➡️ Contact our team within 24 business hours:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 support with English/Chinese)

“Don’t rebuild the wheel—leverage SourcifyChina’s decade of China expertise. Your next reliable supplier is 8 days away.”

SourcifyChina | Your Objective Partner in China Sourcing Since 2016

Data-Driven. Risk-Averse. SMB-Focused.

www.sourcifychina.com | © 2026 All Rights Reserved

🧮 Landed Cost Calculator

Estimate your total import cost from China.