The global ceramic materials market is experiencing robust growth, driven by increasing demand across industries such as electronics, automotive, aerospace, and healthcare. According to Grand View Research, the market was valued at USD 97.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This growth is fueled by the unique properties of advanced ceramics—such as high thermal stability, wear resistance, and electrical insulation—which make them critical in high-performance applications. With innovation accelerating in sectors like semiconductors and renewable energy, the need for precision-engineered ceramic components has never been greater. As a result, a select group of manufacturers are leading the charge in processing technologies, scaling production, and driving material science advancements. Below, we spotlight the top 10 ceramic materials processing manufacturers shaping the future of this dynamic industry.

Top 10 Processing Of Ceramic Materials Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Homepage

Domain Est. 1995

Website: ceramicmaterials.saint-gobain.com

Key Highlights: Saint-Gobain ZirPro, one of the world’s leading manufacturers of ceramic grinding beads, blasting and peening media, zirconium oxide powders and zirconium ……

#2 Blasch Precision Ceramics

Domain Est. 1997

Website: blaschceramics.com

Key Highlights: Blasch Precision Ceramics. Our mission is to provide products which improve upon existing models and solve problems at every stage of the industrial process….

#3 Ferro

Domain Est. 1998

Website: ferroceramic.com

Key Highlights: At Ferro-Ceramic, we’re a technical ceramics manufacturer with over five decades of experience, ready to take on your next grinding project….

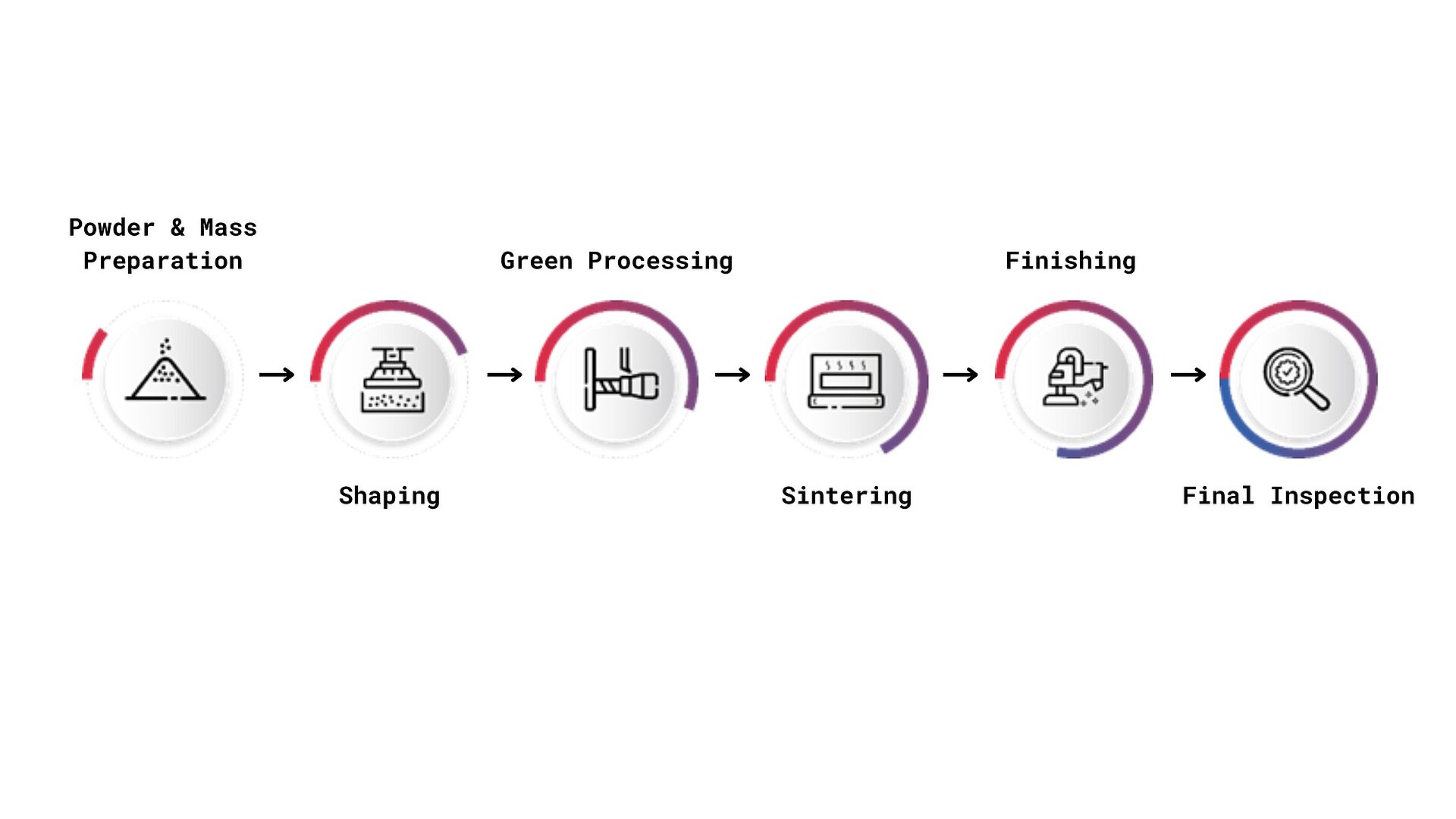

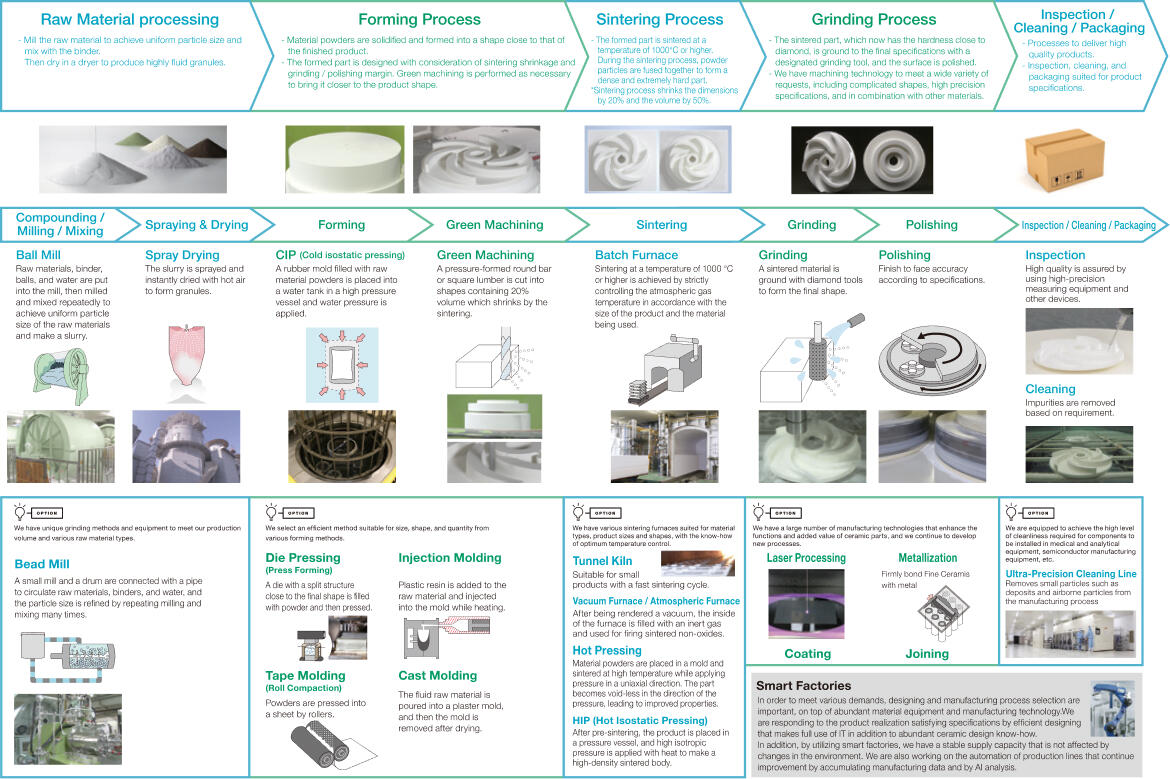

#4 Manufacturing process of ceramics (polycrystalline)

Domain Est. 1993

Website: global.kyocera.com

Key Highlights: Learn about Fine Ceramics with various learning contents like manufacturing process of ceramics, design points for ceramic parts, and more….

#5 Superior Technical Ceramics

Domain Est. 1997

Website: ceramics.net

Key Highlights: With over 116 years of ceramic manufacturing experience, Superior Technical Ceramics can be your partner in the design and production of specialized ceramic ……

#6 Additive Manufacturing of Ceramics

Domain Est. 1997

Website: nist.gov

Key Highlights: The NIST program seeks to facilitate the commercialization of the ceramics additive manufacturing via the concurrent development of:…

#7 CoorsTek

Domain Est. 1999

Website: coorstek.com

Key Highlights: CoorsTek is the global leader in technical ceramics. With over 50 locations worldwide, CoorsTek manufactures advanced ceramic components for virtually every ……

#8 Advanced Ceramics Manufacturing

Domain Est. 2000

Website: acmtucson.com

Key Highlights: A AS9100D/ISO 9001:2015 certified company, specializing in the development and production of water soluble mandrels and tooling, composite parts, and ceramic ……

#9 System Ceramics

Domain Est. 2010

Website: systemceramics.com

Key Highlights: System Ceramics designs and produces process systems for the ceramic tile industry worldwide. Find out our solutions….

#10 Production Process for High

Domain Est. 2020

Website: ceramtec-group.com

Key Highlights: The production of high-performance ceramics begins with the selection and preparation of the raw materials. These ceramic masses are pressed into moulded parts ……

Expert Sourcing Insights for Processing Of Ceramic Materials

H2: Market Trends in the Processing of Ceramic Materials (2026 Outlook)

The global market for the processing of ceramic materials is poised for significant transformation by 2026, driven by technological innovation, expanding industrial applications, and a growing emphasis on sustainability. As industries from aerospace to healthcare demand materials with superior thermal, mechanical, and electrical properties, advanced ceramic processing techniques are becoming increasingly critical. This analysis explores key H2-level trends shaping the ceramic materials processing sector through 2026.

Advancements in Additive Manufacturing (3D Printing)

One of the most influential trends is the integration of additive manufacturing (AM) in ceramic processing. By 2026, ceramic 3D printing is expected to mature significantly, enabling complex geometries and customized components previously unachievable through traditional sintering or molding methods. Technologies such as stereolithography (SLA), digital light processing (DLP), and binder jetting are being refined to improve resolution, reduce defects, and scale production. The aerospace and medical implant sectors are leading adopters, leveraging AM for lightweight, high-strength ceramic parts and biocompatible components.

Growth in Demand from High-Performance Industries

The demand for advanced ceramics in high-performance applications is accelerating. In the aerospace and defense sector, ceramic matrix composites (CMCs) are being increasingly used in jet engines and hypersonic vehicles due to their ability to withstand extreme temperatures. Similarly, the automotive industry is adopting silicon carbide (SiC) ceramics in electric vehicle (EV) power electronics for improved efficiency and thermal management. These applications are driving investments in high-purity powder synthesis and precision sintering technologies, key stages in ceramic processing.

Sustainability and Green Processing Innovations

Sustainability is emerging as a core driver in ceramic material processing. By 2026, there is a growing shift toward energy-efficient sintering methods such as spark plasma sintering (SPS) and microwave sintering, which reduce processing time and energy consumption. Additionally, manufacturers are exploring bio-based binders and recycling of ceramic waste to minimize environmental impact. Regulatory pressures and corporate ESG (Environmental, Social, and Governance) goals are pushing the industry toward greener supply chains and circular economy models.

Expansion of Functional Ceramics in Electronics

Functional ceramics—particularly piezoelectrics, dielectrics, and ionic conductors—are witnessing robust growth due to their role in next-generation electronics. With the proliferation of 5G, IoT devices, and solid-state batteries, demand for ceramic substrates, capacitors, and sensors is rising. Processing innovations such as thin-film deposition and nanostructuring are enhancing performance and miniaturization. By 2026, Asia-Pacific—especially China, Japan, and South Korea—is expected to dominate production, supported by strong electronics manufacturing ecosystems.

Regional Market Dynamics and Supply Chain Resilience

Geopolitical factors and supply chain disruptions are reshaping regional production strategies. North America and Europe are investing in domestic ceramic processing capabilities to reduce reliance on imported raw materials and components, particularly for strategic sectors like defense and energy. Meanwhile, emerging markets in Southeast Asia and India are developing local processing infrastructure, supported by government incentives and growing domestic demand.

Conclusion

By 2026, the processing of ceramic materials will be characterized by technological sophistication, sustainability integration, and cross-industry convergence. As additive manufacturing, energy-efficient sintering, and functional material innovations mature, the ceramic processing market is expected to grow at a compound annual growth rate (CAGR) of approximately 7–9%, reaching a projected value exceeding USD 150 billion. Companies that invest in R&D, digital process control, and sustainable practices will be best positioned to capitalize on these evolving trends.

Common Pitfalls in Sourcing Processing of Ceramic Materials (Quality, IP)

Sourcing the processing of ceramic materials—whether through toll manufacturing, contract R&D, or joint development—presents unique challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to product failures, legal disputes, and loss of competitive advantage.

Quality Consistency and Process Control

One of the most significant pitfalls in sourcing ceramic processing lies in ensuring consistent quality across batches and suppliers. Ceramics are highly sensitive to processing parameters, and minor deviations can drastically affect final product performance.

-

Inadequate Process Documentation and Control: Many suppliers may lack robust process documentation or fail to implement strict process controls. Without standardized sintering profiles, pressing pressures, or raw material traceability, batch-to-batch variations in density, grain size, and mechanical strength are common.

-

Hidden Variability in Raw Materials: Ceramic performance heavily depends on precursor powders (e.g., purity, particle size distribution). Sourcing from multiple raw material suppliers without vetting can introduce variability that impacts the final product, even if processing conditions remain constant.

-

Lack of In-Process Quality Monitoring: Some processors may only perform end-point testing, missing critical process deviations during shaping, drying, or sintering. Without real-time monitoring (e.g., thermal analysis, dimensional checks), defects like warping, cracking, or delamination may go undetected until too late.

-

Insufficient Technical Expertise: Ceramic processing requires deep domain knowledge in materials science and thermodynamics. Choosing a supplier based solely on cost, rather than technical capability, often leads to poor yield rates and suboptimal material properties.

Intellectual Property Exposure and Protection

Ceramic formulations and processing know-how are often core to a company’s IP. Sourcing externally increases the risk of IP leakage or misappropriation.

-

Inadequate IP Clauses in Contracts: Many sourcing agreements lack clear definitions of IP ownership, especially regarding improvements or derivative processes developed during collaboration. Ambiguity can lead to disputes over who owns process optimizations or new material variants.

-

Over-Disclosure of Sensitive Information: Sharing full formulations or proprietary sintering cycles without proper safeguards (e.g., staged disclosure, non-disclosure agreements) exposes trade secrets. Suppliers may reuse or reverse-engineer this knowledge for competing clients.

-

Weak Trade Secret Protection at Supplier Sites: Even with NDAs, suppliers may not have adequate internal controls (e.g., access restrictions, employee training, IT security) to protect sensitive ceramic processing data, increasing the risk of accidental or intentional leaks.

-

Joint Development Without Clear Governance: In co-development scenarios, failure to establish joint ownership terms, usage rights, or licensing frameworks can create long-term legal entanglements and hinder commercialization.

To mitigate these risks, companies should conduct thorough technical and legal due diligence, implement phased disclosure protocols, define clear IP ownership in contracts, and audit supplier quality systems—particularly for critical-to-quality process parameters in ceramic manufacturing.

Logistics & Compliance Guide for Processing of Ceramic Materials

Overview of Ceramic Materials Processing

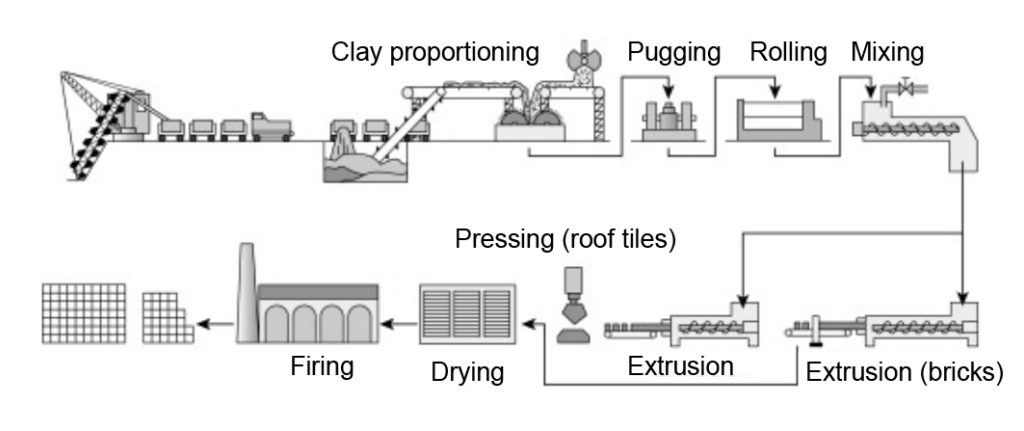

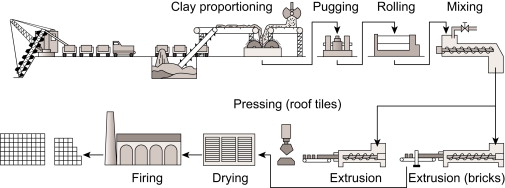

Ceramic materials processing involves the transformation of raw mineral resources—such as clay, silica, alumina, and feldspar—into finished ceramic products through stages including mixing, shaping, drying, and high-temperature firing. These materials are used in industries ranging from construction and electronics to aerospace and medical devices. Efficient logistics and strict compliance with regulatory standards are essential throughout the supply chain to ensure safety, quality, and environmental responsibility.

Raw Material Sourcing & Procurement

Supplier Qualification and Due Diligence

Ensure all raw material suppliers are vetted for compliance with international and local environmental and labor standards. Preference should be given to suppliers with ISO certifications (e.g., ISO 9001, ISO 14001) and proof of sustainable mining practices.

Material Specifications and Traceability

Establish clear material specifications for each ceramic component (e.g., purity levels, particle size distribution). Implement batch tracking systems to maintain traceability from source to final product, supporting quality assurance and regulatory compliance.

Import/Export Regulations

Ceramic raw materials such as kaolin, zircon, and rare earth oxides may be subject to export restrictions or tariffs in certain countries. Verify compliance with:

– International Trade Commission (ITC) regulations

– U.S. Customs and Border Protection (CBP) or EU equivalent

– CITES (if applicable to mineral sources)

– Sanctions lists (OFAC, UN)

Transportation and Storage

Packaging Standards

Use moisture-resistant, durable packaging (e.g., sealed poly-lined bags, palletized containers) to prevent contamination and degradation during transit. Clearly label packages with:

– Material name and grade

– Hazard symbols (if applicable)

– Handling instructions (e.g., “Keep Dry,” “Fragile”)

Transport Mode Selection

Choose transport modes based on volume, distance, and sensitivity:

– Bulk shipments: Rail or sea freight for large volumes of raw minerals

– High-purity/finished components: Air freight with climate control

– Ensure vehicles and containers are clean and dedicated to non-hazardous or compatible cargo

Warehouse Management

Store materials in dry, temperature-controlled environments to prevent moisture absorption or chemical changes. Segregate raw materials by type and hazard class. Implement FIFO (First In, First Out) inventory rotation.

Processing Facility Compliance

Environmental Regulations

Ceramic processing often involves high-temperature kilns and dust-generating operations. Facilities must comply with:

– EPA Clean Air Act (USA) or Industrial Emissions Directive (EU) for particulate matter and NOx/SOx emissions

– Permitting requirements for air and water discharges

– Waste management under RCRA (USA) or Waste Framework Directive (EU)

Install appropriate pollution control equipment (e.g., baghouses, scrubbers) and conduct regular emissions monitoring.

Occupational Health and Safety

Adhere to OSHA (USA) or equivalent national safety standards, including:

– Respiratory protection for silica and alumina dust (in accordance with OSHA 29 CFR 1910.1000)

– Hearing protection due to high noise levels from milling and grinding

– Machine guarding and lockout/tagout (LOTO) procedures

– Regular employee training and medical surveillance

Process Control and Quality Assurance

Implement ISO 9001 or IATF 16949 (for automotive ceramics) quality systems. Monitor critical process parameters such as:

– Sintering temperature and duration

– Dimensional tolerances

– Mechanical and thermal properties testing

Maintain documentation for audits and customer certifications.

Waste Management and Byproducts

Classification of Waste Streams

Identify and classify waste materials generated during processing:

– Non-hazardous: Spent refractories, unfired scrap

– Hazardous: Wastewater sludge containing heavy metals (e.g., from glaze operations), spent solvents

Recycling and Reuse

Maximize internal recycling of unfired ceramic scrap. Partner with certified recyclers for:

– Recovery of valuable oxides

– Reuse of kiln waste as aggregate

Disposal Compliance

Dispose of non-recyclable waste via licensed facilities. Maintain manifests and records in accordance with:

– RCRA Subtitle C (USA)

– Hazardous Waste Regulations (EU Directive 2008/98/EC)

Export and End-Use Compliance

Product Certification and Standards

Ensure finished ceramic products meet industry-specific standards such as:

– ASTM C242 (for whiteware)

– ISO 6344 (for abrasive grains)

– REACH and RoHS (EU) for chemical content, especially in electronic ceramics

Dual-Use and ITAR Considerations

High-performance ceramics used in aerospace, defense, or nuclear applications may be subject to export controls:

– EAR (Export Administration Regulations) – Check Commerce Control List (CCL)

– ITAR (International Traffic in Arms Regulations) – For defense-related ceramics (e.g., missile components)

Obtain necessary licenses before international shipment.

Documentation and Recordkeeping

Required Documentation

Maintain accurate records including:

– Material Safety Data Sheets (MSDS/SDS) for all chemicals and raw materials

– Batch production records

– Emissions and waste disposal reports

– Export licenses and customs declarations

Audit Preparedness

Conduct internal audits annually to verify compliance with:

– Environmental permits

– Safety protocols

– Quality management systems

Prepare documentation for third-party audits (e.g., ISO, customer-specific requirements).

Conclusion

Effective logistics and compliance in ceramic materials processing require a proactive, integrated approach across sourcing, manufacturing, transportation, and disposal. By adhering to regulatory standards, leveraging traceability systems, and investing in sustainable practices, companies can ensure product integrity, protect worker safety, and minimize environmental impact. Regular training, monitoring, and documentation are essential to maintaining compliance in a highly regulated global industry.

Conclusion for Sourcing and Processing of Ceramic Materials

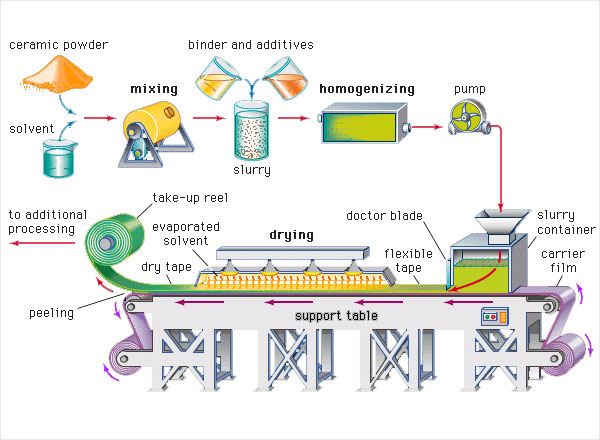

The sourcing and processing of ceramic materials are critical steps that significantly influence the performance, quality, and application potential of the final product. Sustainable and responsible sourcing of raw materials—such as clays, alumina, silica, and other oxides—requires careful consideration of geological availability, environmental impact, and supply chain reliability. Effective processing techniques, including crushing, milling, mixing, shaping, and thermal treatment (drying and sintering), must be precisely controlled to achieve desired microstructures and mechanical, thermal, or electrical properties.

Advancements in processing technologies—such as additive manufacturing, hot isostatic pressing, and nanoparticle synthesis—have expanded the capabilities of ceramics in high-performance industries like aerospace, electronics, biomedical devices, and energy systems. Furthermore, the drive toward eco-friendly practices has emphasized the importance of recycling ceramic waste and developing alternative, low-impact raw materials.

In conclusion, a holistic approach that integrates responsible material sourcing with innovative and efficient processing methods is essential for advancing ceramic technology. This synergy not only enhances material performance and cost-effectiveness but also supports sustainable manufacturing in the evolving landscape of advanced materials.