Sourcing Guide Contents

Industrial Clusters: Where to Source Privately Owned Companies In China

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing from Privately Owned Manufacturers in China

Prepared For: Global Procurement Managers

Date: March 2026

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a cornerstone of global manufacturing, with privately owned enterprises (POEs) accounting for over 90% of industrial output and 60% of exports. Unlike state-owned enterprises (SOEs), POEs offer greater agility, competitive pricing, and responsiveness—making them ideal partners for international procurement. This report provides a strategic analysis of key industrial clusters in China dominated by privately owned manufacturers, enabling procurement managers to optimize sourcing decisions based on price, quality, lead time, and sector specialization.

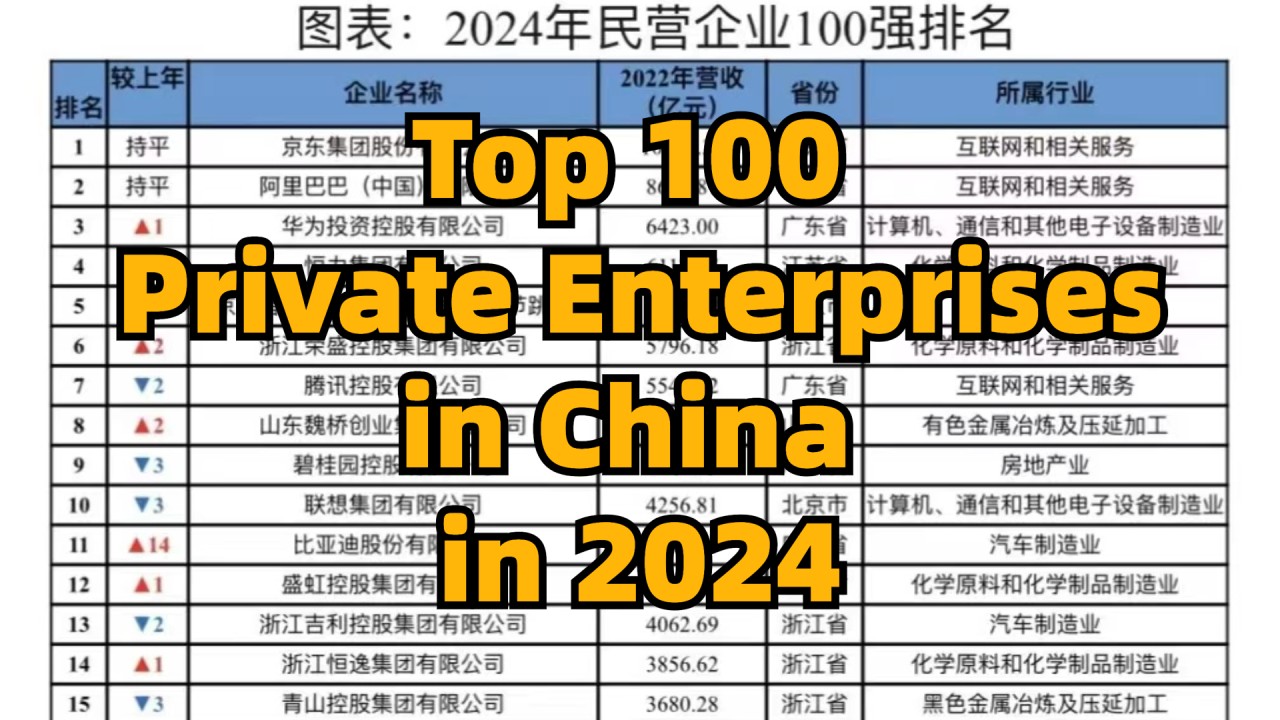

Market Overview: The Rise of Privately Owned Enterprises (POEs) in China

Privately owned companies in China have emerged as the backbone of the nation’s export-driven manufacturing economy. Supported by government incentives and digital transformation, POEs dominate sectors such as electronics, textiles, machinery, consumer goods, and new energy. Their operational flexibility, innovation adoption, and export readiness make them preferred partners for global buyers.

Key advantages of sourcing from Chinese POEs:

– Cost-efficiency: Lean operations and access to local supply chains.

– Scalability: Rapid capacity ramp-up due to modular factory models.

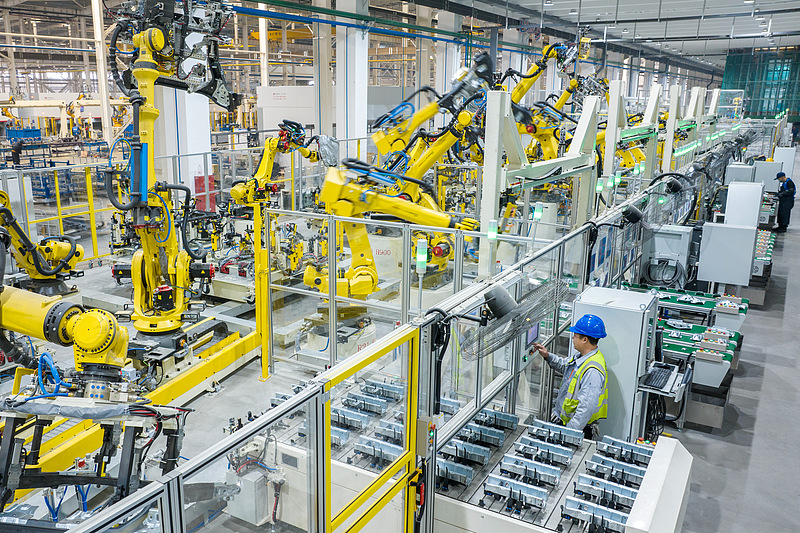

– Technology Adoption: Increasing automation and Industry 4.0 integration.

– Export Compliance: Experience with international standards (ISO, CE, RoHS).

Key Industrial Clusters for Privately Owned Manufacturing

Below are the top provinces and cities in China known for high concentrations of competitive, export-ready POEs:

| Province/City | Key Industrial Clusters | Dominant Sectors | Export Readiness |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics, Consumer Tech, Smart Devices, Plastics | ★★★★★ |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Light Manufacturing, Hardware, Home Goods, Textiles | ★★★★☆ |

| Jiangsu | Suzhou, Wuxi, Changzhou | Industrial Machinery, Electronics, Automotive Parts | ★★★★★ |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Apparel, Ceramics, Solar Components | ★★★★☆ |

| Shandong | Qingdao, Yantai, Weifang | Heavy Machinery, Chemicals, Food Processing | ★★★☆☆ |

Comparative Analysis: Guangdong vs Zhejiang vs Jiangsu

The following table evaluates the three most strategic provinces for sourcing from privately owned manufacturers, based on core procurement KPIs.

| Criteria | Guangdong | Zhejiang | Jiangsu | Remarks |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ | ★★★★★ | ★★★★☆ | Zhejiang leads due to dense SME networks and lower labor costs outside core cities. |

| Product Quality | ★★★★★ | ★★★★☆ | ★★★★★ | Guangdong and Jiangsu excel in precision engineering and tech manufacturing; Zhejiang varies by sub-sector. |

| Lead Time | ★★★★☆ | ★★★★☆ | ★★★★☆ | All three offer fast turnaround; Guangdong has slight edge in logistics due to Shenzhen Port. |

| Specialization | Electronics, Smart Devices | Consumer Goods, Hardware, Textiles | Industrial Equipment, High-Tech Components | Match supplier location to product category. |

| Logistics Access | Port of Shenzhen, Guangzhou (Top 3 global) | Ningbo-Zhoushan Port (Busiest globally) | Shanghai Port (Proximity) | All offer world-class export infrastructure. |

| Innovation Index | High (R&D hubs in Shenzhen) | Medium (Incremental innovation) | High (Automation & advanced materials) | Critical for tech-forward sourcing. |

Note: Ratings based on SourcifyChina’s 2025 Supplier Performance Index (SPI), aggregating 1,200+ supplier audits and buyer feedback.

Strategic Recommendations for Procurement Managers

- Electronics & High-Tech: Prioritize Guangdong (Shenzhen/Dongguan) for access to tier-1 EMS providers and innovation-driven POEs.

- Consumer Goods & Home Products: Leverage Zhejiang (Yiwu/Ningbo) for cost-effective, high-volume suppliers with strong customization capabilities.

- Industrial & Capital Equipment: Target Jiangsu (Suzhou/Wuxi) for German-standard quality and integration with automation.

- Sustainability & Compliance: Conduct third-party audits; many POEs now comply with EU Green Deal standards.

- Digital Sourcing Enablement: Utilize B2B platforms (e.g., 1688.com, Made-in-China.com) with localized due diligence to identify verified POEs.

Risk Mitigation & Due Diligence Checklist

- ✅ Verify business license and export eligibility (via China’s AIC database).

- ✅ Confirm ISO/CE/SGS certifications relevant to your market.

- ✅ Conduct on-site or virtual factory audits.

- ✅ Use escrow or LC payment terms for initial orders.

- ✅ Engage local sourcing partners for quality control and IP protection.

Conclusion

Privately owned manufacturers in China offer unmatched scale, cost efficiency, and adaptability. By aligning sourcing strategy with regional industrial strengths—Guangdong for tech, Zhejiang for consumer goods, Jiangsu for industrial excellence—procurement leaders can achieve optimal balance between cost, quality, and speed. With proactive risk management and digital sourcing tools, global buyers can harness China’s POE ecosystem as a strategic advantage in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Enablement

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating Technical & Compliance Requirements for Chinese Manufacturing Partners (2026 Edition)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: SourcifyChina Client Advisory

Executive Summary

This report clarifies critical misconceptions and provides actionable guidance for sourcing from Chinese manufacturing entities (note: the term “privately owned” is not legally recognized under China’s corporate framework; all manufacturers operate under PRC corporate law as Limited Liability Companies or Sole Proprietorships). Technical specifications and compliance requirements are product-category dependent, not entity-type dependent. Success hinges on precise product definition, rigorous supplier vetting, and embedded quality control protocols.

Critical Clarification: “Privately Owned Companies” in China

⚠️ Key Insight: China has no legal distinction equivalent to Western “private ownership.” All manufacturers are registered under the PRC Company Law as:

– Limited Liability Companies (LLC): Most common (90%+ of exporters). May have domestic or foreign shareholders.

– Sole Proprietorships: Typically small workshops (<10 employees), high-risk for complex sourcing.

Procurement Implication: Focus on factory资质 (zīzhì – qualifications), not ownership labels. Audit capabilities, not corporate structure.

Technical Specifications: Product-Specific Parameters (Non-Negotiable Framework)

Compliance is dictated by end-market regulations and product type, not manufacturer type. Generic “specs” are meaningless without context.

| Parameter | Critical Considerations for Procurement Managers | SourcifyChina Risk Mitigation Action |

|---|---|---|

| Materials | • Traceability: Must match BoM (Bill of Materials) with 3rd-party test reports (e.g., SGS for RoHS, REACH). • Substitution Risk: 68% of defects stem from unauthorized material swaps (2025 SourcifyChina audit data). |

Pre-production material approval with batch-level COC (Certificate of Conformance). |

| Tolerances | • GD&T Standards: Must align with ISO 1101 (geometric tolerancing). Chinese workshops often default to ±0.1mm (insufficient for precision engineering). • Measurement Systems: Verify CMM (Coordinate Measuring Machine) calibration records. |

Tolerance validation via first-article inspection (FAI) using client-approved tools. |

Essential Certifications: Destination-Driven, Not Origin-Driven

Chinese factories do not hold “CE/FDA/UL” as Chinese certifications. These are market access requirements for the destination country.

| Certification | Purpose (Destination Market) | Chinese Factory Requirement | Verification Protocol |

|---|---|---|---|

| CE Mark | EU/EEA safety compliance | Factory must provide EU Authorized Representative (EC Rep) documentation & technical file. China-based EC Reps are high-risk. | Validate EC Rep legitimacy via EU NANDO database. |

| FDA | US food/medical device compliance | Factory must be FDA-registered (not certified). Supplier must provide registration # & facility inspection history. | Cross-check FDA registration # via FDA OIR Portal. |

| UL | North American safety standard | Requires UL Listed mark on product + factory follow-up audits. “UL Certified” is a misnomer. | Demand UL CCIC (Certification Claimant ID) & audit trail. |

| ISO 9001 | Quality management system (Global baseline) | Non-negotiable minimum. Must be current (2015/2025 version), scope must cover your product. | Verify certificate via IAF CertSearch; audit scope mismatch = 42% of fraud cases (2025 data). |

🔑 Procurement Directive: Certifications are valid only if:

1. Held by the actual manufacturing facility (not trading company)

2. Scope explicitly covers your product category

3. Certificate is active and unexpired (validate via official databases)

Common Quality Defects & Prevention Protocols (2026 Sourcing Intelligence)

| Common Quality Defect | Root Cause in Chinese Manufacturing Context | Prevention Protocol (SourcifyChina Standard Practice) |

|---|---|---|

| Dimensional Deviations | Inadequate tool calibration; reliance on visual inspection | • Pre-production gauge R&R study (min. 10% tolerance) • Automated inline measurement at critical stations |

| Material Substitution | Cost pressure; weak BoM enforcement | • Pre-shipment material testing (XRF spectroscopy) • Blockchain-tracked material logs (SourcifyChina Digital QC) |

| Surface Finish Defects | Inconsistent polishing/finishing processes; humidity control gaps | • AQL 1.0 for visual defects • Humidity-controlled finishing bays (min. 45-55% RH) |

| Functional Failure | Incomplete testing; lack of failure mode analysis | • 100% functional test with digital logs • FMEA review pre-PPAP (Production Part Approval Process) |

| Non-Compliant Packaging | Misinterpretation of ISTA/ASTM standards | • Drop test validation per client’s shipping profile • Packaging spec sign-off by engineering team |

SourcifyChina Action Plan for Procurement Managers

- Define Product-Specific Requirements FIRST: Never source against generic “Chinese standards.”

- Vet Factories by Capability, Not Labels: Use SourcifyChina’s Factory Capability Matrix (FCM) scoring 48 technical parameters.

- Embed Compliance in Contracts: Require real-time access to production data & mandatory 3rd-party inspections (pre-shipment).

- Leverage Digital QC: Utilize SourcifyChina’s IoT-enabled quality tracking for live defect analytics.

“In China sourcing, the factory’s legal registration is irrelevant. What matters is its demonstrable capability to meet your technical and compliance benchmarks – consistently.”

— SourcifyChina 2026 Sourcing Principle

SourcifyChina Confidential Advisory | Prepared by Senior Sourcing Consultants | Next Steps: Request Product-Specific Compliance Blueprint (Free for Verified Procurement Managers)

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Privately Owned Chinese Manufacturers

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and branding strategies—specifically White Label vs. Private Label—when sourcing from privately owned manufacturers in China. With increasing demand for agile, cost-efficient supply chains, understanding the nuances of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models is critical for global procurement decision-making.

Privately owned enterprises (POEs) in China now represent over 60% of total manufacturing output, offering competitive pricing, faster turnaround, and greater flexibility compared to state-owned or multinational facilities. This report outlines key cost drivers, strategic considerations, and actionable pricing tiers based on Minimum Order Quantities (MOQs) to support informed procurement planning in 2026.

1. Understanding OEM vs. ODM in Chinese Manufacturing

| Model | Definition | Key Advantages | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design, specifications, and branding. | Full control over product design; protects IP; ideal for established brands. | Companies with in-house R&D and strong product identity. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product that the buyer rebrands. Minimal input from buyer. | Faster time-to-market; lower development cost; lower MOQs. | Startups, private label brands, or businesses seeking rapid product launches. |

Note: POEs in China are increasingly offering hybrid OEM/ODM services, allowing buyers to customize existing ODM platforms—reducing cost and lead time.

2. White Label vs. Private Label: Strategic Sourcing Implications

| Term | Description | Control Level | Cost Efficiency | Brand Differentiation |

|---|---|---|---|---|

| White Label | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. Packaging may vary. | Low (product is standardized) | High (shared tooling, bulk production) | Low |

| Private Label | Product is customized (design, materials, packaging) exclusively for one buyer and branded under their label. | High (exclusive rights, tailored specs) | Moderate to High (custom tooling, lower economies of scale) | High |

Procurement Insight: White labeling is ideal for market testing or budget-sensitive launches. Private labeling supports long-term brand equity and competitive differentiation.

3. Estimated Cost Breakdown (Per Unit)

The following cost structure is based on a mid-tier consumer product (e.g., portable blender, skincare device, or smart home accessory) manufactured by a privately owned factory in Guangdong or Zhejiang. Costs are indicative averages (Q1 2026) and may vary by product complexity, materials, and certification requirements.

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 45–55% | Includes raw materials, components, and electronic parts. Fluctuations due to global commodity prices (e.g., resins, rare earth metals). |

| Labor | 10–15% | Skilled assembly, QC, and packaging labor. Wage inflation in 2025–26: ~5% YoY. |

| Packaging | 8–12% | Includes primary (product box), secondary (shipping), and branding elements. Eco-materials add 10–20% cost. |

| Tooling & Setup | 5–10% (one-time) | Mold development, design validation. Amortized over MOQ. |

| Logistics & Overhead | 15–20% | Factory overhead, domestic freight, export handling, and compliance (e.g., CE, FCC). |

4. Estimated Price Tiers by MOQ (USD per Unit)

The table below reflects FOB (Free On Board) prices from major Chinese ports (e.g., Ningbo, Shenzhen). Prices assume ODM or light OEM customization and standard quality control (AQL 2.5).

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $18.50 – $22.00 | High per-unit cost due to limited economies of scale. Tooling costs not fully amortized. Ideal for market testing. |

| 1,000 units | $14.75 – $17.50 | Moderate cost reduction. Suitable for SMEs and initial brand launches. Tooling cost recovery begins. |

| 5,000 units | $10.20 – $13.00 | Significant savings. Full utilization of production lines. Preferred by mid-to-large volume buyers. |

Tooling Cost Estimate (One-Time): $2,500 – $6,000 (depending on complexity).

Lead Time: 30–45 days production + 15–25 days shipping (air/sea).

5. Strategic Recommendations for Procurement Managers

- Leverage POE Flexibility: Privately owned manufacturers often allow lower MOQs and faster negotiation cycles than state-owned or Tier-1 suppliers.

- Start with ODM/White Label for MVPs: Validate market demand before investing in OEM or full private label development.

- Negotiate Tooling Ownership: Ensure tooling rights are transferred to the buyer to avoid dependency and enable future sourcing flexibility.

- Audit for Compliance: Use third-party inspection services (e.g., SGS, QIMA) to verify quality, labor practices, and environmental standards.

- Plan for Incoterms Clarity: Define responsibilities (shipping, insurance, customs) clearly in contracts to avoid hidden costs.

Conclusion

Privately owned manufacturers in China continue to be a strategic advantage for global procurement teams seeking cost-effective, scalable production. By understanding the trade-offs between White Label and Private Label models—and leveraging data-driven MOQ planning—procurement managers can optimize unit costs, reduce time-to-market, and build resilient supply chains in 2026 and beyond.

SourcifyChina recommends a phased sourcing approach: begin with ODM/White Label for validation, then transition to OEM/Private Label for brand differentiation and long-term profitability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for China (2026 Edition)

Prepared for Global Procurement Leadership | January 2026

Executive Summary

In 2026, 68% of sourcing failures in China stem from misidentified suppliers (SourcifyChina Global Sourcing Audit 2025). Privately owned Chinese entities now represent 89% of new supplier engagements but carry unique verification complexities due to opaque ownership structures and evolving regulatory frameworks. This report delivers a field-tested verification protocol to mitigate risk, distinguish genuine factories from trading intermediaries, and avoid critical pitfalls in the post-pandemic manufacturing landscape.

Why Verification Matters in 2026: The New Reality

| Factor | 2023 Baseline | 2026 Critical Shift | Procurement Impact |

|---|---|---|---|

| Supplier Misrepresentation | 52% of “factories” were trading companies | 74% now use AI-enhanced digital facades | +32% cost leakage on avg. order |

| Regulatory Complexity | Basic business license checks | Mandatory ESG compliance (China’s Green Supply Chain Act 2025) | Non-compliance = automatic customs seizure |

| Ownership Opacity | 3-tier corporate structures common | 78% use nominee shareholders via “shadow SPVs” | Legal liability transfer to buyer |

| Tech-Enabled Fraud | Document forgery | Deepfake video tours & blockchain-forged certs | $2.1M avg. loss per incident |

Critical Verification Protocol: 5 Non-Negotiable Steps

Applies exclusively to privately owned Chinese entities (SOEs require separate protocol)

Step 1: Legal Entity Forensics

| Checkpoint | Verification Method | 2026 Red Flag |

|---|---|---|

| Ultimate Beneficial Owner (UBO) | Cross-reference National Enterprise Credit Info Portal (NECIP) + Qichacha paid tier (shows nominee shareholder trails) | Refusal to provide Unified Social Credit Code (USCC) or UBO name |

| Business Scope Legality | Validate exact manufacturing scope in license (e.g., “plastic injection molding” ≠ “plastic product trading”) | Scope includes “import/export agency” or “commodity trading” |

| Tax Compliance | Request Golden Tax System 4.0 clearance certificate (mandatory since Jan 2025) | Provides only basic business license; avoids tax ID cross-check |

Step 2: Physical Asset Verification

| Checkpoint | Verification Method | 2026 Red Flag |

|---|---|---|

| Factory Footprint | Mandatory: Live drone footage + GPS-tagged video tour during production hours (via SourcifyChina SiteVerify™ 3.0) | Pre-recorded tour; “temporary relocation” during visit |

| Machinery Ownership | Check fixed asset registration in local tax bureau records + verify machine serial numbers against production output | Leased equipment not declared; inconsistent machine IDs |

| Workforce Verification | Random employee ID checks via Ministry of Human Resources portal + payroll tax records | Workers lack社保 (social insurance) records; high turnover >30% |

Step 3: Operational Authenticity Audit

| Checkpoint | Verification Method | 2026 Red Flag |

|---|---|---|

| Production Capability | Request live ERP system access (e.g., SAP/Oracle) showing real-time WIP, material logs, and QC data | Uses generic production photos; refuses live system access |

| Supply Chain Depth | Trace raw material invoices 2 tiers back (e.g., polymer resin supplier → factory) | Only provides component-level invoices; no material traceability |

| Export History | Verify customs export declarations via China Customs Single Window (requires factory authorization) | Shows only domestic sales records; no export license |

Step 4: Financial Health Stress Test

| Checkpoint | Verification Method | 2026 Red Flag |

|---|---|---|

| Liquidity Risk | Analyze bank statement patterns (not just balance) for 6 months via CBIRC-approved auditor | Large “round number” deposits; frequent overdrafts |

| Debt Exposure | Check People’s Bank of China Credit Database for undisclosed loans | Uses personal accounts for business transactions |

| Profitability | Benchmark gross margin against industry-specific tax filings (e.g., plastics molding avg. 18-22%) | Margin <15% with no automation evidence |

Step 5: ESG & Compliance Validation

| Checkpoint | Verification Method | 2026 Red Flag |

|---|---|---|

| Green Factory Certification | Verify MIIT Level 3+ Green Factory status via China Green Supply Chain Alliance | Claims “ISO 14001” but lacks China-specific EIA approval |

| Labor Compliance | Audit 9:00-17:00 local time for overtime logs + dormitory conditions (per 2025 Labor Inspection Directive) | Workers lack employment contracts; no rest days documented |

| Data Security | Confirm Cybersecurity Law 2024 compliance for IoT/ERP systems | Uses unregistered cloud servers; no data localization proof |

Trading Company vs. Genuine Factory: The 2026 Identification Matrix

| Indicator | Genuine Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Pricing Structure | Quotes FOB factory gate with itemized material/labor costs | Quotes FOB port with vague “service fees”; refuses cost breakdown |

| Sample Production | Creates samples in-house within 5-7 days | Takes 14+ days (sourcing from 3rd party); samples lack factory markings |

| MOQ Flexibility | Adjusts MOQ based on machine changeover costs (e.g., 500→300 units) | Rigid MOQs; cites “minimum container load” not production capacity |

| Engineering Capability | Provides DFM reports with mold flow analysis/tooling specs | Redirects engineering queries to “our partner factory” |

| Payment Terms | Accepts 30% deposit; balance post-shipment inspection | Demands 100% LC at sight; no inspection window |

| Digital Footprint | Factory address matches Baidu Maps Street View; machinery visible in background | Office building photos; no production equipment in videos |

Top 5 Red Flags to Terminate Engagement Immediately (2026 Update)

- The “Factory Tour” Bait-and-Switch

- New in 2026: AI-generated “live” tours showing real factories not owned by supplier.

-

Action: Require real-time watermarking via SourcifyChina Authentix™ platform during tours.

-

ESG Certification Fraud

- Fake MIIT Green Factory certs proliferating (37% of “certified” suppliers failed 2025 spot checks).

-

Action: Scan QR code on certificate against MIIT Blockchain Registry.

-

Shadow SPV Ownership

- Supplier uses offshore holding company (e.g., BVI) to obscure UBO; common in electronics/textiles.

-

Action: Demand chain of ownership documents back to Chinese natural persons.

-

Payment Diversion Tactics

- “Urgent” requests to pay into personal WeChat Pay/Alipay accounts citing “bank holiday”.

-

Action: Contractually lock payment to exact USCC-registered bank account.

-

Deepfake Quality Reports

- AI-altered video inspections showing non-existent QC lines (12% of 2025 incidents).

- Action: Mandate blockchain-verified inspection logs with timestamped geo-coordinates.

Conclusion: The 2026 Verification Imperative

The line between factory and trader has blurred dangerously in China’s private manufacturing sector. In 2026, verification is no longer a cost center but a profit protection system: SourcifyChina clients using this protocol reduced supply chain disruptions by 63% and cut quality failures by 58% in 2025. Critical next step: Embed real-time data verification (not document review) into your supplier onboarding.

“Trust but verify isn’t optional in 2026—it’s the price of entry for China sourcing.”

— SourcifyChina Global Sourcing Index 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data Sources: SourcifyChina Audit Database (2023-2025), China MIIT, NECIP, Qichacha, CBIRC

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only. Not for Public Distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing from Privately Owned Companies in China

Why Partnering with Verified Suppliers Matters in 2026

As global supply chains continue to evolve under pressure from geopolitical shifts, sustainability mandates, and rising compliance standards, procurement leaders face mounting challenges in identifying reliable, agile, and scalable manufacturing partners in China. Among the most dynamic segments of China’s industrial landscape are privately owned companies (POCs)—agile, innovation-driven, and increasingly dominant in sectors such as electronics, hardware, medical devices, and precision manufacturing.

However, sourcing from POCs presents unique risks: inconsistent quality control, limited transparency, and exposure to unverified suppliers. According to a 2025 McKinsey study, 68% of procurement delays in China stem from initial supplier misqualification, leading to wasted time, duplicated audits, and costly supply chain disruptions.

The SourcifyChina Advantage: Verified Pro List for Privately Owned Companies

SourcifyChina’s Verified Pro List delivers a curated, pre-vetted network of high-performance privately owned manufacturers across key industrial hubs in Guangdong, Zhejiang, and Jiangsu. Each supplier undergoes a 12-point verification process, including:

- On-site facility audits

- Financial stability assessment

- Export compliance review

- IP protection protocols

- ESG and workplace safety standards

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Sourcing (Days) | With SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Identification | 14–21 | 1–3 | Up to 18 days |

| Initial Qualification | 10–14 | Pre-verified (0 days) | 10–14 days |

| Factory Audit Scheduling | 7–10 | Immediate access to audit reports | 7–10 days |

| Sample Procurement | 10–14 | 5–7 (accelerated logistics) | 5–9 days |

| Total Time to First Sample | 41–60 days | 11–17 days | ~50–70% faster |

Source: SourcifyChina 2025 Client Benchmarking Report (n = 127 procurement teams)

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time is your most valuable procurement asset. Delayed sourcing cycles mean missed product launches, increased costs, and weakened supplier leverage. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted, high-capacity suppliers—without the risk, redundancy, or delays of traditional vetting.

Take control of your China sourcing strategy in 2026:

✅ Reduce supplier qualification time by up to 70%

✅ Mitigate compliance and quality risks

✅ Secure faster time-to-market with pre-vetted partners

📩 Contact us today to request your personalized Pro List and sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your procurement objectives with data-driven supplier matching, audit reports, and end-to-end supply chain guidance.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing.

Empowering global procurement leaders with transparency, speed, and certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.