The global engineered wood products market, including pressure-treated LVL (Laminated Veneer Lumber), is experiencing robust growth driven by rising demand for sustainable and high-strength building materials. According to Grand View Research, the global LVL market size was valued at USD 2.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030, fueled by increasing construction activities and the shift toward eco-friendly alternatives in residential and commercial projects. Similarly, Mordor Intelligence projects a CAGR of over 6% for the engineered wood market through 2028, with North America and Europe leading adoption due to stringent building codes and growing investments in infrastructure. As demand for durable, dimensionally stable, and pressure-treated LVL rises—particularly in moisture-prone or load-bearing applications—select manufacturers are emerging as industry leaders. These companies combine scalable production, consistent quality, and compliance with ASTM and APA standards to meet expanding global needs. Below are the top 7 pressure-treated LVL lumber manufacturers shaping the future of modern construction.

Top 7 Pressure Treated Lvl Lumber Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Pacific Woodtech Treated LVL

Domain Est. 1998

Website: coastalforestproducts.com

Key Highlights: PWT Treated LVL is the only manufacturer of treated LVL, and it is covered by a 25-year limited, transferable warranty. PWT Treated LVL is protected against ……

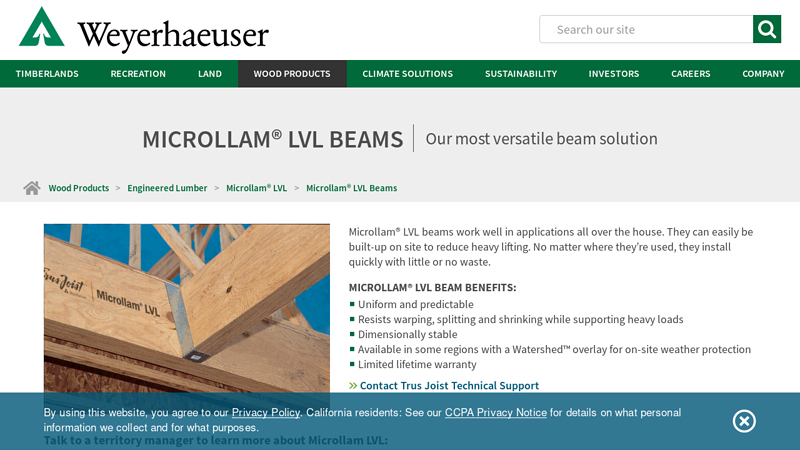

#2 Microllam® LVL Beams

Domain Est. 1995

Website: weyerhaeuser.com

Key Highlights: Weyerhaeuser Microllam® LVL beams work well in applications all over the house. They can easily be built-up on site to reduce heavy lifting….

#3 Fire Retardant Treated LVL and Scaffold Plank

Domain Est. 1996

Website: frtw.com

Key Highlights: Hoover now offers fire retardant or preservative treatment for laminated veneer lumber (LVL) and Scaffold Plank . Contact Sales via email ([email protected]) ……

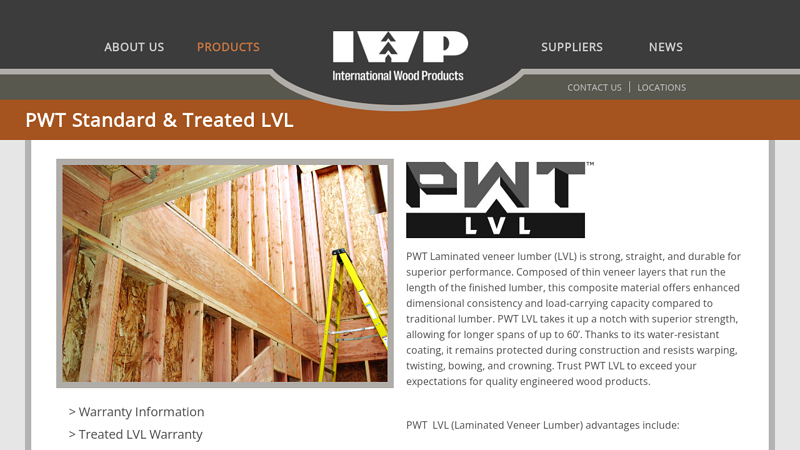

#4 PWT Standard & Treated LVL

Domain Est. 1997

Website: iwpllc.com

Key Highlights: PWT’s Treated LVL’s are lighter weight than traditional pressure treated material and PWT offers a 25 year warranty against rot and decay. PWT Treated LVL is ……

#5 LVL

Domain Est. 1997

Website: westfraser.com

Key Highlights: LVL headers and beams, made from rotary-peeled veneers bonded under heat and pressure, support heavier loads and allow greater spans than conventional lumber….

#6 PWT Pressure Treated LVL

Domain Est. 1998

Website: weekesforest.com

Key Highlights: Features & Benefits. PWT Treated LVL is protected against damage caused by fungal rot, decay and wood destroying insects, including Formosan termites….

#7 PWT Treated™ LVL

Domain Est. 2022

Website: pwtewp.com

Key Highlights: PWT Treated™ LVL, the first on the market treated during manufacturing, is perfect for demanding outdoor and structural applications….

Expert Sourcing Insights for Pressure Treated Lvl Lumber

H2: Projected 2026 Market Trends for Pressure-Treated LVL Lumber

As the construction and building materials industries evolve, pressure-treated laminated veneer lumber (PT LVL) is expected to experience notable shifts in demand, innovation, and market dynamics by 2026. Driven by increasing emphasis on sustainable construction, durability in harsh environments, and resilience to climate change, PT LVL lumber is positioned for moderate but strategic growth in specific market segments.

-

Growth in Residential and Light Commercial Construction

The U.S. and several international markets are projected to see continued expansion in single-family housing and light commercial developments. PT LVL, known for its high strength-to-weight ratio and resistance to moisture and decay when treated, is increasingly specified in elevated structural applications such as floor joists, beams, and roof trusses in high-humidity or coastal regions. By 2026, demand is expected to rise, especially in hurricane-prone zones and flood-risk areas where building codes are tightening. -

Stringent Building Codes and Regulatory Influence

Regulatory trends favoring resilient and long-lasting materials are a key driver. Updated International Building Code (IBC) and International Residential Code (IRC) requirements—particularly in coastal and termite-prone regions—are likely to promote the use of pressure-treated engineered wood products. By 2026, building authorities may increasingly mandate preservative-treated structural components in ground-contact or high-moisture applications, further boosting adoption of PT LVL. -

Sustainability and Environmental Compliance

Environmental concerns around chemical preservatives (e.g., alkaline copper quaternary – ACQ, copper azole) persist, but advancements in eco-friendly treatment technologies are expected to alleviate some market resistance. By 2026, manufacturers may offer low-toxicity, longer-lasting treatment options that align with green building certifications such as LEED and the National Green Building Standard. This shift could enhance market acceptance and open doors in eco-conscious construction projects. -

Competition from Alternative Materials

PT LVL will continue to face competition from alternatives such as glulam, steel, and cross-laminated timber (CLT). However, its cost-effectiveness, dimensional stability, and compatibility with standard framing techniques give it a competitive edge in mid-rise and custom residential builds. Innovations in hybrid systems—combining PT LVL with other engineered materials—could create new niche applications by 2026. -

Supply Chain and Raw Material Availability

Fluctuations in softwood veneer supply and rising costs of treatment chemicals may impact pricing and availability. However, improved manufacturing efficiency and regional production scaling—especially in the Southern U.S., a major LVL production hub—are expected to stabilize supply. Increased investment in domestic timber resources and plantation management may further support a steady supply chain by 2026. -

Technological Integration and Smart Lumber

While still in early stages, research into sensor-integrated or “smart” engineered wood products could influence future LVL applications. By 2026, pilot projects may explore moisture-monitoring PT LVL beams that provide real-time structural health data, enhancing maintenance and safety in critical infrastructure.

Conclusion

By 2026, the pressure-treated LVL lumber market is expected to grow steadily, driven by regulatory demands for durability, regional climate challenges, and advancements in treatment technology. While not experiencing explosive growth, PT LVL will solidify its role as a preferred structural solution in high-performance and resilient construction, particularly where moisture resistance and long-term reliability are paramount. Stakeholders should focus on sustainability innovation, code compliance, and strategic positioning in coastal and high-risk building zones to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Pressure-Treated LVL Lumber (Quality & Intellectual Property)

Sourcing pressure-treated laminated veneer lumber (LVL) requires careful attention to both material quality and intellectual property concerns. Overlooking key factors can lead to structural failures, compliance issues, and legal risks. Below are the most common pitfalls to avoid.

Inadequate Understanding of Treatment Standards and Specifications

One of the most frequent mistakes is failing to verify that the pressure-treated LVL meets applicable building codes and performance standards. Not all treatments are suitable for every application. Using lumber treated for above-ground use in ground-contact scenarios can lead to premature decay and structural compromise. Always confirm that the product complies with AWPA (American Wood Protection Association) standards such as UC3B, UC4A, or UC4B, depending on the exposure conditions.

Poor Quality Control and Lack of Certification

Procuring LVL without proper third-party certification (e.g., from APA – The Engineered Wood Association) increases the risk of receiving substandard materials. Unverified manufacturers may use inconsistent adhesive bonds, poor veneer grading, or inadequate drying techniques, all of which compromise strength and durability. Insist on mill test reports, APA stamps, and documentation of quality control processes to ensure consistency and reliability.

Misalignment with Project-Specific Load and Span Requirements

Engineers and builders sometimes assume that all pressure-treated LVLs have the same structural capacity. However, different grades (e.g., 1.9E, 2.0E, 2.2E) offer varying modulus of elasticity and strength values. Selecting a lower-grade LVL than required can lead to excessive deflection or failure under load. Always match the LVL specifications to the engineered design, including span, load duration, and environmental exposure.

Inconsistent Moisture Content and Dimensional Stability

Improperly dried or inconsistently treated LVL can suffer from warping, twisting, or shrinking after installation. Pressure treatment processes must maintain strict moisture content controls. Lumber with high initial moisture may appear sound but can degrade performance over time or cause issues with finishes and connections. Verify moisture content at delivery and ensure proper acclimatization before installation.

Intellectual Property Infringement and Unauthorized Manufacturing

A significant but often overlooked pitfall involves intellectual property (IP) rights. Many LVL products are patented or protected under proprietary manufacturing processes. Sourcing from unauthorized producers—especially overseas suppliers—may result in counterfeit or knockoff products that mimic branded LVL but lack performance validation. Using such materials can void warranties, fail inspections, and expose contractors and designers to liability in case of failure.

Lack of Traceability and Documentation

Without proper documentation—such as batch numbers, mill certifications, treatment logs, and chain-of-custody records—it becomes difficult to trace the origin and treatment history of LVL. This lack of traceability can cause problems during inspections, code compliance reviews, or in the event of a product recall. Ensure suppliers provide complete documentation aligned with building code and audit requirements.

Overlooking Long-Term Durability and Corrosion Risks

Pressure-treated LVL often requires compatible fasteners and connectors due to the chemicals used in treatment (e.g., ACQ, CA). Using standard steel hardware can lead to accelerated corrosion and structural weakening. Failing to specify corrosion-resistant connectors (e.g., hot-dipped galvanized or stainless steel) is a common oversight that compromises long-term integrity.

Conclusion

To mitigate these pitfalls, always source pressure-treated LVL from reputable, certified suppliers, verify compliance with engineering and environmental requirements, and confirm intellectual property legitimacy. Due diligence in procurement protects structural performance, ensures code compliance, and reduces legal and safety risks.

Logistics & Compliance Guide for Pressure Treated LVL Lumber

Overview of Pressure Treated LVL Lumber

Laminated Veneer Lumber (LVL) is an engineered wood product made from thin wood veneers bonded with adhesives under heat and pressure. When pressure treated, LVL is infused with preservatives to resist decay, fungi, and insect damage, making it suitable for outdoor and high-moisture applications. This guide outlines key logistics and compliance considerations for handling, transporting, and using pressure treated LVL lumber.

Regulatory Compliance Requirements

Pressure treated LVL lumber must comply with national and international standards to ensure safety and environmental protection. Key regulatory frameworks include:

– American Wood Protection Association (AWPA) Standards: Specifies treatment levels (e.g., UC1–UC4 depending on application) and preservative types (e.g., alkaline copper quaternary (ACQ), copper azole (CA)).

– Environmental Protection Agency (EPA) Regulations: Governs the use of chemical preservatives under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Treatments must be registered with the EPA.

– International Building Code (IBC) and International Residential Code (IRC): Dictate approved uses based on exposure conditions and load requirements.

– Forest Stewardship Council (FSC) or Sustainable Forestry Initiative (SFI): May apply if sustainable sourcing is required for green building certifications (e.g., LEED).

Handling and Storage Guidelines

Proper handling and storage are critical to maintain the integrity and safety of pressure treated LVL:

– Storage Conditions: Store lumber off the ground on level, well-drained surfaces. Use spacers between layers to allow airflow and prevent moisture accumulation. Cover with breathable tarps to protect from rain while permitting ventilation.

– Avoid Direct Soil Contact: Even when treated, prolonged soil contact can compromise performance. Use approved hardware and supports when installing in ground-contact applications.

– Personal Protective Equipment (PPE): Workers should wear gloves, dust masks, and safety goggles when cutting or sanding treated LVL to minimize exposure to preservative chemicals.

Transportation and Shipping Considerations

Logistics planning must account for the product’s dimensions, weight, and handling requirements:

– Packaging and Bundling: LVL is typically shipped in secured bundles with steel or synthetic strapping. Ensure straps are tight and labeled with treatment type, grade, and manufacturer information.

– Load Securing: Use appropriate blocking and bracing to prevent shifting during transit. Overhang beyond the trailer must comply with DOT regulations (e.g., FMCSA guidelines).

– Documentation: Shipping manifests should include product specifications, treatment certification, safety data sheets (SDS), and compliance labels (e.g., ICC-ES evaluation reports).

– Hazard Communication: While pressure treated LVL is not classified as hazardous material for transport under DOT 49 CFR, SDS must be available to inform carriers and handlers of chemical content.

Installation and Job Site Compliance

On-site practices must align with manufacturer specifications and code requirements:

– Cutting and Modification: All field cuts, notches, or drill holes must be treated with an approved end-cut preservative meeting AWPA M4 standards to maintain protective integrity.

– Fastener Compatibility: Use corrosion-resistant fasteners (e.g., hot-dipped galvanized, stainless steel) compatible with the preservative type (e.g., ACQ requires higher corrosion resistance than CCA).

– Permitting and Inspections: Verify local building department requirements. Provide evaluation reports (e.g., ESR numbers) and treatment documentation for inspector review.

Environmental and Disposal Regulations

End-of-life management must follow environmental regulations:

– Prohibited Uses: Do not burn pressure treated LVL, as combustion releases toxic fumes. Disposal in regular landfills may be restricted in some jurisdictions.

– Waste Disposal: Follow local, state, and federal regulations for disposal of treated wood. Some areas require disposal at designated facilities or recycling through approved channels.

– Spill Management: In case of chemical runoff during storage or construction, contain and clean spills per EPA and local environmental guidelines.

Documentation and Traceability

Maintain a clear chain of custody and compliance records:

– Mill Certification: Each shipment should include a grade stamp indicating species, manufacturer, treatment type, retention level, and compliance with relevant standards (e.g., ANSI A190.1).

– Treatment Certification: Documentation from the treating facility verifying compliance with AWPA standards and EPA registration.

– Project Submittals: Provide spec sheets, SDS, and evaluation reports to architects, engineers, and code officials as part of project documentation.

Conclusion

Proper logistics and compliance management ensure that pressure treated LVL lumber performs safely and effectively throughout its lifecycle. Adherence to regulatory standards, careful handling, and accurate documentation mitigate risks and support structural integrity in construction applications. Always consult manufacturer guidelines and local authorities for project-specific requirements.

Conclusion for Sourcing Pressure-Treated LVL Lumber:

Sourcing pressure-treated Laminated Veneer Lumber (LVL) requires careful consideration of several critical factors including structural requirements, environmental exposure, building codes, and availability. While LVL is inherently strong and dimensionally stable, it is typically not manufactured with preservative treatment for ground or moisture contact. Therefore, when using LVL in applications exposed to moisture or in corrosive environments, proper protective measures—such as using non-combustible or water-resistive barriers, ensuring proper flashings, or selecting alternative treated wood products—must be implemented.

In cases where both high structural performance and moisture resistance are needed, engineers and builders should consult with manufacturers to determine if treated LVL options are available, or consider combining untreated LVL with secondary protective treatments or encapsulation methods that comply with code requirements. Additionally, sourcing from reputable suppliers who provide certified materials with full documentation ensures compliance with design specifications and industry standards.

Ultimately, while standard LVL is not commonly available in pressure-treated form, successful project outcomes depend on early coordination between design professionals, suppliers, and contractors to ensure appropriate material selection, protection strategies, and long-term durability in demanding service conditions.