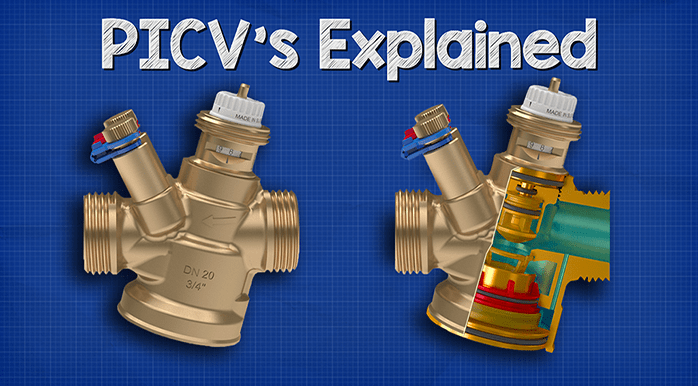

The global pressure independent control valve (PICV) market is experiencing robust growth, driven by rising demand for energy-efficient HVAC systems in commercial and industrial applications. According to Grand View Research, the global control valves market was valued at USD 106.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, with PICVs gaining significant traction due to their ability to maintain precise flow control regardless of system pressure fluctuations. Mordor Intelligence further highlights that increasing adoption of smart building technologies and stringent energy regulations are accelerating the deployment of advanced control solutions—particularly PICVs—in regions such as North America, Europe, and Asia Pacific. As building automation systems evolve, the need for reliable, stable, and energy-saving flow control has placed PICVs at the forefront of hydronic system design. This growing demand has elevated the importance of selecting manufacturers that combine innovation, precision engineering, and global support. Below are the top 8 pressure independent control valve manufacturers leading the market through technological advancement and proven performance.

Top 8 Pressure Independent Control Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Flow Control Industries

Domain Est. 1997

Website: flowcontrol.com

Key Highlights: Flow Control Industries, Inc. (FCI) is a specialty manufacturer of high-performance pressure independent control valves, delivering energy efficient products ……

#2 Pressure Independent Control Valves

Domain Est. 1986

Website: siemens.com

Key Highlights: Siemens offers a range of valves and actuators for any control and hydronic requirement in generation, distribution and consumption for heating and cooling….

#3 Pressure Independent Control Valves

Domain Est. 1995

Website: johnsoncontrols.com

Key Highlights: The VP140 Series Pressure Independent Control Valve increases comfort and efficiency without balancing valves, and delivers a stable flow, regardless of ……

#4 AB

Domain Est. 1995

Website: danfoss.com

Key Highlights: AB-QM is a pressure independent control valve with a built-in, integrated differential pressure regulator….

#5 Pressure Independent Valves

Domain Est. 1997

Website: griswoldcontrols.com

Key Highlights: PI control valves are designed to replace the conventional 2 way control valve and balancing valve pair, installed at heating and cooling coils in buildings….

#6 Pressure independent control valves (PICV)

Domain Est. 1997

Website: caleffi.com

Key Highlights: Proportional linear actuator for FLOWMATIC® 145 series control valve and 149 series kit, with fail-safe function….

#7 Pressure Independent Control Valves – Nexus

Domain Est. 1999

Website: nexusvalve.com

Key Highlights: Pressure Independent Control Valves (PICV) provide multiple functions to a Hydronic System in two different ways; by controlling flow in proportion to the load….

#8 Pressure Independent Control Valves

Domain Est. 2000

Website: advancevalves.com

Key Highlights: The Pressure Independent Control Valves (PICV) incorporate a small diaphragm type DPCV in order to keep a constant differential pressure across an orifice….

Expert Sourcing Insights for Pressure Independent Control Valve

2026 Market Trends for Pressure Independent Control Valves (PICVs)

The Pressure Independent Control Valve (PICV) market is poised for significant evolution by 2026, driven by global imperatives for energy efficiency, building automation, and sustainable infrastructure. Key trends shaping this market include:

Accelerated Adoption Driven by Stringent Energy Regulations

Global and regional energy efficiency standards (such as EU Ecodesign, ASHRAE 90.1, and national building codes) are becoming increasingly stringent. PICVs, which inherently maintain precise flow control regardless of variable system pressure, directly contribute to reducing HVAC system energy consumption by up to 30%. By 2026, regulatory compliance will be a primary driver, making PICVs not just an efficiency upgrade but a mandatory solution in new commercial, healthcare, and high-rise residential constructions, particularly in Europe and North America.

Integration with Smart Building and IoT Platforms

The convergence of PICVs with Building Management Systems (BMS) and IoT technologies is transforming them into intelligent components. By 2026, demand will surge for PICVs equipped with digital communication protocols (BACnet, Modbus, LonWorks) and embedded sensors for real-time flow, temperature, and pressure monitoring. This enables predictive maintenance, remote diagnostics, and dynamic optimization of HVAC performance. Vendors are increasingly offering cloud-based analytics platforms that leverage PICV data to enhance building-wide energy management and occupant comfort.

Growth in Retrofit and Modernization Projects

As building owners seek to meet sustainability targets and reduce operational costs, retrofitting existing HVAC systems with PICVs becomes economically compelling. By 2026, the retrofit segment will experience robust growth, especially in aging commercial and institutional buildings. Modern PICVs are designed for easier installation and commissioning, reducing downtime and labor costs, further accelerating adoption in upgrade projects.

Expansion in Emerging Markets

While Europe remains a mature market for PICVs, significant growth is expected in Asia-Pacific (especially China, India, and Southeast Asia) and the Middle East. Rapid urbanization, increasing construction of energy-intensive smart cities, and rising awareness of green building certifications (like LEED, BREEAM, and local equivalents) are driving demand. Government initiatives promoting energy-efficient infrastructure will further catalyze PICV deployment in these regions by 2026.

Focus on Hydronic Balancing and System Stability

With the proliferation of variable speed pumps and complex hydronic systems, maintaining stable and balanced flow is critical. PICVs provide inherent pressure independence, eliminating the need for manual balancing and reducing commissioning time. By 2026, the industry will increasingly recognize PICVs as essential for ensuring consistent thermal comfort, minimizing noise, and extending equipment lifespan, solidifying their role as standard components in high-performance HVAC designs.

Product Innovation and Competitive Differentiation

Competition among manufacturers will intensify, leading to innovations in materials, compact design, enhanced turndown ratios, and wireless connectivity options. Vendors will differentiate through integrated digital services, lifecycle cost calculators, and sustainability reporting tools. By 2026, the market will see a shift from commoditized products to value-added solutions that combine hardware, software, and service support.

Common Pitfalls Sourcing Pressure Independent Control Valves (PICVs): Quality and Intellectual Property (IP) Concerns

Sourcing Pressure Independent Control Valves (PICVs) requires careful attention to avoid significant performance, compliance, and legal risks. Two critical areas where pitfalls frequently occur are quality assurance and intellectual property (IP) protection.

Quality-Related Pitfalls

-

Inadequate Performance Verification:

- Pitfall: Relying solely on manufacturer-provided datasheets without independent verification or third-party testing (e.g., according to EN 1349, EN 17530, or ASHRAE standards).

- Consequence: Valves may not deliver the promised flow accuracy, pressure independence, or turndown ratio under real system conditions, leading to poor hydraulic balancing, energy waste, and occupant discomfort.

- Mitigation: Require test reports from accredited laboratories, conduct site acceptance testing, and verify performance across the specified differential pressure range.

-

Substandard Materials and Construction:

- Pitfall: Selecting valves based on lowest price, leading to the use of inferior materials (e.g., lower-grade brass, unsuitable elastomers, thin castings) or poor manufacturing processes.

- Consequence: Premature failure due to corrosion, erosion, seal degradation, or mechanical weakness, resulting in leaks, maintenance costs, and system downtime.

- Mitigation: Specify required material standards (e.g., DZR brass, EPDM/Viton seals), conduct factory audits if possible, and prioritize suppliers with proven quality management systems (ISO 9001).

-

Lack of Traceability and Documentation:

- Pitfall: Receiving valves without proper documentation (material certifications, test reports, calibration certificates, unique serial numbers).

- Consequence: Inability to verify compliance, trace failures, or provide evidence for warranties or regulatory requirements. Hinders maintenance and replacement.

- Mitigation: Make comprehensive documentation a mandatory part of the procurement specification and contract.

-

Insufficient Pressure and Temperature Ratings:

- Pitfall: Overlooking the actual maximum system pressure (including water hammer) and temperature extremes the valve will experience.

- Consequence: Valve failure (leaks, ruptures) under surge conditions or high temperatures, posing safety risks and system damage.

- Mitigation: Clearly define the maximum operating and test pressures/temperatures in the system design and ensure the selected PICV model explicitly meets or exceeds these ratings with a safety margin.

Intellectual Property (IP) and Design Integrity Pitfalls

-

Sourcing Counterfeit or “Clone” Valves:

- Pitfall: Unintentionally purchasing valves that are illegal copies of patented designs, often marketed deceptively or through unreliable channels.

- Consequence: Significant legal liability for infringement (fines, injunctions), voided warranties, unknown quality/reliability, lack of technical support, and reputational damage. Performance and safety are unverified.

- Mitigation: Source exclusively from authorized distributors or directly from reputable manufacturers. Verify supplier credentials and be wary of prices significantly below market. Check for official product markings and documentation.

-

Undermining Innovation and Long-Term Support:

- Pitfall: Choosing “me-too” products or clones solely on price, disregarding the R&D investment and ongoing technical support provided by original innovators.

- Consequence: Reduced incentive for genuine innovation in the industry. Lack of access to reliable technical support, software tools, spare parts, and firmware updates for the lifespan of the valve.

- Mitigation: Recognize the value of IP protection in fostering innovation. Factor in total cost of ownership (TCO), including support and longevity, not just initial purchase price.

-

Ambiguous Design Source and Liability:

- Pitfall: Purchasing valves where the actual manufacturer (OEM) is obscured, or the design’s origin is unclear.

- Consequence: Difficulty in assigning responsibility for performance, failures, or IP issues. Complicated warranty claims and support requests.

- Mitigation: Ensure the procurement contract clearly identifies the responsible manufacturer (not just the supplier/distributor) and their warranty terms. Prefer transparent supply chains.

-

Ignoring Patented Features:

- Pitfall: Specifying or accepting valves that incorporate patented technologies (e.g., specific actuator designs, sensor integration, flow measurement methods) without confirming the supplier has the necessary licenses.

- Consequence: End-user (the buyer) can still be liable for contributory infringement, even if the supplier is the direct infringer, especially if aware of the infringement.

- Mitigation: When specifying features known to be patented (e.g., from leading brands), ensure the chosen supplier explicitly confirms they hold the required licenses for those technologies.

By proactively addressing these quality and IP-related pitfalls during the sourcing process, purchasers can ensure they acquire reliable, high-performing PICVs that meet specifications, comply with regulations, avoid legal risks, and deliver long-term value.

Logistics & Compliance Guide for Pressure Independent Control Valves (PICVs)

This guide outlines essential logistics considerations and compliance requirements for the procurement, transportation, installation, and operation of Pressure Independent Control Valves (PICVs) in HVAC systems. Adherence to these guidelines ensures safety, performance, regulatory compliance, and supply chain efficiency.

Regulatory & Standards Compliance

PICVs must conform to a range of international, national, and industry-specific standards to ensure safety, performance, and interoperability. Key compliance areas include:

- Pressure Equipment Directive (PED) 2014/68/EU: Mandatory for valves placed on the market in the European Economic Area (EEA). PICVs intended for use with fluids under pressure may fall under PED categories requiring CE marking, notified body involvement, and technical documentation.

- ASME B16.34: Governs the design, materials, pressure ratings, and testing of valves for use in steam, water, gas, and related services in North America. Compliance ensures mechanical integrity.

- ISO 5208: Specifies leakage and strength testing requirements for industrial valves. PICVs should be tested and rated according to leakage class (e.g., Class A, B, or C) as per this standard.

- EN 15650: Applies specifically to control valves in HVAC systems, including PICVs. It defines performance, testing, and marking requirements for fire and smoke control dampers and valves.

- Water Regulations Advisory Scheme (WRAS) Approval / NSF/ANSI 61: Required for PICVs used in potable water systems. Ensures materials do not leach harmful substances into drinking water.

- Energy Efficiency Regulations: Compliance with local and regional energy codes (e.g., EU Energy Performance of Buildings Directive – EPBD, ASHRAE 90.1) may be required, as PICVs contribute to system energy optimization.

- REACH & RoHS Compliance: Ensures restriction of hazardous substances in materials used in valve construction, particularly relevant for valves exported to or used within the EU.

Manufacturers must provide Declaration of Conformity (DoC), CE marking (if applicable), test reports, and material certifications. Always verify compliance documentation before procurement.

Certification & Documentation Requirements

Proper documentation is critical for customs clearance, installation approval, and long-term operational compliance.

- Certificate of Conformity (CoC): Must accompany each shipment, confirming compliance with relevant standards and directives (e.g., PED, ASME, ISO).

- Material Test Reports (MTRs): Provide traceability of raw materials (e.g., brass, stainless steel) and confirm chemical and mechanical properties.

- Pressure Test Certificates: Document results of shell and seat leakage tests performed per ISO 5208 or ASME B16.104.

- Traceability & Serial Numbers: Each PICV should have a unique serial number for traceability throughout its lifecycle.

- User Manuals & Installation Instructions: Must be provided in the local language(s) of the destination country and include safety warnings, commissioning procedures, and maintenance schedules.

- Safety Data Sheets (SDS): Required if valves contain any chemicals or coatings subject to hazardous material regulations.

Ensure all documents are accurate, up to date, and available in digital and physical formats.

Packaging & Handling Specifications

Proper packaging and handling prevent damage during transit and ensure safe on-site handling.

- Protective Packaging: Valves must be individually wrapped or boxed with protective end caps to prevent contamination and thread damage. Use moisture-resistant materials.

- Shipping Containers: Use sturdy, sealed crates or pallets with cushioning (e.g., foam inserts) to prevent movement. Clearly label with handling instructions (e.g., “Fragile,” “This Side Up”).

- Environmental Protection: Include desiccants in packaging to prevent internal condensation, especially for ocean freight.

- Labeling Requirements: Each package must display:

- Product name and model number

- Serial number or batch code

- Net and gross weight

- Dimensions

- Handling symbols (ISO 780)

- Country of origin

- Compliance marks (e.g., CE, UL)

- Lifting & Storage: Use appropriate lifting equipment; never lift by valve handles or actuators. Store in a dry, indoor environment away from direct sunlight and corrosive agents.

Transportation & Import/Export Regulations

Transport logistics must comply with international trade laws and carrier requirements.

- Hazard Classification: PICVs are generally non-hazardous but verify with manufacturer data. No special hazard labeling is typically required.

- Incoterms: Clearly define responsibilities (e.g., FOB, DDP) in purchase agreements to avoid disputes over shipping, insurance, and customs.

- Customs Documentation: Prepare commercial invoice, packing list, bill of lading/airway bill, and certificate of origin. Include HS Code (e.g., 8481.80 for control valves).

- Import Duties & Taxes: Research applicable tariffs in destination country. Some regions offer reduced rates for energy-efficient components.

- Export Controls: Verify if PICVs or their components are subject to export restrictions (e.g., dual-use technologies under EU or U.S. regulations).

- Transit Conditions: Monitor temperature and humidity during transit; avoid freezing or excessive heat that may affect seals or actuators.

Installation & Commissioning Compliance

Correct installation is critical to ensure PICV performance and compliance with building codes.

- Qualified Personnel: Installation and commissioning must be performed by certified HVAC technicians familiar with PICV technology and local codes.

- System Flushing: The HVAC system must be thoroughly flushed and filtered before PICV installation to prevent debris from damaging internal mechanisms.

- Orientation & Positioning: Follow manufacturer guidelines for flow direction, actuator position, and proximity to bends or obstructions.

- Pressure & Flow Settings: Set PICVs according to design flow rates using built-in measurement ports or external balancing tools.

- Commissioning Reports: Document initial settings, measured flows, and pressure differentials. Retain records for compliance audits and maintenance.

Maintenance & Lifecycle Compliance

Ongoing maintenance ensures long-term performance and regulatory adherence.

- Scheduled Inspections: Follow manufacturer-recommended intervals for checking valve operation, actuator function, and calibration.

- Calibration Records: Maintain logs of any recalibration or adjustments made during service life.

- Waste Disposal: Decommissioned PICVs must be disposed of in accordance with WEEE (Waste Electrical and Electronic Equipment) and local environmental regulations, especially if actuators contain electronics or batteries.

- Spare Parts & Support: Ensure availability of genuine spare parts and technical support throughout the valve’s operational life.

By following this guide, stakeholders can ensure PICVs are handled, installed, and maintained in full compliance with logistics and regulatory requirements, supporting system reliability, energy efficiency, and legal conformity.

Conclusion for Sourcing Pressure Independent Control Valves (PICVs):

Sourcing Pressure Independent Control Valves (PICVs) represents a strategic investment in improving the efficiency, accuracy, and reliability of modern hydronic heating and cooling systems. These advanced valves automatically maintain a constant flow rate regardless of pressure fluctuations in the system, ensuring optimal performance, enhanced thermal comfort, and significant energy savings. By eliminating the need for additional balancing valves and reducing commissioning time, PICVs streamline installation and lower lifecycle costs.

When sourcing PICVs, it is essential to prioritize product quality, technical support, and compatibility with building automation systems. Selecting reputable manufacturers with proven track records, certified performance data, and comprehensive warranties ensures long-term system reliability. Additionally, considering factors such as control accuracy, turndown ratio, pressure range, and integration capabilities will help match the valve to specific project requirements.

In conclusion, sourcing high-quality PICVs not only supports sustainable building operations and reduces energy consumption but also contributes to system resilience and occupant comfort. As building standards continue to evolve toward higher efficiency, PICVs are becoming a critical component in modern HVAC design—making informed sourcing decisions vital for achieving optimal system performance.