The global PPR (polypropylene random copolymer) pipe fittings market is experiencing robust growth, driven by increasing demand for durable, corrosion-resistant, and cost-effective plumbing solutions in residential, commercial, and industrial applications. According to Mordor Intelligence, the global plastic piping systems market—which prominently includes PPR—is projected to grow at a CAGR of over 5.8% from 2024 to 2029, with Asia-Pacific emerging as the largest and fastest-growing region due to rapid urbanization and infrastructure development. Similarly, Grand View Research estimates that the global PPR pipe market size was valued at USD 11.2 billion in 2023 and is expected to expand at a CAGR of 6.1% through 2030, fueled by green building initiatives and the replacement of traditional metal piping systems. As demand surges, a select group of manufacturers have risen to prominence through innovation, quality compliance, and global distribution networks. Below, we spotlight the top 10 PPR pipe fittings manufacturers shaping the industry’s future.

Top 10 Ppr Pipe Fittings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China IFAN PPR Manufacturers Suppliers Factory

Domain Est. 2022

Website: ifan-solution.com

Key Highlights: IFAN can design and produce all plumbing pipe and fittings include PPR PVC PPSU HDPE PEXA PEXB PERT pipe and fittings, brass fittings, brass ball valve,heating ……

#2 Euroaqua PPR Pipe

Domain Est. 2009

Website: euroaquappr.com

Key Highlights: We are the Leading Manufacturer and Exporter of PPR Pipes & Fittings. · Sizes Available From Ø20mm to Ø315mm · Our pipes withstand temperatures from -10°C to 99°C ……

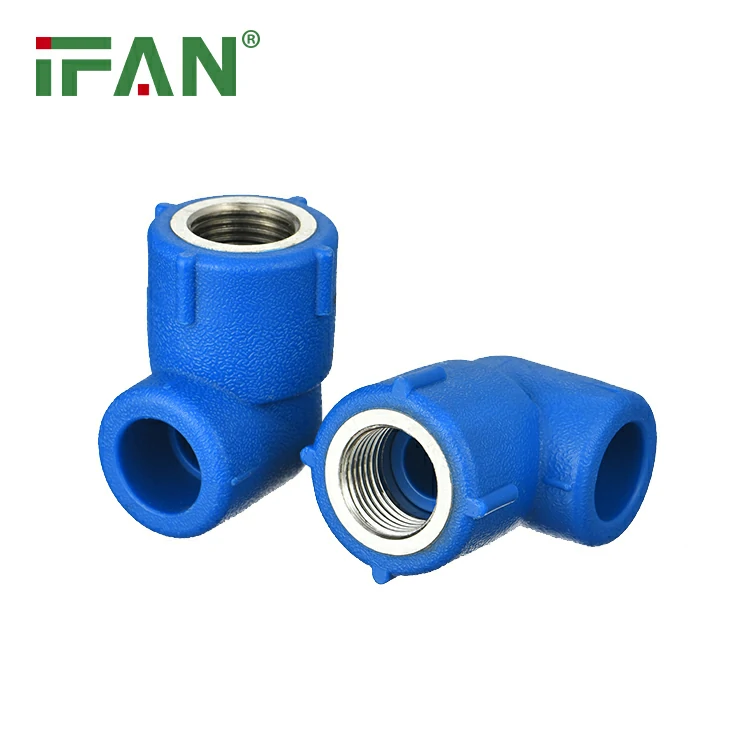

#3 ppr pipe fittings direct factory, PPR Pipes, PPR Fittings

Domain Est. 2015

Website: pprpipefittings.com

Key Highlights: We are direct factory producing pp-r pipe fittings and dedicated to the sales and distribution of plumbing, hard-wares, building materials and sanitary ……

#4 PPR Fittings Archives

Domain Est. 2021

Website: ifanplus.com

Key Highlights: WhatsApp Email Facebook · English. English. Spanish Arabic French Portuguese Indonesian. ifanplus. Home · About Us · Products · Plastic Industry · PPR….

#5 China PPR Pipe, PPR Fitting, PEX Pipe Suppliers, Manufacturers …

Domain Est. 2022

Website: ifanpiping.com

Key Highlights: IFAN can design and produce all plumbing pipe and fitting include PPR, PVC, CPVC PPSU HDPE PEXA PEXB PERT pipe and fitting, brass fitting, brass ball valve….

#6 PP

Website: aquapipe.com.tr

Key Highlights: We are one of the leading and pioneering manufacturers in the sector for PP-R pipes and fittings. We also manufacture PVC pipes and fittings….

#7 Aquatherm: The Leader in Polypropylene Piping

Domain Est. 2002

Website: aquatherm.com

Key Highlights: The original polypropylene piping systems. Faster to install. Corrosion-free. Lasts for decades. These are just a few of the many benefits of aquatherm’s PP- ……

#8 PPR Pipe Fittings

Domain Est. 2009

Website: shreeharikrishna.net

Key Highlights: Our SHK brand Polymer based Pipe product range includes complete range of Polypropylene Random Copolymer (PPR-C) Pipes having various application….

#9 PPR SUPPLY: PP

Domain Est. 2014

Website: pprsupply.com

Key Highlights: PPR Supply is your number one source for PP-RCT Pipe, PPR Fittings, and PPR Fusion Equipment….

#10 Best PPR Pipes And Fittings

Domain Est. 2016

Website: kptpipes.com

Key Highlights: KPT is leading PPR pipes manufacturers in India. KPT pipes are used in the extensive variety of applications, our PPR fittings suppliers and exporters have ……

Expert Sourcing Insights for Ppr Pipe Fittings

H2: 2026 Market Trends for PPR Pipe Fittings

The global market for Polypropylene Random (PPR) pipe fittings is poised for significant growth and transformation by 2026, driven by urbanization, infrastructure development, and increasing demand for energy-efficient plumbing solutions. This analysis explores the key trends shaping the PPR pipe fittings market in 2026.

-

Rising Demand in Residential and Commercial Construction

The expansion of residential and commercial infrastructure, particularly in emerging economies across Asia-Pacific, the Middle East, and Africa, is a primary driver for PPR pipe fittings. With governments investing heavily in affordable housing and smart city projects, the need for durable, corrosion-resistant, and low-maintenance plumbing materials is accelerating demand for PPR systems. Their ease of installation and compatibility with modern building techniques further enhance their appeal in new construction. -

Shift Toward Sustainable and Eco-Friendly Materials

Environmental regulations and green building certifications are pushing the construction sector toward sustainable materials. PPR pipe fittings, being recyclable, non-toxic, and energy-efficient during production and use, align well with these sustainability goals. By 2026, manufacturers are expected to emphasize eco-labeling and carbon footprint reduction, gaining favor in markets with stringent environmental standards such as the EU and North America. -

Technological Advancements and Product Innovation

Innovation in material science is leading to enhanced PPR formulations with improved thermal stability, pressure resistance, and longevity. The integration of smart technologies—such as embedded sensors for leak detection and flow monitoring—is beginning to emerge in premium PPR systems. These advancements are expected to open new applications in smart buildings and industrial automation by 2026. -

Growth in Replacement and Retrofit Markets

As aging plumbing systems in developed regions require upgrades, there is increasing replacement demand for traditional metal and PVC pipes with more efficient PPR alternatives. PPR’s resistance to scaling, chemical corrosion, and lower thermal conductivity make it ideal for both hot and cold water applications, driving retrofitting in healthcare, hospitality, and municipal water supply systems. -

Expansion of Manufacturing Capacity in Asia

China, India, and Southeast Asian countries are not only major consumers but also global manufacturing hubs for PPR pipe fittings. By 2026, localized production is expected to reduce costs and improve supply chain resilience, especially in response to geopolitical shifts and trade dynamics. Regional players are investing in automation and quality control to meet international standards and export demands. -

Regulatory Support and Standardization

Governments and industry bodies are increasingly adopting standardized norms for plumbing materials, favoring PPR due to its safety and performance. In countries like India and Saudi Arabia, national building codes now recommend or mandate PPR for potable water systems, providing a regulatory tailwind for market growth. -

Competitive Landscape and Market Consolidation

The market is witnessing increased competition between established multinational players and regional manufacturers. Strategic partnerships, mergers, and R&D investments are becoming common as companies aim to expand their product portfolios and geographic reach. By 2026, market consolidation is expected to intensify, especially in high-growth regions.

In conclusion, the PPR pipe fittings market in 2026 will be shaped by infrastructure growth, sustainability imperatives, technological innovation, and supportive regulations. Companies that prioritize quality, sustainability, and adaptability to regional demands will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing PPR Pipe Fittings: Quality and Intellectual Property Risks

Sourcing PPR (Polypropylene Random Copolymer) pipe fittings can be cost-effective, but it comes with significant risks related to quality and intellectual property (IP) infringement. Being aware of these pitfalls is essential for ensuring system reliability, safety, and legal compliance.

Poor Material Quality and Non-Compliance

One of the most frequent issues is substandard raw materials. Some suppliers use recycled plastics, incorrect polymer blends, or inadequate stabilizers, leading to fittings that fail under pressure, degrade prematurely, or leach harmful substances. These products often do not meet international standards such as ISO 15874 or ASTM F2389, resulting in leaks, bursts, or contamination in plumbing or heating systems.

Inaccurate Dimensional Tolerances

Low-quality fittings may have inconsistent wall thicknesses or incorrect thread dimensions, causing improper seals or difficulty in assembly. Even slight deviations can compromise the integrity of the entire piping system, increasing the risk of joint failure and water damage over time.

Lack of Certification and Testing Documentation

Many suppliers, especially in unregulated markets, provide falsified or incomplete certification documents. Buyers may receive fittings labeled as “pressure-rated” or “food-grade” without valid test reports from accredited laboratories. Always verify third-party certifications such as WRAS, KIWA, or NSF to ensure compliance with health and safety standards.

Intellectual Property (IP) Infringement

Several reputable brands invest heavily in patented designs, logos, and trademarks for their PPR fittings. Sourcing from unauthorized manufacturers can lead to the procurement of counterfeit products that mimic well-known brands. Using these infringing products exposes buyers to legal liability, shipment seizures, and reputational damage—especially in regulated markets like the EU or North America.

Inadequate Traceability and Batch Control

Reputable manufacturers implement strict batch tracking and quality control systems. In contrast, low-cost suppliers often lack traceability, making it nearly impossible to identify the source of defective fittings during a system failure or recall. This absence of accountability increases long-term risk for contractors and end-users.

Short-Term Cost vs. Long-Term Risk

While cheaper fittings may reduce upfront costs, the long-term consequences of failure—such as property damage, system downtime, and health hazards—often far exceed initial savings. Investing in certified, high-quality fittings from IP-compliant suppliers ensures durability, safety, and regulatory compliance.

To mitigate these risks, conduct thorough due diligence: audit suppliers, request material test reports, verify IP rights, and prioritize suppliers with a proven track record and transparent manufacturing practices.

Logistics & Compliance Guide for PPR Pipe Fittings

Overview

This guide outlines essential logistics and compliance considerations for the international and domestic transportation, handling, and regulatory approval of Polypropylene Random Copolymer (PPR) pipe fittings. Adherence to these guidelines ensures product integrity, regulatory conformity, and smooth supply chain operations.

Product Classification and HS Code

PPR pipe fittings are typically classified under the Harmonized System (HS) code 3917.40 or 3917.40.00 (Plugs, caps, and lids, of plastics; other fittings for pipes, tubing, or hoses, of plastics). Accurate classification is critical for customs clearance, duty assessment, and trade compliance across jurisdictions.

Packaging and Handling Requirements

Proper packaging safeguards PPR fittings during transit. Use sturdy corrugated cardboard boxes or wooden crates suited for stacking. Include internal dividers or foam inserts to prevent abrasion and impact damage. Label packages with handling symbols (e.g., “Fragile,” “This Side Up”). Store fittings in dry, shaded areas away from UV exposure and extreme temperatures to prevent deformation or material degradation.

Transportation and Shipping

Transport PPR pipe fittings via road, rail, sea, or air based on volume, destination, and urgency. Ensure vehicles are clean, dry, and protected from moisture. For sea freight, use moisture-resistant wrapping and desiccants to prevent condensation. Stack pallets securely and limit height to avoid crushing bottom layers. Avoid exposure to chemicals or sharp objects during loading and unloading.

Storage Conditions

Store PPR fittings in a controlled environment with temperatures between 5°C and 40°C (41°F to 104°F). Maintain low humidity and avoid direct sunlight to prevent UV degradation and thermal expansion. Keep products elevated on pallets and away from walls for air circulation. Implement a first-in, first-out (FIFO) inventory system to minimize aging and ensure product quality.

Regulatory Compliance Standards

PPR pipe fittings must comply with regional and international standards depending on their application (e.g., potable water, heating systems). Key standards include:

– ISO 15874: Series for plastic piping systems using PPR

– EN 12609: European standard for PP piping systems

– ASTM F2389: Standard specification for PPR piping systems (USA)

– GB/T 18742: Chinese national standard for PPR pipes and fittings

Ensure all products are tested and certified by accredited laboratories and carry relevant markings (e.g., CE, WRAS, NSF, or AS/NZS).

Documentation Requirements

Accurate documentation is essential for customs and compliance. Required documents typically include:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Conformity (CoC)

– Test Reports (e.g., pressure, temperature, material composition)

– Material Safety Data Sheet (MSDS), if applicable

– Certificate of Origin

Import and Export Regulations

Verify import restrictions, labeling requirements, and conformity assessment procedures in the destination country. Some markets (e.g., EU, UAE, Australia) require third-party certification or local representation. Ensure compliance with REACH, RoHS (if additives are used), and other chemical regulations where applicable.

Quality Assurance and Traceability

Maintain batch-level traceability through unique lot numbering and quality control records. Conduct regular inspections during production and before shipment to verify dimensional accuracy, color consistency, and absence of defects. Retain documentation for audit and recall readiness.

Environmental and Safety Considerations

PPR fittings are generally non-toxic and recyclable (plastic code #5). Promote responsible disposal and recycling at end-of-life. During logistics operations, follow OSHA or local safety regulations for manual handling and warehouse operations to prevent workplace injuries.

Conclusion

Effective logistics and compliance management for PPR pipe fittings minimizes risks, ensures regulatory approval, and supports customer satisfaction. Regular audits, staff training, and engagement with certified suppliers and freight partners are key to maintaining a compliant and efficient supply chain.

Conclusion on Sourcing PPR Pipe Fittings

Sourcing PPR (Polypropylene Random Copolymer) pipe fittings requires a strategic approach that balances quality, cost, compliance, and reliability. These fittings are essential in modern plumbing, heating, and water supply systems due to their durability, corrosion resistance, and ease of installation. When sourcing PPR pipe fittings, it is crucial to partner with reputable manufacturers or suppliers who adhere to international standards such as ISO 15874 or ASTM F2389 to ensure performance and safety.

Key considerations include material quality, certifications, production capacity, and technical support. Evaluating suppliers based on their track record, product testing procedures, and after-sales service can mitigate risks related to leaks, system failures, or non-compliance. Additionally, factors such as lead times, pricing, and logistics should be assessed to maintain project timelines and budget efficiency.

In conclusion, successful sourcing of PPR pipe fittings hinges on thorough supplier vetting, emphasis on quality assurance, and long-term partnership building. Investing time in selecting the right supplier not only ensures reliable system performance but also contributes to the longevity and safety of plumbing installations.