The global powder coating market is experiencing robust growth, driven by increasing demand for durable, environmentally friendly finishing solutions across industries such as construction, automotive, and consumer electronics. According to Mordor Intelligence, the market was valued at USD 13.62 billion in 2024 and is projected to reach USD 17.84 billion by 2029, growing at a CAGR of 5.5% over the forecast period. A significant portion of this growth is attributed to the rising adoption of powder coating on aluminium substrates, valued for their lightweight, corrosion resistance, and recyclability. As sustainability regulations tighten and performance expectations rise, manufacturers are prioritizing powder-coated aluminium for architectural facades, automotive parts, and industrial enclosures. This shift has intensified competition among producers to deliver high-quality, consistent finishes with efficient turnaround times. In this evolving landscape, the following ten manufacturers stand out for their technological innovation, global reach, and commitment to quality—setting the benchmark in the powder coating aluminium sector.

Top 10 Powder Coating Aluminium Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Powder Coatings

Domain Est. 1990

Website: ppg.com

Key Highlights: A pioneering powder coatings partner for over 30 years. Realize next-layer brilliance with customizable powder coatings in a spectrum of over 200 shades….

#2 Powder Coatings Manufacturer

Domain Est. 2001

Website: ifscoatings.com

Key Highlights: IFS Coatings is a leading powder coatings manufacturer for all applications. Find the perfect color and powder chemistry for your project with IFS….

#3 Gema Switzerland GmbH

Domain Est. 2011

Website: gemapowdercoating.com

Key Highlights: Gema is a worldwide leading manufacturer of products and systems for electrostatic powder coating….

#4 Powder Coatings by AkzoNobel

Domain Est. 1997

Website: interpon.com

Key Highlights: Discover Interpon, AkzoNobel’s brand transforming powder coatings. Explore innovative solutions tailored to every need and join the powder revolution!…

#5 Powder coating

Domain Est. 1998

Website: alumil.com

Key Highlights: Powder coating is a process in which a film of decorative powder is laid on the aluminum surface to color it and protect it from external factors….

#6 Powder Coating & Surface Finishing Solutions

Domain Est. 2000

Website: tiger-coatings.com

Key Highlights: Powder Coatings & Digital Printing Solutions – Protection, Function, Color, Effect, Gloss and Texture. – For your products – Lasting for years!…

#7 Prismatic Powders

Domain Est. 2001

#8

Domain Est. 2004

Website: axalta.com

Key Highlights: Axalta offers the most comprehensive portfolio of powder technologies in the industry, with a strong focus on efficiency and environmental responsibility….

#9 Surface Aluminium Technologies Srl

Domain Est. 2010

Website: sataluminium.com

Key Highlights: SAT S.R.L.is an Italian company which main activities are engineering, manufacturing, installation and customer care related to powder coating on vertical ……

#10 High-Quality IGP Powder Coating Systems

Domain Est. 2013

Website: igp-powder.com

Key Highlights: IGP Powder Coating provides top-quality, eco-friendly coating systems for architecture, wood, transport, and industry. Find durable solutions here….

Expert Sourcing Insights for Powder Coating Aluminium

H2: Market Trends in Powder Coating Aluminium (2026 Outlook)

The global powder coating aluminium market is poised for significant transformation and growth by 2026, driven by evolving industrial demands, environmental regulations, and technological advancements. The following key trends are expected to shape the market landscape:

-

Sustainability and Environmental Compliance

Environmental concerns are increasingly influencing material and process choices across industries. Powder coating—being solvent-free and emitting negligible volatile organic compounds (VOCs)—aligns with global sustainability goals. By 2026, stricter environmental regulations in North America, Europe, and parts of Asia-Pacific are expected to accelerate the shift from traditional liquid coatings to powder coating solutions. Aluminium, with its recyclability and lightweight properties, further enhances the eco-profile, making powder-coated aluminium a preferred choice in green building, transportation, and renewable energy sectors. -

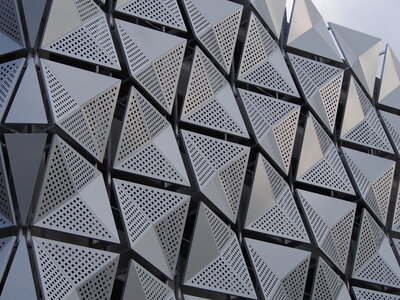

Growth in Architectural and Construction Applications

The construction industry remains a dominant consumer of powder-coated aluminium, particularly for window frames, curtain walls, and façades. Urbanization, infrastructure development in emerging economies, and the rise of energy-efficient buildings are fueling demand. Innovations such as thermally broken aluminium profiles with advanced powder coatings for improved insulation are gaining traction. By 2026, smart building integrations and aesthetic customization will push demand for high-performance, durable, and architecturally versatile finishes. -

Expansion in Automotive and Transportation

The automotive industry is increasingly adopting aluminium components to reduce vehicle weight and improve fuel efficiency or extend EV battery range. Powder coating offers excellent corrosion resistance and durability for under-the-hood, structural, and exterior components. With the rise of electric vehicles (EVs), demand for powder-coated aluminium in battery enclosures, chassis parts, and heat exchangers is expected to grow substantially by 2026. OEMs are investing in automation-compatible powder coating systems to ensure consistent quality and throughput. -

Technological Advancements in Coating Formulations

Ongoing R&D is leading to next-generation powder coatings with enhanced properties such as UV resistance, anti-graffiti performance, self-cleaning capabilities, and improved thermal stability. For aluminium substrates, specialty primers and pretreatment processes (e.g., zirconium or titanium-based) are improving adhesion and longevity. By 2026, smart coatings with embedded sensors or responsive properties may begin to emerge in niche industrial applications. -

Regional Market Shifts and Supply Chain Dynamics

Asia-Pacific, led by China, India, and Southeast Asia, is expected to dominate the market in volume terms due to rapid industrialization and construction activity. However, Europe and North America will remain innovation hubs, driven by stringent environmental standards and high-value applications. Supply chain resilience, including local sourcing of raw materials and coatings, will become a strategic focus, particularly as geopolitical tensions and logistics costs influence procurement decisions. -

Digitalization and Process Automation

The integration of Industry 4.0 technologies—such as automated powder application systems, real-time quality monitoring, and AI-driven process optimization—is enhancing efficiency and consistency in powder coating operations. By 2026, digital twin simulations and predictive maintenance will be more commonplace, especially in high-volume production environments serving automotive and consumer electronics sectors.

In conclusion, the 2026 outlook for powder coating aluminium is marked by robust growth, innovation, and a strong alignment with sustainability and performance demands across key end-use industries. Companies that invest in eco-friendly technologies, application-specific solutions, and digital manufacturing capabilities are likely to lead the evolving market landscape.

Common Pitfalls in Sourcing Powder Coated Aluminium (Quality & Intellectual Property)

Sourcing powder coated aluminium involves navigating technical, aesthetic, and legal challenges. Overlooking key aspects can lead to subpar products, project delays, or legal disputes. Here are critical pitfalls to avoid:

Quality-Related Pitfalls

Inadequate Specification of Powder Coating Standards

Failing to clearly define coating performance standards (e.g., AAMA 2603, 2604, or 2605) can result in coatings unsuitable for the project’s environmental exposure. Lower-grade finishes may degrade quickly in coastal or high-UV areas, leading to chalking, fading, or delamination.

Poor Surface Preparation by the Supplier

The durability of powder coating heavily depends on proper pre-treatment (e.g., chrome or chrome-free conversion coating, phosphating). Suppliers who skip or inadequately perform these steps compromise adhesion and corrosion resistance, increasing the risk of premature failure.

Inconsistent Film Thickness Application

Variations in coating thickness—too thin or too thick—can affect appearance, durability, and performance. Thin areas may offer insufficient protection, while excessive build can cause orange peel or cracking. Ensure suppliers use calibrated equipment and adhere to specified ranges (typically 60–120 microns).

Color and Gloss Mismatch from Batch to Batch

Without strict color control and batch traceability, slight variations in pigment or curing can lead to visible inconsistencies in large installations. Always require color samples (with Delta E values) and lot-specific approvals before full production.

Inadequate Curing Process Control

Under-cured coatings remain soft and chemically vulnerable; over-cured coatings become brittle. Verify that suppliers monitor oven temperature and dwell time to ensure complete cross-linking of the powder resin.

Failure to Test for Adhesion and Corrosion Resistance

Relying solely on visual inspection is insufficient. Require third-party or in-house test reports for cross-hatch adhesion (ASTM D3359) and salt spray resistance (ASTM B117), especially for exterior applications.

Intellectual Property (IP)-Related Pitfalls

Unlicensed Use of Proprietary Coating Formulations or Colors

Some premium powders (e.g., specific metallics, textured finishes) are protected by patents or trademarks. Sourcing from unauthorized suppliers may involve counterfeit or reverse-engineered products, risking performance issues and legal liability.

Copying Design-Specific Finishes Without Authorization

Architectural projects often specify unique colors or finishes protected under design rights or contractual exclusivity. Reproducing these without permission—even by a different supplier—can infringe on intellectual property and lead to cease-and-desist orders.

Lack of IP Clauses in Supplier Contracts

Failing to include clear IP ownership and liability terms in procurement agreements leaves buyers exposed. Ensure contracts state that the supplier warrants all materials are non-infringing and indemnifies the buyer against IP claims.

Using Supplier’s “House Brand” as a Substitute Without Approval

Substituting a specified branded powder (e.g., AkzoNobel Interpon) with a generic alternative, even if visually similar, may breach specifications and void performance warranties. Always require substitution requests in writing with technical and aesthetic validation.

Insufficient Documentation for Chain of Custody

Without batch certificates, material safety data sheets (MSDS), and proof of authorized distribution, proving the legitimacy and compliance of the coating becomes difficult—especially during audits or disputes.

By proactively addressing these quality and IP pitfalls through clear specifications, supplier vetting, and robust contractual terms, buyers can ensure the longevity, aesthetics, and legal integrity of their powder coated aluminium products.

Logistics & Compliance Guide for Powder Coating Aluminium

Overview

Powder coating aluminium components is a widely adopted finishing process known for its durability, environmental benefits, and aesthetic quality. However, ensuring efficient logistics and compliance with regulatory standards is essential throughout the supply chain—from raw material sourcing to final delivery. This guide outlines key considerations for the safe, legal, and efficient handling of aluminium parts during powder coating operations.

Material Handling and Transportation

Incoming Aluminium Components

- Packaging: Ensure aluminium parts are packaged to prevent scratching, deformation, or contamination. Use protective wraps, edge guards, and non-abrasive separators.

- Labeling: Clearly label shipments with part numbers, batch identifiers, and handling instructions (e.g., “Fragile,” “This Side Up”).

- Storage: Store incoming aluminium in a dry, climate-controlled environment to prevent moisture-related oxidation or surface contamination.

In-Plant Movement

- Use non-marking carts or racks to transport parts between cleaning, pretreatment, coating, and curing stations.

- Minimize manual handling to reduce the risk of surface damage and worker injury.

- Implement a first-in, first-out (FIFO) system to prevent prolonged storage and potential quality degradation.

Pre-Treatment and Surface Preparation

Chemical Management

- Comply with local regulations (e.g., REACH, OSHA, GHS) for handling and storing cleaning and conversion coating chemicals (e.g., alkaline cleaners, chrome or chrome-free pretreatments).

- Ensure Material Safety Data Sheets (MSDS/SDS) are accessible and that personnel are trained in proper chemical handling and spill response.

Waste Disposal

- Treat and dispose of rinse water and sludge according to environmental regulations (e.g., EPA, local wastewater authorities).

- Segregate hazardous waste and use licensed disposal contractors.

- Maintain records of waste generation and disposal for audit purposes.

Powder Coating Process Compliance

Powder Material Handling

- Store powder in a cool, dry place (ideally 15–25°C, <50% RH) to prevent clumping and degradation.

- Rotate stock to avoid expiration; most powders have a shelf life of 6–12 months.

- Use grounded equipment to prevent static discharge, which poses explosion risks in powder storage and application areas.

Application and Curing

- Follow equipment manufacturer guidelines for spray booth operation, ensuring proper ventilation and dust collection.

- Adhere to ATEX or NFPA standards for explosion protection in powder handling zones.

- Monitor and record curing oven temperatures and dwell times to ensure coating integrity and consistency.

Environmental and Safety Regulations

Air Emissions

- Install and maintain high-efficiency filtration systems (e.g., cartridge collectors) to capture overspray.

- Conduct periodic emissions testing to comply with local air quality regulations (e.g., EPA NESHAP, EU Industrial Emissions Directive).

- Report volatile organic compound (VOC) and particulate emissions as required—note that powder coating emits minimal VOCs compared to liquid coatings.

Worker Safety

- Provide personal protective equipment (PPE), including respirators, gloves, and protective clothing.

- Conduct regular training on chemical safety, lockout/tagout (LOTO), and emergency procedures.

- Perform air quality monitoring in work areas to ensure exposure to powders and fumes remains below occupational exposure limits (OELs).

Packaging and Outbound Logistics

Finished Goods Protection

- Use anti-static and non-abrasive packaging materials to protect coated surfaces.

- Separate parts with foam, cardboard, or plastic interleaving to prevent scratching.

- Clearly label packages with handling instructions, product details, and compliance markings (e.g., CE, RoHS if applicable).

Shipping and Documentation

- Choose carriers experienced in handling fragile or high-value industrial goods.

- Provide accurate shipping manifests and compliance documentation, including:

- Certificate of Conformance (CoC)

- SDS for any residual consumables

- Export documentation (if applicable, e.g., ECCN, commercial invoice)

- Ensure traceability with batch/lot numbers and digital tracking systems.

Regulatory Compliance Requirements

International Standards

- ISO 14001: Environmental Management – ensures sustainable practices in waste, energy, and emissions.

- ISO 9001: Quality Management – supports consistent coating quality and process control.

- AAMA 2604/2605: Performance standards for architectural aluminium coatings (if applicable).

- REACH & RoHS (EU): Confirm powder and pretreatment chemicals are compliant with substance restrictions.

Regional Considerations

- North America: Comply with OSHA, EPA, and NFPA standards.

- Europe: Adhere to REACH, CLP, and the Industrial Emissions Directive (IED).

- Asia-Pacific: Follow local regulations (e.g., China RoHS, Korea K-REACH) and export control laws.

Recordkeeping and Audits

- Maintain logs for:

- Incoming material inspections

- Coating batch records

- Equipment maintenance

- Emissions and waste disposal

- Employee training

- Conduct internal audits annually and prepare for third-party certifications or customer audits.

Conclusion

Efficient logistics and strict compliance are critical to the success of powder coating aluminium operations. By implementing robust handling procedures, adhering to environmental and safety regulations, and maintaining comprehensive documentation, companies can ensure product quality, worker safety, and legal compliance across global markets. Regular review and updates to this guide will help adapt to evolving standards and customer requirements.

Conclusion for Sourcing Powder Coating Aluminium

Sourcing powder coating aluminium involves a strategic evaluation of suppliers, material quality, surface treatment standards, and cost-efficiency. Powder-coated aluminium offers excellent durability, aesthetic versatility, and resistance to corrosion, making it ideal for architectural, industrial, and consumer applications. When sourcing, it is crucial to partner with reliable suppliers who adhere to international quality standards such as AAMA, Qualicoat, or GSB, ensuring consistent coating thickness, color accuracy, and long-term performance.

Additionally, considering the environmental benefits of powder coating—such as low VOC emissions and recyclability—supports sustainable manufacturing practices. Factors like lead times, customization capabilities, and technical support should also influence supplier selection. Ultimately, a well-informed sourcing strategy for powder coating aluminium enhances product quality, reduces maintenance costs, and contributes to overall project success in both functionality and design.