The pontoon boat market has experienced steady expansion over the past decade, driven by rising recreational boating demand and increased consumer interest in freshwater and coastal leisure activities. According to Grand View Research, the global recreational boat market was valued at approximately USD 45.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. A significant contributor to this growth is the rising popularity of pontoon boats, particularly in North America, where favorable climatic conditions and strong disposable incomes support marine recreation. As pontoon boat production scales, so does the demand for high-performance, corrosion-resistant materials—making aluminum decking a critical component. Aluminum is favored for its durability, lightweight properties, and low maintenance, prompting both established and emerging manufacturers to innovate in extrusion technologies, surface treatments, and eco-friendly production. With the market shift toward premium, customizable pontoons, the importance of reliable decking suppliers has never been greater. The following list highlights the top 10 aluminum decking manufacturers shaping the pontoon boat industry through innovation, quality, and strategic market presence.

Top 10 Pontoon Boat Decking Aluminum Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Bennington Pontoon Boats

Domain Est. 1999

Website: benningtonmarine.com

Key Highlights: Luxury pontoon and tritoon boats from Bennington, the top-selling pontoon boat manufacturer. Perfect for cruising, entertaining, skiing, or fishing….

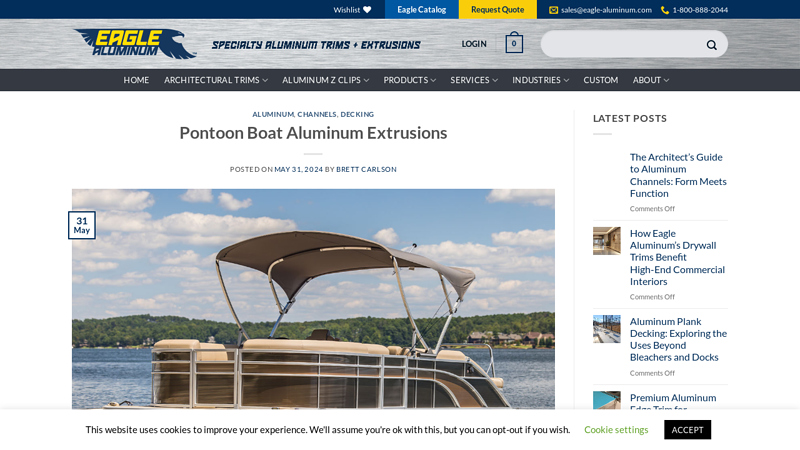

#2 Pontoon Boat Aluminum Extrusions

Domain Est. 2010

Website: eagle-aluminum.com

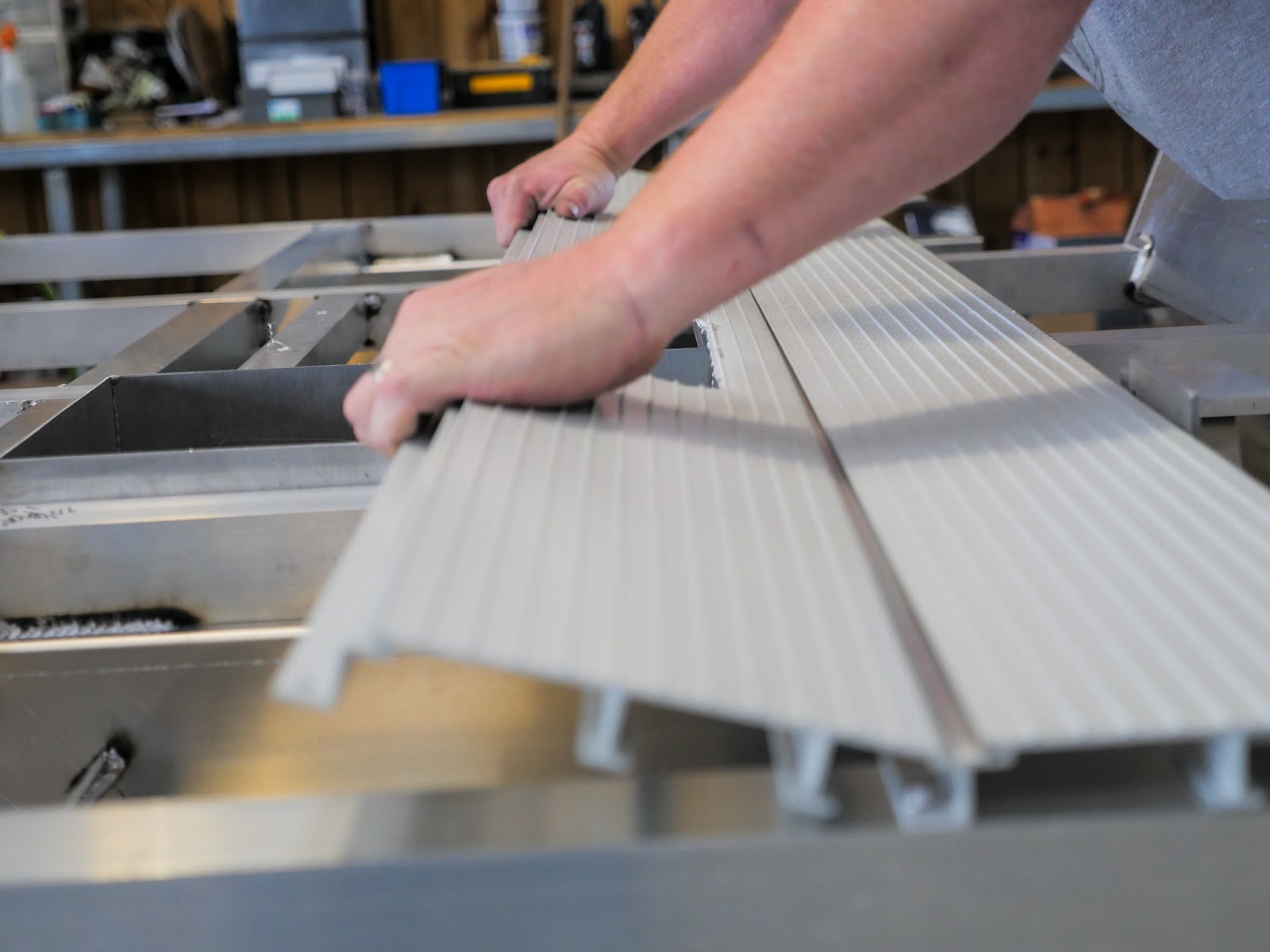

Key Highlights: We take pride in offering a comprehensive range of high-quality aluminum extrusions tailored to meet the specific needs of pontoon boat manufacturers….

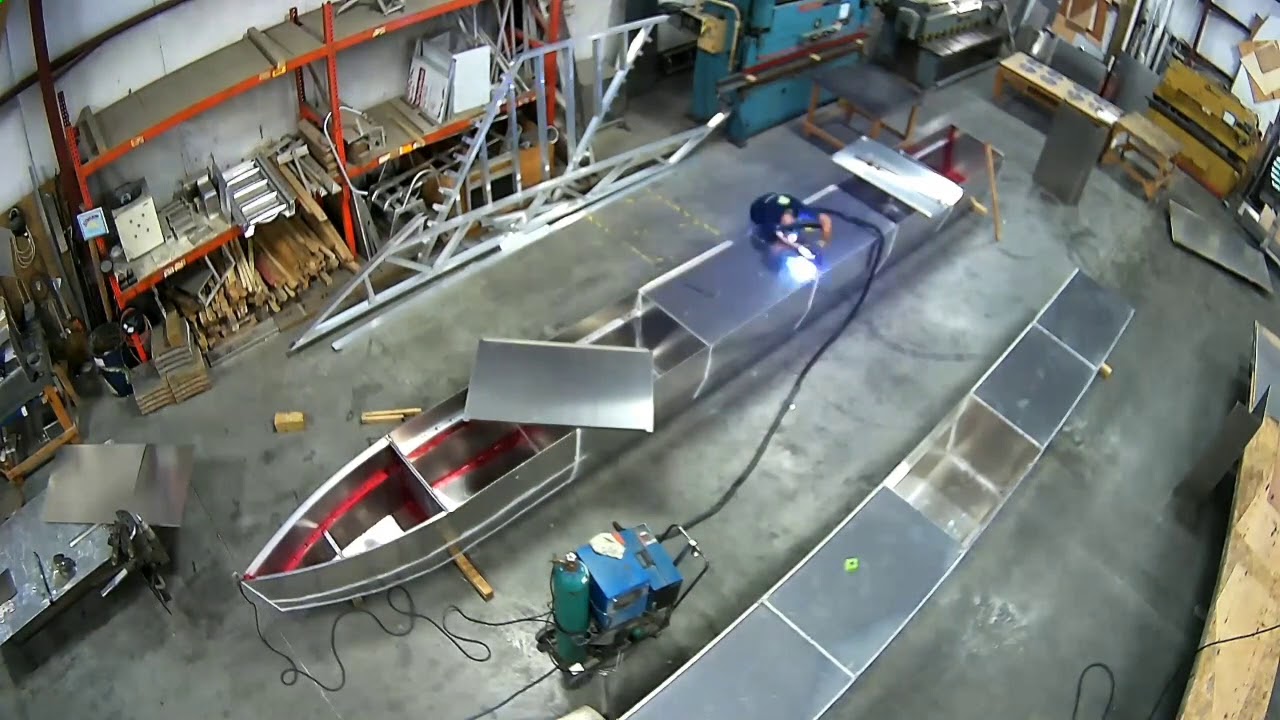

#3 pontoon boat, house boat, aluminum boat Manufacturer & Supplier …

Domain Est. 2022

Website: allhouseboat.com

Key Highlights: We are committed to the design, trade and production of Pontoon Boat and houseboat with a professional sales team of more than 60 workshop production workers….

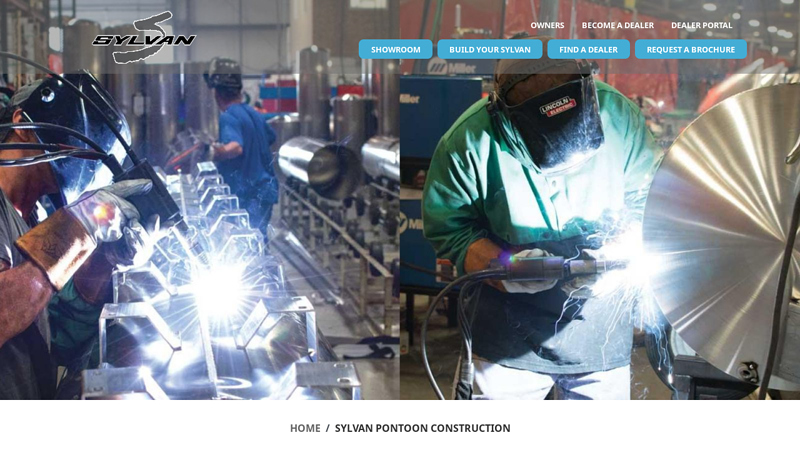

#4 Sylvan Pontoon Construction

Domain Est. 1995

Website: sylvanmarine.com

Key Highlights: Thru-Bolted Transom – Sylvan transoms are made from aluminum gauges as heavy as .190, and are supported with up to 20 stainless steel boats – all to handle ……

#5 Landau Boats

Domain Est. 1997

Website: landauboats.com

Key Highlights: Search for the perfect luxury pontoon boat from a family-run business that specializes in custom manufacturing. We guarantee you won’t be disappointed with our ……

#6 Princecraft®

Domain Est. 1998

Website: princecraft.com

Key Highlights: At Princecraft ®, we make no compromises on quality. That’s why we use only H36 aluminum to build our boat hulls and pontoon tubes. More rigid, stronger, and ……

#7 Avalon Pontoons

Domain Est. 2004

Website: avalonpontoons.com

Key Highlights: For over 50 years, Avalon Pontoons have been built with meticulous craftsmanship, our pontoons deliver the perfect balance of comfort and reliability….

#8 Aluminum Luxury Pontoon Boats

Domain Est. 2006

Website: verandamarine.com

Key Highlights: Veranda uses the finest quality aluminum to produce each pontoon boat deck ensuring a lifetime of trouble free fun….

#9 Godfrey Construction

Domain Est. 2009

Website: godfreypontoonboats.com

Key Highlights: Premium Quality, Warranty Backed. All Godfrey Pontoon Boats are built to last, and our warranty reflects our commitment to craftsmanship and confidence….

#10 Best Value Aluminum Boat by Starcraft Marine

Domain Est. 1998

Website: starcraftmarine.com

Key Highlights: We’re proud to be the largest name in aluminum fishing and pleasure boats, with five trusted brands you know and love—Smoker Craft, Starcraft, Sylvan, SunChaser ……

Expert Sourcing Insights for Pontoon Boat Decking Aluminum

H2: 2026 Market Trends for Pontoon Boat Decking Aluminum

The pontoon boat decking aluminum market is poised for significant evolution by 2026, driven by technological advancements, shifting consumer preferences, and broader economic and environmental factors. Aluminum remains a preferred material for pontoon decking due to its lightweight nature, corrosion resistance, and durability in marine environments. As the recreational boating industry continues to recover and expand post-pandemic, demand for high-performance, low-maintenance materials like aluminum decking is expected to rise steadily.

A key trend shaping the 2026 market is the growing emphasis on sustainability and eco-friendly manufacturing. Aluminum’s high recyclability aligns well with environmental regulations and consumer demand for greener products. Manufacturers are increasingly adopting closed-loop recycling systems and investing in energy-efficient production methods to reduce their carbon footprint. This shift not only meets regulatory requirements but also enhances brand reputation among environmentally conscious buyers.

Another notable trend is the integration of advanced surface treatments and coatings. By 2026, expect widespread adoption of non-slip, UV-resistant, and anti-microbial finishes on aluminum decking. These enhancements improve safety, longevity, and aesthetics, making aluminum decking more competitive against traditional wood and composite alternatives. Brands are also focusing on customization, offering a range of colors, textures, and patterns to cater to personalized boat designs.

The rise of premium and luxury pontoon models is further fueling demand for high-end aluminum decking solutions. Consumers are investing in larger, more feature-rich boats with upgraded interiors and exteriors, increasing the need for durable, visually appealing decking materials. Aluminum, with its sleek, modern look and minimal maintenance requirements, fits perfectly within this premium segment.

Geographically, North America remains the dominant market due to high recreational boating participation, particularly in the United States. However, growth in Europe and the Asia-Pacific region—especially in countries with expanding middle classes and increasing interest in water-based recreation—is expected to accelerate. This global expansion will drive innovation and competition among aluminum decking suppliers.

Finally, supply chain resilience and material cost volatility will remain critical challenges. Fluctuations in aluminum prices and logistics constraints may impact production costs and pricing strategies. As a result, manufacturers are likely to pursue vertical integration, strategic sourcing, and inventory optimization to maintain margins and ensure consistent supply.

In summary, the 2026 market for pontoon boat decking aluminum will be characterized by innovation in materials and finishes, a strong push toward sustainability, rising demand in the premium segment, and expanding global reach. Companies that prioritize durability, design flexibility, and environmental responsibility are best positioned to capture market share in this dynamic landscape.

Common Pitfalls When Sourcing Pontoon Boat Decking Aluminum (Quality, IP)

Sourcing aluminum decking for pontoon boats requires careful attention to material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, safety risks, legal complications, and reputational damage. Below are key pitfalls to avoid.

Poor Material Quality and Specifications

One of the most frequent issues is receiving aluminum decking that fails to meet marine-grade standards. Suppliers may offer substandard alloys or incorrect thicknesses that compromise durability. Using non-marine-grade aluminum, such as alloys not resistant to saltwater corrosion (e.g., non-6000 series like 6061-T6), can lead to premature degradation, pitting, and structural failure. Additionally, inconsistent anodizing or powder coating can result in fading, chipping, and reduced slip resistance—critical safety concerns on wet decks.

Inadequate Structural Design and Engineering

Some sourced decking lacks proper structural integrity due to poor extrusion design or inadequate support integration. Thin-walled extrusions or insufficient reinforcing ribs may flex under load, causing fatigue cracks over time. Moreover, mismatched decking profiles with the pontoon frame can lead to improper installation, water pooling, and accelerated wear. Always verify load ratings and compatibility with your pontoon’s frame system before procurement.

Ignoring Intellectual Property (IP) Rights

Many premium aluminum decking systems are protected by design patents, trademarks, or trade dress. Sourcing knock-off versions that mimic patented profiles or branded aesthetics can expose your business to legal action for IP infringement. These counterfeit products often sacrifice quality and performance while posing legal and financial risks. Always confirm with suppliers that the product does not violate existing patents and request documentation of IP compliance.

Lack of Certification and Traceability

Reputable marine decking should come with material test reports (MTRs), mill certifications, and compliance with standards such as ASTM B221 (aluminum extrusions) or AAMA 2604/2605 (coatings). Sourcing from suppliers who cannot provide traceability or third-party certifications increases the risk of receiving inconsistent or non-compliant materials. Without proper documentation, warranty claims and regulatory compliance become difficult.

Supplier Reliability and After-Sales Support

Choosing suppliers based solely on price often leads to unreliable delivery, inconsistent quality, and poor customer service. Some overseas or unvetted vendors may disappear after payment or fail to honor warranties. Ensure your supplier has a proven track record in marine applications, responsive technical support, and clear warranty terms. Lack of after-sales service can result in costly delays during installation or repairs.

Failure to Consider Long-Term Maintenance and Warranty

Some aluminum decking systems require specific cleaning protocols or protective treatments to maintain appearance and performance. Sourcing products without clear maintenance guidelines or limited warranties can lead to unexpected upkeep costs. Additionally, pro-rated or non-transferable warranties may offer little protection, especially in commercial or rental pontoon operations. Always review warranty terms for coverage of corrosion, delamination, and structural defects.

Logistics & Compliance Guide for Pontoon Boat Decking Aluminum

Overview

This guide outlines the essential logistics considerations and compliance requirements for handling, transporting, storing, and using aluminum decking materials in pontoon boat manufacturing and distribution. Adherence to these guidelines ensures operational efficiency, legal compliance, and product integrity.

Material Specifications & Classification

Aluminum decking used in pontoon boats typically consists of marine-grade alloys such as 5052, 6061, or 6063, chosen for corrosion resistance and structural performance. Understanding the material grade, thickness, finish (e.g., anodized, powder-coated), and dimensions is crucial for accurate logistics planning and compliance with industry standards.

Regulatory Compliance

Manufacturers and distributors must comply with national and international regulations governing the use and transport of aluminum components. Key compliance areas include:

– Marine Safety Standards: Adherence to U.S. Coast Guard (USCG) regulations, American Boat and Yacht Council (ABYC) standards, and ISO 12215 for hull construction.

– Material Certification: Provision of mill test reports (MTRs) confirming alloy composition and mechanical properties.

– Environmental Regulations: Compliance with EPA guidelines for surface treatments and coatings (e.g., VOC emissions from finishes).

– International Trade: For cross-border shipments, adherence to Harmonized System (HS) codes (e.g., 7610.90 for aluminum structures), customs documentation, and trade agreements.

Packaging & Handling Requirements

Proper packaging protects aluminum decking from scratches, dents, and corrosion during transit:

– Use edge protectors, plastic wraps, or cardboard separators to prevent surface damage.

– Bundle decking panels securely with non-corrosive strapping.

– Label packages clearly with product details, handling instructions (e.g., “Fragile,” “This Side Up”), and safety warnings.

– Use pallets suitable for warehouse racking and forklift handling; ensure load stability.

Storage Conditions

Store aluminum decking in a dry, covered, and well-ventilated environment to prevent moisture exposure and galvanic corrosion:

– Elevate materials off the floor using pallets.

– Avoid contact with dissimilar metals (e.g., steel) to prevent electrolysis.

– Maintain separation between raw aluminum and treated/coated materials to avoid contamination.

– Implement a first-in, first-out (FIFO) inventory system to minimize long-term storage risks.

Transportation Logistics

Plan transportation based on shipment size, destination, and delivery timelines:

– Use enclosed trailers or containers for long-distance or international shipments to protect against weather and theft.

– Secure loads properly to prevent shifting; use load bars, straps, or air-ride suspension for vibration-sensitive cargo.

– For oversized loads, obtain necessary permits and coordinate with carriers experienced in heavy or awkward freight.

– Maintain temperature and humidity controls if transporting coated or treated aluminum in extreme climates.

Import/Export Documentation

For international movement of aluminum decking, prepare and verify:

– Commercial invoice and packing list

– Bill of lading or air waybill

– Certificate of Origin

– Mill Test Report (MTR) and material compliance certificates

– ISPM 15 certification for wooden pallets (if applicable)

– Import licenses or permits, as required by destination country

Quality Assurance & Traceability

Implement a traceability system to track aluminum decking from supplier to end-use:

– Assign batch or serial numbers to material lots.

– Maintain records of inspections, certifications, and non-conformance reports.

– Conduct periodic audits of suppliers and logistics partners to ensure standards are met.

Safety & Training

Ensure personnel involved in handling and logistics are trained in:

– Safe lifting techniques and use of material handling equipment

– Hazard communication (HazCom) for any coatings or treatments

– Emergency response procedures for spills or damage

– Proper use of personal protective equipment (PPE), including gloves and safety glasses

Sustainability & Recycling Compliance

Aluminum decking is highly recyclable. Comply with local and federal recycling regulations:

– Partner with certified metal recyclers for scrap material.

– Maintain records of recycling activities for environmental reporting.

– Promote circular economy practices in supply chain operations.

Conclusion

Effective logistics and compliance management for pontoon boat aluminum decking ensures product quality, regulatory adherence, and customer satisfaction. Regular review of procedures, supplier audits, and staff training are essential for maintaining high standards across the supply chain.

Conclusion: Sourcing Pontoon Boat Decking Aluminum

Sourcing aluminum for pontoon boat decking requires a strategic balance between material quality, cost-efficiency, durability, and supplier reliability. Aluminum is a preferred choice for pontoon decking due to its excellent strength-to-weight ratio, corrosion resistance—especially in marine environments—and low maintenance requirements. When selecting aluminum, grades such as 5052 or 6061 are commonly recommended for their optimal combination of weldability, strength, and resistance to saltwater corrosion.

Key considerations in the sourcing process include ensuring compliance with marine industry standards, evaluating surface finishes (such as mill finish, anodized, or powder-coated) for slip resistance and aesthetics, and choosing appropriate panel designs like checkered or expanded metal for safety and drainage.

Building relationships with reputable suppliers who offer consistent quality, timely delivery, and technical support is crucial. Additionally, factoring in total cost—including material, fabrication, transportation, and installation—helps in making a cost-effective decision without compromising on performance.

In conclusion, successfully sourcing aluminum decking for pontoon boats hinges on selecting the right alloy and finish, partnering with trusted suppliers, and aligning material specifications with functional and environmental demands. With thoughtful sourcing, aluminum decking can significantly enhance the longevity, safety, and appeal of pontoon boats in both recreational and commercial applications.