The global polypropylene copolymer market is experiencing robust growth, driven by rising demand across packaging, automotive, and consumer goods industries. According to Mordor Intelligence, the market was valued at approximately USD 45.6 billion in 2023 and is projected to grow at a CAGR of over 5.2% through 2029. This expansion is fueled by the material’s excellent chemical resistance, flexibility, and cost-efficiency compared to traditional plastics. Grand View Research further highlights that increasing adoption in lightweight automotive components and food-grade packaging is accelerating regional production and innovation. As sustainability initiatives also push for recyclable materials, polypropylene copolymers—being fully recyclable (PP-5)—are gaining favor among manufacturers and brand owners alike. Against this backdrop, the following list highlights the top 10 polypropylene copolymer manufacturers shaping the industry through scale, technology, and strategic global presence.

Top 10 Polypropylene Copolymer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Polypropylene Copolymer

Domain Est. 1997

Website: emcoplastics.com

Key Highlights: Polypropylene copolymer (PPC) is a bit softer but have better impact strength, is tougher and more durable than homopolymer polypropylene….

#2 Polypropylene

Domain Est. 1998

Website: haldiapetrochemicals.com

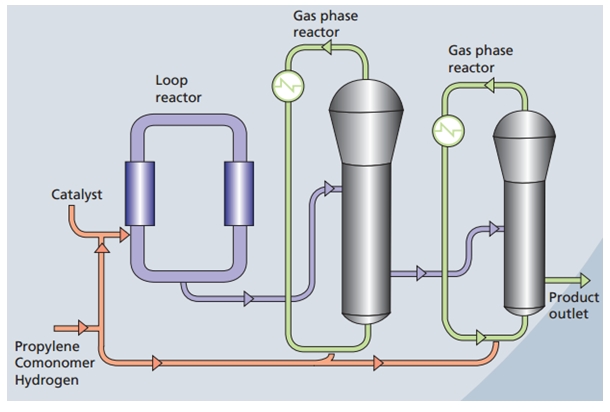

Key Highlights: Haldia Petrochemicals Limited manufactures 3,41,000 tonnes polypropylene per annum using Spheripol-II technology licensed by LyondellBasell, Netherlands….

#3 Pinnacle Polymers

Domain Est. 2000

Website: pinnaclepolymers.com

Key Highlights: As a producer of polypropylene, our goal is to improve the lives of everyone our product touches with our homopolymer, impact copolymer and random copolymer….

#4 Polymers

Domain Est. 2007

Website: lyondellbasell.com

Key Highlights: LyondellBasell (LYB) is one of the world’s largest producers of polymers and plastic resins, including polyethylene, polypropylene, various polypropylene ……

#5 Polypropylene, a versatile material

Domain Est. 1996

Website: repsol.com

Key Highlights: Polypropylene (PP) is a thermoplastic polymer that is obtained by polymerizing propylene. We explain the main uses and applications of this product….

#6 Polypropylene Material Solutions

Domain Est. 1996

Website: oq.com

Key Highlights: Our polyprolypene material is low weight, versatile, cost effective and used widely across different areas and applications. Learn about OQ PP solutions ……

#7 Polypropylene

Domain Est. 1998

Website: ineos.com

Key Highlights: Polypropylene is the world’s second most widely used thermoplastic after polyethylene. It is produced by the polymerization of propylene….

#8 Polypropylene

Domain Est. 2001

Website: braskem.com

Key Highlights: Polypropylene (PP) is a versatile thermoplastic polymer widely used in various industries due to its desirable properties and processability….

#9 Polypropylene

Domain Est. 2014

Website: newkopolymers.com

Key Highlights: Polypropylene is available in two primary forms: homopolymer and copolymer, each offering unique characteristics tailored to specific performance needs….

#10 Polypropylene Copolymer (PPC)

Domain Est. 2018

Website: nexeoplastics.com

Key Highlights: Nexeo Plastics carries polypropylene impact copolymer and random copolymer from top suppliers for thermoplastic processing. Learn about PP copolymers and find…

Expert Sourcing Insights for Polypropylene Copolymer

H2: Projected Market Trends for Polypropylene Copolymer in 2026

By 2026, the global polypropylene copolymer (PP copolymer) market is expected to experience steady growth driven by rising demand across key end-use industries, technological advancements in polymer production, and evolving regulatory landscapes. Below is an in-depth analysis of the major market trends anticipated to shape the PP copolymer sector in 2026:

-

Expanding Demand from Packaging and Consumer Goods

The packaging industry remains the largest consumer of PP copolymer, accounting for over 40% of global demand. By 2026, continued growth in e-commerce, food safety standards, and demand for lightweight, recyclable materials will bolster the use of PP copolymer in flexible packaging, rigid containers, and transparent films. Innovations in high-clarity and heat-resistant grades will further support adoption in microwave-safe and retortable packaging applications. -

Automotive Sector Driving Lightweighting Initiatives

The automotive industry is expected to remain a key growth engine for PP copolymer, particularly in regions with aggressive fuel efficiency and emissions regulations. PP copolymer is favored for interior components (e.g., dashboards, door panels), under-the-hood applications, and bumpers due to its excellent impact resistance and processability. The trend toward electric vehicles (EVs), which prioritize weight reduction to extend battery range, will further amplify demand for advanced copolymer grades. -

Asia-Pacific as the Leading Growth Region

Asia-Pacific is projected to dominate the PP copolymer market in 2026, with China, India, and Southeast Asian countries leading consumption growth. Rapid urbanization, expanding middle-class populations, and industrialization are fueling demand across packaging, automotive, and consumer durables sectors. Domestic production capacity expansions in China and India will also reduce import dependency and strengthen regional supply chains. -

Sustainability and Circular Economy Pressures

Regulatory and consumer pressures for sustainable plastics will influence PP copolymer development. By 2026, there will be increased investment in recyclable copolymer formulations and mechanical/chemical recycling technologies. Major producers are expected to launch certified circular PP copolymers made from post-consumer recycled (PCR) content, aligning with extended producer responsibility (EPR) schemes in Europe and North America. -

Feedstock Volatility and Shift Toward On-Purpose Propylene

Fluctuating crude oil and natural gas prices will continue to impact propylene feedstock costs. However, the growing adoption of on-purpose propylene technologies—such as propane dehydrogenation (PDH)—will provide more stable and independent supply chains. This shift is expected to enhance cost predictability and support consistent PP copolymer production, especially in regions with abundant shale gas reserves like the U.S. and the Middle East. -

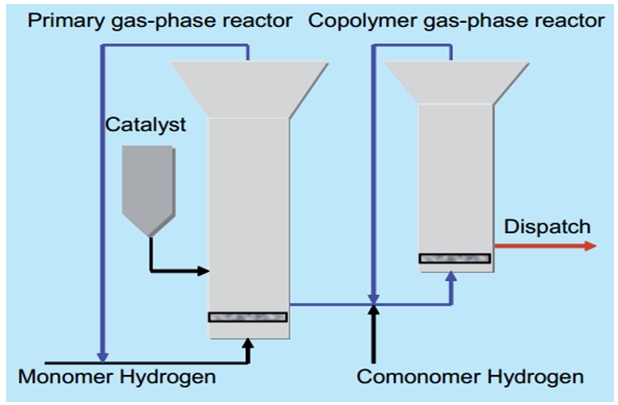

Technological Advancements and Product Differentiation

Innovations in catalyst technologies (e.g., metallocene and Ziegler-Natta catalysts) will enable the production of high-performance PP copolymers with tailored properties such as improved clarity, impact strength, and thermal stability. These advanced grades will find increasing applications in medical devices, specialty films, and technical textiles, creating premium market segments. -

Consolidation and Strategic Partnerships Among Producers

The competitive landscape will likely see further consolidation, with major petrochemical companies forming joint ventures or acquiring specialty polymer producers to expand their PP copolymer portfolios. Strategic collaborations with converters and brand owners will also increase, aimed at co-developing sustainable and application-specific solutions. -

Regulatory Impact and Trade Dynamics

Environmental regulations, particularly in the EU (e.g., Single-Use Plastics Directive) and North America, will push for reduced plastic waste and higher recycled content. Meanwhile, trade tensions and regional supply chain reshoring efforts may lead to localized production hubs, affecting global export flows of PP copolymer.

Conclusion:

By 2026, the polypropylene copolymer market will be shaped by a confluence of demand-side growth, sustainability imperatives, and technological innovation. While challenges related to feedstock costs and regulatory compliance persist, the material’s versatility and adaptability position it strongly across multiple high-growth industries. Companies that invest in sustainable production, advanced formulations, and regional market development will be best positioned to capitalize on emerging opportunities.

Common Pitfalls in Sourcing Polypropylene Copolymer (Quality and Intellectual Property)

Sourcing Polypropylene Copolymer (PP Copolymer) presents several challenges that, if not properly managed, can lead to quality inconsistencies, supply disruptions, and intellectual property (IP) risks. Understanding and mitigating these pitfalls is crucial for manufacturers and converters relying on consistent material performance.

Quality-Related Pitfalls

Inadequate Specification Alignment

A common mistake is relying on generic material grades without defining precise technical specifications. PP Copolymers vary significantly in melt flow rate (MFR), ethylene content, impact strength, stiffness, clarity, and thermal properties. Sourcing based on broad trade names without detailed performance criteria can result in materials that fail to meet application requirements.

Inconsistent Batch-to-Batch Quality

Some suppliers, particularly smaller or regionally focused producers, may lack rigorous quality control systems. This can lead to variability in polymer characteristics such as molecular weight distribution or comonomer dispersion, resulting in processing issues (e.g., poor melt stability, inconsistent cycle times) or end-product defects (e.g., brittleness, warpage).

Contamination and Additive Variability

Contamination during production or handling—such as cross-contamination with other polymers or foreign particles—can compromise product quality. Additionally, inconsistencies in stabilizers, nucleating agents, or other additives can affect long-term performance, color, or regulatory compliance, especially in food-contact or medical applications.

Lack of Traceability and Testing Data

Failure to obtain comprehensive Certificates of Analysis (CoA) or material test reports undermines quality assurance. Without traceability to batch-level data, diagnosing field failures or conducting root cause analysis becomes extremely difficult.

Intellectual Property (IP) Pitfalls

Unlicensed or Grey-Market Material

Sourcing from unauthorized distributors or secondary markets increases the risk of obtaining material produced without proper licensing. Many PP Copolymer technologies are protected by patents covering catalyst systems (e.g., Ziegler-Natta, metallocene) and reactor processes. Using unlicensed material exposes the buyer to potential IP infringement claims, especially in regulated industries or export markets.

Misrepresentation of Technology Origin

Some suppliers may misrepresent the origin or technology behind their copolymer (e.g., claiming metallocene-based performance without using licensed catalysts). This can lead to performance shortfalls and legal exposure if the material infringes on proprietary processes.

Insufficient Supplier Due Diligence

Failing to verify a supplier’s licensing agreements, technology partnerships, or IP compliance history can result in unintentional infringement. This is particularly critical when sourcing from emerging producers in regions with less stringent IP enforcement.

Ambiguous Contractual Terms

Purchase agreements that do not explicitly address IP indemnification, permitted uses, and compliance with patent rights leave buyers vulnerable. Without clear terms, the liability for IP violations may fall on the end user rather than the supplier.

Mitigation Strategies

- Define precise technical specifications aligned with end-use performance needs.

- Audit suppliers for quality management systems (e.g., ISO 9001) and request full batch traceability.

- Require comprehensive CoAs and conduct third-party verification when necessary.

- Verify supplier IP licensing status, especially for performance-grade copolymers.

- Include IP indemnification clauses in supply contracts.

- Engage directly with technology licensors (e.g., Basell, LyondellBasell, Sinopec) when sourcing high-performance grades.

Proactively addressing these quality and IP pitfalls ensures reliable supply, consistent product performance, and legal compliance in the competitive polymer marketplace.

H2: Logistics & Compliance Guide for Polypropylene Copolymer (PP Copolymer)

Polypropylene Copolymer (PP Copolymer) is a widely used thermoplastic polymer valued for its toughness, flexibility, clarity, and chemical resistance. Safe and compliant logistics are essential throughout its supply chain. This guide outlines key considerations for handling, transport, storage, and regulatory compliance.

H2: Transportation & Handling

- Physical Form: Typically transported as free-flowing pellets, granules, or powder in bulk (railcar, tanker, container) or packaged (bags, boxes, super sacks).

- Packaging:

- Primary: Multi-wall paper bags (often with polyethylene liner), woven polypropylene bags (with or without liner), rigid containers, or bulk liners.

- Secondary: Palletized loads secured with stretch wrap or strapping. Ensure packaging is UN-certified if required for specific transport modes.

- Labeling: Packages must be clearly labeled with product name (“Polypropylene Copolymer”), batch/lot number, net weight, manufacturer/supplier details, and relevant hazard warnings (see Safety below).

- Loading/Unloading:

- Use appropriate equipment (forklifts, conveyors, pneumatic transfer systems). Avoid excessive impact or abrasion.

- Prevent contamination from dirt, moisture, or incompatible materials. Ensure transfer systems are clean and dedicated or thoroughly purged.

- Minimize dust generation during handling; use dust collection if necessary.

- In-Transit:

- Protect from moisture (rain, snow, high humidity) and direct sunlight/UV radiation (can cause degradation over time).

- Prevent contamination (e.g., from other cargo, fuel, chemicals). Segregate from foodstuffs, incompatible chemicals, and sources of ignition where feasible.

- Secure loads to prevent shifting or damage during transport (road, rail, sea, air).

- Temperature: While stable at typical ambient temperatures, avoid prolonged exposure to extreme heat (>60°C/140°F) which can cause softening, clumping, or degradation. Avoid freezing, though it generally doesn’t damage the polymer itself.

- Modes of Transport:

- Road: Standard bulk tankers or dry vans/containers. Ensure vehicle compatibility and cleanliness. Follow national road transport regulations (e.g., ADR in Europe – see below).

- Rail: Covered hopper cars or gondolas. Follow relevant rail regulations.

- Sea: Bulk carriers (dry bulk) or containers (packed). Protect from saltwater spray and condensation. Use desiccants in containers if needed. Comply with IMDG Code.

- Air: Packed cargo only (pellets/granules in approved packaging). Subject to IATA DGR regulations.

H2: Storage

- Location: Store in a clean, dry, well-ventilated warehouse or covered area. Protect from direct sunlight and weather.

- Conditions:

- Temperature: Store at ambient temperatures. Avoid locations near heat sources (boilers, ovens, radiators). Long-term storage above 40°C (104°F) should be minimized.

- Humidity: Low humidity is preferred, though PP Copolymer is hygroscopic only to a very minor degree. Protect from direct water contact (flooding, leaks).

- Stacking: Stack pallets or bags according to manufacturer recommendations and packaging strength. Do not exceed safe stacking heights. Use pallets to prevent ground moisture absorption. Rotate stock using FIFO (First-In, First-Out) principle.

- Segregation: Store away from strong oxidizing agents, strong acids, strong bases, and other incompatible chemicals. Keep separate from food, feed, and pharmaceuticals.

- Housekeeping: Maintain clean storage areas. Promptly clean up spills to prevent slipping hazards. Protect material from dust and contamination.

H2: Safety & Regulatory Compliance

- Hazard Classification (Typical – Verify with SDS):

- GHS/CLP: Usually Not classified as hazardous under GHS/CLP for health or environmental hazards in its solid pellet/granule form. May carry the hazard statement “May form combustible dust concentrations in air” (H228) if dust generation is possible.

- Physical Hazards: Combustible solid. Dust may be explosible if dispersed in air at sufficient concentration and ignited (Dust Explosion Hazard – see below). Melts when heated.

- Safety Data Sheet (SDS): MANDATORY. Always obtain and review the most current SDS from the supplier before handling, storing, or transporting. It provides definitive information on hazards, composition, first aid, firefighting, accidental release, handling, storage, exposure controls, and regulatory details.

- Dust Explosion Hazard:

- Risk: Fine PP Copolymer dust suspended in air can form an explosive mixture.

- Prevention: Minimize dust generation (enclosed systems, ventilation, dust collection). Eliminate ignition sources (sparks, static electricity, open flames, hot surfaces). Use conductive equipment and proper grounding/bonding. Follow ATEX/IECEx (EU/Int) or NFPA 652/654 (US) standards for dust hazard analysis and control in processing areas. This is primarily a processing risk, not typically a bulk transport risk for pellets.

- Regulatory Compliance:

- Transport:

- Road (Europe): ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road). PP Copolymer pellets are typically NOT regulated under ADR (UN 3082, Environmentally Hazardous Substance, is usually not applicable to PP Copolymer). Always confirm with SDS and classification.

- Sea: IMDG Code (International Maritime Dangerous Goods). Generally NOT regulated as dangerous goods when transported in solid form (pellets). Bulk transport may have specific cargo securing requirements. Confirm classification.

- Air: IATA DGR (International Air Transport Association Dangerous Goods Regulations). Generally NOT regulated as dangerous goods for air transport in solid form. Packaged according to general provisions.

- Rail (US): 49 CFR (Hazardous Materials Regulations). Typically NOT regulated as a hazardous material.

- Chemical Regulations:

- REACH (EU): Registered. Ensure your use is covered by the supplier’s registration (SCIP notification required for articles containing SVHCs above threshold – unlikely for pure PP Copolymer but verify).

- TSCA (US): Listed on the TSCA Inventory.

- Food Contact: If intended for food contact applications, ensure the specific grade complies with relevant regulations (e.g., FDA 21 CFR 177.1520 in the US, EU Framework Regulation (EC) No 1935/2004 and specific measures). Requires specific certification from the supplier.

- RoHS/REACH SVHC: Generally does not contain restricted substances above thresholds, but verify with supplier for specific grades.

- Transport:

- Environmental:

- Spills: Sweep up mechanically. Place in suitable container for disposal. Avoid creating dust. Do not flush into sewers or waterways. Prevent entry into drains, water courses, or soil.

- Disposal: Dispose of waste material and contaminated packaging in accordance with local, regional, national, and international regulations (e.g., landfill, incineration with energy recovery, recycling). Recycling is strongly encouraged. Consult local authorities and the SDS.

- Ecotoxicity: Solid PP Copolymer has very low toxicity to aquatic life. However, prevent large-scale releases into the environment due to persistence (plastic pollution).

Key Reminders:

- SDS is Paramount: The Safety Data Sheet from your specific supplier for the specific grade is the authoritative source for hazard information and compliance requirements. Always consult it.

- Verify Classification: While generally non-hazardous, confirm the exact regulatory status (ADR, IMDG, IATA, 49 CFR) for your specific material, packaging, and quantity with the supplier and relevant regulations.

- Prevent Contamination: Critical for product quality and downstream processing.

- Control Dust & Ignition Sources: Essential in processing environments due to dust explosion risk.

- Compliance is Dynamic: Regulations change. Stay informed through suppliers, industry associations, and regulatory bodies.

By adhering to these guidelines and prioritizing the information in the SDS, safe, efficient, and compliant logistics for Polypropylene Copolymer can be achieved.

Conclusion for Sourcing Polypropylene Copolymer

Sourcing polypropylene copolymer requires a strategic approach that balances quality, cost, supply chain reliability, and regulatory compliance. As a versatile thermoplastic with excellent chemical resistance, impact strength, and flexibility—especially at low temperatures—polypropylene copolymer is critical for applications in automotive, packaging, healthcare, and consumer goods industries.

After evaluating potential suppliers, key considerations include material specifications (such as melt flow rate, ethylene content, and additive packages), consistency in product quality, and certifications (e.g., ISO, REACH, FDA compliance where applicable). Building strong relationships with reputable suppliers, preferably those with vertical integration and global reach, ensures supply stability and responsiveness to market fluctuations.

Additionally, regional factors—such as logistics costs, import regulations, and local production capacity—should inform sourcing decisions. Increasing emphasis on sustainability also encourages engagement with suppliers offering recyclable or bio-based alternatives, supporting long-term environmental and corporate responsibility goals.

In conclusion, a successful sourcing strategy for polypropylene copolymer combines technical diligence, supplier vetting, and supply chain resilience, enabling cost-effective procurement of a material that meets both current production needs and future market demands.