The global demand for polyethylene tank lining solutions has surged in recent years, driven by increasing industrialization, stringent environmental regulations, and the need for corrosion-resistant storage solutions across chemical, water treatment, and agriculture sectors. According to Grand View Research, the global plastic tanks market was valued at USD 49.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. A significant portion of this growth can be attributed to advancements in liner technologies, particularly high-density polyethylene (HDPE) and cross-linked polyethylene (XLPE), which offer superior chemical resistance, longevity, and cost-efficiency compared to traditional materials. As industries prioritize sustainable and low-maintenance storage infrastructure, the need for reliable polyethylene tank lining manufacturers has intensified—setting the stage for innovation and competition among leading global suppliers.

Top 10 Polyethelene Tank Lining Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

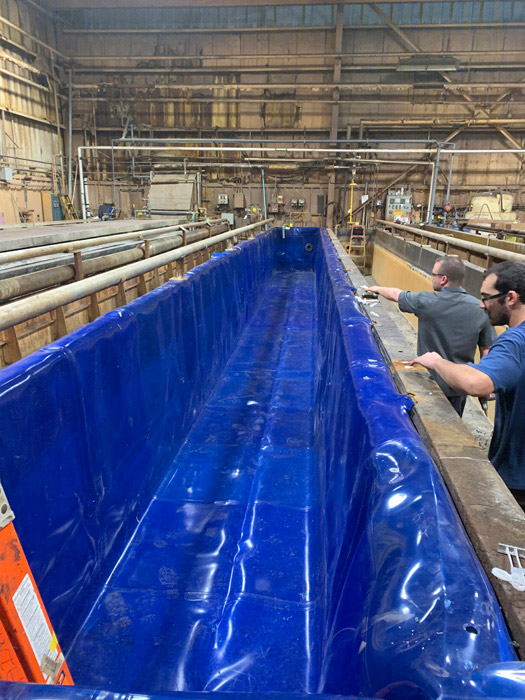

#1 Custom Tank Liners for Industrial Applications

Domain Est. 1998

Website: polyfabrics.com

Key Highlights: Polyfabrics designs and manufactures custom-fit tank liners for a wide range of industrial containment needs. Each liner is precision-fabricated to match ……

#2 Tank Armor Steel Tank Lining

Domain Est. 1998

Website: snydernet.com

Key Highlights: Industrial tank lining made from polyethylene resin to provide excellent chemical resistance for steel tanks….

#3 Rubber Tank Liners

Domain Est. 1999

Website: moontanks.com

Key Highlights: Custom steel tank fabrication manufacturer specializing in rubber tank liners and rubber lined tanks in the USA….

#4 Tank Lining Company

Domain Est. 2001

Website: royalliner.com

Key Highlights: Flexi-Liner is the leading tank lining company, providing flexible industrial tank liners. Our liners prevent corrosion on metal, wood, and concrete tanks….

#5 Industrial Tank Lining Services

Domain Est. 2002

Website: armorshieldlining.com

Key Highlights: Our DuraChem® 500 series is a 100% solids poly lining systems have revolutionized tank lining for the wastewater, potable water and fire suppression water ……

#6 Flexi-Liner: Tank Lining Company

Domain Est. 2002

Website: flexi-liner.com

Key Highlights: Flexi-Liner is the leading tank lining company, providing flexible industrial tank liners. Our liners prevent corrosion on metal, wood, and concrete tanks….

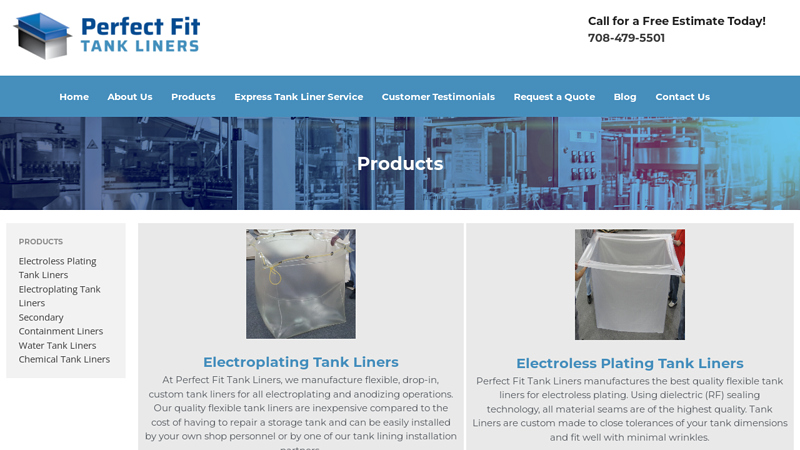

#7 Products

Domain Est. 2018

Website: perfectfittankliners.com

Key Highlights: At Perfect Fit Tank Liners, we manufacture premium custom tank liners for a variety of industrial applications. Give us a call and get a quote today!…

#8 Lined Steel Vessels for Polyethylene Chemical Tanks

Domain Est. 1998

Website: polyprocessing.com

Key Highlights: Use PolyGard™ Steel Vessel Lining for increased performance and better chemical storage solutions. See benefits and learn more about PolyGard™….

#9 Tank Liner Fabrication

Domain Est. 2006

Website: cpsfab.com

Key Highlights: Chicago Plastic Systems offers plastic, water, and chemical tank liners. We want to provide a tank liner that is suited to your need. Request a quote today!…

#10 Tank Linings

Domain Est. 2015

Website: standardpoly.com

Key Highlights: We can supply FDA and NSF approved linings for potable water and food quality tanks as well as concrete, bulk dry-storage or steel tanks, pipe linings and ……

Expert Sourcing Insights for Polyethelene Tank Lining

H2: Projected Market Trends for Polyethylene Tank Lining in 2026

The global market for polyethylene tank lining is poised for significant evolution by 2026, driven by industrial expansion, regulatory demands, and technological innovation. As industries increasingly prioritize chemical resistance, durability, and cost-effective containment solutions, polyethylene (PE) tank linings are emerging as a preferred choice across sectors such as wastewater treatment, chemical processing, mining, and agriculture.

One of the primary growth drivers for 2026 is the rising adoption of high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE) linings due to their superior resistance to corrosion, UV degradation, and a wide range of aggressive chemicals. Regulatory tightening on environmental protection and spill containment—particularly in North America and Europe—is compelling industries to upgrade aging infrastructure with compliant, long-lasting lining systems. This shift is expected to stimulate demand for factory-fabricated and seamless PE lining solutions that minimize leakage risks.

Additionally, the trend toward sustainable and recyclable materials aligns well with polyethylene’s attributes. As environmental, social, and governance (ESG) criteria gain importance, end-users are favoring PE linings over traditional materials like concrete or steel with epoxy coatings, which pose higher lifecycle environmental costs. Innovations such as multilayer co-extruded linings and antimicrobial additives are also expected to gain traction by 2026, enhancing performance in specialized applications like potable water storage and food-grade tanks.

Geographically, the Asia-Pacific region is anticipated to witness the fastest growth due to rapid industrialization, urbanization, and government investments in water infrastructure. Meanwhile, Latin America and Africa are expected to see increased demand in mining and agricultural storage, where cost-effective and portable tank solutions are critical.

In summary, by 2026, the polyethylene tank lining market is projected to expand robustly, supported by material advancements, regulatory tailwinds, and growing emphasis on sustainable industrial practices. Companies investing in R&D, quality certification, and application-specific solutions are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls in Sourcing Polyethylene Tank Lining: Quality and Intellectual Property (IP) Concerns

When sourcing polyethylene (PE) tank linings for industrial, chemical, or water storage applications, buyers often encounter challenges related to material quality and intellectual property rights. Overlooking these factors can lead to operational failures, regulatory non-compliance, and legal risks. Below are common pitfalls in these two critical areas.

Quality-Related Pitfalls

1. Inadequate Material Specifications

One of the most frequent issues is sourcing PE linings without clearly defined material standards. Suppliers may provide generic “polyethylene” without specifying the type (e.g., HDPE, LDPE, or cross-linked PE), density, melt index, or additives. This can result in linings that degrade prematurely when exposed to UV, chemicals, or thermal stress.

Best Practice: Require compliance with recognized standards such as ASTM D3350 (for PE pipe and lining materials) or ISO 4427. Specify required resin grades and performance characteristics like stress crack resistance and environmental stress cracking resistance (ESCR).

2. Poor Welding and Fabrication Techniques

Even high-quality PE material can fail if seams and joints are poorly welded. Inconsistent heat application, improper surface preparation, or lack of weld testing can create weak points leading to leaks or delamination.

Best Practice: Verify that the supplier employs certified welding personnel (e.g., certified by IWW or similar bodies) and performs non-destructive testing (e.g., vacuum, spark, or ultrasonic testing) on all welds.

3. Lack of Third-Party Certification

Some suppliers claim compliance with industry standards but lack verifiable third-party testing or certification. This increases the risk of receiving substandard products that may fail under operational conditions.

Best Practice: Require independent test reports from accredited laboratories and look for certifications such as NSF/ANSI 61 (for potable water applications) or AWWA C901/C906.

4. Inconsistent Thickness and Material Homogeneity

Inconsistent wall thickness or the use of recycled or regrind materials can compromise the integrity of the lining. Thin spots are prone to puncture, while contaminants in recycled content can reduce chemical resistance.

Best Practice: Enforce strict tolerances for thickness (e.g., ±10% per ASTM standards) and require documentation on raw material sources. Avoid suppliers who do not disclose the use of virgin vs. recycled resin.

Intellectual Property (IP) Concerns

1. Use of Counterfeit or Cloned Linings

Some manufacturers produce linings that mimic patented designs, formulations, or manufacturing processes of established brands (e.g., specific anti-slip textures, co-extruded layers, or antioxidant packages). This infringes on IP rights and may result in poor performance.

Best Practice: Source directly from authorized manufacturers or distributors. Request documentation proving the legitimacy of the product design and formulation. Be cautious of unusually low prices, which may indicate IP violations.

2. Unclear Ownership of Custom Designs

When commissioning custom tank linings, buyers may assume they own the design or mold. However, without a clear agreement, the supplier may retain IP rights, limiting future sourcing options or exposing the buyer to legal disputes.

Best Practice: Include IP ownership clauses in contracts. Specify that all custom designs, tooling, and technical data developed for the project are the buyer’s property or licensed for exclusive use.

3. Unauthorized Use of Proprietary Additives or Processes

Some high-performance linings incorporate proprietary stabilizers, UV inhibitors, or manufacturing processes protected by patents. Sourcing linings that use these without licensing can expose end-users to liability, especially in regulated industries.

Best Practice: Ask suppliers to disclose any patented technologies used and confirm they have the necessary rights to use or sublicense them. Conduct due diligence on suppliers with a history of IP litigation.

4. Inadequate Documentation and Traceability

Poor recordkeeping on material batches, production dates, and resin sources can hinder traceability during quality audits or failure investigations. It also complicates IP verification.

Best Practice: Require a full material traceability system, including batch numbers, resin certification, and production logs. Ensure documentation supports both quality assurance and IP compliance.

Conclusion

Sourcing polyethylene tank linings requires careful attention to both material quality and intellectual property integrity. Buyers should perform thorough supplier vetting, demand clear specifications and certifications, and secure IP rights in contractual agreements. Proactive due diligence minimizes the risk of performance failures, regulatory issues, and legal exposure.

Logistics & Compliance Guide for Polyethylene Tank Lining

Transportation and Handling

Ensure polyethylene lining materials are transported in clean, dry vehicles protected from direct sunlight, extreme temperatures, and physical damage. Use non-puncturing securing methods to prevent abrasion or tearing during transit. Upon delivery, inspect all materials for damage before acceptance and store in a covered, well-ventilated area off the ground to avoid contamination.

Storage Requirements

Store polyethylene liners in a cool, shaded environment with temperatures between 10°C and 30°C (50°F–86°F). Keep away from direct UV exposure, ozone sources (e.g., motors, welding equipment), and reactive chemicals. Roll liners loosely to prevent permanent creasing, and avoid stacking heavy objects on top to maintain material integrity.

Installation Compliance

Installation must be performed by certified technicians following manufacturer specifications and industry standards (e.g., ASTM D1998, ISO 9001). Conduct pre-installation site assessments to verify tank compatibility and surface preparation. All welding procedures (extrusion or hot gas) must adhere to approved parameters, with joint integrity verified through visual and vacuum testing.

Environmental Regulations

Comply with local, national, and international environmental regulations (e.g., EPA, REACH, RoHS) governing containment systems. Polyethylene liners must be chemically compatible with stored substances to prevent leaching or degradation. For potable water applications, ensure material certification to NSF/ANSI 61 or equivalent standards.

Workplace Safety

Personnel involved in handling and installation must wear appropriate PPE, including gloves, safety glasses, and flame-resistant clothing. Ensure adequate ventilation when using welding tools or adhesives. Follow OSHA or equivalent safety guidelines for confined space entry when lining tanks.

Documentation and Certification

Maintain complete records including material safety data sheets (MSDS), installation logs, weld inspection reports, and compliance certifications. Provide clients with an as-built package confirming adherence to project specifications and regulatory standards.

Disposal and Recycling

Dispose of trimmings or damaged polyethylene material in accordance with local waste management regulations. High-density polyethylene (HDPE) is recyclable; coordinate with certified recycling facilities to minimize environmental impact. Never incinerate without proper emission controls due to potential release of hazardous fumes.

Conclusion for Sourcing Polyethylene Tank Lining

In conclusion, sourcing polyethylene tank lining presents a reliable, cost-effective, and durable solution for protecting storage tanks from corrosion, chemical degradation, and environmental damage. High-density polyethylene (HDPE) and cross-linked polyethylene (XLPE) offer excellent chemical resistance, long service life, and low maintenance requirements, making them ideal for applications in industries such as water treatment, chemical processing, mining, and agriculture.

The selection of the appropriate polyethylene lining should be based on specific operational needs, including chemical exposure, temperature variations, and mechanical stress. Additionally, proper installation by certified professionals and adherence to manufacturer guidelines are critical to ensuring optimal performance and leak prevention.

When sourcing, it is essential to partner with reputable suppliers who provide quality-certified materials, technical support, and warranties. Conducting thorough evaluations of product specifications, lifecycle costs, and supplier reliability will ensure a successful lining solution that enhances tank integrity, extends asset lifespan, and supports environmental safety.

Overall, polyethylene tank lining is a proven and sustainable choice for corrosion protection, delivering long-term value and operational efficiency in demanding industrial environments.