The global polyester poplin fabric market has experienced steady growth, driven by rising demand in apparel, home textiles, and industrial applications. According to Grand View Research, the global polyester fabric market size was valued at USD 94.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by polyester’s durability, wrinkle resistance, and cost-efficiency, making poplin—a tightly woven, lightweight variant—particularly popular in both fashion and performance wear. Additionally, Mordor Intelligence projects sustained market expansion due to increasing urbanization, fast fashion trends, and advancements in textile technology that enhance sustainability and performance characteristics. As demand rises, manufacturers are scaling production and investing in innovation to meet evolving consumer and industrial needs, positioning the top polyester poplin producers as key players in the global textile supply chain.

Top 8 Polyester Poplin Material Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Buy Poly Poplin Fabric from Our Fabric Manufacturer & Factory

Domain Est. 2024

Website: fandafabrics.com

Key Highlights: As a leading poplin fabric manufacturer, we offer a diverse range of polyester poplin options, customizable to meet your specific needs….

#2 Poplin Fabric Manufacturers & Suppliers in Rajasthan, India

Domain Est. 2023

Website: palimills.com

Key Highlights: Pali Mills is a top Poplin fabric manufacturer and supplier in Rajasthan, offering high-quality cotton Poplin fabric. Buy Poplin fabric online or in bulk ……

#3 100% Polyester Poplin Fabric for Workwear MH Wholesale Price

Domain Est. 2001

Website: mh-chine.com

Key Highlights: MH 100% Polyester Poplin Fabric combines exceptional durability with superior comfort, making it ideal for uniforms and corporate attire….

#4 Polyester Poplin

Domain Est. 2001

#5 Visa Polyester Fabric by the Yard & Wholesale Bolt

Domain Est. 2008

Website: onthegolinens.com

Key Highlights: In stock $5.55 deliveryVisa Polyester, also known as Poly Poplin, is a versatile woven fabric made from 100% polyester made for various purposes. Made with 100% durable polyester….

#6 Polyester Poplin

Domain Est. 2011

Website: cncfabrics.com

Key Highlights: Free delivery over $75We carry a wide variety of polyester poplin fabric in solid colors, two-toned, and more and we are sure we have the color that you’re looking for….

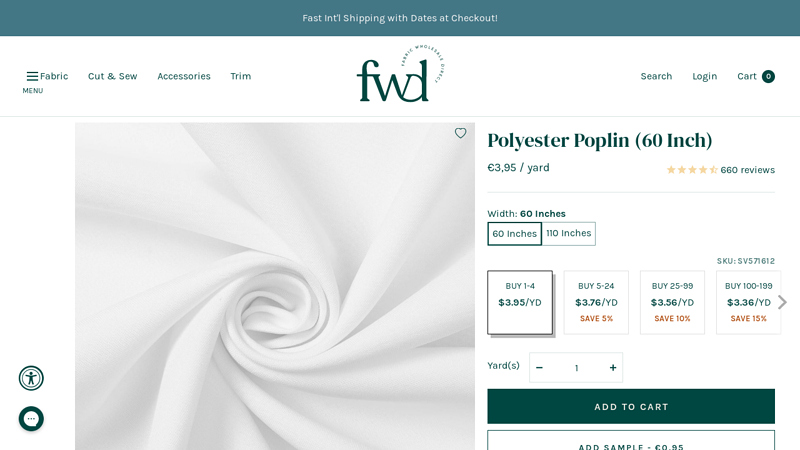

#7 Polyester Poplin (60 Inch)

Domain Est. 2014

Website: fabricwholesaledirect.com

Key Highlights: In stock Rating 4.9 (559) Polyester Poplin (60 Inch) is a breathable, medium-weight fabric ideal for apparel, décor, and crafts. Shop by the yard online at wholesale prices!…

#8 Quality 100 Poly Poplin Fabric Wholesale

Domain Est. 2020

Website: perfectextile.com

Key Highlights: Perfectextile provides one-stop polyester poplin fabric solutions for global customers. We have a lot of model cases for reference….

Expert Sourcing Insights for Polyester Poplin Material

H2: Projected 2026 Market Trends for Polyester Poplin Material

The polyester poplin market in 2026 is expected to be shaped by a confluence of established demand drivers, evolving consumer preferences, and increasing environmental scrutiny. While maintaining its position as a dominant, cost-effective fabric, the market will face pressures to innovate and adapt. Key trends include:

- Sustained Demand in Apparel & Workwear: Polyester poplin’s durability, wrinkle resistance, and affordability will ensure continued strong demand in core segments like shirts (especially formal/business, uniforms, and casual wear), trousers, and protective workwear. Growth in emerging economies and expanding service industries will fuel this demand.

- Intensifying Focus on Sustainability & Circularity: This is the most critical trend shaping the 2026 landscape:

- Rise of Recycled Polyester (rPET): Demand for poplin made from recycled plastic bottles (rPET) will surge significantly, driven by brand sustainability commitments (e.g., H&M, Zara, Uniqlo), consumer pressure, and potential regulatory frameworks (like extended producer responsibility). Expect rPET poplin to move from niche to mainstream.

- Biodegradable & Bio-based Alternatives: Development and commercialization of bio-based polyester variants (partially derived from renewable sources) and truly biodegradable polyesters will accelerate, though cost and scalability remain challenges for widespread poplin adoption by 2026.

- Transparency & Traceability: Brands will demand greater supply chain transparency for their poplin, requiring certifications (GRS, RCS) and blockchain tracking to verify recycled content and ethical production.

- Performance Enhancement & Functional Finishes: To compete with natural fibers and meet specific needs, polyester poplin will increasingly feature advanced finishes:

- Moisture Management & Breathability: Improvements to reduce the “plastic feel” and enhance comfort, especially in warm climates or active wear applications.

- Antimicrobial & Odor Control: Crucial for activewear, uniforms, and travel clothing.

- Easy Care & Anti-Static: Reinforcing inherent advantages for mass-market appeal.

- Durability & UV Protection: Maintained or enhanced for outdoor and workwear applications.

- Price Volatility & Cost Pressures: The market will remain sensitive to fluctuations in crude oil prices (the primary feedstock) and energy costs, particularly in regions with high energy prices (e.g., Europe). This could squeeze margins for producers and influence brand sourcing decisions, potentially favoring regions with lower energy costs or established rPET infrastructure.

- Competition from Alternative Materials: Polyester poplin will face increasing competition:

- Lyocell (Tencel) & Modal: Gaining favor for their softness, drape, breathability, and biodegradability, appealing to eco-conscious consumers.

- Recycled Cotton Blends: Offering a more sustainable cotton-like feel.

- Innovative Plant-Based Fibers: Emerging fibers from sources like bamboo (mechanically processed), hemp, or agricultural waste will target the sustainable segment.

- Consolidation & Vertical Integration: To manage costs, ensure supply security (especially for rPET), and control quality, larger textile manufacturers and brands may pursue further vertical integration (controlling more steps from polymer to fabric) or strategic partnerships/acquisitions within the polyester supply chain.

- Regional Shifts in Production & Consumption:

- Asia-Pacific (APAC): Will remain the dominant production hub (China, India, Southeast Asia) and a key consumption market, driven by large populations and growing middle classes. India and Southeast Asia are likely growth hotspots.

- Demand for Localized Sourcing: Geopolitical tensions and supply chain resilience concerns may lead some Western brands to explore nearshoring or friend-shoring options, potentially boosting production in regions like Turkey, North Africa, or the Americas, though cost will be a major barrier.

In Summary for 2026: The polyester poplin market will be characterized by robust baseline demand underpinned by functionality and cost, but its future growth trajectory will be heavily contingent on successful adaptation to sustainability imperatives. Success will favor producers and brands that can offer high-quality recycled (rPET) and potentially bio-based poplin with enhanced performance, backed by provable transparency. While facing competition from more sustainable natural and next-gen fibers, polyester poplin’s versatility and established infrastructure ensure its significant role, provided it evolves beyond its traditional, oil-based image.

Common Pitfalls When Sourcing Polyester Poplin Material (Quality & Intellectual Property)

Sourcing polyester poplin may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to significant issues, including production delays, customer dissatisfaction, and legal risks. Here are common pitfalls to avoid:

Inadequate Quality Specifications and Verification

One of the most frequent pitfalls is failing to define and verify detailed quality standards. Buyers often rely on vague descriptions like “good quality polyester poplin,” leading to inconsistencies. Key quality aspects such as thread count, weight (gsm), tensile strength, colorfastness, shrinkage rate, and finish (e.g., anti-static, wrinkle-resistant) must be clearly specified in the purchase agreement. Without standardized testing protocols (e.g., AATCC or ISO methods) and third-party lab reports, suppliers may deliver subpar fabric that fails performance expectations.

Overlooking Batch-to-Batch Consistency

Polyester poplin from different production batches can vary significantly in shade, texture, and hand feel—even from the same supplier. Sourcing without requiring color matching (e.g., using Pantone or lab dips) and lot numbering increases the risk of visible inconsistencies in the final product, especially for large orders. Failing to inspect pre-production samples and bulk shipments before shipment can result in costly rework or rejected goods.

Ignoring Sustainable and Chemical Compliance Standards

Many buyers assume polyester poplin is inherently low-risk, but hazardous chemicals (e.g., APEOs, formaldehyde, phthalates) may be present in dyes or finishes. Sourcing without requiring compliance with regulations like REACH, OEKO-TEX® Standard 100, or ZDHC can lead to import rejections or reputational damage. Additionally, greenwashing is common—suppliers may claim “eco-friendly” polyester without providing certifications for recycled content (e.g., GRS or RCS) or sustainable manufacturing practices.

Supply Chain Opacity and Fabric Origin Misrepresentation

Suppliers may source polyester poplin from unverified subcontractors or misrepresent the country of origin. This lack of traceability increases exposure to forced labor risks (e.g., Xinjiang cotton concerns, even in synthetics) and undermines ethical sourcing commitments. Without audit rights and supply chain mapping, buyers may unknowingly support unethical practices or violate import laws such as the Uyghur Forced Labor Prevention Act (UFLPA).

Intellectual Property Infringement Risks

Using proprietary patterns, prints, or technical finishes without proper licensing is a major IP pitfall. Some suppliers offer “inspired by” designs that closely mimic branded textiles, exposing the buyer to infringement claims. Additionally, custom-developed fabric constructions or treatments may not have clear IP ownership agreements, leading to disputes if the supplier replicates and sells the material to competitors. Always secure written confirmation of IP rights and require original design certifications.

Cost-Driven Sourcing at the Expense of Long-Term Reliability

Choosing suppliers solely based on the lowest price often leads to hidden costs. Bargain polyester poplin may use inferior raw materials (e.g., low-tenacity filament yarns), resulting in pilling, poor durability, or dimensional instability. Unreliable suppliers may also lack the capacity for consistent delivery or responsive quality control. Investing in vetted, long-term partners with proven track records reduces long-term risk and total cost of ownership.

Avoiding these pitfalls requires thorough due diligence, clear contracts, and ongoing quality management. Prioritizing transparency, compliance, and IP protection ensures dependable supply and protects your brand’s reputation.

Logistics & Compliance Guide for Polyester Poplin Material

This guide outlines key logistics and compliance considerations for the transportation, handling, and regulatory requirements associated with polyester poplin fabric in international and domestic supply chains.

Material Overview

Polyester poplin is a tightly woven, plain-weave fabric primarily composed of polyester fibers. Known for its durability, wrinkle resistance, and smooth finish, it is widely used in apparel (shirts, dresses), home textiles (bedding, curtains), and industrial applications. Logistics and compliance protocols must account for its synthetic composition and textile classification.

International Trade Compliance

Ensure adherence to international trade regulations when shipping polyester poplin across borders:

- Harmonized System (HS) Code: Typically classified under HS Code 5514.11 (woven fabrics of polyester staple fibers, unbleached or bleached). Confirm exact code based on fabric composition, weight, and finish per destination country’s tariff schedule.

- Country of Origin Labeling: Accurate country of origin must be declared on shipping documents and product labels as required by importing countries (e.g., “Made in Vietnam” for U.S. Customs).

- Textile Regulations: Comply with destination-specific textile labeling laws (e.g., FTC rules in the U.S., EU Textile Regulation (EU) No 1007/2011), which mandate fiber content disclosure.

- Restricted Substances: Verify compliance with regulations such as REACH (EU), CPSIA (U.S.), and Oeko-Tex® Standard 100, which restrict harmful substances (e.g., azo dyes, phthalates, heavy metals).

Packaging and Handling

Proper packaging and handling are critical to maintain fabric quality during transit:

- Roll Packaging: Polyester poplin is typically wound on cardboard tubes and wrapped in plastic (polyethylene) to protect against moisture, dust, and abrasion.

- Palletization: Rolls should be securely stacked on wooden or plastic pallets and stretch-wrapped to prevent shifting. Use corner boards for added edge protection.

- Labeling: Each roll and pallet must be clearly labeled with product ID, lot number, color, width, length, weight, and handling instructions (e.g., “This Side Up,” “Protect from Moisture”).

- Storage Conditions: Store in dry, temperature-controlled environments (15–25°C, 40–60% RH) away from direct sunlight to prevent UV degradation and static buildup.

Transportation Logistics

Select appropriate transportation modes and carriers based on volume, destination, and lead time:

- Sea Freight: Ideal for bulk shipments. Use dry container vans with desiccant bags to prevent condensation. Ensure containers are watertight and clean before loading.

- Air Freight: Suitable for urgent or high-value shipments. Use moisture-resistant packaging and consolidate to reduce costs.

- Ground Transport: For regional distribution, use enclosed trailers to protect against weather and contamination.

- Documentation: Provide commercial invoice, packing list, bill of lading/air waybill, and certificate of origin. Include fabric specifications (fiber content, GSM, width) for customs clearance.

Environmental and Sustainability Compliance

Address growing regulatory and consumer demands for sustainable practices:

- Recyclability: Polyester is recyclable; provide information on recyclability and disposal per local waste regulations.

- Environmental Claims: Avoid unsubstantiated green claims (e.g., “eco-friendly”) unless backed by certifications (e.g., GRS – Global Recycled Standard, if using recycled polyester).

- Carbon Footprint: Monitor and report emissions from transportation and production where required by customers or regulations (e.g., EU Green Claims Directive).

Customs Clearance and Duties

Facilitate smooth customs processing by ensuring complete and accurate documentation:

- Duty Rates: Duty rates vary by country and depend on the HS code and trade agreements (e.g., USMCA, RCEP). Verify preferential rates if applicable.

- Import Restrictions: Confirm no import bans or quotas apply to textile products from the country of origin.

- Inspection Readiness: Be prepared for customs inspections; retain mill certificates, test reports, and compliance documentation for at least five years.

Quality Assurance and Traceability

Maintain quality and compliance through robust tracking and testing:

- Lot Tracking: Assign unique batch/lot numbers to enable traceability from production to delivery.

- Testing Protocols: Conduct periodic testing for colorfastness, tensile strength, pH level, and restricted substances per ISO or AATCC standards.

- Supplier Compliance: Require suppliers to provide compliance documentation (e.g., test reports, certificates) and conduct audits as needed.

Conclusion

Effective logistics and compliance management for polyester poplin material requires attention to classification, labeling, packaging, transportation, and regulatory frameworks across all stages of the supply chain. Proactive documentation, adherence to international standards, and investment in sustainable practices will minimize risks and ensure market access.

In conclusion, sourcing polyester poplin material offers a practical and cost-effective solution for a wide range of apparel and textile applications. Its durability, wrinkle resistance, and ease of care make it an ideal choice for garments requiring structure and longevity, such as shirts, blouses, uniforms, and linings. When sourcing, it is essential to consider factors such as quality consistency, supplier reliability, environmental impact, and compliance with industry standards. Exploring suppliers in key manufacturing regions like China, India, and Bangladesh can provide competitive pricing and scalability, while prioritizing suppliers with sustainable practices can support long-term brand values and consumer expectations. By establishing strong supplier relationships and conducting thorough due diligence, businesses can ensure a reliable supply of high-quality polyester poplin that meets both performance and ethical standards.