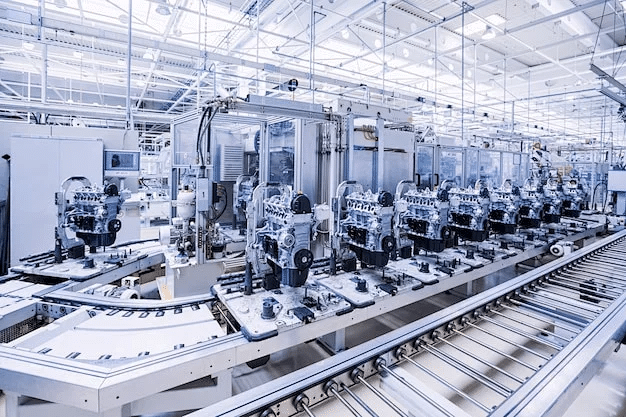

The global pneumatics systems market is experiencing robust growth, driven by rising industrial automation, advancements in manufacturing technologies, and increasing demand for energy-efficient solutions across automotive, packaging, and pharmaceutical sectors. According to a report by Mordor Intelligence, the global pneumatics market was valued at USD 38.15 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 4.6% from 2023 to 2028. Similarly, Grand View Research highlights expanding applications in smart factories and the Industrial Internet of Things (IIoT) as key growth catalysts, with heightened emphasis on precision, reliability, and reduced maintenance costs. As industries continue to prioritize operational efficiency, leading pneumatics manufacturers are investing in innovative components such as smart valves, integrated sensors, and eco-friendly compressors. In this competitive and evolving landscape, the top 10 pneumatics system manufacturers stand out through advanced R&D, global reach, and comprehensive product portfolios that meet the escalating demands of modern automation.

Top 10 Pneumatics System Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chicago Pneumatic Homepage

Domain Est. 1994

Website: cp.com

Key Highlights: We are a global manufacturer of high-performance power tools, air compressors, generators, light towers, and hydraulic equipment for professional and industrial ……

#2 Pneumatic & electric automation technology

Domain Est. 1997

Website: festo.com

Key Highlights: Festo US Corporation is a leading supplier of pneumatic and electrical automation technology offering industrial and process automation, components and ……

#3 Coilhose Pneumatics

Domain Est. 1995

Website: coilhose.com

Key Highlights: Coilhose Pneumatics is an industry-leading manufacturer of superior pneumatic tools, fabricating an extensive, high-quality selection of air tool ……

#4 SMC CORPORATION

Domain Est. 1998

Website: smcworld.com

Key Highlights: A leading manufacturer of pneumatic control devices that use compressed air as a power source for automation. We support automation in a variety of ……

#5

Domain Est. 2001

Website: airtec-usa.com

Key Highlights: For 50 years, AIRTEC has been a leader in innovative pneumatic solutions, bringing German engineering excellence to automation technology across the US….

#6 The Pneumatic Store

Domain Est. 2010

Website: thepneumaticstore.com

Key Highlights: The Pneumatic Store offers a full line of pneumatic automation products from the most progressive manufacturers in the fluid power industry….

#7 Air Cylinders, Solenoid Valves and Pneumatics

Domain Est. 1995

Website: smcusa.com

Key Highlights: Our Products · Air Management System · Valve I/O · Sensors & Switches · Electro-Pneumatic Regulators – ITV with Fieldbus · Electric Actuator Controllers ……

#8 SMC Pneumatics

Domain Est. 2001

Website: smcpneumatics.com

Key Highlights: SMC Pneumatics direct to your door. Free fast shipping. 99% of our orders leave within 24 hours or less. Order online or call 1-800-660-0733….

#9 Pneumatic Systems Company

Domain Est. 2002

Website: pneumaticsys.com

Key Highlights: We have everything you need for your compressed air systems, from air compressors and dryers to piping, parts, and accessories….

#10 PneumaticPlus: Pneumatic Parts

Domain Est. 2011

Website: pneumaticplus.com

Key Highlights: Explore quality pneumatic parts at PneumaticPlus. Trusted for reliability and expertise, we offer top-notch solutions to boost system performance….

Expert Sourcing Insights for Pneumatics System

H2: 2026 Market Trends for Pneumatic Systems

The global pneumatic systems market is poised for significant transformation by 2026, driven by advancements in automation, sustainability mandates, and evolving industrial demands. As industries continue to prioritize efficiency, precision, and energy savings, pneumatics—long-standing pillars of manufacturing and automation—face both challenges and opportunities. Below is an analysis of key market trends anticipated to shape the pneumatic systems landscape in 2026:

-

Growth in Industrial Automation and Smart Manufacturing

The proliferation of Industry 4.0 and smart factories is accelerating the integration of intelligent pneumatic components. By 2026, demand for smart pneumatics—equipped with sensors, IoT connectivity, and data analytics capabilities—is expected to surge. Manufacturers are increasingly adopting self-diagnosing valves, digitally controlled actuators, and condition monitoring systems to enhance predictive maintenance and reduce downtime. This shift supports real-time monitoring and control, aligning with broader digital transformation goals across automotive, electronics, and pharmaceutical sectors. -

Energy Efficiency and Environmental Regulations

Stringent global energy efficiency standards and carbon reduction targets are pushing manufacturers to optimize compressed air systems—the largest consumer of energy in pneumatic operations. In 2026, energy-efficient pneumatic components such as low-friction cylinders, variable speed drive (VSD) compressors, and leakage detection systems will gain prominence. Regulatory pressures in regions like the EU and North America are compelling industries to adopt sustainable practices, fostering innovation in eco-friendly pneumatic solutions. -

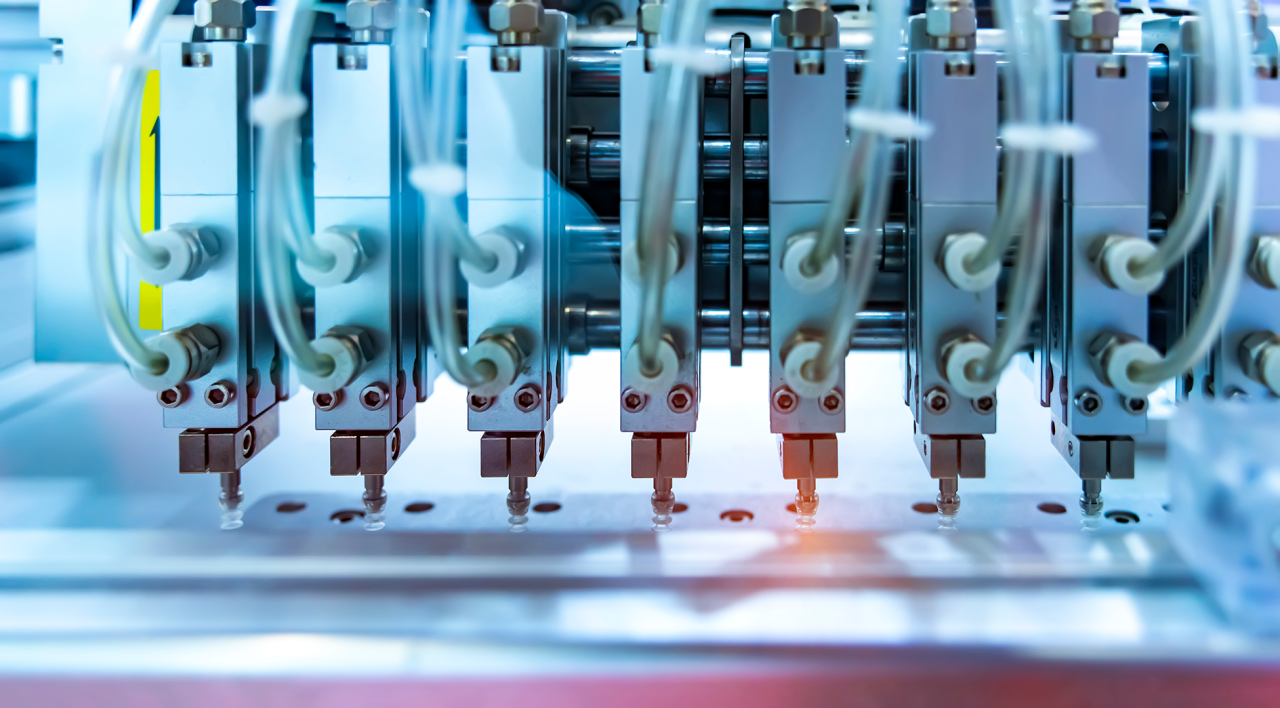

Miniaturization and Customization

As automation expands into compact and high-precision applications (e.g., medical devices, robotics, and semiconductor manufacturing), the demand for miniaturized pneumatic components is rising. By 2026, vendors will increasingly offer modular and customizable pneumatic systems tailored to specific applications, enabling faster integration and reduced footprint. This trend is particularly evident in the electronics and life sciences industries, where space constraints and precision are critical. -

Integration with Electrification and Hybrid Systems

While electric actuators are gaining traction due to their precision and energy efficiency, pneumatics will maintain a strong foothold in applications requiring high-speed, robust, and cost-effective linear motion. The trend toward hybrid automation systems—combining the benefits of electric and pneumatic technologies—will grow by 2026. Electropneumatic systems, which use electrical signals to control pneumatic actuators, offer enhanced control and are expected to see increased adoption in packaging and material handling. -

Regional Market Dynamics

Asia-Pacific, led by China, India, and Southeast Asia, will remain the fastest-growing market for pneumatic systems in 2026, driven by expanding manufacturing bases and government initiatives like “Make in India” and “Smart Manufacturing.” Meanwhile, North America and Europe will focus on retrofitting legacy systems with smart and energy-efficient pneumatic solutions. The automotive, food & beverage, and logistics sectors will be key end-users across all regions. -

Supply Chain Resilience and Localized Production

Post-pandemic disruptions have prompted companies to re-evaluate supply chain strategies. By 2026, there will be a greater emphasis on localized manufacturing and nearshoring of pneumatic components to mitigate risks. This trend supports faster delivery times, customization, and reduced logistics costs, particularly in high-demand industrial corridors. -

Advancements in Materials and Design

Innovation in materials—such as lightweight composites, corrosion-resistant coatings, and 3D-printed components—will enhance the durability and performance of pneumatic systems. Additive manufacturing will enable rapid prototyping and production of complex valve manifolds and custom parts, reducing lead times and inventory costs.

In conclusion, the 2026 pneumatic systems market will be characterized by digitalization, sustainability, and adaptability. While facing competition from electric alternatives, pneumatics will retain relevance through technological evolution and strategic integration into next-generation automation ecosystems. Companies that invest in smart, efficient, and flexible pneumatic solutions are likely to lead the market in this transformative period.

Common Pitfalls When Sourcing Pneumatic Systems: Quality and Intellectual Property Risks

Sourcing pneumatic systems—especially from new or low-cost suppliers—can present significant challenges related to both component quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to operational failures, safety hazards, legal disputes, and long-term reputational damage. Below are key risks to watch for:

Quality-Related Pitfalls

1. Inconsistent Component Performance

Low-cost suppliers may use substandard materials or deviate from design specifications, resulting in cylinders, valves, or fittings that fail prematurely under pressure or frequent cycling. This inconsistency can lead to unplanned downtime and increased maintenance costs.

2. Non-Compliance with Industry Standards

Reputable pneumatic systems adhere to international standards such as ISO 15552 (cylinders), ISO 5599 (valves), or ISO 4414 (safety). Sourcing from vendors who do not certify compliance increases the risk of system failure and may void insurance or regulatory approvals.

3. Poor Sealing and Leakage Issues

A common quality flaw is inadequate sealing in connectors, regulators, or actuators. Air leaks reduce system efficiency, increase energy costs, and can compromise process control—especially in precision automation or cleanroom environments.

4. Lack of Traceability and Documentation

Reliable suppliers provide material certifications, test reports, and batch traceability. Sourcing from vendors who omit these documents makes it difficult to diagnose failures or validate system integrity during audits.

Intellectual Property (IP) Risks

1. Design and Component Copying

Some suppliers, particularly in regions with lax IP enforcement, may reverse-engineer proprietary pneumatic designs or replicate patented components. Purchasing from such vendors can inadvertently support IP infringement and expose your company to legal liability.

2. Use of Counterfeit or Gray-Market Parts

Unauthorized suppliers may offer “compatible” or “OEM-equivalent” parts that infringe on trademarks or patents. While seemingly cost-effective, these components often lack performance guarantees and may violate licensing agreements.

3. Exposure of Sensitive System Designs

When outsourcing custom pneumatic solutions, sharing detailed schematics or performance requirements can expose proprietary system architecture. Without strong contractual IP clauses, suppliers may reuse or sell your design to competitors.

4. Weak Contractual Protections

Many sourcing agreements lack explicit IP ownership clauses, confidentiality terms, or restrictions on reverse engineering. This oversight can result in loss of control over innovations developed during collaboration.

Mitigation Strategies

- Conduct thorough supplier audits, including factory inspections and sample testing.

- Require certifications (e.g., ISO, CE) and validate compliance independently.

- Use Non-Disclosure Agreements (NDAs) and clearly define IP ownership in contracts.

- Source critical components from authorized distributors or OEMs.

- Implement supply chain traceability and quality assurance protocols.

By proactively addressing quality and IP concerns, companies can ensure reliable pneumatic system performance while protecting their technological investments.

Logistics & Compliance Guide for Pneumatic Systems

Introduction

This guide outlines the essential logistics and compliance considerations for the procurement, transportation, installation, operation, and maintenance of pneumatic systems. Adherence to these guidelines ensures safety, regulatory compliance, and operational efficiency across the supply chain and throughout the system lifecycle.

Regulatory Compliance Requirements

Pressure Equipment Directive (PED) – EU

Pneumatic systems operating above specified pressure-volume thresholds must comply with the EU Pressure Equipment Directive (2014/68/EU). Key requirements include:

– CE marking of components (e.g., air receivers, regulators, valves).

– Conformity assessment procedures based on risk classification.

– Technical documentation and Declaration of Conformity.

Ensure suppliers provide full PED compliance documentation for applicable components.

OSHA Standards – United States

In the U.S., pneumatic systems must meet Occupational Safety and Health Administration (OSHA) regulations, particularly:

– 29 CFR 1910.169 – Safety standards for compressed air equipment and usage.

– Requirements for pressure relief devices, guarding, and safe operating practices.

– Mandatory inspection and maintenance procedures.

Employers must train personnel on safe handling and emergency protocols.

ASME Boiler and Pressure Vessel Code (BPVC)

For pressure vessels such as air receivers, compliance with ASME BPVC Section VIII is often required:

– Design, fabrication, and testing under authorized inspection.

– Stamp certification (e.g., U-Stamp) for qualifying vessels.

– Periodic in-service inspections.

ISO Standards

Relevant ISO standards include:

– ISO 4414: General rules for pneumatic systems (safety, design, labeling).

– ISO 1219: Fluid power systems – graphical symbols and circuit diagrams.

– ISO 8573: Quality classes for compressed air (contaminants, dew point, particulates).

Design and documentation must align with applicable ISO standards.

Transportation & Handling Logistics

Packaging and Protection

- Secure valves, actuators, and control units in anti-static, moisture-resistant packaging.

- Use protective caps on ports and fittings to prevent contamination.

- Clearly label fragile components and orientation-sensitive items.

Shipping Classification

- Most pneumatic components are non-hazardous and exempt from dangerous goods regulations.

- Compressed gas cylinders (e.g., nitrogen for testing) may be classified as hazardous (UN 1013, UN 1978) and require:

- Proper labeling (Class 2.2 – Non-flammable, non-toxic gas).

- DOT/ADR/IATA-compliant packaging and documentation.

- Securement in upright position during transit.

Import/Export Compliance

- Verify customs classification (HS Code) for pneumatic components (e.g., 8481.80 for valves).

- Comply with export control regulations (e.g., EAR in the U.S.) if technology has dual-use potential.

- Provide commercial invoices, packing lists, and certificates of origin as required.

Installation & Operational Compliance

Site Requirements

- Install air receivers and compressors on stable, ventilated foundations.

- Ensure adequate clearance for maintenance and safety access.

- Comply with local fire codes and electrical zoning (if using electric compressors).

Safety Systems

- Install pressure relief valves (PRVs) rated below the system’s maximum allowable working pressure (MAWP).

- Use burst discs and emergency shut-off controls where required.

- Implement lockout/tagout (LOTO) procedures per OSHA 1910.147.

Air Quality & Filtration

- Maintain compressed air quality per ISO 8573-1:2010 standards.

- Install coalescing filters, dryers, and oil separators as needed for application (e.g., food processing, pharmaceuticals).

- Monitor dew point, particulate levels, and oil content regularly.

Maintenance & Documentation

Preventive Maintenance

- Schedule routine inspection of hoses, fittings, seals, and pressure regulators.

- Replace worn components to prevent leaks and pressure loss.

- Drain moisture from air receivers daily or via automatic drains.

Recordkeeping

- Maintain logs of:

- Pressure tests and inspections.

- PRV certifications and replacements.

- Maintenance activities and part replacements.

- Retain technical files, compliance certificates, and safety data sheets (SDS) for critical components.

Environmental & Sustainability Considerations

Noise Control

- Use silencers on exhaust ports to meet OSHA and EU noise directives (e.g., 2003/10/EC).

- Enclose noisy compressors where feasible.

Energy Efficiency

- Comply with energy efficiency standards (e.g., EU Ecodesign Directive 2009/125/EC for compressors).

- Implement variable speed drives (VSD) and leak detection programs to reduce energy waste.

Waste Management

- Recycle used filters, lubricants, and metal components in accordance with local environmental regulations.

- Avoid venting compressed air directly into the environment; use exhaust manifolds with filtration.

Conclusion

Proper logistics planning and regulatory compliance are critical for the safe and efficient deployment of pneumatic systems. By adhering to international standards, transportation regulations, and maintenance best practices, organizations can minimize risk, ensure personnel safety, and achieve long-term operational reliability.

Conclusion for Sourcing a Pneumatic System:

Sourcing a pneumatic system requires a comprehensive evaluation of application requirements, system performance, reliability, and total cost of ownership. By clearly defining operational needs—such as pressure, flow rate, duty cycle, and environmental conditions—organizations can select components that ensure optimal efficiency and longevity. Partnering with reputable suppliers offering high-quality valves, actuators, compressors, and accessories is critical to maintaining system integrity and minimizing downtime. Additionally, considering factors like energy efficiency, ease of maintenance, and compatibility with existing infrastructure enhances overall system effectiveness. A well-sourced pneumatic system not only improves operational performance but also contributes to cost savings and sustainability over time. Ultimately, strategic sourcing—balancing quality, support, and value—lays the foundation for a robust and reliable pneumatic solution.