The global pneumatic valve market is experiencing robust expansion, driven by rising automation across industrial and manufacturing sectors. According to Grand View Research, the global pneumatic components market was valued at USD 17.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. A key contributor to this growth is the increasing demand for precision control and energy-efficient solutions in industries such as automotive, food and beverage, pharmaceuticals, and chemical processing. Mordor Intelligence further projects that the industrial valves market will grow at a CAGR of over 5% from 2023 to 2028, citing advancements in pneumatic actuation technologies and the integration of IoT-enabled systems in valve automation. With such momentum, identifying leading pneumatic valve engine manufacturers has become critical for engineers, procurement managers, and system integrators seeking reliable, high-performance components. The following list highlights the top 10 manufacturers driving innovation and market share in this evolving sector.

Top 10 Pneumatic Valve Engine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chicago Pneumatic Homepage

Domain Est. 1994

Website: cp.com

Key Highlights: We are a global manufacturer of high-performance power tools, air compressors, generators, light towers, and hydraulic equipment for professional and industrial ……

#2 Pneumatic & electric automation technology

Domain Est. 1997

Website: festo.com

Key Highlights: Festo US Corporation is a leading supplier of pneumatic and electrical automation technology offering industrial and process automation, components and ……

#3 Valves

Domain Est. 1996

Website: eaton.com

Key Highlights: From aerospace to mobile and industrial machinery, Eaton hydraulic valves deliver a competitive advantage in markets all over the world….

#4 SMC CORPORATION

Domain Est. 1998

Website: smcworld.com

Key Highlights: A leading manufacturer of pneumatic control devices that use compressed air as a power source for automation. We support automation in a variety of ……

#5 Humphrey Products

Domain Est. 2000

Website: humphrey-products.com

Key Highlights: Specializing in the design and manufacture of pneumatic and fluid control valves, valve systems and customized products for industry….

#6 Valves

Domain Est. 1995

Website: ph.parker.com

Key Highlights: |; Sign In · My Account Log Out · Home · Products · Adhesives, Coatings and Encapsulants Aerospace Systems and Technologies Air Preparation (FRL) and Dryers ……

#7 Fabco-Air

Domain Est. 1995

Website: fabco-air.com

Key Highlights: Fabco-Air offers a complete line of pneumatic components including cylinders, rotary actuators, slides, grippers and valves….

#8 Flow Control Valves

Domain Est. 1996

Website: meggitt.com

Key Highlights: Parker Meggitt valves reliably function in extreme conditions. They increase engine efficiency, save energy and minimise emissions….

#9 SAMSON AG

Domain Est. 1998

Website: samsongroup.com

Key Highlights: SAMSON offers products and systems to control all kinds of media. We specialize in control valve engineering. As a trendsetter for over 100 years….

#10 Enfield Technologies

Domain Est. 2002

Expert Sourcing Insights for Pneumatic Valve Engine

H2: 2026 Market Trends for Pneumatic Valve Engines

The global market for pneumatic valve engines is poised for notable transformation by 2026, driven by advancements in automation, energy efficiency demands, and evolving industrial applications. As industries continue to prioritize reliability, low maintenance, and operational safety, pneumatic valve engines—known for their robustness in harsh environments and explosion-proof characteristics—are gaining renewed interest across key sectors.

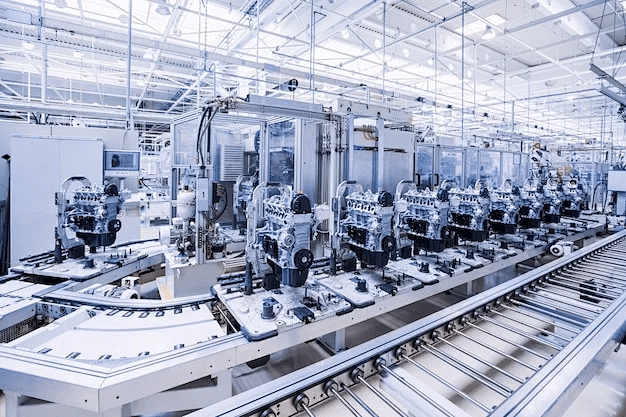

1. Industrial Automation and Smart Manufacturing Expansion

By 2026, the integration of Industry 4.0 technologies is expected to significantly influence the demand for intelligent pneumatic systems. Pneumatic valve engines are increasingly being equipped with digital sensors, IoT connectivity, and real-time monitoring capabilities. This shift enables predictive maintenance, remote diagnostics, and seamless integration with centralized control systems, particularly in automotive manufacturing, food and beverage processing, and pharmaceutical production.

2. Growth in Energy-Efficient and Sustainable Solutions

With global emphasis on reducing carbon emissions and improving energy efficiency, manufacturers are investing in optimized pneumatic systems that minimize compressed air waste—a historically energy-intensive aspect of pneumatic technology. Innovations such as variable-speed compressors, low-leakage valve designs, and energy recovery systems are expected to enhance the sustainability profile of pneumatic valve engines, making them more competitive against electric alternatives in specific applications.

3. Rising Adoption in Emerging Economies

Industrialization in Asia-Pacific (particularly China, India, and Southeast Asia), along with infrastructure development in Latin America and Africa, is driving demand for reliable and cost-effective control systems. Pneumatic valve engines are favored in these regions due to their durability, simple maintenance, and ability to operate without electricity in remote or hazardous environments. This trend is expected to accelerate market growth through 2026.

4. Competitive Pressure from Electrification

Despite their advantages, pneumatic valve engines face increasing competition from electric actuators, which offer higher precision and energy efficiency in controlled environments. However, pneumatics maintain a strong foothold in high-cycle, high-force, or safety-critical applications where speed, reliability, and fail-safe operation are paramount. Market players are responding by developing hybrid systems that combine pneumatic actuation with electric control for optimal performance.

5. Regulatory and Safety Standards Driving Innovation

Stricter safety and environmental regulations, especially in oil & gas, chemical processing, and mining, are reinforcing the use of intrinsically safe pneumatic systems. By 2026, compliance with standards such as ATEX, IECEx, and ISO 50001 will be a key differentiator, prompting manufacturers to innovate in materials, sealing technologies, and electromagnetic interference (EMI) resistance.

6. Consolidation and Strategic Partnerships

The market is witnessing increased consolidation among component suppliers and system integrators. Major players like Festo, SMC Corporation, Parker Hannifin, and ABB are expanding their portfolios through acquisitions and R&D collaborations focused on smart pneumatics. These partnerships aim to deliver turnkey solutions that integrate pneumatic valve engines into broader industrial automation ecosystems.

Conclusion

By 2026, the pneumatic valve engine market will be characterized by technological convergence, regional diversification, and a strong focus on sustainability and digital integration. While challenges from electrification persist, the inherent advantages of pneumatics in rugged and safety-sensitive applications ensure continued relevance and growth. Companies that invest in intelligent, energy-efficient, and compliant pneumatic solutions will be best positioned to capture emerging opportunities in the evolving industrial landscape.

Common Pitfalls in Sourcing Pneumatic Valve Engines (Quality & Intellectual Property)

Sourcing pneumatic valve engines, especially for specialized or high-performance applications, involves navigating significant challenges related to both product quality and intellectual property (IP) protection. Overlooking these areas can lead to operational failures, financial loss, legal disputes, and reputational damage. Below are the most common pitfalls in both domains.

Quality-Related Pitfalls

1. Inadequate Supplier Vetting and Certification Gaps

Many buyers fall into the trap of selecting suppliers based solely on price or proximity, neglecting thorough due diligence. Key quality risks include:

– Lack of recognized certifications (e.g., ISO 9001, ISO 13849 for functional safety, ATEX for explosive environments).

– Unverified or falsified test reports and material certifications.

– Inconsistent manufacturing processes due to poor process control.

Best Practice: Conduct on-site audits, request third-party test results, and verify compliance with industry-specific standards.

2. Substandard Material and Component Selection

Pneumatic valve engines operate under high pressure and cyclic loads. Common quality failures arise from:

– Use of inferior seal materials (e.g., non-compliant elastomers) leading to premature leakage.

– Non-precision machined valve bodies or spools causing internal leakage and reduced efficiency.

– Inadequate surface finishes or corrosion protection in harsh environments.

Best Practice: Specify exact material grades (e.g., ASTM, DIN), require material traceability (mill test reports), and mandate performance testing under operational conditions.

3. Poor Testing and Validation Procedures

Suppliers may conduct only basic functional checks rather than comprehensive performance validation. Pitfalls include:

– No cycle life testing (e.g., 1 million+ cycles for industrial use).

– Absence of leak rate testing under pressure and temperature extremes.

– Skipping environmental stress screening (vibration, thermal cycling).

Best Practice: Include detailed testing protocols in procurement contracts and require witnessed or third-party validation.

4. Inconsistent Tolerances and Assembly Quality

Precision is critical in pneumatic systems. Variability in:

– Valve spool-to-bore clearances.

– Alignment of actuator linkages.

– Torque control during assembly.

…can lead to inconsistent performance, increased wear, and system failure.

Best Practice: Define geometric dimensioning and tolerancing (GD&T) requirements and require statistical process control (SPC) data from the supplier.

Intellectual Property-Related Pitfalls

1. Lack of Clear IP Ownership Agreements

When customizing or co-developing pneumatic valve engines, ambiguity in IP rights is a major risk:

– Assumption that paying for development grants full IP ownership.

– Failure to define background vs. foreground IP in joint development projects.

– No formal assignment of IP rights in contracts.

Best Practice: Draft comprehensive development agreements specifying IP ownership, licensing terms, and restrictions on reverse engineering.

2. Design Theft and Unauthorized Replication

Suppliers, especially in regions with weaker IP enforcement, may:

– Copy design blueprints or CAD models for resale to competitors.

– Manufacture and sell “compatible” or “replacement” parts that infringe on patented features.

– Use proprietary performance data to develop competing products.

Best Practice: Limit access to sensitive design data, use non-disclosure agreements (NDAs), and watermark or segment technical documentation.

3. Infringement of Third-Party Patents

Sourcing from suppliers who unknowingly (or knowingly) use patented technologies exposes the buyer to liability:

– Use of protected valve actuation mechanisms.

– Implementation of patented control algorithms or sensor integration.

– Copying of trademarked designs or branding.

Best Practice: Conduct freedom-to-operate (FTO) analyses and require IP indemnification clauses in supply contracts.

4. Weak Enforcement and Jurisdictional Challenges

Even with IP protections in place, enforcement can be difficult:

– Suppliers located in jurisdictions with poor IP law enforcement.

– Difficulty in monitoring unauthorized production or exports.

– Cost and complexity of international litigation.

Best Practice: Choose suppliers in IP-respectful regions when possible, include arbitration clauses in contracts, and register IP (patents, trademarks) in all relevant markets.

Conclusion

Successfully sourcing pneumatic valve engines requires a dual focus: rigorous quality assurance and proactive IP protection. Buyers must move beyond cost-centric procurement, investing in supplier qualification, detailed technical specifications, and legally robust contracts. By addressing these common pitfalls early, organizations can ensure reliable performance, protect innovation, and mitigate long-term risks.

Logistics & Compliance Guide for Pneumatic Valve Engine

Overview

This guide outlines the essential logistics and regulatory compliance considerations for the transportation, handling, and use of Pneumatic Valve Engines. Adherence to these guidelines ensures safe operations, legal compliance, and efficient supply chain management.

Regulatory Compliance Requirements

International Standards

Pneumatic Valve Engines must comply with relevant international standards, including:

– ISO 6953 (Pneumatic fluid power – Air treatment – Filter, regulator, lubricator units)

– ISO 1219 (Fluid power systems and components – Graphical symbols and circuit diagrams)

– ISO 4414 (Pneumatic systems – General rules relating to installations)

– ATEX Directive 2014/34/EU (for use in potentially explosive atmospheres, if applicable)

– IECEx Certification (for international hazardous locations)

Ensure product certification documentation is available and up to date.

Regional & Local Regulations

- North America: Compliance with OSHA 29 CFR 1910.169 (Compressed Air Systems), ANSI B11.0 (Machine Safety), and CSA Z462 (Electrical Safety in Workplaces) if integrated with electrical controls.

- European Union: CE marking required under Machinery Directive 2006/42/EC and Pressure Equipment Directive (PED) 2014/68/EU if pressure thresholds are exceeded.

- Asia-Pacific: Conformity with local regulations such as Japan’s Industrial Safety and Health Law or China’s CCC certification, where applicable.

Verify country-specific import requirements and conformity assessment procedures prior to shipment.

Packaging & Handling

Packaging Specifications

- Use robust, moisture-resistant packaging to prevent damage during transit.

- Secure internal components with foam inserts or custom cradles to minimize vibration and impact.

- Clearly label packages with handling instructions: “Fragile,” “This Side Up,” and “Protect from Moisture.”

Handling Instructions

- Use appropriate lifting equipment (e.g., forklifts, pallet jacks) when moving packaged units.

- Avoid dropping or dragging crates.

- Store units in dry, temperature-controlled environments (ideally 5°C to 40°C).

Transportation Guidelines

Domestic & International Shipping

- Classify cargo accurately under the Harmonized System (HS) Code; typical classification: 8412.21 (Pneumatic engines and motors).

- Provide Material Safety Data Sheets (MSDS) if lubricants or compressed components are included.

- For air freight, comply with IATA Dangerous Goods Regulations if shipping with pressurized components (typically exempt if depressurized).

Special Considerations

- Do not transport with residual pressure in lines; fully depressurize before packaging.

- Include desiccant packs in packaging to prevent internal condensation.

- Use tamper-evident seals on critical access points to ensure integrity upon delivery.

Import & Customs Documentation

Required Documents

- Commercial Invoice

- Bill of Lading or Air Waybill

- Packing List

- Certificate of Conformity (CE, ISO, etc.)

- Certificate of Origin

- Test Reports (if requested by customs authorities)

Ensure all documents are accurately completed and match the shipped goods in quantity, description, and value.

Installation & Operational Compliance

Site Preparation

- Confirm installation site meets ventilation, pressure supply, and environmental requirements.

- Verify pneumatic supply lines are clean, dry, and within specified pressure ranges (typically 6–10 bar).

Safety & Training

- Provide operators with documented training on proper use, emergency shutdown, and maintenance.

- Install appropriate guards and safety interlocks as required by local regulations.

- Post warning labels in local languages if deployed internationally.

Maintenance & Recordkeeping

Scheduled Maintenance

- Follow manufacturer-recommended intervals for filter replacement, lubrication, and seal inspection.

- Maintain logs of servicing, repairs, and component replacements.

Compliance Audits

- Retain compliance documentation for minimum of 10 years (or as required by jurisdiction).

- Conduct periodic internal audits to ensure continued adherence to safety and operational standards.

Environmental & Disposal Compliance

End-of-Life Management

- Dispose of components in accordance with WEEE Directive (EU) or local e-waste regulations.

- Recycle metal housings and avoid landfill disposal of electronic or coated parts.

- Follow proper procedures for draining and recycling any internal lubricants.

Environmental Protection

- Prevent oil or particulate contamination during maintenance.

- Use eco-friendly cleaning agents and dispose of rags and fluids per local hazardous waste rules.

Contact & Support

For compliance or logistics support, contact:

Technical Compliance Team

Email: [email protected]

Phone: +1 (555) 123-4567

Available Monday–Friday, 8:00 AM – 5:00 PM (GMT)

Conclusion for Sourcing Pneumatic Valve Actuators (Engine/Actuation System)

In conclusion, sourcing pneumatic valve actuators requires a comprehensive evaluation of operational requirements, system compatibility, reliability, and total cost of ownership. Pneumatic actuators offer distinct advantages such as fast response times, fail-safe operation, and suitability for hazardous environments, making them ideal for many industrial applications including oil & gas, chemical processing, and power generation.

When selecting a supplier or model, key considerations include air pressure requirements, control signal compatibility (e.g., 3-15 psi or 20–100 kPa), material construction, environmental resilience, and integration with control systems. It is also essential to partner with reputable manufacturers or suppliers who provide compliance with international standards (such as ISO, ATEX, or IEC), technical support, and after-sales service.

Furthermore, evaluating lifecycle costs—factoring in maintenance, energy efficiency, and durability—leads to more sustainable and cost-effective sourcing decisions. Automation trends and digital integration (e.g., smart positioners, remote diagnostics) are increasingly influencing procurement choices, highlighting the need for future-ready solutions.

Ultimately, a well-informed sourcing strategy for pneumatic valve actuators ensures optimal performance, safety, and reliability within the broader fluid control system.