The global pneumatic palletizing equipment market is experiencing robust growth, driven by rising demand for automation in manufacturing and logistics. According to Mordor Intelligence, the industrial palletizing systems market—encompassing robotic, mechanical, and pneumatic solutions—is projected to grow at a CAGR of over 5.8% from 2024 to 2029, with pneumatic systems maintaining a significant share due to their reliability, cost-efficiency, and suitability for high-speed operations in food and beverage, pharmaceutical, and consumer goods industries. As companies prioritize operational efficiency and labor optimization, pneumatic palletizers offer a scalable automation solution, particularly in mid-volume production environments. This data-backed momentum underscores the importance of identifying leading manufacturers who combine innovation, durability, and application-specific engineering. Based on market presence, technological advancements, and global customer adoption, the following list highlights the top 10 pneumatic palletizing manufacturers shaping the future of automated material handling.

Top 10 Pneumatic Palletizing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Palletizing Equipment Manufacturers

Domain Est. 2003

Website: toptier.com

Key Highlights: We offer both traditional and robotic palletizing solutions. We also provide a one-of-a-kind solution that combines the stretch wrapper with the palletizer….

#2 Palletizer Manufacturers

Website: palletizermanufacturers.com

Key Highlights: Easily contact leading Palletizer manufacturers and suppliers that specialize in producing pallets for your custom bulk handling applications….

#3 Palletizing Solutions

Domain Est. 1988

Website: automation.honeywell.com

Key Highlights: Robotic palletizers from Honeywell Intelligrated are designed to increase your pattern flexibility and enable fast, easy product reconfiguration….

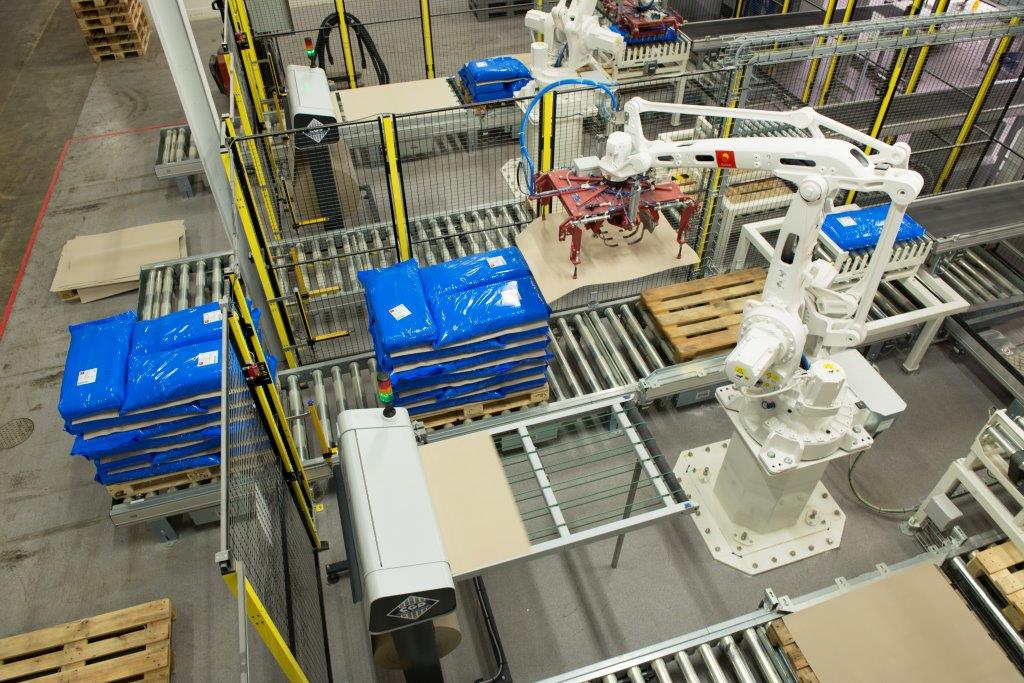

#4 Palletising in intralogistics with modular solutions.

Domain Est. 1997

Website: festo.com

Key Highlights: Palletising with Festo: Combine the possibilities of electric, pneumatic and digital automation to create flexible solutions….

#5 JOULIN

Domain Est. 1998

Website: joulin.com

Key Highlights: Joulin, the inventor of the foam vacuum gripper, manufactures innovative handling systems from the simple foam vacuum gripper integrated on your palletizing ……

#6 PALLETIZING GRIPPERS

Domain Est. 2000

Website: effecto.com

Key Highlights: PALLETIZING GRIPPERS is a pneumatically actuated palletizing gripper to clamp the bags from the sides, Hard coated for protection in extreme environments….

#7 Premier Tech

Domain Est. 2009

Website: ptchronos.com

Key Highlights: Thanks to its 100 years of expertise, Premier Tech is a global partner with a local presence for your packaging and processing equipment….

#8 Palletizing Robots: Expertise in Custom Robotics with Kuka

Domain Est. 2023

Website: smb-international.com

Key Highlights: Palletizing with Gantry or Articulated Arm Robots. Our palletizing robots are advanced load handling systems equipped with customizable gripping elements….

#9 Palletizing systems

Domain Est. 2024

Website: e2pack.com

Key Highlights: Our palletizing systems are designed with a modular concept that includes various types of palletizers, all configurable with interchangeable gripper heads….

#10 Palletizing

Website: iconsystems.gr

Key Highlights: Palletizing or palletization most often refers to the act of placing products on a pallet for shipment or storage in logistics supply chains….

Expert Sourcing Insights for Pneumatic Palletizing

H2: Pneumatic Palletizing Market Trends in 2026

By 2026, the pneumatic palletizing market is expected to experience steady evolution, shaped by broader industrial automation trends, sustainability demands, and cost optimization pressures. While facing increasing competition from electric and hybrid solutions, pneumatic systems will maintain a significant niche, particularly in specific applications. Key trends shaping the market include:

-

Continued Dominance in Harsh Environments: Pneumatic palletizers will remain the preferred choice in industries with demanding operating conditions. Their inherent resistance to dust, moisture, temperature extremes, and washdown requirements (common in food & beverage, pharmaceuticals, and chemicals) ensures reliability where electric actuators might fail or require expensive protection. This robustness solidifies their position in these critical sectors.

-

Focus on Energy Efficiency and Sustainability: Growing pressure to reduce operational costs and carbon footprints will drive innovation in pneumatic systems. Key developments include:

- Advanced Air Management: Widespread adoption of intelligent air preparation units, flow control valves, and sensors to minimize compressed air consumption – the primary operational cost of pneumatics.

- Regenerative Systems: Exploration and limited deployment of systems that capture and reuse exhaust air energy.

- Leak Detection & Monitoring: Integration of IoT sensors for real-time monitoring of air pressure and flow, enabling predictive maintenance and rapid leak detection to prevent energy waste.

-

Enhanced Integration with Smart Manufacturing (Industry 4.0): Pneumatic palletizing systems will increasingly feature built-in connectivity:

- Smart Pneumatics: Valves and cylinders equipped with sensors and communication protocols (e.g., IO-Link) will provide real-time data on position, pressure, cycle count, and health status.

- Predictive Maintenance: This data enables predictive maintenance, reducing unplanned downtime and optimizing component lifespan.

- Seamless PLC/MES Integration: Easier integration with higher-level control systems (PLCs, SCADA, MES) for centralized monitoring, data analytics, and production optimization.

-

Hybridization and System Optimization: Pure pneumatic systems will see increased competition, leading to:

- Hybrid Solutions: Growth in systems combining pneumatic actuators (for gripping, clamping, simple vertical lifts) with electric linear actuators or servo motors (for precise, high-speed horizontal movement or complex positioning). This leverages the strengths of both technologies.

- Modular & Scalable Designs: Emphasis on modular pneumatic components and pre-engineered palletizing cells that are easier to install, reconfigure, and scale as production needs change, reducing engineering time and cost.

-

Cost-Effectiveness Driving Adoption in Emerging Markets and SMEs: The lower initial investment cost and proven reliability of pneumatic systems will continue to make them highly attractive for:

- Small and Medium Enterprises (SMEs): Seeking affordable automation solutions to improve efficiency and compete.

- Emerging Economies: Where capital expenditure constraints are significant, and robust, simple technology is prioritized. Demand will grow in regions like Southeast Asia, Latin America, and parts of Africa.

-

Competitive Pressure from Electric and Robotic Solutions: The market will face persistent pressure from:

- Electric Palletizers: Offering superior energy efficiency, precision, speed, and quieter operation, especially for complex patterns and high-speed applications.

- Robotic Palletizers (SCARA/Articulated): Providing ultimate flexibility for handling diverse, unstable, or heavy loads and complex pallet patterns, albeit at a higher cost.

- Impact: This competition will push pneumatic solutions to innovate (as seen in trends 2 & 3) and focus on their core strengths (simplicity, robustness, cost) rather than trying to match electric performance in all areas.

In Summary for 2026: The pneumatic palletizing market will not dominate overall growth but will hold strong in its established niches. Success will depend on vendors offering smarter, more energy-efficient, and easily integrable pneumatic solutions, often within hybrid architectures. While electric and robotic systems capture high-end and highly flexible applications, pneumatics will remain the workhorse for reliable, cost-effective automation in harsh environments and for SMEs globally, driven by continuous improvements in efficiency and connectivity.

Common Pitfalls Sourcing Pneumatic Palletizing Systems (Quality, IP)

When sourcing pneumatic palletizing systems, overlooking critical quality and intellectual property (IP) factors can lead to significant operational, financial, and legal risks. Being aware of these common pitfalls helps ensure a reliable, compliant, and cost-effective investment.

Poor Component Quality and Build Standards

Many suppliers cut costs by using substandard pneumatic components (cylinders, valves, fittings), low-grade materials, or inadequate manufacturing processes. This results in frequent breakdowns, inconsistent performance, and higher maintenance costs. Always verify material specifications, pressure ratings, and adherence to international quality standards (e.g., ISO 8573 for air quality, ISO 9001 certification).

Lack of System Integration Expertise

Pneumatic palletizing systems must integrate seamlessly with existing conveyors, sensors, and control systems. Sourcing from vendors without proven integration experience often leads to compatibility issues, extended downtime, and costly retrofits. Ensure the supplier provides detailed interface documentation and has a track record with similar production environments.

Inadequate Documentation and Technical Support

Weak technical documentation—such as missing schematics, control logic diagrams, or maintenance manuals—hamstrings in-house teams when troubleshooting. Similarly, poor post-sale support can delay repairs and increase downtime. Insist on comprehensive documentation packages and clear service-level agreements (SLAs) before purchase.

Ignoring Intellectual Property Rights

Using a system that incorporates unlicensed or copied designs, software, or patented mechanisms exposes your company to legal action and potential product recalls. Always confirm the supplier owns or has legitimate rights to the technology used. Conduct due diligence on patents, especially for unique motion control or gripper designs.

Insufficient Protection of Your Own IP

When customizing a system or providing proprietary process data, ensure non-disclosure agreements (NDAs) are in place and that the contract clearly assigns ownership of any co-developed IP to your organization. Without these safeguards, suppliers may reuse your designs for competitors.

Overlooking Future Scalability and Obsolescence

Cheap or outdated pneumatic systems may lack modular design or use obsolete components, making upgrades difficult or impossible. This limits future expansion and forces premature replacement. Evaluate the supplier’s roadmap and component availability to ensure long-term support and scalability.

By proactively addressing these quality and IP-related pitfalls, businesses can secure robust, legally sound, and future-ready pneumatic palletizing solutions.

Logistics & Compliance Guide for Pneumatic Palletizing

Overview of Pneumatic Palletizing Systems

Pneumatic palletizing leverages compressed air to power robotic arms, grippers, and conveyors for automated stacking of goods onto pallets. These systems are valued for their reliability, low maintenance, and suitability in environments where electrical hazards are a concern. Understanding the logistics and compliance requirements is essential for safe, efficient, and regulatory-compliant operations.

Equipment Selection and Installation

Choose pneumatic palletizing equipment based on payload, cycle speed, footprint, and integration with existing material handling systems. Ensure compatibility with facility air supply (pressure, volume, and quality). Install systems according to manufacturer specifications, including proper anchoring, air line routing, and exhaust management. Conduct a site risk assessment prior to installation to identify potential hazards.

Safety Compliance Standards

Pneumatic palletizing systems must comply with relevant safety standards such as:

– OSHA 29 CFR 1910 Subpart O (Machinery and Machine Guarding)

– ANSI B15.1 – Safety Standards for Mechanical Power Transmission Apparatus

– ISO 13849-1 (Safety of machinery – Safety-related parts of control systems)

Implement proper guarding, emergency stop functions, lockout/tagout (LOTO) procedures, and pressure relief mechanisms. Conduct regular safety audits and maintain documentation of compliance.

Air Supply and Pneumatic System Requirements

Ensure a clean, dry, and stable compressed air supply. Use filters, regulators, and lubricators (FRL units) to protect pneumatic components from moisture, particulates, and oil contamination. Maintain system pressure within recommended ranges (typically 80–100 psi). Monitor air quality and pressure regularly to prevent equipment failure or inconsistent performance.

Maintenance and Operational Procedures

Develop a preventive maintenance schedule for valves, cylinders, air lines, filters, and control systems. Train personnel on proper operation, troubleshooting, and shutdown protocols. Keep detailed logs of maintenance activities, component replacements, and system performance. Use standardized operating procedures (SOPs) to minimize human error and ensure consistency.

Environmental and Workplace Considerations

Control noise from pneumatic exhaust using mufflers or silencers to meet OSHA noise exposure limits (e.g., 90 dBA over 8 hours). Ensure proper ventilation in areas with high concentrations of pneumatic equipment. Address potential slip hazards from oil mist or lubricants. Implement energy-efficient practices, such as using regulators to minimize air consumption.

Regulatory Compliance and Documentation

Maintain records of equipment certifications, risk assessments, safety training, and inspection reports. Comply with local, state, and federal regulations related to workplace safety, emissions, and machine operation. For international operations, adhere to standards such as CE marking (EU), CSA (Canada), or other regional requirements.

Integration with Supply Chain Logistics

Synchronize pneumatic palletizing systems with warehouse management systems (WMS) and enterprise resource planning (ERP) platforms for real-time tracking of palletized goods. Ensure compatibility with downstream logistics processes such as stretch wrapping, labeling, and automated guided vehicles (AGVs). Optimize pallet patterns and load stability for safe transportation.

Training and Personnel Qualifications

Provide comprehensive training for operators and maintenance staff on system functionality, safety protocols, and emergency response. Ensure personnel understand pneumatic system hazards, including high-pressure air, pinch points, and uncontrolled motion. Maintain training records and conduct periodic refresher courses.

Risk Management and Contingency Planning

Identify potential failure modes such as air leaks, valve malfunctions, or control system errors. Implement redundancy where critical, and establish procedures for rapid response and system recovery. Conduct regular drills for equipment failure and safety incidents to ensure preparedness.

In conclusion, sourcing pneumatic palletizing systems offers a reliable, efficient, and cost-effective solution for automating material handling in manufacturing and logistics operations. These systems provide consistent performance in repetitive palletizing tasks, particularly in environments where electrical or hydraulic systems may pose safety or maintenance concerns. The advantages include simplicity of design, ease of maintenance, durability in harsh conditions, and reduced energy consumption. However, careful consideration must be given to factors such as compressed air availability, noise levels, and application-specific requirements when selecting a pneumatic solution.

To ensure optimal results, it is essential to partner with experienced suppliers who can provide tailored designs, technical support, and after-sales service. Conducting a thorough assessment of throughput needs, load specifications, and integration capabilities will further enhance system effectiveness. Overall, when properly implemented, pneumatic palletizing can significantly improve operational efficiency, reduce labor costs, and enhance workplace safety, making it a valuable investment for many industrial applications.