The global plywood market is experiencing robust growth, driven by increasing demand in interior applications such as wall paneling, furniture, and architectural finishes. According to Grand View Research, the global plywood market size was valued at USD 36.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030, fueled by rising construction activities and consumer preference for aesthetically pleasing, durable interior solutions. Interior wall plywood, in particular, has gained traction due to its versatility, ease of installation, and ability to enhance acoustic and thermal insulation. As urbanization accelerates and modular interior design gains popularity—especially in residential and commercial spaces across Asia-Pacific and North America—manufacturers are innovating with moisture-resistant, eco-friendly, and decorative-grade plywood options. With such momentum, identifying leading suppliers that combine quality, sustainability, and design innovation is essential for architects, designers, and contractors. Based on product performance, market presence, and customer reviews, here are the top 9 plywood manufacturers excelling in interior wall applications.

Top 9 Plywood For Walls Interior Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Columbia Forest Products

Domain Est. 1996

Website: columbiaforestproducts.com

Key Highlights: Discover Columbia Forest Products, North America’s largest manufacturer of sustainable, decorative hardwood plywood and veneers for residential and commercial…

#2 Buy Plywood Wholesale Direct from Manufacturer

Domain Est. 2018

Website: plyterra.com

Key Highlights: Plyterra is a trusted plywood manufacturer with over 20 years of expertise. Offering a wide range of plywood grades and types for wholesale buyers….

#3 States Industries

Domain Est. 1996

Website: statesind.com

Key Highlights: States Industries manufactures custom, environmentally conscious plywood panels in a range of non-standard sizes, finished or unfinished….

#4 FalconPly™ Hardwood Plywood

Domain Est. 1996

Website: timberproducts.com

Key Highlights: FalconPly is a premium hardwood plywood for furniture, cabinetry & architectural applications offering strength, durability, and sustainable CARB-compliant ……

#5 Atlantic Plywood

Domain Est. 1999

Website: atlanticplywood.com

Key Highlights: Wholesale Supplier of Hardwood Plywood, Panel Product and More! Since our inception in 1974, Atlantic Plywood Corporation has prided itself on delivering ……

#6 Plywood Company

Domain Est. 1999

Website: plywoodcompany.com

Key Highlights: Plywood Company of Fort Worth is one of leading and largest single-location, independent family owned, operated GREEN plywood supply and lumber distributor ……

#7 Chesapeake Plywood

Domain Est. 2000

Website: chesapeakeplywood.com

Key Highlights: Our architectural plywood pairs high-grade cores with stunning, hand-selected veneers—designed for projects where visual impact and performance matter most….

#8 Products

Domain Est. 2006

Website: nashvilleplywood.com

Key Highlights: Find your building solutions with our premium wood products, including domestic and imported plywood, lumber, and innovative cabinetry at Nashville Plywood….

#9 Interior Hardwood Plywood Panels for MCM Homes

Domain Est. 2014

Website: vintageplywood.com

Key Highlights: Vintage Plywood Millworks to produce the unique plywood, paneling, and siding specific to homes built in the mid-century….

Expert Sourcing Insights for Plywood For Walls Interior

H2: 2026 Market Trends for Plywood for Walls Interior

The global market for interior wall plywood is poised for significant transformation by 2026, driven by evolving consumer preferences, technological advancements, and sustainability imperatives. As homeowners and designers increasingly prioritize aesthetics, durability, and eco-conscious materials, plywood engineered specifically for interior wall applications is gaining traction across residential, commercial, and hospitality sectors. The following analysis outlines key trends shaping the 2026 landscape.

1. Rising Demand for Aesthetic Versatility

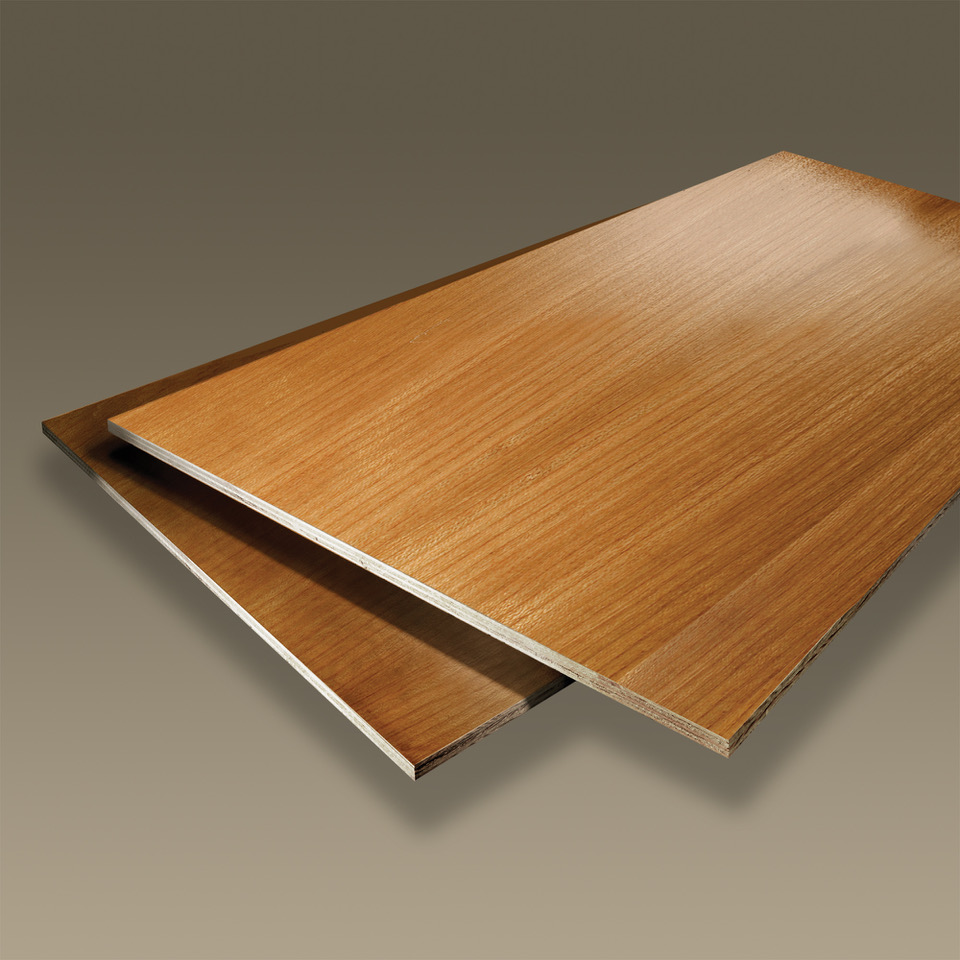

By 2026, interior plywood will no longer be seen merely as a structural substrate but as a design-forward finishing material. Manufacturers are responding to demand for high-quality veneers—such as birch, walnut, teak, and bamboo—that offer natural grain patterns and warm textures. Pre-finished and decorative plywood panels with matte, textured, or UV-coated surfaces will dominate, enabling quick installation and minimal maintenance. Customizable options, including laser-cut patterns and 3D relief designs, will further expand design possibilities.

2. Sustainability and Eco-Certification as Market Drivers

Environmental concerns are reshaping material selection. In 2026, consumers will increasingly favor plywood products certified by FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification). Low-formaldehyde or formaldehyde-free adhesives (e.g., E0 or E1 emission standards) will become standard, especially in health-sensitive spaces like homes and healthcare facilities. Recycled wood fiber integration and biobased binders will also emerge as innovative solutions to reduce carbon footprints.

3. Growth in Prefabricated and Modular Construction

The rise of modular and prefabricated buildings will boost demand for dimensionally stable, ready-to-install interior plywood wall panels. These panels, often pre-insulated and pre-wired, align with faster construction timelines and reduced on-site waste—key benefits for urban developments and affordable housing projects. In 2026, supply chains will increasingly support B2B integration with prefab manufacturers.

4. Technological Integration and Smart Surfaces

Interior plywood walls may evolve into smart surfaces by 2026. Embedded heating elements, acoustic dampening layers, or compatibility with IoT-enabled lighting and sensors could become premium offerings. Nanocoatings for moisture resistance, anti-microbial properties, and self-cleaning abilities will enhance functionality, especially in high-humidity areas like bathrooms and kitchens.

5. Regional Market Expansion

Asia-Pacific will remain the largest market due to rapid urbanization, especially in India, China, and Southeast Asia, where rising disposable incomes fuel demand for modern interior finishes. North America and Europe will focus on renovation and retrofitting projects, favoring sustainable and design-centric plywood solutions. Meanwhile, the Middle East and Africa will witness growing adoption in luxury developments and hospitality interiors.

6. Competitive Landscape and Innovation

Leading manufacturers such as Century Ply, Green Ply, and Kronospan will intensify R&D efforts to differentiate products through innovation in finishes, durability, and environmental performance. Strategic partnerships with interior designers and architects will become crucial for market penetration. Digital visualization tools (e.g., AR/VR apps) will enable consumers to preview plywood wall designs pre-purchase, enhancing customer experience.

Conclusion

By 2026, interior wall plywood will be redefined as a high-value, design-integrated material that combines beauty, functionality, and sustainability. Success in this market will hinge on innovation, eco-compliance, and alignment with global construction trends. Businesses that adapt to these shifts will capture significant growth opportunities in the evolving interior design ecosystem.

Common Pitfalls When Sourcing Plywood for Interior Walls (Quality & Indoor Pollution)

Sourcing the right plywood for interior wall applications requires careful attention to both structural quality and indoor air quality (IAQ). Overlooking key factors can lead to aesthetic failures, structural issues, and health concerns. Below are common pitfalls to avoid:

Choosing the Wrong Plywood Grade

One of the most frequent mistakes is selecting a plywood grade unsuitable for visible interior surfaces. Lower grades (e.g., D or C) often contain knots, patches, and voids that become glaringly obvious once installed and finished. For interior walls, especially those that will be painted or left exposed, opt for higher appearance grades like A, B, or ACX to ensure a smooth, consistent surface.

Ignoring Moisture Resistance in Humid Areas

Using standard interior plywood in high-moisture areas like bathrooms or laundry rooms can lead to swelling, delamination, and mold growth. Always consider moisture-resistant options like MR (Moisture Resistant) or marine-grade plywood in damp environments—even for walls—to prevent long-term damage and maintain indoor air quality.

Overlooking Adhesive Type and Formaldehyde Emissions

The adhesive used in plywood manufacturing significantly impacts indoor air pollution. Plywood containing urea-formaldehyde (UF) resins can off-gas formaldehyde over time, contributing to poor IAQ and potential health risks. Always request low-emission or formaldehyde-free alternatives such as:

- E0 or E1 emission standards (common in Europe and increasingly adopted globally)

- CARB Phase 2 (California Air Resources Board) compliant products

- NAF (No Added Formaldehyde) certified plywood

Verify certifications through product documentation to ensure compliance.

Failing to Inspect for Consistent Core Quality

A smooth face veneer can mask a poorly constructed core. Gaps, uneven layers, or soft spots in the core can cause warping, sagging, or poor screw-holding ability in wall installations. Always inspect sheet edges and request cross-section samples when possible to ensure a void-free, consistent core.

Neglecting VOC Content Beyond Formaldehyde

While formaldehyde is a primary concern, other volatile organic compounds (VOCs) from finishes, sealants, or even the wood itself can impact indoor air quality. Choose plywood that has been tested for total VOC emissions and consider post-installation sealing with low-VOC sealants to further minimize off-gassing.

Skipping Acclimatization Before Installation

Plywood not properly acclimated to the installation environment can expand or contract after fitting, leading to gaps, buckling, or stress on joints. Always store sheets in the installation space for at least 48–72 hours under controlled temperature and humidity conditions before use.

Assuming All “Interior” Plywood is Safe for Living Spaces

Not all interior plywood is designed with occupant health in mind. Some budget options use adhesives and treatments unsuitable for bedrooms, living rooms, or other frequently occupied areas. Always confirm the product’s suitability for residential interiors and request material safety data sheets (MSDS) or environmental product declarations (EPDs).

By avoiding these common pitfalls, you can ensure that the plywood used on interior walls performs well aesthetically and structurally while supporting a healthy indoor environment.

Logistics & Compliance Guide for Plywood for Walls Interior

When sourcing and installing interior wall plywood, understanding the logistics and compliance requirements is essential for timely delivery, cost efficiency, and adherence to regulations. This guide outlines key considerations for safe, legal, and efficient handling of plywood used in interior wall applications.

Sourcing and Supplier Selection

Choose suppliers with a proven track record of delivering high-quality interior-grade plywood that meets industry standards. Verify that materials are certified for interior use (e.g., CARB2, EPA TSCA Title VI compliant) and suitable for wall applications. Consider proximity to reduce shipping costs and lead times, and confirm the supplier’s ability to provide documentation for chain-of-custody and sustainability (e.g., PEFC or FSC certification, if required).

Packaging and Handling Requirements

Interior plywood is typically delivered in stacked sheets protected by edge banding and shrink-wrapped or palletized to prevent moisture absorption and physical damage. Ensure that packaging is intact upon delivery. Handle sheets using forklifts or panel lifters—never drag or drop panels. Store plywood flat on a level, dry surface off the ground, and under cover to prevent warping, swelling, or contamination.

Transportation and Delivery

Coordinate delivery schedules to match project timelines and on-site storage capacity. Use enclosed or covered trucks to protect plywood from weather during transit. Confirm that delivery vehicles can access the site, especially in urban or restricted areas. For large orders, consider phased deliveries to minimize on-site storage needs and reduce risk of damage.

Import/Export and Trade Compliance (if applicable)

If importing plywood, ensure compliance with destination country regulations. For U.S. imports, confirm compliance with the Lacey Act and EPA TSCA Title VI for formaldehyde emissions. For EU markets, adhere to CE marking requirements and REACH regulations. Provide accurate Harmonized System (HS) codes (e.g., 4412.31 or 4412.32 for plywood) and complete customs documentation, including certificates of origin and material safety data sheets (MSDS), if requested.

Building Code and Safety Compliance

Verify that the plywood meets local building code requirements for interior wall use. While structural sheathing may require specific performance ratings, interior wall applications often require compliance with fire safety standards (e.g., ASTM E84 for surface burning characteristics). Use flame-retardant treated (FRT) plywood if mandated by code for certain occupancies or wall types.

Environmental and Indoor Air Quality Standards

Prioritize low-emitting materials to maintain healthy indoor air quality. Select plywood that complies with CARB Phase 2 (California Air Resources Board) or EPA TSCA Title VI standards for formaldehyde emissions. For green building certifications (e.g., LEED, WELL), consider using plywood with third-party sustainability certifications (FSC, SCS Indoor Advantage Gold) to contribute toward credits.

On-Site Storage and Job Site Management

Store plywood in a dry, well-ventilated area away from direct sunlight and moisture sources. Elevate sheets on wood spacers to allow air circulation. Limit exposure to humidity and temperature extremes. Protect from construction site contaminants such as dust, adhesives, or overspray. Rotate stock using a first-in, first-out (FIFO) approach to prevent aging or deterioration.

Waste Management and Sustainability

Plan for efficient cutting layouts to minimize off-cuts and waste. Recycle or responsibly dispose of packaging materials (e.g., plastic wrap, wood pallets). Salvage usable scraps for blocking or backing. Comply with local regulations regarding wood waste disposal, especially if treated or coated with finishes.

Documentation and Recordkeeping

Maintain records of material certifications, safety data sheets (SDS), delivery receipts, and compliance documentation. These are essential for audits, warranty claims, and building inspections. For commercial or institutional projects, comprehensive documentation may be required for final occupancy approval.

By adhering to this logistics and compliance guide, contractors, designers, and project managers can ensure that interior wall plywood is handled efficiently, installed correctly, and meets all regulatory and performance standards.

Conclusion for Sourcing Plywood for Interior Walls:

Sourcing plywood for interior wall applications requires a balance between aesthetics, durability, cost, and sustainability. After evaluating various options, it is clear that high-quality, FSC-certified plywood with a smooth finish—such as birch, oak, or maple veneer—is ideal for achieving a modern, natural look while ensuring environmental responsibility. Moisture-resistant plywood (such as MR grade) should be selected in areas with higher humidity, like bathrooms or kitchens, to prevent warping and degradation.

Additionally, considering thickness (typically 6–12 mm) and panel size can optimize installation efficiency and minimize waste. Working with reputable suppliers who offer consistent quality, accurate grading, and reliable lead times is crucial for project success. Prefinished or ready-to-paint plywood options can reduce labor costs and improve finish uniformity.

In conclusion, careful selection based on design intent, performance requirements, and sustainable sourcing practices ensures that plywood not only enhances the interior ambiance but also delivers long-term value and durability in wall applications.