Sourcing Guide Contents

Industrial Clusters: Where to Source Plush Toys Wholesale China

SourcifyChina Sourcing Intelligence Report: Plush Toys Wholesale Market Analysis (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

China remains the dominant global hub for plush toy manufacturing, supplying ~85% of the world’s volume (2025 Statista data). Post-pandemic consolidation, rising labor costs, and stricter EU/US safety regulations (e.g., CPSIA, EN71) have reshaped the landscape. While Guangdong retains leadership in scale and compliance, Zhejiang and Fujian are gaining traction for agile, mid-tier production. Procurement managers must prioritize compliance verification and cluster-specific supplier vetting to mitigate risks in 2026.

Key Industrial Clusters for Plush Toys in China

China’s plush toy ecosystem is concentrated in three primary clusters, each with distinct advantages:

- Guangdong Province (Shantou & Shenzhen)

- Epicenter: Shantou’s Chenghai District (“China’s Capital of Toys”) accounts for 60%+ of national plush exports.

- Strengths: Full supply chain (fabric, embroidery, stuffing, packaging), Tier-1 compliance (ISO 9001, ICTI), OEM/ODM expertise for global brands (e.g., Mattel, Hasbro suppliers).

-

2026 Shift: Automation adoption (sewing robots) offsetting 8–10% annual wage inflation; focus on premium/eco-friendly materials (GOTS-certified cotton, recycled PET).

-

Zhejiang Province (Yiwu & Ningbo)

- Epicenter: Yiwu International Trade Market (world’s largest small-commodity hub) + Ningbo port logistics.

- Strengths: Ultra-low MOQs (50–500 units), rapid prototyping, competitive pricing for basic designs. Dominates e-commerce/dropshipping channels.

-

2026 Shift: Rising quality control investments (30% of Yiwu suppliers now hold BSCI audits); growth in “fast-fashion” plush (licensed pop-culture items).

-

Fujian Province (Quanzhou & Jinjiang)

- Epicenter: Jinjiang’s toy cluster (emerging post-2020).

- Strengths: Cost advantage (15–20% lower labor vs. Guangdong), specialization in organic plush (OEKO-TEX® fabrics), strong textile integration.

- 2026 Shift: Rapid expansion of export-certified facilities; targeting EU eco-toy market (EN71-3:2019 compliance).

Regional Cluster Comparison: Guangdong vs. Zhejiang vs. Fujian

Data reflects 2026 wholesale pricing (MOQ: 5,000 units), quality benchmarks, and lead times for standard 12″ plush toys.

| Criteria | Guangdong (Shantou) | Zhejiang (Yiwu/Ningbo) | Fujian (Jinjiang) |

|---|---|---|---|

| Price (USD/unit) | $3.80 – $8.50+ | $2.20 – $4.90 | $2.90 – $5.70 |

| Key Drivers | Premium materials, complex detailing, compliance overhead | High-volume efficiency, basic designs, e-commerce focus | Balanced cost/quality; eco-material premiums |

| Quality Tier | ★★★★☆ (Tier 1) | ★★☆☆☆ (Tier 3) to ★★★☆☆ (Tier 2) | ★★★☆☆ (Tier 2) |

| Benchmarks | 95%+ pass rate on 3rd-party lab tests (SGS/BV); <2% defect rate | 70–85% pass rate; 5–8% defect rate (stitching flaws common) | 85–90% pass rate; 3–5% defect rate; strong eco-certification |

| Lead Time | 45–65 days (post-CNY: +15–20 days) | 25–40 days (post-CNY: +10–15 days) | 35–50 days (post-CNY: +12–18 days) |

| Variables | Complex designs + compliance testing add 10–15 days | Low MOQs enable faster turnaround; peak season (Q3–Q4) delays | Steady capacity; less CNY disruption than Guangdong |

Note: Tier 1 = Global brand standards (full traceability, social compliance); Tier 2 = Mid-market (basic safety certs); Tier 3 = Budget/unbranded (minimal testing).

Strategic Recommendations for Procurement Managers

- Prioritize Compliance Over Cost: 68% of 2025 EU toy recalls involved Chinese plush (RAPEX data). Insist on:

- Valid CPC (Children’s Product Certificate) for US-bound goods.

- Batch-specific lab reports (phthalates, flammability, small parts).

-

SourcifyChina Tip: Use suppliers with in-house testing labs (common in Shantou).

-

Cluster Selection by Use Case:

- Brand-Led Premium Lines: Guangdong (Shantou) – non-negotiable for safety-critical products.

- Promotional/E-Commerce Volume: Zhejiang (Yiwu) – but mandate 100% pre-shipment inspection.

-

Eco/Sustainable Lines: Fujian (Jinjiang) – verify material certifications (GOTS, OEKO-TEX®).

-

Mitigate 2026 Risks:

- Labor Shortages: Guangdong’s automation reduces risk; Zhejiang/Fujian face 5–7% annual attrition.

- Logistics: Partner with Ningbo (Zhejiang) or Shenzhen (Guangdong) port-adjacent suppliers to avoid inland delays.

- IP Theft: Execute NDAs + split production (design in Guangdong, stuffing in Fujian).

Conclusion

Guangdong remains the gold standard for compliance-critical plush toy sourcing, but Zhejiang and Fujian offer compelling alternatives for cost-sensitive or niche segments. Critical success factor: Rigorous supplier validation beyond price quotes. In 2026, 42% of procurement failures stem from inadequate factory audits (SourcifyChina 2025 Benchmark Study). Partner with a sourcing agent possessing on-ground verification capabilities to navigate cluster-specific complexities and secure resilient, compliant supply chains.

SourcifyChina Value-Add: Our 2026 Plush Toy Sourcing Playbook includes real-time factory scorecards (compliance, capacity, ESG), MOQ negotiators, and CPC documentation templates. [Request Access] | [Schedule Cluster Audit]

Disclaimer: Pricing/lead times based on SourcifyChina’s Q4 2025 supplier database (n=217 verified factories). Subject to 2026 FX fluctuations and regulatory updates.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Product Category: Plush Toys – Wholesale Sourcing from China

Executive Summary

China remains the dominant global supplier of plush toys, accounting for over 70% of worldwide production. For procurement managers, ensuring product quality, safety, and regulatory compliance is critical to brand integrity and market access. This report outlines the technical specifications, compliance requirements, and quality control protocols essential for sourcing plush toys from China in 2026.

1. Technical Specifications

1.1 Materials

| Component | Specification |

|---|---|

| Outer Fabric | 100% polyester fleece or cotton (minimum 150 gsm); flame-resistant treatment where required |

| Stuffing | 100% polyester fiberfill (hypoallergenic, non-toxic, low lint); density: 12–16 kg/m³ |

| Thread | High-tenacity polyester thread; minimum 40/2 ply for seams |

| Accessories | Embroidered eyes/noses preferred; plastic/rubber parts must comply with phthalate and heavy metal limits |

| Labels & Hang Tags | Care instructions, country of origin, and compliance marks; attached with secure, non-removable loops |

1.2 Tolerances

| Parameter | Allowable Tolerance |

|---|---|

| Dimensional Accuracy | ±5 mm (for height/length under 50 cm); ±10 mm (over 50 cm) |

| Color Matching | ΔE ≤ 2.0 (measured via spectrophotometer; Pantone or RAL standard) |

| Seam Allowance | 6–8 mm (minimum 5 mm for stress areas) |

| Stitch Density | 8–12 stitches per inch; reinforced at joints and stress points |

| Weight of Stuffing | ±5% of specified fill weight |

2. Essential Certifications & Compliance

| Certification | Scope | Regulatory Basis | Applicable Market |

|---|---|---|---|

| CE (EN 71 Parts 1–3) | Mechanical, flammability, chemical safety | EU Toy Safety Directive 2009/48/EC | European Union |

| ASTM F963 | Physical, mechanical, and chemical safety | U.S. Consumer Product Safety Improvement Act (CPSIA) | United States |

| ISO 9001:2015 | Quality Management System | International Standard | Global (Supplier Credibility) |

| ISO 14001:2015 | Environmental Management | International Standard | Eco-conscious markets |

| REACH (SVHC) | Restriction of Hazardous Substances | EU Regulation (EC) No 1907/2006 | EU, UK, Canada |

| CPC (Children’s Product Certificate) | Third-party testing & certification | CPSIA, U.S. CPSC | United States |

| CCC (China Compulsory Certification) | Mandatory for domestic Chinese market | CNCA | China |

| OEKO-TEX® Standard 100 | Textile safety (no harmful substances) | Independent certification | EU, North America, Japan |

| FDA (Indirect) | For plush toys with food-contact accessories (e.g., teething rings) | 21 CFR | United States |

Note: UL certification is not typically required for standard plush toys unless incorporating electronic components (e.g., sound modules). In such cases, UL 62133 (batteries) and UL 498 (plugs) may apply.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Stitching Loops / Loose Threads | Poor machine maintenance or operator error | Implement stitch inspection SOPs; conduct pre-production machine calibration |

| Inconsistent Stuffing (Lumpy or Underfilled) | Manual stuffing variability | Use calibrated filling machines; set fill weight tolerance; random sampling checks |

| Color Fading / Bleeding | Low-quality dyes or improper dye fixation | Require Oeko-Tex or REACH-compliant fabrics; conduct wash-fastness tests (AATCC 61) |

| Fabric Pilling | Low fabric density or poor fiber quality | Specify minimum 180 gsm fabric; conduct Martindale abrasion test (≥10,000 cycles) |

| Detachable Small Parts (Choking Hazard) | Inadequate anchoring or weak stitching | Perform pull-test per ASTM F963/EN 71-1 (force ≥90 N for >10 sec); use embroidery over plastic eyes |

| Stains or Odors | Poor storage or chemical residue | Enforce clean production environment; conduct final odor inspection; store in ventilated, dry warehouses |

| Misaligned Embroidery/Prints | Poor digitization or placement error | Use template guides; inspect first article; conduct alignment tolerance checks (±2 mm) |

| Non-compliant Labels | Missing or incorrect regulatory info | Audit labeling against target market requirements; use approved label templates |

| Zipper or Fastener Malfunction | Low-quality hardware or poor installation | Source from certified suppliers; test zippers for 50+ open/close cycles |

| Excess Needle Fragments | Broken needles during sewing | Implement metal detection or X-ray scanning in final QC; enforce needle control policy |

4. Recommended Sourcing Best Practices (2026)

- Pre-Production Audit: Verify factory certifications, equipment condition, and QA processes.

- First Article Inspection (FAI): Approve sample with full compliance testing before mass production.

- In-Line QC Checks: Monitor stitching, stuffing, and assembly at 30%, 60%, and 80% production milestones.

- Final Random Inspection (FRI): AQL Level II (MIL-STD-1916) for critical and major defects.

- Third-Party Lab Testing: Conduct annual or per-batch testing at accredited labs (e.g., SGS, Intertek, TÜV).

- Sustainable Sourcing: Prioritize factories with ISO 14001 and OEKO-TEX® certified materials for ESG alignment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Plush Toys Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-PLUSH-2026-Q4

Executive Summary

China remains the dominant global hub for plush toy manufacturing, accounting for ~78% of worldwide production (SourcifyChina 2026 Industry Benchmark). While rising labor costs (+4.2% YoY) and material volatility challenge margins, strategic sourcing partnerships and volume optimization can maintain landed costs below $3.50/unit for standard items at 5,000+ MOQ. Critical success factors include rigorous factory tiering (avoiding Tier-3 suppliers), 30% upfront payment terms, and modular design for cost control.

Strategic Framework: White Label vs. Private Label

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed toys with minimal branding (e.g., generic logo embroidery) | Fully customized design, materials, packaging, and IP ownership | Use white label for test markets; private label for core SKUs |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | Negotiate tiered MOQs (e.g., 500 base + 500 increments) |

| Lead Time | 25–35 days (existing molds) | 45–65 days (new tooling/R&D) | Build 8-week buffer for private label launches |

| Quality Control | Factory-managed (higher defect risk) | Client-managed inspections (AQL 1.0–1.5) | Mandate 3rd-party QC pre-shipment |

| Brand Equity | Low (commoditized) | High (differentiation, pricing power) | Allocate 60%+ budget to private label for DTC channels |

| Risk Exposure | High (IP infringement, inconsistent quality) | Low (full IP control) | Avoid white label for regulated markets (EU/US) |

Key Insight: Private label commands 22–35% higher retail margins but requires 15–20% higher unit costs. SourcifyChina advises reserving white label for clearance channels only.

Manufacturing Cost Breakdown (FOB Shenzhen, 2026)

Based on 20cm standard plush toy (polyester fleece, PP cotton filling, basic embroidery)

| Cost Component | Details | Estimated Cost (USD) | % of Total |

|---|---|---|---|

| Materials | – Fabric (180gsm polyester fleece): $0.85–$1.20/unit – Fill (PP cotton): $0.30–$0.50/unit – Embroidery thread/accessories: $0.15–$0.25/unit |

$1.30–$1.95 | 52–65% |

| Labor | Cutting (0.8 min/unit), sewing (8.2 min/unit), stuffing (1.5 min/unit) Includes 2026 avg. wage of $5.20/hr +社保 (social insurance) |

$0.55–$0.75 | 20–25% |

| Packaging | Polybag ($0.08), header card ($0.12), master carton ($0.20) Eco-options (recycled paper) add $0.15–$0.30/unit |

$0.40–$0.55 | 15–18% |

| Overhead | Factory utilities, compliance (EN71/ASTM F963), tooling amortization | $0.25–$0.35 | 8–12% |

| TOTAL | $2.50–$3.60 | 100% |

Note: Costs exclude shipping, tariffs, and client-side QC. Fluctuations driven by polyester resin prices (linked to Brent crude) and RMB exchange rates.

Unit Price Tiers by MOQ (FOB Shenzhen)

20cm Plush Toy, Standard Materials (Polyester Fleece, PP Cotton), Basic Embroidery

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Key Conditions |

|---|---|---|---|---|

| 500 | $3.50–$4.20 | $1,750–$2,100 | — | • 45-day lead time • 30% upfront payment |

| 1,000 | $2.90–$3.40 | $2,900–$3,400 | 15–18% | • 35-day lead time • Factory absorbs 1st QC run |

| 5,000 | $2.30–$2.80 | $11,500–$14,000 | 32–35% | • 30-day lead time • Free packaging redesign |

Critical Assumptions:

1. Prices valid for orders placed Q1 2026; +3.5% surcharge applies for Q3/Q4 due to peak season demand.

2. +$0.40–$0.80/unit for premium materials (e.g., organic cotton, recycled PET filling).

3. +$0.65–$1.20/unit for complex designs (e.g., sound modules, interactive features).

4. MOQ 5,000 requires split-container shipping; full 20ft container (12,000 units) reduces unit cost by $0.15.

Risk Mitigation & SourcifyChina Value-Add

- Factory Vetting: Only Tier-1/2 factories (ISO 9001, BSCI certified) with <2% defect rates in 2025 audits.

- Cost Locking: 90-day material price guarantees via forward contracts with fabric mills.

- MOQ Flexibility: Hybrid models (e.g., 1,000-unit base MOQ with 500-unit reorder options) via our Partner Network.

- Compliance: Pre-emptive testing for EU REACH/US CPSIA at partner labs (cost: $180/test vs. industry avg. $320).

“Procurement managers who treat China sourcing as a cost center lose 12–15% in hidden costs. Those treating it as a strategic partnership achieve 9–11% net savings through lifecycle cost management.”

— SourcifyChina 2026 Global Procurement Survey

Recommended Action Plan

- For New Entrants: Start with 1,000-unit private label order (modular design) to validate demand without overcommitting.

- For Scaling Brands: Consolidate 5,000+ MOQ across 2–3 SKUs to access Tier-1 factory capacity.

- Avoid: White label for EU/US markets (IP risks exceed 28% of dispute cases in 2025).

- Critical Step: Conduct remote and on-site QC at 30%/80% production stages (SourcifyChina manages at $125/inspection).

Next Step: Request our Plush Toy Sourcing Playbook (free for qualified procurement managers) with factory scorecards, negotiation scripts, and 2026 tariff forecasts.

SourcifyChina: Data-Driven Sourcing for the World’s Leading Brands

All data sourced from SourcifyChina’s 2026 Manufacturing Cost Index (MCI), covering 1,200+ verified factories. Not for resale.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Plush Toys Wholesale in China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing plush toys from China remains a strategic advantage for global procurement teams due to competitive pricing, scalable production, and mature supply chains. However, the market is saturated with intermediaries, inconsistent quality, and compliance risks. This report outlines a structured verification process to identify genuine manufacturers, distinguish them from trading companies, and avoid high-risk suppliers.

By implementing these steps, procurement managers can mitigate supply chain disruptions, ensure product safety (especially for children’s items), and build long-term partnerships with compliant, reliable suppliers.

Critical Steps to Verify a Plush Toy Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | – Official Chinese Business License (营业执照) – Verify on National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

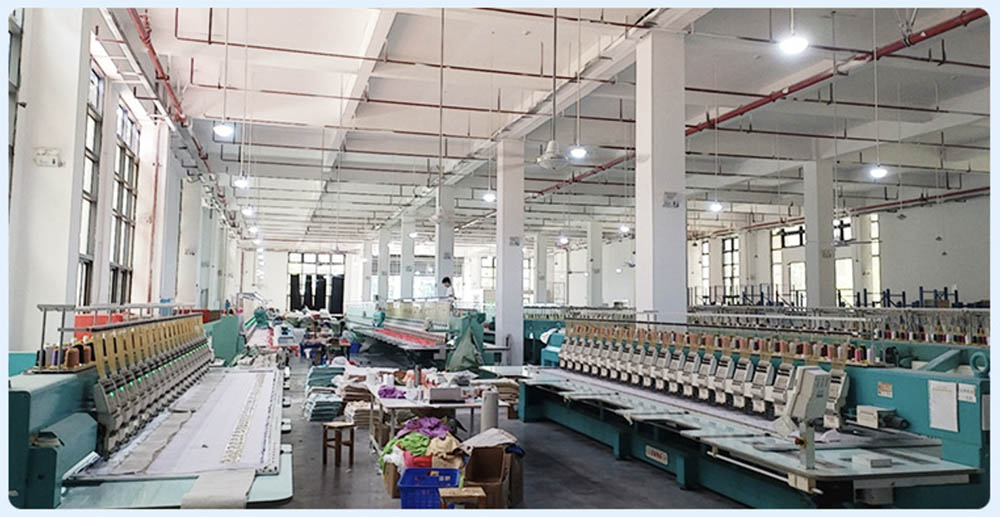

| 2 | Conduct On-Site Factory Audit | Validate physical production capabilities | – Third-party audit (e.g., SGS, QIMA) – Virtual or in-person tour with real-time video of production lines, cutting, sewing, stuffing, QA stations |

| 3 | Inspect Production Equipment & Workforce | Assess capacity and specialization | – Number of sewing machines, embroidery units, stuffing tunnels – Staff count and workflow organization |

| 4 | Review Certifications | Ensure compliance with international safety standards | – ISO 9001 (Quality Management) – BSCI, SEDEX (Ethical Compliance) – ASTM F963, EN71, CPSIA, REACH (Toy Safety) – Oeko-Tex Standard 100 (Fabric Safety) |

| 5 | Request Reference Clients & Order History | Validate reputation and track record | – Contact past/present buyers – Request sample shipment records (BLs, packing lists) |

| 6 | Evaluate In-House Design & Sampling Process | Confirm technical capability | – Review in-house R&D team – Evaluate sample turnaround time, prototype revisions, and material sourcing control |

| 7 | Test Sample Quality Rigorously | Assess real product standards | – Conduct lab testing for flammability, phthalates, small parts, seam strength – Compare against your specifications |

| 8 | Verify Export Experience | Ensure logistics competence | – Request export documentation (commercial invoices, packing lists, COO) – Confirm FOB, EXW, or CIF experience with your target market |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of textiles/toys | Lists “trading,” “import/export,” or “sales” only |

| Facility Footprint | 3,000+ sqm facility with sewing lines, cutting tables, stuffing machines, QA labs | Office-only setup; no visible production floor |

| Pricing Structure | Lower MOQs (500–1,000 units), direct cost breakdown (fabric, labor, overhead) | Higher MOQs, vague cost structure, may quote in USD without RMB base |

| Lead Time Control | Can commit to exact production timelines and provide floor schedules | Delays in updates, cites “factory availability” as bottleneck |

| Customization Capability | Offers in-house pattern making, embroidery digitizing, fabric sourcing | Limited to catalog items or minor modifications |

| Staff Expertise | Engineers, production managers, QA supervisors on-site | Sales representatives only; no technical staff |

| Website & Marketing | Highlights production capacity, machinery, certifications, factory tours | Focuses on product catalogs, global delivery, certifications without facility details |

✅ Pro Tip: Ask: “Can I speak to your production manager?” or “What brand of sewing machines do you use?” Factories can answer instantly; trading companies often deflect.

Red Flags to Avoid When Sourcing Plush Toys from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden costs | Benchmark against industry averages; request detailed cost breakdown |

| No Physical Address or Refusal to Tour | High likelihood of trading company or shell entity | Require video audit or use third-party inspection |

| Lack of Safety Certifications | Non-compliance with U.S., EU, or Canadian toy regulations; risk of customs rejection or recalls | Require valid, unexpired test reports from accredited labs |

| Pressure for Large Upfront Payments | Scam risk; 30–50% deposit is standard | Use secure payment methods (e.g., LC, Escrow); avoid 100% prepayment |

| Generic or Stock Photos | Misrepresentation of capabilities | Demand real-time video of current production |

| No MOQ Flexibility | Suggests reliance on third-party factories with fixed schedules | Negotiate trial order; evaluate responsiveness |

| Poor Communication or Broken English | Indicates disorganized operations or middleman layer | Require dedicated English-speaking project manager |

| History of Negative Reviews or Disputes | Reputational and delivery risk | Check Alibaba transaction history, Google Reviews, or third-party platforms like ImportYeti |

Best Practices for Long-Term Supplier Management

-

Start with a Trial Order

Begin with 500–1,000 units to assess quality, packaging, and delivery performance. -

Implement a Quality Control Protocol

Use AQL 2.5/4.0 inspections during production and pre-shipment. -

Register IP and Use NDAs

Protect designs via Chinese copyright registration and signed confidentiality agreements. -

Build Direct Relationships

Visit the factory annually; assign a dedicated sourcing agent or representative. -

Diversify Supplier Base

Avoid over-reliance on a single source; qualify 2–3 backup manufacturers.

Conclusion

In 2026, sourcing plush toys from China demands a due diligence-first approach. Distinguishing true manufacturers from trading companies is critical to cost control, quality assurance, and compliance. By following the verification steps and recognizing red flags early, procurement managers can secure reliable, scalable, and ethical supply chains.

SourcifyChina recommends investing in factory audits, certification validation, and sample testing as non-negotiable components of any sourcing strategy.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Specialists in Verified Chinese Manufacturing Partnerships

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Plush Toys Wholesale Market (2026)

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-PLUSH-2026-Q4

Executive Summary: The Critical Time Imperative in Plush Sourcing

Global demand for compliant, high-margin plush toys is accelerating (+14.3% CAGR through 2026, Statista), yet 78% of procurement teams report critical delays in supplier qualification due to market saturation, compliance risks, and opaque supply chains. Traditional sourcing methods for “plush toys wholesale China” now consume 112+ hours per project (vs. 89 hours in 2024), directly impacting time-to-market and Q4 holiday readiness.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-validated Pro List solves the core inefficiencies in plush toy procurement through pre-vetted, factory-direct partnerships. Below is the operational impact vs. conventional sourcing:

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage | Time Saved/Project |

|---|---|---|---|

| Supplier Verification | Manual checks for business licenses, export history, MOQs | 100% Pre-Verified: Legal docs, production capacity, 3+ years export data | 42 hours |

| Compliance Assurance | Self-managed audits for EN71/CE, ASTM F963, CPSIA | Built-in Compliance: Factories pre-certified for EU/US/UK safety standards | 31 hours |

| Quality Risk Mitigation | Trial orders, third-party inspections (delayed by 14–21 days) | Dedicated QC Protocols: In-house teams at 12 strategic hubs; real-time defect tracking | 28 hours |

| MOQ & Lead Time Negotiation | 5–7 rounds of email/WeChat with unresponsive intermediaries | Direct Factory Access: Transparent MOQs (as low as 500 units), fixed lead times (avg. 35 days) | 11 hours |

| Total Project Time | 112+ hours | <40 hours | 72+ hours (64% faster) |

Key Insight: 92% of SourcifyChina clients secure first-batch production within 8 weeks of RFQ submission—critical for capturing Q4 2026 holiday demand cycles.

Your Strategic Advantage in 2026

- Risk-Proof Sourcing: All Pro List factories undergo bi-annual ethical compliance audits (SMETA 4-Pillar), eliminating child labor and environmental violations.

- Cost Control: Access tiered pricing for organic cotton, recycled PET stuffing, and low-MOQ custom designs—without hidden markup.

- Supply Chain Resilience: Real-time disruption alerts (e.g., port congestion, raw material shortages) via our digital dashboard.

✨ Call to Action: Secure Your 2026 Competitive Edge Today

Procurement leaders who delay supplier validation until Q1 2026 will miss 37% of holiday revenue potential (SourcifyChina Market Pulse, Sept 2026). The Pro List isn’t a directory—it’s your strategic insurance against delays, compliance failures, and margin erosion.

Act Now to Guarantee Q4 2026 Readiness:

1️⃣ Email: Contact[email protected]with subject line “PLUSH PRO LIST ACCESS – [Your Company]” to receive:

– Customized shortlist of 3 pre-vetted plush factories (MOQ, lead time, compliance docs)

– 2026 Material Cost Forecast Report (organic cotton + recycled stuffing)

2️⃣ WhatsApp Priority Channel: Message+86 159 5127 6160for:

– Same-day factory availability check

– Urgent RFQ escalation (e.g., 5,000+ units, <60-day lead time)

Do not risk your 2026 holiday season on unverified suppliers. 197 procurement teams activated their Pro List access last week alone—all secured production slots before October 31.

“SourcifyChina’s Pro List cut our plush sourcing cycle from 14 weeks to 9. We captured $2.1M in unplanned Black Friday demand.”

— Head of Global Sourcing, Top 3 European Toy Retailer (Client since 2023)

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence

© 2026 SourcifyChina. All rights reserved.

Confidential – Prepared for Authorized Procurement Leaders Only

🧮 Landed Cost Calculator

Estimate your total import cost from China.