The global plexiglass (polymethyl methacrylate, or PMMA) market is experiencing steady growth, driven by increasing demand in construction, signage, and consumer goods—particularly in picture framing and display applications. According to Grand View Research, the global PMMA market size was valued at USD 5.37 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Rising consumer preference for lightweight, shatter-resistant alternatives to glass—especially in picture frames for homes, galleries, and commercial spaces—is a key factor fueling this trend. With durability, UV resistance, and optical clarity making plexiglass an ideal choice, manufacturers are innovating to meet performance and sustainability demands. As the market evolves, a select group of producers has emerged as leaders in supplying high-quality plexiglass sheets tailored for picture framing applications. These top nine manufacturers combine advanced production capabilities, consistent material quality, and strong distribution networks to serve a growing international clientele.

Top 9 Plexiglass Sheets For Picture Frames Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Acrylic

Domain Est. 1997

Website: meyerplastics.com

Key Highlights: Acrylic Clear Extruded Sheet. Clear extruded acrylic sheet is lighter weight and stronger than glass. It is also clearer than glass, and more UV resistant….

#2 CRL

Domain Est. 1995

Website: crlaurence.com

Key Highlights: The leading full-service provider of architectural metals, glass fittings & professional-grade glazing supplies. Shop CRL’s architectural hardware today….

#3 Accessories: Acrylic (Plexi

Domain Est. 1996

#4 Plexiglass Sheet

Domain Est. 1997

Website: professionalplastics.com

Key Highlights: 3-day returnsWe will cut-to-size & ship sheets of plexiglass directly to your door. Buy plexiglass online or shop for various grades of plexiglass from our website….

#5 Frame Grade Acrylic Sheets

Domain Est. 1997

Website: acmeplastics.com

Key Highlights: Free delivery 15-day returnsAcme Plastics crafts frame grade acrylic sheets to attain the highest optical clarity. Perfect for individuals or framing businesses, we offer both pre-…

#6 Plexiglass at Jerry’s Artarama

Domain Est. 1999

Website: jerrysartarama.com

Key Highlights: Free delivery over $79Convenient glass and backing inserts for any standard sized open-face frame! You have found the perfect frame for your latest masterpiece, but there is a catc…

#7 Plexiglass Wall Frames — Cut

Domain Est. 2000

Website: novadisplay.com

Key Highlights: At Nova Display, we specialize in creating high-quality, custom-fabricated plexiglass wall frames tailored to your exact specifications….

#8 Plexiglass Acrylic Sheets

Domain Est. 2004

Website: estreetplastics.com

Key Highlights: Plexiglass acrylic sheets in a variety of thickness, colors and pre-cut sizes. We can also custom cut to size. Explore our range of plexiglass sheets today!…

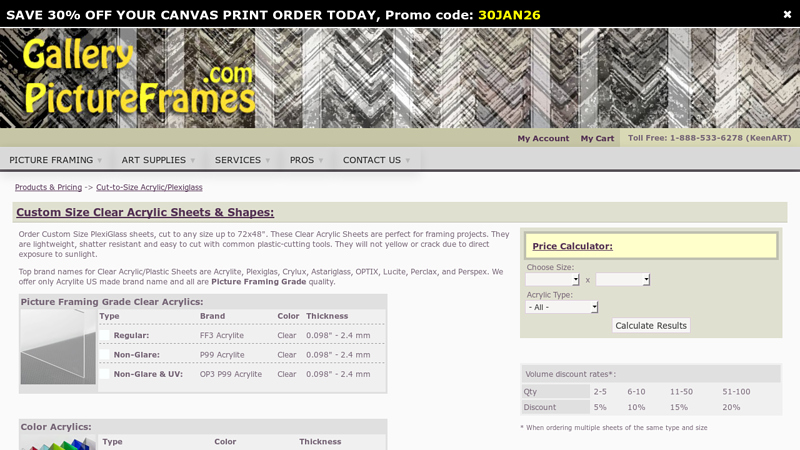

#9 Gallery Picture Frames Custom Size Clear Acrylic Sheets

Domain Est. 2013

Website: gallerypictureframes.com

Key Highlights: Order Custom Size PlexiGlass sheets, cut to any size up to 72×48″. These Clear Acrylic Sheets are perfect for framing projects….

Expert Sourcing Insights for Plexiglass Sheets For Picture Frames

H2: Projected 2026 Market Trends for Plexiglass Sheets in Picture Frames

The market for plexiglass (acrylic) sheets specifically used in picture framing is expected to experience steady, albeit moderate, growth and significant shifts in demand drivers by 2026, shaped by evolving consumer preferences, economic factors, and environmental considerations.

1. Steady Growth Driven by Value and Safety:

* Continued Preference Over Glass: Plexiglass will maintain its dominant position over traditional glass for many framing applications due to its inherent advantages: lightweight (crucial for large frames and shipping), shatter-resistance (safer for homes, galleries, children’s rooms, and shipping), and UV resistance (especially with UV-filtering grades, protecting artwork from fading). This value proposition remains strong.

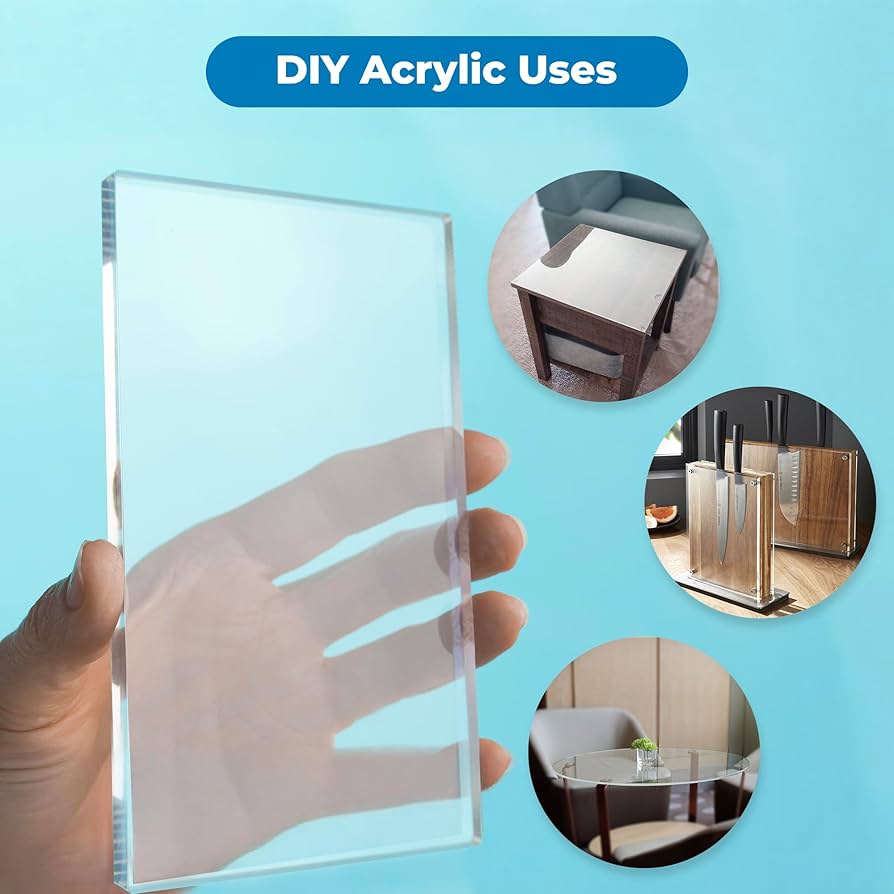

* Expansion in Specific Segments: Growth will be particularly evident in online framing services, DIY framing kits, and the framing of larger or more valuable artwork where safety and weight are paramount. The art and photography market, both amateur and professional, will continue to be a primary driver.

2. Rising Demand for Premium and Specialty Grades:

* UV-Protective & Museum-Grade Acrylic: Demand for high-clarity, anti-reflective (AR), and UV-filtering acrylic sheets (often marketed as “museum” or “conservation” grade) will increase significantly. Consumers and professionals alike are increasingly aware of the need to preserve artwork, driving adoption beyond high-end galleries into the home market.

* Anti-Static and Anti-Scratch Coatings: Features that enhance durability and ease of handling during framing (reducing dust attraction and surface damage) will become more standard expectations, especially in higher tiers.

3. Price Volatility and Cost Sensitivity:

* Raw Material Fluctuations: The market will remain sensitive to the price of methyl methacrylate (MMA), the primary raw material. Geopolitical tensions, energy costs, and supply chain disruptions (e.g., from key production regions like Asia) could lead to price volatility in 2026.

* Competition with Alternatives: While plexiglass dominates, persistent cost pressures may lead some budget-conscious consumers and mass-market framers to consider alternatives like polycarbonate (though heavier and more expensive) or even improved glass options (like lightweight glass), potentially capping average selling prices for standard grades.

4. Sustainability as a Growing Imperative:

* Increased Scrutiny on Recyclability: While inherently more durable than glass, acrylic is less readily recyclable in standard municipal streams. By 2026, environmental concerns will be a major market influence. Framers and consumers will demand clearer information on recyclability and sustainable sourcing.

* Rise of Recycled Content: Expect market leaders and eco-conscious brands to introduce and promote plexiglass sheets made with post-industrial recycled acrylic (PIR). Framing suppliers emphasizing sustainability will gain a competitive edge. True closed-loop recycling for post-consumer acrylic remains a challenge but will be a focus area.

* Lifecycle Assessment (LCA) Focus: Buyers, especially commercial framers and institutions, may increasingly use LCA to compare the environmental footprint of acrylic vs. glass, considering weight (shipping emissions), breakage rates, and end-of-life options.

5. E-commerce and Direct-to-Consumer (DTC) Impact:

* Online Sales Dominance: The primary channel for purchasing plexiglass sheets for picture frames will remain online, driven by framing supply websites, DIY retailers, and DTC framers. Convenience, wide selection, and competitive pricing online will solidify this trend.

* Customization Demand: Online platforms will increasingly offer easy tools for customers to order custom-cut sheets to exact frame dimensions, reducing waste and DIY effort, further driving online sales.

6. Regional Variations:

* Developed Markets (North America, Europe): Will lead in demand for premium, UV-protective, and sustainable options. Regulatory pressure on plastics may influence formulations and recycling infrastructure.

* Developing Markets (Asia-Pacific, Latin America): Likely to see stronger volume growth, potentially driven more by economic development and urbanization, with a focus on standard grades initially, but awareness of premium features will grow.

Conclusion:

By 2026, the plexiglass sheet market for picture frames will be characterized by consolidation around value (safety, weight) and quality (clarity, UV protection), heightened sensitivity to cost and sustainability, and the dominance of online channels. Success will depend on manufacturers and suppliers offering a clear tiered product range (from standard to premium conservation grade), transparently addressing environmental concerns (especially recycling and recycled content), navigating raw material costs, and seamlessly integrating with the online DIY and professional framing ecosystem. The shift towards sustainability will be the most transformative long-term trend shaping the market’s future.

Common Pitfalls When Sourcing Plexiglass Sheets for Picture Frames (Quality & IP)

When sourcing plexiglass (acrylic) sheets for picture frames, overlooking quality and intellectual property (IP) considerations can lead to product failures, customer dissatisfaction, or legal risks. Here are the most common pitfalls to avoid:

Poor Optical Clarity and Surface Defects

Low-quality plexiglass often suffers from haze, waviness, or surface scratches, diminishing the visual appeal of framed artwork. Off-brand or recycled materials may appear cloudy or have inconsistent thickness, leading to distorted viewing and unprofessional results.

Inconsistent Sheet Thickness and Dimensional Accuracy

Inaccurate thickness (e.g., labeled as 1/8” but actually 2.8mm) affects frame fit and structural integrity. Poorly cut sheets with uneven edges complicate assembly and result in gaps or misalignment, especially in mass production settings.

Susceptibility to Scratching and Static Buildup

Many inexpensive acrylic sheets lack anti-scratch or anti-static coatings. This makes them prone to damage during handling and attracts dust, requiring frequent cleaning and reducing user satisfaction, particularly in display environments.

UV Degradation and Yellowing Over Time

Non-UV-stabilized plexiglass can yellow or become brittle when exposed to sunlight. For picture frames, especially those used in well-lit areas or galleries, this compromises both protection and appearance of the artwork over time.

Misrepresentation of Material Grade and Brand Authenticity

Suppliers may falsely claim their acrylic is “brand-name” (e.g., Lucite, Plexiglas®) when it’s a generic or inferior substitute. This misrepresentation affects optical performance and resale value, and may violate trademark laws.

Intellectual Property (IP) Infringement Risks

Using counterfeit branded materials or copying patented frame designs that incorporate specific plexiglass features can lead to legal liability. Sourcing from unauthorized suppliers increases exposure to IP violations, especially when selling in regulated markets like the EU or U.S.

Inadequate Certifications and Compliance Documentation

Reputable applications (e.g., museums, commercial displays) require proof of material specifications, fire ratings (e.g., ASTM E84), or environmental compliance (e.g., RoHS). Lack of proper documentation can disqualify suppliers or lead to rejected shipments.

Unreliable Supply Chain and Lead Time Variability

Overseas suppliers may offer lower prices but often come with unpredictable lead times, minimum order quantities, and inconsistent quality control. This complicates inventory planning and can delay production cycles.

Avoiding these pitfalls requires vetting suppliers thoroughly, requesting material certifications, testing samples, and ensuring transparency around branding and IP compliance.

Logistics & Compliance Guide for Plexiglass Sheets for Picture Frames

Product Overview and Classification

Plexiglass sheets used for picture frames are typically made from polymethyl methacrylate (PMMA), a transparent thermoplastic often used as a lightweight, shatter-resistant alternative to glass. These sheets may be supplied in cut-to-size formats, rolled, or in bulk sheets. Accurate classification is essential for logistics and compliance.

Harmonized System (HS) Code and Tariff Classification

The appropriate HS code for Plexiglass (PMMA) sheets is generally 3920.51 in most countries, including the United States and members of the World Customs Organization. This code covers “other plates, sheets, film, foil, and strip, of polymethyl methacrylate.” Confirm the specific code with local customs authorities, as variations may exist based on thickness, surface treatment, or intended use.

Packaging and Handling Requirements

- Use edge protectors and corner guards to prevent chipping or scratching.

- Separate sheets with protective film or interleaving paper to avoid surface damage.

- Pack flat in sturdy cardboard or wooden crates to prevent warping during transit.

- Clearly label packages as “Fragile,” “This Side Up,” and “Protect from Scratches.”

- Avoid stacking excessive weight on packaged sheets to prevent deformation.

Transportation and Shipping Considerations

- Mode of Transport: Suitable for road, air, and sea freight. Air freight is recommended for high-value or time-sensitive orders due to reduced risk of damage.

- Temperature Control: Avoid prolonged exposure to extreme temperatures; PMMA can become brittle in cold environments and soften in high heat.

- Moisture Protection: Use moisture-resistant wrapping (e.g., plastic film) to prevent condensation, especially in sea freight.

- Dimensional Weight: Due to low density but large surface area, shipping costs may be based on dimensional weight—optimize packaging size accordingly.

Import/Export Documentation

Ensure the following documents are prepared and accurate:

– Commercial Invoice (with full product description, HS code, value, and origin)

– Packing List (detailing dimensions, weight, and quantity per package)

– Bill of Lading (for sea freight) or Air Waybill (for air freight)

– Certificate of Origin (may be required for tariff preferences)

– Material Safety Data Sheet (MSDS) or Safety Data Sheet (SDS) – recommended for customs clearance

Regulatory Compliance

- REACH & RoHS (Europe): Confirm that the PMMA formulation complies with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances), especially if additives are used.

- TSCA (USA): Ensure compliance with the Toxic Substances Control Act; PMMA is generally compliant but verify with suppliers.

- Proposition 65 (California): Verify that the product does not contain chemicals listed under Proposition 65 requiring warning labels.

- Food Contact Compliance (if applicable): Standard picture frame plexiglass is not intended for food contact, but confirm with manufacturer if repurposed.

Labeling and Marking Requirements

- Include product specifications (thickness, dimensions, material type: PMMA)

- Display handling instructions and safety warnings (e.g., “Protective film to be removed before use”)

- Add supplier/manufacturer branding and contact information

- Affix country of origin marking per destination country regulations (e.g., “Made in Germany”)

Environmental and Sustainability Compliance

- PMMA is recyclable (resin identification code #7 – “Other”). Provide guidance for proper disposal or recycling.

- Some markets may require reporting under Extended Producer Responsibility (EPR) schemes for plastics—verify local requirements.

- Consider using recycled-content PMMA where available to meet sustainability goals.

Quality Assurance and Inspection

- Conduct pre-shipment inspections for optical clarity, surface defects, dimensional accuracy, and packaging integrity.

- Maintain quality certifications (e.g., ISO 9001) if applicable.

- Retain batch records and material certifications for traceability.

Risk Mitigation and Contingency Planning

- Insure shipments against damage, loss, or delay.

- Work with experienced freight forwarders familiar with plastic sheet logistics.

- Establish backup suppliers and alternate shipping routes to avoid disruptions.

By adhering to this logistics and compliance guide, businesses can ensure smooth international trade operations, regulatory adherence, and customer satisfaction when handling plexiglass sheets for picture frames.

In conclusion, sourcing plexiglass sheets for picture frames requires a balance between optical clarity, durability, cost, and ease of handling. By evaluating suppliers based on material quality, thickness options, UV protection, and anti-reflective coatings, you can ensure the final product offers excellent visual appeal and long-term protection for artwork or photographs. Local suppliers may provide faster turnaround and lower shipping costs, while online vendors often offer a broader selection and competitive pricing. It’s essential to consider custom cutting services, minimum order quantities, and shipping logistics—especially due to the material’s size and fragility. Ultimately, establishing relationships with reliable suppliers and ordering samples before large purchases will help you consistently source high-quality plexiglass that meets your framing standards and customer expectations.