The global plastics manufacturing industry continues to expand at a steady pace, driven by rising demand across packaging, automotive, healthcare, and consumer goods sectors. According to Grand View Research, the global plastics market was valued at USD 596.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This sustained growth, fueled by innovations in polymer technology and increasing material substitution in lightweight applications, underscores the critical role of reliable plastics supply manufacturers. As downstream industries demand greater consistency, sustainability, and scalability, identifying leading suppliers with proven production capacity, global reach, and technical expertise has become essential. Based on market presence, revenue performance, and product portfolio breadth, the following ten manufacturers represent the top tier in the plastics supply landscape.

Top 10 Plastics Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastics Industry Association

Domain Est. 1999

Website: plasticsindustry.org

Key Highlights: We protect, promote, and grow the plastics industry. · Join · News · Serving the entire supply chain · Equipment Manufacturers & Moldmakers · Material Suppliers….

#2 Modern Plastics

Domain Est. 1996

Website: modernplastics.com

Key Highlights: Modern Plastics is an ISO-certified distributor of medical-grade, aerospace, and high-performance plastics — precision cut and trusted worldwide….

#3 Universal Plastics: Thermoforming

Domain Est. 1996

Website: universalplastics.com

Key Highlights: We specialize in large plastic enclosures, medical equipment covers, kiosk covers, bezels, skins, handles, and other customer facing parts. MEDICAL PARTS….

#4 Meyer Plastics Inc

Domain Est. 1997

Website: meyerplastics.com

Key Highlights: Meyer Plastics is a multifunctional plastic supplier combining the best parts of plastic distribution with excellent plastic manufacturing….

#5 Grafix Plastics

Domain Est. 1997

Website: grafixplastics.com

Key Highlights: Grafix Plastics is a quality plastic film and plastic sheets supplier and full-service material converter. Contact us to help you innovate with confidence!…

#6 Cope Plastics

Domain Est. 1998 | Founded: 1946

Website: copeplastics.com

Key Highlights: Cope Plastics has the U.S.’s largest set of fabrication capabilities and is a leading distributor of performance plastics. Family and woman-owned since 1946 ……

#7 Multi

Domain Est. 1998

Website: multi-plastics.com

Key Highlights: Multi-Plastics is a full-service, vertically integrated company from polymerization and extrusion to roll slitting and sheet converting to global distribution….

#8 Plastic Supply of PA

Domain Est. 1999

Website: plasticsupply.net

Key Highlights: Today we have the distinction of being not only an excellent source for plastic materials, but also for both the fabrication and machining of those products….

#9 Calsak Plastics

Domain Est. 2000 | Founded: 1972

Website: calsakplastics.com

Key Highlights: Since 1972, Calsak Plastics has been a trusted plastic supplier and nationwide distributor of high-performance plastic sheets, rods, and tubes….

#10 Interstate Advanced Materials

Domain Est. 2022

Website: interstateam.com

Key Highlights: Nationwide supplier of plastics and high-performance materials. Shop sheet, rod, tube, & profiles across hundreds of material types and industry ……

Expert Sourcing Insights for Plastics Supply

H2: Market Trends in the Plastics Supply Industry for 2026

As we approach 2026, the global plastics supply market is undergoing a transformative shift driven by technological innovation, regulatory changes, sustainability imperatives, and evolving consumer demand. The second half of the decade is expected to accelerate trends that began in earlier years, reshaping supply chains, material preferences, and production methodologies across the sector.

1. Accelerated Shift Toward Sustainable and Biodegradable Plastics

Environmental regulations and corporate sustainability goals are pushing the plastics supply industry toward greener alternatives. In 2026, demand for bio-based plastics—such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA)—is projected to grow at a compound annual growth rate (CAGR) of over 12%. Governments in the EU, North America, and parts of Asia are enforcing stricter single-use plastic bans and extended producer responsibility (EPR) schemes, compelling suppliers to invest in compostable and recyclable materials. Plastics supply companies are increasingly integrating circular economy models, including chemical recycling and closed-loop systems, to meet compliance and consumer expectations.

2. Expansion of Chemical Recycling Technologies

Mechanical recycling has limitations in handling contaminated or mixed plastic waste. In response, chemical recycling—converting plastic waste back into monomers or feedstock—is gaining traction. By 2026, major supply players like LyondellBasell, SABIC, and Dow are expected to have scaled commercial chemical recycling operations, particularly for polyolefins. This trend enhances the availability of recycled content in virgin-quality resins, supporting high-end applications in automotive, electronics, and food packaging. Investment in pyrolysis, depolymerization, and solvent-based purification technologies is rising, with North America and Europe leading deployment.

3. Regionalization and Resilience in Supply Chains

Geopolitical volatility, trade tensions, and post-pandemic disruptions have driven a strategic reevaluation of plastics supply chains. In 2026, regional self-sufficiency is a key focus, with increased investment in domestic resin production and recycling infrastructure—especially in the U.S. and Southeast Asia. Nearshoring and onshoring initiatives are bolstering supply chain resilience, reducing dependence on imported feedstocks like naphtha and natural gas derivatives. This shift is also supported by government incentives, such as the U.S. Inflation Reduction Act (IRA) and EU Green Deal funding.

4. Digitalization and Smart Manufacturing

The integration of Industry 4.0 technologies is transforming plastics supply operations. By 2026, digital twins, AI-driven demand forecasting, and IoT-enabled production monitoring are becoming standard in leading plastics manufacturing facilities. These tools enhance energy efficiency, reduce waste, and enable real-time supply chain visibility. Blockchain is being piloted for tracking recycled content and ensuring supply chain transparency, particularly in regulated industries such as medical devices and food packaging.

5. Rising Demand in Emerging Applications

While traditional sectors like packaging remain dominant, new growth areas are emerging. The electric vehicle (EV) revolution is increasing demand for lightweight, high-performance plastics in battery housings, interiors, and composites. Similarly, advancements in medical devices, 3D printing, and renewable energy systems (e.g., wind turbine blades, solar panel encapsulants) are creating niche but high-value markets for engineering plastics like PEEK, PC, and PPS. Suppliers are tailoring product portfolios to meet stringent performance and regulatory requirements in these sectors.

6. Feedstock Volatility and Energy Transition Pressures

Despite the move toward sustainability, most plastics are still derived from fossil fuels. Fluctuations in crude oil and natural gas prices continue to impact resin pricing and margins. However, by 2026, there is a noticeable shift toward renewable feedstocks, such as bio-naphtha and e-methanol, supported by carbon pricing mechanisms and green certification programs. Plastics suppliers are forming partnerships with energy companies and waste management firms to secure alternative feedstock streams and reduce carbon footprints.

Conclusion

The 2026 plastics supply landscape is defined by sustainability, innovation, and strategic adaptation. Companies that invest in circular solutions, embrace digital transformation, and align with global decarbonization goals are best positioned to lead the market. While challenges remain—particularly in scaling new technologies and managing cost competitiveness—the shift toward a more responsible and resilient plastics economy is now irreversible.

Common Pitfalls Sourcing Plastics Supply (Quality, IP)

Sourcing plastic materials, components, or finished goods involves significant risks beyond just pricing and lead times. Two critical areas where companies frequently encounter problems are quality consistency and intellectual property (IP) protection. Ignoring these pitfalls can lead to production delays, safety issues, financial losses, and legal disputes.

Quality-Related Pitfalls

Inconsistent Material Properties

Plastics sourced from different batches or suppliers can exhibit variations in critical properties like tensile strength, impact resistance, thermal stability, and color. Without strict specifications and testing, these inconsistencies can compromise product performance, lead to field failures, or cause assembly issues.

Non-Compliance with Specifications or Standards

Suppliers may claim compliance with industry standards (e.g., UL, FDA, RoHS, REACH) but fail to provide proper certifications or test reports. Using non-compliant materials can result in regulatory penalties, product recalls, or safety hazards, particularly in medical, food-contact, or electronics applications.

Poor Process Control at Supplier Facilities

Even high-quality raw resin can be compromised by poor processing conditions such as incorrect drying, improper molding parameters, or contamination during production. Without audits or oversight, hidden process flaws may go undetected until defects appear downstream.

Lack of Traceability

Inadequate batch tracking makes it difficult to investigate quality failures or conduct targeted recalls. Without clear documentation linking raw materials to finished goods, root cause analysis becomes nearly impossible.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Proprietary Resin Formulations

Some suppliers may claim to supply engineering-grade plastics (e.g., specialty nylons, PEEK) but actually use cheaper, off-spec, or counterfeit materials. This not only affects performance but may also infringe on the IP of original resin manufacturers.

Design or Tooling IP Theft

When sourcing custom-molded parts, especially in low-cost regions, there’s a risk that suppliers may copy molds, replicate designs, or sell similar parts to competitors. Inadequate legal agreements or weak IP enforcement in certain jurisdictions amplify this risk.

Insufficient IP Clauses in Contracts

Many procurement agreements fail to clearly assign ownership of custom tooling, molds, or product designs. Without explicit terms, suppliers may claim partial rights, restrict future sourcing options, or demand additional fees for tool usage.

Reverse Engineering and Market Competition

Suppliers with access to your product designs may reverse-engineer them to create competing products or supply look-alikes to your competitors. This erodes market share and undermines competitive advantage.

Mitigation Strategies

- Enforce Strict Quality Agreements with defined material specs, testing protocols, and compliance documentation.

- Conduct Supplier Audits to assess quality systems, process controls, and regulatory compliance.

- Require Full Traceability and batch-level documentation for all materials.

- Use Legally Binding Contracts that clearly define IP ownership, restrict unauthorized use, and include confidentiality clauses.

- Work with Reputable, Certified Suppliers who have a proven track record and transparent supply chains.

- Consider Third-Party Testing to independently verify material quality and compliance.

By proactively addressing these quality and IP pitfalls, companies can reduce risk, ensure product integrity, and protect their competitive innovations when sourcing plastic supplies.

Logistics & Compliance Guide for Plastics Supply

This guide outlines the key logistics and compliance considerations for companies involved in the supply of plastics, from raw material procurement to delivery at the destination. Adhering to these standards ensures operational efficiency, legal compliance, and environmental responsibility.

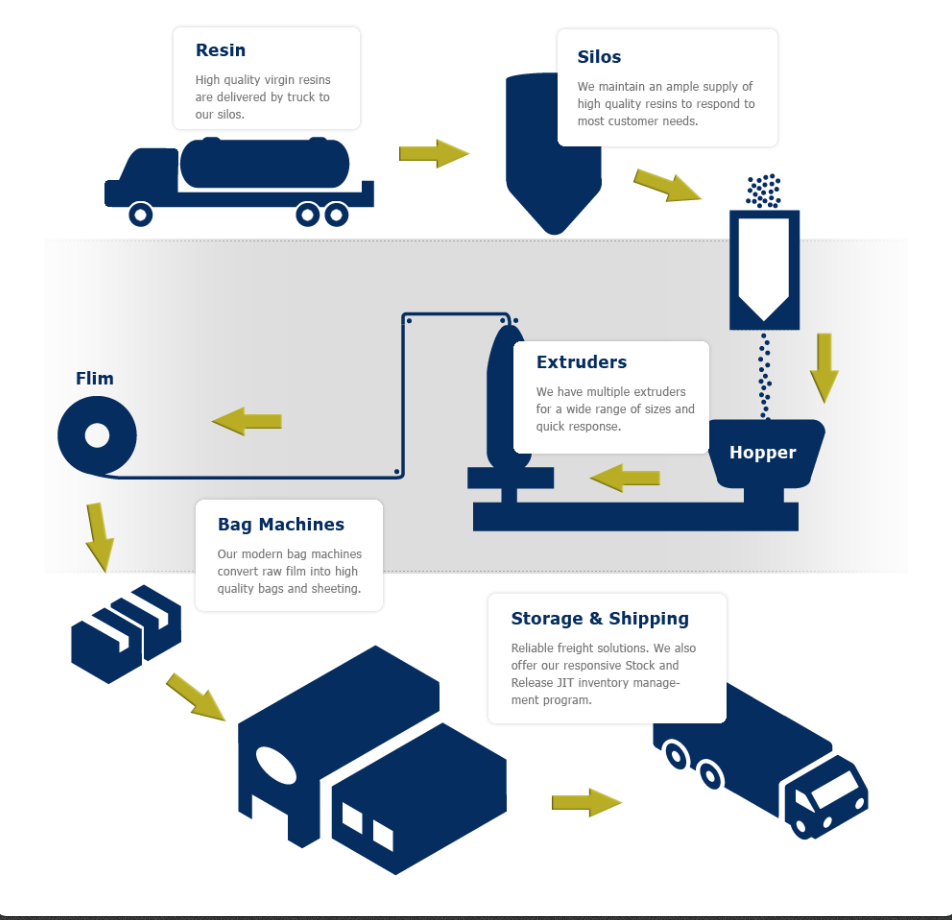

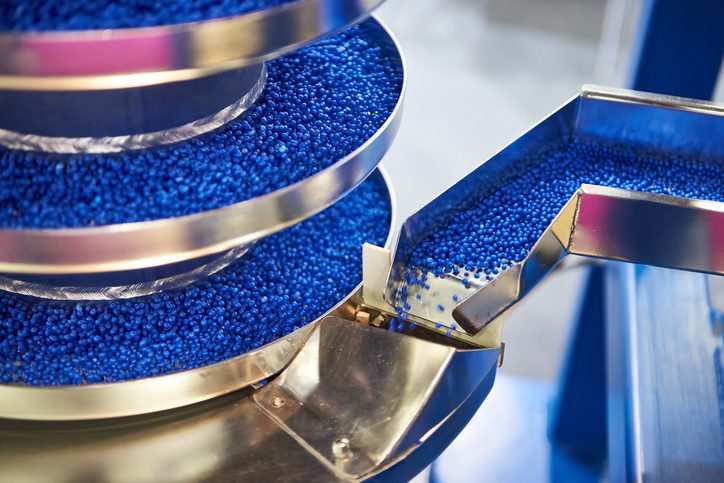

Supply Chain Overview

Understanding the end-to-end supply chain is essential. The plastics supply chain typically includes resin producers, compounders, distributors, converters (manufacturers), and end customers. Each stage presents unique logistical and regulatory challenges, including temperature control, hazardous material classification, and tracking requirements.

Regulatory Compliance

Plastics suppliers must comply with a range of international, national, and regional regulations. Key frameworks include:

– REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals. Requires full disclosure of substances used and compliance with restrictions.

– RoHS (EU): Restriction of Hazardous Substances in electrical and electronic equipment.

– TSCA (USA): Toxic Substances Control Act, regulating the manufacture, import, and use of chemical substances.

– FDA (USA): For plastics used in food contact applications, compliance with 21 CFR is mandatory.

– REACH & CLP (Classification, Labelling and Packaging): Requires proper hazard communication via safety data sheets (SDS) and GHS-compliant labeling.

Ensure all shipped materials are accompanied by up-to-date Safety Data Sheets (SDS) and that packaging meets regulatory labeling requirements.

Transportation & Shipping

Plastics, especially in resin pellet or powder form, are often classified under specific transport regulations:

– IMDG Code: For sea freight of dangerous goods (e.g., flammable plastics or additives).

– ADR: For road transport within Europe; applies if materials are classified as hazardous.

– IATA DGR: For air freight; stricter rules apply due to safety concerns.

– Non-hazardous plastics still require secure packaging to prevent spillage and contamination.

Use closed containers or bulk bags (FIBCs) to prevent pellet loss (“nurdle spillage”), which contributes to microplastic pollution. Consider ISO container liners or specialized bulk containers for large-volume shipments.

Environmental & Sustainability Regulations

Environmental compliance is increasingly critical:

– Plastic Packaging Tax (UK): Applies to plastic packaging with less than 30% recycled content.

– Single-Use Plastics Directive (EU): Restricts certain plastic products and mandates recycled content targets.

– Extended Producer Responsibility (EPR): Requires suppliers to contribute to the cost of recycling or disposal of plastic products.

Implement tracking systems to document recycled content and support environmental claims. Align with circular economy principles by participating in take-back or recycling programs where applicable.

Customs & Trade Compliance

For international shipments:

– Ensure accurate HS (Harmonized System) code classification for plastics (e.g., 3901–3914 for polymers).

– Prepare complete documentation: commercial invoice, packing list, bill of lading, certificate of origin, and SDS.

– Comply with import/export controls, especially for dual-use or regulated materials.

– Monitor trade restrictions or tariffs related to specific countries or plastic types.

Use automated trade management software to reduce errors and expedite customs clearance.

Storage & Handling

Proper warehousing practices are vital to maintain material quality:

– Store in dry, temperature-controlled environments to prevent moisture absorption (especially hygroscopic resins like nylon or PET).

– Use FIFO (First In, First Out) inventory rotation to prevent material degradation.

– Segregate incompatible materials (e.g., oxidizing agents from flammable resins).

– Implement spill containment measures and train staff in safe handling procedures.

Quality Assurance & Traceability

Maintain robust quality systems:

– Conduct incoming and outgoing material inspections.

– Use batch/lot tracking to ensure traceability throughout the supply chain.

– Certify compliance with ISO 9001 (Quality Management) and, where relevant, ISO 14001 (Environmental Management).

Provide customers with material certifications (e.g., FDA compliance, UL recognition, or recyclability statements).

Incident Response & Reporting

Establish protocols for:

– Spill response (especially nurdle spills during transport or handling).

– Regulatory reporting (e.g., chemical releases under EPCRA in the U.S.).

– Product recalls due to non-compliance or contamination.

Train personnel and conduct regular drills to ensure readiness.

Conclusion

Effective logistics and compliance in the plastics supply chain require proactive planning, cross-functional coordination, and continuous monitoring of regulatory changes. By integrating compliance into core operations, plastics suppliers can reduce risk, enhance sustainability, and maintain customer trust in a highly regulated global market.

In conclusion, sourcing plastic supply requires a strategic approach that balances cost-efficiency, material quality, sustainability, and supply chain reliability. As global demand for plastics continues to rise, businesses must carefully evaluate suppliers based on certifications, production capabilities, environmental practices, and compliance with regulations. Prioritizing partnerships with responsible and innovative suppliers not only ensures a consistent and high-quality material supply but also supports long-term business resilience and environmental stewardship. Additionally, exploring alternative materials and incorporating circular economy principles—such as using recycled plastics or designing for recyclability—can enhance sustainability and meet evolving consumer and regulatory expectations. Ultimately, a well-structured sourcing strategy for plastics is essential for maintaining competitiveness, reducing risk, and contributing to a more sustainable future.