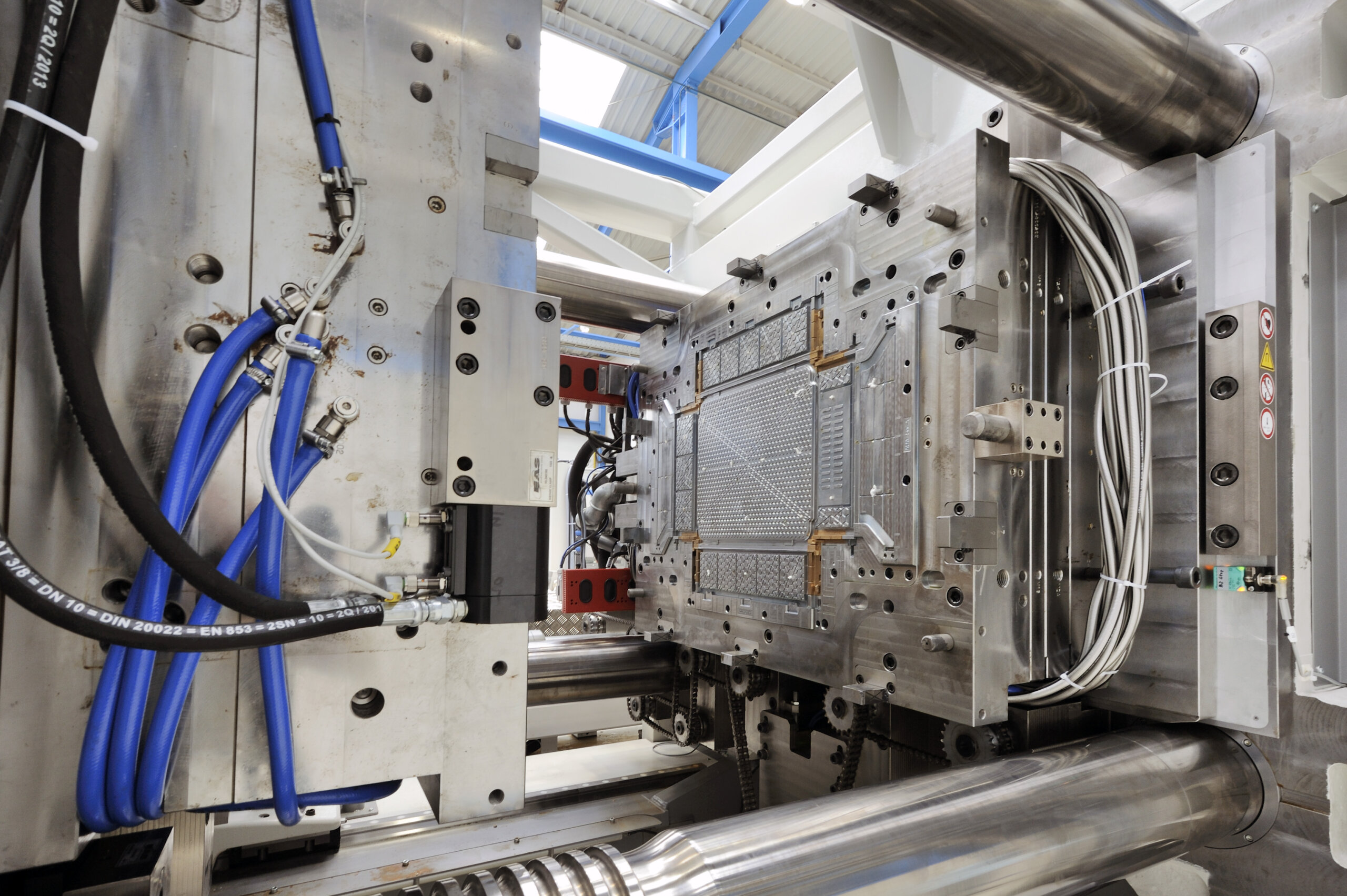

The global plastics mold manufacturing industry is experiencing robust growth, driven by rising demand across automotive, packaging, consumer goods, and healthcare sectors. According to Grand View Research, the global plastic molds market size was valued at USD 191.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. This expansion is fueled by advancements in injection molding technologies, increased adoption of lightweight components in automobiles, and growing emphasis on precision manufacturing. Additionally, Mordor Intelligence projects continued momentum in mold manufacturing, particularly in Asia-Pacific, where countries like China and India are emerging as key production hubs due to cost-efficient labor, government support for manufacturing, and expanding industrial infrastructure. As competition intensifies and innovation accelerates, identifying the top players in the plastics mold space has become critical for OEMs and supply chain leaders seeking high-quality, scalable, and technologically advanced partners. The following list highlights the top 10 plastics mold manufacturers based on market presence, production capacity, technological expertise, and client portfolios.

Top 10 Plastics Mold Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastic Molding Technology

Domain Est. 2002

Website: plasticmolding.com

Key Highlights: Plastics manufacturer with broad capabilities that focuses on mission-critical applications and investing in automation and technologies….

#2 Dutchland Plastics

Domain Est. 1999

Website: dutchland.com

Key Highlights: Dutchland Plastics is a rotational molding plastic products manufacturer offering engineering, mold maintenance, finishing services, assembly and logistics….

#3 Universal Plastics: Thermoforming

Domain Est. 1996

Website: universalplastics.com

Key Highlights: Universal Plastics offers many injection molding services, including structural foam and gas assist to offer the proper process, engineering support, global ……

#4 PCS Company

Domain Est. 1997

Website: pcs-company.com

Key Highlights: PCS Company is a team of industry experts providing solutions and innovative products for the plastic injection molding, mold making, and die casting industries ……

#5 All

Domain Est. 1997

Website: all-plastics.com

Key Highlights: All-Plastics is a leading scientific injection plastic molding company that can reduce your manufacturing costs and improve your quality….

#6 American Plastic Molding

Domain Est. 1998

Website: apmc.com

Key Highlights: APM is an innovative engineering and manufacturing organization, focused on “product realization.” Our manufacturing core competencies in assembly and ……

#7 SyBridge Technologies

Domain Est. 2003

Website: sybridge.com

Key Highlights: Precision molds powering the world’s leading plastic products. With over 50 years of mold-making experience, we’re true experts in our craft. SyBridge builds ……

#8 Plastic Injection Molding

Domain Est. 2004

Website: precisionmoldedplastics.com

Key Highlights: Precision is a vertically integrated, plastic injection molding company that builds custom molds and tooling, manufactures parts and products, and performs a ……

#9 Plastic Molding Manufacturing

Domain Est. 2008

Website: plasticmoldingmfg.com

Key Highlights: Plastic Molding Manufacturing is a U.S.-based custom plastic injection molding company, providing full-service, single-source solutions for custom molded ……

#10 Springboard Manufacturing

Domain Est. 2019

Website: springboardmfg.com

Key Highlights: We offer state-of-the-art medical injection molding and assembly services for numerous types of medical device applications in a wide range of sizes….

Expert Sourcing Insights for Plastics Mold

H2: 2026 Market Trends for Plastics Mold

The global plastics mold market is poised for significant transformation by 2026, driven by technological advancements, evolving industry demands, and shifting regulatory landscapes. As manufacturers across automotive, healthcare, packaging, and consumer electronics sectors continue to prioritize efficiency and sustainability, the plastics mold industry is adapting to meet these challenges and opportunities.

-

Increased Adoption of Automation and Smart Manufacturing

By 2026, automation and Industry 4.0 integration are expected to become standard in plastics mold production. Advanced CNC machining, robotic mold handling, and real-time monitoring systems will enhance precision, reduce cycle times, and minimize human error. Smart molds equipped with embedded sensors will allow for predictive maintenance and quality control, improving overall production efficiency. -

Rise in Demand for Lightweight and Complex Components

The automotive and aerospace industries are pushing for lighter, fuel-efficient vehicles, increasing the need for complex, high-precision plastic components. This trend is fueling demand for advanced mold designs capable of producing intricate geometries with tight tolerances. Multi-cavity and hot-runner molds are expected to gain prominence to meet volume and quality requirements. -

Growth in Sustainable and Biodegradable Molding Solutions

Environmental regulations and consumer preferences are accelerating the shift toward eco-friendly materials. By 2026, there will be greater demand for molds compatible with bioplastics and recyclable resins. Mold manufacturers are investing in tooling designs that support sustainable production, such as energy-efficient cooling systems and molds engineered for longer lifecycles to reduce waste. -

Expansion in Medical and Healthcare Applications

The medical device sector is a key growth driver, with rising demand for disposable and precision-molded components such as syringes, diagnostic devices, and surgical instruments. Strict regulatory standards are pushing mold makers to adopt cleanroom molding technologies and high-precision tooling, fostering innovation in micro-molding and insert molding techniques. -

Regional Shifts and Supply Chain Resilience

Asia-Pacific, particularly China and India, will remain dominant in mold manufacturing due to cost advantages and robust industrial infrastructure. However, reshoring and nearshoring trends in North America and Europe—driven by supply chain disruptions and geopolitical factors—are prompting investments in local mold production capabilities. This shift supports faster turnaround times and greater supply chain resilience. -

Digitalization and Simulation-Driven Design

Mold flow analysis and 3D simulation software are becoming integral to mold development. By 2026, digital twin technology will allow manufacturers to simulate entire molding processes virtually, optimizing designs before physical prototyping. This reduces time-to-market and material waste, especially for high-value or customized molds. -

Customization and On-Demand Production

Growing demand for personalized products—especially in consumer goods and medical fields—is pushing the adoption of modular and reconfigurable mold systems. Additive manufacturing (3D printing of molds) is gaining traction for low-volume, high-mix production, offering faster prototyping and design flexibility.

In conclusion, the 2026 plastics mold market will be characterized by innovation, sustainability, and digital transformation. Companies that embrace automation, eco-conscious practices, and advanced design technologies will be best positioned to lead in this evolving landscape.

Common Pitfalls Sourcing Plastic Molds: Quality and Intellectual Property Risks

Sourcing plastic injection molds, especially from overseas suppliers, offers cost advantages but introduces significant risks related to quality control and intellectual property (IP) protection. Overlooking these pitfalls can lead to production delays, defective parts, financial losses, and long-term competitive damage.

Quality-Related Pitfalls

Inadequate Mold Design and Engineering Expertise

Sourcing from suppliers lacking deep expertise in mold design can result in fundamental flaws. Poor gating, cooling, or ejection system design leads to part defects (warping, sink marks, short shots) and reduced mold lifespan. Always verify the supplier’s engineering credentials and request detailed design reviews before tooling begins.

Use of Substandard Materials and Components

Some suppliers cut costs by using lower-grade steel (e.g., P20 instead of H13 for high-wear applications) or inferior mold bases and standard parts. This compromises mold durability, dimensional stability, and surface finish, increasing maintenance costs and downtime. Specify material grades and require certification in the purchase agreement.

Insufficient Quality Control and Testing

Skipping or rushing mold trials, cavity pressure monitoring, or First Article Inspection (FAI) reports invites defects into production. Without rigorous validation, issues may only surface during high-volume manufacturing, causing costly interruptions. Mandate comprehensive testing protocols and on-site witness trials.

Poor Surface Finishes and Dimensional Accuracy

Inconsistent polishing, texture application, or machining tolerances affect part aesthetics and functionality. Suppliers may lack access to advanced EDM or CNC equipment needed for tight tolerances. Clearly define surface finish requirements (e.g., SPI standards) and verify capabilities upfront.

Intellectual Property-Related Pitfalls

Lack of Legal IP Protection Agreements

Operating without a robust Non-Disclosure Agreement (NDA) and clear ownership clauses in contracts exposes your mold design and product to theft or unauthorized replication. Ensure contracts explicitly state that IP rights belong to the buyer and prohibit third-party use.

Risk of Mold Replication and Unauthorized Production

Suppliers may duplicate molds and sell identical parts to competitors, especially in regions with weak IP enforcement. This undermines market exclusivity and pricing. Mitigate this by retaining physical possession of the mold or using escrow services, and conduct regular audits.

Design Theft and Reverse Engineering

Sharing 3D CAD files without safeguards enables easy copying. Suppliers may reverse-engineer your design to create similar products. Limit file access, use watermarked or encrypted designs, and consider splitting mold components across multiple trusted vendors.

Weak Jurisdiction and Enforcement Challenges

Disputes involving international suppliers often fall under foreign legal systems where IP laws are poorly enforced. Litigation is costly and ineffective. Choose suppliers in jurisdictions with strong IP protections, and include dispute resolution mechanisms (e.g., international arbitration) in contracts.

Mitigating these risks requires due diligence, clear contractual terms, ongoing oversight, and strategic partner selection. Investing in reputable suppliers and comprehensive legal safeguards ultimately protects both product quality and long-term business value.

Logistics & Compliance Guide for Plastics Mold

Overview and Importance

Plastics molds are critical tools in manufacturing, enabling the mass production of plastic components. Efficient logistics and strict compliance with international, national, and industry-specific regulations are essential to ensure timely delivery, cost-effectiveness, and legal operation. This guide outlines key considerations for transporting, storing, and managing regulatory requirements related to plastic molds.

International Shipping and Customs Compliance

When shipping plastic molds across borders, adherence to customs regulations is mandatory. Ensure all shipments include accurate documentation such as commercial invoices, packing lists, and certificates of origin. Harmonized System (HS) codes specific to molds (e.g., HS 8480.71 for mold bases) must be correctly applied to avoid delays or penalties. Comply with export control laws, including ITAR or EAR, if molds incorporate proprietary or sensitive technology.

Packaging and Handling Requirements

Proper packaging protects molds during transit and storage. Use wooden crates or metal containers with internal cushioning to prevent mechanical damage. Desiccants and corrosion inhibitors should be included to guard against moisture, especially for steel molds. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include unique identification numbers for traceability.

Import Regulations and Duties

Importers must verify country-specific regulations, including conformity assessments and labeling requirements. Some regions may require molds to meet specific safety or environmental standards before entry. Research duty rates and potential exemptions—many countries offer reduced tariffs for molds used in local manufacturing under temporary importation regimes (e.g., ATA Carnet).

Intellectual Property and Legal Protection

Plastics molds often embody proprietary designs. Protect intellectual property (IP) by registering designs and patents where applicable. Include confidentiality and non-disclosure agreements (NDAs) with logistics and manufacturing partners. Clearly mark molds and documentation with IP notices to deter unauthorized replication.

Environmental and Safety Compliance

Mold manufacturing and transport may involve hazardous materials (e.g., mold release agents, cleaning solvents). Comply with safety data sheet (SDS) regulations and transport hazardous goods according to IMDG (sea), ADR (road), or IATA (air) standards. Disposal of damaged or obsolete molds must follow local environmental laws, particularly regarding metal recycling and chemical residues.

Recordkeeping and Traceability

Maintain detailed records of mold movements, maintenance, and compliance documentation. Implement a digital tracking system to log location, condition, and usage history. This supports audit readiness and facilitates quick response to regulatory inquiries or quality issues.

Industry Standards and Certifications

Adhere to relevant standards such as ISO 9001 (quality management) and ISO 14001 (environmental management). For molds used in regulated industries (e.g., medical, automotive), ensure compliance with sector-specific standards like ISO 13485 or IATF 16949. Certifications enhance credibility and streamline global logistics.

Summary and Best Practices

Successful logistics and compliance for plastics molds require proactive planning, accurate documentation, and ongoing regulatory awareness. Partner with experienced freight forwarders familiar with industrial tooling, conduct regular compliance audits, and invest in secure tracking systems. By following this guide, manufacturers can minimize risks, reduce costs, and ensure uninterrupted production cycles.

Conclusion for Sourcing Plastic Molds

Sourcing plastic molds is a critical step in ensuring the success of any plastic injection molding project. It involves careful evaluation of mold design, material selection, manufacturing capabilities, cost considerations, and supplier reliability. A well-sourced mold not only ensures high-quality, consistent part production but also contributes to long-term cost efficiency and reduced downtime. By partnering with experienced and reputable mold manufacturers, emphasizing clear communication, and conducting thorough due diligence—such as reviewing technical expertise, quality control processes, and lead times—businesses can mitigate risks and optimize production outcomes. Ultimately, strategic sourcing of plastic molds lays the foundation for product excellence, scalability, and competitive advantage in the market.