The global adhesive market is experiencing robust expansion, driven by rising demand across automotive, electronics, packaging, and consumer goods industries. According to Grand View Research, the global adhesives and sealants market was valued at USD 61.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key segment within this growth is plastic bonding adhesives, where performance, speed, and durability are critical. Plastic super glues—cyanoacrylate-based formulations engineered for rapid bonding on challenging substrates—are gaining particular traction. Mordor Intelligence forecasts the cyanoacrylate adhesives market to grow at a CAGR of over 6.2% during the 2023–2028 period, fueled by advancements in material science and increasing DIY consumer activity. As demand surges, manufacturers are innovating to deliver stronger, faster-curing, and more versatile solutions. Below are eight leading plastic super glue manufacturers at the forefront of this high-performance adhesive revolution.

Top 8 Plastic Super Glue Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rubber and Plastic Cyanoacrylate Super Glue

Domain Est. 1999

Website: hotmelt.com

Key Highlights: In stock Rating 5.0 (4) This general purpose industrial grade super glue comes in a full range of viscosity, cure times and sizes. Available at Hotmelt.com….

#2 About us

Domain Est. 2001

Website: superglue.pl

Key Highlights: Welcome to the official website of the manufacturer and distributor of the Super Glue “original with star only” – Glue-Invest Sp.z o.o….

#3 Cyanoacrylate Adhesives

Domain Est. 2012

Website: infinitybond.com

Key Highlights: 5-day delivery 30-day returnsInfinity Bond cyanoacrylate super glues are formulated to meet and exceed the properties of the big name adhesive manufacturers at significant cost sav…

#4 Loctite Super Glue Plastics Bonding System

Domain Est. 1999

Website: loctiteproducts.com

Key Highlights: Loctite Plastics Bonding System is a two-part cyanoacrylate adhesive that sets in seconds, dries transparent, and successfully bonds plastics with no mixing or ……

#5 CA Glue from Satellite City Instant Glues

Domain Est. 2000 | Founded: 1970

Website: caglue.com

Key Highlights: CA Glue, Glue faster with Satellite City instant glues! Providing customers with the best CA glue aka cyanoacrylate glue since 1970….

#6 Adhesive Products Overview

Domain Est. 2001

Website: supergluecorp.com

Key Highlights: Our product overview page covers instant glues, tapes, expoxies, specialty glues, stationary, mounting, and much more for your glue and adhesive needs….

#7 CECCORP

Domain Est. 2018

Website: ceccorp.ca

Key Highlights: CECCORP is a Canadian company manufacturing and supplying, locally and worldwide, high-quality adhesives and coatings. Our R&D team is constantly involved ……

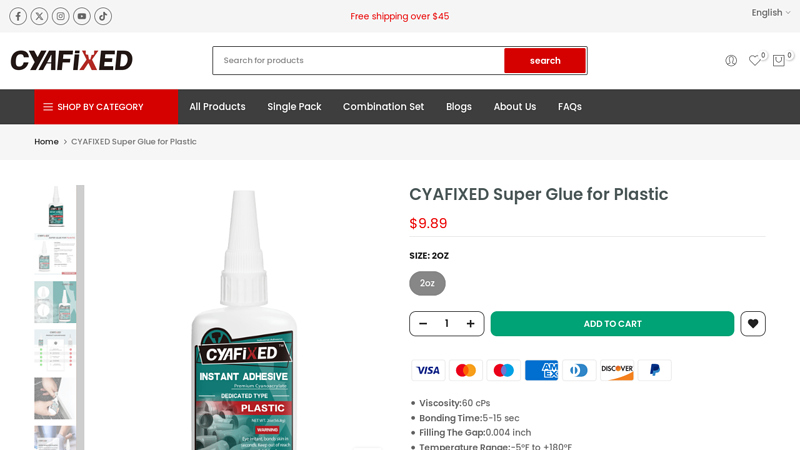

#8 CYAFIXED Super Glue for Plastic

Domain Est. 2023

Website: cyafixed.com

Key Highlights: In stock Rating 4.7 (49) CYAFIXED Instant Adhesive for Plastics can quickly bond a variety of plastic materials in 5-15 seconds with a viscosity of 60 CPS….

Expert Sourcing Insights for Plastic Super Glue

H2: Market Trends in the Plastic Super Glue Industry for 2026

The plastic super glue market is poised for significant evolution by 2026, driven by technological innovation, shifting consumer demands, and sustainability imperatives. As industries ranging from consumer electronics to automotive manufacturing increasingly rely on high-performance adhesives, the demand for specialized plastic super glues—formulations optimized for bonding diverse plastic substrates—is projected to rise steadily.

One of the key drivers shaping the 2026 market landscape is the growing adoption of engineering plastics in lightweight and durable products. With industries prioritizing weight reduction to improve energy efficiency—particularly in automotive and aerospace sectors—the need for reliable adhesives that bond plastics like polycarbonate, ABS, and polypropylene without compromising structural integrity is expanding. This has spurred R&D efforts to develop next-generation cyanoacrylate-based super glues with enhanced flexibility, impact resistance, and temperature tolerance.

Sustainability is another major trend influencing the plastic super glue market. By 2026, regulatory pressures and consumer preferences are expected to accelerate the shift toward eco-friendly formulations. Leading manufacturers are investing in bio-based raw materials, low-VOC (volatile organic compound) emissions, and recyclable packaging. Some companies are introducing water-based or solvent-free super glues designed specifically for plastic bonding, aligning with global environmental standards such as REACH and RoHS.

The rise of DIY culture and home improvement projects, particularly in North America and Europe, continues to fuel retail demand for consumer-grade plastic super glues. Enhanced product labeling, faster curing times, and user-friendly applicators (such as precision nozzles and anti-clog caps) are becoming standard features to improve customer experience. E-commerce platforms are also playing a pivotal role, offering wider product availability and competitive pricing, which is expected to sustain market growth through 2026.

Regionally, Asia-Pacific is anticipated to be the fastest-growing market, driven by rapid industrialization, expanding electronics manufacturing, and urban construction in countries like China, India, and Vietnam. Local production of adhesives is increasing to reduce import dependence, fostering innovation in cost-effective yet high-performance plastic bonding solutions.

In summary, the 2026 plastic super glue market will be characterized by advanced formulations, a strong focus on sustainability, and growing demand across both industrial and consumer applications. Companies that prioritize innovation, environmental responsibility, and regional market adaptation are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Plastic Super Glue (Quality and Intellectual Property)

Sourcing plastic super glue—especially for industrial, medical, or consumer applications—requires careful attention to both quality assurance and intellectual property (IP) compliance. Overlooking these areas can lead to product failure, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Adhesive Quality and Performance

Substandard plastic super glue may fail to bond properly, degrade over time, or react adversely with substrates. Common quality-related issues include inconsistent viscosity, short shelf life, weak bond strength, or incompatibility with specific plastics (e.g., polyethylene or polypropylene). Buyers often assume all cyanoacrylates are interchangeable, but formulations vary widely.

To mitigate this, require suppliers to provide technical data sheets (TDS), certificates of conformance (CoC), and batch testing results. Conduct independent performance testing under real-world conditions (temperature, humidity, stress) before scaling procurement.

Lack of Regulatory Compliance

Plastic super glues used in regulated industries (e.g., medical devices, food packaging, aerospace) must meet specific standards such as ISO 10993 (biocompatibility), FDA CFR 21 compliance, or REACH and RoHS directives. Sourcing non-compliant products—even unintentionally—can result in shipment rejections, fines, or product recalls.

Always verify that the adhesive formulation and manufacturing process are certified for the intended application. Request documentation proving compliance and confirm whether changes in formulation are communicated promptly.

Counterfeit or Unlicensed Products

The market for industrial adhesives includes counterfeit or gray-market products falsely branded as premium brands (e.g., Loctite, Permabond, 3M). These may mimic packaging but use inferior or unsafe chemistries. Sourcing from unauthorized distributors increases the risk of receiving such products.

To protect against IP violations, purchase only through authorized distributors or directly from the brand manufacturer. Verify supplier credentials, check for holograms or batch traceability, and conduct periodic audits. Unauthorized resellers may infringe on trademarks or distribute products without the IP holder’s consent.

Inadequate IP Due Diligence

When developing private-label or custom-formulated super glues, ensure that the formulation does not infringe on existing patents. Many cyanoacrylate technologies are protected by active patents covering cure speed, flexibility, or substrate adhesion.

Conduct a patent landscape analysis before finalizing a supplier or formulation. Work with legal counsel to assess freedom-to-operate (FTO) and avoid costly litigation or forced reformulation down the line.

Insufficient Supply Chain Transparency

Opaqueness in the supply chain—such as undisclosed subcontractors or raw material sources—can hide quality risks and IP vulnerabilities. A supplier may claim to produce the glue in-house but actually outsource to a third party using unlicensed technology.

Require full supply chain disclosure, including raw material suppliers and manufacturing locations. Include audit rights in contracts and ensure chain-of-custody documentation is maintained.

Overlooking Long-Term Support and Scalability

A supplier may offer a low-cost solution initially but lack the capacity, technical support, or R&D capability to sustain quality or adapt formulations as needs evolve. This can disrupt production and expose IP if alternative suppliers must be sourced urgently.

Evaluate suppliers not just on price, but on technical support, scalability, and innovation pipeline. Establish long-term agreements with clear IP ownership clauses, especially if co-developing formulations.

By addressing these pitfalls proactively—focusing on verified quality, regulatory alignment, and robust IP practices—buyers can ensure reliable performance and legal safety in their plastic super glue sourcing.

H2: Logistics & Compliance Guide for Plastic Super Glue

This guide outlines essential logistics and compliance considerations for the safe and legal handling, storage, transport, and disposal of Plastic Super Glue (typically based on cyanoacrylate adhesives). Adherence to these guidelines is critical for regulatory compliance, personnel safety, and environmental protection.

H2: 1. Product Classification & Regulatory Identification

- Chemical Name: Ethyl 2-cyanoacrylate (common base), may contain additives.

- CAS Number: 7085-85-0 (Ethyl 2-cyanoacrylate).

- UN Number: UN 3065 (ADHESIVE, FLAMMABLE LIQUID, TOXIC, 3, PG II) – Primary classification for transport.

- UN Proper Shipping Name: ADHESIVE, FLAMMABLE LIQUID, TOXIC.

- Hazard Class: 3 (Flammable Liquids) + 6.1 (Toxic Substances).

- Packing Group: II (Medium Danger).

- GHS Classification:

- Flammability: Category 2 (Highly flammable liquid and vapor).

- Acute Toxicity (Inhalation): Category 4 (Harmful if inhaled).

- Skin Corrosion/Irritation: Category 1B (Causes severe skin burns and eye damage).

- Serious Eye Damage/Eye Irritation: Category 1 (Causes serious eye damage).

- Specific Target Organ Toxicity (Single Exposure): Category 3 (Respiratory tract irritation).

- Hazardous to the Aquatic Environment: Chronic Category 3.

- Regulatory Frameworks: REACH (EU), TSCA (USA), WHMIS (Canada), GHS (Global), ADR/RID/ADN (Europe), IMDG Code (Sea), IATA DGR (Air), 49 CFR (USA – DOT).

H2: 2. Safety Data Sheet (SDS) Management

- Mandatory Requirement: A current, compliant SDS (GHS-aligned) must be available for every batch shipped.

- Accessibility: SDSs must be readily accessible to all personnel handling the product (warehouse, transport, emergency responders) and provided to customers upon request or with the first shipment.

- Review: SDSs must be reviewed and updated at least every 3-5 years or immediately upon new hazard information.

H2: 3. Packaging & Labeling Requirements

- Primary Container:

- Use original, manufacturer-approved, leak-proof containers (typically small plastic bottles with precision tips).

- Ensure containers are compatible with cyanoacrylate (resistant to adhesion and degradation).

- Secondary Packaging (Outer Packaging):

- Use strong, rigid, UN-certified packaging suitable for Packing Group II (e.g., fiberboard box, wooden crate).

- Inner containers must be securely cushioned (e.g., with vermiculite, foam, or absorbent material) to prevent breakage and contain leaks.

- Include sufficient absorbent material to soak up the entire contents of the largest inner package in case of rupture.

- Labeling (Outer Packaging):

- Proper Shipping Name: “ADHESIVE, FLAMMABLE LIQUID, TOXIC”

- UN Number: “UN 3065”

- Hazard Class Labels: Class 3 (Flammable Liquid) and Class 6.1 (Toxic) diamond labels (red for Class 3, white with skull & crossbones for 6.1).

- Packing Group: “PG II”

- Orientation Arrows: Required if inner packaging contains >4L or >4kg (less common for consumer super glue).

- Shipper/Consignee Information: Full name, address, and contact details.

- GHS Pictograms: Flame (Flammability), Skull & Crossbones (Acute Toxicity), Corrosion (Skin/Eye Damage) – on consumer packaging and likely on transport packaging.

- Precautionary Statements (P-Phrases): e.g., P210 (Keep away from heat/sparks/open flames), P280 (Wear protective gloves/eye protection), P305+P351+P338 (IF IN EYES: Rinse cautiously with water…).

- Net Quantity: Total quantity of the hazardous material in the package.

H2: 4. Storage Guidelines

- Location: Dedicated, well-ventilated, cool, dry area away from direct sunlight, heat sources, and ignition sources (sparks, open flames, hot surfaces). Temperature typically <25°C (77°F) recommended, avoid freezing.

- Segregation: Store away from:

- Strong oxidizers (e.g., peroxides, nitrates, chlorates).

- Strong bases (alkalis).

- Acids.

- Ammonia.

- Other flammable materials (if possible, in a flammable storage cabinet).

- Containers: Keep containers tightly closed when not in use. Store upright.

- Spill Control: Secondary containment (drip trays) recommended for bulk storage. Have spill kits (absorbents compatible with organics, PPE) readily available.

- Inventory: Practice FIFO (First-In, First-Out). Monitor shelf life (typically 1-2 years unopened, shorter after opening).

H2: 5. Transportation Regulations

- Mode-Specific Rules: Strictly adhere to the relevant regulations:

- Road (Europe): ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road).

- Road/Rail (Europe): ADR/RID.

- Sea: IMDG Code (International Maritime Dangerous Goods Code).

- Air: IATA DGR (International Air Transport Association Dangerous Goods Regulations) – Note: Air transport of PG II quantities is often highly restricted or prohibited for passenger aircraft; cargo aircraft may have limitations.

- USA: 49 CFR (Code of Federal Regulations, Department of Transportation).

- Documentation: Shipping papers (Dangerous Goods Note, Air Waybill, Bill of Lading) must include:

- UN Number (3065)

- Proper Shipping Name (ADHESIVE, FLAMMABLE LIQUID, TOXIC)

- Hazard Class (3, 6.1)

- Packing Group (II)

- Total Quantity

- Emergency Contact Number (available 24/7)

- Vehicle Requirements: May require specific placarding (e.g., “3”, “6.1”, “3065” on orange panels for road in Europe/US). Ensure vehicle is suitable and maintained.

- Driver/Handler Training: Personnel involved in handling or transporting must have appropriate dangerous goods training (e.g., ADR Driver Training, IATA DGR training) valid and documented.

H2: 6. Handling Procedures

- PPE (Personal Protective Equipment): Mandatory use of:

- Chemical-resistant gloves (e.g., Nitrile).

- Safety goggles or face shield.

- Lab coat or protective clothing.

- Respiratory protection (e.g., fume respirator) may be needed in poorly ventilated areas or during large-scale handling to avoid inhalation of vapors.

- Ventilation: Use in well-ventilated areas. Local exhaust ventilation (fume hood) is recommended for bulk handling or prolonged use.

- Minimize Exposure: Avoid skin and eye contact. Do not breathe vapors/mist. Do not eat, drink, or smoke while handling.

- Spills:

- Evacuate non-essential personnel.

- Ventilate area.

- Wear full PPE (gloves, goggles, respirator).

- Absorb with inert, non-combustible material (vermiculite, sand, specialized absorbents). Do not use sawdust (can polymerize violently).

- Place absorbent and contaminated material in a suitable container for hazardous waste disposal.

- Ventilate thoroughly. Do not use water to wash down drains.

- First Aid:

- Skin Contact: Do not pull skin apart if glued. Soak in warm soapy water to soften glue. Seek medical advice if irritation occurs or skin is damaged.

- Eye Contact: Immediately flush eyes with plenty of water for at least 15 minutes. Seek immediate medical attention.

- Inhalation: Move to fresh air. If breathing is difficult, give oxygen. Seek medical attention.

- Ingestion: Rinse mouth. Do not induce vomiting. Seek immediate medical attention.

H2: 7. Environmental & Waste Disposal

- Environmental Hazard: Toxic to aquatic life with long-lasting effects. Prevent release to environment (sewers, soil, water).

- Waste Classification: Empty containers and spill cleanup materials are hazardous waste due to residue.

- Disposal: Dispose of waste and empty containers in accordance with local, regional, and national regulations for hazardous chemical waste. Use authorized waste disposal contractors.

- Recycling: Empty containers cannot typically be recycled through standard streams due to chemical residue. Follow hazardous waste procedures.

H2: 8. Emergency Response

- Emergency Contacts: Ensure 24/7 emergency contact number is on shipping papers and SDS.

- Spill Kits: Maintain readily accessible spill kits suitable for flammable toxic liquids.

- Fire: Use dry chemical, CO2, or foam extinguishers. Water may be ineffective and spread fire. Small fires can sometimes be smothered. Evacuate area. Combustion produces toxic fumes (hydrogen cyanide, nitrogen oxides).

- Leak/Spill: Follow spill procedure above. Isolate area. Prevent entry into sewers/waterways.

- Fire/Spill Response: In case of fire or major spill, evacuate immediately and call emergency services. Provide SDS to responders.

H2: 9. Record Keeping & Training

- Training Records: Maintain records of all employee training on SDS, handling, storage, emergency procedures, and specific transport regulations (if applicable).

- Shipping Documents: Retain copies of shipping papers and manifests for the required period (often 2-3 years).

- SDS Archive: Keep historical SDS versions as required by regulation.

- Incident Reports: Document any spills, exposures, or near misses.

Disclaimer: This guide provides general information. Regulations vary significantly by country, region, and mode of transport. Always consult the specific, up-to-date regulations (SDS, ADR, IATA DGR, 49 CFR, etc.) applicable to your location and shipment details. Engage qualified dangerous goods safety advisors (DGSAs) for complex shipments or regulatory interpretation. Safety and compliance are paramount.

In conclusion, sourcing plastic super glue requires careful consideration of factors such as bond strength, curing time, viscosity, temperature resistance, and compatibility with specific plastic types (e.g., ABS, polycarbonate, or PVC). It is essential to evaluate both supplier reliability and product quality to ensure consistency and performance in the intended application. Whether for industrial manufacturing, DIY projects, or repair work, selecting the right super glue—such as cyanoacrylate (CA) adhesives formulated specifically for plastics—can significantly impact the durability and success of the bond. Additionally, prioritizing cost-effective sourcing without compromising safety and environmental standards will contribute to long-term efficiency and sustainability. Ultimately, a well-informed sourcing strategy ensures access to high-performance plastic super glue that meets technical requirements and operational goals.