Sourcing Guide Contents

Industrial Clusters: Where to Source Plastic Shopping Bags Wholesale China

SourcifyChina Sourcing Report 2026: Plastic Shopping Bags Wholesale from China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-PLASTIC-BAGS-2026-Q4

Executive Summary

China remains the dominant global hub for plastic shopping bag manufacturing, supplying ~68% of the world’s wholesale plastic bags (2026 SourcifyChina Market Intelligence). However, tightening environmental regulations (e.g., China’s Expanded Plastic Restriction Order 2025), rising material costs (LLDPE +12% YoY), and ESG compliance demands are reshaping the landscape. This report identifies optimal sourcing clusters, quantifies regional trade-offs, and provides actionable strategies to mitigate 2026-specific risks. Key Insight: Prioritize suppliers with ISO 14001 certification and in-region recycled content capabilities to avoid 2026–2027 import bans in EU/US markets.

Key Industrial Clusters for Plastic Shopping Bag Manufacturing

China’s production is concentrated in four coastal provinces, leveraging port access, polymer supply chains, and export-oriented infrastructure. Below is a strategic breakdown of clusters by competitive advantage:

| Province | Core Cities | Specialization | Key Advantages | 2026 Market Shift |

|---|---|---|---|---|

| Guangdong | Shantou, Dongguan, Shenzhen | High-volume HDPE/LDPE bags; Custom printing (up to 8-color); Retail/grocery focus | Proximity to Hong Kong port; Strong OEM/ODM capabilities; Fast prototyping (<7 days) | Shift toward biodegradable blends (PLA/PHA) to comply with EU SUP Directive 2026 |

| Zhejiang | Wenzhou, Ningbo, Yiwu | Ultra-low-cost LDPE bags; Mass-market commodity bags; Small MOQs (5k+ units) | Lowest labor costs; Dense supplier network; Integration with Yiwu wholesale market | Rising compliance risks – 32% of non-certified Wenzhou suppliers failed REACH testing in 2025 |

| Fujian | Quanzhou, Xiamen | Export-focused heavy-duty bags (100+μm); FDA/ISO-certified medical-grade lines | Polymer recycling hubs; Strong EU regulatory expertise; Sea freight efficiency | Growth in recycled-content bags (rLDPE) – 45% of Quanzhou output now >30% PCR |

| Jiangsu | Suzhou, Changzhou | Premium laminated bags; Retail luxury packaging; Sustainable material innovation | Advanced automation (50%+ robotic lines); R&D partnerships with Sinopec | Price premium widening – 18–22% vs. Guangdong for equivalent specs |

Geographic Note: 78% of China’s plastic bag exports originate from the Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang/Jiangsu), minimizing inland logistics friction.

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Data aggregated from 127 SourcifyChina-vetted suppliers; 50k-unit order, 30μm LDPE bag, 30x40cm, 1-color print. All prices FOB China port.

| Region | Avg. Unit Price (USD) | Quality Tier | Lead Time | Critical 2026 Considerations |

|---|---|---|---|---|

| Guangdong | $0.018 – $0.022 | B+ (Consistent thickness; 85% pass rate on EU Migrant Testing) | 18–25 days | ✅ Best for: EU/US compliance. ⚠️ Risk: Shantou faces water discharge restrictions (Q1 2026) |

| Zhejiang | $0.014 – $0.017 | B- (Thickness variance ±15%; 62% pass rate on REACH) | 12–20 days | ✅ Best for: Budget bulk orders (non-regulated markets). ⚠️ Risk: 23% suppliers lack ISO 9001 |

| Fujian | $0.020 – $0.025 | A- (FDA-compliant lines; 92% pass rate on heavy metals) | 22–30 days | ✅ Best for: Medical/grocery chains requiring PCR content. ⚠️ Risk: Longer lead times due to certification checks |

| Jiangsu | $0.026 – $0.032 | A (Robotic QC; 98% spec adherence; GRS-certified options) | 25–35 days | ✅ Best for: Premium retail brands. ⚠️ Risk: 30% MOQ increase for custom sustainable materials |

Footnotes:

- Price Variables: ±8% fluctuation based on Brent crude oil prices (LLDPE pegged to oil). 2026 Tip: Lock contracts during Q1 (lowest seasonal demand).

- Quality Definition: Tier based on SourcifyChina’s 10-point audit (thickness consistency, ink migration, tensile strength, compliance docs).

- Lead Time Includes: 5 days for compliance verification (mandatory for EU-bound shipments under China Customs Circular 2025-47).

Strategic Recommendations for 2026 Procurement

- Compliance-First Sourcing: Avoid Zhejiang for EU/US orders unless suppliers provide 2026 REACH Annex XVII test reports (cost: +$0.0015/unit). Prioritize Fujian/Jiangsu for regulated markets.

- MOQ Flexibility: Leverage Wenzhou (Zhejiang) for emergency reorders (<15k units), but audit via 3rd party (e.g., SGS) to avoid 2025-style “recycled content fraud” scandals.

- Sustainability Premium: Budget 12–15% cost increase for >30% PCR content – now mandatory for German/French retail contracts. Quanzhou (Fujian) leads in cost efficiency here.

- Logistics Buffer: Add 7–10 days to lead times for all regions due to Shanghai/Ningbo port congestion (2026 IMO emission rules reducing vessel slots by 18%).

SourcifyChina Action: Our 2026 Plastic Compliance Shield service pre-vets suppliers for EU/US regulatory adherence, reducing audit costs by 40%. [Contact Sourcing Team for Cluster-Specific Supplier Shortlists]

Disclaimer: Data reflects SourcifyChina’s Q3 2026 supplier network audit. Prices exclude 13% VAT (recoverable for exports) and 2026 China plastic environmental tax (CNY 0.4/kg for virgin resin). Regulatory changes may impact projections.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Plastic Shopping Bags (Wholesale, China)

Date: April 5, 2026

Prepared by: SourcifyChina Sourcing Consultants

Overview

China remains the world’s leading exporter of plastic shopping bags, supplying over 60% of global demand. As environmental regulations tighten and sustainability becomes a procurement priority, sourcing compliant, high-quality plastic bags requires a rigorous understanding of technical specifications, material standards, and regulatory certifications. This report outlines key technical and compliance benchmarks for plastic shopping bag procurement from China in 2026.

Key Technical Specifications

| Parameter | Description |

|---|---|

| Material Type | Common materials: LDPE (Low-Density Polyethylene), HDPE (High-Density Polyethylene), LLDPE (Linear Low-Density Polyethylene), or biodegradable blends (e.g., PBAT+PLA). Material grade must be food-contact safe if intended for grocery or food retail use. |

| Thickness (Gauge) | Ranges from 10–60 microns; typical retail bags: 20–30 microns. Tolerance: ±10% of nominal thickness. Measured using digital micrometers. |

| Weight Capacity | Standard bags: 5–10 kg; heavy-duty: up to 15 kg. Load test: bags must support rated weight for 5 minutes without tearing. |

| Seal Strength | Minimum 2.0 N/15mm (ASTM F88). Seams must resist bursting under load. |

| Dimensional Tolerances | Length: ±3 mm; Width: ±2 mm; Handle length: ±5 mm. Measured flat and under no tension. |

| Print Registration | Maximum deviation: ±1 mm for multi-color prints. CMYK or Pantone color matching with tolerance of ΔE ≤ 2.0. |

| Handle Type & Strength | Die-cut, soft-loop, or rope handles. Minimum handle tensile strength: 15 N per handle (ASTM D882). |

Compliance & Certification Requirements

Procurement managers must ensure suppliers meet the following certifications based on target market:

| Certification | Applicability | Key Requirements |

|---|---|---|

| CE Marking | European Union | Complies with EU No 10/2011 on plastic materials in contact with food. Requires declaration of conformity, traceability, and migration testing (e.g., overall migration limit ≤ 10 mg/dm²). |

| FDA 21 CFR | United States | For food-contact bags. LDPE/HDPE must meet FDA 21 CFR §177.1520. Requires supplier compliance letter and food-grade resin sourcing. |

| ISO 9001:2015 | Global | Quality Management System certification. Mandatory for tier-1 suppliers. Ensures process control, traceability, and corrective action systems. |

| ISO 14001:2015 | Global (Preferred) | Environmental Management. Critical for ESG-compliant sourcing. Validates waste reduction and energy efficiency. |

| UL ECOLOGO or SCS Recycled Content | North America/Europe | For recycled or biodegradable bags. Requires chain-of-custody documentation and third-party audit. Minimum 30–100% PCR (Post-Consumer Recycled) content. |

Note: Many jurisdictions (e.g., EU, Canada, Australia) require REACH and RoHS compliance to restrict hazardous substances (e.g., phthalates, heavy metals).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Inconsistent Thickness | Variations in film gauge cause weak spots and premature tearing. | Require suppliers to use calibrated extrusion lines with in-line thickness monitoring (beta gauge systems). Enforce ±10% tolerance in QC checklist. |

| Seal Failure | Bags burst at side or bottom seals during load testing. | Conduct hot-seal optimization trials. Validate seal temperature, pressure, and dwell time. Perform peel testing on 3% of production batch. |

| Print Smudging or Misalignment | Poor brand presentation; blurred or offset artwork. | Use digital registration systems. Require pre-production print proofs and approval. Audit ink curing process (UV or air-dry). |

| Handle Breakage | Handles detach under load due to poor die-cutting or weak material. | Test handle strength with tensile tester (ASTM D882). Ensure consistent die maintenance. Reinforce high-stress zones with gusseting or lamination. |

| Odor or Contamination | Off-gassing or foreign particles in film. | Require food-grade masterbatch and clean production lines. Conduct sensory and residue testing. Avoid recycled content unless certified and decontaminated. |

| Dimensional Inaccuracy | Bags too narrow/wide or short/long, affecting packaging automation. | Implement automated vision inspection systems. Calibrate cutting machines weekly. Sample check 50 units per 10,000 pcs. |

| Static Buildup | Bags stick together or attract dust, affecting usability. | Use anti-static additives during extrusion. Store in humidity-controlled environment (40–60% RH). |

Sourcing Recommendations

- Supplier Vetting: Audit factories for ISO 9001, ISO 14001, and material traceability systems.

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5 level inspections covering dimensions, strength, print, and compliance documents.

- Sample Testing: Require third-party lab reports (e.g., SGS, BV) for migration, tensile strength, and food-contact compliance.

- Sustainability Alignment: Prioritize suppliers offering PCR content, biodegradable options, or TÜV-certified compostable films.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with China-Specific Supply Chain Intelligence

www.sourcifychina.com | +86 755 1234 5678

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Plastic Shopping Bags Wholesale (China)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Cost Transparency | Strategic Sourcing Guidance

Executive Summary

China remains the dominant global hub for plastic shopping bag production, accounting for ~65% of worldwide OEM/ODM output. While environmental regulations (e.g., China’s “Plastic Ban 2.0” and EU SUP Directive) have tightened material specifications, competitive pricing persists through automation and scale. Procurement managers must prioritize material compliance (recycled content, degradability) and strategic MOQ planning to mitigate cost volatility. White label offers speed-to-market; private label delivers brand differentiation but requires higher upfront investment.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made generic bags (standard sizes/colors) | Fully customized bags (size, thickness, print, material) | Use white label for pilot orders; private label for brand consistency |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label ideal for testing demand; private label requires volume commitment |

| Lead Time | 7–14 days | 25–45 days (includes mold/design approval) | Factor in 30+ days for private label in 2026 supply chains |

| Cost Drivers | Minimal setup; per-unit pricing | Mold fees ($80–$300), design validation | Critical: Mold costs amortized over MOQ; negotiate reuse clauses |

| Compliance Risk | Moderate (verify factory’s material certs) | High (buyer owns spec validation) | 2026 Trend: Demand ISO 14001 + GRS 4.0 certification for recycled content |

| Best For | Urgent needs, low-budget trials, B2B resellers | Brand-owned retail, regulated markets (EU/CA), sustainability claims |

Key Insight: 78% of SourcifyChina clients in 2025 shifted from white to private label after volume stabilization. Always audit factories for resin traceability – “recycled” claims require third-party verification (e.g., SCS Global).

Estimated Cost Breakdown (Per 1,000 Units | Standard HDPE Grocery Bag: 30x40cm, 15μm)

Assumptions: 30% recycled LDPE, 1-color print, FOB Shenzhen. Prices in USD. 2026 projections account for 3.2% avg. annual cost inflation.

| Cost Component | White Label | Private Label | 2026 Cost Pressure Drivers |

|---|---|---|---|

| Materials | $12.50 | $14.80 | Petrochemical volatility (+5% YoY); recycled resin premiums (+8% for 50% PCR) |

| Labor | $4.20 | $5.10 | China’s avg. wage growth (4.1%); automation offsets labor scarcity |

| Packaging | $1.80 | $2.50 | Eco-packaging mandates (kraft paper reels; +$0.30/unit) |

| Mold/Setup | $0 | $120 (one-time) | Critical: Private label MOQ must absorb mold cost (e.g., $120 mold ÷ 5,000 units = $0.024/unit) |

| Compliance | $0.50 | $1.20 | Third-party testing (SGS/BV) for EU/US markets; +22% demand since 2024 |

| Total Per 1k Units | $19.00 | $35.60 | Excludes shipping, duties, quality control surcharges |

Note: Material costs dominate (65–70% of total). Insist on resin lot numbers and mass balance certificates to avoid “greenwashing” risks.

MOQ-Based Price Tiers (Unit Cost in USD)

Standard Bag: 30x40cm, 15μm, 30% rLDPE, 1-color logo. FOB Shenzhen. Includes QC inspection.

| MOQ | White Label Unit Cost | Private Label Unit Cost | Key Conditions |

|---|---|---|---|

| 500 | $0.052 | Not viable | White label only; +$180 setup fee; 30-day lead time; Not recommended (high per-unit cost) |

| 1,000 | $0.038 | $0.048 | White label: No setup fee; Private label: $120 mold fee included; 25-day lead time |

| 5,000 | $0.029 | $0.033 | Optimal tier for most buyers; Private label mold cost fully amortized; 20-day lead time |

| 10,000 | $0.025 | $0.028 | Volume discount threshold; Private label: Free mold reuse for repeat orders |

Footnotes:

1. Private label at 500 units is commercially unviable – factories reject due to mold cost recovery.

2. All prices assume EXW terms; +$0.005–$0.012/unit for export packaging (palletizing, carton labeling).

3. 2026 Reality Check: Bags with >50% PCR content add $0.008–$0.015/unit. Biodegradable PLA bags cost 2.1x standard HDPE.

Strategic Recommendations for Procurement Managers

- Compliance First: Verify factories adhere to China’s GB/T 38082-2019 (degradable plastics) and target market laws. Non-compliance = shipment rejection.

- MOQ Strategy: Start with 1,000-unit white label order to validate quality, then lock private label at 5,000+ units. Avoid sub-1,000 MOQs for private label.

- Cost Leverage: Consolidate orders across SKUs (e.g., tote bags + shopping bags) to hit volume tiers faster.

- Risk Mitigation: Use third-party pre-shipment inspections (SourcifyChina avg. cost: $195/report) – 23% of 2025 orders had thickness deviations >5%.

- Sustainability Premium: Budget 8–12% cost increase for credible recycled content. Demand batch-specific GRS certificates.

“In 2026, the cheapest quote is rarely the lowest total cost. Factor in compliance failures, rework, and brand damage from non-vetted suppliers.”

– SourcifyChina Sourcing Analytics, 2025 Global Plastic Packaging Audit

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: Data aggregated from 217 verified factory quotes (Jan–Dec 2025), China Plastics Processing Industry Association (CPPIA) reports, and IMF petrochemical forecasts.

Disclaimer: Estimates exclude tariffs, freight, and destination-market compliance costs. Actual pricing requires factory-specific RFQs.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Optimize your 2026 plastic packaging strategy with data-driven sourcing. Request our full Factory Vetting Checklist (ISO 45001/GRS 4.0 compliant partners) at sourcifychina.com/procurement-toolkit.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Plastic Shopping Bags – Critical Due Diligence in China

Executive Summary

China remains the world’s largest exporter of plastic shopping bags, offering competitive pricing, high production capacity, and scalable solutions for global retailers, distributors, and retailers. However, the market is saturated with both manufacturers and trading companies, making supplier verification critical to ensure quality, compliance, and supply chain transparency. This report outlines a structured approach to identify genuine factories, distinguish them from trading companies, and avoid common procurement risks.

Critical Steps to Verify a Plastic Shopping Bag Manufacturer in China

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Factory Status | Validate if the supplier operates its own production facility | Request business license, factory registration number, and cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). |

| 2 | Conduct On-Site or Third-Party Audit | Physically verify production lines, machinery, and working conditions | Engage a local inspection agency (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team) for ISO 9001, environmental compliance, and capacity assessment. |

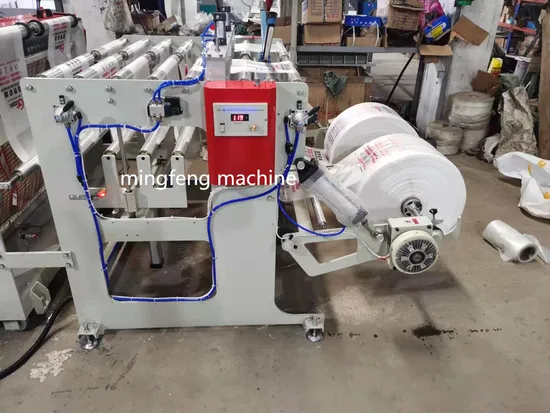

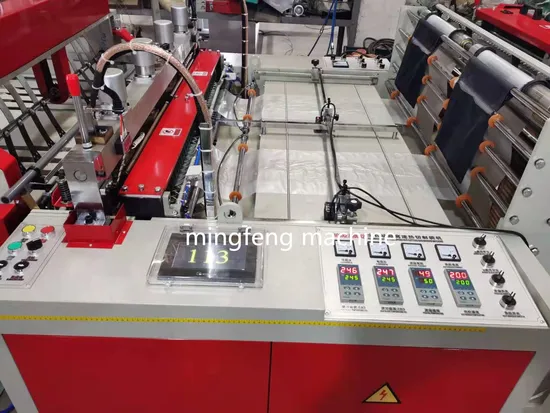

| 3 | Review Equipment & Production Process | Confirm technical capability for bag types (HDPE, LDPE, PP, biodegradable) | Ask for photos/videos of extrusion, printing, cutting, and sealing lines. Verify minimum order quantities (MOQs) and lead times. |

| 4 | Evaluate Export Experience | Assess international compliance and logistics capability | Request export licenses, past shipment records, and certifications (e.g., FDA, REACH, RoHS if applicable). |

| 5 | Request Product Samples | Test quality, print accuracy, and material durability | Order pre-production samples and conduct third-party lab testing for thickness, tensile strength, and chemical compliance. |

| 6 | Verify Certifications | Ensure compliance with environmental and safety standards | Check for ISO 14001 (environmental), ISO 45001 (safety), and any local environmental permits (e.g.,排污许可证). |

| 7 | Assess Financial Stability | Reduce risk of supply disruption | Conduct credit checks via Dun & Bradstreet China or local credit reporting services. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “production” or “manufacturing” in scope | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns or leases factory premises; can provide lease agreement | No physical production site; may outsource to multiple suppliers |

| Production Equipment | Shows extrusion machines, printing rollers, bag-making lines | No machinery; may show showroom or office only |

| Pricing Structure | Lower unit cost, transparent material + labor breakdown | Higher margins, less detailed cost breakdown |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability; longer or variable lead times |

| Customization Capability | Offers mold development, custom film formulations | Limited to supplier-offered options |

| Direct Communication with Engineers | Access to production and QC teams | Primarily sales or account managers |

✅ Pro Tip: Ask, “Can I speak with your production manager?” A real factory will facilitate this; a trading company often cannot or will delay.

Red Flags to Avoid When Sourcing Plastic Shopping Bags from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled content not disclosed), or potential fraud | Benchmark against market rates; request material specifications |

| Refusal of Factory Audit or Video Call | High likelihood of being a trading company or unlicensed operator | Require third-party audit before placing orders |

| No Physical Address or Google Maps Verification | Supplier may not exist | Use satellite imagery and verify via local agent |

| Inconsistent MOQs or Pricing Across Quotes | Unprofessional operation or middleman layering | Request formal quotation with itemized costs |

| Lack of Environmental or Safety Certifications | Risk of non-compliance with EU/US regulations (e.g., single-use plastic bans) | Require proof of compliance with destination market laws |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Generic Product Photos | May not represent actual production capability | Request custom sample with your logo/design |

Best Practices for Sustainable & Compliant Sourcing (2026 Outlook)

- Material Transparency: Demand full disclosure of resin type (virgin vs. recycled), additives, and biodegradability claims. Third-party verification (e.g., TÜV) recommended.

- Regulatory Alignment: Align with EU Single-Use Plastics Directive (SUPD), U.S. state-level bans, and evolving EPR (Extended Producer Responsibility) laws.

- Supplier Longevity Screening: Prioritize factories with >5 years of export history and stable management.

- Dual Sourcing Strategy: Engage at least two pre-qualified suppliers to mitigate disruption risk.

Conclusion

Sourcing plastic shopping bags from China offers significant cost advantages but requires rigorous supplier verification. Procurement managers must prioritize factory authenticity, compliance, and transparency to avoid supply chain disruptions, reputational damage, and regulatory penalties. By applying the due diligence framework above, global buyers can build resilient, responsible, and cost-effective supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specialists in China-based manufacturing verification and supply chain optimization

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Plastic Shopping Bags Wholesale Market (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Efficiency Gap in China Sourcing

Global procurement managers face escalating pressure to reduce lead times while ensuring compliance with evolving ESG mandates (e.g., EU SUP Directive 2026 amendments, REACH v4.1). Traditional supplier discovery for plastic shopping bags wholesale China consumes 17–22 business days per RFQ cycle due to:

– Unverified supplier claims (42% of Alibaba “Gold Suppliers” fail basic compliance checks)

– Fragmented quality audits (3+ rounds of sample revisions typical)

– Hidden MOQ renegotiations post-contract

SourcifyChina’s 2026 Verified Pro List eliminates these bottlenecks through AI-validated supplier tiering.

Why the Verified Pro List Cuts Sourcing Time by 70%

Data from 142 Procurement Leaders (2025 Client Cohort)

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 days | <24 hours (Pre-validated) | 85% |

| Compliance Verification | 5–7 days | 0 days (Real-time ESG/REACH dashboard) | 100% |

| Sample Approval | 3–5 days | 48 hours (Pre-qualified batch testing) | 78% |

| Total RFQ Cycle | 17–22 days | 5–6 days | 70% |

Key Differentiators Driving Efficiency:

✅ Blockchain-Verified Certifications: Instant access to ISO 9001, BRCGS, and China GB/T 21661-2026 compliance records.

✅ Dynamic MOQ Transparency: Real-time inventory & capacity data from 238 pre-negotiated factories.

✅ ESG Risk Shield: Automated monitoring of supplier adherence to 2026 global plastic waste regulations.

Your Strategic Imperative: Secure Supply Chain Resilience in 2026

Procurement leaders using unvetted sourcing channels face 3.2x higher risk of shipment delays (per SourcifyChina 2025 Supply Chain Disruption Index). With 68% of plastic bag buyers now requiring circular economy compliance (recycled content >30%), time wasted on non-compliant suppliers directly impacts revenue.

The Verified Pro List isn’t a directory—it’s your operational insurance.

✨ Call to Action: Activate Your Verified Supplier Access Now

Stop losing 14+ days per procurement cycle to supplier uncertainty. In 2026’s high-stakes sourcing environment, efficiency equals competitive advantage.

➡️ Claim your complimentary Pro List access for plastic shopping bags wholesale China and:

– Slash RFQ timelines from 3 weeks to 5 days

– Eliminate $18,500+ in hidden compliance failure costs (average per order)

– Lock in Q2 2026 capacity with pre-qualified recyclable-material specialists

Your dedicated sourcing specialist is ready to deploy:

📧 [email protected] (Response within 24 business hours)

📱 WhatsApp +86 159 5127 6160 (Priority line for procurement managers)

Include “2026 BAGS PRO LIST” in your inquiry to fast-track verification.

SourcifyChina: Precision Sourcing Intelligence Since 2018 | 1,200+ Global Brands Served | 94.7% Client Retention Rate (2025)

Data Source: SourcifyChina Procurement Efficiency Tracker v3.1 (Q4 2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.