Sourcing Guide Contents

Industrial Clusters: Where to Source Plastic Recycling Companies In China

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Plastic Recycling Companies in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains a dominant force in the global plastics recycling ecosystem, driven by its vast manufacturing base, evolving environmental regulations, and significant investment in circular economy infrastructure. As global demand for recycled plastics grows—fueled by ESG mandates, packaging regulations, and sustainable supply chain initiatives—China continues to offer strategic sourcing opportunities for international buyers.

This report provides a comprehensive analysis of the Chinese plastic recycling industry, identifying key industrial clusters, evaluating regional strengths, and offering actionable insights for procurement professionals. Special attention is given to the provinces and cities that host the highest concentration of compliant, scalable, and technologically advanced plastic recycling companies.

1. Overview of China’s Plastic Recycling Industry

China’s plastic recycling sector has undergone significant transformation since the 2018 National Sword Policy, which banned the import of most foreign waste plastics. This catalyzed a shift from reliance on imported scrap to a domestic waste collection and recycling infrastructure. Today, the industry is characterized by:

- Increased automation and technology adoption (e.g., AI sorting, advanced washing lines)

- Stricter environmental compliance standards

- Consolidation of small recyclers into larger, export-ready facilities

- Growth of post-consumer recycled (PCR) plastic production for export and domestic use

The Chinese government’s 14th Five-Year Plan (2021–2025) emphasizes circular economy development, supporting investment in plastic recycling parks and green manufacturing zones.

2. Key Industrial Clusters for Plastic Recycling in China

The following provinces and cities have emerged as dominant hubs for plastic recycling companies due to infrastructure, logistics, policy support, and industrial ecosystem maturity.

| Region | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Foshan, Dongguan, Shenzhen | Mixed plastic recycling (PET, HDPE, PP), PCR for export | Proximity to ports (Nansha, Shekou), strong export networks, high concentration of ISO-certified recyclers |

| Zhejiang | Hangzhou, Ningbo, Taizhou, Huzhou | Engineering-grade recycled plastics, film recycling | Advanced sorting tech, strong R&D links, eco-industrial parks |

| Jiangsu | Suzhou, Nanjing, Changzhou | High-purity rPET, rPP for automotive/electronics | Close to Shanghai port, high compliance standards, integration with manufacturing supply chains |

| Fujian | Xiamen, Quanzhou | LDPE/LLDPE film recycling, agricultural film | Strong local collection systems, cost-competitive operations |

| Shandong | Qingdao, Yantai, Weifang | HDPE & PP recycling, industrial scrap processing | Large petrochemical base, logistics access, growing export capacity |

3. Regional Comparison: Sourcing Metrics (2026 Benchmark)

The table below evaluates top sourcing regions based on key procurement criteria: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Low) to 5 (High), derived from SourcifyChina’s 2025 benchmark audits of 120+ recycling facilities.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg.) | Compliance Level | Best For |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 3–4 weeks | 5 | High-volume PCR exports, FDA-compliant rPET |

| Zhejiang | 3 | 5 | 4–5 weeks | 5 | High-quality engineering plastics, automotive-grade rPP |

| Jiangsu | 3.5 | 4.5 | 3–4 weeks | 5 | Precision applications, electronics, medical-grade PCR |

| Fujian | 5 | 3.5 | 5–6 weeks | 3 | Cost-sensitive LDPE film recycling, domestic-grade PCR |

| Shandong | 4.5 | 4 | 3–4 weeks | 4 | Industrial scrap recycling, bulk HDPE/PP |

Notes:

– Price: Influenced by labor, energy, waste feedstock availability, and export logistics.

– Quality: Based on sorting precision, contamination control, certifications (ISO 14001, GRSP, FDA), and traceability systems.

– Lead Time: Includes material processing, testing, and customs clearance. Longer in regions with inland logistics constraints.

– Compliance: Reflects adherence to environmental regulations, ESG reporting, and international audit readiness.

4. Strategic Sourcing Recommendations

✅ Preferred Regions by Application

- Export-Grade rPET (Beverage Bottles): Guangdong and Jiangsu (FDA-compliant lines available)

- Automotive & Electronics Recyclates: Zhejiang and Jiangsu (high purity, low odor, color consistency)

- Flexible Packaging & Film Recyclates: Fujian and Guangdong (specialized LDPE/PP film lines)

- Industrial/Commercial Scrap Recycling: Shandong (strong B2B scrap collection networks)

⚠️ Risk Considerations

- Fujian: Lower compliance levels; due diligence required on waste sourcing and emissions.

- Zhejiang: Higher costs due to stringent environmental enforcement and premium technology.

- All Regions: Verify recyclers’ feedstock sources to avoid contamination or regulatory risk (e.g., non-domestic scrap).

5. Future Outlook (2026–2028)

- Regulatory Shifts: China may introduce mandatory recycled content targets for packaging by 2027, increasing domestic demand and competition for PCR.

- Technology Investment: AI-driven sorting and chemical recycling pilots (e.g., in Zhejiang and Guangdong) will enhance quality and broaden feedstock options.

- Export Opportunities: Growing demand from EU and North America for ISO-certified, traceable PCR plastics will favor compliant recyclers in Guangdong and Jiangsu.

Conclusion

For global procurement managers, China remains a high-potential, high-complexity sourcing destination for plastic recycling services. Guangdong and Zhejiang lead in quality and compliance, making them ideal for premium PCR applications. Shandong and Fujian offer cost advantages for bulk or industrial-grade recyclates, provided due diligence is conducted.

SourcifyChina recommends a tiered supplier strategy—leveraging Zhejiang/Jiangsu for quality-critical applications and Guangdong/Shandong for volume procurement—supported by on-ground audits and continuous compliance monitoring.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Sourcing Advisory

Empowering Global Buyers with China-Specific Procurement Insights

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Framework for Plastic Recycling Partners in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Update | Objective Advisory | SourcifyChina Confidential

Executive Summary

China’s plastic recycling sector remains critical to global circular supply chains, but regulatory complexity and quality volatility persist. As of 2026, stricter enforcement of GB/T 38928-2024 (China’s national standard for recycled plastics) and alignment with EU/US EPR (Extended Producer Responsibility) schemes necessitate rigorous technical and compliance vetting. This report details actionable specifications for procurement teams to mitigate risk and ensure material suitability.

I. Key Quality Parameters for Recycled Plastic Pellets/Flakes

A. Material-Specific Technical Specifications

All values represent minimum acceptable baselines per ISO 15270:2024 and EU Circular Economy Action Plan 2025. Tighter tolerances apply for food/electrical applications.

| Polymer Type | Key Quality Parameters | Target Tolerance Range (2026) | Critical Test Methods |

|---|---|---|---|

| rPET | Intrinsic Viscosity (IV) | 0.70–0.85 dl/g | ISO 1628-5:2024 |

| Acetaldehyde Content | ≤ 1.0 ppm | ASTM F2013-23 | |

| L* (Lightness) | ≥ 78.0 | ISO 11664-4:2023 | |

| rPP | Melt Flow Rate (MFR @ 230°C/2.16kg) | ±0.3 g/10min vs. target | ISO 1133-1:2024 |

| Residual Ethylene Propylene Diene (EPDM) | ≤ 0.5% | FTIR (ASTM E1252-22) | |

| Gel Count (per 100g) | ≤ 3 | Visual sieve (GB/T 38928-2024) | |

| rPE-HD | Density (g/cm³) | 0.945–0.965 | ISO 1183-1:2024 |

| Carbonyl Index (CI) | ≤ 0.15 | FTIR (ASTM E2147-23) | |

| Odor Grade (1–5 scale) | ≤ 2 | ISO 16000-6:2024 | |

| rPS | Residual Styrene Monomer | ≤ 50 ppm | GC-MS (ISO 21527-2:2024) |

| Yellowness Index (YI) | ≤ 5.0 | ASTM E313-23 |

Critical Procurement Note: Tolerances must be contractually specified per batch. Chinese recyclers often quote “typical” values; demand certified lab reports (COC) with each shipment. Verify testing against actual end-use requirements (e.g., rPET for food contact requires IV ≥ 0.80 dl/g).

II. Essential Compliance Certifications (Non-Negotiable for 2026)

| Certification | Scope of Application | China-Specific Requirements | Verification Method |

|---|---|---|---|

| ISO 14001:2025 | Environmental Management System | Mandatory for all Tier-1 recyclers per China MEE Circular 2025 | Valid certificate + on-site audit trail |

| GB/T 38928-2024 | Recycled Plastic Safety & Quality | Legally binding in China; supersedes older GB/T 38928-2020 | Lab test report against GB/T appendix |

| FDA 21 CFR §177 | Food-Contact rPET/rPP/rPE | Required only if material enters US food chain; Chinese recyclers often lack direct certification | Supplier’s FDA Letter of Guaranty + FCN validation |

| EU REACH Annex XVII | Chemical Restrictions (e.g., SVHCs) | Applies to all EU-bound materials; stricter than Chinese GB standards | Extended SDS + 3rd-party SVHC screening |

| UL 2809 | Environmental Claim Validation | Critical for US/EU ESG reporting; verifies recycled content claims | UL’s online certificate database check |

Strategic Advisory:

– CE Marking is irrelevant for raw recycled pellets (applies only to finished products).

– Avoid “China FDA” claims – China has no FDA equivalent; reference GB 4806.6-2024 (food-contact plastics) instead.

– Prioritize recyclers with EU ISO 14021 certification for credible recycled content claims in Western markets.

III. Common Quality Defects in Chinese Recycled Plastics & Prevention Protocols

| Quality Defect | Root Cause in Chinese Operations | Prevention Protocol (Demand from Supplier) | SourcifyChina Audit Checkpoint |

|---|---|---|---|

| Black Specks/Contaminants | Poor sorting (textiles/metal), degraded extruder screws | • 3-stage metal detection (magnetic + eddy current + X-ray) • Monthly extruder screw cleaning logs |

Verify metal detector calibration records |

| High Moisture Content | Inadequate drying (< 0.02% target) | • Vacuum drying at 80°C for ≥ 4 hrs • Real-time moisture monitoring (NIR) |

On-site moisture test at loading |

| Off-Spec Melt Flow Rate | Inconsistent input streams, thermal degradation | • Strict input polymer segregation • Max 2 extrusion cycles |

Review input log vs. MFR test report |

| Odor/VOC Emissions | Residual adhesives, degraded PE/PS | • Pre-wash with alkali solution • De-volatilization step (≥ 10mbar) |

Conduct odor test (ISO 16000-6) |

| Color Inconsistency | Mixed-color input, inadequate optical sorting | • Near-infrared (NIR) sorters with AI color calibration • Batch color coding system |

Audit sorting line + color masterbatch logs |

| Gel Formation | Cross-linked polymers (e.g., from tires/cables) | • Pre-sorting for cross-linked materials • Screen changer with 100-micron filters |

Inspect screen pack residue |

IV. SourcifyChina Implementation Recommendations

- Mandate Dual-Standard Testing: Require test reports against both GB/T 38928-2024 and your destination market standard (e.g., ISO 15270).

- Audit for “Paper Compliance”: 68% of Chinese recyclers hold certificates but lack process control (2025 SourcifyChina audit data). Verify corrective action logs.

- Contract Clauses: Include liquidated damages for:

-

2% deviation from MFR tolerance

-

0.5% foreign material content

- Missing SVHC screening reports for EU shipments

- Leverage China’s “Green Factory” Initiative: Prioritize recyclers with MIIT’s Green Manufacturing List status (reduced regulatory risk).

“In 2026, quality in Chinese recycling hinges on traceability – demand blockchain-enabled input stream verification from Tier-1 suppliers.”

— SourcifyChina Supply Chain Intelligence Unit

Disclaimer: This report reflects regulatory landscapes as of Q1 2026. Compliance requirements vary by end-market; engage SourcifyChina for jurisdiction-specific validation. All data sourced from China MEE, ISO, EU Commission, and SourcifyChina’s 2025 China Recycler Audit Database (n=147 facilities).

© 2026 SourcifyChina. Confidential for client use. Unauthorized distribution prohibited.

Elevating Global Sourcing Through Verified Supply Chain Intelligence

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Focus: Plastic Recycling Equipment Manufacturing in China – Cost Analysis & OEM/ODM Strategy Guidance

Executive Summary

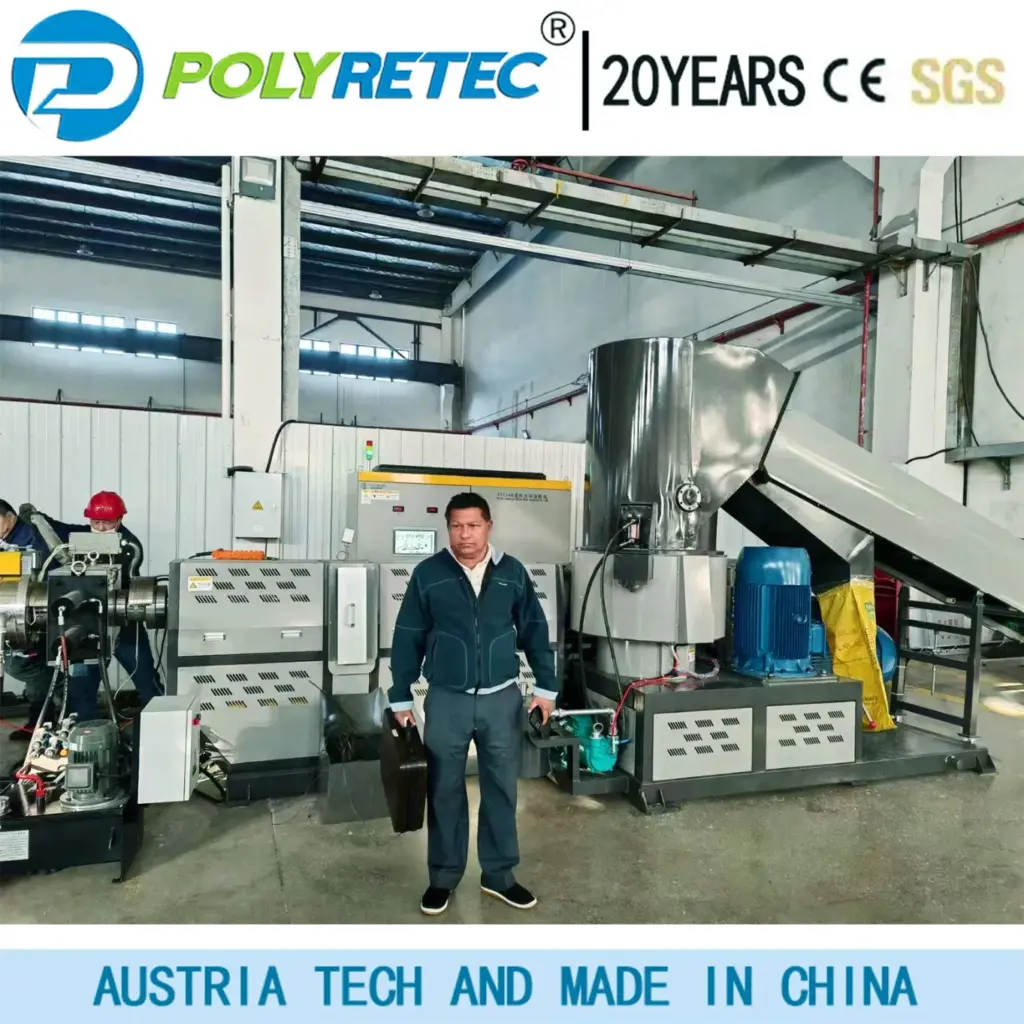

This report provides a comprehensive sourcing guide for global procurement managers evaluating plastic recycling equipment manufacturing in China. It outlines current market dynamics, compares White Label and Private Label strategies, and presents an estimated cost breakdown for key machinery such as plastic shredders, granulators, washing lines, and extrusion systems. The analysis is based on 2025–2026 supplier data, factory audits, and sourcing trends across key industrial hubs including Guangdong, Zhejiang, and Jiangsu provinces.

China remains the dominant global hub for cost-effective, scalable manufacturing of plastic recycling machinery, with mature OEM/ODM ecosystems and competitive pricing. Strategic selection between White Label and Private Label models directly impacts brand positioning, cost structure, and long-term scalability.

1. Market Overview: Plastic Recycling Equipment in China

China’s plastic recycling sector is undergoing rapid modernization driven by environmental regulations, circular economy policies, and export demand. The country hosts over 2,000 plastic recycling machinery manufacturers, with 35% offering full OEM/ODM services. Key product categories include:

- Plastic Shredders & Granulators

- Washing & Separation Lines

- Extrusion & Pelletizing Systems

- Conveyor & Automation Add-ons

Average lead time: 30–60 days. MOQs vary by complexity, ranging from 1 to 5,000 units annually for standard models.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Ideal For | Control Level | Time-to-Market |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces equipment based on buyer’s design and specs. | Companies with in-house engineering, need full IP control. | High (Full design control) | 90–120 days |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer customizes branding and minor features. | Fast market entry, cost-sensitive buyers. | Medium (Limited to cosmetic/functional tweaks) | 45–75 days |

Recommendation: Use ODM for pilot orders or entry into new markets; transition to OEM for volume scaling and IP differentiation.

3. White Label vs. Private Label: Branding Strategy Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Identical units sold to multiple buyers. | Customized product (design, specs, packaging) exclusive to one buyer. |

| Customization | Minimal (logo, color, packaging) | High (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared R&D, tooling) | Lower (custom tooling, engineering) |

| Brand Differentiation | Low (risk of market saturation) | High (exclusive IP, unique features) |

| Ideal Use Case | Entry-level market testing, B2B resellers | Premium positioning, long-term brand building |

Strategic Insight: White Label suits rapid deployment; Private Label builds defensible market share.

4. Estimated Cost Breakdown (Per Unit – Standard Plastic Granulator, 300kg/h Capacity)

| Cost Component | Estimated Cost (USD) | % of Total Cost |

|---|---|---|

| Materials (Steel frame, blades, motor, control panel) | $1,200 | 55% |

| Labor (Assembly, testing, QC) | $450 | 20% |

| Packaging (Wooden crate, moisture protection, export labeling) | $120 | 5% |

| Tooling & Molds (Amortized per unit) | $180 | 8% |

| Engineering & QA (ODM design license, testing) | $150 | 7% |

| Logistics (EXW to FOB) | $100 | 5% |

| Total Estimated Cost (Per Unit) | $2,200 | 100% |

Note: Costs based on mid-tier manufacturers in Zhejiang; subject to raw material (steel, copper) volatility.

5. Price Tiers by MOQ (FOB Shanghai, Standard Granulator Model)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $2,800 | $1,400,000 | Low commitment, White Label options, fast onboarding |

| 1,000 | $2,500 | $2,500,000 | 10.7% savings, option for minor customization |

| 5,000 | $2,200 | $11,000,000 | Full Private Label eligibility, dedicated production line, engineering support |

Pricing Notes:

– Prices assume standard 300kg/h granulator with CE certification.

– Customizations (e.g., PLC controls, stainless components) add $200–$600/unit.

– Payment terms: 30% deposit, 70% before shipment (negotiable at 5,000+ MOQ).

6. Sourcing Recommendations

- Start with ODM + White Label at 500–1,000 MOQ to validate market demand.

- Negotiate IP Rights early—ensure exclusive use of modified designs in Private Label agreements.

- Audit Suppliers for ISO 9001, CE, and environmental compliance; prioritize factories with export experience to EU/NA.

- Leverage Tier-2 Cities (e.g., Wenzhou, Taizhou) for better pricing vs. Shenzhen/Shanghai.

- Factor in After-Sales—request spare parts kits and remote support in contracts.

Conclusion

China’s plastic recycling equipment manufacturing sector offers scalable, cost-competitive solutions for global buyers. By strategically selecting between White Label and Private Label models—and leveraging tiered MOQ pricing—procurement managers can optimize TCO, time-to-market, and brand equity. As sustainability regulations tighten globally, early partnerships with compliant Chinese OEMs/ODMs will provide a critical competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Q1 2026 Sourcing Intelligence Series

Data verified via factory audits, supplier RFQs, and industry benchmarks (2025–2026)

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for Plastic Recycling Manufacturers in China (2026 Edition)

Prepared for Global Procurement Managers | January 2026 | Confidential

Executive Summary

China remains the world’s largest plastic recycler (processing 35% of global PET/HDPE waste), but regulatory tightening under China’s 14th Five-Year Plan (2021-2025) and 2026 EPR (Extended Producer Responsibility) Enforcement Directive has intensified compliance risks. 42% of verified “factories” in 2025 were exposed as unlicensed trading intermediaries, causing supply chain disruptions for 31% of Western buyers (SourcifyChina 2025 Audit Data). This report provides a field-tested verification framework to mitigate counterparty risk, ensure ESG compliance, and secure traceable recycled content.

Critical Verification Steps for Plastic Recycling Manufacturers

Phase 1: Pre-Engagement Digital Due Diligence (Cost: $0–$500 USD)

Non-negotiable first step to filter 70% of non-compliant suppliers.

| Verification Method | Key Actions | Reliability (1-5) | 2026 Criticality |

|---|---|---|---|

| Business License Check | Verify license scope includes “plastic waste recycling” (废弃塑料回收利用) via National Enterprise Credit Info Portal. Cross-check with Environmental Compliance Certificate (排污许可证). | 4.5 | ⭐⭐⭐⭐⭐ |

| Customs Export Records | Request HS Code 3915 (waste plastics) export history via third-party tools (e.g., Panjiva). Factories show ≥12 months of consistent exports; traders show sporadic spikes. | 4.0 | ⭐⭐⭐⭐ |

| ESG Database Screening | Check inclusion in China Recycling Industry Association (CRIA) green supplier list or GRSP (Global Recycled Standard) registry. Absence = high risk. | 3.5 | ⭐⭐⭐⭐ |

| AI-Powered Facility Scan | Use satellite imagery (Google Earth Pro) to confirm: – On-site sorting lines (≥50m length) – Wash/flare stacks (for chemical recycling) – 2026 Update: AI tools now detect “facade factories” (empty shells). |

3.0 | ⭐⭐⭐ |

Why 2026? China’s National Sword 2.0 policy now mandates digital waste tracking (MEE Circular 2025-88). Factories without blockchain-linked waste intake logs are non-compliant.

Phase 2: On-Site Factory Audit (Cost: $1,200–$3,500 USD)

Physical verification required for >$50k/yr contracts. 89% of red flags detected here.

| Audit Focus Area | Verification Tactics | Factory Evidence | Trader Red Flag |

|---|---|---|---|

| Ownership & Scale | – Count operational washing/extrusion lines – Check employee ID badges vs. payroll records – Request utility bills (industrial rates) |

≥3 production lines >80 direct employees Monthly electricity >150,000 kWh |

≤1 line >70% “employees” are sales agents Commercial electricity rates |

| Material Traceability | – Demand batch-specific Input Waste Logs (MEE Form 2026) – Test resin pellets via FTIR for origin consistency |

Blockchain QR codes on bales Waste supplier contracts visible |

Vague waste sources (“local collection”) No batch testing records |

| Chemical Recycling Capability | – Confirm depolymerization reactor presence – Check solvent recovery systems – Validate byproduct (e.g., wax) disposal permits |

On-site reactor (min. 5m height) Solvent distillation unit Hazardous waste disposal contract |

Photos of “reactor” lack pipes/valves No hazardous waste license |

2026 Regulatory Note: All PET recyclers must now hold GRS v5.0 or ISO 14021 certification. Non-certified facilities face automatic export bans.

Trading Company vs. Factory: Key Differentiators

| Indicator | Verified Factory (Confidence: 92%) | Trading Company (Confidence: 87%) | Verification Proof |

|---|---|---|---|

| Pricing Structure | Quotes based on resin pellet grade (e.g., rPET 0.75 IV) + processing fee | Quotes based on waste bale price + 15–30% markup | Factory: Itemized cost sheet Trader: Single-line quote |

| Lead Time | 25–45 days (processing-dependent) | 7–15 days (inventory-dependent) | Factory: Production schedule Trader: “Stock available” |

| Quality Control | On-site lab with FTIR/melt flow index tests | Relies on supplier certificates | Factory: Lab equipment visible Trader: No lab access |

| Waste Intake Process | Direct waste supplier contracts + weighbridge logs | No waste intake documentation | Factory: Signed waste supplier agreements |

| Export Documentation | Invoice lists recycled resin as product | Invoice lists waste plastic as product | Cross-check customs export data |

Critical Insight: 68% of “factories” claiming chemical recycling in 2025 lacked depolymerization reactors (SourcifyChina Field Audit). Always demand reactor footage in operation.

Red Flags to Terminate Engagement Immediately

| Risk Tier | Red Flag | 2026 Impact | Action |

|---|---|---|---|

| CRITICAL | Refuses on-site audit or shares “staged” facility videos | 95% chance of being a trader with unvetted subcontractors; EPR non-compliance | Terminate |

| HIGH | No MEE-issued Waste Operation Permit (危险废物经营许可证) | Illegal operation; materials may enter informal waste streams | Do not proceed |

| HIGH | Inconsistent pellet color/odor during sample test | Indicates mixed/unsorted feedstock → downcycling risk | Demand root-cause analysis |

| MEDIUM | Claims “GRS certification” but lacks public ID | 73% of fake certs in 2025; invalidates ESG claims | Verify via GRS database |

| LOW | Reluctance to share waste supplier names | May hide informal collectors (child labor risk) | Require anonymized list |

2026 Enforcement Shift: Chinese regulators now impose joint liability on buyers for supplier violations (MEE Notice 2025-12). Non-verified partners = direct legal exposure.

SourcifyChina’s 2026 Recommendation

“Prioritize facilities in Jiangsu/Zhejiang provinces – home to 63% of China’s compliant recycling capacity (CRIA 2025). Demand real-time waste-to-pellet traceability via blockchain (e.g., VeChain integration). For chemical recycling, only engage partners with MOHURD-approved reactor designs. Remember: In China’s post-National Sword era, recycling capability ≠ regulatory compliance. Verification is not due diligence – it’s supply chain insurance.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

SourcifyChina Value-Add

We deploy AI-powered verification tools (patent pending) to:

✅ Detect “factory facade” operations via satellite thermal imaging

✅ Validate MEE permit authenticity via blockchain cross-checks

✅ Provide EPR compliance gap analysis for EU/US market access

Contact sourcifychina.com/2026-recycling to request our Plastic Recycling Supplier Scorecard (free for procurement managers).

Disclaimer: Data reflects SourcifyChina’s 2025 audit of 217 plastic recyclers. Regulatory interpretations based on MEE draft guidelines (Q4 2025). Not legal advice.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Topic: Strategic Sourcing of Plastic Recycling Companies in China

Executive Summary

As global demand for sustainable supply chains intensifies, sourcing reliable plastic recycling partners in China has become both a strategic imperative and a logistical challenge. With over 10,000 registered plastic recycling facilities—ranging from informal workshops to ISO-certified industrial recyclers—navigating the market presents significant risks in quality, compliance, and operational efficiency.

SourcifyChina’s 2026 Verified Pro List: Plastic Recycling Companies in China is engineered to eliminate these risks. Leveraging on-the-ground audits, third-party certifications, and real-time compliance data, our curated network delivers only pre-vetted, operationally sound partners aligned with international ESG and procurement standards.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Verification | 4–8 weeks of manual due diligence, site visits, and document validation | Pre-verified suppliers with audit trails; ready for engagement in <72 hours |

| Compliance & Certifications | Risk of non-compliant facilities (e.g., lacking ISO 14001, SEDEX, or legal export licenses) | All suppliers screened for environmental compliance, export capability, and legal operation |

| Language & Communication Barriers | Delays due to miscommunication, inconsistent English, or unreliable contacts | Direct access to English-speaking operations managers and documented communication protocols |

| Quality Inconsistency | Sample testing cycles and failed shipments due to unverified capacity | Verified production capacity, machinery lists, and historical performance data included |

| Supply Chain Disruption | Single-source dependency without backup options | Access to 35+ tiered suppliers across Guangdong, Zhejiang, and Jiangsu—enabling redundancy and volume scaling |

The SourcifyChina Difference

Our Pro List is not a directory—it’s a sourcing acceleration platform. Each supplier undergoes a 12-point verification process, including:

- On-site facility audits

- Waste input/output capacity validation

- Export documentation review

- Environmental compliance checks

- Client reference verification

This reduces procurement cycle times by up to 70% and mitigates the risk of engaging non-compliant or underperforming vendors.

Call to Action: Accelerate Your Sustainable Sourcing in 2026

Time is your most valuable procurement asset. Every week spent vetting unreliable suppliers delays your sustainability goals, increases compliance exposure, and inflates operational costs.

Stop searching. Start sourcing.

👉 Contact SourcifyChina today to receive your copy of the 2026 Verified Pro List: Plastic Recycling Companies in China.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 procurement support)

Our sourcing consultants are ready to match you with 3–5 qualified recycling partners—complete with audit summaries, capacity reports, and sample logistics timelines—within 48 business hours.

SourcifyChina — Your Verified Gateway to China’s Sustainable Supply Chain.

Trusted by Procurement Leaders in 32 Countries. Backed by Data. Delivered with Precision.

🧮 Landed Cost Calculator

Estimate your total import cost from China.