The global plastic drums market is experiencing steady growth, driven by increasing demand across industries such as chemicals, pharmaceuticals, food & beverage, and oil & lubricants. According to Grand View Research, the global plastic drums market size was valued at USD 3.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This growth is fueled by the superior durability, corrosion resistance, and cost-efficiency of plastic over traditional steel containers, particularly for storing and transporting oils and viscous liquids. As sustainability and logistics efficiency become key priorities, high-density polyethylene (HDPE) drums have emerged as the preferred packaging solution. With rising industrialization and stringent regulations around material safety, manufacturers are focusing on innovation in design, capacity, and compliance (UN/DOT certification). In this evolving landscape, selecting reliable suppliers of plastic oil drums is critical for operational efficiency and supply chain integrity. Here’s a data-driven look at the top 8 plastic oil drum manufacturers leading the market with proven production capabilities, global reach, and quality certifications.

Top 8 Plastic Oil Drums For Sale Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 B. Stephen Cooperage Inc.

Domain Est. 2009

Website: bstephencooperage.com

Key Highlights: Stephen Cooperage collects your used 55 gallon steel drums, plastic drums, fibre drums, and intermediate bulk containers. Reconditioned Drums….

#2 Reconditioned Drum Manufacturers Suppliers

Website: 55gallondrumcompanies.com

Key Highlights: At U.S. Plastic Corp., we provide high-quality 55-gallon drums designed to meet the rigorous demands of various industries. Our selection includes a variety of ……

#3 Drums & Barrels

Domain Est. 1996

Website: usplastic.com

Key Highlights: Here at US Plastic Corp.®, you can find an extensive range of plastic barrels, drums, and accessories that serve as excellent storage and shipping solutions….

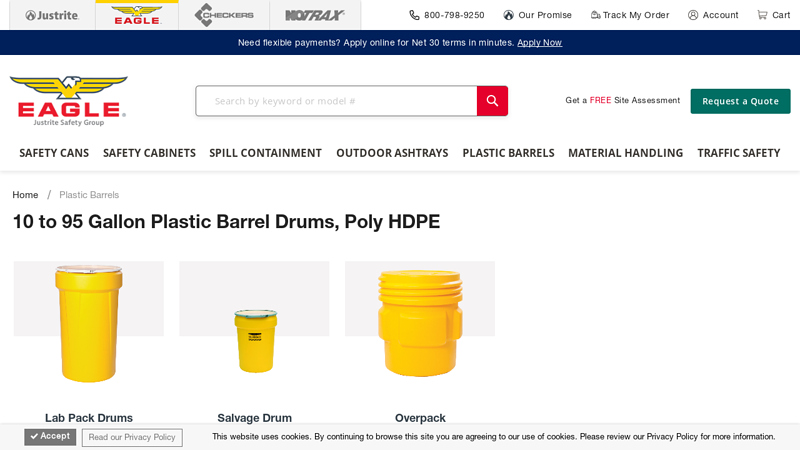

#4 Plastic Drums & Barrels – 55, 30, 20 Gallon HDPE

Domain Est. 1997

Website: eagle.justrite.com

Key Highlights: 30-day returnsEagle has a selection of plastic HDPE polyethylene barrel drums, ranging from 10 to 95 gallons, with locking lids and metal band or screw-on options….

#5 Plastic Drums & Shipping Barrels

Domain Est. 1999

Website: thecarycompany.com

Key Highlights: 30-day returns21 Gallon White Plastic Drum with Screw On Lid and Handles, Tamper Evident, UN Rated · Quantity Qty Price · 1 $135.950 ea. · 24 $108.760 ea. · 48 $90.640 ea. · 96 ……

#6 San Diego Drums & Totes

Domain Est. 2010

Website: sddrums.com

Key Highlights: High Quality plastic drums available in various sizes for liquid and solid storage needs. Versatile Plastic Drums for Liquid and Solid Storage. Our Plastic ……

#7 Seattle Barrel Co

Domain Est. 2011 | Founded: 1916

Website: seattlebarrel.com

Key Highlights: Seattle Barrel Company supplies steel and plastic drums, pails, totes and environmental supplies since 1916. We sell new and reconditioned items….

#8 Drums

Domain Est. 2018

Website: mauserpackaging.com

Key Highlights: Mauser Packaging Solutions offers plastic, steel, and fiber drums that will meet and exceed your expectations….

Expert Sourcing Insights for Plastic Oil Drums For Sale

H2: 2026 Market Trends for Plastic Oil Drums for Sale

The global market for plastic oil drums is poised for significant transformation by 2026, driven by technological advancements, sustainability demands, and evolving industrial needs. As industries continue to shift away from metal containers toward lightweight, corrosion-resistant alternatives, plastic oil drums are gaining prominence across sectors such as manufacturing, automotive, chemical processing, and logistics. The following analysis outlines key 2026 market trends shaping the landscape for plastic oil drums for sale.

1. Rising Demand for HDPE and Recyclable Materials

High-Density Polyethylene (HDPE) remains the dominant material in plastic oil drum production due to its durability, chemical resistance, and recyclability. By 2026, manufacturers are expected to increasingly adopt recycled HDPE to meet corporate sustainability goals and comply with tightening environmental regulations. Demand for drums made from post-consumer recycled (PCR) content is projected to grow, especially in Europe and North America, where circular economy policies are advancing rapidly.

2. Expansion in Emerging Markets

Growth in industrialization and infrastructure development across Asia-Pacific, Latin America, and Africa is fueling demand for plastic oil drums. Countries like India, Vietnam, and Brazil are witnessing increased activity in oil & gas, agrochemicals, and manufacturing—sectors that rely heavily on bulk liquid storage and transport. As a result, local production and distribution networks for plastic drums are expanding, reducing import reliance and lowering costs.

3. Technological Innovations and Smart Drum Solutions

By 2026, the integration of IoT-enabled tracking and monitoring systems into plastic oil drums is expected to become more prevalent. Smart drums equipped with RFID tags or QR codes allow for real-time tracking of contents, location, and condition—enhancing supply chain transparency, reducing theft, and improving inventory management. These innovations are particularly attractive to large-scale industrial users seeking operational efficiency.

4. Emphasis on Reusability and Returnable Packaging Models

With increasing focus on waste reduction, businesses are adopting reusable plastic drum systems over single-use containers. Closed-loop logistics models, where used drums are collected, cleaned, and reused, are gaining traction among chemical and lubricant producers. This trend not only reduces environmental impact but also lowers long-term packaging costs, making reusable drums a cost-effective solution by 2026.

5. Regulatory and Safety Compliance Driving Design Changes

Stringent international regulations regarding the transport of hazardous materials (e.g., UN certification standards, DOT compliance) are influencing drum design and manufacturing. By 2026, plastic oil drums will increasingly feature improved sealing mechanisms, UV resistance, and stackability to meet safety and durability requirements. Compliance with standards like UN 1H1/1H2 will be a key selling point for suppliers.

6. Competitive Pricing and Online Marketplaces

The proliferation of B2B e-commerce platforms is transforming how plastic oil drums are bought and sold. By 2026, online marketplaces will offer greater price transparency, customization options, and faster delivery—empowering small and medium enterprises (SMEs) to access high-quality drums at competitive rates. Suppliers are also offering bundled services such as drum printing, labeling, and logistics support to differentiate their offerings.

7. Sustainability Pressures and ESG Considerations

Environmental, Social, and Governance (ESG) criteria are increasingly influencing procurement decisions. Companies seeking to reduce their carbon footprint are prioritizing suppliers that demonstrate sustainable manufacturing practices, such as energy-efficient production, reduced water usage, and waste minimization. Plastic drum manufacturers that invest in green certifications and lifecycle assessments will have a competitive edge in 2026.

Conclusion

By 2026, the market for plastic oil drums for sale will be shaped by sustainability, digitalization, and global industrial growth. Suppliers who innovate in material science, adopt circular economy models, and leverage digital sales channels will be best positioned to capture market share. As demand continues to rise, plastic oil drums will remain a critical component of safe, efficient, and environmentally responsible liquid storage and transport solutions.

Common Pitfalls When Sourcing Plastic Oil Drums for Sale (Quality, IP)

Sourcing plastic oil drums for sale requires careful evaluation to avoid compromising on quality, safety, and intellectual property (IP) considerations. Below are some common pitfalls buyers encounter, particularly related to product quality and IP issues.

Poor Material Quality and Non-Compliance

One of the most frequent issues is receiving plastic oil drums made from substandard or recycled materials that do not meet industry standards (e.g., UN certification, FDA compliance for food-grade use). Low-quality polyethylene may degrade when exposed to certain oils or environmental conditions, leading to leaks, cracks, or contamination.

Buyers may also overlook compliance with international shipping regulations (such as UN/DOT certification for hazardous materials), which can result in rejected shipments or safety risks.

Inadequate Structural Integrity and Testing

Some suppliers provide drums that appear visually acceptable but fail under pressure, stacking, or impact tests. Without proper drop tests, hydrostatic pressure testing, or UV resistance verification, drums may fail during transportation or long-term storage—especially in extreme temperatures.

Misrepresentation of Specifications

Suppliers may exaggerate or falsify key specifications such as drum capacity (e.g., 200L vs. actual volume), wall thickness, or chemical resistance. This misrepresentation can lead to incompatibility with the intended oil type, potentially causing chemical reactions or container failure.

Lack of Traceability and Certification

Reputable plastic oil drums should come with traceability documentation, including batch numbers, material certifications (e.g., HDPE resin source), and test reports. Sourcing from manufacturers who cannot provide this documentation increases the risk of receiving counterfeit or non-compliant products.

Intellectual Property Infringement

Some suppliers replicate branded drum designs (e.g., shape, logos, patented closure systems) without authorization, leading to IP violations. Purchasing such products—even unknowingly—can expose buyers to legal liability, especially when importing or reselling. It’s essential to verify that drum designs do not infringe on existing patents or trademarks.

Counterfeit or Refurbished Drums Sold as New

A major risk is receiving used or reconditioned drums marketed as “new.” These may retain residual contaminants, compromising oil quality. Additionally, counterfeit branding or fake certifications can deceive buyers into believing they are purchasing high-quality, compliant containers.

Inconsistent Manufacturing Standards

Sourcing from unvetted overseas manufacturers may result in inconsistent quality due to poor quality control processes. Variations in mold precision, closure mechanisms, or sealing surfaces can compromise drum performance and safety.

Failure to Verify Supplier Credibility

Buyers often skip due diligence on suppliers, such as factory audits, sample testing, or checking customer references. This increases the likelihood of dealing with fraudulent or inexperienced vendors who prioritize cost over reliability.

Avoiding these pitfalls requires thorough vetting, clear specifications, third-party inspections, and legal checks on product design and documentation.

Logistics & Compliance Guide for Plastic Oil Drums For Sale

Understanding Your Product: HDPE Plastic Oil Drums

High-Density Polyethylene (HDPE) plastic oil drums are widely used for storing and transporting various types of oils, including lubricants, hydraulic fluids, and some industrial chemicals. Before selling, you must clearly identify the drum’s specifications, including capacity (e.g., 55-gallon/208L), UN rating (if applicable), and whether they are new, reconditioned, or used.

Regulatory Compliance Overview

Selling plastic oil drums, especially if they have contained hazardous materials, involves compliance with environmental, transportation, and safety regulations. Key regulatory bodies include the U.S. Department of Transportation (DOT), Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and international equivalents such as ADR (Europe) or TDG (Canada).

UN Certification and Drum Classification

If your plastic oil drums are intended for transporting hazardous materials, they must be UN-certified. Look for a UN marking on the drum (e.g., UN 1H1/Y1.8/150/23), which indicates the packaging type, performance level, and testing standards met. Selling non-certified drums for hazardous cargo could lead to legal liability.

Proper Drum Preparation and Decontamination

Used plastic oil drums must be thoroughly cleaned and decontaminated in accordance with EPA or local environmental regulations. This includes removing all residues and ensuring the drum is “triple-rinsed” or steam-cleaned, with documentation of the cleaning process if required. Selling improperly cleaned drums may violate hazardous waste disposal laws.

Labeling and Marking Requirements

Ensure drums are correctly labeled with relevant information such as:

– Original contents (if known)

– Date of last use or cleaning

– UN certification (if applicable)

– “Used – For Non-Hazardous Use Only” (if not cleaned to hazardous material standards)

Mislabeling or omitting required markings can result in penalties during transport or resale.

Transporting Plastic Oil Drums

When shipping drums, follow DOT Hazardous Materials Regulations (49 CFR) if the drums are classified as hazardous waste or contain residual hazardous substances. Even empty drums that previously held hazardous materials may require hazardous waste placards, shipping papers, and proper packaging during transport.

Domestic vs. International Sales Considerations

For domestic sales (e.g., within the U.S.), compliance with EPA and DOT rules is essential. For international sales, verify import regulations in the destination country. Some nations restrict the import of used containers or require specific certifications. Always provide accurate documentation, including material safety data sheets (MSDS/SDS) if applicable.

Storage and Handling Best Practices

Store drums in a covered, well-ventilated area away from direct sunlight and extreme temperatures to prevent degradation of HDPE. Use drum handling equipment (e.g., drum carts, forklifts with drum clamps) to prevent damage and ensure worker safety. Follow OSHA guidelines for workplace storage and handling.

Environmental and Sustainability Compliance

Plastic oil drums are recyclable. If selling end-of-life drums, ensure disposal or recycling is done through licensed facilities compliant with RCRA (Resource Conservation and Recovery Act) standards. Avoid illegal dumping, which can result in severe fines.

Recordkeeping and Documentation

Maintain records of:

– Drum sourcing (new, used, reconditioned)

– Cleaning and decontamination procedures

– Certifications (UN, ISO)

– Sales transactions (especially for business-to-business)

These records may be required during regulatory audits.

Liability and Warranty Disclaimers

Clearly state in your sales terms whether drums are sold “as-is,” with no warranty regarding suitability for hazardous materials. Include disclaimers to limit liability, especially if selling used or non-UN-rated drums.

Final Recommendations

Prioritize transparency, safety, and regulatory compliance in every transaction. Consult legal or regulatory experts when in doubt, particularly when dealing with international shipments or hazardous material classifications. Proper compliance protects your business and ensures customer safety.

In conclusion, sourcing plastic oil drums for sale requires careful consideration of several key factors including material quality (typically HDPE for durability and chemical resistance), compliance with industry standards (such as UN certification for hazardous materials), supplier reliability, and cost-efficiency. Whether sourcing domestically or internationally, it is essential to evaluate the supplier’s reputation, production capacity, and ability to meet required volumes and delivery timelines. Additionally, sustainability practices—such as using recyclable materials or offering take-back programs—are becoming increasingly important for environmentally responsible procurement. By conducting thorough due diligence and establishing strong supplier relationships, businesses can secure high-quality, cost-effective plastic oil drums that meet operational needs while ensuring safety, compliance, and environmental stewardship.