The global plastic mold manufacturing industry is experiencing robust growth, driven by rising demand across automotive, consumer electronics, packaging, and healthcare sectors. According to Grand View Research, the global plastic molds market size was valued at USD 19.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This expansion is fueled by advancements in injection molding technologies, increased adoption of lightweight materials in automotive production, and the growing need for precision molds in high-volume manufacturing. Additionally, Mordor Intelligence projects steady growth in the Asia-Pacific region—particularly in China and India—due to industrialization, expanding manufacturing bases, and rising domestic consumption. As competition intensifies and customers demand faster turnaround times and higher complexity molds, leading manufacturers are investing in automation, mold simulation software, and sustainable practices to maintain a competitive edge. In this evolving landscape, identifying the top plastic mold manufacturing companies becomes critical for brands seeking reliability, quality, and innovation. Here are the top 9 plastic mold manufacturing manufacturers shaping the industry in 2024.

Top 9 Plastic Mold Manufacturing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastic Molding Technology

Domain Est. 2002

Website: plasticmolding.com

Key Highlights: Plastics manufacturer with broad capabilities that focuses on mission-critical applications and investing in automation and technologies….

#2 Technimark

Domain Est. 1996

Website: technimark.com

Key Highlights: We Make What Makes Life Better. Your global manufacturing partner specializing in precision injection molding, complex assembly, and contract manufacturing….

#3 Midwest Precision Molding

Domain Est. 2021

Website: mpmplastics.com

Key Highlights: MPM Plastics is a leading manufacturer of injection molded plastic parts. We excel in providing top quality coil winding bobbins, components, and custom ……

#4 PCS Company

Domain Est. 1997

Website: pcs-company.com

Key Highlights: Turn to the Industry Experts at PCS Company, a leading supplier of mold bases, mold components, and molding supplies….

#5 SyBridge Technologies

Domain Est. 2003

Website: sybridge.com

Key Highlights: Precision molds powering the world’s leading plastic products. With over 50 years of mold-making experience, we’re true experts in our craft. SyBridge builds ……

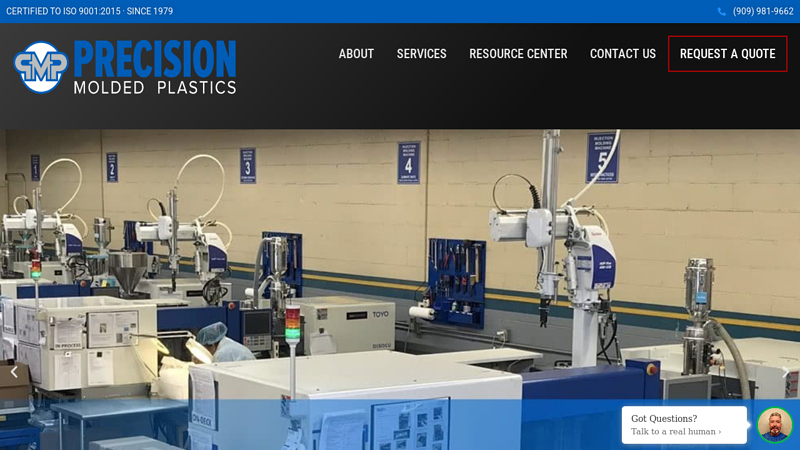

#6 Plastic Injection Molding

Domain Est. 2004

Website: precisionmoldedplastics.com

Key Highlights: A vertically integrated, plastic injection molding company that builds custom molds and tooling, manufactures parts and products, and performs a variety of ……

#7 Plastic Molding Manufacturing

Domain Est. 2008

Website: plasticmoldingmfg.com

Key Highlights: Plastic Molding Manufacturing is a U.S.-based custom plastic injection molding company, providing full-service, single-source solutions for custom molded ……

#8 Springboard Manufacturing

Domain Est. 2019

Website: springboardmfg.com

Key Highlights: We offer state-of-the-art medical injection molding and assembly services for numerous types of medical device applications in a wide range of sizes….

#9 Thunderbird Molding

Domain Est. 2021

Website: thunderbird-molding.com

Key Highlights: An experienced resource for high-precision custom plastic injection molding and contract manufacturing, we offer comprehensive mold design, prototyping, ……

Expert Sourcing Insights for Plastic Mold Manufacturing

H2: 2026 Market Trends in Plastic Mold Manufacturing

The plastic mold manufacturing industry in 2026 is poised for transformation, driven by technological innovation, evolving customer demands, and a growing emphasis on sustainability. While H2 (the second half of the year) will reflect trends building throughout the year, several key developments are expected to shape the competitive landscape and strategic direction for mold makers globally.

1. Accelerated Adoption of Smart Manufacturing & Industry 4.0

By H2 2026, the integration of digital technologies will move from pilot projects to core operations. Mold shops will increasingly leverage:

* AI-Powered Process Optimization: Artificial intelligence will analyze real-time data from sensors embedded in molds and machines to predict maintenance needs, optimize cycle times, reduce scrap rates, and automatically adjust parameters for maximum efficiency and part quality.

* Digital Twins: Comprehensive digital replicas of molds and production lines will be used for virtual testing, performance simulation, and predictive analytics, significantly reducing physical prototyping costs and time-to-market.

* Enhanced Connectivity (IoT): Seamless data flow between CAD/CAM systems, machine tools, inspection equipment, and enterprise resource planning (ERP) software will enable end-to-end visibility and faster decision-making.

2. Dominance of High-Precision & Complex Molds for Advanced Applications

Demand will surge for molds capable of producing intricate, high-tolerance parts, particularly in high-growth sectors:

* Medical & Healthcare: Strict regulatory requirements (ISO 13485) will drive demand for ultra-precise, cleanroom-compatible molds for disposable devices, drug delivery systems (e.g., auto-injectors), and diagnostic equipment. Micro-molding capabilities will be critical.

* Electronics & Miniaturization: Shrinking consumer electronics and advanced automotive electronics (e.g., sensors, connectors) will require molds with exceptional precision, fine surface finishes, and the ability to handle complex multi-cavity or family molds for miniaturized components.

* Automotive Lightweighting: Despite EV shifts, the need for lightweight, durable plastic components (especially for interiors, electronics, and under-the-hood applications) will sustain demand for robust, high-cavitation molds. Molds for hybrid materials (plastic-metal composites) will gain traction.

3. Sustainable Manufacturing as a Core Competitive Imperative

Sustainability will transition from a compliance issue to a central business strategy:

* Energy-Efficient Molds & Processes: Design focus will shift towards molds enabling faster cycle times and lower energy consumption in molding presses. Integration of conformal cooling channels (using AM) will become standard for complex geometries to minimize energy use and warpage.

* Material Efficiency & Recycled Content: Mold designs will increasingly facilitate the use of recycled resins (rPET, rPP) and bio-based plastics, requiring adaptations for different flow characteristics and potential abrasiveness. Minimizing sprue and runner systems (e.g., hot runners) remains crucial.

* Circular Economy Integration: Mold makers will play a role in designing for disassembly and recyclability of end products. Services around mold refurbishment, remanufacturing, and end-of-life management for molds themselves will grow.

4. Reshoring & Supply Chain Resilience Strategies

Geopolitical uncertainties and the lessons of recent supply chain disruptions will continue to influence sourcing:

* Nearshoring/Reshoring: Increased investment in mold manufacturing capacity in North America and Western Europe will accelerate, particularly for high-value, complex, or safety-critical applications (medical, aerospace, defense). This aims to reduce lead times, enhance IP protection, and improve supply chain control.

* Strategic Sourcing: Companies will adopt a dual-sourcing strategy, balancing cost-effective manufacturing in established hubs (Asia) with resilient, responsive capacity closer to key end markets. Transparency and traceability in the mold supply chain will be paramount.

* Regional Specialization: Mold makers will increasingly specialize in specific industries or technologies (e.g., medical, micro-molding, large-scale automotive) to differentiate themselves in a competitive global market.

5. Advanced Materials and Processing Integration

Mold design and manufacturing will need to adapt to evolving material science:

* High-Performance Polymers: Increased use of engineering plastics (PEEK, PEI, PPS) and composites in demanding applications (aerospace, EVs, industrial) will require molds made from advanced tool steels or coatings to withstand higher processing temperatures, pressures, and potential abrasiveness.

* Multi-Material & Overmolding: Growth in products requiring soft-touch grips, seals, or combined rigid/flexible components will drive demand for sophisticated multi-component molds (2K, 3K) and insert molding, demanding higher precision and reliability.

* Additive Manufacturing (AM) for Molds: While not replacing traditional machining for high-volume production, AM (especially metal AM) will see wider adoption for creating conformal cooling inserts, low-volume prototype molds, and highly complex core/cavity features impossible with conventional methods.

Conclusion for H2 2026

The plastic mold manufacturing landscape in H2 2026 will be characterized by a convergence of digitalization, sustainability, and specialization. Success will depend on mold makers’ ability to leverage smart technologies for efficiency and quality, embrace sustainable practices throughout the mold lifecycle, cater to the exacting demands of high-growth advanced industries, navigate resilient supply chains, and adapt to new materials and processes. Companies that proactively invest in these areas will be best positioned to thrive in an increasingly competitive and demanding market.

Common Pitfalls in Sourcing Plastic Mold Manufacturing: Quality and Intellectual Property Risks

Quality-Related Pitfalls

Inadequate Supplier Vetting

Failing to thoroughly evaluate a mold manufacturer’s capabilities, experience, and quality management systems can lead to subpar molds. Many suppliers may claim expertise but lack the infrastructure, skilled workforce, or quality certifications (e.g., ISO 9001) to consistently deliver precision molds. Without site audits or reference checks, buyers risk working with underqualified vendors.

Poor Communication and Specifications

Ambiguous or incomplete technical drawings, material specifications, or tolerance requirements often result in molds that do not meet functional needs. Language barriers or lack of engineering alignment can compound misunderstandings, leading to costly rework, production delays, or part defects.

Compromised Material and Workmanship Standards

Some manufacturers may use lower-grade steel, inferior components, or shortcuts in heat treatment and surface finishing to reduce costs. These compromises reduce mold longevity, increase maintenance, and negatively impact part quality—such as surface finish, dimensional accuracy, and cycle time efficiency.

Insufficient Prototyping and Testing

Skipping or rushing mold trials (T0, T1, etc.) can result in undetected design flaws, gate issues, or ejection problems. Without rigorous testing and validation under real production conditions, defects may only surface during mass production, causing significant downtime and scrap.

Intellectual Property (IP) Risks

Lack of Legal IP Protection Agreements

Engaging with manufacturers without legally binding Non-Disclosure Agreements (NDAs) or IP ownership clauses leaves designs vulnerable. In some jurisdictions, especially where enforcement is weak, molds and designs can be replicated or sold to competitors without recourse.

Unauthorized Mold Replication or Second-Tier Sales

A major risk is the manufacturer producing additional molds without consent or selling copies to other clients. Without strict contractual control and physical safeguards (e.g., mold marking, ownership documentation), your tooling design may be duplicated, flooding the market with counterfeit parts.

Insecure Digital File Handling

Sharing CAD files, especially in editable formats, without encryption or access controls increases the risk of theft or misuse. Some suppliers may retain digital copies long after project completion, enabling reverse engineering or unauthorized manufacturing.

Weak Supply Chain Transparency

When mold fabrication is outsourced to subcontractors, IP exposure multiplies. Without visibility into the supply chain and assurance that all parties are bound by IP agreements, sensitive design information may be exposed to untrusted third parties.

Logistics & Compliance Guide for Plastic Mold Manufacturing

1. Regulatory Compliance

1.1 International Standards and Certifications

Plastic mold manufacturers must adhere to globally recognized standards to ensure product quality and safety. Key certifications include:

– ISO 9001: Quality management systems for consistent manufacturing processes.

– ISO 14001: Environmental management to minimize ecological impact.

– ISO 45001: Occupational health and safety standards for workplace safety.

– RoHS and REACH Compliance: Essential for molds used in electronics or consumer goods, ensuring restricted use of hazardous substances.

– FDA Compliance (if applicable): Required for molds producing parts in food contact or medical applications.

1.2 Export and Import Regulations

- Harmonized System (HS) Codes: Accurately classify molds for customs purposes (e.g., HS Code 8480 for molds and dies).

- Export Controls: Check for dual-use or strategic technology restrictions (e.g., ECCN classification under EAR).

- Customs Documentation: Prepare commercial invoices, packing lists, certificates of origin, and export declarations.

- Trade Agreements: Leverage preferential tariffs under FTAs (e.g., USMCA, CPTPP) with proper certification.

1.3 Country-Specific Requirements

- CE Marking (EU): Required if the mold or final product falls under applicable EU directives.

- China Compulsory Certification (CCC): May apply if the mold produces regulated consumer products in China.

- Customs-Trade Partnership Against Terrorism (C-TPAT): Recommended for U.S.-bound shipments to expedite clearance.

2. Supply Chain Management

2.1 Raw Material Sourcing

- Source high-grade tool steels (e.g., P20, H13, S136) and alloys from certified suppliers.

- Ensure material certifications (e.g., mill test reports) are traceable and compliant.

- Implement vendor qualification programs to assess reliability and compliance.

2.2 Supplier and Subcontractor Oversight

- Audit subcontractors (e.g., heat treaters, EDM services) for quality and regulatory compliance.

- Enforce contractual agreements covering IP protection, delivery timelines, and quality expectations.

- Maintain dual sourcing strategies to mitigate supply chain disruptions.

3. Logistics and Shipping

3.1 Packaging and Handling

- Use custom wooden crates with moisture barriers and cushioning to protect precision molds.

- Apply anti-rust coatings (e.g., VCI paper) and seal molds in vacuum wraps when necessary.

- Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up,” “Do Not Stack”).

3.2 Transportation Modes

- Air Freight: For urgent deliveries; ensures faster transit but at higher cost.

- Sea Freight: Cost-effective for heavy or large molds; use FCL (Full Container Load) to prevent damage.

- Land Transport: Ideal for regional distribution; ensure shock-absorbing trailers and secure loading.

3.3 Incoterms Selection

Choose appropriate Incoterms to define responsibilities:

– EXW (Ex Works): Buyer handles all logistics from the seller’s facility.

– FCA (Free Carrier): Seller delivers to a carrier; common for multimodal transport.

– DDP (Delivered Duty Paid): Seller manages all logistics and customs clearance—ideal for customer convenience but increases seller risk.

4. Quality Assurance and Traceability

4.1 Inspection and Documentation

- Conduct pre-shipment inspections using CMM (Coordinate Measuring Machines) and mold testing reports.

- Provide detailed documentation: mold drawings, steel certificates, heat treatment reports, and first-article inspection (FAI) data.

- Maintain digital records for traceability throughout the mold’s lifecycle.

4.2 Non-Conformance and Corrective Actions

- Implement a CAPA (Corrective and Preventive Action) system for quality issues.

- Track and document deviations, root cause analyses, and resolution timelines.

5. Intellectual Property and Data Security

5.1 IP Protection

- Execute Non-Disclosure Agreements (NDAs) with clients and partners.

- Register mold designs under applicable IP laws (e.g., design patents).

- Secure digital CAD/CAM files with encryption and access controls.

5.2 Cybersecurity in Digital Manufacturing

- Protect CNC programming and 3D model data from unauthorized access.

- Use secure cloud platforms with audit trails for file sharing and collaboration.

6. Environmental and Sustainability Compliance

6.1 Waste Management

- Recycle metal scrap, coolant, and packaging materials in accordance with local regulations.

- Partner with certified waste disposal vendors.

6.2 Energy Efficiency and Carbon Footprint

- Optimize machining processes to reduce energy consumption.

- Monitor and report carbon emissions for ESG (Environmental, Social, Governance) compliance.

7. Risk Management and Contingency Planning

7.1 Risk Assessment

- Identify risks: supply chain delays, customs holds, quality defects, or geopolitical issues.

- Conduct regular risk audits and update mitigation plans.

7.2 Business Continuity

- Maintain backup tooling suppliers and alternate shipping routes.

- Store critical mold components in secure off-site locations.

8. Training and Compliance Audits

8.1 Staff Training

- Train employees on safety protocols, quality standards, and export compliance.

- Conduct regular workshops on updates in regulations (e.g., customs, environmental laws).

8.2 Internal and External Audits

- Schedule annual internal audits to assess compliance with ISO and regulatory standards.

- Prepare for third-party audits from clients or certification bodies.

By adhering to this guide, plastic mold manufacturers can ensure smooth logistics operations, maintain regulatory compliance, protect intellectual property, and deliver high-quality molds on time and to specification.

In conclusion, sourcing plastic mold manufacturing requires a strategic approach that balances cost, quality, lead time, and reliability. Partnering with experienced and technologically advanced mold manufacturers—whether domestic or overseas—can significantly impact product development, production efficiency, and long-term profitability. Key considerations such as material selection, mold design expertise, quality control processes, and effective communication are critical to ensuring successful outcomes. By conducting thorough due diligence, leveraging supplier audits, and maintaining strong collaboration throughout the manufacturing process, companies can secure high-quality molds that meet exact specifications and support scalable, repeatable production. Ultimately, a well-informed sourcing strategy enables businesses to achieve superior product performance, reduce time-to-market, and maintain a competitive edge in the global marketplace.