The global plastic extrusion market is experiencing robust expansion, driven by rising demand across packaging, construction, automotive, and consumer goods industries. According to Grand View Research, the market was valued at USD 36.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030. This growth is fueled by advancements in extrusion technology, increasing adoption of lightweight materials, and the push for energy-efficient processing solutions. As demand intensifies, leading manufacturers are investing heavily in innovation, automation, and sustainability to gain a competitive edge. In this evolving landscape, the top 10 plastic extrusion process manufacturers stand out for their technological expertise, global footprint, and ability to deliver high-precision, scalable solutions tailored to diverse industrial applications.

Top 10 Plastic Extrusion Process Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Guill Tool & Engineering Co. Inc.

Domain Est. 1998

Website: guill.com

Key Highlights: Guill is the leading Extrusion Tooling Designer & Manufacturer with nearly 60 years of experience. Our engineers specialize in plastic extrusion tooling design….

#2 Jifram Extrusions Inc.

Domain Est. 2000

Website: jifram.com

Key Highlights: Jifram Extrusions is a premier Plastic Extrusions Manufacturing Company specializing in custom plastic extrusions for multiple industries & applications….

#3 Lakeland Plastics

Domain Est. 1998

Website: lakelandplastics.com

Key Highlights: Lakeland Plastics is the top plastic extrusion manufacturer in the industry, specializing in advanced resins and complex profiles. Request a quote today!…

#4 Custom Plastic Extrusion Manufacturers

Domain Est. 1999

Website: seagateplastics.com

Key Highlights: Get custom plastic extrusions from Seagate Plastics in Waterville, OH. We offer a wide range of profiles, materials, and services to meet your needs….

#5 Plastic Extrusion Manufacturers

Domain Est. 2000

Website: extrudedplastics.com

Key Highlights: Quickly view leading plastic extrusion suppliers and manufacturers that offer custom profiles, designs, tooling, quality materials, and quick turnaround….

#6 Pexco

Domain Est. 1997

Website: pexco.com

Key Highlights: The North American leader in custom plastic extrusion, injection molding, and high-performance polymers. We are where ideas take shape….

#7 Omega Plastics

Domain Est. 1997

Website: omegaplastics.com

Key Highlights: Our custom plastic extrusion design process aids in the design of customer profiles and shapes to produce items like tubing, sheets, and complex profiles. This ……

#8 Plastics Extrusion Machinery

Domain Est. 2000

Website: pemusa.com

Key Highlights: Plastics Extrusion Machinery LLC (PEM) is an industry-leading provider of quality downstream equipment in the PVC pipe and custom profile industries….

#9 Bausano

Domain Est. 2000

Website: bausano.com

Key Highlights: Bausano designs and manufactures customized plastic extrusion lines & machinery completely made in italy and perfectly suiting your needs. Find out more!…

#10 Plastic Extrusion Technologies

Domain Est. 2006

Website: plasticextrusiontech.net

Key Highlights: Plastic Extrusion Technologies offers over 100 years of experience in the plastic extrusions, plastic tubing and plastic profiles industry….

Expert Sourcing Insights for Plastic Extrusion Process

H2: 2026 Market Trends for the Plastic Extrusion Process

The plastic extrusion process is poised for significant evolution by 2026, driven by technological innovation, sustainability demands, and shifting end-user industry needs. Several key trends are expected to shape the market landscape over the next few years:

-

Growth in Sustainable and Bio-Based Materials

Increasing regulatory pressure and consumer demand for eco-friendly products are accelerating the adoption of biodegradable and bio-based polymers in extrusion. By 2026, manufacturers are projected to expand the use of materials such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and recycled plastics. Extrusion equipment will be increasingly adapted to handle these alternative feedstocks, necessitating modifications in temperature control, screw design, and downstream processing. -

Advancements in Smart Manufacturing and Industry 4.0 Integration

The integration of IoT sensors, real-time monitoring systems, and AI-driven process optimization is transforming traditional extrusion lines. By 2026, smart extrusion systems capable of predictive maintenance, automatic parameter adjustment, and remote diagnostics will become standard in high-efficiency operations. This digital transformation will improve product consistency, reduce waste, and lower operational costs. -

Rise in Multi-Layer and Co-Extrusion Technologies

Demand for high-performance plastic films, pipes, and profiles with enhanced barrier, mechanical, or aesthetic properties is boosting the adoption of co-extrusion. Multi-layer extrusion allows cost-effective combination of materials—such as combining recyclable layers with functional barrier layers—making it ideal for packaging and construction applications. This trend will see continued investment in precision die design and layer distribution control. -

Expansion in Healthcare and Medical Applications

The medical device sector is increasingly relying on precision plastic extrusion for catheters, tubing, and minimally invasive device components. By 2026, the market will see heightened demand for extrusion systems that support cleanroom compatibility, ultra-high tolerances, and compliant materials (e.g., medical-grade silicones and thermoplastic elastomers). Regulatory adherence and process validation will become critical success factors. -

Regional Shifts and Localization of Production

Geopolitical uncertainties and supply chain disruptions are prompting companies to localize extrusion operations. North America and Europe are expected to see a resurgence in domestic manufacturing, supported by automation and nearshoring strategies. Meanwhile, Asia-Pacific will remain the largest market due to rapid industrialization, urban development, and packaging demand—particularly in India and Southeast Asia. -

Energy Efficiency and Circular Economy Initiatives

Extrusion equipment manufacturers are focusing on reducing energy consumption through improved motor efficiency, heat recovery systems, and lightweight machine designs. Additionally, closed-loop recycling systems that integrate post-consumer recycled (PCR) material directly into extrusion lines will gain traction, aligning with circular economy goals. -

Innovation in Specialty Profiles and 3D Extrusion

Custom-shaped profiles for automotive, aerospace, and construction sectors are driving innovation in die technology and material engineering. Concurrently, hybrid systems combining extrusion with 3D printing techniques are emerging, enabling complex geometries and on-demand manufacturing—particularly in prototyping and low-volume production.

In summary, the 2026 plastic extrusion market will be defined by sustainability, digitalization, and performance-driven innovation. Companies that invest in advanced materials, automation, and flexible manufacturing systems will be best positioned to capitalize on evolving industry demands.

Common Pitfalls in Sourcing Plastic Extrusion Processes (Quality and Intellectual Property)

Sourcing plastic extrusion components or services involves significant risks related to both product quality and intellectual property (IP) protection. Failing to address these pitfalls can lead to production delays, compromised product performance, legal disputes, and damage to brand reputation.

Quality-Related Pitfalls

Inadequate Material Specifications and Traceability

One of the most frequent issues is unclear or incomplete material specifications. Sourcing partners may substitute resins or additives without approval, leading to inconsistencies in mechanical properties, color, or regulatory compliance (e.g., FDA, RoHS). Lack of material traceability makes it difficult to diagnose failures or conduct root cause analysis during quality issues.

Poor Process Control and Lack of Documentation

Extrusion quality depends heavily on precise control of temperature, line speed, cooling rate, and die design. Suppliers with insufficient process monitoring may produce inconsistent dimensions, surface defects (e.g., melt fracture, shark skin), or internal voids. Absence of documented process parameters and process capability (Cp/Cpk) data limits quality assurance and scalability.

Insufficient Quality Assurance and Testing Protocols

Many suppliers lack comprehensive in-house testing capabilities (e.g., tensile strength, impact resistance, dimensional checks). Relying solely on visual inspection or infrequent third-party testing increases the risk of undetected defects. Failure to conduct regular batch testing or environmental aging tests can lead to field failures.

Tooling and Die Design Limitations

Low-cost suppliers may use substandard or poorly maintained dies, resulting in inconsistent wall thickness, warping, or surface imperfections. Inadequate die design can also affect flow distribution and cause material degradation, especially with complex profiles.

Intellectual Property-Related Pitfalls

Lack of Clear IP Ownership Agreements

Without a legally binding agreement, extrusion tooling, process know-how, or custom profile designs may not be clearly assigned to the buyer. Suppliers could claim ownership or reuse designs for competing clients, especially in regions with weak IP enforcement.

Insufficient Protection of Proprietary Processes and Formulations

Sharing sensitive information—such as custom resin blends, additive packages, or process parameters—without non-disclosure agreements (NDAs) or technical safeguards exposes companies to IP theft. Suppliers may reverse-engineer formulations or replicate the process for other customers.

Tooling Misuse and Unauthorized Replication

Extrusion dies and tooling are high-value assets. If not explicitly owned and controlled by the buyer, suppliers may use them to produce parts for other clients or sell them to competitors. Poor physical and digital security at supplier facilities increases the risk of replication.

Weak Contractual Clauses and Enforcement Challenges

Contracts that lack specific clauses on IP rights, usage restrictions, audit rights, and liability for IP infringement leave buyers vulnerable. Enforcing IP rights across international borders—particularly in jurisdictions with underdeveloped legal systems—can be costly and ineffective.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Define detailed material and process specifications.

– Require process validation and quality documentation (e.g., PPAP, SPC).

– Conduct on-site audits of supplier facilities.

– Establish clear IP ownership through legal agreements.

– Use NDAs and limit access to sensitive data.

– Retain ownership of tooling and implement usage controls.

– Partner with suppliers in jurisdictions with strong IP protections when possible.

Proactively managing both quality and IP aspects during sourcing is critical to ensuring reliable supply and protecting competitive advantage.

Logistics & Compliance Guide for Plastic Extrusion Process

Raw Material Sourcing and Handling

Ensure that all polymer resins, additives, and colorants are sourced from certified suppliers adhering to relevant industry standards (e.g., ISO 9001, REACH, RoHS). Maintain detailed supplier documentation, including Certificates of Analysis (CoA) and Safety Data Sheets (SDS). Implement a secure inventory management system to track material lot numbers, expiration dates, and storage conditions (e.g., dry, temperature-controlled environments) to prevent degradation. Conduct incoming material inspections to verify quality and compliance before entering production.

Equipment and Process Compliance

Use extrusion machinery that meets applicable safety and operational standards (e.g., CE marking, ANSI/RIA R15.06 for robotics, if applicable). Regularly calibrate temperature controls, screw speed drives, and downstream equipment (e.g., haul-offs, cutters) to maintain process consistency. Document preventive maintenance schedules and equipment validations in alignment with ISO 13485 (if producing medical-grade parts) or other relevant quality management systems. Ensure process parameters (e.g., melt temperature, line speed, cooling rates) are recorded and controlled to meet product specifications.

Environmental, Health, and Safety (EHS) Regulations

Comply with OSHA, EPA, and local environmental regulations regarding emissions, noise levels, and worker safety. Install and maintain ventilation and filtration systems (e.g., fume extractors) to capture volatile organic compounds (VOCs) and particulates generated during extrusion. Provide appropriate personal protective equipment (PPE) such as heat-resistant gloves, safety glasses, and hearing protection. Conduct regular safety training and emergency drills. Monitor and document workplace air quality and noise exposure levels.

Waste Management and Recycling

Adhere to waste disposal regulations (e.g., RCRA in the U.S.) by segregating production waste (start-up scrap, trimmings, off-spec material) and managing it through approved recycling or disposal channels. Prioritize in-house regrind reuse where material properties allow, following validated processes to ensure product consistency. Maintain records of waste generation, recycling rates, and disposal manifests to support sustainability reporting and regulatory audits.

Product Compliance and Traceability

Ensure extruded products meet applicable regulatory requirements such as FDA 21 CFR for food-contact applications, UL/CSA for electrical components, or ASTM/ISO performance standards. Implement a robust traceability system using batch/lot coding to track raw materials through production to final shipment. Maintain production logs, quality inspection reports, and non-conformance records. Conduct routine quality checks (e.g., dimensional accuracy, tensile strength) and retain samples for the required retention period.

Packaging, Labeling, and Shipping

Package extruded products to prevent damage during transit, using environmentally responsible materials where possible. Label all shipments with required information, including product name, batch number, handling instructions, and compliance markings (e.g., recyclability symbols, REACH/ RoHS conformity). Ensure transport providers are vetted for reliability and compliance with hazardous materials regulations if applicable (e.g., for flammable additives). Maintain shipping documentation for audit and recall preparedness.

Documentation and Audit Preparedness

Keep comprehensive records of all logistics and compliance activities, including supplier audits, equipment validations, training logs, EHS reports, and customer certifications. Conduct internal audits at regular intervals to verify adherence to regulatory and quality standards. Prepare documentation for external audits by customers, regulatory bodies, or certification organizations (e.g., ISO, FDA). Implement a corrective and preventive action (CAPA) system to address non-conformities and drive continuous improvement.

Conclusion for Sourcing Plastic Extrusion Process:

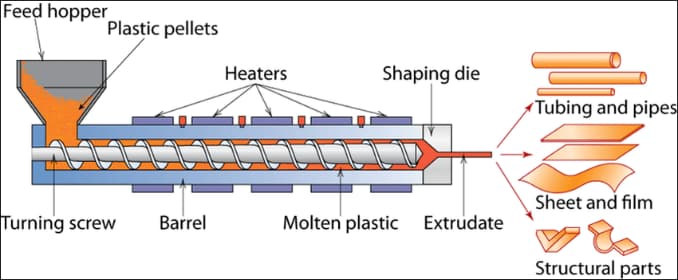

Sourcing plastic extrusion is a strategic decision that requires careful evaluation of material specifications, product complexity, volume requirements, and supplier capabilities. The process offers significant advantages in terms of cost-efficiency, design flexibility, and high-volume production capacity, making it ideal for manufacturing continuous profiles such as tubing, sheets, films, and custom shapes. When outsourcing, selecting a reliable extrusion partner with proven expertise, quality certifications, in-house tooling, and strict process control is critical to ensuring consistent product performance and regulatory compliance.

Furthermore, considerations such as material sourcing, tolerance control, secondary operations, and lead times must align with project timelines and cost constraints. By conducting thorough due diligence and fostering strong collaboration with suppliers, companies can leverage plastic extrusion to achieve scalable, high-quality production outcomes while maintaining competitive advantage in their respective markets. Ultimately, effective sourcing of plastic extrusion not only supports manufacturing efficiency but also drives innovation and product reliability across industries such as automotive, medical, construction, and consumer goods.