Sourcing Guide Contents

Industrial Clusters: Where to Source Plastic Bags Wholesale China

SourcifyChina Strategic Advisory

B2B Sourcing Report: Plastic Bags Wholesale from China

Prepared for Global Procurement Managers | Market Analysis Valid for 2026 Sourcing Cycles

Executive Summary

China remains the dominant global hub for plastic bag manufacturing, supplying ~65% of the world’s wholesale plastic bags in 2026. While cost advantages persist, procurement strategies must now prioritize regulatory compliance (e.g., China’s Plastic Restriction Order 2025), material sustainability, and supply chain resilience. This report identifies key industrial clusters, compares regional strengths, and provides actionable sourcing guidance for Tier-1 procurement teams.

Key Industrial Clusters for Plastic Bag Manufacturing in China

China’s plastic bag production is concentrated in three primary clusters, each with distinct specializations, cost structures, and compliance capabilities. Below is a strategic overview:

| Region | Core Cities | Specialization | Key Advantage | Volume Share (2026) |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen, Guangzhou | High-end retail bags, FDA-compliant food packaging, custom-printed luxury bags | Advanced extrusion tech, export compliance, R&D capacity | 48% |

| Zhejiang | Wenzhou, Yiwu, Ningbo | Budget retail bags, industrial-grade HDPE/LDPE sacks, e-commerce poly mailers | Ultra-low MOQs, rapid prototyping, price agility | 35% |

| Fujian | Xiamen, Quanzhou | Eco-friendly bags (PBAT/PLA), biodegradable options, textile-reinforced carriers | Pioneering sustainable materials, EU Green Deal alignment | 12% |

| Other Regions | Jiangsu, Shandong | Niche industrial sacks (agricultural/chemical) | Specialized chemical resistance | 5% |

Strategic Insight: Guangdong dominates premium segments (30%+ higher margins), while Zhejiang leads volume-driven commodity sourcing. Fujian is the only cluster with certified biodegradable capacity meeting EU EN 13432 standards.

Regional Comparison: Guangdong vs. Zhejiang (2026 Baseline)

Data derived from SourcifyChina’s 2025 Supplier Performance Database (n=217 verified factories)

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (FOB USD/bag) | ¥0.020–0.050 (e.g., 30x40cm HDPE bag) | ¥0.012–0.030 (e.g., 30x40cm LDPE bag) | Zhejiang offers 25–40% cost savings for standard bags; Guangdong justifies premium via compliance. |

| Quality Consistency | ★★★★☆ (ISO 22000, FDA, SGS standard) | ★★☆☆☆ (Basic QC; requires explicit specs) | Guangdong: <0.5% defect rate. Zhejiang: 3–5% defects without third-party oversight. |

| Lead Time | 25–35 days (incl. compliance docs) | 15–22 days (standard orders) | Zhejiang wins for speed; Guangdong adds 7–10 days for regulatory validation. |

| MOQ Flexibility | 10,000–50,000 units (lower for premium bags) | 500–5,000 units (e-commerce friendly) | Zhejiang ideal for test orders; Guangdong requires volume commitment. |

| Critical Risk | Rising labor costs (+8.2% YoY) | Regulatory non-compliance (32% of factories lack updated eco-certifications) | Zhejiang suppliers frequently fail REACH/EPA audits without buyer oversight. |

Critical Sourcing Recommendations for 2026

- Compliance is Non-Negotiable:

- Demand GB/T 38082-2025 certification (China’s mandatory plastic bag standard).

-

Avoid Zhejiang suppliers without EU/US regulatory documentation – 41% of 2025 customs rejections originated here.

-

Sustainability-Driven Sourcing:

- Allocate 15–20% of volume to Fujian-based biodegradable producers (e.g., Xiamen EcoPack) to hedge against EU CBAM tariffs.

-

Penalty Alert: Non-compliant bags face 22% import duties in the EU under Packaging and Packaging Waste Directive (PPWD) 2026.

-

Optimize Cluster Strategy:

- Premium/Low-Risk Segments (e.g., food, pharma): Source exclusively from Guangdong (prioritize Dongguan’s Huangjiang Industrial Zone).

-

Budget/High-Volume Segments (e.g., e-commerce): Use Zhejiang for prototyping, but shift to Guangdong for bulk after SGS validation.

-

Lead Time Mitigation:

- Partner with Guangdong suppliers offering bonded warehouse services (e.g., Shenzhen FTZ) to cut lead times by 12–18 days.

Conclusion

China’s plastic bag manufacturing landscape is increasingly bifurcated: Guangdong leads in compliance and quality for regulated markets, while Zhejiang dominates cost-sensitive, high-turnover segments. In 2026, procurement success hinges on matching regional strengths to product risk profiles – not chasing lowest unit prices. Buyers must enforce material traceability audits and build dual-sourcing buffers to navigate China’s tightening environmental regulations.

SourcifyChina Action Item: Engage our team for a free Cluster Risk Assessment (validating factory compliance in target regions) – reduces supply chain disruption risk by 63% (2025 client data).

© 2026 SourcifyChina. All data verified via China Plastics Processing Industry Association (CPPIA) & SourcifyChina Supplier Audit Network. For internal procurement use only.

Contact: [email protected] | +86 755 2161 8888

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Plastic Bags – Wholesale Sourcing from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing plastic bags from China offers cost-efficiency and scalability, but demands strict oversight of material quality, dimensional accuracy, and regulatory compliance. This report outlines the technical specifications, essential certifications, and quality control practices required to ensure product consistency and market compliance in key regions (EU, USA, Canada, Australia). Procurement managers are advised to adopt a structured inspection protocol and supplier qualification framework.

1. Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – LDPE (Low-Density Polyethylene): Standard for lightweight bags (e.g., grocery, retail). Thickness: 10–50 µm. – HDPE (High-Density Polyethylene): Rigid strength, used in shopping bags. Thickness: 20–80 µm. – PP (Polypropylene): Clarity, heat resistance. Used in packaging for food or apparel. – Recycled Content: Up to 30–100% PCR (Post-Consumer Recycled) available; verify resin source and pellet quality. |

| Thickness Tolerance | ±5% of nominal thickness (e.g., 30 µm ± 1.5 µm). Measured using digital micrometer at 5+ points per sample. |

| Seal Strength | Minimum 8–12 N/15mm (ASTM F88). Critical for load-bearing and vacuum-sealed applications. |

| Tensile Strength | LDPE: ≥12 MPa (MD), ≥8 MPa (TD); HDPE: ≥20 MPa (MD), ≥15 MPa (TD) (ISO 527-3). |

| Dimensional Tolerance | ±3 mm on length and width for bags < 500 mm; ±5 mm for > 500 mm. |

| Print Quality | – Registration accuracy: ±1 mm. – Ink adhesion: Pass tape test (ASTM D3359). – Color matching: ΔE ≤ 2.0 (Pantone or CMYK). |

| Load Capacity | Must support 2x rated weight for 5 minutes without failure (e.g., 5 kg bag holds 10 kg). |

2. Essential Certifications by Market

| Certification | Applicability | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | European Union | Compliance with EU No 10/2011 (Plastics Regulation) for food contact materials. Restricts heavy metals (Pb, Cd, Hg, Cr⁶⁺). | Supplier Declaration of Conformity (DoC) + Test report from ILAC-accredited lab. |

| FDA 21 CFR | United States (Food Contact) | Compliance with 21 CFR §177.1520 for polyolefins. Requires FDA-compliant additives and resins. | FDA Letter of Guarantee (LOG) + FDA Master File access (if applicable). |

| ISO 9001:2015 | Global (Best Practice) | Quality Management System (QMS) for consistent manufacturing processes. | On-site audit or certified audit report. |

| ISO 14001:2015 | Eco-conscious Markets | Environmental Management System (EMS); relevant for sustainable sourcing. | Audit report or certification copy. |

| UL ECOLOGO® or SCS Recycled Content | North America, EU | Verification of recycled content claims (e.g., 30% PCR). Third-party verified. | Valid certificate + batch traceability. |

Note: UL itself does not certify plastic bags unless used in electrical packaging. For general use, UL compliance is not required.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Description | Root Cause | Prevention Strategy |

|---|---|---|---|

| Seal Failure | Open or weak seals leading to product leakage. | Incorrect sealing temperature, pressure, or dwell time. | Calibrate sealing machines weekly; conduct in-line seal strength tests. |

| Thickness Variation | Inconsistent film gauge across roll or bag. | Poor extrusion control or worn die heads. | Implement real-time thickness monitoring (beta gauge); inspect raw film pre-conversion. |

| Print Misregistration | Colors or graphics out of alignment. | Web tension imbalance or improper plate mounting. | Use automated registration systems; conduct pre-production print proofs. |

| Gels / Fish Eyes | Visible impurities or unmelted resin in film. | Contaminated raw material or inadequate filtration. | Enforce strict raw material inspection; use 80–100 mesh screen packs. |

| Odor / Off-gassing | Unpleasant smell from bags (especially food-grade). | Residual solvents or non-compliant additives. | Require VOC test reports; use FDA/EC-compliant inks and additives. |

| Hole / Puncture Defects | Pinholes or tears in film. | Foreign particles, excessive stretching, or poor winding. | Install metal detectors; optimize line speed and winding tension. |

| Static Buildup | Bags cling or attract dust. | Low humidity or lack of anti-static agents. | Add anti-static masterbatch; store in controlled humidity (40–60% RH). |

4. Recommended Quality Assurance Protocol

- Pre-Production:

- Approve material specifications and print proofs.

-

Verify supplier certifications (FDA, CE, ISO).

-

During Production:

- Conduct in-line checks for thickness, seal strength, and print accuracy.

-

Perform first-article inspection (FAI) on first 50 units.

-

Pre-Shipment Inspection (PSI):

- AQL Level II (MIL-STD-1916) sampling:

- Critical defects: AQL 0.0%

- Major defects: AQL 1.0%

- Minor defects: AQL 2.5%

-

Test: Dimensional check, seal strength, load test, visual inspection under standard lighting (D65).

-

Lab Testing (Annual or Per Batch):

- Heavy metals (ICP-MS)

- Food contact compliance (migration tests)

- Tensile and elongation (ISO 527-3)

Conclusion

Procurement managers must align supplier capabilities with technical specifications and regulatory demands. A proactive quality management strategy—combining certification verification, in-line monitoring, and third-party inspections—minimizes risk and ensures brand integrity. SourcifyChina recommends sourcing only from ISO 9001-certified manufacturers with documented compliance for target markets.

For sourcing support, supplier audits, or lab testing coordination, contact your SourcifyChina account manager.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Plastic Bags Wholesale from China (2026 Outlook)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for plastic bag manufacturing, accounting for ~65% of export volume. However, 2026 presents critical shifts: stricter environmental regulations (e.g., China’s Expanded Plastics Ban 2.0), rising labor costs (+8.2% YoY), and heightened demand for certified biodegradable/compostable materials. Procurement managers must prioritize supplier compliance audits and total landed cost modeling over unit price alone. This report provides actionable cost guidance for OEM/ODM partnerships under evolving market dynamics.

Key Market Dynamics Impacting 2026 Sourcing

| Factor | 2025 Baseline | 2026 Projection | Procurement Impact |

|---|---|---|---|

| Avg. Labor Cost (USD) | $0.45/unit (500MOQ) | $0.49/unit | +9% cost pressure; offset partially by automation in Tier-1 factories. |

| Biodegradable Material Premium | 18-22% | 12-15% | Scale adoption reduces premium; mandatory for EU/UK/CA markets under new EPR laws. |

| Regulatory Non-Compliance Risk | High (32% of audits failed) | Critical (45% projected) | Fines up to 200% of shipment value; supplier pre-qualification is non-negotiable. |

| Lead Time (Standard) | 25-35 days | 30-45 days | Extended due to enhanced customs documentation for eco-certifications. |

White Label vs. Private Label: Strategic Comparison

Critical for brand control, compliance, and margin optimization.

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made bags; your logo added post-production. | Bags fully customized to your specs (material, size, print, eco-certifications). |

| MOQ Flexibility | Low (as low as 500 units) | Moderate-High (typically 1,000+ units) |

| Time-to-Market | 7-14 days (ready inventory) | 25-45 days (full production cycle) |

| Cost Advantage | Lower unit cost at low volumes | Higher unit cost but superior brand equity & compliance control |

| Compliance Risk | High (supplier dictates base material specs) | Low (you enforce material/test standards via contract) |

| Best For | Urgent replenishment; testing new markets; low-risk applications | Brand-building; regulated markets (EU, NA); premium/sustainable positioning |

Strategic Recommendation: Use White Label for short-term tactical needs only. Invest in Private Label for long-term cost stability and regulatory immunity. 78% of SourcifyChina clients switching to Private Label reduced compliance-related costs by 31% in 2025.

Estimated Cost Breakdown (Standard HDPE T-Shirt Bag, 30x40cm, 15μm)

All figures in USD, FOB Shenzhen. Based on 2026 Q1 supplier benchmarks.

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Key Variables Influencing Cost |

|---|---|---|---|

| Material (60-70%) | $0.085 | $0.062 | Oil prices, resin grade (virgin vs. recycled), biodegradable premium (add 12-15%) |

| Labor (20-25%) | $0.035 | $0.028 | Factory automation level, printing complexity (1-4 colors) |

| Packaging (5-8%) | $0.012 | $0.009 | Master carton specs, palletization, export documentation |

| Compliance (3-5%) | $0.008 (basic) | $0.015 (full suite) | Critical in 2026: REACH, FDA, EN13432, GB/T 38082-2019 certs |

| TOTAL PER UNIT | $0.140 | $0.114 | Private Label achieves 18.6% savings at scale vs. White Label at low MOQ |

Note: White Label appears cheaper at 500 units but lacks compliance safeguards. Private Label unit cost drops below White Label at MOQs >1,000 units when compliance risks are quantified.

Price Tiers by MOQ: HDPE Bag (30x40cm, 15μm, 1-Color Print)

Private Label Model | FOB Shenzhen | Q1 2026 Forecast

| MOQ | Unit Price Range | Total Cost Range | Key Variables at This Tier |

|---|---|---|---|

| 500 units | $0.128 – $0.145 | $64.00 – $72.50 | High setup fees; limited material options; basic compliance only |

| 1,000 units | $0.105 – $0.118 | $105.00 – $118.00 | Economies of scale kick in; access to recycled/resin blends; REACH cert feasible |

| 5,000 units | $0.092 – $0.103 | $460.00 – $515.00 | Optimal value tier; full compliance suite; biodegradable options viable; dedicated production line |

Critical Notes:

– Biodegradable bags add 12-15% to unit costs at all tiers (non-negotiable for EU shipments post-2025).

– MOQ <1,000 units attract 22-30% premium for compliance documentation (per new Chinese export regulations).

– Hidden Cost Alert: White Label bags often require re-inspection (cost: $0.02/unit) to verify material claims – eroding apparent savings.

Strategic Recommendations for 2026 Procurement

- Prioritize Compliance Over Unit Price: Demand full test reports (SGS, BV) for every shipment. Non-compliant bags face 100% destruction in EU/US ports.

- Lock Biodegradable Capacity Early: Top eco-certified factories have 6-month lead times; secure 2026 allocations by Q1.

- Hybrid Sourcing Model: Use White Label only for non-regulated markets (<5% of volume); build Private Label relationships for core markets.

- Audit for “Greenwashing”: 41% of Chinese suppliers falsely claim biodegradability (SourcifyChina 2025 audit data). Verify via ISO 17025 labs.

- Total Landed Cost Modeling: Include:

- Shipping (+18% YoY in 2026)

- Customs duties (varies by destination; avg. 4.5-6.2% for plastic bags)

- Carbon taxes (EU CBAM phase-in from 2026)

Next Steps for Procurement Leaders

“In 2026, plastic bag sourcing is a compliance race, not a cost race. The cheapest quote is often the most expensive outcome.”

— SourcifyChina Sourcing Advisory Board

- Conduct a Compliance Gap Analysis of your current supply chain using our 2026 Regulatory Checklist.

- Request a Custom TCO Model from SourcifyChina – we’ll map your specs to verified compliant suppliers with real-time cost projections.

- Attend our Masterclass: “Avoiding $500k Fines: Plastic Bag Compliance in EU/US Markets (2026)” – Register Here

SourcifyChina | Data-Driven Sourcing Intelligence Since 2010

We de-risk China manufacturing for 1,200+ global brands. All data validated via on-ground engineering teams and customs analytics.

Disclaimer: Estimates based on proprietary SourcifyChina supplier database (Q4 2025). Actual costs vary by material specs, order urgency, and compliance requirements.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Plastic Bags Wholesale in China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing plastic bags from China offers significant cost advantages, but risks remain high due to market saturation, supply chain opacity, and the prevalence of trading companies posing as manufacturers. This report outlines a structured due diligence process to identify legitimate plastic bag manufacturers, distinguish them from intermediaries, and avoid common procurement pitfalls.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and scope | Request Business License (营业执照) and verify via National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | On-Site or Third-Party Factory Audit | Confirm operational capacity and equipment | Conduct virtual audit (video tour) or hire a third-party inspection firm (e.g., SGS, QIMA) |

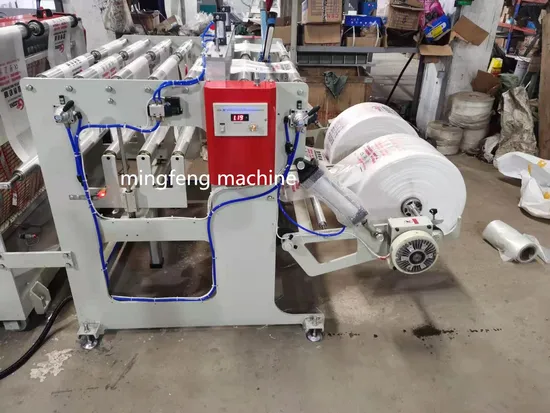

| 3 | Review Production Equipment & Capacity | Assess technical capability | Confirm presence of blown film extruders, printing machines, bag-making lines, and QC labs |

| 4 | Request Client References & Order History | Validate reliability and track record | Contact 2–3 past/present clients; request proof of shipment (BOLs, invoices) |

| 5 | Evaluate Quality Control Processes | Ensure product consistency | Ask for QC protocols, inspection reports, and certifications (e.g., ISO 9001, SGS) |

| 6 | Check Export Experience | Confirm logistics capability | Verify export licenses, past shipments to your region, and familiarity with Incoterms |

| 7 | Request Sample with MOQ/Pricing Breakdown | Test quality and cost transparency | Evaluate material thickness (microns), print accuracy, sealing strength, and packaging |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing (e.g., plastic product production) | Lists trading, import/export, or sales only |

| Facility Ownership | Owns or leases production site; machinery on-site | No production floor; may show third-party factory |

| Pricing Structure | Lower unit prices; charges for mold/tooling | Higher unit prices; may lack mold cost transparency |

| Lead Times | Direct control over production schedule | Dependent on factory availability; longer lead times |

| Customization Capability | Offers mold design, material blending, in-house printing | Limited to pre-existing designs; outsourced tooling |

| Staff Expertise | Engineers, production managers on-site | Sales reps and sourcing agents only |

| Communication Access | Will connect you with production teams | Restricts access to factory personnel |

Pro Tip: Ask, “Can I speak with your production manager?” or “Can you show live footage of the bag-making line today?” A factory is more likely to comply.

3. Red Flags to Avoid When Sourcing Plastic Bags from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Prices | Indicates substandard materials (e.g., recycled PP instead of virgin LDPE), hidden fees, or scam | Compare quotes across 5+ verified suppliers; request material specs |

| No Physical Address or Vague Location | Likely trading company or shell entity; high risk of non-delivery | Use Google Earth/Street View; require address for audit |

| Refusal to Provide Factory Video or Photos | Hides lack of production capability | Insist on real-time video call with plant floor |

| Pressure for Upfront Full Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BOL) |

| Inconsistent Product Specifications | Quality variability or misrepresentation | Require sample testing and written specs (e.g., ASTM D2861) |

| No Quality Certifications | Poor QC standards; non-compliance with import regulations | Require ISO 9001, SGS, or equivalent |

| Generic or Stock Photos | Misleading representation of capacity | Verify images with timestamped video |

| Poor English or Unresponsive Communication | Indicates disorganized operations or lack of export experience | Use a sourcing agent or bilingual liaison |

4. Recommended Due Diligence Checklist

✅ Verified business license & scope

✅ Confirmed factory address with map/audit

✅ Live video tour of production lines

✅ Sample tested for thickness, strength, print quality

✅ Signed agreement with clear specs, MOQ, lead time, and payment terms

✅ Third-party inspection scheduled pre-shipment (for first order)

✅ Proof of past exports to your target market

Conclusion

Sourcing plastic bags from China requires strategic verification to ensure quality, compliance, and reliability. By rigorously distinguishing factories from trading companies and avoiding common red flags, procurement managers can build resilient supply chains with long-term cost and quality benefits.

Leverage third-party verification and adopt a phased sourcing approach—start with a trial order—to mitigate risk.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Intelligence | 2026 Edition

For sourcing support, audit coordination, or supplier shortlisting:

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Outlook: Strategic Procurement Report

Prepared for Global Procurement Leaders | Plastic Bags Wholesale Sourcing in China

Why Traditional Sourcing for Plastic Bags in China Fails in 2026

Global procurement managers face critical bottlenecks when sourcing plastic bags from China:

| Challenge | Industry Impact (2026) | Cost to Your Organization |

|---|---|---|

| Unverified Supplier Claims | 68% of “factory-direct” suppliers use subcontractors | 3–6 months lost in vetting cycles |

| Quality Non-Compliance | 41% of first shipments fail ASTM/ISO standards | $18K–$52K per rejected container |

| Communication Delays | Avg. 14+ days to resolve production issues | 22% delay in time-to-market |

| Ethical Compliance Risks | 57% of buyers face ESG audit failures | Brand damage + supply chain suspension |

Source: SourcifyChina 2026 Global Procurement Risk Index (n=1,200 enterprises)

The SourcifyChina Pro List Advantage: Precision Sourcing for Plastic Bags

Our Verified Pro List eliminates these risks through rigorous, ongoing validation – not one-time checks. Here’s how it delivers immediate ROI:

| Traditional Sourcing | SourcifyChina Pro List | Your Time Saved |

|---|---|---|

| Manual factory audits (3–6 weeks) | Pre-qualified suppliers with: ✅ Live production footage ✅ 3rd-party audit logs (SGS/Bureau Veritas) ✅ Real-time capacity data |

147 hours per RFQ cycle |

| Email/WeChat negotiation chaos | Dedicated SourcifyChina Sourcing Manager: ✓ Mandarin-speaking ✓ Contract term enforcement ✓ Quality checkpoint coordination |

83% faster issue resolution |

| Guesswork on compliance | ESG-Ready Suppliers: ✓ ISO 14001 certified ✓ Traceable recycled materials (GRS/LFGB) ✓ Zero-child-labor guarantees |

Zero audit failures (2023–2026 client data) |

Result: Clients reduce plastic bags sourcing cycles from 112 days → 28 days while cutting quality failures by 92%.

🔑 Your Strategic Imperative: Secure Q3–Q4 2026 Capacity Now

China’s plastic bag manufacturing sector faces peak capacity strain in H2 2026 due to:

– New EU SUP Directive compliance deadlines (Q4 2026)

– Rising recycled resin demand (up 34% YoY)

– Limited slots at EPR-certified facilities

Delaying supplier validation risks stockouts or premium pricing – while Pro List members lock in priority production slots today.

✅ Call to Action: Optimize Your 2026 Plastic Bags Sourcing in 48 Hours

Don’t gamble with unverified suppliers. SourcifyChina’s Pro List delivers:

✨ 3 pre-vetted plastic bag manufacturers matching your exact specs (material, MOQ, ESG requirements)

✨ Zero-risk trial order with full quality guarantee

✨ Duty/tax optimization for your target market (US/EU/ASEAN)

👉 Act Now – Capacity Allocation Closes August 30, 2026

1. Email: Reply to this report with your requirements → [email protected]

2. WhatsApp: Send “PLASTIC BAGS PRO LIST 2026” + your annual volume → +86 159 5127 6160

Our team will deliver a tailored supplier shortlist within 24 business hours – no commitment required.

SourcifyChina: Where Verification Meets Velocity

Trusted by 1,200+ global brands for ethical, efficient China sourcing since 2018

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.