The global hydraulic accumulators market is experiencing steady expansion, driven by rising demand across industrial machinery, automotive, and energy sectors. According to Grand View Research, the global hydraulic accumulators market size was valued at USD 1.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth is fueled by increasing automation, the need for energy efficiency in hydraulic systems, and advancements in heavy equipment technology. Within this expanding market, piston accumulators—known for their high-pressure capacity, durability, and suitability for demanding environments—are gaining prominence over other accumulator types. As industries prioritize reliability and performance, leading manufacturers are investing in innovation and global distribution networks. Based on market presence, technological expertise, and product range, the following nine companies have emerged as key players in the piston accumulator segment, shaping the future of hydraulic energy storage solutions.

Top 9 Piston Accumulator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Accumulators, Inc.

Domain Est. 1996

Website: accumulators.com

Key Highlights: We are an American manufacturer of Bladder Accumulators, Piston Accumulators, Diaphragm Accumulators, and accessories. Located in Houston, Texas….

#2 Piston Accumulators: Industrial Pressure Vessels

Domain Est. 2020

Website: kocsisusa.com

Key Highlights: Kocsis is a piston accumulator manufacturer, offering 3000 PSI, 5000 PSI, 10000 PSI, and 15000 PSI accumulators for pressure vessel applications….

#3 Piston accumulators

Domain Est. 1996

Website: saip.it

Key Highlights: Repairable piston accumulators for industrial systems requiring high discharge and liquid flow rates. Volumes up to 100 litres, pressures up to 415 Bar….

#4 Piston Accumulators

Domain Est. 2016

Website: sfphyd.com

Key Highlights: Piston accumulators from SFP Hydraulics Inc. are essential for managing high-pressure fluid volumes in a range of industries, including oil & gas, agriculture, ……

#5 Piston Accumulators

Domain Est. 1995

Website: ph.parker.com

Key Highlights: Piston accumulators are the optimal choice when fluid energy storage, hydraulic shock absorption, auxiliary power, or supplemental pump flow is required….

#6 Accumulators

Domain Est. 1995

Website: fst.com

Key Highlights: Freudenberg Sealing Technologies (FST) offers its customers a complete line of hydraulic accumulators which include piston, diaphragm and bladder accumulators….

#7 Piston accumulators

Domain Est. 1998

Website: hydroleduc.com

Key Highlights: Hydro Leduc piston accumulators: robust, high pressure (up to 350 bar), suitable for construction, agricultural and suspension applications….

#8 Hydroll

Domain Est. 2002

Website: hydroll.com

Key Highlights: Hydroll is the only company in the world purely specialized in the design and production of high-quality piston accumulators. The latest piston accumulator ……

#9 Piston Accumulators, Bladder Accumulators, Diaphragm Accumulators

Domain Est. 2014

Website: tobulaccumulators.com

Key Highlights: Discover our comprehensive range of Tobul Accumulators, including piston accumulators, bladder accumulators, diaphragm accumulators, gas bottles, accessories, ……

Expert Sourcing Insights for Piston Accumulator

H2: 2026 Market Trends for Piston Accumulators

The piston accumulator market is poised for steady growth and transformation in 2026, driven by evolving industrial demands, technological advancements, and sustainability imperatives. Key trends shaping the market include:

1. Growing Demand from Renewable Energy & Hydropower:

The global push for clean energy is significantly boosting hydropower infrastructure investments. Piston accumulators are critical for maintaining stable pressure and damping pressure surges in large-scale hydroelectric plants. As countries expand or modernize their hydropower fleets to meet decarbonization goals, demand for high-capacity, durable piston accumulators is expected to rise notably by 2026.

2. Expansion in Offshore and Subsea Applications:

The offshore oil & gas sector, particularly in deepwater and ultra-deepwater operations, continues to rely on hydraulic systems for subsea control and safety functions. Piston accumulators, known for their robustness and reliability in high-pressure, high-temperature (HPHT) environments, are increasingly preferred for blowout preventer (BOP) systems. Rising offshore exploration activities and aging infrastructure requiring upgrades will drive demand through 2026.

3. Increased Adoption in Heavy Industrial Machinery:

Industries such as mining, construction, and metal processing are investing in larger, more efficient hydraulic systems. Piston accumulators offer superior energy storage density and longevity compared to bladder or diaphragm types, making them ideal for heavy-duty applications requiring frequent energy cycling. Automation and electrification trends in these sectors are also increasing reliance on hybrid hydraulic systems incorporating accumulators.

4. Focus on Efficiency and Energy Recovery:

With rising energy costs and ESG (Environmental, Social, Governance) priorities, industries are adopting energy recovery systems. Piston accumulators play a vital role in capturing and reusing kinetic or potential energy in applications like injection molding, cranes, and mobile machinery. By 2026, more manufacturers will integrate piston accumulators into closed-loop hydraulic systems to reduce energy consumption and operational costs.

5. Advancements in Materials and Design:

Innovation in seal technology, corrosion-resistant coatings (e.g., HVOF, ceramic), and lightweight alloys is enhancing the performance and lifespan of piston accumulators. Smart accumulators equipped with integrated pressure and temperature sensors are emerging, enabling predictive maintenance and real-time monitoring—trends that will gain traction as Industry 4.0 adoption grows.

6. Regional Market Shifts:

Asia-Pacific, led by China, India, and Southeast Asia, will remain the fastest-growing market due to rapid industrialization and infrastructure development. Meanwhile, North America and Europe will see steady growth driven by energy transition projects and equipment modernization, supported by regulatory standards promoting efficiency and safety.

Conclusion:

By 2026, the piston accumulator market will be characterized by stronger demand from energy, offshore, and heavy industrial sectors, underpinned by technological innovation and sustainability trends. Manufacturers who prioritize reliability, efficiency, and smart integration will be best positioned to capitalize on these evolving opportunities.

Common Pitfalls When Sourcing Piston Accumulators (Quality, IP)

Sourcing piston accumulators requires careful evaluation to ensure reliability, safety, and compliance—especially concerning quality and intellectual property (IP). Overlooking these aspects can lead to system failures, safety hazards, and legal risks. Below are common pitfalls to avoid:

Poor Quality Control and Substandard Materials

One of the most frequent issues is procuring piston accumulators made with inferior materials or lacking rigorous quality assurance. Low-cost suppliers may use subpar seals, inadequate heat treatment on pistons, or flawed welding techniques. This compromises the accumulator’s pressure integrity and fatigue life, leading to leaks, premature failure, or even catastrophic rupture under operating conditions.

Mitigation: Require documented quality certifications (e.g., ISO 9001), material traceability, pressure test records (including proof and burst tests), and third-party inspection reports. Prioritize suppliers with proven track records in high-pressure hydraulic systems.

Inadequate Design Validation and Testing

Some piston accumulators—especially from lesser-known manufacturers—are sold without sufficient design verification. Issues like improper piston alignment, poor dynamic sealing under cycling conditions, or inadequate damping can go undetected until field failure.

Mitigation: Insist on design validation data, including cycle life testing, temperature performance curves, and dynamic response reports. Request prototype testing under your specific operating conditions if possible.

Misrepresentation of Performance Specifications

Suppliers may exaggerate performance claims, such as maximum working pressure, temperature range, or fluid compatibility. This is especially common with generic or rebranded components that do not adhere to international standards (e.g., ASME, PED, or ISO 11439).

Mitigation: Verify specifications against recognized industry standards. Cross-check technical data sheets with independent test results or certification bodies. Avoid suppliers who cannot provide detailed test documentation.

Intellectual Property Infringement Risks

Sourcing piston accumulators from certain regions or unauthorized distributors can expose your company to IP infringement. Counterfeit or cloned products may replicate patented designs, seals, or assembly methods without licensing, potentially implicating your organization in legal disputes.

Mitigation: Source only from authorized distributors or OEMs with clear IP ownership. Conduct due diligence on suppliers’ manufacturing rights and avoid “copycat” designs that closely mimic branded products. Include IP indemnification clauses in procurement contracts.

Lack of Traceability and Certification

Failure to obtain proper documentation—such as serial numbers, material certificates (e.g., EN 10204 3.1), and pressure equipment directives (PED) compliance—can result in non-compliance with safety regulations, particularly in industries like oil & gas, marine, or heavy machinery.

Mitigation: Ensure all units come with full traceability, including test reports, CE or ASME markings where applicable, and compliance declarations. Maintain a documented audit trail for each accumulator.

Insufficient After-Sales Support and Warranty

Choosing suppliers based solely on price often means sacrificing technical support, spare parts availability, and comprehensive warranties. This becomes critical when troubleshooting field issues or performing maintenance.

Mitigation: Evaluate the supplier’s service network, technical support responsiveness, and warranty terms before purchase. Prefer suppliers offering long-term support and repair services.

By proactively addressing these quality and IP-related pitfalls, organizations can ensure the safe, reliable, and legally compliant integration of piston accumulators into their hydraulic systems.

Logistics & Compliance Guide for Piston Accumulators

Overview

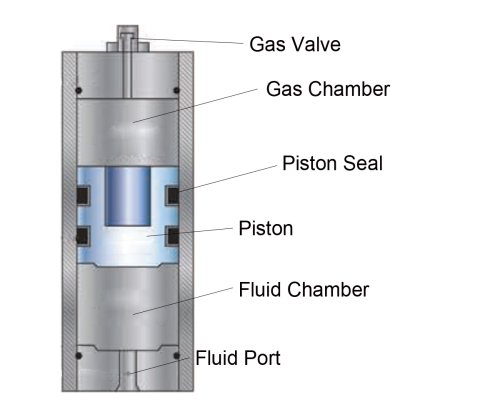

Piston accumulators are hydraulic energy storage devices used in industrial, mobile, and marine applications to maintain system pressure, absorb shocks, and provide emergency power. Safe and compliant logistics handling is essential due to their pressurized components and potential hazards if mishandled.

Classification & Hazard Identification

Piston accumulators are classified as pressure vessels under international transport regulations. They may contain compressed gas (typically nitrogen) and hydraulic fluid. Even when depressurized, residual energy or fluid contamination can pose risks.

- UN Number: UN 3444 (for pressure receptacles containing non-flammable, non-toxic gas)

- Proper Shipping Name: “Gas cylinder, non-flammable, non-toxic, without subsidiary risk”

- Hazard Class: Class 2 (Gases), Division 2.2

- Packing Group: Not applicable (PG III may apply if mixed hazards)

- Regulatory Frameworks:

- IMDG Code (Maritime)

- IATA DGR (Air)

- ADR/RID (Road/Rail in Europe)

- 49 CFR (U.S. DOT)

Packaging & Preparation

Proper packaging ensures the accumulator remains secure and leak-free during transit.

- Depressurization: Fully discharge internal pressure before shipping. Verify using calibrated gauges.

- Fluid Drainage: Drain all hydraulic fluid; residues must be below regulatory thresholds for hazardous waste.

- Port Protection: Cap or plug all ports to prevent contamination and damage. Use protective end caps.

- Packaging Type: Use robust, UN-certified packaging suitable for pressure equipment. Include cushioning material to prevent movement.

- Labeling: Affix appropriate hazard labels (Class 2.2) if shipped under pressure. Mark “EMPTY” or “RESIDUE LAST CONTAINED” if depressurized and drained.

Transport Requirements

Each mode of transport has specific compliance rules.

- Air Transport (IATA):

- Accumulators must be completely depressurized.

- Classify as “Not Restricted” or “Empty” under Special Provision A180 if fully purged.

-

Documentation must specify internal pressure and fluid type.

-

Sea Transport (IMDG):

- Follow Packing Instruction P200 for gas cylinders.

- Secure upright in containers; avoid stacking on top.

-

Declare on Dangerous Goods Declaration if pressurized.

-

Road Transport (ADR):

- Secure against movement; use restraints and blocking.

-

Vehicles may require orange placards if transporting pressurized units in quantity.

-

Rail Transport (RID):

- Comply with ADR standards; ensure compatibility with rail safety protocols.

Documentation

Accurate documentation is required for customs and safety compliance.

- Commercial Invoice: Include product description, value, and country of origin.

- Packing List: Detail quantities, weights, and dimensions.

- Dangerous Goods Declaration: Required only if shipped pressurized.

- Certificate of Conformity: Confirm adherence to pressure vessel standards (e.g., ASME, PED).

- Material Safety Data Sheet (MSDS/SDS): Provide for hydraulic fluid residues.

Import & Export Compliance

Ensure adherence to national and international trade regulations.

- Export Controls: Verify if accumulators are subject to dual-use or ITAR/EAR restrictions.

- Import Requirements: Comply with destination country’s pressure equipment directives (e.g., EU PED 2014/68/EU).

- Customs Codes: Use correct HS Code (e.g., 8412.21 or 8412.29 for hydraulic machinery parts).

- Certifications: Provide CE, UKCA, or other regional conformity marks as needed.

Storage & Handling

Safe practices during warehousing and transfer.

- Storage Conditions: Store upright in dry, well-ventilated areas away from heat and corrosive substances.

- Handling Equipment: Use forklifts or cranes with appropriate slings; never lift by valves or ports.

- Inspection: Check for corrosion, leaks, or damage before and after transport.

Environmental & Safety Considerations

Mitigate environmental and personnel risks.

- Spill Management: Have containment kits for hydraulic fluid leaks.

- Recycling: Dispose of drained fluids per local hazardous waste regulations.

- Training: Ensure staff are trained in handling pressurized equipment and emergency response.

Summary

Proper logistics and compliance for piston accumulators require adherence to pressure vessel regulations, correct classification, and thorough documentation. Always prioritize depressurization and fluid removal before shipping, and confirm compliance with transport mode and destination-specific requirements to ensure safety and regulatory approval.

Conclusion for Sourcing a Piston Accumulator:

In conclusion, sourcing a piston accumulator requires a comprehensive evaluation of technical specifications, operating conditions, application requirements, and supplier reliability. Piston accumulators are ideal for high-pressure and high-volume applications, offering durability, minimal gas loss, and effective performance in demanding industrial environments such as oil and gas, hydraulics, and heavy machinery. When selecting a supplier, key factors such as quality certifications (e.g., ISO, ASME), material standards, customization capabilities, after-sales support, and lead times must be carefully assessed.

Prioritizing reputable manufacturers with proven experience ensures long-term reliability, safety, and compliance with industry standards. Additionally, total cost of ownership—including maintenance, lifecycle, and energy efficiency—should be considered over initial purchase price. By conducting thorough due diligence and aligning technical needs with supplier capabilities, organizations can effectively source piston accumulators that enhance system performance, reduce downtime, and support operational efficiency.