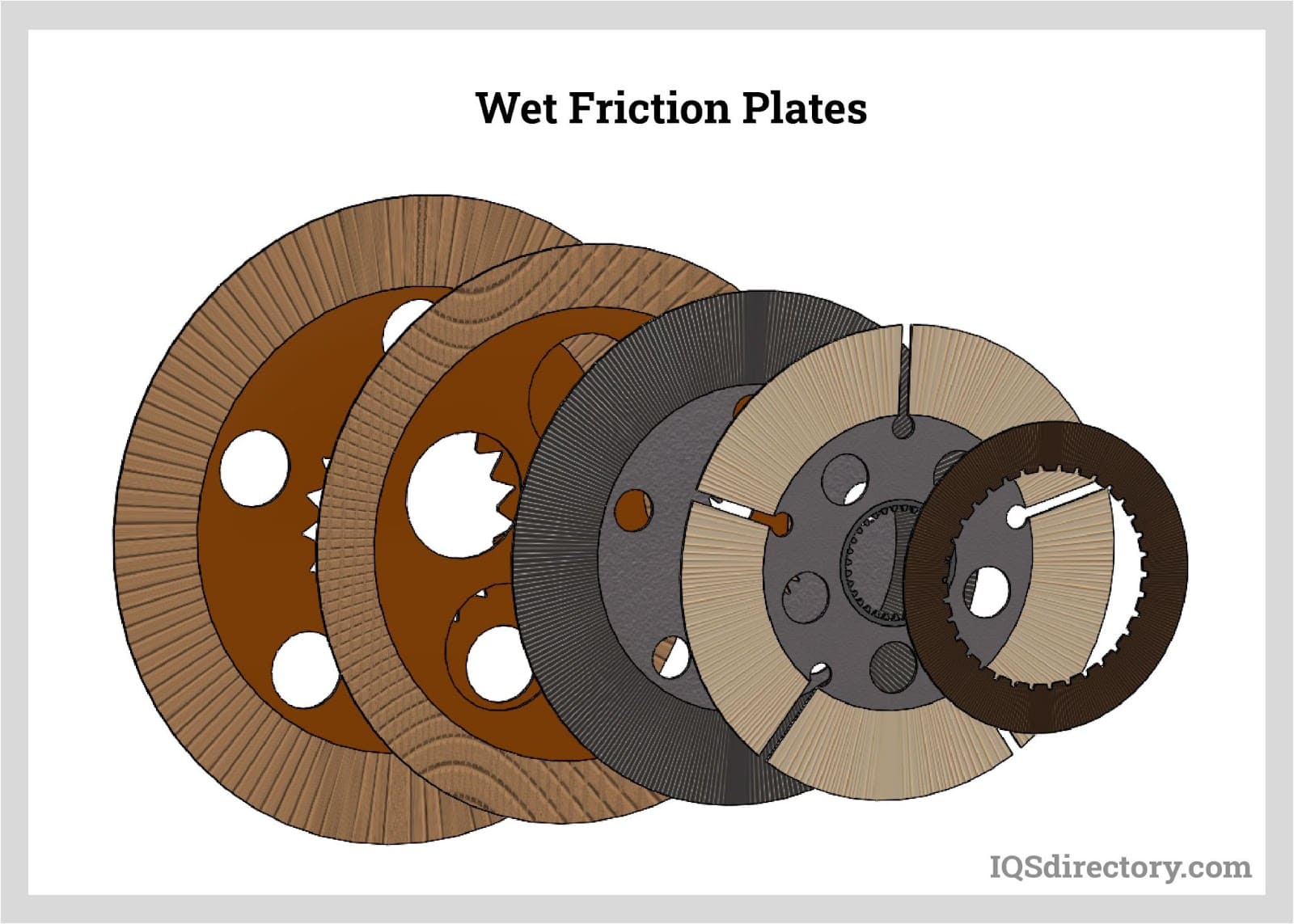

The global friction materials market is poised for steady expansion, projected to grow at a CAGR of 5.2% from 2023 to 2028, according to Mordor Intelligence. With increasing demand for high-performance braking systems in automotive and industrial applications, regional hubs like Phoenix, Arizona have emerged as key centers for friction product innovation and manufacturing. Fueled by a robust industrial base, strategic logistics, and a skilled workforce, Phoenix is home to a growing cluster of friction material specialists serving aerospace, commercial vehicle, and off-highway equipment markets. As OEMs and Tier 1 suppliers prioritize durability, heat resistance, and low noise, the top three friction manufacturers in the Phoenix area—Loranger Manufacturing Corporation, Tri-Metallic Bearings, and Phoenix Friction Products—have distinguished themselves through advanced material engineering, rigorous testing protocols, and ISO-certified production processes. These companies are not only meeting stringent industry standards but are also contributing to the broader upward trajectory of the North American friction materials sector, which Grand View Research values at over USD 25 billion in 2023.

Top 3 Phoenix Friction Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Phoenix Friction Products, Inc.

Domain Est. 2002

Website: frictionmaterials.com

Key Highlights: Phoenix Friction Products is a leading manufacturer and supplier of friction materials, offering a wide range of products and services to meet the needs of ……

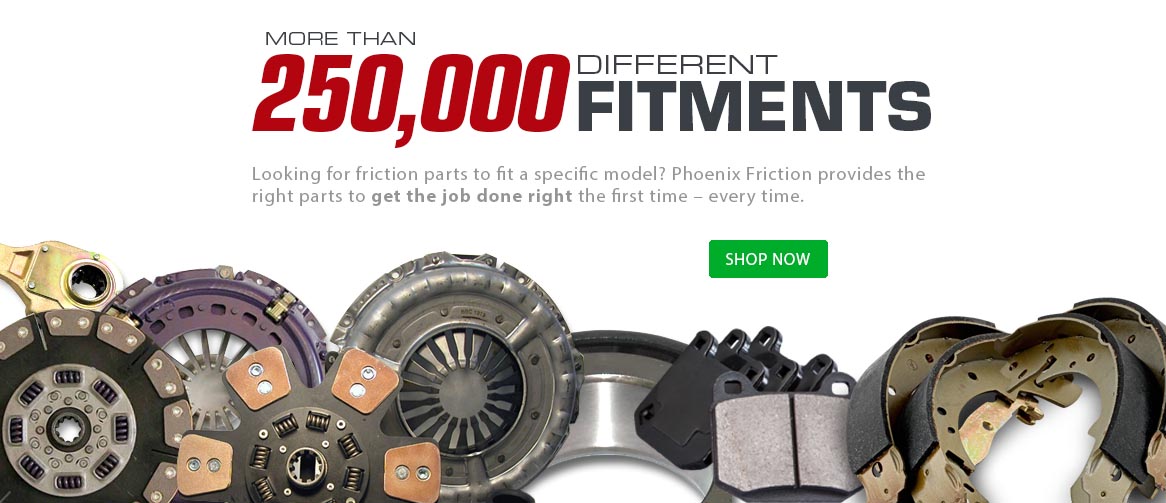

#2 Phoenix Friction

Domain Est. 1999

Website: phoenixfriction.com

Key Highlights: We are the industry leader in bringing you solid flywheel conversion kits for all your towing and performance needs. There are up to six levels of performance….

#3 Phoenix Friction

Domain Est. 2002

Website: phoenixfriction.ca

Key Highlights: At our Toronto plant, we can reline brakes, clutches, bands, disc pads, cones, shoes, rings, discs and plates of any size and shape and in any order quantity….

Expert Sourcing Insights for Phoenix Friction

H2: Market Trends Shaping Phoenix Friction in 2026

As we approach 2026, Phoenix Friction—presumably a company operating in the friction materials sector, such as brake pads, clutches, or industrial braking systems—is poised to navigate a dynamic landscape shaped by technological innovation, regulatory shifts, and evolving end-market demands. Key market trends under the H2 economic and industrial outlook suggest both challenges and strategic opportunities for the company.

1. Acceleration of Electric Vehicle (EV) Adoption

The global transition to electric vehicles is one of the most influential trends affecting Phoenix Friction. By 2026, EVs are projected to account for over 30% of new vehicle sales worldwide (depending on region), reducing reliance on traditional friction-based braking systems due to regenerative braking. However, hybrid and high-performance EV models still require high-efficiency friction materials. Phoenix Friction can capitalize by developing low-dust, noise-reducing, and thermally stable brake solutions tailored for EV applications, positioning itself as a premium supplier in a niche but growing segment.

2. Stricter Environmental and Safety Regulations

Global emissions and particulate regulations—such as the EU’s Brake Wear Emissions standards and California’s AB 2280—are pushing manufacturers to reduce copper and other harmful materials in friction products. By 2026, compliance will be non-negotiable. Phoenix Friction must continue investing in eco-friendly, low-metal or copper-free formulations. The H2 regulatory environment will favor companies with strong R&D capabilities and sustainable supply chains, offering a competitive edge through certification and green branding.

3. Growth in Industrial Automation and Rail Transportation

Beyond automotive, industrial machinery, elevators, and rail systems represent expanding markets for friction technologies. With urbanization and investment in public transit accelerating in regions like Asia-Pacific and North America, demand for high-reliability, maintenance-efficient braking systems is rising. Phoenix Friction can diversify its portfolio by targeting rail and automated logistics sectors, where safety and durability are paramount.

4. Supply Chain Resilience and Localization

Geopolitical instability and post-pandemic supply chain lessons have led to a regionalization trend. In H2 2026, nearshoring and regional manufacturing hubs are expected to grow, especially in North America and Eastern Europe. Phoenix Friction can strengthen its market position by localizing production or forming strategic partnerships to reduce lead times and logistics costs, while improving responsiveness to customer needs.

5. Digital Integration and Predictive Maintenance

The rise of IoT-enabled components allows friction products to be monitored in real time for wear and performance. By 2026, smart braking systems integrated with fleet management software will become standard in commercial and industrial applications. Phoenix Friction has an opportunity to develop “smart friction” solutions—embedding sensors or partnering with tech firms—to offer predictive maintenance services, adding value beyond physical components.

6. Competitive Pressure and Consolidation

The friction materials market is seeing increased consolidation, with larger players acquiring niche innovators. To remain competitive, Phoenix Friction may need to scale operations, pursue M&A, or focus on differentiation through performance, sustainability, or service bundling. Brand reputation for quality and innovation will be critical in H2 2026’s buyer-driven market.

Conclusion

In H2 2026, Phoenix Friction’s success will depend on its agility in responding to electrification, sustainability mandates, and digital transformation. By focusing on R&D, strategic market expansion, and sustainable innovation, the company can transition from a traditional component supplier to a value-added technology partner in the global mobility and industrial sectors.

Common Pitfalls Sourcing Phoenix Friction (Quality, IP)

Sourcing friction components from Phoenix or suppliers associated with the Phoenix brand can present specific challenges related to quality consistency and intellectual property (IP) risks. Being aware of these pitfalls is crucial for maintaining product integrity and avoiding legal complications.

Quality Inconsistencies Across Suppliers

Not all manufacturers or distributors using the “Phoenix” name are authorized or adhere to the same quality standards. Sourcing from unauthorized or unverified suppliers may result in substandard materials, inconsistent performance, and premature product failure. These knock-offs often lack rigorous testing, leading to variability in friction coefficients, heat resistance, and durability. Always verify certifications and request material test reports to ensure alignment with OEM specifications.

Intellectual Property and Counterfeit Risks

The “Phoenix” name may be associated with patented designs or proprietary technology. Sourcing from third parties without proper licensing can expose your company to IP infringement claims, especially if the components replicate protected engineering. Counterfeit parts may also bear misleading branding, making it difficult to distinguish legitimate products. Conduct due diligence on suppliers, confirm authenticity through official channels, and ensure supply agreements include IP indemnification clauses.

Logistics & Compliance Guide for Phoenix Friction

This guide outlines the essential logistics and compliance procedures for Phoenix Friction to ensure efficient operations, regulatory adherence, and supply chain integrity.

Supply Chain Management

Establish a reliable network of suppliers and distributors with clear service-level agreements (SLAs). Conduct regular performance evaluations and maintain safety stock levels to prevent disruptions. Utilize inventory management systems to track raw materials and finished goods in real time.

Transportation & Distribution

Partner with certified carriers experienced in handling industrial materials. Ensure all shipments comply with domestic and international transportation regulations, including hazardous materials (if applicable). Optimize routing and load planning to reduce costs and environmental impact.

Import/Export Compliance

Adhere to all relevant customs regulations, including accurate classification under the Harmonized System (HS), proper valuation, and country of origin marking. Maintain up-to-date licenses and authorizations for international trade. Utilize Automated Export System (AES) filings where required.

Regulatory Standards & Certifications

Ensure all friction products meet industry-specific standards such as ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and any region-specific safety certifications (e.g., DOT, ECE R90). Maintain documentation for audits and customer inquiries.

Product Labeling & Documentation

Apply compliant labels that include product identification, batch/lot numbers, safety warnings, and regulatory marks. Generate accurate commercial invoices, packing lists, and certificates of conformity for every shipment.

Environmental & Safety Compliance

Follow OSHA and EPA guidelines for handling, storing, and disposing of materials. Implement a waste management program and train employees on safety protocols. Monitor and report emissions or hazardous substance usage as required.

Recordkeeping & Audits

Retain all logistics and compliance records for a minimum of seven years. Conduct internal audits annually to identify gaps and ensure continuous improvement. Prepare for third-party or regulatory inspections with organized, accessible documentation.

Training & Accountability

Provide regular training to staff on logistics procedures and compliance updates. Assign compliance officers to oversee adherence and serve as points of contact for regulatory matters.

Incident Response & Corrective Actions

Establish a protocol for reporting and addressing compliance violations or logistics failures. Implement corrective and preventive actions (CAPA) to mitigate recurrence and maintain customer trust.

By following this guide, Phoenix Friction will maintain operational excellence, legal compliance, and a strong reputation in the global marketplace.

Conclusion for Sourcing Phoenix Friction

In conclusion, sourcing friction materials from Phoenix Friction presents a strategic advantage for organizations seeking high-performance, reliable, and technically advanced solutions for industrial, automotive, or specialty applications. Phoenix Friction’s reputation for innovation, stringent quality control, and extensive product range positions them as a trusted supplier in the global friction materials market. Their commitment to research and development ensures continuous improvement in product durability, thermal stability, and environmental compliance, meeting evolving industry standards.

Additionally, their ability to customize solutions for specific operational demands enhances their value proposition, particularly for OEMs and maintenance providers requiring consistent performance under extreme conditions. When evaluating total cost of ownership — including longevity, safety, and reduced downtime — Phoenix Friction proves to be a cost-effective and dependable sourcing partner.

Therefore, based on technical expertise, product reliability, and strong customer support, sourcing friction materials from Phoenix Friction is a sound decision that aligns with long-term operational efficiency and safety goals.