The global pet bottles market is experiencing robust growth, driven by rising demand for lightweight, durable, and recyclable packaging across the food & beverage, pharmaceutical, and personal care sectors. According to a 2023 report by Grand View Research, the global plastic packaging market—of which PET bottles are a dominant segment—was valued at USD 221.7 billion and is expected to expand at a compound annual growth rate (CAGR) of 3.8% from 2023 to 2030. Mordor Intelligence further projects that the PET bottles market alone will grow at a CAGR of over 5.3% during the same period, fueled by increased consumer preference for convenient, portable, and sustainable packaging solutions. With Asia-Pacific emerging as the fastest-growing region due to urbanization and expanding retail infrastructure, manufacturers are prioritizing innovation in bottle design, material efficiency, and recycling technologies. In this competitive landscape, eight key PET bottle manufacturers stand out for their technological advancements, global footprint, and sustainable practices—shaping the future of the industry.

Top 8 Pet Bottles Meaning Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

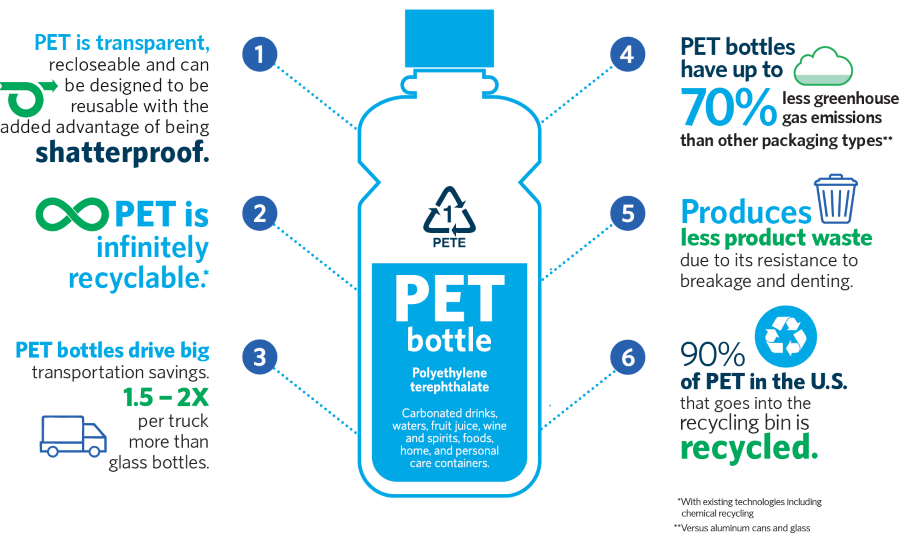

#1 Polyethylene Terephthalate (PET) Bottle

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: This article provides an overview of PET bottle-to-bottle recycling and guidance for beverage manufacturers looking to advance goals for sustainability….

#2 Recycled RPET FACTS – Bottled Water

Domain Est. 1996

Website: bottledwater.org

Key Highlights: PET plastic is used to make clear, strong, and lightweight food and beverage containers and packaging. PET is 100 percent recyclable and is the most recycled ……

#3 Material Type Description (CalRecycle Waste Characterization …

Domain Est. 1997

Website: www2.calrecycle.ca.gov

Key Highlights: A PETE container usually has a small dot left from the manufacturing process, not a seam. It does not turn white when bent. Examples include soft drink and ……

#4 Polyethylene Terephthalate – an overview

Domain Est. 1997

Website: sciencedirect.com

Key Highlights: PET bottles are commonly used for carbonated drinks. PET is very compact and can be semirigid or rigid. It is a strong gas and moisture blocker, and also a ……

#5 The story of PET Bottles

Domain Est. 1999

Website: ammeraalbeltech.com

Key Highlights: PET bottles became in demand in the 1970s when Beverage Industry leaders realised that the new kind of plastic had been approved by Food Safety authorities….

#6 PET plastic bottle recycling

Domain Est. 2006

Website: petainer.com

Key Highlights: PET is the preferred for plastic bottles (and other uses) as it’s 100% recyclable and highly sustainable. It can be recovered and recycled into new products ……

#7 What is PET Plastic?

Domain Est. 2013

Website: theplasticbottlescompany.com

Key Highlights: This plastic is generally used for packaging foods and beverages, especially carbonated soft drinks, juices and water bottles. Its raw materials are ethylene ……

#8 What is PET?

Domain Est. 2020

Website: americanbeverage.org

Key Highlights: PET (polyethylene terephthalate) is a type of clear, durable and versatile plastic. In fact, it is the most recyclable and recycled plastic ……

Expert Sourcing Insights for Pet Bottles Meaning

H2: 2026 Market Trends for PET Bottles – Analysis

The global market for polyethylene terephthalate (PET) bottles is poised for significant evolution by 2026, shaped by sustainability mandates, technological innovation, shifting consumer behavior, and regulatory frameworks. As environmental concerns intensify and circular economy models gain traction, the PET bottle industry is undergoing a transformation that balances convenience with ecological responsibility. Below are the key market trends expected to define the PET bottle landscape in 2026:

-

Increased Demand for Recycled PET (rPET)

By 2026, the use of recycled PET is projected to surge due to tightening regulations and brand commitments to sustainability. Major beverage companies are aiming for 50–100% rPET content in their bottles, driven by Extended Producer Responsibility (EPR) laws and consumer demand for eco-friendly packaging. This shift will boost the mechanical recycling infrastructure and catalyze investments in advanced recycling technologies like chemical recycling. -

Growth of Deposit Return Schemes (DRS)

Governments worldwide are expanding or implementing DRS to improve PET bottle collection and recycling rates. Regions such as Europe, North America, and parts of Asia-Pacific are expected to see higher return rates—some exceeding 90%—which will ensure a steady supply of high-quality post-consumer PET for recycling, supporting a closed-loop system. -

Lightweighting and Design for Recycling

Manufacturers are innovating to reduce material usage through lightweighting without compromising structural integrity. Simultaneously, design-for-recycling principles—such as eliminating mixed materials, using mono-materials, and adopting easily removable labels—are becoming standard practices to enhance recyclability and meet regulatory standards like the EU’s Packaging and Packaging Waste Regulation (PPWR). -

Rise of Bio-based and Plant-based PET

Bio-PET, derived from renewable resources like sugarcane ethanol, is gaining momentum as a lower-carbon alternative to fossil-based PET. While cost and scalability remain challenges, strategic partnerships between chemical companies and agribusinesses are expected to expand production capacity by 2026, particularly in regions with strong green policies. -

Technological Advancements in Recycling

Advanced recycling methods, including depolymerization and purification technologies, are expected to scale up by 2026. These innovations enable the conversion of contaminated or mixed plastic waste into food-grade rPET, overcoming limitations of traditional mechanical recycling and enabling broader reuse in sensitive applications like bottled water and beverages. -

Regulatory Pressure and Policy Harmonization

Stricter global regulations on single-use plastics, carbon emissions, and recycled content mandates are compelling manufacturers to adapt. The EU, Canada, and several U.S. states are leading with legislation requiring minimum rPET content and banning non-recyclable packaging. This regulatory pressure will drive standardization and transparency across the supply chain. -

Consumer Preference Shift Toward Sustainable Packaging

Environmental awareness is reshaping consumer behavior. By 2026, a growing segment of consumers will actively favor brands using sustainable packaging, influencing purchasing decisions. Transparency in labeling—such as disclosing rPET content and carbon footprint—will become a competitive advantage. -

Regional Market Diversification

While Europe leads in PET recycling rates and circular economy adoption, emerging markets in Asia and Africa are investing in collection and recycling infrastructure. Countries like India and Indonesia are expected to witness rapid growth in formalized PET waste management systems, supported by public-private partnerships. -

Integration of Digital Technologies

The adoption of digital watermarks, blockchain for traceability, and smart packaging solutions will enhance PET bottle lifecycle tracking. These technologies support recycling sorting efficiency and provide verifiable data on material origin and recycling history, reinforcing trust in the circular economy. -

Competition from Alternative Packaging Formats

Although PET remains dominant, it faces growing competition from refillable glass, aluminum, and paper-based bottles. However, PET’s lightweight nature, shatter resistance, and recyclability will help it retain market share, especially as the industry improves its sustainability profile.

In conclusion, the 2026 PET bottle market will be defined by a convergence of environmental responsibility, technological innovation, and regulatory compliance. Companies that proactively invest in recycling infrastructure, sustainable materials, and transparent supply chains will be best positioned to thrive in this evolving landscape.

Common Pitfalls in Sourcing PET Bottles: Quality and Intellectual Property Concerns

Sourcing PET (Polyethylene Terephthalate) bottles for packaging—especially in food, beverage, or pharmaceutical applications—requires careful attention to both quality standards and intellectual property (IP) rights. Overlooking these aspects can lead to product recalls, legal disputes, reputational damage, and supply chain disruptions. Below are key pitfalls to avoid.

Quality-Related Pitfalls

Inadequate Material Specifications

One of the most common mistakes is failing to define clear, detailed material specifications. PET bottles must meet food-grade safety standards (e.g., FDA, EU 10/2011), but suppliers may use recycled content (rPET) or off-spec resins if not properly controlled. Without strict specifications for resin type, intrinsic viscosity (IV), color, and contamination levels, you risk bottles that are weak, discolored, or leach harmful substances.

Inconsistent Manufacturing Standards

Variability in blow-molding processes, wall thickness, and sealing performance can compromise product integrity. Sourcing from manufacturers without robust quality control systems (e.g., ISO 9001 certification) increases the risk of inconsistent bottle strength, leakage, or failure under pressure (e.g., carbonated drinks).

Lack of Batch Testing and Certification

Relying solely on supplier assurances without requiring independent batch testing or Certificates of Conformance (CoC) is risky. Always verify compliance with migration tests, stress cracking resistance, and barrier properties—especially if packaging sensitive products like oils or alcohol-based beverages.

Poor Compatibility with Contents

Not all PET bottles are suitable for every product. Exposure to UV light, high temperatures, or aggressive formulations can cause degradation. Failing to test bottle compatibility with your specific product formulation may result in flavor scalping, cloudiness, or structural failure over time.

Intellectual Property (IP) Pitfalls

Unlicensed Use of Bottle Designs

Many bottle shapes, especially in premium beverage or cosmetics markets, are protected by design patents or trademarks. Sourcing generic versions that closely mimic branded designs (e.g., Coca-Cola contour bottle) can lead to infringement claims, even if the supplier claims the design is “open source.” Always verify the IP status of any bottle design.

Supplier Claims of Ownership Without Verification

Suppliers may assert they own the mold or design rights, but this isn’t always true—especially with OEM manufacturers in regions with weak IP enforcement. Using such molds without proper licensing exposes your business to legal action from the original rights holder.

Lack of IP Clauses in Contracts

Failing to include clear IP ownership terms in procurement contracts is a major oversight. Ensure agreements specify who owns custom molds, design modifications, and any new IP developed during the sourcing process. Without this, disputes over mold usage, exclusivity, or resale to competitors may arise.

Grey Market or Counterfeit Products

Some suppliers may offer “genuine” bottles at suspiciously low prices, but these could be diverted, overproduced, or counterfeit goods. This not only breaks IP agreements but also risks inconsistent quality and brand damage.

Mitigation Strategies

- Require detailed technical specifications and compliance documentation (e.g., FDA compliance letters, test reports).

- Audit suppliers’ production and quality management systems.

- Conduct third-party testing on sample batches.

- Consult legal counsel to verify design freedom-to-operate.

- Include strong IP clauses in supply agreements, ensuring exclusive rights if custom tooling is involved.

- Work with reputable, transparent suppliers and avoid those offering well-known branded designs at unusually low costs.

By proactively addressing these quality and IP pitfalls, businesses can ensure reliable supply, regulatory compliance, and protection of their brand and legal standing.

Logistics & Compliance Guide for PET Bottles

Understanding the logistics and compliance requirements for PET (Polyethylene Terephthalate) bottles is essential for manufacturers, distributors, and recyclers to ensure efficient operations and adherence to environmental and safety regulations. This guide outlines key considerations in handling, transporting, and complying with standards related to PET bottles.

What Are PET Bottles?

PET (Polyethylene Terephthalate) bottles are a type of plastic container commonly used for packaging beverages, food products, personal care items, and household chemicals. Known for their clarity, strength, lightweight nature, and recyclability, PET bottles are one of the most widely used plastic packaging solutions globally. They are identified by the resin identification code “1” within the chasing arrows recycling symbol.

Logistics Considerations for PET Bottles

Efficient logistics management is crucial to minimize costs, reduce environmental impact, and maintain product integrity throughout the supply chain.

Packaging and Palletization

- Unit Load Optimization: PET bottles should be securely packed in shrink-wrapped or stretch-wrapped pallets to prevent shifting during transit.

- Stackability: Design packaging to allow stable stacking without deformation, particularly for empty or lightweight bottles.

- Load Securing: Use corner boards, dunnage, or containment systems to protect bottles from compression damage in mixed cargo environments.

Transportation Modes

- Trucking: Most common for regional distribution; ensure temperature control if bottles contain sensitive contents.

- Rail and Sea Freight: Used for long-distance or international shipping; requires compliance with international container standards (e.g., ISO containers).

- Intermodal Compatibility: Ensure pallets and packaging are compatible with automated handling systems (e.g., forklifts, conveyors).

Cold Chain and Temperature Sensitivity

- Monitor temperature during transport if PET bottles contain perishable or heat-sensitive contents (e.g., certain beverages or pharmaceuticals).

- Avoid prolonged exposure to high temperatures, which can cause bottle deformation or pressure build-up.

Reverse Logistics and Returnable Systems

- Implement systems for collecting and reusing returnable PET bottles where applicable (e.g., milk or beer bottles in deposit schemes).

- Establish cleaning and inspection protocols for returned bottles to ensure hygiene and structural integrity.

Compliance Requirements

Adherence to regulatory standards ensures environmental responsibility, consumer safety, and market access.

Environmental Regulations

- Recycling Mandates: Comply with local and national recycling laws (e.g., EU Packaging Waste Directive, U.S. state-level bottle bills).

- Extended Producer Responsibility (EPR): Producers may be required to fund or manage recycling programs based on the volume of PET they introduce to the market.

- Post-Consumer Recycled (PCR) Content: Some jurisdictions (e.g., California, EU) mandate minimum percentages of recycled material in new PET bottles.

Food Safety and Material Compliance

- FDA (U.S.) and EFSA (EU) Standards: PET used in food and beverage packaging must meet strict safety standards for migration of substances into contents.

- Food-Grade Certification: Ensure resins and additives comply with food contact material regulations (e.g., FDA 21 CFR, EU Regulation 10/2011).

- BPA-Free and Phthalate-Free: Confirm that PET bottles do not contain harmful additives, although PET is inherently free of BPA.

Labeling and Traceability

- Resin Identification Code: Clearly mark bottles with the “1” or “PET” symbol to facilitate proper sorting and recycling.

- Country-Specific Labeling: Include required information such as volume, manufacturer details, recycling logos, and language-specific instructions.

- Digital Traceability: Implement batch tracking systems (e.g., barcodes, RFID) for quality control and recall preparedness.

International Trade and Customs

- Import/Export Documentation: Maintain accurate records of material composition, origin, and safety certifications.

- Tariff Classifications: Correctly classify PET bottles under Harmonized System (HS) codes (e.g., 3923.30 for plastic bottles).

- REACH and RoHS Compliance: Ensure compliance with chemical restrictions in the EU (REACH) and hazardous substance limits (RoHS) if applicable.

Sustainability and Corporate Responsibility

- Carbon Footprint Reporting: Measure and report emissions associated with PET bottle production and logistics.

- Plastic Tax Compliance: Pay applicable levies on plastic packaging containing less than 30% recycled content (e.g., UK Plastic Packaging Tax).

- Eco-Design Practices: Optimize bottle weight (lightweighting), reduce material use, and design for recyclability.

Conclusion

Managing the logistics and compliance of PET bottles requires a comprehensive approach that balances operational efficiency with environmental and regulatory responsibilities. By adhering to packaging best practices, transportation standards, and global compliance frameworks, businesses can ensure the safe, sustainable, and lawful distribution of PET bottle products. Regular audits, staff training, and engagement with recycling stakeholders further support long-term success in this dynamic industry.

In conclusion, sourcing PET (polyethylene terephthalate) bottles refers to the process of identifying, selecting, and procuring high-quality plastic bottles made from PET material from reliable suppliers or manufacturers. This process is crucial for industries such as beverage, food, cosmetics, and pharmaceuticals, where packaging integrity, safety, sustainability, and cost-efficiency are key priorities. Effective sourcing involves evaluating factors like material quality, production capacity, compliance with regulatory standards, environmental impact, and supply chain reliability. With the growing emphasis on recycling and circular economy, responsible sourcing of PET bottles also includes considering recycled content (rPET) and supporting sustainable packaging solutions. Ultimately, strategic sourcing ensures a consistent supply of safe, durable, and environmentally conscious packaging that meets both business and consumer needs.