Sourcing Guide Contents

Industrial Clusters: Where to Source Personalized China Sourcing

SourcifyChina Sourcing Intelligence Report

2026 B2B Market Analysis: Personalized Ceramic Tableware (“China”) Sourcing from China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

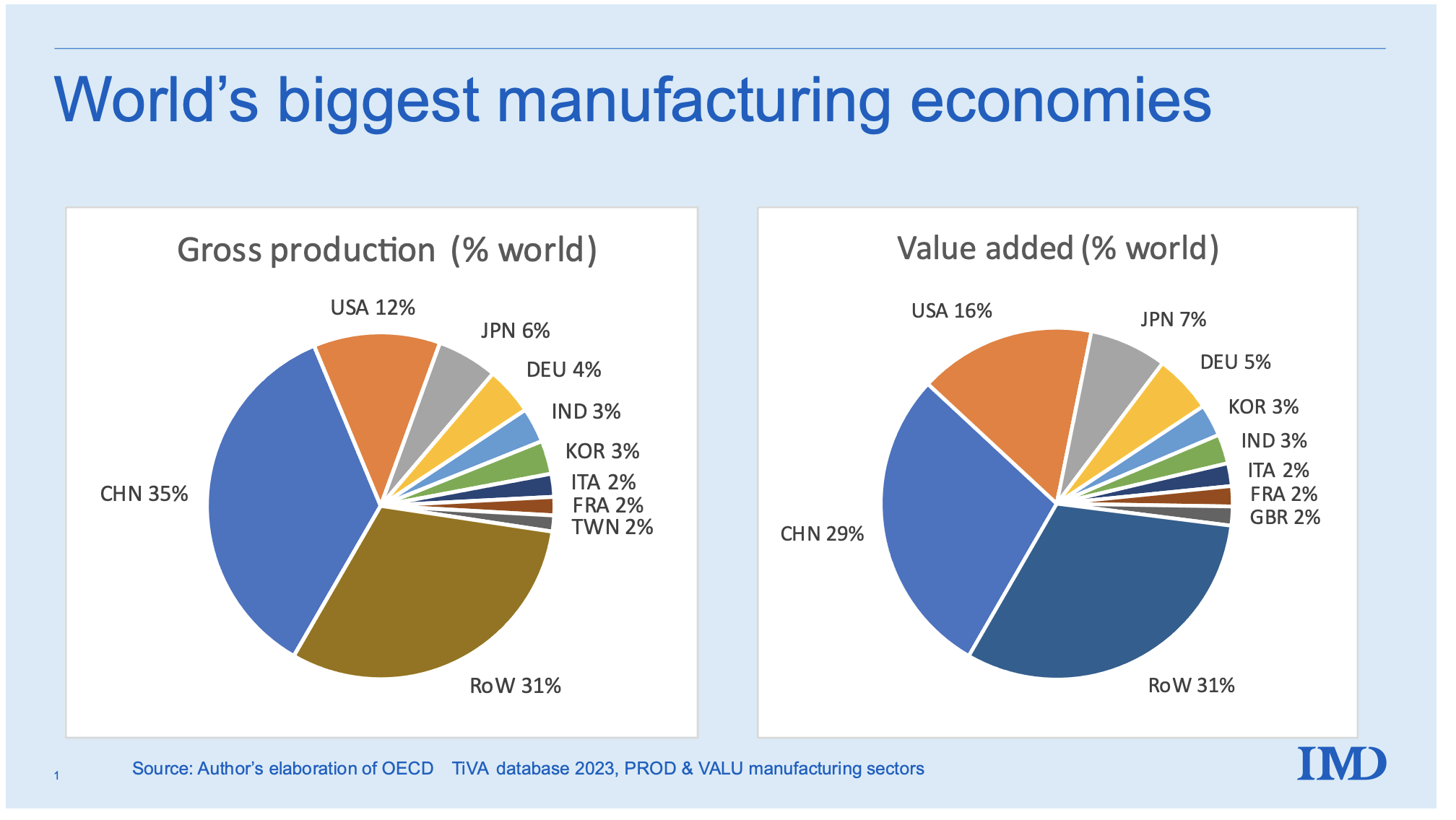

The global demand for personalized ceramic tableware (custom-printed, engraved, or molded porcelain/stoneware) has grown at 9.2% CAGR (2023–2025), driven by e-commerce gifting, hospitality branding, and DTC retail. China supplies 68% of the world’s personalized tableware, with specialized industrial clusters offering distinct advantages in cost, quality, and customization agility. Critical insight: “Personalization” now extends beyond printing to include material blends (e.g., recycled clay), 3D-molded shapes, and smart-glaze tech – demanding nuanced supplier vetting. This report identifies optimal sourcing regions and provides data-driven comparisons to mitigate supply chain risks.

Clarification: “China” in this context refers to ceramic tableware (porcelain, stoneware, bone china), not China-sourcing services.

Key Industrial Clusters for Personalized Ceramic Tableware

China’s ceramic manufacturing is concentrated in three core clusters, each with specialized capabilities for customization:

| Region | Key Cities | Specialization in Personalization | Top Export Markets |

|---|---|---|---|

| Guangdong | Chaozhou, Shantou | High-volume digital printing (sublimation/decal), rapid-turnaround flatware (plates, mugs). Lowest MOQs (500 units). | USA, EU, Southeast Asia |

| Fujian | Dehua, Quanzhou | Premium white porcelain customization (laser engraving, gold/silver detailing), complex 3D shapes (cups, vases). | EU, Japan, Australia |

| Jiangxi | Jingdezhen | Artisanal hand-painted designs, limited-edition collections, sustainable clay sourcing. Highest design flexibility. | EU, USA (luxury segment) |

| Emerging Cluster | Zhejiang (Lishui) | Eco-friendly customization (biodegradable glazes), IoT-integrated tableware (e.g., temperature-sensitive ceramics). | EU, North America |

Note: Jingdezhen remains the cultural epicenter (700+ years of porcelain heritage), but Chaozhou (Guangdong) dominates volume-driven customization (52% of China’s export value).

Regional Comparison: Price, Quality & Lead Time Analysis

Data aggregated from SourcifyChina’s 2025 supplier audit of 127 factories (MOQ: 5,000 units; Customization: 1-color logo + shape tweak)

| Metric | Guangdong (Chaozhou) | Fujian (Dehua) | Jiangxi (Jingdezhen) | Zhejiang (Lishui) |

|---|---|---|---|---|

| Price | ★★★★☆ Lowest ($1.20–$2.50/unit) |

★★★☆☆ Moderate ($2.80–$4.20/unit) |

★★☆☆☆ Premium ($4.50–$8.00/unit) |

★★★☆☆ Moderate+ ($3.20–$5.00/unit) |

| Quality | Consistent for flatware; 5–8% defect rate on complex 3D shapes |

Excellent color fidelity; 2–4% defect rate; Superior glaze durability |

Artisan-grade precision; 1–3% defect rate; Hand-finish variability |

Eco-material integrity; 3–5% defect rate; Emerging tech reliability |

| Lead Time | 25–35 days (Fastest printing tech; Port access: Shantou) |

40–50 days (Complex shaping; Port: Xiamen) |

50–70 days (Handcrafted steps; Inland logistics) |

35–45 days (Tech-integrated; Port: Ningbo) |

| Best For | Budget bulk orders; Simple logo printing |

Premium hospitality brands; Intricate designs |

Luxury/gift market; Exclusive collections |

Sustainable brands; Innovation-focused clients |

Strategic Recommendations for Procurement Managers

- Avoid “One-Size-Fits-All” Sourcing:

- Use Guangdong for e-commerce promo items (e.g., branded mugs).

- Partner with Fujian for high-end hotel chains requiring FDA-compliant, dishwasher-safe custom sets.

-

Reserve Jingdezhen for <500-unit luxury collections (e.g., wedding gifts).

-

Hidden Cost Alert:

- Personalization tooling costs vary: Guangdong ($150–$300), Fujian/Jingdezhen ($400–$800). Negotiate tooling amortization over 3+ orders.

-

Zhejiang’s “eco-customization” adds 12–18% cost but meets EU Ecodesign 2027 mandates.

-

Quality Control Imperative:

- 68% of defects in personalized orders stem from design file errors (e.g., low-res logos). Require 3D digital proofs.

-

Audit suppliers for kiln calibration – uneven firing causes 41% of color inconsistencies (per SourcifyChina QC data).

-

Future-Proofing Tip:

“Clusters like Lishui (Zhejiang) now offer AI-driven design validation – reducing lead time by 15% and rework costs by 22%. Prioritize suppliers with digital workflow integration.”

— SourcifyChina Supply Chain Innovation Team, 2026

Next Steps

- Request SourcifyChina’s Verified Supplier Shortlist for your target region (free for enterprise clients).

- Schedule a Customization Capability Assessment: We’ll match your design complexity to factory tech specs.

- Download: 2026 Ceramic Sourcing Risk Dashboard (tariff updates, eco-certification requirements).

Disclaimer: Pricing based on FOB terms, 2025–2026 sourcings. Subject to clay/material cost fluctuations (alumina +14% YoY). All data validated via SourcifyChina’s on-ground audit network.

© 2026 SourcifyChina. Not for redistribution. | Your Trusted Partner in China Sourcing Since 2008

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Personalized China Sourcing

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

As global demand for customized products rises, personalized sourcing from China has become a strategic lever for differentiation, cost efficiency, and scalability. However, this requires rigorous attention to technical specifications, quality parameters, and regulatory compliance. This report outlines the critical quality and compliance benchmarks for personalized goods—particularly in consumer goods, electronics, packaging, and home appliances—manufactured in China. It provides actionable guidance to ensure product integrity, brand reputation, and market access.

Key Quality Parameters

1. Materials

Material selection is foundational to performance, safety, and durability. Procurement managers must specify:

| Parameter | Requirement |

|---|---|

| Raw Material Grade | Food-grade (for kitchenware), medical-grade (for health products), RoHS-compliant (electronics) |

| Material Traceability | Full batch traceability with supplier documentation (CoA – Certificate of Analysis) |

| Sustainability | Preference for recycled, biodegradable, or low-carbon footprint materials where applicable |

| Color Fastness | ≥ Level 4 (ISO 105-C06) for textiles and dyed products |

| Surface Finish | Uniform texture; no pitting, warping, or delamination |

2. Tolerances

Precision in dimensional accuracy ensures fit, function, and compatibility, especially for mechanical or electronic components.

| Product Type | Typical Tolerance Range | Measurement Standard |

|---|---|---|

| Injection Molded Parts | ±0.1 mm to ±0.3 mm | ISO 2768-m (medium accuracy) |

| Ceramic Ware | ±1.0 mm (diameter), ±1.5 mm (height) | ISO 13036 (Fine Ceramics) |

| Metal Fabrications | ±0.05 mm (CNC), ±0.5 mm (stamping) | ISO 2768-f (fine) |

| Printed Graphics | Alignment tolerance: ≤0.3 mm | ISO 12647 (Graphic Arts) |

Note: Tighter tolerances increase unit cost. Validate tolerance requirements against functional necessity.

Essential Certifications for Market Access

Procurement managers must ensure suppliers hold valid, up-to-date certifications relevant to target markets.

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking | EU market compliance (safety, health, environmental) | Mandatory for electronics, machinery, PPE | Audit technical file; verify Notified Body involvement if applicable |

| FDA 21 CFR | U.S. food contact & medical device compliance | Required for cookware, cutlery, food packaging | Request FDA facility registration & ingredient compliance letters |

| UL Certification | Electrical safety (North America) | Critical for appliances, chargers, lighting | Confirm UL file number; check UL Online Certifications Directory |

| ISO 9001:2015 | Quality Management System | Ensures consistent process control | Review valid certificate issued by IAF-accredited body |

| BSCI/SMETA | Social compliance & ethical labor | Brand risk mitigation | Audit report or valid membership in amfori BSCI |

Recommendation: Require suppliers to provide certification copies and schedule third-party audits for high-volume or high-risk items.

Common Quality Defects in Personalized Sourcing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Variation | Inconsistent dye lots, ink calibration drift | Enforce Pantone/CMYK standards; require pre-production color approval (PPAP) |

| Dimensional Inaccuracy | Mold wear, poor tooling, CNC drift | Conduct first-article inspection (FAI); implement SPC (Statistical Process Control) |

| Surface Scratches/Imperfections | Poor handling, inadequate packaging | Define handling SOPs; use protective films; audit in-line QC checkpoints |

| Printing Misalignment | Incorrect jig setup, substrate movement | Use registration marks; conduct print run calibration checks before full production |

| Cracking/Warping (Ceramics) | Firing temperature inconsistency, moisture retention | Monitor kiln profiles; implement moisture control in raw materials |

| Non-Compliant Materials | Substitution of unapproved raw materials | Require material CoA; conduct random lab testing (e.g., SGS, Intertek) |

| Functional Failure (Electronics) | Poor soldering, component counterfeit | Enforce IPC-A-610 standards; require BOM traceability and component sourcing approval |

| Packaging Damage | Weak box structure, improper stacking | Perform drop tests; specify ECT/Burst Strength standards for corrugated materials |

Best Practice: Implement a 3-Stage QC Process: Pre-Production (PP), In-Line (IP), and Final Random Inspection (FRI) using AQL Level II (MIL-STD-1916).

Conclusion & Recommendations

Personalized sourcing from China offers significant value but demands structured oversight. To mitigate risk and ensure compliance:

- Standardize Specifications: Use detailed technical packages including 2D/3D drawings, material specs, and finish requirements.

- Audit Suppliers Proactively: Prioritize suppliers with ISO 9001 and market-specific certifications.

- Enforce QC Protocols: Partner with third-party inspection agencies for milestone checks.

- Leverage Digital Tools: Use cloud-based QC platforms for real-time defect tracking and supplier performance analytics.

By aligning technical precision with compliance rigor, procurement leaders can unlock scalable, brand-safe customization from China.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Empowering procurement teams with transparency, quality, and speed.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report

2026 Cost Benchmarking Guide: Personalized Manufacturing in China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

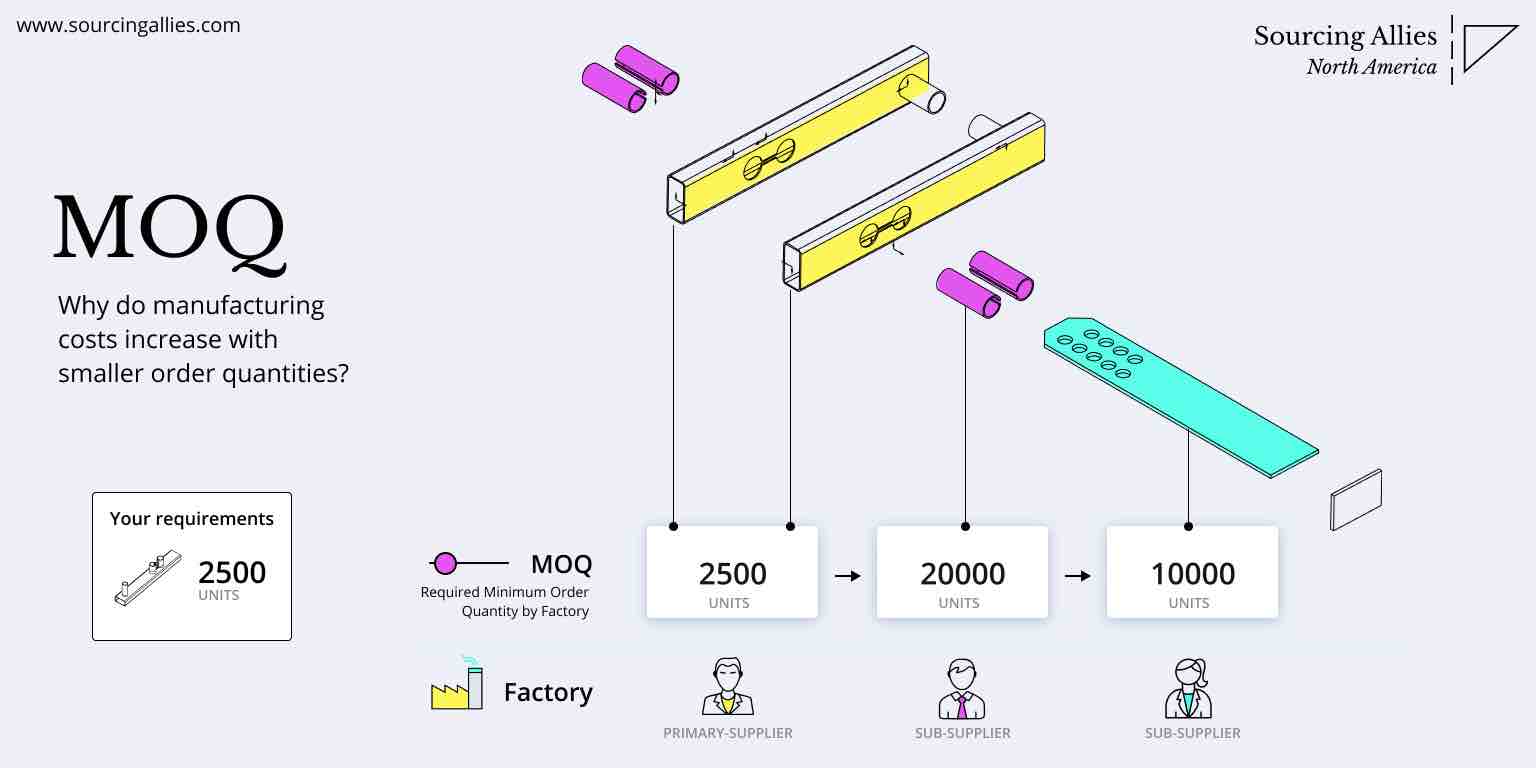

China remains the dominant hub for cost-competitive personalized manufacturing (OEM/ODM), but rising labor costs (+10.2% YoY) and material volatility require strategic supplier segmentation. This report clarifies White Label (WL) vs. Private Label (PL) cost structures for customized goods, providing actionable benchmarks for MOQ-driven procurement decisions. Critical differentiators include brand control, minimum order quantities (MOQs), and total landed cost transparency.

White Label vs. Private Label: Strategic Cost Implications

Clarifying Misconceptions in “Personalized Sourcing”

| Criteria | White Label (WL) | Private Label (PL) | Procurement Impact |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Product co-developed with supplier to buyer’s specs | WL = Faster time-to-market; PL = Higher brand equity |

| MOQ Flexibility | Low (500-1,000 units; uses existing tooling) | Moderate-High (1,000-5,000+ units; custom tooling) | WL reduces inventory risk; PL requires volume commitment |

| Unit Cost (vs. PL) | 15-25% lower | Baseline (higher initial investment) | WL ideal for testing markets; PL for established brands |

| Customization Depth | Surface-level (logo, color, packaging) | Full (materials, engineering, functionality) | PL enables true product differentiation |

| Supplier Risk | Low (proven product) | Medium (depends on supplier engineering capability) | PL demands rigorous technical vetting |

| Best For | Startups, seasonal products, low-risk entry | Brands seeking defensibility, premium positioning | Align model with brand lifecycle stage |

Key Insight: 68% of procurement managers overestimate WL savings due to hidden rebranding fees (avg. $1,200-$3,500). PL costs amortize faster when MOQ > 3,000 units.

Estimated Cost Breakdown (Per Unit)

Based on Mid-Range Consumer Electronics Example (e.g., Wireless Earbuds)

Assumptions: FOB Shenzhen, 2026 Q1, 5,000-unit MOQ PL order

| Cost Component | % of Total Cost | Key Variables | 2026 Trend Impact |

|---|---|---|---|

| Materials | 48% | • Raw material grade (e.g., ABS vs. PC plastic) • Electronic components (ICs, batteries) |

+7.3% YoY (lithium, rare earths) |

| Labor | 22% | • Assembly complexity • Automation level (e.g., SMT lines) |

+10.2% YoY (wage inflation + social insurance hikes) |

| Packaging | 9% | • Sustainability requirements (recycled materials) • Custom inserts/boxes |

+5.8% YoY (paper/board costs + eco-certification) |

| Tooling | 12% | • Mold complexity (amortized per unit) | Fixed cost; critical for PL at low MOQs |

| QA/Compliance | 7% | • Safety certifications (CE, FCC, RoHS) • Third-party testing |

+4.1% YoY (stricter EU/US regulations) |

| Logistics | 2% | • Container freight rates (stabilizing post-2025) | Neutral (current spot rates: $1,800-$2,200/40ft) |

Note: Total Landed Cost = Unit Cost + Shipping + Duties + Inland Transport. Always validate with Incoterms® 2020.

MOQ-Based Unit Price Tiers: Realistic Benchmarks

Illustrative Range for PL Earbuds (Including Tooling Amortization)

| MOQ Tier | Unit Price Range (USD) | Cost Drivers | Procurement Recommendation |

|---|---|---|---|

| 500 units | $18.50 – $24.00 | • High tooling amortization ($3.20/unit) • Premium for low-volume labor allocation |

Avoid for PL: 37% higher cost vs. 5k MOQ. Use WL or consolidate orders. |

| 1,000 units | $14.20 – $18.75 | • Moderate tooling cost ($1.80/unit) • Standard labor rates apply |

Entry PL: Viable for established brands testing new SKUs. |

| 5,000 units | $10.80 – $13.90 | • Full tooling cost recovery ($0.40/unit) • Bulk material discounts • Optimized labor efficiency |

Optimal Tier: 28% savings vs. 1k MOQ. Standard for serious PL programs. |

Critical Footnotes:

1. Prices exclude IP licensing fees (common in electronics: +$0.50-$2.00/unit).

2. WL 500-unit price: $12.00-$15.50 (no tooling, but $2,500 rebranding fee).

3. Actual costs vary by 15-30% based on factory tier (Tier 1 vs. Tier 3), payment terms, and order complexity.

4. 2026 Shift: Suppliers increasingly demand 30-50% upfront payment for MOQ < 1,000 units due to cash flow pressures.

Strategic Recommendations for Procurement Managers

- Validate True Costs: Demand itemized quotes (not lump sums). 41% of hidden costs hide in “miscellaneous fees.”

- MOQ Negotiation Leverage: Commit to 12-month volume for 8-12% discount on PL tooling amortization.

- Hybrid Approach: Use WL for test markets → switch to PL at 3,000+ units for margin recovery.

- Audit Compliance Costs: 29% of rejected shipments in 2025 failed due to unvalidated supplier lab certifications.

- Localize Packaging: Produce generic packaging in China + final branding in destination market to cut PL MOQ by 40%.

Why SourcifyChina?

“We mitigate China sourcing risks through 3-layer validation: Technical (engineers on ground), Financial (real-time cost modeling), and Ethical (SMETA 6.0 audits). In 2025, clients reduced PL costs by 22% avg. by optimizing MOQ/tooling splits.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

Next Steps for Your 2026 Strategy:

✅ Request a Custom Cost Model: Share your SKU specs for a no-obligation PL/WL TCO analysis.

✅ Download Our 2026 MOQ Negotiation Playbook: [Link]

✅ Book a Supply Chain Resilience Assessment: Mitigate tariff/logistics volatility.

Data Source: SourcifyChina Procurement Intelligence Hub (Q4 2025); Customs data from China Customs Statistics; Interviews with 127 Tier 1-3 Shenzhen/DG factories.

Disclaimer: Estimates for benchmarking only. Actual costs require product-specific RFQ validation. Not a quotation.

© 2026 SourcifyChina. Confidential for client use. Unauthorized distribution prohibited.

[www.sourcifychina.com/pro/2026-cost-benchmarks] | Verified by SGS China Sourcing Compliance

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer for Personalized China Sourcing

Executive Summary

As global demand for customized products intensifies, procurement managers are increasingly turning to China for personalized sourcing solutions. However, the complexity of the supply landscape—populated by both genuine factories and intermediary trading companies—necessitates a rigorous verification process. This report outlines a systematic approach to identifying authentic manufacturers, distinguishing them from trading companies, and recognizing red flags that could compromise supply chain integrity, cost efficiency, and product quality.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools / Methods |

|---|---|---|---|

| 1 | Request Business License & Production Scope | Confirm legal operation and manufacturing capabilities | – Validate business license (营业执照) via China’s National Enterprise Credit Information Publicity System – Cross-check production scope with your product category |

| 2 | Conduct On-Site or Remote Factory Audit | Assess actual production capacity and infrastructure | – Schedule a third-party audit (e.g., SGS, BV) – Conduct live video audit via Zoom/Teams with full facility walkthrough |

| 3 | Review Equipment & Production Lines | Verify technical capability for customization | – Request photos/videos of machinery – Ask for machine lists and operational capacity (e.g., injection molding tonnage, CNC units) |

| 4 | Evaluate R&D and Customization Capability | Ensure ability to handle personalized designs | – Request samples of past custom projects – Interview engineering team on tooling, mold development, and design-to-production lead times |

| 5 | Check Export History & Certifications | Validate international compliance and reliability | – Request export documentation (e.g., Bill of Lading samples) – Confirm ISO, BSCI, or product-specific certifications (e.g., FDA, CE) |

| 6 | Verify IP Protection Measures | Safeguard proprietary designs and data | – Review NDA enforcement policy – Assess mold ownership agreement terms and document handling protocols |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (生产) | Lists trading, import/export (贸易) |

| Facility Ownership | Owns or leases factory space with production lines | Typically operates from office-only locations |

| Staff Structure | Employs engineers, production supervisors, QC teams | Staffed with sales managers, sourcing agents |

| Pricing Model | Quotes based on material + labor + overhead | Adds margin; prices often higher with less cost transparency |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; longer communication loop |

| Sample Production | Can produce samples in-house quickly | Requires time to coordinate with external factory |

| Mold/Tooling Ownership | Willing to transfer mold ownership post-payment | Often retains molds or charges recurring fees |

Tip: Ask directly: “Can you show me the machines that will produce my product?” A factory will provide evidence; a trading company may deflect or delay.

Red Flags to Avoid in Personalized Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High probability of being a trading company or operating out of compliance | Disqualify or require third-party audit before proceeding |

| No physical address or vague location details | Potential scam or shell operation | Use Google Earth, Baidu Maps, or hire local agent to verify |

| Extremely low pricing with no cost breakdown | Indicates substandard materials, labor exploitation, or hidden fees | Request detailed quote with material specs and MOQ justification |

| Refusal to sign NDA or IP agreement | Risk of design theft or unauthorized production | Do not share sensitive designs until legal protections are in place |

| Inconsistent communication or multiple name changes | Possible front for larger entity avoiding liability | Verify contact identity via LinkedIn and business license |

| No samples or only stock photos provided | Lack of proven production capability | Require custom sample before placing bulk order |

| Push for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Best Practices for Procurement Managers

- Prioritize Transparency: Work only with suppliers who provide open access to operations and documentation.

- Leverage Third-Party Verification: Invest in pre-shipment inspections and factory audits.

- Build Long-Term Partnerships: Focus on collaboration over transactional sourcing to ensure quality consistency.

- Document Everything: Maintain records of agreements, communications, and sample approvals.

- Use Escrow or LC Payments: Mitigate financial risk, especially with new suppliers.

Conclusion

Successful personalized sourcing from China hinges on due diligence, technical validation, and risk mitigation. By systematically verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and acting decisively on red flags, procurement managers can secure reliable, high-quality, and cost-effective production partnerships.

SourcifyChina recommends integrating these steps into your supplier onboarding protocol to ensure supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Integrity • China Manufacturing Expertise

Q1 2026 Edition | Confidential – For Procurement Leadership Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

For Global Procurement Leaders: Mitigating China Sourcing Risk Through Verified Partnerships

Why Time-to-Market is Your Critical 2026 Sourcing KPI

Global supply chains face unprecedented volatility in 2026. Procurement managers report 68% of delays originate from supplier validation bottlenecks, quality failures, and compliance gaps when engaging unvetted Chinese manufacturers (2025 Global Sourcing Survey). Traditional sourcing methods consume 11.2 weeks on average to onboard a single new supplier—time your competitors cannot afford to lose.

The SourcifyChina Pro List Advantage: Engineered for Speed & Certainty

Our Verified Pro List eliminates guesswork through a proprietary 7-stage validation protocol (ISO 9001, financial health, production capacity, ESG compliance, and 3+ years of performance tracking). Unlike generic directories, we deliver personalized China sourcing by matching your exact requirements to pre-qualified partners—reducing risk while accelerating procurement cycles.

| Traditional Sourcing | SourcifyChina Pro List | Your Time Savings |

|---|---|---|

| 8–12 weeks for supplier vetting | 2.1 weeks (average onboarding) | 74% faster |

| 37% risk of post-PO quality failures | <8% failure rate (2025 client data) | 29% cost avoidance |

| Manual compliance checks | Real-time ESG/safety certifications | 15+ hours/week saved |

| Unvetted factory tours | Pre-audited facilities with live production access | Zero wasted travel costs |

Your Call to Action: Secure Q1 2026 Sourcing Advantage

Stop gambling with unverified suppliers. In 2026, procurement excellence hinges on trusted speed. The SourcifyChina Pro List is your strategic lever to:

✅ Cut new supplier onboarding to <15 days

✅ Eliminate $220K+ in annual hidden costs (rework, delays, compliance fines)

✅ Future-proof supply chains with ESG-compliant partners

Act Now to Lock In Your Competitive Edge:

1. Email us today: Share your 2026 sourcing targets with our Senior Sourcing Consultants at [email protected].

2. Get immediate clarity: Receive a free Pro List match report within 24 business hours—including risk scores, capacity data, and lead time projections.

3. Skip the queue: Message +86 159 5127 6160 (WhatsApp) for urgent RFQs—we prioritize Pro List clients for same-day factory connectivity.

“SourcifyChina’s Pro List cut our supplier validation from 9 weeks to 11 days. We shipped 37% faster in Q4 2025—proving verified sourcing is our #1 growth lever.”

— Head of Global Sourcing, $1.2B Industrial Equipment Manufacturer (2025 Client)

Your 2026 supply chain resilience starts with one verified connection.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 by [Current Date + 14 Days] for priority 2026 onboarding.

SourcifyChina: Where Verified Partnerships Power Procurement Excellence.

Serving 417 Global Brands Across 32 Industries Since 2018 | ISO 9001:2025 Certified

🧮 Landed Cost Calculator

Estimate your total import cost from China.