The global peptide synthesis and research reagents market has experienced robust growth, driven by increasing demand in pharmaceutical development, personalized medicine, and biomedical research. According to Grand View Research, the global peptide therapeutics market size was valued at USD 49.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. This growth is fueled by rising investment in peptide-based drug discovery, technological advancements in solid-phase synthesis, and expanding applications in oncology, metabolic diseases, and immunology. As research institutions and biotech firms seek high-purity, reliable peptide suppliers, the need for vetted manufacturing partners has become critical. In this landscape, nine key manufacturers have emerged as leaders, combining scalability, stringent quality control, and innovation to support cutting-edge scientific inquiry.

Top 9 Peptide Research Supply Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aapptec Peptides

Domain Est. 1994

Website: peptide.com

Key Highlights: Welcome to AAPPTec! We have over 35 years of experience in supplying products worldwide for peptide research and industrial-scale production….

#2 Bachem

Domain Est. 1996

Website: bachem.com

Key Highlights: PEPTIDES. & OLIGOS. Bachem is a leading, innovation-driven company specializing in the development and manufacture of peptides and oligonucleotides….

#3 Phoenix Pharmaceuticals, Inc.

Domain Est. 1997

Website: phoenixpeptide.com

Key Highlights: As a leading peptide manufacturing company, we specialize in producing a wide range of synthetic peptides, including biologically active peptides, peptide ……

#4 BCNpeptides

Domain Est. 2004

Website: bcnpeptides.com

Key Highlights: Generic peptides. Commercial supply of fully GMP API for global markets ; New Chemical Entities. Custom synthesis of NCEs for preclinical, clinical & commercial….

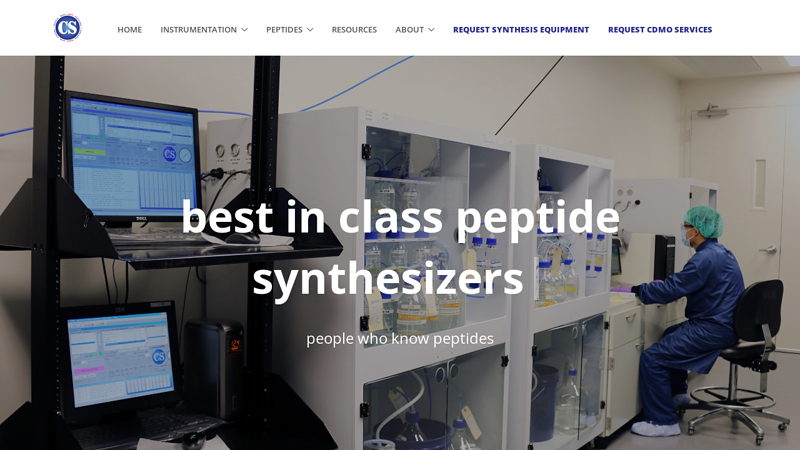

#5 CSBio

Domain Est. 1996

Website: csbio.com

Key Highlights: CSBio is a leading peptide and instrumentation manufacturing company located in Silicon Valley, California. CSBio provides nonGMP and cGMP peptides….

#6 PolyPeptide

Domain Est. 1997

Website: polypeptide.com

Key Highlights: PolyPeptide Labs is a world leader in the manufacture of polypeptide, custom peptide Synthesis, peptide synthesis and generic peptide : generic GMP peptide ……

#7 Catalog Peptide

Domain Est. 2001

Website: genscript.com

Key Highlights: Overview. With more than 20 years of experience in peptide synthesis, GenScript has provided peptides to more than 10,000 customers worldwide….

#8 AmbioPharm

Domain Est. 2007

Website: ambiopharm.com

Key Highlights: AmbioPharm produces peptide products to cGMP standards and provides process development and analytical services for non-GMP peptides….

#9 Peptide Research Supply

Domain Est. 2024

Website: peptideresearchsupply.com

Key Highlights: Our products boast an impressive 99% purity level, verified through rigorous third-party testing. FREE SHIPPING On all orders over $125….

Expert Sourcing Insights for Peptide Research Supply

H2: Projected 2026 Market Trends for Peptide Research Supply

As the global biopharmaceutical and life sciences sectors continue to evolve, the peptide research supply market is poised for significant transformation by 2026. Driven by advancements in synthetic biology, rising demand for targeted therapeutics, and increased investment in personalized medicine, several key trends are expected to shape the industry landscape.

-

Growing Demand for Custom Peptide Synthesis

By 2026, demand for custom and modified peptides is expected to surge, particularly in oncology, metabolic disorders, and immunotherapy research. Academic institutions, biotech startups, and pharmaceutical companies will increasingly rely on specialized peptide suppliers to develop novel peptide-based drug candidates, fueling growth in the research supply segment. -

Expansion of Peptide Therapeutics Pipeline

With over 80 peptide-based drugs currently in clinical trials and more entering development, the research supply chain will experience heightened demand for high-purity peptides, conjugated peptides (e.g., peptide-drug conjugates), and stable isotope-labeled peptides. This trend will drive innovation in synthesis technologies such as solid-phase peptide synthesis (SPPS) and recombinant methods. -

Technological Advancements in Synthesis and Purification

Automation, AI-driven sequence design, and machine learning tools are expected to streamline peptide synthesis and quality control by 2026. Suppliers investing in high-throughput platforms and advanced analytical techniques (e.g., LC-MS, HPLC) will gain a competitive edge by offering faster turnaround times and higher batch consistency. -

Increased Focus on Sustainability and Green Chemistry

Environmental concerns will prompt peptide suppliers to adopt greener manufacturing practices. By 2026, expect wider use of solvent recovery systems, bio-based reagents, and energy-efficient synthesis methods to meet regulatory and corporate sustainability goals—particularly in Europe and North America. -

Geographic Market Shifts and Supply Chain Resilience

Asia-Pacific, especially China and India, will continue to expand as key manufacturing hubs for peptide intermediates due to cost advantages and improving regulatory standards. However, geopolitical tensions and pandemic-era disruptions will push companies to diversify supply chains, increasing nearshoring and regional sourcing in North America and Western Europe. -

Regulatory and Quality Standardization

As peptide therapeutics move closer to commercialization, research suppliers will face stricter regulatory expectations. Compliance with Good Manufacturing Practices (GMP) and alignment with ICH guidelines will become increasingly important, even at the research stage, to support seamless transition into clinical development. -

Rise of Peptide Libraries and High-Throughput Screening

Drug discovery programs will rely heavily on large, diverse peptide libraries for target validation and lead optimization. Suppliers offering pre-built, off-the-shelf peptide libraries—especially for targets like GPCRs, ion channels, and immune checkpoints—will see growing market opportunities.

In summary, by 2026, the peptide research supply market will be characterized by innovation, scalability, and regulatory rigor. Companies that invest in advanced synthesis platforms, global compliance, and sustainable practices will be best positioned to meet the evolving needs of the research and drug development communities.

Common Pitfalls in Sourcing Peptide Research Supplies: Quality and Intellectual Property Concerns

Sourcing peptides for research purposes requires careful evaluation to ensure both the reliability of the supply chain and compliance with intellectual property (IP) standards. Researchers and institutions often encounter significant challenges in these two critical areas—quality assurance and IP integrity. Below are the most common pitfalls associated with each.

Quality-Related Pitfalls

1. Inadequate Purity and Characterization Data

A major issue when sourcing peptides is receiving products with inaccurate or incomplete purity data. Some suppliers may provide misleading HPLC or mass spectrometry results, or fail to test for critical impurities such as truncation sequences, deletion peptides, or residual solvents. Without verified analytical data, the reproducibility and validity of research outcomes can be compromised.

2. Contamination and Poor Handling Practices

Peptides are sensitive to degradation due to improper storage, handling, or manufacturing processes. Sourcing from facilities without Good Manufacturing Practice (GMP) or current GMP (cGMP) compliance increases the risk of microbial contamination, oxidation, or aggregation. This is especially problematic in long-term studies or in vivo applications.

3. Batch-to-Batch Variability

Inconsistent synthesis and purification processes can result in significant differences between peptide batches. This variability undermines experimental consistency and may lead to conflicting results, particularly in dose-response studies or comparative analyses.

4. Mislabeling and Incorrect Sequences

Errors in peptide sequence synthesis or labeling are not uncommon, particularly with custom peptides. A single amino acid substitution or incorrect modification (e.g., acetylation, amidation) can drastically alter biological activity, leading to flawed conclusions.

5. Lack of Certificates of Analysis (CoA)

Reputable suppliers provide a Certificate of Analysis with each batch, detailing purity, molecular weight confirmation, and other quality metrics. Relying on vendors who do not supply CoAs increases the risk of using substandard or unverified materials.

Intellectual Property-Related Pitfalls

1. Sourcing from IP-Infringing Suppliers

Some peptide suppliers produce sequences that are protected by patents, especially those derived from published therapeutic candidates. Using such peptides without proper licensing may expose researchers or institutions to legal risks, particularly if the work leads to commercial development.

2. Unclear IP Ownership in Custom Synthesis

When commissioning custom peptides, researchers must clarify IP ownership in the service agreement. Some contract manufacturers may claim partial rights to novel sequences or modifications, potentially complicating future patent applications or commercialization efforts.

3. Use of Proprietary Sequences Without Authorization

Academic and industry researchers sometimes replicate peptide sequences described in patented literature for “research use only.” However, depending on jurisdiction and intended use, even non-commercial research may violate IP rights if the peptides are under active composition-of-matter or method-of-use patents.

4. Export and Regulatory Compliance Issues

Peptides, especially those with potential therapeutic applications, may be subject to export controls or require regulatory documentation. Sourcing from international suppliers without verifying compliance can lead to shipment delays, confiscation, or legal consequences—particularly if the peptide is classified as a controlled substance or dual-use material.

5. Inadequate Documentation for Due Diligence

Failing to maintain records of peptide sourcing, supplier credentials, and sequence origins can hinder IP due diligence during grant applications, publication reviews, or technology transfer processes. Proper documentation is essential to demonstrate responsible research conduct and freedom to operate.

Conclusion

To mitigate these risks, researchers should source peptides from reputable, transparent suppliers that provide full analytical data and operate under recognized quality standards. Additionally, conducting IP landscape reviews and consulting legal experts when working with novel or patented sequences can prevent future legal and ethical complications. Due diligence in both quality and IP aspects ensures the integrity, reproducibility, and compliance of peptide-based research.

Logistics & Compliance Guide for Peptide Research Supply

This guide outlines essential logistics and compliance considerations for the lawful and ethical procurement, handling, storage, and distribution of peptides for research purposes only. Adherence to these principles ensures regulatory compliance, maintains research integrity, and promotes safety.

Regulatory Classification and Legal Status

Peptides intended for research use only (RUO) are not approved for human or veterinary use and must be clearly labeled as such. In most jurisdictions, including the United States (regulated by the FDA) and the European Union (regulated by EMA), peptides sold without approval for therapeutic use cannot be marketed or sold for human consumption. Suppliers must comply with controlled substance regulations if applicable (e.g., certain peptide sequences may fall under analog acts) and must avoid making health claims or implying medical use.

Supplier Qualification and Due Diligence

Prior to procurement, research institutions must vet peptide suppliers thoroughly. Valid suppliers should provide certificates of analysis (CoA), detailed product specifications (purity, sequence, molecular weight), and clear RUO labeling. Suppliers must operate under Good Manufacturing Practices (GMP) or current Good Laboratory Practices (cGLP) as appropriate for research materials. Documentation verifying the supplier’s legal standing and compliance history should be retained.

Import and Export Compliance

International shipments of research peptides are subject to customs regulations, import permits, and dual-use controls. Exporters must classify peptides using the appropriate Harmonized System (HS) code and comply with export administration regulations (e.g., U.S. Department of Commerce, Bureau of Industry and Security). Importing agencies may require documentation such as material safety data sheets (MSDS/SDS), end-use certificates, and declarations confirming non-human use. Biological material transport regulations (e.g., IATA Dangerous Goods Regulations) may apply depending on packaging and destination.

Shipping and Handling Requirements

Peptides must be shipped under appropriate conditions to maintain stability. Lyophilized peptides are typically shipped at ambient temperature with desiccants, while liquid formulations may require cold chain logistics (2–8°C or -20°C). Use of validated packaging, temperature monitoring devices, and tamper-evident seals is recommended. Carriers must be compliant with applicable transportation regulations, including those for hazardous materials if applicable. Delivery documentation should confirm chain of custody.

Storage and Inventory Management

Upon receipt, peptides must be stored according to manufacturer specifications—typically at -20°C or lower for long-term stability. Storage areas should be secure, access-controlled, and monitored for temperature. Inventory systems must track lot numbers, expiration dates, and usage logs to ensure traceability and prevent use of degraded materials. Regular audits should verify compliance with storage protocols.

Recordkeeping and Documentation

Maintain comprehensive records for all peptide transactions, including purchase orders, CoAs, shipping manifests, storage logs, and disposal records. Documentation must support the RUO status of materials and demonstrate compliance with institutional, local, and national regulations. Records should be retained for a minimum of five years or as required by institutional policy.

Disposal and Waste Management

Expired or unused research peptides must be disposed of in accordance with local environmental and hazardous waste regulations. Incineration or chemical deactivation by licensed waste disposal services is typically required. Never dispose of peptides via sink or standard trash. Maintain disposal logs with dates, quantities, and methods used.

Institutional Oversight and Training

Principal investigators and laboratory managers are responsible for ensuring compliance with all aspects of peptide handling. Personnel involved in procurement, storage, or use of research peptides must receive training on regulatory requirements, safety protocols, and institutional policies. Regular compliance reviews and internal audits help maintain standards and identify areas for improvement.

Prohibited Uses and Ethical Considerations

Under no circumstances should research peptides be used in humans, animals, or clinical applications without appropriate regulatory approvals (e.g., IND, clinical trial authorization). Suppliers and researchers must avoid any activity that could facilitate misuse, including distribution to unverified entities or participation in underground markets. Ethical research conduct requires transparency, accountability, and strict adherence to legal frameworks.

By following this guide, research organizations can ensure responsible peptide supply chain management, maintain regulatory compliance, and uphold the integrity of scientific inquiry.

In conclusion, sourcing peptides for research requires careful consideration of several critical factors to ensure quality, reliability, and regulatory compliance. Researchers must prioritize suppliers that demonstrate a strong commitment to purity, rigorous quality control, transparent documentation (such as Certificates of Analysis), and adherence to ethical and legal standards. Evaluating vendor reputation, customer support, and consistency in peptide synthesis and delivery is essential for maintaining the integrity of scientific studies. Additionally, understanding the specific needs of the research—such as peptide sequence, modification, quantity, and end-use—guides informed decision-making. By partnering with reputable and experienced peptide suppliers, researchers can obtain high-quality materials that support accurate, reproducible, and impactful scientific outcomes.