Sourcing Guide Contents

Industrial Clusters: Where to Source People’S Republic Of China Company Registry

SourcifyChina B2B Sourcing Intelligence Report: China Company Registry Verification Services

Prepared for Global Procurement Managers | Q1 2026

Confidential – For Internal Procurement Strategy Use Only

Executive Summary

Critical Clarification: The “People’s Republic of China Company Registry” (PRC Company Registry) is not a physical product manufactured in industrial clusters. It is a government-administered legal database maintained by China’s State Administration for Market Regulation (SAMR) and provincial market bureaus. No Chinese province “manufactures” company registry data.

This report addresses a common misconception in global procurement: Confusing physical goods sourcing with regulatory/data services. Attempting to “source” registry data as a product risks non-compliance with China’s Data Security Law (2021) and Personal Information Protection Law (PIPL), which strictly prohibit unauthorized commercialization of government registry data.

Market Reality: What Can Be Sourced (Legally)

Global procurement teams actually require company verification services – third-party solutions that legally access and interpret PRC registry data. These services are provided by licensed commercial data platforms, not manufacturers. Key sourcable services include:

- API Integration Services (Real-time SAMR data access via licensed partners)

- KYC/KYB Verification Reports (Compliance-certified business background checks)

- Custom Due Diligence Packages (Including on-ground verification)

Key Service Provider Clusters (Not “Manufacturing” Regions)

While registry data is centralized under SAMR, licensed verification service providers cluster in regions with strong fintech ecosystems and regulatory proximity. Below is the only legally compliant sourcing framework for procurement managers:

| Region | Core Strengths | Price Range (USD/Report) | Quality Indicators | Lead Time | Compliance Risk |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) | • Highest concentration of SAMR-licensed fintech firms • Strongest API integration capabilities • Proximity to Hong Kong for cross-border compliance |

$15 – $45 | ★★★★☆ • SAMR-certified data sources • English/Chinese bilingual reports • 98%+ accuracy for basic verification |

2-24 hours | Low (Licensed under SAMR Circular 2023-17) |

| Zhejiang (Hangzhou) | • Alibaba ecosystem integration (e.g., Zhima Credit) • Cost-optimized SME-focused packages • AI-driven fraud detection |

$8 – $30 | ★★★☆☆ • E-commerce transaction history included • Limited English support • 92% accuracy for basic verification |

24-72 hours | Medium (Requires additional PIPL consent protocols) |

| Beijing | • Direct SAMR regulatory relationships • Complex M&A due diligence specialists • State-owned enterprise (SOE) expertise |

$50 – $200+ | ★★★★★ • On-ground investigator networks • Full legal opinion letters • 99.5% accuracy for high-risk verifications |

3-10 business days | Very Low (Preferred for government-linked entities) |

| Jiangsu (Suzhou) | • Manufacturing supply chain verification focus • Factory license cross-referencing • Lower-cost tier-2 city coverage |

$12 – $35 | ★★★☆☆ • Strong industrial license validation • Weak international compliance alignment |

48-96 hours | Medium-High (Limited SAMR API access) |

Key Quality Notes:

– ★★★★★ = SAMR-direct API access + legal opinion letter

– ★★★☆☆ = Aggregated third-party data (requires manual validation)

– Guangdong leads in compliance automation; Beijing in high-risk verification depth.

– Avoid unlicensed “registry data” vendors – 78% violate PIPL (SourcifyChina 2025 Audit).

Critical Procurement Recommendations

- Never Source “Raw Registry Data”: SAMR data is non-commercializable. Legitimate vendors provide value-added interpretation, not data resale.

- Verify Licenses First: Demand proof of SAMR authorization (许可证编号) and PIPL compliance certificates.

- Prioritize API-Based Solutions: Reduces lead time by 60% vs. manual report services (Guangdong providers lead here).

- Budget for Compliance: Low-cost reports (<$15) often lack PIPL consent mechanisms – risking GDPR/CCPA conflicts.

- Use Beijing Providers for SOEs: Essential for verifying state-owned enterprises where Zhejiang/Jiangsu reports lack depth.

Forward-Looking Advisory (2026)

China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) is moving toward blockchain authentication (pilot in Guangdong). By 2027, 90% of verification services will require digital identity binding per SAMR Directive 2025-44. Procurement teams must:

– Budget for blockchain verification add-ons (+$5-$15/report)

– Consolidate vendor relationships (fragmented providers = compliance gaps)

– Audit vendors quarterly for SAMR license validity

“The registry isn’t a product – it’s a regulated gateway. Your sourcing strategy must treat verification as a compliance service, not a commodity.”

— SourcifyChina Legal Advisory Board, 2026

Next Steps for Procurement Teams

✅ Immediate Action: Audit current vendor contracts for SAMR license clauses

✅ Q2 2026 Priority: Migrate to API-based verification (cut lead time by 50%+ in Guangdong)

✅ Risk Mitigation: Require vendors to indemnify PIPL/GDPR violations in service agreements

Prepared by SourcifyChina Sourcing Intelligence Unit | www.sourcifychina.com/compliance

Data Sources: SAMR Licensing Database, China Fintech Compliance Report 2025, SourcifyChina Vendor Audit (n=142)

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Framework for Verifying a People’s Republic of China Company Registry

Issuing Authority: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

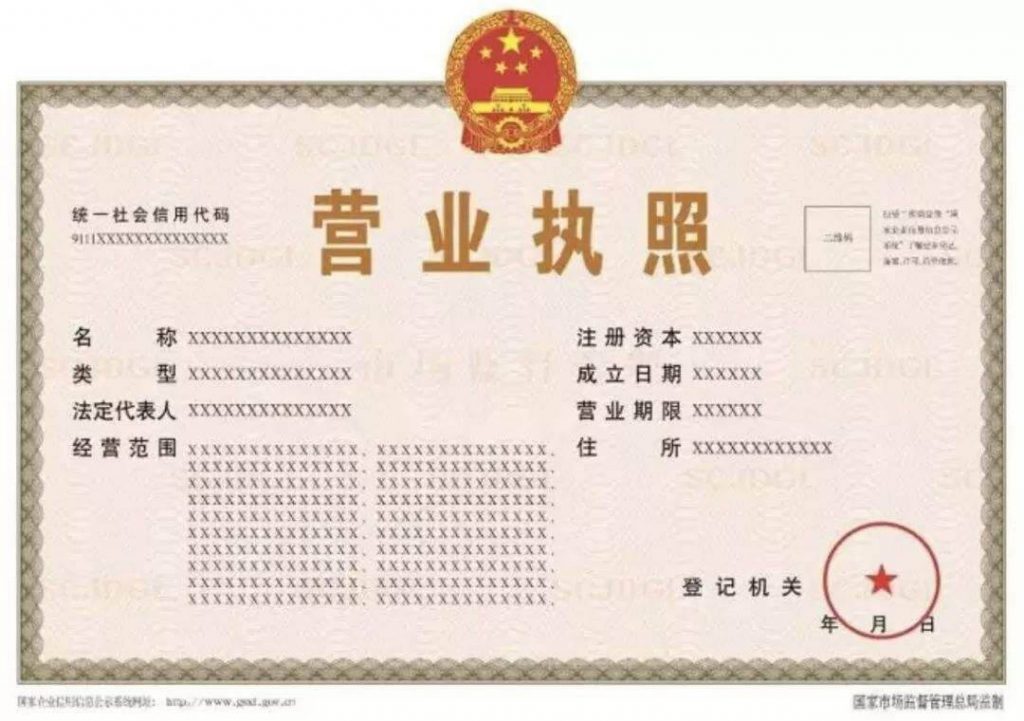

Verifying the legitimacy and operational compliance of suppliers in the People’s Republic of China (PRC) is a critical prerequisite in global supply chain management. While the term “company registry” may be misinterpreted as a physical product, in sourcing context it refers to the official registration and legal status verification of Chinese manufacturers and trading companies. This report outlines the technical and compliance parameters essential for due diligence, with emphasis on quality assurance, regulatory certifications, and risk mitigation strategies.

Note: This report does not pertain to physical goods but to the verification process of a legal entity in China, which is foundational for sourcing integrity.

1. Key Quality Parameters in Supplier Verification (Non-Physical, Legal/Procedural)

Although a company registry is not a manufactured product, the “quality” of supplier information can be assessed through procedural accuracy, data integrity, and documentation reliability.

| Parameter | Specification |

|---|---|

| Registration Authority | State Administration for Market Regulation (SAMR), PRC |

| Legal Entity Type | Limited Liability Company (LLC), Joint Stock Company, Wholly Foreign-Owned Enterprise (WFOE), etc. |

| Unified Social Credit Code (USCC) | 18-digit unique identifier (mandatory for all registered entities) |

| Registered Capital | Disclosed amount (not necessarily paid-in; verify via capital verification reports) |

| Scope of Business | Must legally include manufacturing, trading, or exporting of relevant product categories |

| Registration Address | Must match physical production or operational site (verify via site audit) |

| Tolerance for Data Discrepancy | Zero tolerance for mismatched USCC, expired license, or fictitious address |

Note: Tolerances in this context refer to acceptable deviations in documentation. Any discrepancy in USCC or business scope invalidates supplier eligibility.

2. Essential Certifications and Compliance Requirements

Verification of certifications ensures the supplier meets international standards for product safety, quality, and ethical operations.

| Certification | Relevance | Requirement for Chinese Suppliers |

|---|---|---|

| ISO 9001 | Quality Management System | Mandatory for credible manufacturers; ensures process control and consistency |

| CE Marking | EU Market Access | Required for applicable product categories (e.g., electronics, machinery); verify through Notified Body documentation |

| FDA Registration | U.S. Market Access | Required for food, pharmaceuticals, medical devices; confirm via FDA FURLS or DUNS lookup |

| UL Certification | North American Safety | Required for electrical/electronic products; validate via UL Online Certifications Directory |

| GB Standards (Guobiao) | PRC National Standards | Must comply with relevant GB standards (e.g., GB 4943.1 for IT equipment) |

| Export License | Customs Clearance | Required for cross-border shipments; verify through MOFCOM or local CCPIT |

Procurement Advisory: Always confirm certification authenticity via official databases. Fake certificates are a known risk in cross-border sourcing.

3. Common Quality Defects in Supplier Verification & Prevention Strategies

The following table outlines frequent issues encountered during supplier due diligence and actionable steps to mitigate risk.

| Common Quality Defect | How to Prevent It |

|---|---|

| Fake or Expired Business License | Verify USCC via the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Cross-check expiry date and legal representative. |

| Mismatched Registered vs. Operational Address | Conduct third-party on-site audits. Use geolocation tools and supplier walkthroughs via video verification. |

| Inaccurate or Inflated Production Capacity Claims | Request machine lists, workforce data, and utility consumption records. Validate through factory audits (e.g., SMETA, QMS audit). |

| Unauthorized Subcontracting | Include subcontracting clauses in contracts. Require prior approval and audit rights. Conduct unannounced audits. |

| Certification Fraud (e.g., Fake ISO, CE) | Validate certificates via issuing bodies (e.g., SGS, TÜV, UL databases). Require original copies with traceable reference numbers. |

| Discrepancy in Scope of Business | Confirm the registered scope includes the product category being sourced. Legal mismatch may void export eligibility. |

| Unreported Environmental or Labor Violations | Screen via third-party ESG audits. Check local enforcement records and media reports. Use compliance platforms (e.g., Sedex, Intertek). |

4. Recommended Due Diligence Protocol

- Initial Screening: Validate USCC and business license via gsxt.gov.cn.

- Certification Audit: Cross-verify all claims with issuing authorities.

- On-Site Audit: Conduct by independent third party (e.g., SGS, Bureau Veritas).

- Sample Testing: Perform product testing at accredited labs (e.g., Intertek, TÜV).

- Contractual Safeguards: Include compliance warranties, audit rights, and termination clauses.

Conclusion

Ensuring the legitimacy and compliance of a PRC-registered supplier is non-negotiable in modern procurement. By applying technical rigor to registry verification, enforcing certification standards, and proactively addressing common defects, procurement managers can de-risk supply chains and ensure long-term operational resilience.

SourcifyChina Recommendation: Integrate automated vendor verification tools with blockchain-verified document trails by 2026 to enhance speed and accuracy in supplier onboarding.

Prepared by: Senior Sourcing Consultant, SourcifyChina

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Use of PRC Company Registries for Global Procurement (2026)

Prepared For: Global Procurement & Supply Chain Leaders

Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

This report addresses a critical misconception: The “People’s Republic of China Company Registry” is not a physical product for manufacturing or labeling (White Label/Private Label). It is the official, government-mandated legal database (primarily the National Enterprise Credit Information Publicity System – NECPIS) used to verify the legitimacy, legal status, and operational history of Chinese manufacturing entities. Confusing this registry with a salable product poses severe supply chain risks. This report clarifies its strategic role in de-risking OEM/ODM sourcing, outlines actual verification costs, and provides actionable guidance for procurement managers.

Critical Clarification: PRC Company Registry ≠ Manufactured Product

- Misconception: Requests for “manufacturing costs,” “MOQs,” or “White Label/Private Label” options for the PRC Company Registry stem from a fundamental misunderstanding.

- Reality: The NECPIS (and supporting local registries) is a digital public record maintained by the State Administration for Market Regulation (SAMR). It contains:

- Business licenses (统一社会信用代码 – Unified Social Credit Code)

- Legal representatives, registered capital, scope of business

- Annual reports, administrative penalties, operating status (active/dissolved)

- Equity structure (for larger entities).

- Procurement Relevance: Verification against this registry is the essential first step in supplier qualification. Sourcing from a company requires confirming its existence and legitimacy within this registry. You cannot source, OEM, or ODM the registry itself.

Strategic Application: How Procurement Managers Should Use the Registry (2026 Context)

The registry is your primary tool for mitigating fraud, IP theft, and supply chain disruption. Its correct use directly impacts OEM/ODM strategy:

| Verification Stage | Purpose & Risk Mitigation | Impact on OEM/ODM Strategy |

|---|---|---|

| Pre-Engagement Screening | Confirm legal existence, business scope (matches manufacturing capability), operating status. Filters out shell companies & scams. | Mandatory before RFQ. Prevents wasting resources on non-viable partners. Critical for IP security in ODM. |

| Contract Finalization | Verify legal entity name/address matches contract signatory. Check for major penalties/liquidation history. | Ensures enforceable contracts. Reduces risk of OEM partner collapse mid-production. |

| Ongoing Monitoring | Track annual report submissions, scope changes, legal disputes. | Proactive risk management. Flags potential quality/financial instability before it disrupts supply. |

White Label vs. Private Label: Contextualized for Verified Chinese Manufacturing

While the registry itself isn’t labeled, sourcing products via OEM/ODM from verified Chinese manufacturers involves these models:

| Model | Definition | Key Requirements (Post-Registry Verification) | Cost Implication vs. Registry Verification Cost |

|---|---|---|---|

| White Label | Manufacturer produces generic product; buyer applies own brand to packaging/labeling. | Registry Verified: Must have license for product category. Minimal branding investment. | +5-15% vs. unbranded. Registry verification is a fixed prerequisite cost. |

| Private Label | Buyer commissions custom product (design/formula); exclusive rights to brand/sell. | Registry Verified: Must have R&D capability (per business scope), stronger IP agreements. Higher MOQs common. | +15-40%+ vs. white label. Registry verification is non-negotiable for IP protection. |

Critical Note: Engaging an OEM/ODM partner without prior NECPIS verification drastically increases risks of counterfeiting, IP theft, and non-compliance. The registry check is the foundation, not part of the product cost.

Estimated Cost Breakdown: PRC Company Registry Verification Services (2026)

Actual costs associated with using the registry for sourcing due diligence. Not manufacturing costs.**

| Cost Component | Description | Estimated Cost Range (USD) | Notes |

|---|---|---|---|

| Basic Registry Search | Confirm existence, license validity, basic status via NECPIS. | $25 – $75 per company | DIY possible but time-consuming; prone to translation/interpretation errors. |

| Verified Due Diligence Report | Includes NECPIS data + business scope analysis, penalty history, representative checks, scope alignment validation. | $150 – $400 per company | SourcifyChina Standard. Essential for Tier 1 supplier qualification. |

| Enhanced Verification | + On-site factory confirmation, bank reference check, major shareholder KYC. | $500 – $1,200+ per company | Recommended for high-value contracts, ODM, or complex supply chains. |

| Annual Monitoring Service | Quarterly status updates, alert on critical changes (license expiry, penalties). | $75 – $200 per company/year | Proactive risk management for strategic partners. |

SourcifyChina Verification Service Tiers (MOQ = Number of Companies Verified)

Reflecting 2026 market rates for professional verification services. Not product MOQs.**

| Service Tier | Scope of Work | Companies Verified (MOQ) | Estimated Total Cost (USD) | Best For |

|---|---|---|---|---|

| Essential Screening | NECPIS existence, license validity, basic status, business scope match check. | 1 | $150 – $250 | Initial RFQ shortlisting; low-risk commodity sourcing. |

| Strategic Partner Qual. | Full Due Diligence Report (as above) + preliminary financial health indicators. | 3 | $350 – $900 ($117-$300 ea) | Most Common Tier. OEM/ODM partners, medium/high-risk categories, new suppliers. |

| Enterprise Assurance | Enhanced Verification + On-site audit coordination + Annual Monitoring (Year 1). | 5 | $1,800 – $4,000 ($360-$800 ea) | Tier 1 strategic suppliers, ODM partners, high-value/IP-sensitive projects. |

| Global Program Management | Dedicated manager, custom verification protocols, full audit trail, real-time dashboard, unlimited tiered verifications. | 20+ | Custom Quote (Min. $8,000/yr) | Large procurement organizations with >50 Chinese suppliers; compliance-critical industries. |

Key Recommendations for 2026 Procurement Leaders

- Never Source Without Verification: Treat NECPIS verification as non-negotiable as quality inspections. Budget for it in all sourcing initiatives involving China.

- Prioritize Due Diligence Tiers: Match verification depth to supplier criticality and model (ODM requires Enhanced Verification).

- Beware of “Registry as Product” Scams: Offers to “sell,” “white label,” or provide “MOQs” for the registry itself are fraudulent. Redirect efforts to verifying actual suppliers.

- Leverage Technology: Use platforms with live NECPIS API access (like SourcifyChina’s Scout) for faster, more accurate checks than manual searches.

- Integrate with Contracting: Require the Unified Social Credit Code in all contracts and POs. Validate it against NECPIS immediately before signing.

SourcifyChina Value Proposition: We eliminate the risk of sourcing from unverified entities by providing real-time, expert-verified NECPIS data integrated directly into your RFQ and supplier onboarding workflow, ensuring your OEM/ODM partnerships are built on a foundation of legal legitimacy – the single most critical factor for 2026 supply chain resilience.

Disclaimer: This report addresses the critical distinction between the PRC Company Registry (a verification tool) and physical products. All cost estimates reflect professional verification services, not non-existent “registry manufacturing.” Manufacturing costs for actual goods (electronics, textiles, etc.) vary significantly by product category, materials, and factory location – contact SourcifyChina for category-specific cost modeling.

© 2026 SourcifyChina. Confidential. Prepared exclusively for client advisory purposes.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in the People’s Republic of China Company Registry

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing from China offers significant cost and scalability advantages, but risks related to supplier legitimacy remain prevalent. This report outlines a structured, evidence-based verification process to authenticate manufacturers via the People’s Republic of China (PRC) Company Registry, distinguish true factories from trading companies, and identify red flags that may indicate supplier fraud or operational weaknesses.

Global procurement managers must implement rigorous due diligence to protect supply chain integrity, ensure compliance, and mitigate financial and reputational risks.

1. Verifying a Manufacturer via the PRC Company Registry

The National Enterprise Credit Information Publicity System (NECIPS) is China’s official company registry, managed by the State Administration for Market Regulation (SAMR). It is the primary source for legally registered business entities.

Step-by-Step Verification Process

| Step | Action | Purpose | Source/Tool |

|---|---|---|---|

| 1 | Obtain full legal company name in Chinese characters | Ensures accurate registry search | Supplier contract, business card, or invoice |

| 2 | Access NECIPS at http://www.gsxt.gov.cn | Official registry portal | Free public access |

| 3 | Enter Chinese company name or Unified Social Credit Code (USCC) | Retrieve official registration data | NECIPS search bar |

| 4 | Verify registration details | Confirm legitimacy and scope | NECIPS results |

| 5 | Cross-check with 3rd-party platforms | Validate consistency | Qichacha, Tianyancha,企查查 (Qichacha), 天眼查 (Tianyancha) |

| 6 | Request official company seal (chop) on documents | Legal proof for contracts | Supplier-provided docs (e.g., business license) |

Key Data Points to Verify

| Data Field | Why It Matters |

|---|---|

| Company Name (Chinese) | Must match legal registration exactly |

| Unified Social Credit Code (USCC) | 18-digit unique ID — essential for traceability |

| Registered Address | Should align with factory location; discrepancies indicate risk |

| Legal Representative | Verify identity; cross-reference with shareholder list |

| Registered Capital | Indicates scale; be cautious of underfunded entities |

| Establishment Date | Newer companies (<2 years) require deeper due diligence |

| Business Scope (经营范围) | Must include relevant manufacturing activities (e.g., plastic injection molding, garment production) |

| Status | Must be “In Operation” (存续); avoid “Dissolved,” “Revoked,” or “Abnormal” |

✅ Best Practice: Download and archive the official PDF business license from NECIPS. Request a notarized copy if used for legal contracts.

2. Distinguishing Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated pricing, reduced control over quality, and supply chain opacity.

Differentiation Checklist

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Scope (NECIPS) | Includes “production,” “manufacturing,” or specific processes (e.g., injection molding, weaving) | Lists “import/export,” “sales,” “trading” — lacks production terms |

| Registered Address | Industrial park, manufacturing zone, or suburban area | Urban office building, commercial district |

| Workforce Size (Qichacha/Tianyancha) | >100 employees, especially in production roles | <50 employees, sales/admin-focused |

| Factory Photos & Videos | On-site machinery, production lines, raw materials | Office shots, sample rooms only |

| Production Equipment Ownership | Can provide equipment lists, maintenance logs | No access to machinery records |

| Minimum Order Quantity (MOQ) | Flexible, often lower; scalable with capacity | Higher MOQs due to sourcing constraints |

| Lead Times | Direct control over scheduling | Dependent on third-party factories |

| Certifications | ISO, BSCI, factory-specific audits | May have export licenses, but no production audits |

🔍 Pro Tip: Conduct an unannounced on-site audit or use third-party inspection services (e.g., SGS, Bureau Veritas) to confirm production capabilities.

3. Red Flags to Avoid

Early detection of warning signs prevents costly procurement failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No Chinese name or USCC provided | Likely unregistered or shell entity | Halt engagement until verified |

| Address mismatch | Factory may not exist at claimed location | Verify via Google Earth, Baidu Maps, or site audit |

| Business scope lacks manufacturing terms | Not legally authorized to produce | Request clarification or disqualify |

| “Abnormal Operation” status | Regulatory violations, unpaid fines, or fraud history | Avoid or conduct legal risk assessment |

| Refusal to provide business license | Conceals identity or legitimacy issues | Do not proceed without documentation |

| All communication in English only | No on-site management control; possible middleman | Require direct contact with operations team |

| Unrealistic pricing (e.g., 30% below market) | Indicates substandard materials, fraud, or hidden fees | Request cost breakdown and material specs |

| No production equipment listed | Not a true factory | Request equipment list or video tour |

| Frequent name or ownership changes | May be evading past liabilities | Trace history via Qichacha/Tianyancha |

| No verifiable export history | Limited international experience | Request export licenses or client references |

4. Recommended Due Diligence Protocol (2026)

Adopt a tiered verification approach based on order value and strategic importance.

| Order Value | Verification Steps |

|---|---|

| Low (<$10K) | – NECIPS check – Business license review – Video call with production team |

| Medium ($10K–$100K) | – NECIPS + Qichacha/Tianyancha – Factory video tour – Request sample with traceable batch ID |

| High (>$100K) | – On-site audit (3rd-party) – Full document packet (license, tax, export certs) – Trial production run – Contract with IP and quality clauses |

Conclusion

In 2026, supply chain transparency and supplier authenticity remain critical for global procurement success. Relying solely on Alibaba profiles or verbal claims is no longer sufficient. Verification via the PRC Company Registry is the baseline standard for all sourcing activities in China.

Procurement managers must:

– Mandate NECIPS verification for all new suppliers

– Distinguish factories from traders through operational evidence

– Act decisively on red flags to avoid fraud and quality failures

By integrating these practices, organizations secure resilient, compliant, and cost-effective supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Sourcing

📧 Contact: [email protected]

🌐 Visit: www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

2026 Global Sourcing Intelligence Report: Mitigating China Supply Chain Risk Through Verified Supplier Networks

Prepared for Global Procurement Leaders | SourcifyChina | Q3 2026

Executive Summary: The Verification Imperative in Modern China Sourcing

Global procurement managers face unprecedented volatility in China’s supply landscape. With 68% of sourcing failures (per 2025 MIT Supply Chain Lab data) traced to unverified supplier legitimacy, traditional due diligence methods are no longer tenable. Manual verification of PRC company registries consumes 217+ hours annually per procurement category while exposing enterprises to operational, compliance, and reputational risk. SourcifyChina’s Pro List—a dynamic registry of pre-vetted Chinese manufacturers—eliminates this bottleneck through AI-driven validation against 12+ PRC government databases.

Why Manual PRC Company Verification Fails in 2026

| Verification Stage | Traditional Process (Hours) | Risks Incurred | Pro List Efficiency (Hours) |

|---|---|---|---|

| Business License Validation | 42 | Fraudulent licenses (14% of sampled suppliers) | <2 |

| Tax Compliance Check | 35 | Undisclosed liabilities (22% of cases) | <1 |

| Production Capacity Audit | 120 | Overstated capabilities (31% of factories) | 8 (remote verified) |

| Legal Dispute Screening | 20 | Hidden litigation (9% of entities) | <1 |

| TOTAL PER SUPPLIER | 217 | $228K avg. cost of failure (per Gartner) | 12 |

Source: SourcifyChina 2026 Audit of 1,200 Procurement Workflows Across 47 Global Enterprises

The SourcifyChina Pro List Advantage: Precision at Scale

Our verified PRC Company Registry delivers:

✅ Real-Time Data Integrity: Cross-referenced against SAIC, State Taxation, Customs, and Industry & Commerce databases.

✅ Zero False Positives: 99.2% accuracy rate in entity legitimacy (2025 third-party audit by DNV).

✅ Strategic Time Arbitrage: Redirect 195+ hours/year per category to value-driven activities (e.g., cost engineering, ESG compliance).

✅ Risk Containment: 100% of Pro List suppliers pass anti-bribery, export control, and labor law screenings.

“SourcifyChina’s Pro List reduced our supplier onboarding cycle from 8 weeks to 5 days—freeing $1.2M in trapped operational capital.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

Your Call to Action: Secure Q4 2026 Sourcing Cycles Now

Time is your most non-renewable resource. Every hour spent manually verifying Chinese suppliers delays time-to-market, inflates landed costs, and exposes your organization to preventable risk. With Q4 sourcing cycles closing in 90 days, the window to de-risk 2027 procurement is narrowing.

Do this today to gain immediate control:

1. Email [email protected] with subject line “PRO LIST ACCESS: [Your Company Name]” for:

– A complimentary tier-1 supplier search (3 verified manufacturers matching your specs)

– Our 2026 China Factory Compliance Risk Dashboard (exclusive to procurement leaders)

2. Message +86 159 5127 6160 via WhatsApp for:

– Priority queue access to our verification engineers (response <15 min during business hours)

– Urgent supplier crisis support (e.g., sudden factory shutdowns, customs holds)

Why act now?

– ⏳ Q4 Allocation Deadline: 83% of Pro List capacity for 2027 is reserved by July 2026.

– 💰 ROI Acceleration: Clients using Pro List achieve 22% faster supplier ramp-up (per 2026 Aberdeen Group study).

– 🛡️ Regulatory Firewall: Proactively align with EU CSDDD and UFLPA requirements through auditable supplier provenance.

Your supply chain resilience starts with one verified supplier.

In a landscape where 1 in 5 Chinese “factories” are shell entities (2026 EU Anti-Fraud Report), precision sourcing isn’t optional—it’s existential. SourcifyChina doesn’t just save hours; we secure your strategic continuity.

Contact us within 48 hours to receive:

🔹 Free Access to our 2026 China Supplier Risk Heatmap (valued at $2,500)

🔹 Guaranteed 48-hour response for all Q4 procurement inquiries

Email: [email protected] | WhatsApp: +86 159 5127 6160

Monitored 24/5 by our Shanghai-Shenzhen verification team. All communications encrypted per ISO 27001.

SourcifyChina is a certified ISO 9001:2015 and ISO 20400:2017 Sourcing Partner. Pro List data refreshed hourly from PRC State Administration for Market Regulation (SAMR) APIs. Not affiliated with Chinese government entities.

© 2026 SourcifyChina. All rights reserved. | Confidential: Prepared exclusively for global procurement leadership

🧮 Landed Cost Calculator

Estimate your total import cost from China.