The global bicycle components market, driven by rising demand for high-performance and electric bicycles, is experiencing robust growth, with the segment for precision parts like pedal crank bearings gaining increased attention. According to Mordor Intelligence, the global bicycle market was valued at USD 65.28 billion in 2023 and is projected to reach USD 94.75 billion by 2029, growing at a CAGR of 6.28% during the forecast period. This expansion is fueled by urbanization, growing health consciousness, and government initiatives promoting sustainable transportation. As bicycles evolve toward higher efficiency and durability, the demand for premium pedal crank bearings—critical for smooth power transfer and reduced mechanical resistance—has surged. These components are essential across performance road bikes, mountain bikes, and e-bikes, where reliability under stress is paramount. With original equipment manufacturers and aftermarket suppliers alike prioritizing quality and innovation, the competitive landscape among bearing manufacturers has intensified. The following list highlights the top 10 pedal crank bearings manufacturers leveraging advanced materials, precision engineering, and global supply chains to meet the evolving needs of the cycling industry.

Top 10 Pedal Crank Bearings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HOLLOWTECH II

Domain Est. 1995

Website: bike.shimano.com

Key Highlights: HOLLOWTECH technology is an ultra-lightweight hollow crankarm created by SHIMANO with the company’s own proprietary forging technology that also maintains ……

#2 Cane Creek eeWings Titanium Cranks (8

Domain Est. 1996

Website: canecreek.com

Key Highlights: Rating 5.0 (5) · Free delivery over $99eeWings come with a fully machined, 7000 series aluminum preloader for precisely setting the preload on your bottom bracket bearings and …

#3 Chris King Precision Components

Domain Est. 1996 | Founded: 1976

Website: chrisking.com

Key Highlights: We’ve been making bicycle bearings in the U.S.A. since 1976. Chris King Precision Components are long lasting, fully serviceable, and fast….

#4 About Us

Domain Est. 1997

Website: philwood.com

Key Highlights: We produced our first sealed crank bearing cartridge system (circa 1971). Today’s crank bearing is compatible with any and all bottom bracket threading ……

#5 CeramicSpeed

Domain Est. 2004

Website: ceramicspeed.com

Key Highlights: Free delivery over $199 Free 14-day returns…

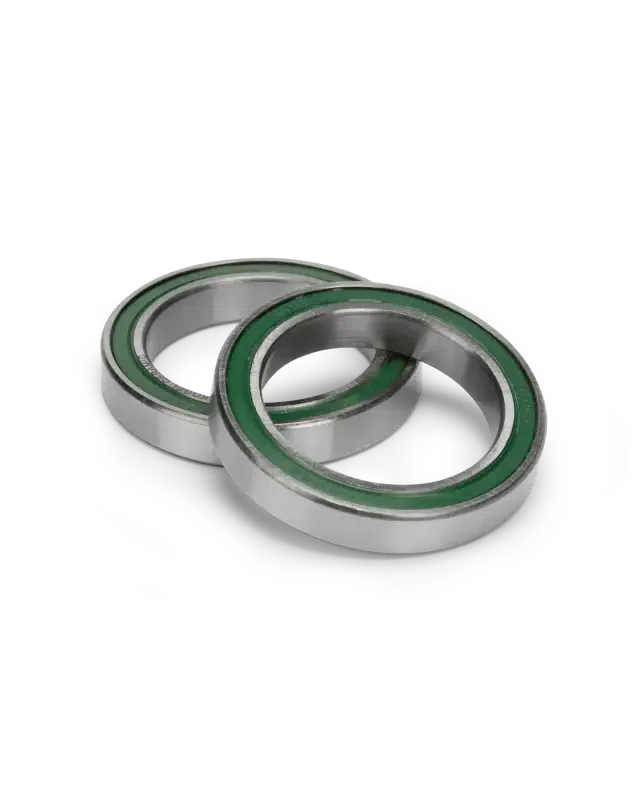

#6 Bearing Basics

Domain Est. 2004

Website: cycling.endurobearings.com

Key Highlights: Enduro manufactures roller bearings used in pedals, shock mounts and suspension pivots. Thrust Bearings are designed to function on a perpendicular axis ……

#7 CRANK Bearings / OCC spindle

Domain Est. 2010

Website: pedalchopper.com

Key Highlights: This is everything you would need to refurbish your crank bearings for your OCC Chopper or most any bike that has a smaller 3 piece crank….

#8 Kogel Bearings

Domain Est. 2013

Website: kogel.cc

Key Highlights: Enjoy Guaranteed Performance ceramic bottom bracket, derailleur pulleys, and wheel bearings for your bike. Kogel sells only high-quality ceramic bearings….

#9 5DEV

Domain Est. 2021

Website: ride5dev.com

Key Highlights: 6-day delivery 60-day returnsConstructed from space-grade aluminum and double-sealed bearings, 5DEV pedals provide reliable durability for DH, Enduro, and Trail riders. SHOP NOW. 5…

#10 sugino engineering corporation

Website: suginoltd.co.jp

Key Highlights: Hight strength pedal spacers, are used to protect the crank from being damaged by the pedal or adjust the pedal’s lateral position when the pedal threads ……

Expert Sourcing Insights for Pedal Crank Bearings

H2: 2026 Market Trends for Pedal Crank Bearings

The global market for pedal crank bearings is poised for significant transformation by 2026, driven by advancements in cycling technology, rising demand for high-performance bicycles, and the growing popularity of e-bikes. Several key trends are expected to shape the industry landscape:

-

E-Bike Boom Driving Demand

The rapid expansion of the electric bicycle (e-bike) market is a primary growth catalyst. E-bikes place greater mechanical stress on components, including pedal crank bearings, due to higher torque and frequent use. This necessitates more durable, sealed, and low-maintenance bearings, increasing demand for high-quality solutions from manufacturers. The global e-bike market is projected to grow at over 7% CAGR through 2026, directly benefiting the pedal crank bearing segment. -

Shift Toward Sealed and Cartridge Bearings

There is a clear industry shift from loose ball bearings to sealed cartridge bearings, which offer improved resistance to water, dirt, and corrosion. In 2026, sealed units are expected to dominate the market, especially in mid-to-high-end bicycles. This trend is supported by consumers’ growing preference for low maintenance and longer service intervals. -

Material Innovation and Lightweighting

Manufacturers are increasingly adopting advanced materials such as stainless steel, ceramic hybrids, and composite seals to enhance bearing performance. Ceramic bearings, although premium-priced, are gaining traction among performance cyclists due to their reduced friction and weight. By 2026, expect broader adoption of hybrid ceramic bearings in mid-tier performance bikes as production costs decline. -

Integration with Smart Cycling Systems

As bicycles become more integrated with smart technology—such as pedal power meters and IoT-enabled drivetrains—there is a growing need for bearings that support additional sensor integration without compromising durability. Some pedal crank systems are being designed with built-in torque sensors, requiring precision bearings that maintain accuracy under variable loads. -

Sustainability and Circular Economy Initiatives

Environmental concerns are influencing design and manufacturing practices. Leading bearing producers are focusing on recyclable materials, longer product lifecycles, and modular designs that allow easy servicing. By 2026, sustainability certifications and repairability will become key differentiators in competitive markets, particularly in Europe and North America. -

Regional Market Dynamics

Asia-Pacific is expected to remain the largest market due to strong domestic cycling cultures, government support for green mobility, and robust e-bike production in China and India. Meanwhile, Europe leads in premium and performance bicycle segments, driving innovation in bearing technology. North America shows steady growth, fueled by recreational cycling and urban commuting trends. -

Consolidation and Vertical Integration

The supply chain is seeing increased consolidation, with major drivetrain and component manufacturers acquiring or partnering with bearing specialists to ensure quality control and innovation. This vertical integration trend will likely accelerate through 2026, enhancing product compatibility and performance optimization.

In conclusion, the 2026 pedal crank bearing market will be defined by technological refinement, material advances, and alignment with broader cycling industry shifts—especially electrification and sustainability. Manufacturers that invest in R&D, durability, and eco-conscious production will be best positioned to capture growing market opportunities.

Common Pitfalls Sourcing Pedal Crank Bearings (Quality, IP)

Sourcing pedal crank bearings involves navigating several critical challenges related to quality consistency and intellectual property (IP) risks. Overlooking these pitfalls can lead to performance issues, customer dissatisfaction, and legal complications.

Inconsistent Quality Standards

Suppliers, especially in competitive low-cost markets, may offer bearings that appear identical but vary significantly in material composition, heat treatment, and precision tolerances. Bearings made with substandard chrome steel or inadequate sealing can lead to premature wear, increased friction, and failure under load. Without stringent quality audits and third-party testing, buyers risk integrating unreliable components that compromise the entire drivetrain’s performance and durability.

Misrepresentation of Bearing Specifications

Some suppliers falsely advertise bearings as meeting international standards (e.g., ABEC, ISO) without proper certification. This mislabeling can result in the procurement of bearings with incorrect internal clearances, improper grease types, or inadequate load ratings. Such discrepancies often go unnoticed until field failures occur, damaging brand reputation and increasing warranty costs.

Intellectual Property Infringement Risks

Sourcing from manufacturers that replicate branded bearing designs—such as those from Shimano, SRAM, or established bearing OEMs—poses serious IP concerns. These “copy” or “compatible” bearings may infringe on patented designs, seals, or cage technologies. Distributing such products can expose the buyer to legal action, import bans, or product recalls, particularly in regions with strong IP enforcement like the EU or North America.

Lack of Traceability and Documentation

Many suppliers fail to provide complete material certifications, test reports, or production traceability. This absence hinders compliance with industry regulations and makes root cause analysis difficult during failure investigations. Without proper documentation, verifying authenticity and performance claims becomes nearly impossible.

Supply Chain Transparency Gaps

Opaqueness in the supply chain—such as undisclosed subcontractors or unverified factory audits—increases exposure to unethical practices and inconsistent quality. Bearings may be produced in facilities without ISO certification or proper environmental controls, leading to variability and reputational risk.

Logistics & Compliance Guide for Pedal Crank Bearings

This guide outlines the essential logistics and compliance considerations for the import, export, storage, and distribution of pedal crank bearings used in bicycles. Adhering to these guidelines ensures smooth operations, regulatory compliance, and product integrity.

Product Classification & Regulatory Compliance

Pedal crank bearings are precision mechanical components subject to international trade regulations, safety standards, and environmental directives.

- HS Code Classification: Typically classified under 8482.10 (Ball bearings) or 8714.91 (Parts and accessories for cycles) depending on form and intended use. Confirm with local customs authorities and use country-specific tariff databases for accuracy.

- REACH & RoHS Compliance: Ensure bearings are free from restricted substances (e.g., lead, cadmium, certain phthalates) as per EU REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives. Suppliers must provide valid compliance documentation.

- REACH SVHC Disclosure: If any Substance of Very High Concern (SVHC) is present above threshold levels (0.1% w/w), notify the European Chemicals Agency (ECHA) and communicate to downstream users.

- Proposition 65 (California): For U.S. markets, verify that no listed chemicals (e.g., cobalt, nickel compounds) are present above safe harbor levels. Include warning labels if required.

Packaging & Labeling Requirements

Proper packaging safeguards product quality and ensures adherence to shipping and safety standards.

- Packaging Standards: Use anti-corrosion packaging (e.g., VCI paper or sealed plastic) to prevent rust and moisture damage during transit. Individual bearings should be sealed or grouped in labeled inner packaging.

- Labeling: Each package must include:

- Product name and part number

- Quantity

- Manufacturer or supplier name and address

- Country of origin

- Batch/lot number for traceability

- Handling symbols (e.g., “Fragile,” “Do Not Stack,” “Keep Dry”)

- Barcoding & Traceability: Implement UPC/EAN barcodes for inventory tracking. Maintain lot traceability from production to distribution for recall management.

Import/Export Documentation

Accurate documentation is critical for customs clearance and regulatory compliance.

- Commercial Invoice: Must detail product description, HS code, quantity, unit price, total value, Incoterms (e.g., FOB, DDP), and country of origin.

- Packing List: Include gross/net weight, dimensions, and number of packages.

- Certificate of Origin: Required for preferential tariff treatment under trade agreements (e.g., USMCA, EU-UK Trade Agreement).

- Export Licenses: Generally not required for standard bearings, but verify if dual-use or high-precision variants are subject to export controls (e.g., under Wassenaar Arrangement).

- Bill of Lading / Air Waybill: Ensure correct consignee, notify party, and freight details. Use electronic versions where possible.

Shipping & Transportation

Optimize logistics for cost, speed, and product protection.

- Mode of Transport: Choose based on volume and urgency:

- Air Freight: For urgent, low-volume shipments; use IATA-compliant packaging.

- Ocean Freight: Cost-effective for bulk orders; ensure containers are sealed and moisture-controlled.

- Ground Transport: For regional distribution; use climate-controlled trucks if storing long-term.

- Incoterms: Clearly define responsibilities using standard Incoterms 2020 (e.g., EXW, FCA, DAP). Specify who manages customs, insurance, and freight.

- Hazardous Material Classification: Bearings are non-hazardous under IATA, IMDG, and ADR regulations unless greased with classified lubricants. Confirm grease composition with supplier.

Storage & Inventory Management

Proper warehousing maintains bearing quality and enables efficient order fulfillment.

- Storage Conditions: Store in a dry, temperature-controlled environment (ideally 15–25°C, <60% humidity). Keep away from direct sunlight and corrosive chemicals.

- Shelf Life: Most sealed bearings have a shelf life of 2–5 years. Rotate stock using FIFO (First In, First Out) methodology.

- Inventory Controls: Use WMS (Warehouse Management System) to track stock levels, batches, and expiration dates. Conduct regular cycle counts.

Quality Assurance & Supplier Compliance

Ensure components meet technical and regulatory standards.

- Supplier Audits: Evaluate suppliers for ISO 9001 (quality management) and ISO 14001 (environmental management) certification.

- Incoming Inspection: Perform dimensional checks, visual inspection for damage, and verify packaging integrity upon receipt.

- Non-Conformance Handling: Establish a process for quarantining, reporting, and returning defective or non-compliant shipments.

Sustainability & End-of-Life

Address environmental responsibilities throughout the product lifecycle.

- Recyclability: Bearings are typically made from recyclable steel and contain reusable lubricants. Provide guidance for proper disposal or recycling.

- WEEE Compliance (EU): While not classified as EEE (Electrical and Electronic Equipment), bearings in e-bikes may fall under WEEE scope. Confirm applicability and register if required.

- Carbon Footprint: Optimize logistics routes and consolidate shipments to reduce emissions. Consider carbon offset programs for air freight.

Summary

Compliance and logistics for pedal crank bearings require attention to classification, documentation, packaging, and environmental regulations. Partner with certified suppliers, maintain accurate records, and train staff on compliance protocols to ensure efficient, lawful operations across global supply chains.

Conclusion for Sourcing Pedal Crank Bearings:

Sourcing high-quality pedal crank bearings is essential for ensuring optimal performance, durability, and smooth operation of bicycle drivetrains. After evaluating various suppliers, bearing types (such as loose ball, cartridge, and sealed), materials (chromoly steel, stainless steel, and ceramic), and cost considerations, it is clear that reliability, precision engineering, and long-term value should take precedence over initial cost savings. Bearings with strong corrosion resistance, low rolling resistance, and robust sealing mechanisms offer the best balance for both consumer and performance-grade bicycles.

Partnering with reputable manufacturers that adhere to international standards (e.g., ISO, ABEC) and provide consistent quality control ensures product reliability and reduces maintenance costs over time. Additionally, considering factors such as ease of replacement, availability of inventory, and technical support from suppliers enhances supply chain efficiency.

In conclusion, a strategic sourcing approach that prioritizes quality, supplier reliability, and lifecycle performance will lead to improved product integrity, customer satisfaction, and competitive advantage in the bicycle component market.