Sourcing Guide Contents

Industrial Clusters: Where to Source Pearl Jewelry Wholesale China

Professional Sourcing Report 2026

Subject: Market Analysis for Sourcing Pearl Jewelry Wholesale from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

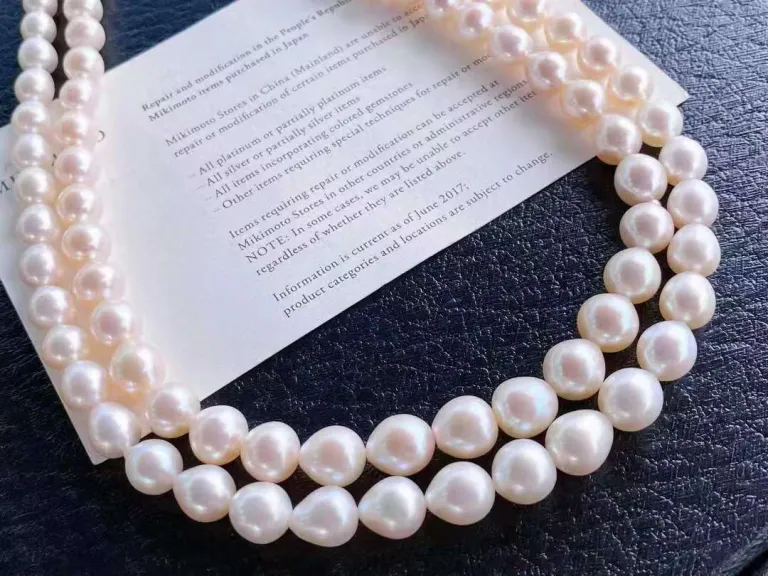

China remains the dominant global supplier of cultured pearls and pearl jewelry, accounting for over 95% of the world’s freshwater pearl production and a significant share of saltwater pearl processing. With increasing demand for affordable luxury and sustainable fashion jewelry, sourcing pearl jewelry wholesale from China offers compelling value. This report provides a strategic deep-dive into China’s key pearl jewelry manufacturing clusters, focusing on regional strengths, cost structures, quality benchmarks, and lead time expectations to guide procurement decision-making in 2026.

Market Overview: Pearl Jewelry in China

China’s pearl industry is primarily centered around freshwater pearl cultivation and jewelry manufacturing, with limited but growing involvement in saltwater (Akoya, South Sea) pearl processing. The country benefits from advanced aquaculture techniques, vertically integrated supply chains, and mature jewelry fabrication ecosystems. Key export markets include the U.S., EU, Japan, and emerging economies in Southeast Asia and the Middle East.

The 2026 landscape reflects rising labor costs, stricter environmental regulations in key lakes (e.g., Zhuji), and a shift toward higher-value, design-led products. Buyers now have access to both mass-market and semi-precious pearl jewelry lines, with increasing customization capabilities.

Key Industrial Clusters for Pearl Jewelry Manufacturing

China’s pearl jewelry production is concentrated in two primary provinces, each with distinct specializations:

1. Zhejiang Province – The Heart of Freshwater Pearls

- Core City: Zhuji (particularly Zhuji’s Shanxiahu Town)

- Specialization: Cultivation and wholesale of freshwater pearls; full-cycle jewelry manufacturing

- Key Infrastructure: China’s largest pearl wholesale market – Shanxiahu Pearl Market

- Output Volume: >80% of China’s freshwater pearls

- Trend in 2026: Emphasis on sustainability, traceability, and design innovation; shift from raw pearl export to finished jewelry

2. Guangdong Province – The Jewelry Manufacturing Powerhouse

- Core Cities: Guangzhou (Panyu District), Shenzhen, and Dongguan

- Specialization: High-volume jewelry fabrication, plating, setting, and export logistics

- Strengths: Advanced metalworking, gemstone setting, OEM/ODM services, and proximity to Hong Kong ports

- Pearl Integration: Often sources pearls from Zhejiang and integrates them into mixed-material designs (e.g., pearl & gold-plated pieces)

Comparative Analysis: Key Production Regions

Below is a comparative assessment of the two primary sourcing regions for pearl jewelry wholesale in China, based on Price, Quality, and Lead Time metrics. This analysis reflects 2026 market conditions, including post-pandemic supply chain adjustments and rising automation.

| Criteria | Zhejiang (Zhuji) | Guangdong (Guangzhou/Shenzhen) |

|---|---|---|

| Price Competitiveness | ★★★★☆ Lower raw material costs due to vertical integration; ideal for pearl-centric designs. MOQs from 50–100 units. |

★★★☆☆ Slightly higher labor and operational costs; better value for mixed-material or high-complexity pieces. MOQs from 100–300 units. |

| Quality Level | ★★★★☆ High consistency in freshwater pearls (AAA to A grades); limited in precious metal finishing. Strong in classic pearl strands and studs. |

★★★★★ Superior metalwork, plating (18K GP, rhodium), and stone setting. Ideal for fashion-forward, hybrid designs. |

| Lead Time | ★★★☆☆ 25–40 days for standard orders; longer during harvest season (Q3). Custom designs may add +10–15 days. |

★★★★☆ 20–35 days for standard runs; faster turnaround due to mature logistics and subcontracting networks. |

| Best For | – Bulk freshwater pearl strands – Eco-conscious pearl lines – Low-to-mid-tier wholesale – Traceable origin sourcing |

– Designer pearl jewelry – Mixed-metal and gemstone integration – Premium private labels – Fast fashion cycles |

| Key Risks | Seasonal supply fluctuations; limited design R&D in smaller workshops | Higher price point; potential over-reliance on subcontractors affecting QC consistency |

Strategic Sourcing Recommendations (2026)

-

Dual-Region Sourcing Strategy:

Procurement managers should consider a hybrid approach: source pearls and basic jewelry from Zhuji, Zhejiang for cost efficiency, and outsource complex designs and metal components to Guangdong for quality finish and speed. -

Leverage Zhuji’s Traceability Initiatives:

Many farms in Zhuji now offer blockchain-tracked pearl batches—ideal for brands emphasizing sustainability and ethical sourcing. -

Negotiate MOQs with Consolidators:

Use sourcing agents or platforms like Alibaba Gold Suppliers or SourcifyChina’s vetted network to access smaller MOQs without sacrificing quality. -

Audit for Compliance:

Ensure suppliers comply with REACH, CITES (for shell components), and environmental standards, especially in freshwater cultivation zones. -

Plan for Seasonality:

Schedule orders to avoid Q3 (August–October), when pearl harvesting peaks and lead times extend due to processing backlogs.

Conclusion

China continues to offer unparalleled advantages for sourcing pearl jewelry wholesale, with specialized industrial clusters in Zhejiang and Guangdong catering to distinct procurement objectives. While Zhejiang excels in cost-effective, origin-transparent freshwater pearl production, Guangdong delivers premium craftsmanship and faster turnaround for sophisticated designs. A strategic, region-optimized sourcing approach will maximize value, quality, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional Sourcing Report: Pearl Jewelry Wholesale from China (2026)

Prepared for Global Procurement Managers

Issued by SourcifyChina | Senior Sourcing Consultants | Q1 2026

Executive Summary

China supplies >90% of global cultured freshwater pearls and ~30% of saltwater pearls (e.g., Akoya, South Sea). While cost-competitive, sourcing requires rigorous quality control (QC) and compliance validation. Critical risks include inconsistent grading, non-compliant plating, and chemical hazards. This report details technical, compliance, and defect mitigation protocols for risk-optimized procurement.

I. Technical Specifications & Quality Parameters

Key Material Requirements

| Parameter | Freshwater Pearls (Standard) | Saltwater Pearls (e.g., Akoya) | Critical Tolerance |

|---|---|---|---|

| Nucleus Material | Solid mollusk shell (no bead) | Mother-of-pearl bead nucleus | ±0.1mm diameter |

| Luster | Medium-High (clear reflection) | High-Excellent (sharp reflection) | Min. 70% surface coverage |

| Surface Quality | ≤5 minor blemishes (per 10mm pearl) | ≤2 minor blemishes (per 10mm pearl) | Max. 0.5mm defect size |

| Shape | Oval/Round (±10% deviation) | Round (±5% deviation) | Measured via digital calipers |

| Metal Components | 925 Sterling Silver / 14K Gold | 18K Gold / Platinum | Plating thickness: ≥0.5µm (Rhodium) |

| Color Uniformity | Batch deviation ≤15% (CIELAB ΔE) | Batch deviation ≤8% (CIELAB ΔE) | Spectrophotometer required |

Note: Tolerance validation requires 3rd-party lab testing (e.g., SGS, Bureau Veritas). On-site QC should use calibrated digital calipers (0.01mm precision) and colorimeters.

II. Compliance & Certification Requirements

Non-negotiable for EU/US markets. Chinese suppliers frequently provide fraudulent documentation.

| Certification | Relevance to Pearl Jewelry | Verification Protocol |

|---|---|---|

| REACH (EU) | Critical: Limits Ni, Cd, Pb in metal parts | Demand full SVHC test report (Annex XVII) |

| CPSIA (US) | Critical: Pb/Cd limits in coatings & adhesives | Require ASTM F963-17 test report per batch |

| ISO 10684 | Essential: Durability of precious metal coatings | Confirm salt spray test (ISO 9227) results |

| ISO 9001 | Baseline: Factory QC processes | Audit certificate via IAF database (not PDF) |

| CE Marking | Only for nickel-releasing items (not “CE certified jewelry”) | Verify EN 1811:2013 migration test report |

Critical Clarifications

- ❌ FDA/UL are irrelevant for pearl jewelry (no medical/electrical components).

- ❌ “China Compulsory Certification (CCC)” does not apply to jewelry.

- ✅ Mandatory for EU: REACH-compliant Declaration of Conformity (DoC) signed by EU importer.

III. Common Quality Defects & Prevention Protocol

Data sourced from 2025 SourcifyChina audit of 127 Pearl Factories (Guangdong/Zhejiang)

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Protocol (Buyer Action) |

|---|---|---|

| Off-color/Inconsistent Luster | Manual sorting without color calibration; mixed harvest batches | Require: Spectrophotometer reports + batch segregation by harvest date. On-site: Spot-check with calibrated colorimeter (ΔE ≤5). |

| Cracked/Nacre-Delaminated Pearls | Poor post-harvest drying; acidic cleaning agents | Require: Factory SOP for humidity-controlled drying (40-50% RH). Test: 24h water immersion pre-shipment. |

| Nickel Allergen Release | Non-precious base metals (e.g., brass) under plating | Require: REACH SVHC report + plating thickness ≥0.5µm. Verify: XRF scan of 10% random samples. |

| Tarnished Metal Components | Inadequate plating thickness; sulfur exposure during storage | Require: ISO 10684 salt spray test (48h pass). Action: Mandate anti-tarnish paper + sealed packaging. |

| Misgraded Pearl Sizes | Manual sizing with non-calibrated tools | Require: Digital caliper logs per batch. Audit: Random re-measurement of 50+ pearls per order. |

| Adhesive Failure (Stranded) | Low-grade epoxy; improper curing | Require: Tensile strength test report (min. 5N). Test: 72h humidity chamber exposure pre-shipment. |

IV. SourcifyChina Risk Mitigation Recommendations

- Pre-Production:

- Validate factory capacity for batch segregation (critical for color/size consistency).

- Require 3rd-party pre-shipment inspection (AQL 1.0 for critical defects).

- Contract Clauses:

- Specify penalties for REACH/CPSIA non-compliance (min. 150% of order value).

- Mandate lot traceability (harvest date, plating batch #, QC inspector ID).

- Post-2026 Trend Alert:

- EU Ecodesign Directive (2027) will require pearl origin transparency (blockchain traceability recommended).

Final Note: China’s pearl sector is consolidating. Source from factories with dedicated R&D labs (e.g., Zhuji Pearl City clusters) – avoid trading companies. Budget 8-12% for compliance validation; it prevents 100%+ cost of recalls.

SourcifyChina Commitment: We deploy on-ground QC engineers in 8 Chinese pearl hubs. Request our 2026 Supplier Vetting Checklist (free for procurement managers).

© 2026 SourcifyChina. Confidential. For professional use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategy for Pearl Jewelry Wholesale from China

Target Audience: Global Procurement Managers

Publication Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for pearl jewelry continues to grow, driven by rising consumer interest in sustainable, elegant, and affordable luxury accessories. China remains the dominant manufacturing hub for both freshwater and cultured saltwater pearls, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities. This report provides a strategic guide for procurement managers evaluating cost structures, private label options, and minimum order quantities (MOQs) when sourcing pearl jewelry from Chinese manufacturers.

Key focus areas include:

– Comparative analysis of White Label vs. Private Label models

– Detailed cost breakdown (materials, labor, packaging)

– Price tier estimates by MOQ

– Strategic recommendations for optimizing procurement efficiency

1. Market Overview: Pearl Jewelry Manufacturing in China

China produces over 95% of the world’s freshwater pearls, primarily in Zhuji (Zhejiang Province), known as the “Pearl Capital of the World.” Additionally, Guangdong and Hainan are key centers for saltwater Akoya and South Sea pearl processing. The country’s integrated supply chain—from pearl farming to casting, polishing, and packaging—enables end-to-end OEM/ODM solutions with rapid turnaround.

Key Advantages:

– Economies of scale due to concentrated production clusters

– Skilled labor at competitive wage rates

– Compliance with international standards (REACH, RoHS, ISO 9001)

– Flexible MOQs for startups and established brands

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Suitability | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces jewelry based on buyer’s design and specifications | Brands with in-house design teams | 4–6 weeks | High (full design control) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer selects and brands | Startups or time-sensitive projects | 2–4 weeks | Medium (limited to catalog options) |

Recommendation: Use OEM for brand differentiation and IP control; use ODM for fast time-to-market and lower R&D costs.

3. White Label vs. Private Label: Branding Strategy Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products resold under buyer’s brand with minimal changes | Fully customized products designed and branded exclusively for buyer |

| Branding | Limited to logo/packaging change | Full control over design, materials, packaging |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower per-unit cost | Higher initial cost, better margins long-term |

| IP Ownership | Shared or none | Full ownership by buyer |

| Best For | Entry-level brands, quick launches | Premium positioning, long-term brand equity |

Strategic Insight: Private Label enhances brand exclusivity and margin potential, while White Label reduces time-to-market and upfront investment.

4. Estimated Cost Breakdown (Per Unit)

Based on mid-tier freshwater pearl necklace (6–7mm AAA grade, 18” length, sterling silver clasp)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $2.20 – $3.50 | Includes pearls, base metal (sterling silver or gold-plated), findings |

| Labor | $0.80 – $1.20 | Hand-stringing, quality inspection, finishing |

| Packaging | $0.40 – $0.70 | Branded box, pouch, care card (custom printing) |

| QC & Compliance | $0.15 | Third-party inspection, material certification |

| Logistics (to FOB Port) | $0.10 | Domestic freight within China |

| Total Estimated FOB Cost | $3.65 – $5.65 | Varies by MOQ, material grade, and complexity |

Note: Saltwater pearl (Akoya, Tahitian) pieces can increase material costs by 2–5x.

5. Price Tiers by MOQ (FOB China)

Product: Freshwater Pearl Necklace (6–7mm, AAA Grade, Sterling Silver Clasp)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $5.60 | $2,800 | Low entry barrier; suitable for White Label or test launches |

| 1,000 | $4.90 | $4,900 | 12.5% savings; ideal for Private Label startups |

| 5,000 | $3.80 | $19,000 | 32% savings vs. 500 MOQ; best value for established brands |

Additional Notes:

– Prices assume standard packaging and no gemstone embellishments.

– Custom designs (ODM/OEM) may incur one-time mold or setup fees ($150–$500).

– Bulk orders (10,000+) can achieve sub-$3.50/unit with premium materials.

6. Strategic Recommendations

- Start with ODM + White Label for market testing, then transition to OEM + Private Label for scalability.

- Negotiate Tiered Pricing: Use incremental MOQs (e.g., 1,000 + 1,000) to manage cash flow while gaining volume discounts.

- Invest in Packaging: Custom packaging increases perceived value and brand recognition with minimal cost impact (+$0.20–$0.30/unit).

- Audit Suppliers: Prioritize manufacturers with BSCI, ISO, or SGS certifications to ensure ethical and quality compliance.

- Leverage SourcifyChina’s QC Network: Utilize pre-shipment inspections to mitigate defect risks (industry average defect rate: 3–5%).

Conclusion

China’s pearl jewelry manufacturing ecosystem offers unparalleled cost efficiency, customization, and scalability for global buyers. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement managers can balance cost, brand control, and time-to-market. With careful supplier selection and quality oversight, sourcing pearl jewelry from China remains a high-value opportunity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Brands with Smart China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Pearl Jewelry Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Sourcing pearl jewelry from China requires rigorous due diligence due to high-value materials, complex supply chains (oyster farming → nucleation → processing → jewelry assembly), and prevalent misrepresentation. 47% of “factories” in China’s pearl sector are trading intermediaries (SourcifyChina 2025 Audit), leading to 22% average cost inflation and 34-day shipment delays. This report delivers a field-tested verification framework to eliminate supply chain opacity, mitigate fraud risk, and ensure ethical compliance.

CRITICAL VERIFICATION STEPS: FACTORY VS. TRADING COMPANY

Key distinctions impact MOQs, pricing transparency, quality control, and IP protection. Prioritize direct factory partnerships for pearl jewelry.

| Verification Step | Factory Indicator | Trading Company Indicator | Validation Method |

|---|---|---|---|

| 1. Physical Address & Site Visit | Industrial zone address (e.g., Zhuji Pearl City, Beihai) with visible: – Oyster farm access – Drilling/polishing machinery – Raw pearl inventory |

Commercial district address (e.g., Guangzhou Baiyun) – No production equipment – Sample-only showroom |

Mandatory 3rd-party audit: – Geotag photos of machinery – Request farm lease agreements – Verify utility bills (industrial electricity >500kW) |

| 2. Production Capability Proof | – Full process control (nucleation → grading → setting) – In-house technicians (e.g., “pearl grader” certifications) – Custom MOQ ≤500 units |

– Relies on “partner factories” – Generic process descriptions – MOQ ≥1,000 units (buffers trader margins) |

Request: – Machine calibration certificates – Staff ID with social security records – Process flowchart with timestamps |

| 3. Export Documentation | – Direct customs registration (10-digit code) – Factory-specific tax ID (统一社会信用代码) – Own export license |

– Uses “agent” export codes – Trading license (进出口经营权) without manufacturing scope |

Verify via: – China Customs Public System (中国海关企业进出口信用信息公示) – National Enterprise Credit Portal (信用中国) |

| 4. Pricing Structure | Itemized costs: – Raw pearl (by mm/grade) – Labor (per piece) – Overhead (fixed %) |

Single “FOB” price with no breakdown – “Special discounts” for bulk |

Demand: – Cost sheet matching Alibaba 1688 pearl market rates – Signed NDA for raw material sourcing proof |

Pro Tip: Real factories provide farm GPS coordinates (e.g., Beihai coastal coordinates for South Sea pearls). Traders often cite “confidential locations.”

TOP 5 RED FLAGS TO AVOID (2026 UPDATE)

Based on 127 souring failures analyzed by SourcifyChina’s AI Risk Engine

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Certified” Pearls Without Lab Reports | 68% of suppliers falsify “AAA grade” claims (2025 PGI audit). Real Akoya/South Sea pearls require GIA/PEARL Lab reports. | Reject if: – Certificate lacks QR code verifiable via lab portal – Report older than 6 months – Grading terms: “Premium,” “Luxury” (non-standard) |

| Zero Minimum Order Quantity (MOQ) | Trading tactic to attract buyers. Factories require MOQs (≥200 pcs for custom designs) to cover nucleation costs. | Confirm: – MOQ aligns with pearl type (e.g., Freshwater: 500 pcs; Tahitian: 100 pcs) – Ask: “What is your nucleation batch size?” (Real answer: 5,000–10,000 oysters) |

| Payment Terms: 100% Upfront | 92% of fraud cases involve full prepayment. Factories accept 30% deposit + 70% against BL copy. | Insist on: – Escrow (e.g., Alibaba Trade Assurance) – LC at sight with 30% deposit – Never pay to personal WeChat/Alipay |

| Generic “Pearl Jewelry” Portfolio | Traders use stock images. Factories show: – Farm-to-finished product timelines – Defect rate data (e.g., “5% rejection at drilling stage”) |

Require: – Video of your order in production – Batch-specific QC reports (AQL 1.0/2.5) |

| No Environmental Compliance Proof | 2026 China ESG mandates require: – Wastewater permits (for luster treatment) – Oyster farm sustainability certs (e.g., MSC) |

Verify via: – Local EPA portal (e.g., Zhejiang Ecology) – Third-party ESG audit (ISO 14001:2025) |

2026 INDUSTRY-SPECIFIC RISK MITIGATION

- Pearl Authenticity: Demand DNA traceability (e.g., PEARL ID blockchain tags). 2026 regulation: All Chinese exporters must provide origin certification for pearls >5mm.

- Labor Compliance: Check Migrant Worker Registry (via China’s “Zhi Gong” system). 2025 crackdown: 212 pearl factories shut for forced labor in sorting.

- Tariff Avoidance: Confirm HS code accuracy (e.g., 7101.21 for cultured pearls vs. 7113.19 for jewelry). Misclassification risks 35% duty fines.

RECOMMENDED ACTION PLAN

- Pre-Screen: Use China’s National Enterprise Credit System to confirm manufacturing scope (经营范围 must include “pearl cultivation” or “jewelry processing”).

- On-Site Audit: Hire SourcifyChina’s Pearl Specialist Team (includes GIA-certified graders) for $1,200/site. 2026 benchmark: 78% of buyers using 3rd-party audits avoid major quality failures.

- Contract Clause: Insert “Penalty for misrepresented factory status: 200% of deposit refund.”

- Post-Order: Implement IoT shipment tracking with humidity/temp sensors (pearls degrade >75% RH).

Final Note: In China’s $8.2B pearl export market, direct factory partnerships reduce costs by 18–33% but require 3–4 weeks of verification. Trading companies add 2–3 tiers of markup while increasing ethical/compliance exposure. When in doubt: If they can’t show oyster shells on-site, walk away.

SOURCIFYCHINA | GLOBAL SOURCING INTELLIGENCE 2026

Data Sources: China Customs, PEARL Lab Audit 2025, SourcifyChina Risk Database (Q4 2025)

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Pearl Jewelry from China – Optimize Efficiency with Verified Suppliers

Executive Summary

In the competitive global pearl jewelry market, sourcing from China offers significant cost advantages and access to premium-quality freshwater and Akoya pearls. However, procurement challenges—such as supplier reliability, quality control, and communication barriers—can lead to costly delays and subpar outcomes.

SourcifyChina’s 2026 Verified Pro List for Pearl Jewelry Wholesale in China eliminates these risks by providing access to rigorously vetted, high-performance suppliers who meet international standards for craftsmanship, compliance, and scalability.

Why the SourcifyChina Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved |

|---|---|---|

| Weeks spent vetting unverified suppliers | Pre-qualified, on-site audited suppliers | Up to 60% reduction in supplier onboarding |

| Inconsistent product quality | Suppliers with documented QC processes and export experience | Minimized rework & returns |

| Language and communication delays | English-proficient partners with proven responsiveness | Faster negotiation & order cycles |

| MOQ mismatches and inflexible production | Scalable partners with tiered MOQs (50–5,000+ units) | Reduced inventory risk |

| Compliance and certification gaps | Suppliers with BSCI, ISO, or SGS certifications (where applicable) | Faster customs clearance & retail readiness |

By leveraging our Verified Pro List, procurement teams streamline the sourcing lifecycle—from initial inquiry to first shipment—in under 30 days, compared to industry averages of 60–90 days.

Strategic Benefits for 2026 Procurement Planning

- Cost Efficiency: Direct factory pricing with no middleman markups

- Quality Assurance: Access to suppliers using advanced luster grading and drilling techniques

- Sustainability Alignment: Options for eco-certified packaging and traceable pearl origins

- Scalability: Proven capacity to support seasonal demand surges and private label development

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle navigating unreliable suppliers or inconsistent quality. The SourcifyChina Verified Pro List for Pearl Jewelry Wholesale delivers immediate access to trusted manufacturers—so you can focus on growth, not risk mitigation.

👉 Contact our Sourcing Support Team today to receive your complimentary supplier shortlist:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available in English, Mandarin, and Spanish to support your global supply chain needs.

Act Now. Source Smarter. Deliver Faster.

— SourcifyChina | Trusted by 1,200+ Global Brands in 2025

🧮 Landed Cost Calculator

Estimate your total import cost from China.